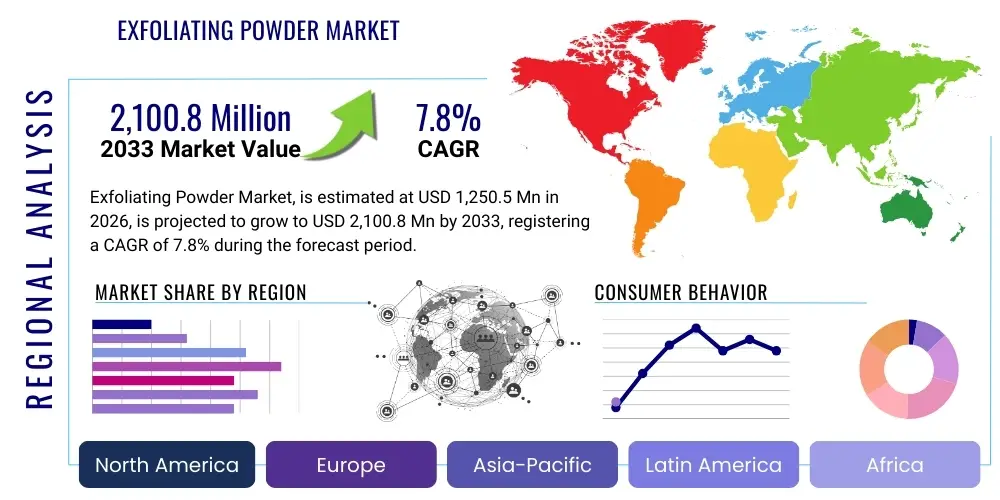

Exfoliating Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437453 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Exfoliating Powder Market Size

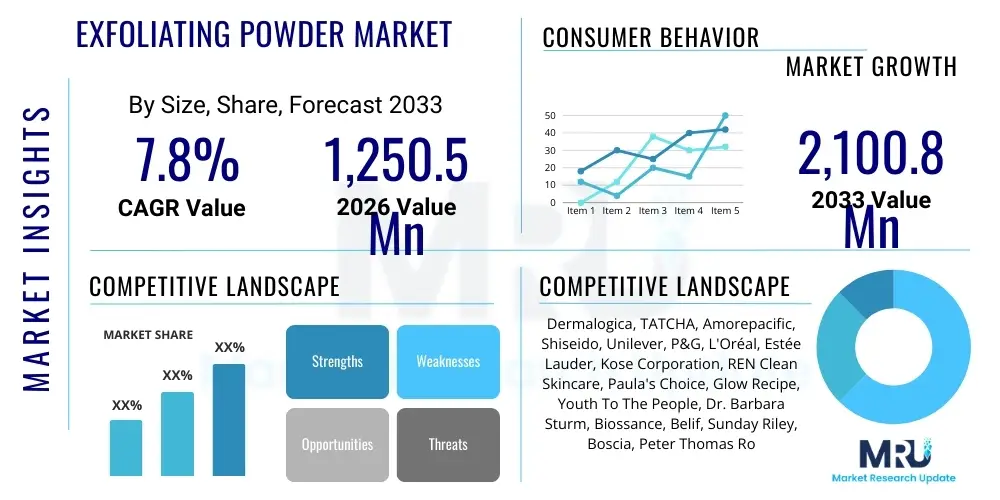

The Exfoliating Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $1,250.5 million in 2026 and is projected to reach $2,100.8 million by the end of the forecast period in 2033.

Exfoliating Powder Market introduction

The Exfoliating Powder Market encompasses specialized skincare products formulated as fine, dry powders that activate upon contact with water, transforming into a creamy cleanser or scrub. This unique delivery mechanism offers several advantages over traditional liquid or cream exfoliants, primarily improved stability, reduced need for harsh preservatives, and customizable exfoliation intensity based on the amount of water added. These products are favored by consumers seeking gentle yet effective chemical or physical exfoliation, often leveraging ingredients like rice bran, enzymes (papain, bromelain), salicylic acid, or finely milled grains. The core consumer appeal lies in their travel-friendliness, hygienic application, and ability to deliver fresh, potent active ingredients, positioning them as a premium segment within the broader skincare industry, particularly appealing to those focused on conscious beauty and minimalist ingredient lists.

The principal applications of exfoliating powders span facial care, body treatments, and increasingly, specialized scalp detoxification routines. In facial care, they are instrumental in promoting cellular turnover, combating dullness, and preparing the skin for subsequent treatment absorption, making them a staple in anti-aging and brightening routines. The adoption of these powders is driven significantly by expanding consumer awareness regarding the detrimental effects of environmental pollution and the desire for non-abrasive, eco-friendly exfoliating options, contrasting sharply with microplastic-laden scrubs of the past. Moreover, the trend toward personalized skincare regimens strongly favors powders, as the user can easily adjust consistency and usage frequency to match their specific skin type and current condition, from sensitive skin needing enzyme action to oily skin benefiting from physical polishing.

Key benefits driving market penetration include enhanced shelf stability due to the anhydrous formulation, which extends product life and maintains ingredient efficacy, particularly for volatile ingredients like Vitamin C or certain enzymes. Furthermore, the market is benefiting from innovations in natural ingredients, such as plant-derived cellulose and finely ground nut shells used as sustainable physical exfoliants, aligning with global shifts toward clean beauty and sustainability. Regulatory pressures restricting microplastics globally have inadvertently accelerated the acceptance and innovation within the powder format, providing manufacturers with a sophisticated, sustainable alternative that meets high consumer standards for both performance and environmental responsibility.

Exfoliating Powder Market Executive Summary

The Exfoliating Powder Market is characterized by robust growth fueled primarily by increasing consumer interest in gentle chemical and enzymatic exfoliation, coupled with a strong preference for clean beauty and sustainable product formulations. Business trends highlight intense innovation focused on bio-fermented ingredients and customizable formulations, pushing major beauty conglomerates to acquire or develop specialized powder lines to capture premium segment value. Digital marketing, particularly through expert dermatologist endorsements and detailed skincare routine videos on social media platforms, plays a critical role in educating consumers about the unique benefits of anhydrous formulations, transforming exfoliating powders from niche products into mainstream skincare essentials, thereby sustaining competitive pricing strategies and high product margins within the luxury and mass-premium sectors.

Regionally, Asia Pacific (APAC), led by South Korea and Japan, maintains its dominance, historically being the birthplace of many powder cleanser technologies and exhibiting high consumer willingness to invest in multi-step skincare routines where exfoliation is paramount. However, North America and Europe are rapidly closing the gap, driven by strong clean beauty movements and the rejection of traditional, harsh physical scrubs. In these Western markets, the adoption is highly concentrated in urban areas and among younger, digitally native demographics who prioritize product efficacy and ingredient transparency. Emerging markets in Latin America and the Middle East & Africa show accelerated growth potential, spurred by rising disposable incomes and the increasing availability of global beauty brands through expanding e-commerce infrastructure.

Segmentation trends indicate a significant pivot towards natural exfoliating powders, especially those leveraging fruit enzymes (like pineapple or pumpkin) due to their perceived gentleness and effectiveness on sensitive skin. While facial exfoliation remains the largest application segment, body and scalp exfoliating powders are experiencing disproportionately high growth rates, reflecting a holistic approach to skincare that extends beyond the face. Distribution channel analysis reveals that direct-to-consumer (DTC) e-commerce platforms and specialty beauty retailers are the preferred routes to market, as they allow for comprehensive product education and personalized recommendations necessary for consumers new to the powder format, although traditional pharmacies and high-end department stores remain important for established luxury brands.

AI Impact Analysis on Exfoliating Powder Market

Common user questions regarding AI's impact on the Exfoliating Powder market primarily revolve around three axes: personalization, supply chain efficiency, and novel ingredient discovery. Users frequently ask if AI can analyze their skin condition via mobile apps and recommend the precise type and concentration of exfoliating powder needed (e.g., enzyme vs. rice powder). They also inquire how AI-driven predictive analytics might optimize inventory management for highly perishable natural enzyme ingredients and how quickly AI can accelerate the identification of new, high-performance, sustainable botanical exfoliants. Key themes emerging from these concerns include expectations for hyper-personalized product recommendations, faster innovation cycles driven by computational chemistry, and enhanced transparency regarding ingredient sourcing and product safety through AI-monitored supply chains, signaling a demand for data-backed efficacy claims and highly efficient, customized consumer experiences.

The application of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming the R&D phase of exfoliating powder development. AI algorithms are adept at analyzing complex genomic and clinical datasets to predict the optimal combination and stability of active ingredients, particularly enzymes and botanical extracts, in an anhydrous base. This predictive modeling minimizes the reliance on traditional, time-consuming lab trials, enabling formulators to achieve superior product efficacy and stability faster. Furthermore, AI assists in optimizing particle size distribution for physical exfoliants, ensuring a consistent and non-abrasive user experience, thereby elevating product quality and reducing manufacturing variability, which is crucial for maintaining brand trust in a sensitive product category.

Beyond R&D, AI significantly influences consumer engagement and distribution strategies. Chatbots and virtual skin consultants powered by AI analyze consumer input—including environmental factors, dietary habits, and existing skincare routines—to recommend the most suitable exfoliating powder formulation, leading to higher conversion rates and improved customer satisfaction. In logistics, ML algorithms are used to forecast regional demand fluctuations based on seasonality and local beauty trends, ensuring that specialized powder ingredients are procured efficiently and minimizing waste, thereby supporting the industry's overarching sustainability goals while streamlining the entire market supply chain and operational efficiency.

- AI-driven personalized product recommendation engines increase consumer conversion and loyalty.

- Machine learning optimizes enzyme stability testing and prediction for longer shelf life.

- Computational chemistry accelerates the discovery of novel, sustainable botanical exfoliants.

- AI-powered supply chain analytics improve inventory management for specialized, raw powder ingredients.

- Virtual try-on and diagnostic tools enhance digital engagement and product suitability assessment.

- Automated quality control systems ensure precise particle size and uniformity in finished powder products.

DRO & Impact Forces Of Exfoliating Powder Market

The Exfoliating Powder Market is propelled by several robust drivers, including the global shift towards waterless, sustainable beauty products, the inherent stability and efficacy benefits of anhydrous formulations, and increasing consumer education regarding the importance of gentle, enzyme-based exfoliation over harsh physical alternatives. Simultaneously, the market faces constraints such as the higher production costs associated with micronization and specialized dry blending techniques, the need for intensive consumer education on proper usage (mixing ratios), and intense competition from established, lower-cost cream and liquid exfoliation formats. Opportunities abound in geographic expansion into emerging Asian and Latin American economies, the development of highly specialized powders targeting niche skin conditions (e.g., fungal acne, sensitive rosacea skin), and leveraging advanced bio-fermentation technologies to create proprietary, high-efficacy enzyme complexes, all while navigating the complex forces of regulation and consumer perception.

Key drivers include the strong clean beauty movement, which favors the compact, preservative-reduced nature of powders, and the environmental benefits derived from reduced water usage in manufacturing and shipping. Furthermore, the convenience of travel-friendly, spill-proof packaging strongly appeals to modern, mobile consumers. However, restraints present substantial market entry barriers. The intricate process of manufacturing exfoliating powders requires sophisticated machinery to achieve uniform, non-abrasive particle sizes, significantly increasing operational expenditure compared to standard liquid formulation processes. Additionally, incorrect usage (e.g., insufficient water leading to harsh scrubbing) can lead to negative consumer experiences, necessitating significant marketing investment in detailed usage instructions and educational content to manage consumer expectations effectively.

Opportunities lie primarily in technological advancements and strategic positioning. The market can significantly expand by incorporating highly active ingredients like stabilized Vitamin C or retinoids into powder form, utilizing the anhydrous nature for enhanced ingredient potency, thereby offering a distinct competitive edge. Impact forces, particularly the high degree of product differentiation possible through unique enzyme blends and specialty packaging, continue to shape market dynamics. Supplier power remains moderate, driven by the specialized nature of high-quality botanical raw materials and active enzymes, while buyer power is high due to the abundance of substitute exfoliating products. Intensity of rivalry is escalating as major beauty houses launch premium powder offerings, forcing existing niche players to constantly innovate in formulation and sustainability to maintain market share.

- Drivers: Growing demand for clean and waterless beauty products; superior ingredient stability in anhydrous form; increased consumer preference for gentle enzyme exfoliation; travel and sustainability benefits of lightweight formulas.

- Restraints: High manufacturing complexity and capital expenditure required for micronization; challenges in consumer education regarding optimal water-to-powder ratios; competition from cost-effective liquid exfoliants.

- Opportunities: Integration of advanced active ingredients (e.g., highly stable Vitamin C) into powder matrices; expansion into specialized body and scalp care segments; geographical penetration into high-growth emerging economies (e.g., Brazil, India).

- Impact Forces: Moderate Supplier Power (driven by enzyme specialization); High Buyer Power (due to substitution availability); High Intensity of Rivalry (major brands entering the premium powder space); High Threat of Substitution (creams, toners, pads).

Segmentation Analysis

The Exfoliating Powder Market is meticulously segmented based on product type, application, end-user, and distribution channel, reflecting the varied consumer needs and market availability across the globe. The segmentation by type is crucial, distinguishing between natural enzyme-based formulations, preferred for sensitive skin, and synthetic chemical powders, which often contain AHAs or BHAs for more potent results, influencing pricing and target demographic. Application segmentation highlights the growing trend of extending sophisticated exfoliation routines beyond the face to the entire body and scalp, demonstrating a holistic approach to wellness. These segmentations are fundamental for stakeholders to tailor their product development, marketing campaigns, and regional supply chain strategies to effectively capitalize on distinct consumer groups and regional preferences, maximizing market penetration.

By analyzing the end-user segmentation, which includes individual consumers, professional salons and spas, and specialized dermatology clinics, manufacturers can target B2B versus B2C distribution channels and formulation concentrations. For instance, professional settings often demand higher-concentration, single-use, medical-grade powders, contrasting sharply with the daily-use, consumer-friendly formulations sold through retail channels. The distribution analysis further breaks down sales by online (e-commerce, brand websites) versus offline (supermarkets, specialty stores), revealing the critical role of digital platforms in educating consumers about the unique usage method of powder products, which is essential for first-time buyers and maintaining market growth momentum.

The pronounced trend within segmentation points toward the rise of customized solutions. Manufacturers are increasingly offering product lines that allow consumers to 'mix and match' powder types (e.g., blending a gentle rice powder with a stronger salicylic acid powder) to create a highly personalized exfoliant tailored to their skin’s immediate needs. This customization capability, facilitated by the powder format, not only drives higher perceived value but also fosters deeper brand loyalty, positioning the market favorably for future innovation in hyper-personalized skincare systems and ensuring sustained growth across multiple consumer segments.

- By Type:

- Natural Exfoliating Powder (Enzyme-based, Rice Powder, Oat-based)

- Synthetic/Chemical Exfoliating Powder (AHA/BHA blends, Microcrystalline Cellulose)

- By Application:

- Facial Exfoliation (Largest Segment)

- Body Exfoliation

- Scalp Exfoliation and Detoxification

- By End-User:

- Individual Consumers (B2C)

- Professional Channels (Salons, Spas, Clinics - B2B)

- By Distribution Channel:

- Online Retail (E-commerce, Brand Websites)

- Offline Retail (Specialty Stores, Drug Stores, Supermarkets, Department Stores)

Value Chain Analysis For Exfoliating Powder Market

The value chain for the Exfoliating Powder Market begins with upstream activities centered on the specialized sourcing and processing of raw materials, which are significantly more complex than those for liquid cosmetics. This stage involves the cultivation and harvesting of unique botanicals, the rigorous extraction and stabilization of sensitive enzymes (like papain or protease), and the meticulous micronization of physical exfoliating agents (such as rice flour or mineral particles) to ensure they are non-abrasive. High-quality upstream suppliers that can guarantee purity, sustainability certifications, and consistent particle size distribution command significant leverage in the market, as formulation success heavily relies on the quality and stability of these dry ingredients. Manufacturers then undertake specialized anhydrous blending and packaging processes, demanding climate-controlled facilities to prevent pre-activation or moisture contamination.

Midstream activities primarily focus on the manufacturing, rigorous quality control testing (including stability and solubility tests), and specialized filling processes. Due to the powder nature, packaging must be highly moisture-resistant, often involving double-sealed containers or custom dispensers to maintain product integrity throughout the supply chain. Distribution channels then move the finished goods downstream. Direct distribution occurs via brand-owned e-commerce platforms, offering manufacturers high control over pricing and customer data. Indirect distribution involves partnerships with specialized beauty retailers, large-scale department stores, and increasingly, professional distributors serving salons and spas, each requiring distinct logistical approaches and inventory strategies tailored to their specific consumer base.

The downstream analysis highlights the crucial role of marketing and consumer education, particularly for indirect channels. Since exfoliating powders represent a departure from traditional liquid scrubs, consumers require comprehensive instructional content to maximize product efficacy and avoid misuse. Direct and indirect channels are differentiated by the level of personalized interaction offered; DTC websites often utilize AI tools for skin consultation and dosage guidance, whereas specialty stores rely on trained sales associates. Efficient logistical networks, minimizing transit time to preserve ingredient potency and navigating international regulatory requirements regarding ingredient labeling, are essential for successful market penetration and maintaining the premium positioning of exfoliating powder products globally.

Exfoliating Powder Market Potential Customers

Potential customers for Exfoliating Powders span a broad demographic spectrum but are highly concentrated among individuals who prioritize high-efficacy, gentle skincare, and sustainable beauty practices. The primary end-users are educated, affluent consumers aged 25-55 who are already engaged in multi-step skincare routines and actively seek out specialized, premium products to address specific concerns like uneven texture, dullness, or sensitivity. These consumers often exhibit high brand loyalty to clean beauty labels and are willing to pay a premium for formulations free from parabens, phthalates, and excessive preservatives, making the powder format particularly appealing due to its intrinsic waterless composition.

A rapidly growing segment includes individuals with sensitive or reactive skin. Traditional physical scrubs often cause irritation, leading these consumers to search for gentle enzymatic alternatives, which are prominently available in powder forms (e.g., rice or oat-based enzymes). Furthermore, professionals constitute a distinct potential customer segment, including high-end aesthetic clinics, luxury spas, and dermatology practices, which utilize concentrated, medical-grade exfoliating powders for in-office treatments. These B2B customers value the consistency, sterility, and customizable strength of powder products for advanced peel preparations or targeted skin resurfacing protocols.

Geographically, customers residing in high-pollution urban centers are key buyers, as they seek effective solutions to mitigate the effects of environmental aggressors and maintain clear pores, often turning to deep-cleaning, activated powder formulations. The rising trend of 'skinimalism' also attracts a segment of customers who prefer multifunctional, compact products that reduce plastic usage and simplify travel, further solidifying the relevance of exfoliating powders among consumers dedicated to both personal wellness and environmental stewardship.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1,250.5 million |

| Market Forecast in 2033 | $2,100.8 million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dermalogica, TATCHA, Amorepacific, Shiseido, Unilever, P&G, L'Oréal, Estée Lauder, Kose Corporation, REN Clean Skincare, Paula's Choice, Glow Recipe, Youth To The People, Dr. Barbara Sturm, Biossance, Belif, Sunday Riley, Boscia, Peter Thomas Roth. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Exfoliating Powder Market Key Technology Landscape

The technological landscape of the Exfoliating Powder market is dominated by advancements in micronization, encapsulation, and specialized anhydrous blending techniques, which are crucial for maintaining the product's efficacy and unique user experience. Micronization technology ensures that physical exfoliating agents, such as bamboo powder or rice bran, are milled to extremely fine, uniform particle sizes (often below 50 microns), eliminating the sharp edges that cause micro-tears in the skin, a key consumer concern that differentiates modern powders from outdated scrubs. Advanced jet milling and air classification techniques are essential to achieve this uniformity and safety profile, driving up the capital investment required for state-of-the-art manufacturing facilities and acting as a barrier to entry for smaller players, thus concentrating specialized manufacturing expertise among key market leaders.

Furthermore, ingredient stabilization relies heavily on advanced encapsulation technologies. Active ingredients, especially highly volatile components like certain vitamins, peptides, and sensitive enzymes (e.g., papain or bromelain), are encapsulated within a protective shell (often lipid or polymer-based) that prevents degradation from light, air, or residual moisture until the moment the powder is mixed with water on the consumer’s palm. This technology is critical for unlocking new product potential, allowing formulators to incorporate previously unstable, high-efficacy actives into an anhydrous format, guaranteeing freshness and maximum potency at the time of use. The integration of advanced flow agents and anti-caking agents, such as optimized silica compounds, also forms a core technological requirement to ensure the powder remains free-flowing, preventing clumping and ensuring accurate dosing throughout the product lifecycle.

Innovation is also evident in the development of sustainable and biodegradable packaging solutions that complement the clean ethos of the powder format. Companies are investing in materials science to create refillable, fully recyclable, and moisture-proof containers that protect the anhydrous formulation without compromising environmental commitments. Coupled with these material advances, analytical technologies like near-infrared (NIR) spectroscopy are increasingly being used during the manufacturing process for real-time quality assurance, verifying moisture content and ingredient homogeneity instantly. This stringent process control is paramount in the production of high-quality exfoliating powders, safeguarding the product's stability and ensuring that the market continues to provide a premium, technologically sophisticated alternative to traditional cosmetic formats.

Regional Highlights

- Asia Pacific (APAC): Dominance and Innovation Hub

- North America: Rapid Adoption and Clean Beauty Integration

- Europe: Focus on Regulation and Natural Certification

- Latin America (LATAM) and Middle East & Africa (MEA): Emerging Growth Frontiers

The Asia Pacific region, particularly South Korea, Japan, and China, holds the largest market share and acts as the primary innovation hub for exfoliating powders. This dominance is rooted in the region's deep cultural emphasis on complex, multi-step skincare routines where gentle yet thorough cleansing and exfoliation are non-negotiable foundations. Consumers in APAC are highly knowledgeable about ingredient efficacy, driving continuous demand for enzyme-based and rice-derived exfoliating powders that align with traditional beauty remedies while utilizing cutting-edge stabilization technology. The market here is highly fragmented but extremely dynamic, characterized by rapid product launches and high influence from social media trends that popularize novel textures and ingredient pairings. Furthermore, robust e-commerce penetration and the high urbanization rate contribute significantly to the accessibility and consumption of these specialized, premium products.

Key growth drivers in APAC include the rising purchasing power in countries like China and India, coupled with heightened awareness regarding skin health and pollution protection. Local brands often collaborate with global scientific institutions to develop proprietary enzyme complexes and fermentation technologies tailored to regional skin concerns and environmental factors. The regulatory environment is generally supportive of cosmetic innovation but maintains strict standards for ingredient safety, ensuring high-quality product output. This region is also leading the charge in sustainable packaging and refill programs for powder products, aligning with global eco-conscious trends and reinforcing its status as the global benchmark for anhydrous skincare formulation and marketing strategies.

North America represents the second-largest and fastest-growing regional market, driven by the powerful clean beauty movement and a strong consumer shift away from abrasive physical scrubs. American consumers, increasingly informed by dermatologists and online resources, favor high-efficacy enzyme and AHA/BHA blend powders for their controlled exfoliation benefits. The market growth is concentrated in the mass-premium and luxury segments, often positioned through specialty retailers and direct-to-consumer brand channels that prioritize ingredient transparency and sustainable sourcing claims. Marketing efforts heavily emphasize the "waterless" aspect as both an environmental benefit and a guarantee of product potency.

The competitive landscape in North America is marked by intense investment from established global beauty conglomerates acquiring niche powder brands or launching proprietary lines. Innovation focuses on incorporating advanced, evidence-backed ingredients like encapsulated Vitamin C and specialized prebiotics into the powder matrix. Regulatory trends, although less stringent than in Europe, still emphasize transparency regarding potential allergens and irritants. The widespread use of social media and influencer marketing rapidly educates consumers on usage protocols, successfully mitigating the initial barrier of adapting to the anhydrous format, leading to sustained double-digit growth rates in this region, particularly among younger and environmentally aware demographics.

The European market for exfoliating powders is characterized by a strong regulatory framework (EU Cosmetic Regulation) that heavily influences ingredient choices and claims, driving manufacturers toward highly certified natural and organic formulations. Consumers in Western Europe, particularly in Germany, France, and the UK, exhibit a strong preference for ecological safety and traceability, favoring powders that utilize locally sourced botanical ingredients and adhere strictly to COSMOS or other stringent natural certifications. The growth, while steady, is often hampered by the need for extensive regulatory approval for new chemical exfoliating agents, pushing innovation predominantly towards sophisticated natural enzyme blends.

The market penetration is particularly strong in pharmacy chains and specialized organic beauty stores, where consumers seek expert advice and trust third-party endorsements. Sustainability remains a central theme, with European brands pioneering sophisticated, biodegradable packaging and minimizing the product's carbon footprint associated with shipping. The region shows robust demand for scalp exfoliating powders and products designed for mature skin, leveraging the gentle nature of the powder format to address age-related texture concerns without causing sensitivity or inflammation, thus maintaining a stable and highly quality-focused market environment.

LATAM and MEA represent emerging high-potential markets for exfoliating powders. Growth in LATAM (led by Brazil and Mexico) is fueled by increasing disposable incomes, a strong cultural appreciation for beauty rituals, and the rapid expansion of digital retail channels, making international brands more accessible. Consumers here are highly experimental and responsive to global trends, quickly adopting premium powder formats as a sign of sophisticated skincare involvement. Innovation often focuses on ingredients native to the region, such as specific fruit enzymes, creating a unique market identity.

The MEA region, particularly the GCC countries, is witnessing substantial growth driven by luxury consumption patterns and extreme environmental factors (heat, dust) necessitating highly effective deep-cleansing solutions. Exfoliating powders are prized for their hygienic, long-shelf-life properties in challenging climates. Market entry is typically through high-end malls and online platforms offering curated international selections. Both regions require strategic logistical planning due to complex import regulations and fragmented distribution networks, but offer substantial long-term growth opportunities as consumer awareness and purchasing power continue their upward trajectory.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Exfoliating Powder Market.- Dermalogica

- TATCHA

- Amorepacific Corporation

- Shiseido Company, Limited

- Unilever PLC

- The Procter & Gamble Company (P&G)

- L'Oréal S.A.

- The Estée Lauder Companies Inc.

- Kose Corporation

- REN Clean Skincare (Unilever)

- Paula's Choice Skincare

- Glow Recipe

- Youth To The People

- Dr. Barbara Sturm

- Biossance (Amyris)

- Belif (LG H&H)

- Sunday Riley

- Boscia

- Peter Thomas Roth Clinical Skin Care

Frequently Asked Questions

Analyze common user questions about the Exfoliating Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards exfoliating powders over traditional scrubs?

The shift is primarily driven by the clean beauty movement favoring waterless and preservative-minimized formulations, and consumer awareness concerning the harshness of plastic microbeads or sharp nut shells. Powders, especially enzyme-based ones, offer gentler, customizable exfoliation and superior ingredient stability, appealing to sensitive skin types seeking high efficacy.

Are exfoliating powders suitable for sensitive skin?

Yes, many exfoliating powders are highly suitable for sensitive skin, particularly those utilizing natural fruit enzymes (like papain or bromelain) or fine rice flour. These formulations provide chemical or enzymatic exfoliation that dissolves dead skin cells without the abrasive action of harsh physical particles, reducing the risk of irritation and micro-tears.

How do anhydrous (waterless) formulations impact product shelf life and potency?

Anhydrous formulations significantly increase product shelf life and maintain ingredient potency because water is the medium for most microbial growth and chemical degradation. By removing water, sensitive active ingredients like enzymes and Vitamin C remain dormant and stable until activated by the consumer during use, ensuring maximum freshness and efficacy.

Which geographical region leads the global Exfoliating Powder Market?

The Asia Pacific (APAC) region, spearheaded by highly innovative markets such as South Korea and Japan, currently leads the global market. This dominance is due to the strong cultural acceptance of multi-step skincare routines and the continuous introduction of sophisticated, premium powder technologies in the region.

What are the key technological advancements shaping the manufacturing of exfoliating powders?

Key advancements include high-precision micronization techniques to ensure non-abrasive particle sizes, advanced encapsulation technologies to stabilize volatile actives (like Vitamin C or retinoids), and specialized anhydrous blending processes crucial for maintaining the product's dry, free-flowing state and overall stability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager