Exhaust Gas Purifier Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433580 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Exhaust Gas Purifier Market Size

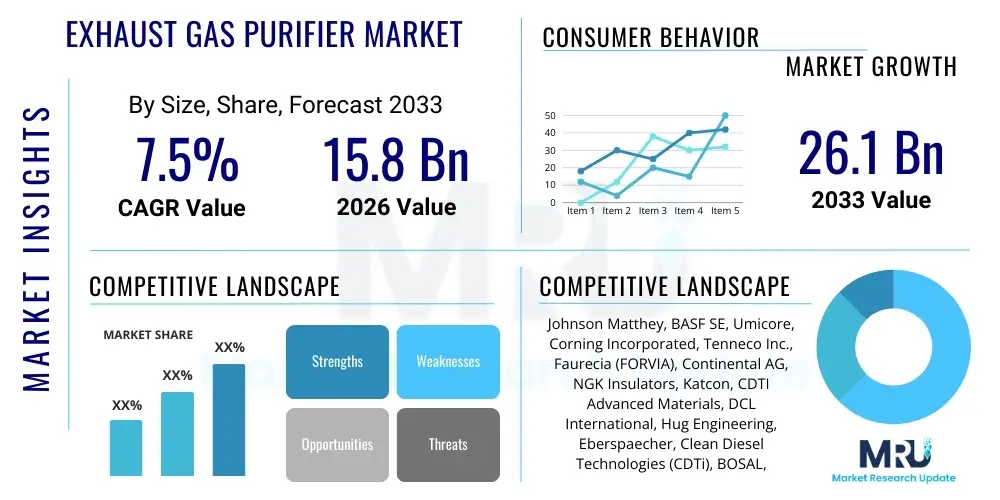

The Exhaust Gas Purifier Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 15.8 Billion in 2026 and is projected to reach USD 26.1 Billion by the end of the forecast period in 2033.

Exhaust Gas Purifier Market introduction

The Exhaust Gas Purifier Market encompasses specialized technologies and systems designed to mitigate harmful pollutants emitted by combustion processes in various sectors, including automotive, marine, industrial power generation, and construction machinery. These purifiers, often utilizing advanced catalytic converters, particulate filters, and selective catalytic reduction (SCR) systems, convert toxic components such as nitrogen oxides (NOx), carbon monoxide (CO), and uncombusted hydrocarbons (HC), as well as fine particulate matter (PM), into less harmful substances like water vapor, nitrogen, and carbon dioxide. The fundamental necessity for these systems stems from escalating global concerns regarding air quality and the direct correlation between industrial and vehicular emissions and adverse health outcomes.

The primary function of an exhaust gas purifier is to ensure compliance with increasingly stringent environmental regulations mandated by international bodies and national governments, such as EPA Tier standards, Euro standards, and IMO emissions limits for marine vessels. Beyond mere compliance, these purifiers offer significant benefits, including improved corporate environmental profiles, reduction of acid rain precursors, and mitigation of urban smog. Key applications span light-duty vehicles (using catalytic converters and GPFs), heavy-duty commercial vehicles and off-road machinery (relying heavily on SCR and DPF technology), and large stationary sources like power plants and chemical processing facilities.

Driving factors for sustained market growth are profoundly rooted in regulatory enforcement and technological innovation. The continuous tightening of emission standards, particularly in emerging economies undergoing rapid industrialization and urbanization, mandates the integration of high-efficiency purification systems across new and existing fleets. Furthermore, technological advancements focusing on reducing precious metal usage in catalysts, improving system durability, and enhancing operational efficiency under varying load conditions are crucial in sustaining market momentum and meeting the demands for next-generation, low-emission engines.

Exhaust Gas Purifier Market Executive Summary

The global Exhaust Gas Purifier Market is positioned for robust expansion, driven by regulatory convergence towards zero-emission targets and a global shift in consumer and corporate environmental consciousness. Business trends indicate a strong move toward consolidated supply chains, where system integration capability—combining complex sensors, controls, and purification modules—is becoming a primary competitive differentiator. Strategic investments are heavily skewed toward Selective Catalytic Reduction (SCR) technology, particularly in the heavy-duty and marine sectors, owing to its superior NOx reduction efficiency required by Tier 4 and IMO regulations. Furthermore, the market is seeing increased penetration in the aftermarket segment as older vehicles and machinery retrofit systems to comply with new urban low-emission zones.

Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market, largely fueled by aggressive regulatory implementation in countries like China and India, coupled with massive growth in automotive production and infrastructure development. While North America and Europe remain key centers for advanced technology adoption and high-value system sales, the focus in these established markets is shifting toward maintaining ultra-low emission standards and developing technologies compatible with alternative fuels, such as natural gas and hydrogen. Regulatory pressures, especially those targeting ultrafine particulate matter and greenhouse gas emissions, are reshaping product offerings globally.

Segment trends reveal that the road transport sector dominates the market in terms of volume, but the marine and stationary engine segments offer higher growth potential due to the late adoption of stringent standards (e.g., IMO 2020) and the increasing use of distributed power generation. By technology, the synergy between Diesel Particulate Filters (DPF) and SCR systems is essential for meeting combined NOx and PM reduction targets. Future trends anticipate greater integration of smart, connected sensors that utilize predictive analytics to optimize catalyst performance, manage regeneration cycles efficiently, and reduce overall operational expenses for fleet operators.

AI Impact Analysis on Exhaust Gas Purifier Market

User inquiries regarding AI's influence in the Exhaust Gas Purifier Market commonly center on three core areas: real-time efficiency monitoring, predictive maintenance requirements, and the optimization of chemical injection rates, particularly for SCR systems. Users seek to understand how AI can minimize reagent consumption (like urea/DEF), prolong catalyst lifespan, and guarantee emissions compliance under highly variable operating conditions (e.g., varying engine load, altitude, and fuel quality). The consensus expectation is that AI integration will shift emission control from reactive regulation to proactive, predictive management, thereby reducing downtime and operational costs.

AI and machine learning algorithms are increasingly being deployed to analyze massive datasets generated by exhaust gas monitoring sensors (temperature, pressure, NOx, PM levels). By correlating operational data with external variables, AI can create highly accurate predictive models for catalyst aging and system failures. This capability allows operators to schedule maintenance precisely when necessary, rather than relying on fixed intervals, optimizing uptime and ensuring continuous emissions compliance. Furthermore, sophisticated algorithms are essential for dynamic control of complex purification processes, ensuring optimal chemical reactions occur instantly as driving or operating conditions change.

The long-term impact of AI extends into the material science and R&D domains of the purification industry. Machine learning is being used to rapidly screen and predict the performance of new catalyst formulations, reducing the reliance on costly and time-consuming physical testing. By simulating how different chemical compositions react to various pollutants and temperatures, researchers can accelerate the development of cheaper, more durable catalysts that require fewer precious metals, addressing a major cost constraint within the industry. This AI-driven innovation pipeline is critical for developing systems capable of tackling future, ultra-low emission standards.

- AI optimizes DEF (Diesel Exhaust Fluid) injection rates in SCR systems, minimizing operational expenditure.

- Predictive maintenance algorithms anticipate catalyst degradation and DPF clogging, maximizing system uptime.

- Machine learning enhances real-time monitoring, ensuring continuous compliance with regulatory limits in dynamic environments.

- AI accelerates R&D for novel catalyst materials, reducing reliance on expensive precious metals.

- Advanced diagnostics utilize AI to identify and isolate sensor failures or component malfunctions rapidly.

DRO & Impact Forces Of Exhaust Gas Purifier Market

The dynamics of the Exhaust Gas Purifier Market are fundamentally shaped by a powerful interplay of regulatory mandates (Drivers), significant capital and maintenance expenditures (Restraints), the transition to alternative fuels (Opportunities), and the underlying forces of geopolitical stability and technological obsolescence (Impact Forces). The core market growth is sustained by the relentless global push toward cleaner air, which translates directly into non-negotiable compliance requirements across transportation and industrial sectors. This regulatory momentum ensures a baseline demand, making purifiers an indispensable component of modern engine architecture.

However, the market faces significant friction points. The high initial capital outlay associated with complex purification systems, especially SCR units requiring ancillary fluids and storage, acts as a primary restraint, particularly for small and mid-sized enterprises or fleets operating on tight margins. Furthermore, the lifetime maintenance and replacement costs of components like catalysts and particulate filters, often containing expensive precious metals (Platinum, Palladium, Rhodium), present continuous operational challenges. The logistical complexity of managing DEF (Diesel Exhaust Fluid) supply chains, particularly in remote operating areas, also impedes seamless adoption.

Opportunities for disruptive growth emerge primarily from the global energy transition. The increasing adoption of cleaner fuels—such as natural gas, LPG, hydrogen, and various biofuels—necessitates the development of entirely new purification systems designed specifically for their unique emission profiles (e.g., controlling methane slip). Furthermore, the substantial and growing global aftermarket segment offers significant revenue potential through mandatory retrofit programs and scheduled component replacement. The key impact forces include evolving geopolitical relationships that influence global shipping regulations (IMO standards) and the rapid pace of battery electric vehicle (BEV) and fuel cell electric vehicle (FCEV) development, which represents a long-term threat of technological obsolescence to the entire combustion engine segment.

Segmentation Analysis

The Exhaust Gas Purifier Market is highly segmented across several critical dimensions, including the type of purification technology employed, the type of fuel used by the engine, the end-use application, and the size of the vehicle or engine power output. Understanding these segments is crucial for analyzing market penetration rates and identifying areas of rapid technological deployment. The functional complexity and cost of the purification system vary dramatically based on the target pollutant and the required reduction efficiency, leading to specialized product lines for road transport, marine, and stationary power generation sectors. Technological segmentation, primarily between catalytic converters, particulate filtration, and chemical reduction systems, dictates the competitive landscape and R&D focus of major industry players.

- By Type of Technology:

- Selective Catalytic Reduction (SCR)

- Diesel Oxidation Catalyst (DOC)

- Diesel Particulate Filter (DPF)

- Gasoline Particulate Filter (GPF)

- Three-Way Catalyst (TWC)

- Exhaust Gas Recirculation (EGR)

- Other Advanced Oxidation Systems

- By Fuel Type:

- Diesel

- Gasoline

- Natural Gas/LPG

- Heavy Fuel Oil (HFO)

- By Application/End-Use:

- Automotive (Passenger Vehicles, Commercial Vehicles)

- Marine (Ocean-going, Inland Waterways)

- Industrial & Power Generation (Stationary Engines, Turbines)

- Construction and Off-Highway Equipment (OHW)

- By Vehicle Type (Automotive Segment):

- Light-Duty Vehicles

- Medium and Heavy-Duty Vehicles

- By Sales Channel:

- Original Equipment Manufacturers (OEM)

- Aftermarket

Value Chain Analysis For Exhaust Gas Purifier Market

The value chain of the Exhaust Gas Purifier Market is intricate, starting from the sourcing of rare and precious raw materials and extending through complex manufacturing processes to distribution via dual channels: direct supply to Original Equipment Manufacturers (OEMs) and indirect sales through the aftermarket. Upstream analysis focuses heavily on the procurement of high-purity ceramic or metallic substrates and critical precious metals (PGMs) like Platinum, Palladium, and Rhodium. The volatility and scarcity of these materials exert significant influence over manufacturing costs and pricing strategies. Key suppliers in this stage are specialized mining operations and chemical processors who refine the catalyst washcoat ingredients, ensuring the required thermal stability and catalytic activity.

The middle segment involves core manufacturing and system integration. This includes coating the substrates with the catalyst washcoat (the most technologically intensive step), fabricating the housing and canning, and integrating the components (such as sensors, injectors, and control units) into a unified exhaust aftertreatment system. Companies successful in this stage are those that maintain rigorous quality control, possess proprietary washcoat formulas, and leverage advanced manufacturing techniques like robotic welding and automated assembly. System integrators, who often serve as Tier 1 suppliers, play a crucial role in validating these systems for specific engine architectures and regulatory compliance before delivery to OEMs.

Downstream analysis highlights the dual distribution strategy. The direct channel involves supplying customized, high-volume systems to OEMs for new vehicle production, characterized by long-term contracts and stringent technical specifications. The indirect channel, or aftermarket, is crucial for replacement parts (catalyst bricks, DPFs) and retrofit solutions, distributed through a network of specialized distributors, service centers, and maintenance providers. The profitability in the aftermarket tends to be higher due to less price sensitivity and the regulatory requirement for timely replacement of spent components to maintain legal operation. Effective logistics and inventory management are paramount to supporting the diverse needs of the global vehicle fleet.

Exhaust Gas Purifier Market Potential Customers

Potential customers for exhaust gas purification systems span several industrial categories, unified by their reliance on internal combustion engines and the necessity of complying with emission standards. The most significant customer segment comprises automotive Original Equipment Manufacturers (OEMs), who incorporate these systems directly into newly manufactured passenger and commercial vehicles. These buyers prioritize integration compatibility, weight reduction, and guaranteed compliance across their diverse engine lineups. The shift toward modular, standardized purification units is appealing to OEMs seeking manufacturing efficiencies and platform scalability across regional regulations.

Another major segment includes fleet operators and owners of heavy machinery and marine vessels. This group often purchases systems through the aftermarket for maintenance replacements or mandated retrofitting. For marine operators, compliance with IMO Tier III and regional sulfur limits (e.g., in Emission Control Areas) drives purchasing decisions, favoring robust, high-capacity SCR and scrubber systems capable of handling varying fuel qualities. Fleet owners are highly sensitive to Total Cost of Ownership (TCO), focusing on systems that offer long service intervals, minimal maintenance downtime, and low operational costs associated with DEF consumption.

Finally, stationary engine operators, including those in power generation, oil & gas exploration, and large industrial facilities, represent a niche but high-value customer base. These users require specialized, heavy-duty purification systems tailored for continuous operation and extremely high flow rates. Regulatory pressure at the state or local level often dictates the type and efficiency of the required emission control equipment, making customized engineering solutions a key selling point for serving these end-users.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.8 Billion |

| Market Forecast in 2033 | USD 26.1 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson Matthey, BASF SE, Umicore, Corning Incorporated, Tenneco Inc., Faurecia (FORVIA), Continental AG, NGK Insulators, Katcon, CDTI Advanced Materials, DCL International, Hug Engineering, Eberspaecher, Clean Diesel Technologies (CDTi), BOSAL, Weifu High-Technology Group, Miratech, Dinex A/S, Eminox Ltd., Rypos, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Exhaust Gas Purifier Market Key Technology Landscape

The Exhaust Gas Purifier Market is defined by a dynamic technology landscape centered on chemical catalysis and mechanical filtration. The dominant technology in heavy-duty diesel applications is Selective Catalytic Reduction (SCR), which chemically reduces Nitrogen Oxides (NOx) into nitrogen and water vapor using a reductant, typically Diesel Exhaust Fluid (DEF). SCR systems require precise temperature control and sophisticated injection strategies, driving innovation in sensor technology and electronic control units (ECUs). Concurrently, Diesel Particulate Filters (DPF) are indispensable for capturing soot and particulate matter (PM). The primary technological challenge for DPFs revolves around optimizing the regeneration process—burning off the collected soot—to minimize fuel penalty and ensure system longevity, leading to the development of highly efficient passive and active regeneration methods.

For gasoline engines, the ubiquitous Three-Way Catalyst (TWC) remains essential, simultaneously oxidizing CO and HC while reducing NOx. However, the advent of Gasoline Direct Injection (GDI) engines, which produce higher levels of particulate matter, has necessitated the rapid integration of Gasoline Particulate Filters (GPF). This evolution highlights a convergence of emission control strategies previously distinct between diesel and gasoline vehicles. Furthermore, the Diesel Oxidation Catalyst (DOC) plays a crucial pre-treatment role in diesel systems, converting CO and HC into water and CO2, and raising the exhaust temperature necessary for effective DPF regeneration and subsequent SCR reaction.

Emerging technological innovations are focused on non-thermal plasma catalysis and advanced material science. Non-thermal plasma techniques offer the potential to treat exhaust gases at lower temperatures, reducing the dependence on high-temperature engine operation and potentially lowering the overall system footprint and cost. Meanwhile, research into perovskites and base metal catalysts aims to significantly reduce the use of expensive Platinum Group Metals (PGMs) without sacrificing performance. The long-term trend involves optimizing these systems for hybrid and mild-hybrid powertrains, where engine operation is intermittent, posing new challenges for maintaining optimal catalyst operating temperatures.

Regional Highlights

The global distribution of the Exhaust Gas Purifier Market reflects regulatory stringency, vehicle production volumes, and industrial activity levels across different geographies. Each major region demonstrates unique market characteristics and growth drivers:

- Asia Pacific (APAC): This region dominates the market in terms of production volume and is poised for the highest growth rate. Key drivers include rapid urbanization, increasing industrialization, and the rigorous implementation of emission standards (e.g., China V/VI, Bharat Stage VI in India). The high volume of automotive manufacturing, coupled with mandatory system adoption in heavy-duty construction and agricultural equipment, makes APAC the central hub for catalyst and filter component fabrication.

- Europe: Characterized by some of the world's most aggressive emission targets (Euro 7 proposals), Europe is a leader in technology adoption, particularly for advanced systems like GPFs and highly efficient SCR systems integrated into complex aftertreatment layouts. Regulatory pushes for low-emission zones in major cities heavily stimulate the aftermarket for retrofit systems and component replacement in older diesel fleets.

- North America: Driven by EPA and CARB regulations (especially in California), the North American market is highly demanding regarding durability and compliance assurance. There is a strong emphasis on systems for heavy-duty commercial vehicles and large stationary power sources. The market focuses on advanced SCR systems and robust DPFs capable of handling extreme operational loads and diverse fuel qualities prevalent across the region.

- Latin America (LATAM): Growth in LATAM is more gradual, dependent on the phased implementation of Euro-equivalent standards in countries like Brazil and Mexico. The market often lags in adopting the latest technologies but offers significant potential for growth as governments enforce stricter controls over vehicle importation and local manufacturing standards.

- Middle East and Africa (MEA): This region is highly fragmented. Demand is primarily driven by industrial projects, oil and gas exploration, and large stationary power generation units. Adoption rates for advanced automotive purifiers are variable, often tied to fuel quality standards and the presence of international vehicle manufacturers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Exhaust Gas Purifier Market.- Johnson Matthey

- BASF SE

- Umicore

- Corning Incorporated

- Tenneco Inc.

- Faurecia (FORVIA)

- Continental AG

- NGK Insulators

- Katcon

- CDTI Advanced Materials

- DCL International

- Hug Engineering

- Eberspaecher

- Clean Diesel Technologies (CDTi)

- BOSAL

- Weifu High-Technology Group

- Miratech

- Dinex A/S

- Eminox Ltd.

- Rypos, Inc.

Frequently Asked Questions

Analyze common user questions about the Exhaust Gas Purifier market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Exhaust Gas Purifier Market?

The primary driver is the enforcement of increasingly strict global emission regulations, such as Euro 6/7, EPA Tier standards, and IMO Tier III for marine vessels. These mandates necessitate the universal adoption of high-efficiency aftertreatment systems (like SCR and DPF) across new engine production and existing fleets.

How does Selective Catalytic Reduction (SCR) technology work in exhaust gas purification?

SCR is a post-combustion process that injects a liquid reductant, typically urea-based Diesel Exhaust Fluid (DEF), into the exhaust stream. When this mixture passes over a specialized catalyst, it chemically converts harmful Nitrogen Oxides (NOx) into harmless diatomic nitrogen (N2) and water (H2O), achieving high NOx reduction efficiencies critical for heavy-duty compliance.

What are the main restraints hindering widespread adoption of advanced purification systems?

The major restraints include the high initial capital cost of installing complex systems, significant operational expenses related to maintenance and the periodic replacement of components containing expensive Platinum Group Metals (PGMs), and the added logistical complexity of managing DEF supply chains for SCR systems.

How is the transition to alternative fuels like hydrogen impacting the demand for traditional exhaust purifiers?

While hydrogen fuel cell vehicles (FCEVs) eliminate tailpipe emissions entirely, the gradual transition means that purification systems are still crucial for engines running on natural gas (managing methane slip) and hybrid powertrains. The long-term impact is a risk of technological obsolescence for internal combustion engine purifiers, balanced by near-term demand for specialized systems compatible with low-carbon fuels.

Which geographical region exhibits the fastest growth potential for exhaust gas purification technologies?

The Asia Pacific (APAC) region is projected to register the fastest growth due to rapid infrastructure and vehicle production expansion, coupled with the recent and rigorous implementation of stringent national emission standards across major economies like China and India, creating enormous demand for compliant aftertreatment technologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager