Exhaust Turbocharger Actuator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438269 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Exhaust Turbocharger Actuator Market Size

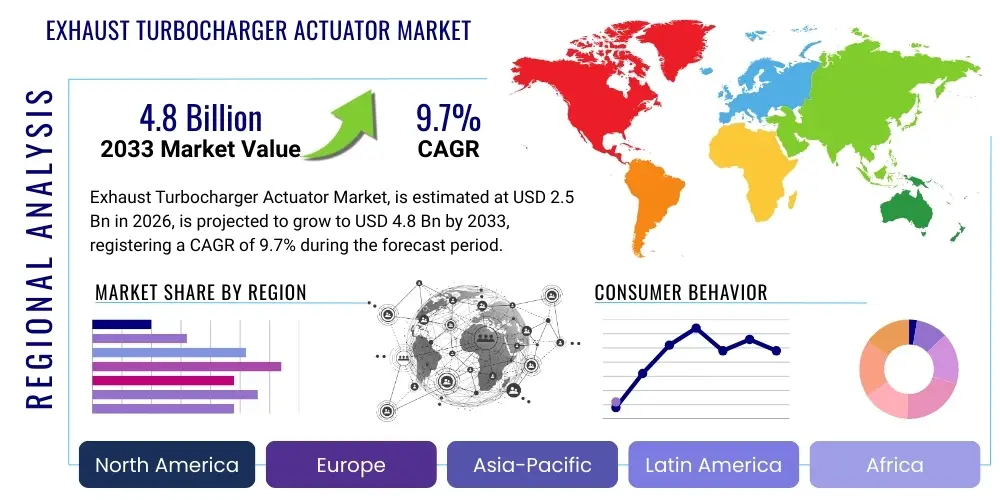

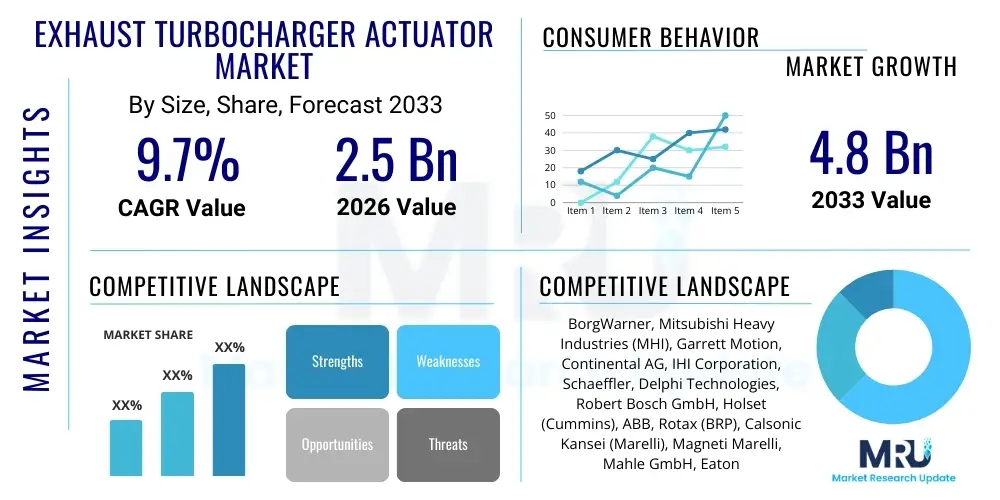

The Exhaust Turbocharger Actuator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.7% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 4.8 Billion by the end of the forecast period in 2033.

The substantial growth trajectory of the turbocharger actuator market is fundamentally driven by the global imperative to enhance fuel efficiency and minimize harmful emissions across the automotive and industrial sectors. Exhaust turbocharger actuators are critical components responsible for controlling the flow of exhaust gases to the turbine, thereby managing boost pressure and optimizing engine performance across varying operating conditions. The increasing penetration of small-displacement, turbocharged gasoline direct injection (GDI) and diesel engines, particularly in emerging economies, provides a robust foundation for market expansion, ensuring that the demand for reliable and precise boost control mechanisms remains high throughout the forecast horizon. Furthermore, the relentless pressure exerted by regulatory bodies, such as those enforcing Euro 7 standards in Europe and CAFE standards globally, necessitates the adoption of highly efficient turbocharging systems, directly fueling the demand for advanced, electronically controlled actuators.

Technological advancements, specifically the widespread shift from traditional pneumatic actuators to sophisticated electric actuators (E-actuators), are major catalysts influencing market valuation. Electric actuators offer superior precision, faster response times, and greater flexibility in engine calibration, which are essential features for meeting the stringent requirements of modern powertrain control units. This transition is capital-intensive but yields significant performance benefits, positioning E-actuators as the primary growth segment. The commercial vehicle sector, facing similar pressure to reduce greenhouse gas emissions and improve operational efficiency, is increasingly integrating advanced turbocharger systems utilizing these high-precision actuators, further consolidating the market's upward momentum toward the projected USD 4.8 Billion valuation by 2033.

Exhaust Turbocharger Actuator Market introduction

The Exhaust Turbocharger Actuator Market encompasses the development, manufacturing, and distribution of components designed to mechanically or electronically control the operational parameters of turbochargers installed in internal combustion engines. These actuators primarily regulate the flow of exhaust gas energy directed to the turbine wheel, effectively managing the boost pressure delivered to the engine cylinders. The two dominant types of actuators are pneumatic (vacuum or pressure controlled) and electric (electronically controlled), each tailored to different levels of performance and precision requirements. Turbocharger actuators are indispensable in modern vehicles, enabling engine downsizing without sacrificing power output, a key strategy employed by Original Equipment Manufacturers (OEMs) to comply with rigorous fuel economy and emissions mandates.

Major applications of these actuators span across light-duty passenger vehicles (sedans, SUVs), heavy-duty commercial vehicles (trucks, buses), and off-highway machinery (construction, agriculture). The primary benefit conferred by these systems is enhanced engine efficiency, resulting in reduced fuel consumption and lower CO2 and NOx emissions. By controlling mechanisms such as wastegates or Variable Geometry Turbine (VGT) vanes, the actuator ensures optimal torque delivery across the entire engine speed range, mitigating the undesirable effect known as turbo lag. The market's driving factors include global regulatory mandates pushing for cleaner engines, the ongoing trend of engine downsizing across major automotive regions, and the continuous innovation in electric actuator technology offering finer control over turbine dynamics compared to their pneumatic predecessors.

The core functionality of an exhaust turbocharger actuator is centered on achieving dynamic engine management, adjusting to instantaneous demands placed upon the vehicle. In VGT systems, the actuator precisely controls the angle of the vanes surrounding the turbine wheel, altering the flow velocity and pressure to match required engine performance. This capability is paramount in high-performance diesel applications and increasingly utilized in gasoline engines. The shift towards higher thermal efficiency and complex thermodynamic cycles in engines ensures that the actuators remain vital components, acting as the dynamic interface between the Engine Control Unit (ECU) and the mechanical turbocharging hardware, essential for maximizing power density and minimizing the environmental footprint of modern powertrains.

Exhaust Turbocharger Actuator Market Executive Summary

The Exhaust Turbocharger Actuator Market is characterized by robust growth, propelled primarily by global efforts to mitigate automotive emissions and the technological transition toward sophisticated electronic controls. Key business trends indicate an increasing focus on vertical integration among major turbocharger manufacturers, who are investing heavily in producing their own electric actuator technology to ensure seamless system integration and proprietary control algorithms. Strategic partnerships between traditional component suppliers and automotive software developers are also emerging to address the complexity of integrating E-actuators with advanced ECU architectures. Furthermore, the aftermarket segment is experiencing moderate growth driven by replacement demand and the need for high-quality components to maintain emission compliance in aging turbocharged fleets, creating diverse revenue streams for specialized suppliers and distributors.

Regionally, Asia Pacific (APAC) dominates the market share, fueled by the massive production capacity in countries like China and India, coupled with the rapid implementation of stringent emission standards (e.g., China VI, Bharat Stage VI). Europe remains the technological leader, driven by rigorous targets like Euro 7, which mandate the adoption of high-precision VGT systems predominantly featuring electric actuators. North America, while having a significant market presence, sees steady growth anchored by the large Light Commercial Vehicle (LCV) segment and the persistent trend of turbocharging gasoline engines for efficiency gains. These regional dynamics are leading to localized manufacturing and supply chain optimization efforts to serve geographically diverse OEM requirements effectively.

Segment trends highlight the undeniable dominance of Electric Actuators (E-actuators) over traditional Pneumatic Actuators, especially in new vehicle platforms that utilize Variable Geometry Turbochargers (VGT) or complex twin-turbo setups. Within the Vehicle Type segmentation, Passenger Cars constitute the largest volume market, but the Heavy Commercial Vehicles (HCV) segment offers higher value per unit due to the necessity of robust, high-durability actuators designed for extreme operating conditions and long service intervals. The Wastegate segment, while facing substitution pressure from VGT technology in premium segments, continues to hold a substantial share in cost-sensitive mid-range gasoline vehicles, ensuring market diversity based on application and cost parameters.

AI Impact Analysis on Exhaust Turbocharger Actuator Market

Common user questions regarding AI's impact on the Exhaust Turbocharger Actuator Market frequently revolve around predictive maintenance capabilities, optimization of actuator control strategies, and the integration of machine learning into real-time engine calibration. Users are particularly interested in how AI algorithms can anticipate actuator failure modes, thereby reducing costly vehicle downtime, and how sophisticated neural networks can optimize the boost response curve more effectively than traditional PID controllers under dynamic driving conditions. Furthermore, there is significant inquiry into the use of AI in computational fluid dynamics (CFD) for designing more efficient turbine and compressor housing geometries, leading to actuators that can handle higher thermal loads and provide finer control, ultimately ensuring that manufacturers are meeting increasingly tighter regulatory margins.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally shifting the operational paradigm of exhaust turbocharger actuators, transitioning them from purely electro-mechanical devices to intelligent components within the larger engine management ecosystem. AI/ML models are being trained using vast datasets from real-world driving cycles and sensor feedback, allowing the Engine Control Unit (ECU) to perform highly adaptive control of the actuator. This adaptive control compensates for component wear, aging effects, and varying environmental conditions (altitude, temperature), ensuring that the turbocharger always operates at peak efficiency. This minimizes the need for fixed calibration maps and enables dynamic adjustments that were previously impossible, leading to further reductions in fuel consumption and localized emissions output.

Beyond operational control, AI significantly impacts the manufacturing and supply chain of actuators. Predictive models are utilized to forecast demand based on global vehicle production schedules and regional regulatory shifts, optimizing inventory levels and reducing lead times. In the manufacturing process itself, computer vision and ML algorithms are deployed for quality control, instantly identifying microscopic defects in actuator components or assembly flaws, which is crucial for components operating under high heat and stress. This proactive approach to quality assurance, driven by AI, enhances the reliability and longevity of the actuator, addressing a key concern among end-users regarding component durability in complex turbocharged systems.

- AI enables predictive maintenance systems, forecasting actuator component wear and preventing unscheduled failures.

- Machine Learning algorithms optimize actuator control strategies in real-time, adapting boost pressure delivery based on dynamic driving inputs and environmental conditions.

- AI facilitates advanced design optimization through computational fluid dynamics (CFD), leading to lighter, more thermally resilient actuator mechanisms.

- AI-driven automated inspection systems improve manufacturing quality control, ensuring zero-defect assembly of precision components.

- Deep Learning models enhance fault detection and diagnostics (FDD) within the ECU, rapidly identifying actuator performance degradation.

- Artificial Neural Networks (ANNs) are used for complex calibration of Variable Geometry Turbochargers (VGT) in diverse engine platforms.

DRO & Impact Forces Of Exhaust Turbocharger Actuator Market

The Exhaust Turbocharger Actuator Market is influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), all subject to significant impact forces, primarily regulatory pressure and technological evolution. The chief driver is the implementation of global emission standards, such as Euro 7, Tier 4, and China VI, which necessitates highly precise boost control achievable only through advanced actuator technologies, specifically electric and integrated systems. Opportunities arise from the rapid electrification of the automotive industry, where actuators find application in highly sophisticated mild-hybrid and plug-in hybrid electric vehicles (PHEVs) that still rely on combustion engines for range extension and primary power, requiring actuators that can manage transient operations and start/stop cycles effectively. Conversely, the market faces restraints due to the high material and development costs associated with advanced E-actuators and the inherent technological complexity of integrating these components flawlessly with diverse engine control units and turbocharger architectures across various OEM platforms.

The primary impact force shaping this market is the technological shift toward Electric Actuators (E-actuators). Unlike older pneumatic systems relying on vacuum or compressed air supplied by the engine, E-actuators use a high-precision DC motor and sophisticated gearing, controlled directly by the ECU. This transition significantly impacts the supply chain, requiring specialized expertise in electronics, motor design, and control software, raising the entry barrier for smaller players. Furthermore, the long-term threat of battery electric vehicles (BEVs) represents a structural restraint, as BEV adoption ultimately eliminates the need for exhaust gas management components like turbochargers and their actuators. This looming transition forces manufacturers to focus R&D efforts on short-to-medium-term solutions, maximizing efficiency in the remaining combustion engine era, while simultaneously exploring non-automotive applications for their precision control technologies.

Another major impact force is the volatile global supply chain for electronic components and rare earth minerals utilized in electric motors within E-actuators. Disruptions in the supply of microcontrollers and specific magnet materials can lead to manufacturing delays and cost inflation, directly affecting OEM profitability and pricing structures in the actuator market. However, opportunities in the aftermarket and remanufacturing sectors remain strong, especially in regions with older vehicle fleets where repairs and replacements of actuators are frequent. The drive for higher durability and temperature resistance is also creating a niche opportunity for suppliers developing actuators based on innovative material science, capable of withstanding the increasingly high exhaust gas temperatures generated by highly boosted, downsized engines, ensuring robust growth within specific high-performance and heavy-duty segments.

Segmentation Analysis

The Exhaust Turbocharger Actuator Market is systematically segmented based on Actuator Type, Turbocharger Technology, Vehicle Type, and Material Type, reflecting the diversity of engine architectures and performance requirements across the global automotive industry. Actuator Type segmentation is critical, highlighting the evolutionary shift from simpler, cost-effective pneumatic systems to highly responsive and sophisticated electric control units. The complexity and precision of the application, dictated by emission standards and performance targets, generally determine which type of actuator is utilized. This segmentation provides clarity regarding technological maturity and market penetration rates for different actuator solutions across geographical regions and vehicle classes.

Segmentation by Turbocharger Technology distinguishes between standard Wastegate systems, which bypass excess exhaust gas, and Variable Geometry Turbochargers (VGT/VNT), which dynamically alter flow characteristics. VGT systems demand much higher precision actuators, leading to a higher average selling price (ASP) and a higher concentration of electric actuator usage. The Vehicle Type segmentation—encompassing Passenger Cars, Light Commercial Vehicles (LCV), and Heavy Commercial Vehicles (HCV)—is crucial for market sizing, as HCVs require actuators optimized for longevity and extreme torque requirements, contrasting sharply with the volume-driven, cost-sensitive passenger car segment. Analyzing these segments helps stakeholders define targeted product development strategies and market entry points.

Furthermore, the Material Type segmentation, focusing on the construction materials used for actuator housings and internal components (e.g., aluminum, stainless steel, high-temperature polymers), influences durability, weight, and cost. Given the extreme thermal environment of the exhaust system, selecting materials that offer both light weight and excellent heat resistance is a key design consideration, particularly for next-generation actuators used in highly boosted GDI engines. The continuous interplay between these segments defines the competitive landscape, with Electric Actuators and VGT Technology in the Passenger Car and HCV sectors driving the majority of value growth throughout the forecast period due to ongoing efficiency mandates.

- Actuator Type:

- Pneumatic Actuators (Vacuum/Pressure Controlled)

- Electric Actuators (E-Actuators)

- Turbocharger Technology:

- Wastegate Turbochargers

- Variable Geometry Turbochargers (VGT/VNT)

- Twin-Turbo/Sequential Turbo Systems

- Vehicle Type:

- Passenger Cars (PC)

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- Off-Highway Vehicles

- Material Type:

- Aluminum-based Housing

- Steel and Alloy-based Components

- High-Temperature Polymer Composites

- Sales Channel:

- OEM (Original Equipment Manufacturer)

- Aftermarket

Value Chain Analysis For Exhaust Turbocharger Actuator Market

The value chain of the Exhaust Turbocharger Actuator Market begins with upstream raw material suppliers, predominantly providing high-grade steels, specialized heat-resistant aluminum alloys, plastics for electrical housings, and critical electronic components such as microcontrollers, sensors, and magnetic materials (rare earth elements) for electric motors. The reliance on sophisticated electronics and precision machining for actuator components, particularly the gear train in E-actuators, places significant quality and sourcing requirements on upstream partners. Manufacturers often face volatility in the prices and availability of rare earth magnets, which necessitates robust supply chain risk mitigation strategies to ensure continuity of production for high-demand electric actuators that require powerful, compact motors.

The midstream involves the core manufacturing process, where specialized turbocharger and actuator suppliers (Tier 1 suppliers) engage in high-precision machining, assembly, testing, and integration. This stage is characterized by significant R&D investment focused on thermal management, vibration resistance, and proprietary control software development. Tier 1 suppliers often collaborate closely with OEMs during the engine design phase to ensure seamless mechanical and electronic integration of the actuator with the specific turbocharger and engine control system. The manufacturing complexity is higher for E-actuators, which require clean-room assembly environments and stringent electronic validation procedures, differentiating the capabilities of major market players.

Downstream analysis focuses on distribution channels, which are broadly categorized into Direct Sales to OEMs and Indirect Sales via the Aftermarket. The majority of actuators are sold directly to OEMs for new vehicle assembly, representing the highest volume and value segment. These contracts are long-term and often exclusive. The Aftermarket distribution channel involves specialized distributors, authorized repair shops, and independent garages. For the aftermarket, product availability, competitive pricing, and certified remanufactured units are key success factors. The high technicality of replacement requires efficient technical support and specialized diagnostic tools, solidifying the importance of authorized distribution networks in maintaining product performance standards and brand reputation across both direct and indirect sales channels.

Exhaust Turbocharger Actuator Market Potential Customers

The primary customers for exhaust turbocharger actuators are Original Equipment Manufacturers (OEMs) in the automotive and industrial machinery sectors. These include global automotive giants specializing in Passenger Cars and Light Commercial Vehicles (Ford, Volkswagen, Hyundai-Kia, General Motors, Toyota, etc.), which represent the highest volume demand, driven by the mass adoption of small-displacement turbocharged engines. OEMs require actuators in large batches, often demanding customized specifications regarding mounting interfaces, control protocols (e.g., CAN bus communication), and thermal resilience testing specific to their engine families. The relationship with OEMs is strategic, focusing on collaborative design and long-term supply contracts to ensure production stability and quality consistency.

A second major customer segment includes manufacturers of Heavy Commercial Vehicles (HCVs) and off-highway equipment (Caterpillar, Volvo, Daimler Truck, Cummins, and John Deere). These industrial customers demand actuators built for extreme durability, resistance to continuous high temperatures, and high duty cycles, prioritizing robustness and longevity over marginal cost savings. Actuators for HCVs are typically larger, more powerful electric units designed to manage the high mass flow rates of large diesel engines. The focus for these buyers is Total Cost of Ownership (TCO) and maximizing uptime, leading to preference for suppliers with proven track records in severe-duty applications and reliable global service networks to minimize maintenance disruption.

The third significant customer segment is the Aftermarket, encompassing independent automotive repair shops, specialized turbocharger rebuilders, and large retail parts distribution networks. These buyers source actuators primarily for replacement and repair purposes across the existing vehicle fleet. Unlike OEM purchasing, the aftermarket demand is highly diverse in terms of product age and specification, requiring suppliers to maintain inventory for multiple generations of actuator technology, including both pneumatic and electric versions. Quality and competitive pricing are paramount in the aftermarket, often leading to a bifurcation between high-quality branded replacements and more economical, but compliant, non-OEM alternatives to meet varied consumer repair budgets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.8 Billion |

| Growth Rate | CAGR 9.7% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BorgWarner, Mitsubishi Heavy Industries (MHI), Garrett Motion, Continental AG, IHI Corporation, Schaeffler, Delphi Technologies, Robert Bosch GmbH, Holset (Cummins), ABB, Rotax (BRP), Calsonic Kansei (Marelli), Magneti Marelli, Mahle GmbH, Eaton Corporation, Knorr-Bremse, Woodward Inc., DENSO Corporation, Honeywell International Inc., Turbonetics Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Exhaust Turbocharger Actuator Market Key Technology Landscape

The technology landscape of the Exhaust Turbocharger Actuator Market is currently dominated by the evolutionary shift from mechanical/vacuum-operated pneumatic systems to fully electronic control systems. Electric actuators (E-actuators) represent the state-of-the-art, offering closed-loop control, higher response rates, and superior accuracy essential for managing complex thermodynamic engine cycles and transient operating conditions. These E-actuators typically incorporate a DC motor, precision gearing (often utilizing planetary or worm gears), and an integrated position sensor to provide feedback to the ECU. This electronic sophistication allows for precise modulation of boost pressure, leading directly to reduced emissions, improved fuel economy, and better engine drivability, fundamentally supporting the success of advanced engine concepts like Miller cycle operation and high-compression ratio GDI engines.

A parallel key technology is the development and refinement of Variable Geometry Turbocharger (VGT) actuation systems. VGTs utilize movable vanes to optimize the flow angle and speed of exhaust gases entering the turbine, effectively allowing the turbocharger to operate optimally across a wider range of engine speeds. The actuators managing these vanes must withstand extremely high temperatures and high cycle counts, driving material science innovation towards robust, thermally stable components. Advancements in sensor technology and embedded control software are crucial here, enabling the actuator to execute complex vane movements quickly and accurately in response to millisecond-level changes in engine load, thereby virtually eliminating "turbo lag" and enhancing torque delivery at low RPMs.

Future technology focus areas include the integration of actuator functionality into compact, lightweight modules and the development of actuators capable of operating at even higher exhaust gas temperatures (up to 1050°C) as engine thermal efficiency continues to increase. There is also significant research into predictive diagnostics and communication protocols. Next-generation actuators are expected to incorporate enhanced onboard computing capabilities to self-diagnose mechanical degradation and communicate highly detailed performance data back to the vehicle network, supporting over-the-air updates and remote diagnostics. This trend towards intelligent, self-monitoring actuator systems underscores the market's trajectory toward integration within the broader framework of connected vehicle powertrain management.

Regional Highlights

The regional analysis reveals distinct market dynamics influenced by localized regulatory frameworks, manufacturing bases, and consumer preferences for vehicle types and powertrain configurations.

- Asia Pacific (APAC): APAC holds the dominant market share, primarily driven by China and India. The rapid implementation of stringent emission norms (like China VI and Bharat Stage VI) has accelerated the shift from naturally aspirated engines to turbocharged ones, particularly in the mass-market passenger car segment. China, being the world's largest automotive producer, also acts as a major manufacturing hub for actuators, benefiting from economies of scale. The growth of the LCV and HCV sectors in developing APAC nations further solidifies the region's lead, demanding large volumes of durable pneumatic and increasingly sophisticated electric VGT actuators.

- Europe: Europe is characterized by high technological penetration and premium pricing, owing to the early adoption of highly efficient diesel and gasoline turbocharged engines. Driven by ambitious carbon reduction targets and the Euro 7 proposal, the region leads the global demand for advanced, high-precision electric actuators integrated with VGT technology. Germany, France, and the UK are key markets, focusing heavily on research and development for hybrid vehicle applications where actuator response time during start/stop operation is critical.

- North America: North America presents a stable growth trajectory, dominated by the demand for turbocharged gasoline engines in Passenger Cars and Light Trucks/SUVs, driven by CAFE standards. While the market initially lagged Europe in electric actuator adoption, the trend is accelerating, particularly within the heavy-duty sector where Cummins, Caterpillar, and other major players are incorporating advanced actuators for compliance with EPA regulations and improved engine efficiency in freight transport.

- Latin America, Middle East, and Africa (LAMEA): This region is generally slower in the technological transition, with pneumatic actuators holding a larger share due to cost sensitivity and varying fuel quality standards. However, urbanization and increasing vehicle penetration in major economies like Brazil and South Africa are driving long-term demand. The focus here is balanced between affordability and necessary compliance upgrades, creating opportunities for suppliers of robust, mid-range actuator solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Exhaust Turbocharger Actuator Market.- BorgWarner

- Mitsubishi Heavy Industries (MHI)

- Garrett Motion

- Continental AG

- IHI Corporation

- Schaeffler

- Delphi Technologies

- Robert Bosch GmbH

- Holset (Cummins)

- ABB

- Rotax (BRP)

- Calsonic Kansei (Marelli)

- Magneti Marelli

- Mahle GmbH

- Eaton Corporation

- Knorr-Bremse

- Woodward Inc.

- DENSO Corporation

- Honeywell International Inc.

- Turbonetics Inc.

Frequently Asked Questions

Analyze common user questions about the Exhaust Turbocharger Actuator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an exhaust turbocharger actuator?

The primary function of an exhaust turbocharger actuator is to control the boost pressure delivered by the turbocharger to the engine intake. It achieves this by modulating the flow of exhaust gases to the turbine, typically by operating a wastegate (bypass valve) or adjusting the vanes in a Variable Geometry Turbocharger (VGT), ensuring optimal performance and emission compliance across all engine speeds.

Why are Electric Actuators (E-actuators) replacing Pneumatic Actuators?

Electric Actuators offer superior precision, much faster response times, and finer control over boost pressure compared to pneumatic systems. Their direct electronic control allows for seamless integration with modern Engine Control Units (ECUs) and is necessary to meet the demanding requirements of stringent emission standards (like Euro 7) and advanced VGT turbocharger systems.

How do emission regulations impact the demand for turbocharger actuators?

Stringent emission regulations globally necessitate higher engine efficiency and cleaner combustion. This drives the adoption of smaller, highly boosted, turbocharged engines, which in turn increases the demand for high-precision actuators (especially VGT E-actuators) required to accurately manage air-fuel ratios and optimize exhaust gas recirculation (EGR) systems crucial for NOx reduction.

Which geographic region leads the Exhaust Turbocharger Actuator Market in terms of volume?

The Asia Pacific (APAC) region, led by mass automotive production in countries like China and India, holds the largest volume share of the market. This dominance is due to rapid market growth, increased vehicle production, and the transition to mandatory turbocharging solutions to comply with newly implemented regional emission standards.

What is the major technological challenge facing actuator manufacturers?

The major technological challenge is designing actuators that maintain high electronic precision and reliability while operating under continuously increasing thermal loads. Modern downsized engines generate very high exhaust gas temperatures, requiring specialized high-temperature materials and robust electronic component protection, particularly for VGT E-actuators.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager