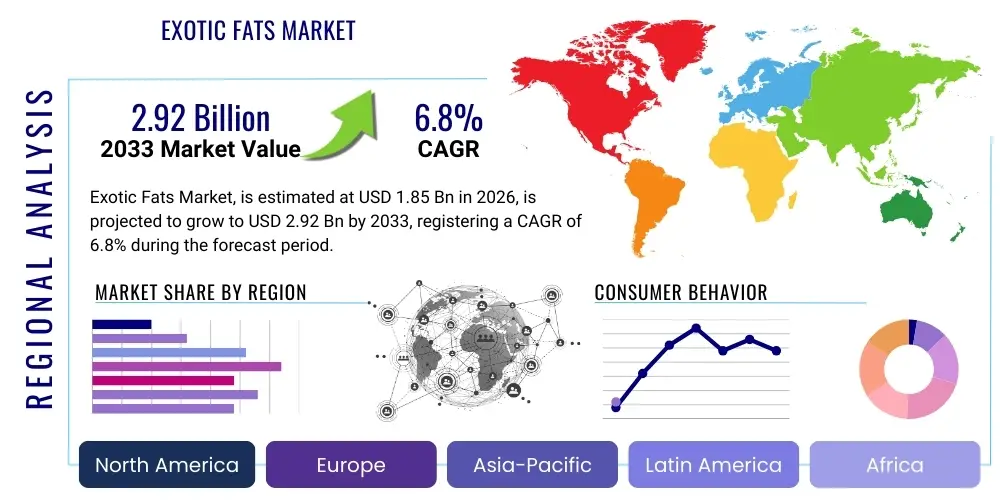

Exotic Fats Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437598 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Exotic Fats Market Size

The Exotic Fats Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.92 Billion by the end of the forecast period in 2033.

Exotic Fats Market introduction

Exotic fats refer to highly specialized, high-value lipids derived from non-traditional plant or fruit sources, often characterized by unique chemical compositions, high oxidative stability, and specific functional properties essential for cosmetic, nutraceutical, and premium food applications. These fats, such as Shea, Cocoa, Mango, Kokum, and various Amazonian butters and oils, are distinguished from common commodity fats (like palm or soy) by their inherent richness in essential fatty acids, antioxidants, vitamins, and phytosterols. The growing consumer preference for natural, clean-label ingredients, coupled with increasing demand for sustainable and ethically sourced raw materials, fundamentally drives the market expansion. These specialty fats are critical structural components in formulating products that require specific textures, melting profiles, or enhanced skin barrier functions.

The primary applications of exotic fats span across several high-growth industries. In the cosmetic and personal care sector, they are crucial emollients, stabilizers, and moisturizing agents used in high-end anti-aging creams, lip balms, sunscreens, and hair care products, valued for their deep moisturizing capabilities and anti-inflammatory properties. Within the food industry, exotic fats, especially those with sharp melting points, are indispensable for specialty confectionery, artisanal chocolates, and vegan alternatives, where they provide desired snap, gloss, and mouthfeel that conventional fats cannot replicate. Furthermore, the pharmaceutical and nutraceutical sectors utilize highly purified exotic oils, rich in specific bioactive compounds, for encapsulation, targeted drug delivery systems, and dietary supplements aimed at enhancing cardiovascular and cognitive health.

Driving factors for the exotic fats market include heightened consumer awareness regarding the potential health risks associated with synthetic and processed ingredients, leading to a pivot toward natural alternatives. Supply chain transparency and traceability are becoming non-negotiable, favoring suppliers who can verify sustainable sourcing and fair trade practices. Regulatory support in various regions for natural cosmetic and food ingredients further bolsters demand. Moreover, significant research and development investments by key market players are leading to the discovery of new exotic fat sources and enhanced extraction technologies (such as supercritical CO2 extraction), which improve purity, yield, and overall efficacy, thereby broadening their functional utility and applicability in premium product categories.

Exotic Fats Market Executive Summary

The Exotic Fats Market is characterized by robust growth, primarily fueled by the surging global demand for natural and sustainable ingredients within the cosmetics and specialty food sectors. Business trends show a strong emphasis on vertically integrated supply chains, allowing manufacturers to ensure quality control, ethical sourcing, and compliance with stringent environmental, social, and governance (ESG) criteria. Mergers, acquisitions, and strategic partnerships focused on securing access to unique raw material sources, particularly in biodiversity-rich regions like West Africa and the Amazon, are key strategies deployed by major market participants to maintain competitive advantage and diversify their product portfolios. Innovation in processing techniques, such as enzymatic modification and fractionation, is also enabling the creation of tailored exotic fat blends optimized for specific functional requirements, thereby expanding their use beyond traditional applications.

Regionally, the market dynamics are driven by distinct consumption patterns and regulatory environments. North America and Europe currently represent the largest revenue generators, primarily due to high consumer spending on premium personal care products and stringent regulations favoring natural ingredients. These regions are the key innovators and early adopters of novel exotic fats. Conversely, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, propelled by rapid urbanization, increasing disposable incomes, and the burgeoning local cosmetic and food processing industries, particularly in countries like China, India, and Japan, where traditional beauty and wellness rituals often incorporate natural oils and butters. Latin America remains a critical supply region, holding a vast reservoir of untapped exotic fat sources, presenting significant future growth potential for both local and international processing companies.

Segment trends highlight the dominance of the Shea Butter and Cocoa Butter segments due to their established industrial usage and large-scale availability, particularly within confectionery and body care applications. However, emerging segments like specialized fruit kernel oils (e.g., Marula, Argan, and Baobab) are demonstrating disproportionately high growth rates as consumers seek niche, high-performance ingredients with unique benefits. By application, the Personal Care and Cosmetics segment maintains the largest market share, driven by the clean beauty movement and the shift away from mineral oil and petroleum-derived ingredients. The Food & Beverage segment, especially the specialty chocolate and plant-based dairy substitute sub-segments, is experiencing accelerated adoption of exotic fats to improve texture and stability in premium formulations, indicating a clear trajectory toward functional specialization across all end-use industries.

AI Impact Analysis on Exotic Fats Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Exotic Fats Market frequently revolve around optimizing supply chain traceability, predicting crop yields based on climate data, enhancing product formulation efficiency, and identifying novel, high-potential exotic fat sources. Users are primarily concerned with how AI can ensure sustainability and ethical sourcing (e.g., verifying fair trade practices autonomously), minimize waste in processing, and accelerate R&D cycles for ingredient optimization. There is a strong expectation that AI will provide predictive analytics for market demand fluctuations, enabling proactive inventory management and reducing the inherent volatility associated with natural commodity sourcing. Key themes center on utilizing AI for quality control by detecting adulteration in high-value oils and using machine learning to customize fat blends for superior performance in complex cosmetic and food matrices.

- AI-powered predictive modeling optimizes harvesting schedules and logistics, minimizing post-harvest losses and ensuring timely delivery of perishable raw materials.

- Machine learning algorithms analyze climate data, soil composition, and historical yield records to forecast the supply volume and quality of exotic fat raw materials, aiding sourcing strategy.

- Computer vision and spectroscopic analysis, enhanced by AI, rapidly detect adulteration or contamination in high-value oils like Argan or Marula, ensuring purity and premium quality compliance.

- AI tools facilitate personalized product development by simulating thousands of fat blend combinations to achieve desired textural and stability properties (e.g., melting point, crystallization behavior) in cosmetics and confectionery.

- Blockchain integration, monitored and verified by AI, enhances supply chain transparency, providing real-time data on ethical sourcing, fair wages, and environmental impact for end-users.

- Natural Language Processing (NLP) analyzes global consumer trends, social media feedback, and regulatory changes to identify emerging niche exotic fats that warrant commercial exploration.

DRO & Impact Forces Of Exotic Fats Market

The Exotic Fats Market is influenced by a dynamic interplay of factors where strong drivers promoting natural ingredients are often counterbalanced by supply chain complexities and price volatility. Key drivers include the overwhelming consumer shift towards 'clean label' products, emphasizing natural origin and minimal processing, particularly in developed economies. This is strongly supported by the increasing global emphasis on sustainable and ethical sourcing, pushing manufacturers to invest in traceable and certified exotic fats. However, restraints present substantial challenges; the dependence on geographically concentrated and often remote harvesting areas creates inherent supply chain instability, vulnerability to adverse weather conditions, and significant price fluctuations. Furthermore, lack of standardization and limited scalability for lesser-known exotic fats hinder rapid commercial adoption, requiring significant R&D investment to overcome technical processing hurdles.

Opportunities for market expansion are significant, especially through the diversification of sourcing and the utilization of advanced processing technologies. There is a vast untapped potential in exploring and commercializing new, regionally specific exotic fats with unique functional benefits that cater to specific unmet needs in cosmetic and nutraceutical formulations. The burgeoning market for plant-based foods, including vegan confectionery and butter alternatives, offers a massive application avenue where exotic fats are essential for texture and sensory replication. Strategic partnerships between large corporations and local producer cooperatives in developing nations can secure sustainable sourcing and provide crucial technology transfer, thereby mitigating supply risks and fostering ethical development.

Impact forces currently shape market structure and competitive dynamics. The intensity of rivalry among existing players is moderate but rising, driven by efforts to secure long-term sourcing contracts and differentiate products based on purity and sustainability certifications. Supplier power is high, particularly for rare or niche fats, due to the specialized geographic concentration of raw materials and the often complex, time-consuming harvesting processes. Buyer power is moderate; while end-product manufacturers demand high quality and stability, the scarcity of suitable alternatives often limits their negotiation leverage. The threat of substitutes, largely synthetic emollients or commodity fats, is diminishing in premium segments due to strong consumer loyalty to natural ingredients, but remains a constraint in cost-sensitive mass-market applications. New entrants face high barriers related to establishing certified, traceable, and scalable supply chains, making market entry challenging without significant capital investment or unique sourcing agreements.

Segmentation Analysis

The Exotic Fats Market is strategically segmented based on factors including source, form, application, and geography, allowing for targeted analysis of consumer behavior and industrial utility. Segmentation by source is critical, differentiating between established market leaders like cocoa and shea, and high-growth niche oils such as mango, kokum, and specialized seed butters. The form segment distinguishes between crude, refined, and fractionated products, reflecting the level of processing required for end-use specifications, particularly in high-purity cosmetic and pharmaceutical grades. The application matrix defines the end market usage, with Personal Care and Cosmetics consistently dominating, followed by the high-growth Food & Beverage and Pharmaceuticals/Nutraceuticals sectors, each demanding specific functional characteristics from the fats used.

- By Source:

- Shea Butter

- Cocoa Butter

- Mango Butter

- Kokum Butter

- Illipe Butter

- Cupuacu Butter

- Others (Marula Oil, Argan Oil, Babassu Oil)

- By Form:

- Crude/Unrefined

- Refined/Deodorized

- Fractionated

- By Application:

- Personal Care & Cosmetics

- Skin Care

- Hair Care

- Make-up & Color Cosmetics

- Food & Beverages

- Confectionery & Bakery

- Specialty Frying & Cooking Oils

- Plant-Based Alternatives

- Pharmaceuticals & Nutraceuticals

- Drug Delivery Systems

- Dietary Supplements

- Personal Care & Cosmetics

- By Distribution Channel:

- Direct Sales/B2B

- Distributors/Intermediaries

- Online Retail

Value Chain Analysis For Exotic Fats Market

The value chain for exotic fats begins with highly specialized upstream activities, encompassing the sustainable harvesting and collection of raw materials, such as fruits, nuts, and kernels, often conducted by local communities or small-scale cooperatives in specific geographic regions (e.g., Shea nuts in West Africa). This upstream segment is highly decentralized and prone to seasonal and climate variability, making secure, long-term sourcing agreements crucial for processors. Key activities at this stage focus on manual collection, sorting, and primary drying or preparation, emphasizing ethical sourcing practices and certifications (Fair Trade, Organic) which add significant initial value and cost structure to the raw material.

The midstream phase involves the extraction and primary processing of the fats. This segment requires significant capital investment in specialized equipment, ranging from traditional cold-pressing techniques, preferred for unrefined, high-purity cosmetic oils, to advanced chemical or physical refining, bleaching, and deodorization (RBD) processes necessary for food-grade applications. Fractionation, which separates the fat into components with different melting points, is a crucial value-add step, enabling the creation of custom ingredients for specific industrial applications like chocolate coatings or stable cosmetic formulations. Major processors often establish facilities close to sourcing regions to reduce transportation costs and ensure ingredient freshness, though advanced refining often occurs near primary consumption markets.

The downstream analysis focuses on the distribution channels and end-user integration. Direct distribution (B2B) is standard for large volumes sold to major multinational cosmetic houses or food manufacturers, often involving customized specification compliance. Indirect distribution involves specialized ingredient distributors and brokers who manage inventory, small-batch orders, and provide technical support to smaller formulators. The final stage is the integration of the exotic fat into the final consumer product (creams, chocolate bars, supplements). The premium positioning of exotic fats means marketing efforts emphasize traceability, natural origin, and functional benefits to justify the higher retail price point, ensuring that the intrinsic value derived upstream is communicated effectively to the end consumer.

Exotic Fats Market Potential Customers

The primary customers for exotic fats are large-scale manufacturers and specialized formulators operating within industries demanding high-performance, natural lipid ingredients. Within the Personal Care and Cosmetics sector, major multinational corporations focused on luxury, clean beauty, and anti-aging product lines are the largest volume buyers, prioritizing certified organic, ethically sourced Shea, Cocoa, and Argan oils for their moisturizing and stabilizing properties. These customers require consistent quality and stable supply volumes, making reliability and compliance with regulatory standards (like REACH in Europe or FDA guidelines in the US) paramount purchasing criteria.

A second major customer group resides in the Food & Beverage industry, specifically niche confectioners, artisan chocolate producers, and the rapidly growing sector of plant-based dairy and meat alternatives. These buyers seek exotic fats, particularly fractionated cocoa and palm kernel alternatives, to achieve specific textural attributes—such as hardness, sharp melting points, or improved bloom resistance—that mimic traditional dairy or animal fats. The demand here is highly driven by functionality and achieving precise fat crystallization profiles critical for product integrity and sensory experience in specialty applications.

Furthermore, Pharmaceutical and Nutraceutical companies represent high-value, albeit lower volume, customers. They require ultra-pure, often highly refined or fractionated exotic oils (rich in specific triglycerides or essential fatty acids like Omega-3 or Omega-9 derived from certain exotic nuts) for use in soft-gel capsules, emulsifiers for drug coatings, and targeted delivery systems. These buyers place the highest premium on purity, standardization, and comprehensive documentation regarding safety and efficacy, often necessitating pharmaceutical-grade (Pharma GMP) certifications from their suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.92 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AAK AB, Cargill Incorporated, Fuji Oil Co., Ltd., Bunge Loders Croklaan, Ghana Nuts Company Ltd., Croda International Plc, SOPHIM, OLVEA Group, IOI Corporation Berhad, Wilmar International Ltd., Agsun International, BASF SE, Arboris LLC, Shebu Industries, Cosphatec GmbH, KimiKirei, Premier Specialties Inc., Akoma Cooperative Multipurpose Society, Savanna Shea, Natural Sourcing, LLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Exotic Fats Market Key Technology Landscape

The technological advancement in the exotic fats market is focused primarily on improving extraction efficiency, maximizing yield, maintaining ingredient integrity, and ensuring high purity for specialized applications. Traditional methods, such as mechanical pressing, are still widely used, particularly cold-pressing for unrefined butters and oils where retaining the maximum level of natural bioactive compounds (vitamins, antioxidants) is prioritized, especially for premium cosmetic grades. However, modern processing heavily relies on advanced solvent-free techniques to meet clean-label requirements.

A crucial technology gaining prominence is Supercritical Fluid Extraction (SFE), particularly using CO2. SFE allows for the efficient isolation of fats and specific high-value lipid fractions without using residual chemical solvents, resulting in ultra-pure, high-quality, and standardized ingredients. This method is highly favored for pharmaceutical and high-end nutraceutical applications where solvent traces are strictly prohibited. Furthermore, advanced physical refining methods, including high vacuum deodorization and specialized bleaching techniques utilizing natural earths, are being optimized to remove impurities, color, and odor while minimizing the degradation of beneficial heat-sensitive compounds, ensuring the refined fats meet the strict quality standards required by industrial formulators without sacrificing too much natural value.

Beyond extraction, fractionation technologies—both dry fractionation (cooling) and solvent fractionation—are vital. Fractionation enables the separation of the exotic fat into distinct fractions with varied melting points and fatty acid compositions. This process is essential for creating custom functional ingredients, such as hard fractions used as cocoa butter substitutes (CBEs) or soft, liquid fractions for lightweight cosmetic serums. Biotechnology is also emerging, focusing on enzymatic modification to alter the structural characteristics of triglycerides, improving oxidative stability, or adjusting the crystallization behavior of exotic fats to tailor them precisely for specific food or cosmetic product matrices, offering formulators highly customized and functional ingredients derived from natural sources.

Regional Highlights

- North America: This region is a leading consumer market, characterized by high disposable incomes and a pervasive preference for high-end, natural, and organic personal care products. The U.S. and Canada drive innovation and necessitate stringent regulatory compliance regarding sourcing and processing. The region is seeing rapid growth in the nutraceutical sector, utilizing exotic oils for supplements.

- Europe: Europe is a mature and highly influential market, largely driven by the 'Green Cosmetics' trend and strict regulatory frameworks like the EU Cosmetics Regulation and REACH, which strongly encourage sustainable and traceable natural ingredients. Countries like Germany, France, and the UK are key demand hubs, demanding certified ingredients (e.g., COSMOS, Fair Trade).

- Asia Pacific (APAC): APAC represents the fastest-growing region, driven by the expanding middle class, rapid urbanization, and massive growth in the domestic cosmetic manufacturing industry (K-Beauty, J-Beauty). While consumption is rising rapidly, the region is also becoming a critical processing hub, particularly for palm and derived specialty fats, though local exotic fats (like Kokum in India) are gaining traction.

- Latin America (LATAM): LATAM is primarily a crucial source region for novel and established exotic fats, especially those sourced from the Amazon rainforest (e.g., Cupuacu, Murumuru). Brazil is both a major producer and a rapidly expanding domestic consumer market, focusing on unique indigenous ingredients for its robust cosmetic industry. Supply chain logistics and ethical sourcing remain key challenges and opportunities in this region.

- Middle East and Africa (MEA): Africa is the foundational source region for globally dominant fats like Shea and Cocoa. The market growth here is driven by initiatives to improve local processing capabilities and value addition. The Middle East, with its luxury consumer market, imports refined exotic fats for high-end personal care products, aligning with global luxury trends.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Exotic Fats Market.- AAK AB

- Cargill Incorporated

- Fuji Oil Co., Ltd.

- Bunge Loders Croklaan

- Croda International Plc

- SOPHIM

- OLVEA Group

- IOI Corporation Berhad

- Wilmar International Ltd.

- Ghana Nuts Company Ltd.

- Agrichem International

- BASF SE

- Arboris LLC

- Shebu Industries

- Cosphatec GmbH

- KimiKirei

- Premier Specialties Inc.

- Akoma Cooperative Multipurpose Society

- Savanna Shea

- Natural Sourcing, LLC

Frequently Asked Questions

Analyze common user questions about the Exotic Fats market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are primarily driving the demand for exotic fats in the cosmetic industry?

The demand is primarily driven by the 'clean beauty' movement, which favors natural, plant-derived, and minimally processed ingredients over synthetic alternatives. Exotic fats offer superior functional benefits, such as deep moisturizing, high vitamin content, and natural stabilizing properties, appealing directly to consumers seeking premium, sustainable, and high-performance skincare solutions.

How does the sustainability and ethical sourcing of exotic fats impact market pricing?

Sustainability and ethical sourcing significantly increase market pricing because they necessitate rigorous certification (Fair Trade, Organic), investment in community development, and complex, traceable supply chain management systems. Consumers and major manufacturers are willing to pay a premium for verified, ethically sourced ingredients, turning sustainability into a competitive differentiator rather than just a cost constraint.

Which exotic fat segment holds the largest market share by volume and why?

The Shea Butter segment currently holds the largest market share by volume due to its established, large-scale supply chain, versatile applications across both food (especially as a cocoa butter alternative) and cosmetics, and widespread recognition as a reliable, high-performing natural emollient, particularly for mass-market body care products.

What technological advancements are crucial for the future growth of the exotic fats market?

Key technological advancements include Supercritical Fluid Extraction (SFE) for producing ultra-pure, solvent-free fats for high-end applications, and advanced fractionation techniques that allow suppliers to customize the functional properties (e.g., melting point, hardness) of fats, meeting precise formulation requirements across food and cosmetic industries.

How does geopolitical instability in sourcing regions affect the global supply of exotic fats?

Geopolitical instability, particularly in regions like West Africa (key for Shea and Cocoa), creates significant volatility in supply, resulting in price surges and supply chain disruptions. This forces manufacturers to diversify sourcing, invest in inventory buffering, or seek alternative, regionally specific exotic fats to mitigate dependency risks associated with concentrated geographic supply.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager