Expanded Beam Fiber Optic Connectors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431508 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Expanded Beam Fiber Optic Connectors Market Size

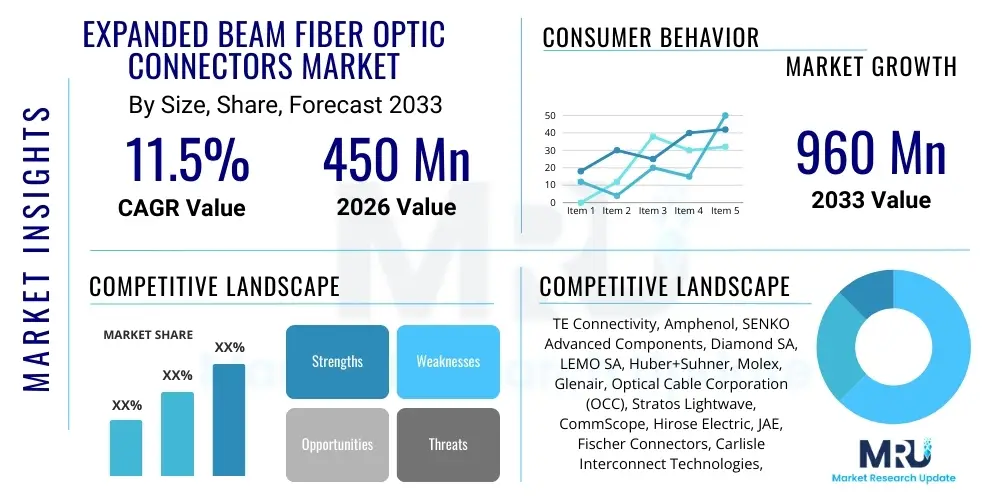

The Expanded Beam Fiber Optic Connectors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 960 Million by the end of the forecast period in 2033.

Expanded Beam Fiber Optic Connectors Market introduction

Expanded Beam Fiber Optic Connectors represent a critical advancement in robust fiber optic connectivity, particularly engineered for operation in harsh environments where traditional physical contact connectors fail due to contamination, shock, or vibration. Unlike standard fiber optic connectors which rely on precise physical contact between ferrules, Expanded Beam technology utilizes lensing elements to expand and collimate the light signal over a larger diameter before transmission across the interface gap. This expansion significantly reduces the sensitivity to dust particles and minor misalignment, enhancing reliability and durability across various mission-critical and industrial applications.

The core product description centers on connectors featuring precision lenses—typically spherical, aspheric, or Graded Index (GRIN) lenses—that transform the small core diameter light beam into a much wider, parallel beam. This non-contact optical pathway eliminates wear on the fiber end face, enabling thousands of mating cycles without degradation in performance. Major applications span military tactical communications (field deployed systems), aerospace avionics and flight control networks, industrial automation (heavy machinery, mining), and broadcast media (outdoor event coverage), all demanding high bandwidth integrity under extreme environmental stress.

The primary benefits driving market adoption include superior tolerance to dirt and debris, exceptional durability, rapid deployment capabilities, and ease of cleaning, often requiring only a simple wipe rather than specialized tools. Driving factors for market growth are the increasing global defense spending focused on ruggedized digital infrastructure, the proliferation of high-speed data requirements in factory automation (Industry 4.0), and the migration of traditional copper-based systems to high-bandwidth fiber optics in aviation and marine settings, where low-maintenance, reliable connections are paramount for operational uptime and safety.

Expanded Beam Fiber Optic Connectors Market Executive Summary

The Expanded Beam Fiber Optic Connectors Market is experiencing robust expansion driven primarily by critical business trends focusing on defense modernization and the global industrial shift towards high-speed, reliable data transmission in extreme operating conditions. Regional trends show North America and Europe leading the adoption due to high defense budgets and advanced aerospace manufacturing bases, while the Asia Pacific region is demonstrating the fastest growth propelled by infrastructure development and rapid adoption of automated industrial processes, particularly in China, South Korea, and Japan. The technological advancement in lens material and assembly processes is continually improving insertion loss specifications, making expanded beam solutions viable for an increasingly wider range of commercial applications beyond their traditional military strongholds.

Segment trends indicate that the Multi-mode fiber type segment currently holds a significant share due to its prevalent use in short-to-medium distance tactical and industrial networks, yet the Single-mode expanded beam segment is projected to grow at a slightly higher CAGR, driven by demanding long-haul and high-density data center interconnection requirements where precision and extremely low loss are crucial. Application segmentation confirms that Military and Defense remains the dominant user, characterized by high-volume, multi-channel connector usage in ground vehicles and C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) systems. However, the Industrial sector, including mining, oil and gas, and heavy transportation, is emerging as a critical growth engine, seeking reliable connectivity solutions that minimize downtime in dusty, vibrating environments.

The competitive landscape is characterized by established interconnect specialists who focus heavily on intellectual property regarding lens design and ruggedized housing materials (such as stainless steel and specialized composites) to meet stringent military specifications (MIL-SPEC). Key strategic movements include increased investment in miniaturization technologies to reduce the overall form factor of connectors, making them suitable for smaller platforms like UAVs and tactical wearables. Furthermore, strategic partnerships between connector manufacturers and system integrators are becoming crucial to offer pre-terminated, integrated cable assembly solutions, thereby simplifying field deployment and ensuring optimal performance right out of the box, addressing the end-user desire for turnkey solutions.

AI Impact Analysis on Expanded Beam Fiber Optic Connectors Market

User queries regarding AI's influence often center on two key themes: how AI-driven high-speed processing impacts the required data throughput capacity, and how AI can be utilized in quality control and autonomous network maintenance related to these rugged connectors. Users are concerned about whether current expanded beam loss characteristics meet the stringent latency and bandwidth demands of real-time AI processing systems, especially in applications like autonomous military vehicles or real-time industrial monitoring where massive sensor data must be processed instantaneously. Furthermore, there is significant user expectation that AI algorithms will be integrated into diagnostic tools to predict the lifespan or performance degradation of expanded beam connections in field deployments, enhancing proactive maintenance strategies and reducing unexpected system failures.

The impact of Artificial Intelligence on the Expanded Beam Fiber Optic Connectors Market is twofold: indirect market growth stimulation and direct operational efficiency improvements. Indirectly, the massive data flows generated by AI-driven applications, such as machine learning training, neural networks, and deep sensing platforms, necessitate incredibly reliable, high-bandwidth physical infrastructure, thereby increasing the demand for robust fiber optic solutions suitable for deployment at the network edge or in harsh data environments. Directly, AI is poised to enhance the manufacturing quality control process by enabling real-time, high-precision inspection of lens alignment and ferrule preparation, minimizing potential defects that lead to higher insertion loss and back reflection, ensuring connectors adhere to rigorous performance standards.

Moreover, AI systems are beginning to play a role in optimizing the usage and maintenance cycle of expanded beam connectors in complex systems. By analyzing historical performance data, environmental factors (temperature, vibration logs), and mating cycle counts, AI can proactively alert maintenance crews to potential failures before they occur. This predictive maintenance capability is extremely valuable in remote or inaccessible installations, such as deep-sea sensors, aerospace structures, or battlefield deployed equipment, significantly increasing the mean time between failures (MTBF) and overall system reliability, thereby reinforcing the value proposition of high-cost, high-reliability expanded beam solutions.

- AI-driven data explosion increases demand for high-reliability, rugged connectivity solutions, particularly at the network edge.

- Predictive maintenance algorithms, fueled by AI, enhance the operational lifespan and reduce downtime of deployed expanded beam systems.

- AI optimizes manufacturing processes by enabling automated, high-precision optical alignment and defect detection during connector assembly.

- Increased complexity of AI applications in defense necessitates highly secure and reliable fiber infrastructure, favoring non-contact expanded beam technology.

- AI analysis of connector performance data in real-time allows for dynamic network optimization in harsh environmental conditions.

DRO & Impact Forces Of Expanded Beam Fiber Optic Connectors Market

The Expanded Beam Fiber Optic Connectors Market is primarily propelled by the critical need for highly reliable, low-maintenance data links in extreme operational settings, especially within the global defense and aerospace sectors where operational reliability is non-negotiable. The high cost associated with the precision lensing and robust housing materials acts as a significant restraint, limiting mass adoption in cost-sensitive commercial applications where standard physical contact connectors suffice. However, the burgeoning opportunity lies in the rapid industrial transition (Industry 4.0) towards automated and networked machinery that demands continuous, reliable data transmission amidst manufacturing floor debris and vibration, offering a substantial new market for rugged expanded beam solutions. The overall impact forces are high, driven by technological necessity in military and industrial upgrades, outweighing the current restraint of high unit cost through lifetime cost savings derived from reduced maintenance and higher uptime.

Key drivers include escalating defense spending globally, with a focus on modernizing C4ISR systems and deploying highly interconnected platforms, alongside the fundamental physical benefit of the expanded beam design, which mitigates performance degradation caused by contamination—a ubiquitous issue in field deployments. Furthermore, the inherent durability and high cycle life (5,000+ matings) of these connectors significantly reduces total cost of ownership (TCO) over the equipment lifespan, driving adoption among users prioritizing long-term reliability over initial capital expenditure. The continuous push for higher bandwidth requirements, even in harsh environments, such as 40G/100G Ethernet over fiber, necessitates reliable, low-loss connections, reinforcing the value proposition of precision-engineered expanded beam products.

Restraints are dominated by the higher insertion loss characteristics inherent to non-contact lensing compared to optimized physical contact connectors, which can limit their use in ultra-long-haul applications or systems with tight power budgets. Furthermore, the specialized manufacturing required for high-precision lens alignment and packaging contributes significantly to the premium pricing, making these connectors cost-prohibitive for non-critical, standard network deployments. Opportunities, however, abound in the diversification of applications into commercial fields like large-scale outdoor broadcasting, renewable energy infrastructure (wind turbines, solar farms), and heavy construction machinery. Technological advancements aimed at reducing the size and improving the optical performance (lowering insertion loss) are key mitigating factors against the current restraints, promising wider market penetration and sustained growth throughout the forecast period.

- Drivers: Increased defense modernization and C4ISR integration; inherent resistance to contamination, shock, and vibration; demand for high reliability in industrial automation (Industry 4.0).

- Restraints: High unit manufacturing cost compared to standard physical contact connectors; slightly higher inherent insertion loss (IL) compared to APC/PC polished connectors; specialization required for installation and maintenance.

- Opportunities: Expansion into commercial rugged applications (Broadcast, Energy, Transportation); miniaturization of connector formats for small form factor devices (UAVs); development of lower-loss lens materials and designs.

- Impact Forces: Necessity for reliable data links in mission-critical systems (High); Total Cost of Ownership reduction through longevity and low maintenance (Medium to High); Initial unit cost pressure (Medium).

Segmentation Analysis

The Expanded Beam Fiber Optic Connectors market is primarily segmented based on Fiber Type (Single-mode and Multi-mode), Application (Military & Defense, Industrial, Broadcast & Media, and Oil & Gas/Mining), and Connector Type (Circular/Tactical, Rectangular, and Hermaphroditic). The analysis of these segments reveals a market finely tuned to meet the specific demands of highly specialized, rugged environments. The distinction between Single-mode (SM) and Multi-mode (MM) is crucial, with MM connectors currently dominating volume due to their robustness and suitability for shorter, tactical links, while SM is rapidly growing, addressing the need for extremely high bandwidth over longer distances in high-precision military radar systems and complex avionics.

The application segmentation underscores the market's reliance on the Military & Defense sector, which drives demand for robust, multi-channel tactical connectors designed to withstand harsh field deployment, rapid deployment, and demounting without performance degradation. However, the fastest growth is anticipated in the Industrial sector, where automation and networking initiatives demand components impervious to the common factory contaminants such as dust, oil, and moisture. The broadcast sector, particularly for large, temporary outdoor events, also represents a vital segment, relying on expanded beam technology for quick setup and reliable high-definition video transmission under challenging conditions.

The segmentation by connector type highlights the importance of Circular/Tactical connectors, which adhere closely to MIL-SPEC standards for environmental sealing and ruggedized housing. Hermaphroditic connectors, capable of mating with identical connectors without distinction between plug and receptacle, are particularly favored in tactical deployments as they simplify logistics and assembly in high-stress, low-visibility situations. Understanding these segment dynamics is critical for manufacturers to align their product development—focusing either on ultra-low loss SM solutions for high-end applications or cost-optimized, highly durable MM solutions for broader industrial deployment.

- By Fiber Type:

- Single-mode (SM)

- Multi-mode (MM)

- By Connector Type:

- Circular/Tactical Connectors

- Rectangular Connectors

- Hermaphroditic Connectors

- Hybrid Connectors (combining fiber and electrical contacts)

- By Application:

- Military & Defense (Field Communications, Avionics, Naval Systems)

- Industrial Automation (Mining, Oil & Gas, Robotics)

- Broadcast & Media (Outdoor Event Coverage, Mobile Units)

- Aerospace (In-flight Entertainment, Flight Control)

- Medical Diagnostics

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Expanded Beam Fiber Optic Connectors Market

The value chain for Expanded Beam Fiber Optic Connectors starts with upstream analysis focusing on the procurement of high-purity glass fiber, precision lensing materials (often quartz or specialized polymers), and robust housing components (stainless steel, high-grade composites). Key activities at this stage involve specialized grinding, polishing, and coating techniques necessary for producing the highly accurate micro-lenses essential for beam expansion and collimation. The specialized nature of these optical components means the upstream segment is concentrated among a few key material suppliers and precision optics manufacturers, dictating quality and influencing overall unit cost significantly.

Moving through the value chain, the manufacturing and assembly phase involves complex integration processes, including passive alignment of the fiber to the lens element within the ferrule structure, and subsequent sealing into the ruggedized connector shell. Quality control, particularly the rigorous testing of insertion loss (IL) and return loss (RL) under varying environmental conditions, is a crucial step. Distribution channels are highly specialized; due to the mission-critical nature of the applications, direct sales and highly trained indirect distributors (Value-Added Resellers or VARs) dominate the channel. Direct sales are preferred for large defense programs and OEM integrators, ensuring technical specifications and customization requirements are met precisely, while specialized VARs handle smaller industrial customers needing assembly and system integration support.

The downstream analysis focuses on the end-users: primarily system integrators in the military, aerospace, and industrial automation fields who incorporate the connectors into broader cable assemblies or system architectures. The installation and maintenance lifecycle require specific field handling procedures, although the non-contact design simplifies cleaning dramatically compared to standard connectors. The high reliance on system integration means that success in the downstream market often depends on providing comprehensive support and training, ensuring the connectors maintain peak performance when integrated into complex battlefield networks or factory control systems.

Expanded Beam Fiber Optic Connectors Market Potential Customers

The primary customers for Expanded Beam Fiber Optic Connectors are organizations operating data networks in environments characterized by extreme physical stress, frequent connection/disconnection cycles, and high levels of contamination risk. The core demographic consists of defense contractors and military end-users requiring tactical communication systems for ground, air, and naval platforms, where adherence to MIL-SPEC standards and absolute reliability are paramount. These customers demand multi-channel, hermaphroditic designs that simplify rapid field deployment under harsh battlefield conditions.

A rapidly expanding customer base resides within the Industrial sector, encompassing heavy machinery manufacturers, mining operations, oil and gas exploration companies, and automated factory floor integrators. These customers prioritize durability against dust, vibration, and chemical exposure (IP68 ratings) to minimize costly operational downtime. The growing adoption of Industry 4.0 standards and the proliferation of sensor networks mandate reliable fiber infrastructure in previously copper-dominated industrial settings, making expanded beam solutions an ideal long-term investment for industrial reliability and efficiency.

Furthermore, major players in the Broadcast and Media sector, particularly those involved in outside broadcasting (OB) vans and temporary venue setup for sporting or cultural events, are crucial customers. They value the ease of deployment, resistance to foot traffic and dirt, and the quick cleanup time that expanded beam technology offers, ensuring high-quality, uninterrupted high-definition (HD) and 4K video feeds. Aerospace manufacturers also represent long-term customers, integrating these connectors into avionics systems where vibration resistance and long-term, maintenance-free performance are essential for flight safety and reliability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 960 Million |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TE Connectivity, Amphenol, SENKO Advanced Components, Diamond SA, LEMO SA, Huber+Suhner, Molex, Glenair, Optical Cable Corporation (OCC), Stratos Lightwave, CommScope, Hirose Electric, JAE, Fischer Connectors, Carlisle Interconnect Technologies, QPC Fiber Optic, Radiall, OFS Fitel, Sumitomo Electric, Prysmian Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Expanded Beam Fiber Optic Connectors Market Key Technology Landscape

The technological landscape of the Expanded Beam Fiber Optic Connectors market is fundamentally centered on micro-optics, material science, and precision mechanical engineering to achieve optimal performance and ruggedization. The defining technology involves the design and manufacturing of the lensing system, which typically employs either ball lenses, GRIN (Graded Index) lenses, or proprietary aspheric lenses to accurately expand and collimate the light beam. Ongoing technological advancements are focused on reducing the size of these lenses and improving their numerical aperture utilization to minimize the inherent insertion loss and maximize signal transmission efficiency, making them comparable to high-performance physical contact connectors over medium distances.

Material science plays a critical role in both the optical path and the connector housing. Housing materials are continuously being developed to provide exceptional resistance to corrosion, extreme temperatures, and electromagnetic interference (EMI/RFI shielding), often utilizing specialized composite polymers and highly durable stainless steel alloys to meet demanding military specifications (e.g., MIL-STD-810G environmental testing). Furthermore, the trend toward miniaturization requires advanced manufacturing techniques, such as precision injection molding and laser welding, to integrate the complex optical components into much smaller form factors, enabling their use in space-constrained applications like UAVs and tactical wearables without sacrificing ruggedness or optical performance.

A key area of innovation is in the development of hybrid expanded beam solutions. These connectors integrate both fiber optic expanded beam channels and traditional electrical contacts within a single connector body. This hybridization allows system designers to consolidate power and high-speed data transmission through one rugged interface, simplifying cabling infrastructure in complex systems such as military ground vehicles or modular factory equipment. The focus on Hermaphroditic design technology also continues to evolve, improving the tolerance stack-up and alignment repeatability across multiple channels, which is crucial for maximizing the system-level reliability during rapid field interconnection by untrained personnel.

Regional Highlights

- North America: Dominates the market share, primarily due to the vast defense industrial base, significant governmental investment in defense modernization programs (C4ISR, tactical networks), and a robust aerospace industry. High adoption rates are seen in specialized industrial automation and test & measurement environments. The region is a leader in developing high-end, low-loss single-mode expanded beam solutions compliant with stringent MIL-SPEC standards.

- Europe: Represents a mature market characterized by strong defense spending (especially UK, France, Germany) and a leading position in industrial automation (Germany) and high-end broadcast media technology. The adoption is driven by the necessity for highly reliable connectivity in complex systems, including naval architecture and renewable energy infrastructure like offshore wind farms. European manufacturers are key innovators in hybrid and miniaturized expanded beam designs.

- Asia Pacific (APAC): Expected to register the highest Compound Annual Growth Rate (CAGR). Growth is fueled by rapid military modernization efforts, particularly in China and India, coupled with massive investments in industrial infrastructure and smart manufacturing (Industry 4.0). The region's need for rugged connectors in demanding environments like mining and large-scale public transportation systems is rapidly expanding the market base, although cost sensitivity remains a factor in certain commercial segments.

- Latin America (LATAM): A developing market characterized by focused demand in specific sectors like mining, oil & gas exploration, and limited military modernization programs. Market growth is stable but less explosive than APAC, driven primarily by investments in reliable field communication infrastructure in remote resource extraction locations where environmental resilience is critical.

- Middle East & Africa (MEA): Growth is primarily concentrated in the Middle East due to substantial defense budgets and investment in critical national infrastructure protection (oil and gas facilities, border surveillance). The demand centers on highly secure, rugged fiber links, driving the need for expanded beam technology in surveillance and tactical command posts. African growth is nascent, primarily linked to telecommunications backhaul infrastructure in challenging terrains and resource exploration activities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Expanded Beam Fiber Optic Connectors Market.- TE Connectivity

- Amphenol

- SENKO Advanced Components

- Diamond SA

- LEMO SA

- Huber+Suhner

- Molex

- Glenair

- Optical Cable Corporation (OCC)

- Stratos Lightwave

- CommScope

- Hirose Electric

- JAE

- Fischer Connectors

- Carlisle Interconnect Technologies

- QPC Fiber Optic

- Radiall

- OFS Fitel

- Sumitomo Electric

- Prysmian Group

Frequently Asked Questions

Analyze common user questions about the Expanded Beam Fiber Optic Connectors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of using expanded beam connectors over traditional physical contact connectors?

The primary benefits include vastly superior tolerance to dirt, debris, shock, and vibration because the light signal is expanded and transmitted without physical contact between the fiber end faces. This non-contact design allows for thousands of mating cycles without degradation and simplifies cleaning procedures, significantly enhancing reliability in harsh environments like military fields or industrial floors.

How does the insertion loss (IL) of expanded beam connectors compare to standard UPC/APC connectors?

Expanded beam connectors typically have a higher inherent insertion loss (IL) than optimally polished physical contact (PC/APC) connectors, primarily due to the optical path length and lensing losses. While standard connectors achieve ILs below 0.3 dB, expanded beam connectors typically range from 0.8 dB to 1.5 dB per mated pair, depending on the design and fiber type (SM or MM). However, their performance remains stable even when slightly contaminated, which is their key operational advantage.

Which applications drive the highest demand for Expanded Beam Fiber Optic Connectors?

The highest demand is driven by Military and Defense applications, specifically tactical communications, ground vehicle networks, and naval systems, where robust, reliable, and rapidly deployable connectivity is essential under extreme environmental stress. Additionally, the Industrial Automation, Oil & Gas, and Broadcast sectors are major growth areas requiring immunity to dust, moisture, and frequent vibration.

Are expanded beam connectors suitable for high-speed single-mode fiber applications?

Yes, expanded beam technology is increasingly being adapted for high-speed single-mode fiber applications. While achieving low insertion loss is more technically challenging for SM due to the smaller core size, modern designs utilizing high-precision aspheric or GRIN lenses are meeting the demanding bandwidth requirements for long-distance, high-throughput systems used in radar and specialized military avionics.

What is the key technological challenge currently facing expanded beam connector manufacturers?

The key technological challenge is simultaneously achieving ultra-low insertion loss comparable to physical contact connectors while maintaining the rugged, non-contact reliability and compact size required by modern systems. Manufacturers are focusing on advanced micro-lensing materials and highly precise automated alignment techniques during assembly to optimize optical performance without compromising environmental resilience.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager