Expanded Polystyrene Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436950 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Expanded Polystyrene Packaging Market Size

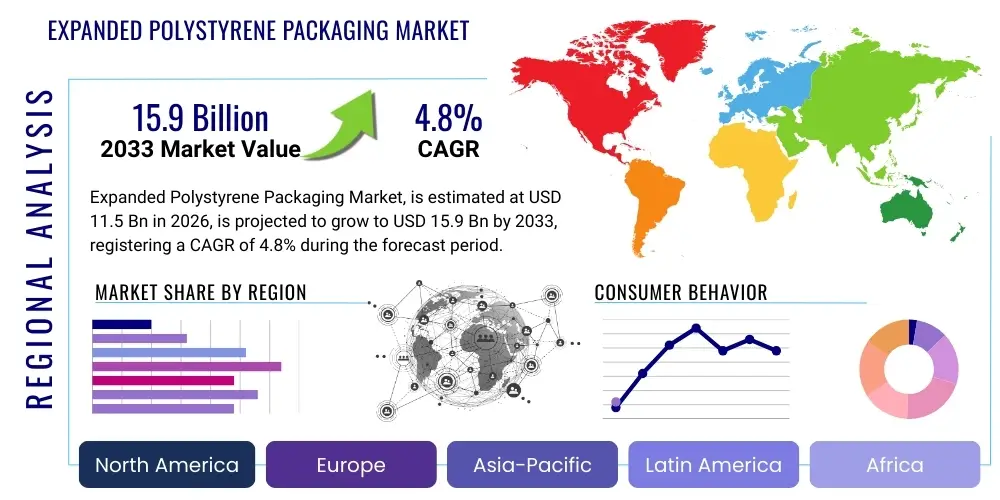

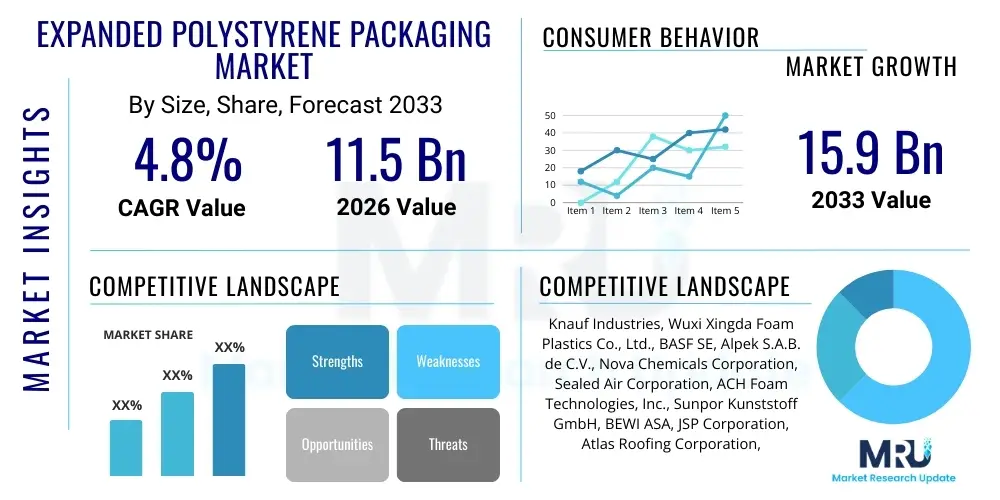

The Expanded Polystyrene Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 15.9 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the sustained expansion of end-use industries such as electronics, food and beverages, and pharmaceuticals, where the material’s superior cushioning, thermal insulation, and lightweight properties offer substantial logistical advantages and product protection.

The market expansion is particularly robust in developing economies, specifically across the Asia Pacific region, driven by rapid urbanization and increasing disposable incomes fueling demand for packaged consumer goods. While regulatory scrutiny regarding single-use plastics and non-biodegradable waste presents structural challenges, continuous innovation in recycling infrastructure and the development of EPS alternatives, such as biodegradable EPS and recycled content EPS, are crucial factors mitigating these restraints and sustaining overall market momentum during the forecast period.

Expanded Polystyrene Packaging Market introduction

The Expanded Polystyrene (EPS) Packaging Market encompasses the global trade and utilization of lightweight, rigid, closed-cell foam materials derived from solid polystyrene beads. This material is distinguished by its exceptional shock absorption capabilities, high strength-to-weight ratio, and thermal insulation efficiency, making it an indispensable choice for protecting fragile and temperature-sensitive goods during storage and transit. Major applications span protective packaging for high-value electronics and appliances, thermal containers for fresh produce and pharmaceuticals (cold chain logistics), and customized molds for industrial components, offering optimized logistical performance and significantly reduced freight costs due to its minimal weight.

Key drivers underpinning the market growth include the relentless expansion of the global e-commerce sector, which necessitates robust and reliable protective packaging solutions to minimize transit damage. Furthermore, the burgeoning demand for chilled and frozen food, especially in metropolitan areas, elevates the requirement for EPS in cold chain applications, where its thermal properties are critical for maintaining product integrity. The inherent benefits of EPS—including cost-effectiveness, versatility in design, and chemical inertness—position it as a primary material choice, despite persistent environmental concerns that necessitate ongoing investment in circular economy initiatives and enhanced recycling mechanisms.

Expanded Polystyrene Packaging Market Executive Summary

The Expanded Polystyrene Packaging Market is characterized by resilient demand fueled by global macroeconomic stability, particularly within the electronics and fast-moving consumer goods (FMCG) sectors. Business trends indicate a strategic shift among major manufacturers toward adopting sophisticated molding technologies that reduce material usage and enhance structural integrity, aligning with corporate sustainability objectives. Investment in chemical recycling technologies, rather than solely mechanical recycling, is emerging as a critical trend, addressing the perceived end-of-life challenges associated with EPS and securing long-term viability against regulatory headwinds targeting non-recyclable materials.

Regionally, Asia Pacific maintains its dominance, driven by massive manufacturing output and infrastructural development, positioning it as the primary consumption hub. North America and Europe, however, lead in technological adoption, particularly concerning high-purity recycled EPS and the integration of traceability systems to enhance supply chain transparency. Segment-wise, the rigid protective packaging category continues to hold the largest share, although the temperature-sensitive packaging segment, primarily serving pharmaceuticals and specialized food delivery, is experiencing the fastest acceleration, reflecting advancements in cold chain logistics optimization globally.

AI Impact Analysis on Expanded Polystyrene Packaging Market

User inquiries regarding AI's influence on the Expanded Polystyrene Packaging Market primarily center on three areas: optimizing packaging design for sustainability and material reduction, enhancing supply chain efficiency through predictive analytics, and improving waste management and recycling processes. Users express concerns about the potential for AI-driven automation to disrupt traditional manufacturing employment while simultaneously anticipating significant operational cost savings and reductions in material waste. Expectations are high that AI algorithms will rapidly accelerate the identification of optimal material compositions and customized packaging geometries, ensuring maximum product protection with minimum environmental footprint, thereby addressing critical regulatory and consumer sustainability demands faced by the packaging industry.

AI is expected to transform the manufacturing floor by enabling predictive maintenance and optimizing machine parameters, minimizing downtime, and ensuring consistent product quality in the complex foaming processes involved in EPS production. Furthermore, in the broader supply chain, machine learning models analyze vast datasets related to transit conditions, shock incidence, and temperature fluctuations, allowing packaging designers to create highly specialized, resilient EPS forms that minimize material overuse without compromising safety. This data-driven design approach is crucial for achieving lightweighting goals, a central focus in logistics sustainability.

- AI-driven optimization of packaging design for material reduction (lightweighting).

- Predictive analytics implementation for inventory management and minimizing transit damage risk.

- Enhanced sorting and identification of EPS waste streams using computer vision and machine learning in recycling facilities.

- Automation of quality control processes during EPS manufacturing, ensuring product consistency.

- Supply chain risk modeling to predict and mitigate disruptions related to raw material procurement (styrene monomer).

DRO & Impact Forces Of Expanded Polystyrene Packaging Market

The EPS packaging market operates under significant tension between robust demand drivers, environmental restraints, and technological opportunities, all moderated by strong impact forces such as global regulatory policies and shifts in consumer preference. The primary drivers are rooted in the proliferation of e-commerce and the necessity for efficient cold chain infrastructure, particularly post-pandemic, where vaccine and temperature-sensitive food logistics require reliable, affordable thermal insulation. Conversely, the market is severely restricted by persistent negative perceptions regarding plastic waste, leading to outright bans in certain jurisdictions and increased regulatory pressure for mandatory recycled content usage. Opportunities exist prominently in chemical recycling technologies and the penetration of EPS into high-growth sectors like specialized medical device packaging.

These dynamics create strong impact forces. Regulatory measures, such as the European Union’s Plastic Strategy and similar initiatives worldwide, exert immense pressure on producers to invest heavily in end-of-life solutions and alternative materials, potentially driving up compliance costs but simultaneously spurring innovation. Consumer awareness and preferences are shifting rapidly towards sustainable alternatives, forcing brands to publicly commit to recyclable or biodegradable packaging formats, influencing sourcing decisions even when EPS offers superior protective performance. Technological advancements in both material science (developing biodegradable blends) and advanced manufacturing (3D printing molds) act as mitigating forces, helping the industry navigate the complex socio-economic landscape while sustaining growth.

The balance of these forces dictates market trajectory; while the structural demand remains high due to EPS's functional superiority, the market's future vitality is intrinsically linked to its success in establishing scalable, commercially viable closed-loop recycling systems and integrating bio-based feedstocks. Failure to effectively address the waste management challenge could lead to more stringent limitations on usage, whereas successful adoption of circular economy models will unlock new growth pathways, particularly within environmentally conscious supply chains.

- Drivers:

- Surging global e-commerce activity demanding robust protective packaging.

- Rapid expansion of the pharmaceutical and specialized food cold chain logistics.

- Cost-effectiveness and superior cushioning properties compared to competing materials.

- High strength-to-weight ratio leading to lower transportation and fuel costs.

- Restraints:

- Increasing governmental regulations and outright bans on single-use EPS packaging in key markets.

- Low recyclability rates of post-consumer EPS in comparison to other plastics due to low density and collection challenges.

- Negative public perception and consumer activism against non-biodegradable plastic materials.

- Volatility in the price of raw material (styrene monomer) linked to petrochemical market fluctuations.

- Opportunities:

- Advancement and scaling of chemical recycling technologies for EPS waste.

- Development of bio-based and biodegradable EPS alternatives using natural feedstocks.

- Increasing application in specialized, high-value industrial and medical packaging requiring strict hygiene standards.

- Leveraging digital twins and IoT sensors to monitor and improve packaging performance in transit.

- Impact Forces:

- Regulatory pressure favoring recycled content mandates and extended producer responsibility (EPR) schemes.

- Technological innovation driving down the cost of advanced recycling processes.

- Shifting consumer behavior towards brands prioritizing sustainable packaging.

- Geopolitical instability impacting petrochemical supply chains and raw material availability.

Segmentation Analysis

The Expanded Polystyrene Packaging Market is broadly segmented based on packaging type, end-use industry, and application, reflecting the diverse functional roles EPS plays across the modern supply chain. Analyzing these segments provides critical insights into specific growth pockets and areas facing structural disruption. By packaging type, the market is divided primarily into molded shape packaging and block/sheet packaging, with molded shapes dominating due to their customization capabilities, essential for snugly fitting and protecting high-value electronics and fragile components during complex transit routes.

The end-use segmentation highlights the concentration of demand, with electronics and home appliances representing the historical core market due to the need for robust shock absorption. However, the Food and Beverage sector, particularly the segment dedicated to fresh and temperature-controlled items, is exhibiting the highest growth rate, fueled by meal kit services, online grocery delivery, and the increasing globalization of perishable goods trade. Geographical analysis further refines this view, showing distinct differences in regulatory impact and adoption rates of advanced recycling technologies across regions, influencing localized material choices and market structures.

- By Packaging Type:

- Molded Shape Packaging (Dominant segment, used for electronics, appliances, and intricate shapes)

- Block/Sheet Packaging (Used for insulation, larger void fill, and construction-related applications)

- By Application:

- Protective Packaging (Shock absorption and cushioning)

- Insulation Packaging (Thermal management, primarily cold chain and temperature-sensitive goods)

- Void Fill Packaging

- By End-Use Industry:

- Food & Beverages (Perishables, fresh produce, frozen food, meal kits)

- Electronics & Home Appliances (TVs, computers, white goods)

- Pharmaceuticals & Healthcare (Vaccines, critical medical supplies, laboratory equipment)

- Automotive & Industrial (Component protection, parts trays)

- Others (Cosmetics, general consumer goods)

Value Chain Analysis For Expanded Polystyrene Packaging Market

The Expanded Polystyrene Packaging value chain begins upstream with the extraction and refining of crude oil, which is processed into benzene and ethylene, the primary feedstocks for producing styrene monomer. This raw material, styrene monomer, is then polymerized and expanded using blowing agents (historically pentane) by chemical manufacturers, resulting in expandable polystyrene beads. Upstream stability is highly dependent on global petrochemical market dynamics, meaning price volatility and supply chain disruptions originating in the oil and gas sector directly impact the cost structure for EPS producers, often creating uncertainty for downstream users.

The midstream segment involves the transformation of these beads into finished packaging. EPS converters utilize specialized steam chest molding and cutting processes to produce customized shapes or standard blocks. This stage is crucial for value addition, where design innovation, material density optimization, and customization for specific client products occur. Distribution channels are varied, including direct sales to large end-users (like appliance manufacturers), sales through third-party logistics (3PL) providers specializing in protective materials, and wholesale distribution to smaller packaging buyers, with complexity increasing as the shift toward customized solutions requires closer collaboration between converters and end-users.

Downstream analysis focuses on the end-use industries—electronics, food, and pharmaceuticals—which dictate the performance requirements and volumes. The ultimate success and sustainability challenge lie in the end-of-life stage, involving collection, mechanical densification, or advanced chemical recycling. The high volume and low weight of EPS packaging create logistical hurdles for collection, often making direct and indirect return loops essential for circularity, significantly influencing the indirect distribution channels focused on reverse logistics and waste management integration.

Expanded Polystyrene Packaging Market Potential Customers

The primary consumers of Expanded Polystyrene packaging are large-scale manufacturers and distributors operating in sectors where product integrity during handling and transit is paramount, and thermal performance is often non-negotiable. These end-users typically purchase in massive volumes, often requiring proprietary, custom-molded packaging designs that integrate seamlessly into their automated assembly and packing lines. The need for specialized engineering support from EPS converters is a defining characteristic of this customer segment, particularly among global appliance and electronics producers who seek standardized packaging solutions across their international operations.

The fastest-growing segment of potential customers includes operators within the modern cold chain ecosystem, specifically pharmaceutical companies managing temperature-sensitive drugs and third-party logistics providers specializing in frozen and chilled food delivery services, such as meal kit providers. These buyers prioritize packaging performance data, regulatory compliance (e.g., FDA/EMA standards), and certified thermal protection capabilities, rather than purely focusing on cost. Their purchasing decisions are heavily influenced by performance validation and the supplier's ability to provide compliant, reliable, temperature-stable solutions that minimize the risk of costly product spoilage or regulatory penalties.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 15.9 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Knauf Industries, Wuxi Xingda Foam Plastics Co., Ltd., BASF SE, Alpek S.A.B. de C.V., Nova Chemicals Corporation, Sealed Air Corporation, ACH Foam Technologies, Inc., Sunpor Kunststoff GmbH, BEWI ASA, JSP Corporation, Atlas Roofing Corporation, Plasti-Fab Ltd., Versalis S.p.A., Flint Group, Drew Foam Companies, Inc., Plymouth Foam, Inc., Foam Products Corporation, Foam Fabricators, Inc., T&R Foam, Polysource. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Expanded Polystyrene Packaging Market Key Technology Landscape

The technological landscape of the Expanded Polystyrene Packaging Market is undergoing a transformation driven primarily by the need for enhanced sustainability, improved material efficiency, and specialized performance characteristics. One key area of innovation is in the development and adoption of alternative blowing agents, moving away from volatile organic compounds (VOCs) to more environmentally benign options like CO2 or bio-based agents, addressing regulatory requirements related to ozone depletion and greenhouse gas emissions. Furthermore, advanced molding techniques, including fusion molding and rapid cycling injection processes, are being refined to produce thinner-walled, yet structurally robust, packaging components, directly contributing to material lightweighting and resource conservation efforts across the supply chain.

A second crucial technological vector involves the integration of high-purity recycled content (rEPS) and the development of chemically recyclable EPS. Chemical recycling technologies, such as depolymerization (turning EPS waste back into styrene monomer), are gaining traction as they can handle contaminated or mixed plastic streams that mechanical recycling struggles with, providing a viable path toward true circularity. This technological advancement is crucial for securing the material's future, enabling converters to meet future recycled content mandates without sacrificing the essential performance qualities—insulation and cushioning—that define EPS packaging.

Finally, digitalization and smart packaging features are beginning to influence manufacturing. The use of sophisticated CAD/CAM software allows for highly customized, performance-optimized packaging designs that minimize waste through precise material placement. Coupled with the use of IoT sensors embedded within cold chain containers, these technologies provide real-time monitoring of temperature and shock, transforming packaging from a passive protectant into an active data-generating asset, essential for high-assurance logistics operations like pharmaceutical transport. This fusion of material science and digital technology defines the competitive edge in the modern EPS market.

Regional Highlights

Regional dynamics heavily influence the EPS packaging market due to divergent regulatory environments, industrial concentration, and consumer preferences regarding sustainability. Asia Pacific (APAC) currently holds the dominant share, driven by its unparalleled scale in electronics manufacturing, coupled with burgeoning infrastructure development in countries like China, India, and Southeast Asian nations. The region benefits from lower manufacturing costs and rapidly expanding domestic consumption bases, propelling continuous demand for both protective and insulated packaging solutions to serve rapidly urbanizing populations and global export markets.

Europe stands out as the most technologically advanced and highly regulated market. While facing strict regulatory constraints on single-use plastics and packaging waste, Europe leads in implementing Extended Producer Responsibility (EPR) schemes and pioneering chemical recycling pilot projects. This stringent environment forces rapid innovation towards closed-loop systems and the early adoption of high-content rEPS, placing a premium on sustainable sourcing and material traceability. The demand here is stable, primarily focused on high-quality cold chain solutions for food and pharmaceuticals, where compliance and safety are paramount.

North America maintains significant market relevance, largely driven by the massive scale of e-commerce operations in the United States and sophisticated logistics networks. Although regulatory environments vary significantly between states and provinces, there is a strong commercial push towards certified sustainable packaging, often dictated by major retail and logistics giants like Amazon and Walmart. The focus is on lightweighting and integrating consumer-friendly recycling instructions, utilizing a blend of mechanical recycling and nascent advanced recycling facilities to service the expansive geographical area efficiently.

- Asia Pacific (APAC): Market dominance fueled by vast electronics manufacturing, expanding e-commerce penetration, and massive infrastructural growth, though facing infrastructural gaps in consumer recycling capabilities.

- Europe: Regulatory leader, driving demand for high-recycled content EPS and pioneering chemical recycling; strong focus on pharmaceutical cold chain integrity and compliance with EU plastic directives.

- North America: Driven by large-scale e-commerce and logistics demands; emphasis on lightweighting and improving the regional collection infrastructure to meet corporate sustainability goals of major retailers.

- Latin America (LATAM): Growth driven by urbanization and modernization of food supply chains; highly sensitive to global raw material price fluctuations due to dependence on imported styrene monomer.

- Middle East and Africa (MEA): Emerging market characterized by strong demand for thermal packaging in extreme climatic conditions (cooling requirements for food and pharmaceuticals) and increasing local manufacturing capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Expanded Polystyrene Packaging Market.- Knauf Industries

- Wuxi Xingda Foam Plastics Co., Ltd.

- BASF SE

- Alpek S.A.B. de C.V.

- Nova Chemicals Corporation

- Sealed Air Corporation

- ACH Foam Technologies, Inc.

- Sunpor Kunststoff GmbH

- BEWI ASA

- JSP Corporation

- Atlas Roofing Corporation

- Plasti-Fab Ltd.

- Versalis S.p.A.

- Flint Group

- Drew Foam Companies, Inc.

- Plymouth Foam, Inc.

- Foam Products Corporation

- Foam Fabricators, Inc.

- T&R Foam

- Polysource

Frequently Asked Questions

Analyze common user questions about the Expanded Polystyrene Packaging market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the EPS packaging market?

The primary factor is the robust growth of the global e-commerce sector, which necessitates lightweight, highly protective, and cost-efficient packaging solutions, especially for fragile and high-value consumer electronics and appliances shipped across long distances.

How is the EPS packaging industry addressing environmental sustainability concerns?

The industry is addressing sustainability through aggressive investment in chemical recycling technologies (depolymerization) to create a circular economy for EPS, development of bio-based EPS alternatives, and optimization of designs for material reduction (lightweighting).

Which end-use industry represents the fastest-growing segment for EPS packaging?

The Pharmaceuticals and Healthcare industry, specifically driven by the necessity for reliable thermal insulation in the cold chain for temperature-sensitive drugs and vaccines, represents the fastest-growing application segment globally.

What are the main regulatory restraints affecting the market, particularly in Europe?

The main regulatory restraints are government bans on single-use EPS food service containers and the implementation of stringent Extended Producer Responsibility (EPR) schemes, which impose mandatory targets for recycled content and overall packaging recyclability across EU member states.

How does AI technology benefit EPS packaging design and logistics?

AI significantly benefits the sector by optimizing packaging geometry via computational analysis to achieve maximum protection with minimum material usage, and by employing predictive logistics to forecast potential transit damages, thereby reducing overall packaging waste and associated shipping costs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager