Expanding Plug Valves Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434739 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Expanding Plug Valves Market Size

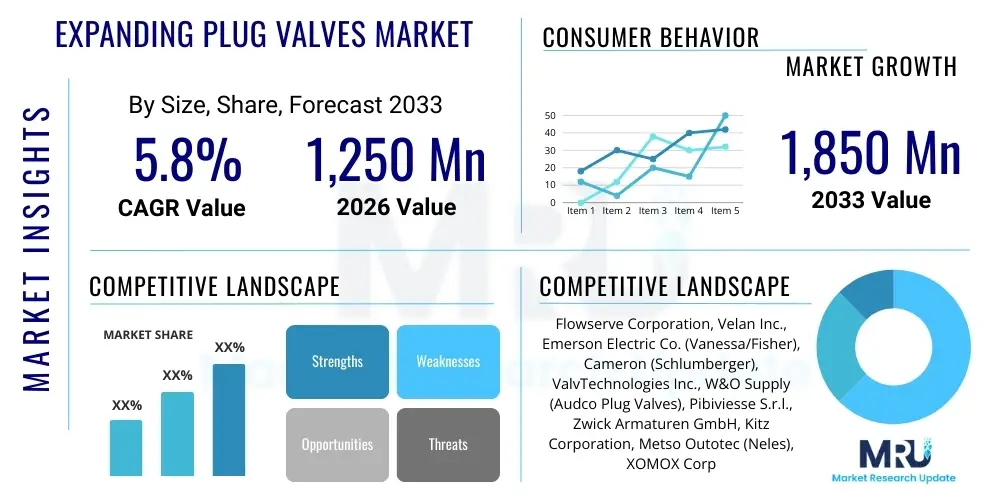

The Expanding Plug Valves Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1,250 Million in 2026 and is projected to reach USD 1,850 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally underpinned by increasing global infrastructure investments in oil and gas pipelines, chemical processing plants, and severe service applications where reliable, bubble-tight shutoff is critically required. Expanding plug valves are increasingly favored over standard ball or gate valves in situations demanding absolute isolation and zero leakage, driving their adoption across high-pressure and high-temperature environments worldwide. The necessity for enhanced operational safety and strict environmental regulations governing fugitive emissions further solidifies the market expansion outlook.

Expanding Plug Valves Market introduction

The Expanding Plug Valves Market encompasses the manufacture, distribution, and utilization of specialized quarter-turn valves designed to provide a mechanical, bubble-tight seal in critical fluid control applications. Unlike conventional plug valves, the expanding variant utilizes a unique mechanical mechanism that expands the plug component outward against the body seats both upstream and downstream, achieving true double block and bleed (DBB) isolation. This design feature ensures zero leakage across the seats, even under varying pressure conditions, making them indispensable in applications where product contamination or environmental hazards associated with leakage are unacceptable risks. Key applications span across petroleum refining, natural gas transmission and distribution, chemical manufacturing, and storage facilities, primarily utilized for isolation service.

The primary benefit driving the market adoption of expanding plug valves lies in their exceptional sealing integrity, offering a verified positive shutoff that greatly enhances pipeline safety and operational efficiency. Furthermore, the mechanical expansion action cleans the seat surface during actuation, reducing the potential for wear and extending the valve's service life, especially when handling abrasive or sticky media. The robust design and capability to operate reliably in highly demanding environments, including high line pressure and temperature differentials, positions them as a premium solution for isolation points. Major driving factors for the market include the continued expansion of cross-country oil and gas pipelines, the modernization of aging energy infrastructure, and stringent industry standards (such as API 6D and ASME B16.34) requiring superior isolation performance to minimize product loss and environmental hazards.

The market environment is characterized by intense focus on engineering precision and material science, as the performance of these valves is directly dependent on the integrity of the seating mechanism and the resistance of the plug material to corrosion and erosion. As the energy sector shifts towards unconventional resources and stricter environmental compliance, the demand for highly specialized and reliable valve technology like expanding plug valves is experiencing sustained growth. The market dynamic is also influenced by replacement cycles in mature infrastructure, where obsolete valves are being substituted with modern expanding plug valve designs that offer superior sealing capabilities and reduced maintenance requirements over the long term, contributing significantly to the overall total cost of ownership reduction for end-users.

Expanding Plug Valves Market Executive Summary

The global Expanding Plug Valves Market is experiencing a robust growth phase, primarily fueled by massive capital expenditure in the global energy infrastructure, particularly within natural gas transmission networks and crude oil transportation pipelines. Business trends indicate a strong preference among major engineering, procurement, and construction (EPC) contractors and pipeline operators for certified DBB-capable valves to meet increasingly demanding safety and environmental regulations. The market structure is moderately consolidated, dominated by established multinational valve manufacturers who possess the necessary expertise in precision engineering and specialized material application required for severe service components. Key strategic trends involve the integration of intelligent monitoring systems and condition-based maintenance features into these valves, enhancing their reliability and reducing unexpected downtime in remote locations.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market, driven by rapid industrialization, burgeoning demand for energy, and significant investment in new pipeline projects in countries like China, India, and Southeast Asia. North America remains a dominant market in terms of installed base and technology adoption, characterized by extensive pipeline infrastructure and high regulatory pressure for operational safety, leading to strong demand for high-specification expanding plug valves for mainline isolation. Europe focuses intensely on infrastructure modernization and complying with strict environmental mandates, driving demand for valves that minimize fugitive emissions, positioning expanding plug valves favorably due to their inherently superior sealing mechanism.

Segment trends suggest that the Oil and Gas sector, specifically midstream transportation and storage, maintains the largest market share due to the critical nature of its isolation requirements. Segmentation by material reveals that carbon steel and stainless steel segments dominate due to their balanced cost-to-performance ratio, although increasing demand for specialized alloys like Inconel and Duplex Steel is observed in highly corrosive or sour gas applications. Furthermore, larger bore sizes (above 12 inches) are exhibiting significant growth due to the construction of large-capacity, long-distance pipelines, while smaller valves continue to be essential in terminal isolation and plant manifold applications. The overriding theme across all segments is the shift toward higher pressure ratings and automated actuation systems to improve operational response times and reduce manual intervention.

AI Impact Analysis on Expanding Plug Valves Market

Users frequently inquire about how Artificial Intelligence (AI) and machine learning (ML) can be practically integrated into the highly mechanical domain of expanding plug valves, focusing particularly on enhancing reliability and optimizing maintenance schedules. Common concerns revolve around predictive failure detection, the automation of remote diagnostics, and the use of AI to analyze actuator performance and valve sealing degradation in real-time. There is a high expectation that AI will transition valve maintenance from fixed schedules to condition-based strategies, reducing unnecessary expenditures and mitigating the risks associated with catastrophic valve failures in critical infrastructure. Users also seek clarity on how sensor data from intelligent actuators, when analyzed by AI algorithms, can provide actionable insights into the physical integrity and sealing mechanisms of the expanding plug valve under fluctuating operational parameters, thereby maximizing uptime and adherence to strict safety standards across global pipeline networks.

- AI algorithms facilitate sophisticated predictive maintenance modeling, analyzing operational data (torque, temperature, vibration) to forecast potential seating failures or actuator degradation in expanding plug valves long before operational impact occurs.

- Machine Learning optimizes inventory management for spare parts, predicting replacement needs for specific valve sizes or materials based on historic usage patterns and failure rates across various applications and environments.

- AI-driven sensor fusion integrates data from various monitoring points to ensure the precise timing and force of the plug expansion mechanism, guaranteeing optimal sealing integrity (bubble-tight shutoff) under diverse pressure and flow conditions.

- Automation systems leveraged by AI enhance remote diagnostics and control capabilities, allowing operators to assess valve health and execute complex actuation sequences securely and efficiently from centralized control centers, crucial for remote pipeline segments.

- Generative AI tools are starting to assist in the design phase, simulating material stress and fluid dynamics to optimize the internal geometry of the expanding plug valve for improved flow characteristics and reduced wear, accelerating product development cycles.

DRO & Impact Forces Of Expanding Plug Valves Market

The market dynamics for expanding plug valves are primarily shaped by robust industrial drivers, significant structural restraints, and emerging opportunities that collectively determine the market's trajectory and profitability. Drivers include the global intensification of oil and gas production, particularly in regions requiring new long-distance transmission infrastructure, and the non-negotiable industry requirement for certified double block and bleed (DBB) isolation in custody transfer and critical pipeline isolation points. The intrinsic design of the expanding plug valve meets these high-integrity isolation requirements perfectly, ensuring zero leakage and enhancing safety standards worldwide. Furthermore, aging infrastructure replacement mandates in developed economies necessitate the adoption of modern, high-reliability isolation valves, sustaining consistent demand for these specialized components.

Restraints largely center on the high initial capital expenditure associated with purchasing expanding plug valves compared to standard ball or gate valves, which can deter adoption in less critical or budget-sensitive projects. Their mechanical complexity also translates into higher manufacturing precision requirements and potentially specialized maintenance procedures, adding to the total ownership cost. Moreover, market growth is often constrained by the cyclical nature and volatility inherent in the oil and gas sector, which directly influences major capital investment decisions in pipeline and plant expansion projects. Geopolitical instability and sudden shifts in energy policy can introduce significant uncertainty into the project pipeline, temporarily dampening market momentum and procurement volumes for high-cost valves.

However, significant opportunities are emerging that promise long-term structural growth. The transition towards alternative energy carriers, specifically the development of hydrogen and Carbon Capture, Utilization, and Storage (CCUS) infrastructure, presents a burgeoning new application space for expanding plug valves, given the extreme sealing demands of these critical gases. Furthermore, technological advances in material science and the integration of smart features (IoT sensors, advanced actuators) are improving the performance envelope and reducing maintenance costs, making these valves more competitive. The increasing focus on reducing methane and other fugitive emissions across the gas value chain provides a powerful impetus, positioning expanding plug valves as the preferred technical solution for environmentally conscious operators seeking guaranteed emission control and regulatory compliance.

Segmentation Analysis

The Expanding Plug Valves Market is comprehensively segmented based on material type, valve size, pressure rating, end-use industry, and application, reflecting the diverse and specialized requirements across various industrial sectors. Segmentation by Material Type is crucial as it dictates the valve's suitability for handling corrosive fluids, high temperatures, and abrasive slurries; key materials include carbon steel for general service, stainless steel for corrosive environments, and specialty alloys for severe service. Valve Size segmentation delineates between small bore (under 6 inches) utilized in manifold systems and terminal connections, and large bore (12 inches and above) essential for mainline pipeline applications and large storage facilities, with the latter segment exhibiting faster growth due to global pipeline expansion.

Further analysis of segmentation by End-Use Industry highlights the dominance of the Oil and Gas sector, particularly the midstream (pipelines) segment, which demands high-integrity isolation for custody transfer and emergency shutoff. The Chemical and Petrochemical sector represents another vital segment, driven by the need for reliable isolation in corrosive processes and hazardous material handling. Pressure rating segmentation (e.g., ANSI Class 150, 300, 600, 900, 1500) reflects the technical capabilities and application severity, with higher pressure classes typically commanding a greater price premium and requiring more stringent manufacturing standards. The complexity and diversity of these segments underscore the specialized nature of the expanding plug valve market, requiring manufacturers to maintain broad product portfolios tailored to specific industrial needs and regulatory environments.

Application-based segmentation divides the market primarily into mainline pipeline isolation, station/terminal isolation, pig launcher/receiver traps, and storage facility shutoff systems. Each application demands slightly different design criteria, such as specific automation requirements or emergency response capabilities. The continuous evolution of these applications, particularly the increasing reliance on automation and remote monitoring capabilities in pipeline networks, shapes product development and investment priorities for market players. Understanding these granular segmentation details is vital for market participants seeking to strategically target high-growth niches within the specialized fluid control landscape, ensuring that product development aligns directly with end-user technical specifications and operational requirements across diverse geographies.

- By Material Type:

- Carbon Steel

- Stainless Steel (304, 316, Duplex, Super Duplex)

- Alloy Steel (e.g., Chrome-Moly)

- Specialty Alloys (e.g., Hastelloy, Inconel)

- By Size:

- Up to 6 Inches

- 6 to 12 Inches

- 12 to 24 Inches

- Above 24 Inches (Large Bore)

- By Pressure Rating:

- ANSI Class 150 - 300

- ANSI Class 600 - 900

- ANSI Class 1500 and Above (Severe Service)

- By End-Use Industry:

- Oil and Gas (Midstream, Upstream, Downstream)

- Chemical and Petrochemical

- Power Generation (e.g., Isolation for Fuel Lines)

- Mining and Metallurgy

- Water and Wastewater (Specialized Applications)

- By Actuation Type:

- Manual (Handwheel/Lever)

- Electric

- Pneumatic

- Hydraulic

Value Chain Analysis For Expanding Plug Valves Market

The value chain for the Expanding Plug Valves Market begins with the sourcing of specialized raw materials, primarily high-grade steels and alloys. Upstream analysis highlights the critical dependency on stable supply chains for materials like forged carbon steel bodies, stainless steel components, and specialty nickel alloys required for severe service applications. Precision casting and forging processes are high-value activities at this stage, as the valve body and plug must maintain extremely tight dimensional tolerances to ensure the unique mechanical sealing mechanism functions reliably. Manufacturers must possess advanced machining capabilities, often utilizing Computer Numerical Control (CNC) equipment, to produce the intricate plug and seat designs, making technology and intellectual property in manufacturing processes a significant competitive differentiator.

Midstream activities involve the complex assembly, testing, and certification of the expanding plug valves. Given the critical applications of these valves (e.g., custody transfer, pipeline isolation), rigorous testing protocols, including hydrostatic, pneumatic, and specialized fugitive emission testing (ISO 15848-1), are mandatory. The value addition at this stage is substantial, encompassing quality control, application-specific coating, and the integration of advanced actuation systems (electric, pneumatic, hydraulic). Downstream analysis focuses on distribution channels, which are typically segmented into direct sales channels for major pipeline projects involving large orders and long-term relationships with EPC firms, and indirect channels relying on authorized distributors and specialized valve stockists for maintenance, repair, and operational (MRO) replacement demand.

Direct distribution often dominates high-value, large-bore project sales, where manufacturers work closely with end-users and EPC contractors from the design phase to installation. Indirect distribution provides necessary localized support, technical expertise, and quicker delivery times for smaller or urgent requirements in diverse geographical regions. Furthermore, after-sales service, including specialized repair, field commissioning, and technical support for the complex mechanical mechanism of expanding plug valves, represents a critical element in the downstream value chain, often determining customer loyalty and repeat business. The entire chain is heavily influenced by international standards and regional certifications, adding layers of complexity and cost, but ensuring the necessary level of reliability demanded by critical infrastructure operators globally.

Expanding Plug Valves Market Potential Customers

Potential customers and primary buyers of expanding plug valves are predominantly large-scale industrial operators who prioritize safety, reliability, and guaranteed positive shutoff in their fluid control systems, often operating in environments where leakage poses significant safety or environmental risks. The largest end-user segment is the Oil and Gas industry, encompassing midstream pipeline operators responsible for the safe and efficient transport of crude oil, refined products, and natural gas, as well as storage terminal operators requiring dependable isolation for tank manifolds and custody transfer metering stations. These buyers value the DBB capability inherent in expanding plug valves, which reduces the need for multiple conventional valves and minimizes potential leak paths, leading to reduced operational expenditure over the lifecycle of the assets.

The Chemical and Petrochemical sectors represent another substantial customer base, utilizing these valves in highly corrosive or hazardous processes, such as ethylene production, fertilizer manufacturing, and polymer plants, where media contamination or escape must be prevented absolutely. These buyers often demand valves manufactured from specialized alloys to resist specific chemical attacks and operate reliably under high thermal cycling and corrosive conditions. Procurement decisions in these sectors are heavily influenced by adherence to process safety management (PSM) standards and the ability of the valve to maintain integrity under emergency shutdown scenarios, reinforcing the demand for high-integrity sealing solutions like the expanding plug design.

Other vital segments include the Power Generation industry, utilizing expanding plug valves for critical fuel line isolation, and specialized applications within the Mining and Metallurgy sectors where abrasive slurries necessitate durable, mechanically actuated sealing mechanisms. The procurement process for these sophisticated components is often centralized, involving specialized procurement teams, project engineers, and safety officers who evaluate potential suppliers based not only on price but critically on demonstrated reliability, operational track record, certification compliance (e.g., API 6D, SIL ratings), and the availability of long-term technical support and spare parts inventory, ensuring seamless integration into complex industrial facilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,250 Million |

| Market Forecast in 2033 | USD 1,850 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Flowserve Corporation, Velan Inc., Emerson Electric Co. (Vanessa/Fisher), Cameron (Schlumberger), ValvTechnologies Inc., W&O Supply (Audco Plug Valves), Pibiviesse S.r.l., Zwick Armaturen GmbH, Kitz Corporation, Metso Outotec (Neles), XOMOX Corporation (Crane Co.), A&R Plug Valves, Tomoe Valve, BFE S.p.A., M&J Valve Services, Neway Valve (Suzhou) Co., Ltd., JC Valves, L&M Valve Co., Vexve Armatury Group, Pentair Valves & Controls (Tyco). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Expanding Plug Valves Market Key Technology Landscape

The technology landscape of the Expanding Plug Valves Market is characterized by a strong focus on enhancing sealing performance, durability, and integration capabilities through advanced material science and digital transformation. Modern expanding plug valves utilize proprietary coating technologies, such as Tungsten Carbide or Stellite overlays, applied to the plug and seating surfaces. These coatings are essential to combat erosion, corrosion, and galling, particularly in abrasive or high-cycling applications, significantly extending the Mean Time Between Failures (MTBF). Furthermore, advancements in sealing materials, including specialized polymers and composite seat inserts, are continuously being researched to ensure leak tightness across a broader range of temperatures and pressures, adhering to increasingly strict fugitive emission standards like ISO 15848-1 requirements.

A crucial technological trend involves the increasing adoption of sophisticated, intelligent actuation systems. These modern actuators, whether electric or electro-hydraulic, are equipped with integrated sensors and microprocessors that monitor critical operational parameters such as torque, cycle time, position, and vibration. This technology allows for precise control over the expansion and contraction of the plug mechanism, which is vital for maintaining the integrity of the bubble-tight seal. These smart components are designed to communicate real-time health data via industrial IoT protocols, enabling operators to implement condition monitoring and predictive maintenance strategies, thereby minimizing unexpected downtime and maximizing asset utilization in remote pipeline segments and critical facilities.

The design methodologies themselves are evolving, with manufacturers leveraging advanced Computational Fluid Dynamics (CFD) and Finite Element Analysis (FEA) software during the design phase. This technology allows for the simulation of stress distribution across the valve body under high-pressure conditions and optimization of flow paths to reduce turbulence and pressure drop. This iterative design optimization results in lighter, yet more robust, valve designs that meet stringent safety requirements without unnecessary material usage. The continuing convergence of robust mechanical engineering principles with digital monitoring technologies represents the future direction of the expanding plug valve market, ensuring longevity, reliable sealing, and operational data accessibility for critical infrastructure management across the globe.

Regional Highlights

Regional dynamics significantly influence the Expanding Plug Valves Market due to varied levels of infrastructure maturity, energy resource distribution, and regulatory environments.

- North America: This region holds a dominant market share, driven by the extensive network of oil and gas pipelines (particularly in the US and Canada), strict pipeline safety regulations (e.g., PHMSA rules), and high adoption rates of advanced valve technologies for mainline isolation and custody transfer applications. The continuous need for infrastructure upgrade and the expansion related to shale gas and oil extraction sustain high demand for high-integrity, large-bore expanding plug valves.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market due to rapid industrial expansion, massive investments in new cross-country natural gas pipelines (especially in China, India, and Southeast Asia), and increasing refinery capacity. Economic growth in developing nations fuels significant capital expenditure on energy infrastructure, necessitating procurement of high-performance valves.

- Europe: Characterized by mature energy infrastructure and an intense regulatory focus on environmental protection and safety. Demand here is driven largely by replacement cycles, modernization projects, and a strong emphasis on achieving near-zero fugitive emissions (met well by the expanding plug design). The region is also becoming a key early adopter of specialized valves for emerging hydrogen and CCUS infrastructure projects.

- Middle East and Africa (MEA): This region is crucial due to vast crude oil and natural gas reserves and ongoing massive investment in export infrastructure. Demand is concentrated on large-bore, high-pressure valves required for mainline transmission and critical isolation points within export terminals and processing facilities, driven by ambitious state-led energy projects.

- Latin America: Growth is steady, primarily linked to recovery in the oil and gas sector (e.g., Brazil, Mexico, Argentina) and regional pipeline connectivity projects. The market requires reliable, cost-effective solutions for harsh operating environments, where expanding plug valves offer a superior solution compared to less robust valve types.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Expanding Plug Valves Market.- Flowserve Corporation

- Velan Inc.

- Emerson Electric Co. (Vanessa/Fisher)

- Cameron (Schlumberger)

- ValvTechnologies Inc.

- W&O Supply (Audco Plug Valves)

- Pibiviesse S.r.l.

- Zwick Armaturen GmbH

- Kitz Corporation

- Metso Outotec (Neles)

- XOMOX Corporation (Crane Co.)

- A&R Plug Valves

- Tomoe Valve

- BFE S.p.A.

- M&J Valve Services

- Neway Valve (Suzhou) Co., Ltd.

- JC Valves

- L&M Valve Co.

- Vexve Armatury Group

- Pentair Valves & Controls (Tyco)

Frequently Asked Questions

Analyze common user questions about the Expanding Plug Valves market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of an expanding plug valve over a standard ball or gate valve?

The primary advantage of the expanding plug valve is its guaranteed Double Block and Bleed (DBB) capability achieved through a mechanical seal. When closed, the plug expands to contact the upstream and downstream seat surfaces, providing verifiable, bubble-tight isolation, which is superior to the relying on soft seals or line pressure for sealing, crucial for critical pipeline and custody transfer applications.

Which end-use industry is the largest consumer of expanding plug valves globally?

The Oil and Gas industry, specifically the midstream sector encompassing high-pressure transmission pipelines and storage terminals, is the largest consumer. This dominance is driven by the stringent regulatory requirements for zero leakage (fugitive emissions control) and reliable isolation at mainline block valve stations and metering points where the integrity of the shutoff is paramount.

How does the material selection influence the performance and cost of expanding plug valves?

Material selection significantly impacts both performance and cost. Standard carbon steel is used for non-corrosive service, offering cost efficiency. However, severe applications involving sour gas or high temperatures require costly specialty alloys (e.g., Duplex Steel, Inconel) to ensure resistance to stress corrosion cracking and erosion, guaranteeing long-term operational integrity and regulatory compliance.

What role does automation play in the deployment of modern expanding plug valves?

Automation, particularly through electric or electro-hydraulic actuators integrated with smart monitoring systems, plays a critical role. It allows for fast, precise remote control of the valve's operation, monitoring of mechanical health (torque, temperature), and integration into Supervisory Control and Data Acquisition (SCADA) systems, facilitating predictive maintenance and rapid emergency response, particularly in remote pipeline locations.

Is the expanding plug valve market impacted by the transition to renewable energy sources?

While the market is historically tied to fossil fuels, the transition to renewable energy is opening new application niches. Expanding plug valves are highly suitable for emerging infrastructure projects, particularly those related to hydrogen transportation and Carbon Capture, Utilization, and Storage (CCUS), due to the necessity of ensuring absolute sealing integrity for these critical, high-pressure gases, mitigating potential long-term displacement risk.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager