Exposed Fastener Panels Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433735 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Exposed Fastener Panels Market Size

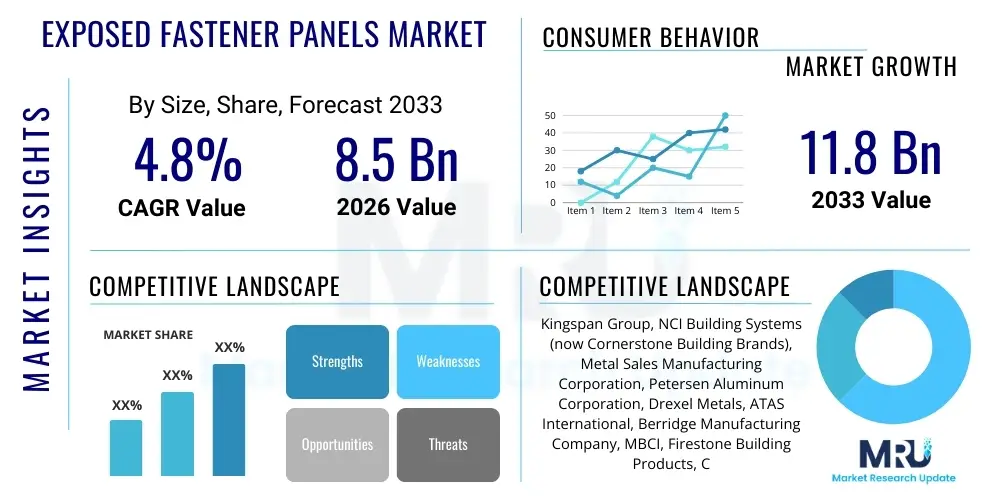

The Exposed Fastener Panels Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 11.8 Billion by the end of the forecast period in 2033.

Exposed Fastener Panels Market introduction

The Exposed Fastener Panels Market encompasses a specialized segment of the construction industry focused on metal cladding and roofing systems where the fasteners used to attach the panels to the substrate remain visible after installation. These panels, typically made from materials such as steel, aluminum, and copper, offer exceptional durability, fire resistance, and relative ease of installation compared to complex concealed systems. They are widely utilized across major sectors including commercial facilities, industrial warehouses, agricultural structures, and increasingly, certain residential applications where a rugged, utilitarian aesthetic is desired. The product design emphasizes functionality and cost-effectiveness, making it a popular choice for large-scale construction projects requiring fast deployment and long-term structural integrity.

Major applications for exposed fastener panels span the protection of exterior walls and roofs against severe weather conditions, mechanical damage, and corrosion. Their primary benefits include superior strength-to-weight ratio, low maintenance requirements over a long service life, and adaptability to various architectural designs through different panel profiles and color coatings. Furthermore, these systems often contribute positively to the energy efficiency of buildings when integrated with appropriate insulation materials. The driving factors behind market expansion include robust growth in the industrial and logistics sectors globally, necessitating large-span, durable building envelopes, coupled with the affordability and speed of construction offered by these panel systems, particularly in developing economies.

The market environment is characterized by intense competition among manufacturers offering diverse profiles, gauges, and coating technologies, such as Kynar 500 (PVDF) and SMP finishes, which enhance longevity and aesthetic appeal. Regulatory compliance regarding structural performance and environmental sustainability (e.g., recycled content) is becoming increasingly important. As construction demands for resilience and rapid turnaround escalate, the simplicity and proven performance of exposed fastener panels solidify their position as essential components in the modern building materials portfolio. The inherent design simplicity minimizes installation complexity, appealing to contractors focused on maximizing project throughput.

Exposed Fastener Panels Market Executive Summary

The Exposed Fastener Panels Market is experiencing steady, moderate growth, primarily driven by sustained global expansion in industrial construction, particularly the rapid development of distribution centers, manufacturing plants, and agricultural facilities. Business trends indicate a strong focus on optimizing material efficiency and adopting specialized coatings to enhance panel lifespan and corrosion resistance, thereby meeting increasing demands for sustainable, low-maintenance building envelopes. Regional trends highlight Asia Pacific (APAC) as the fastest-growing market due to rapid urbanization and massive infrastructure investments, while North America and Europe remain mature markets focused on renovation, replacement, and premium-grade, architecturally integrated exposed systems. The shift towards lightweight, high-strength aluminum panels in specific corrosive environments is a notable material-based trend, contrasting with the continued dominance of galvanized and prepainted steel panels globally due to their cost efficiency and structural robustness.

Segment trends reveal that the Industrial application segment maintains the largest market share, driven by volume demand, although the Commercial segment shows strong value growth due to higher specifications and aesthetic requirements for retail, office, and institutional buildings. Thickness segmentation emphasizes the continued relevance of standard gauge panels for roofing applications where structural integrity is paramount, while thinner gauge panels find niche uses in interior lining or less demanding wall applications. Furthermore, the push towards green building standards is subtly influencing the material mix, encouraging manufacturers to document the recycled content and end-of-life recyclability of their metal panels. Competitive strategies center around backward integration, streamlining distribution channels, and offering comprehensive warranties that certify long-term performance.

Geopolitical stability and macroeconomic performance, particularly in relation to raw material prices (steel and aluminum), significantly influence market pricing and profitability. Companies are actively investing in automated fabrication processes to enhance production scale and precision, thereby reducing operational costs and improving product quality consistency. The executive outlook suggests that while regulatory headwinds regarding energy efficiency might favor concealed systems in some high-specification sectors, the inherent cost advantage and simplicity of installation will ensure exposed fastener panels remain the preferred solution for budget-sensitive and high-volume construction globally throughout the forecast period. Technological advancements primarily revolve around coating chemistry and improved fastening techniques that minimize panel penetration issues and ensure weather tightness.

AI Impact Analysis on Exposed Fastener Panels Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Exposed Fastener Panels Market frequently center on efficiency gains in manufacturing, optimization of material logistics, and the potential for AI-driven design tools to influence panel profile customization and installation planning. Users are keen to understand how AI can predict demand fluctuations to minimize inventory waste, optimize complex supply chains spanning multiple continents, and whether AI vision systems can improve quality control (QC) by detecting minute defects in coating or forming processes. A significant concern relates to how AI algorithms might streamline the panel cutting and bundling process on construction sites to reduce labor time and material scrap, thus directly addressing profitability and sustainability objectives within this cost-sensitive segment.

- AI-Powered Demand Forecasting: Improves raw material procurement and inventory management, reducing the impact of volatile steel/aluminum prices.

- Generative Design Optimization: AI algorithms assist in designing new panel profiles (rib heights, spacing) for maximum structural performance using minimum material, enhancing cost efficiency.

- Automated Quality Control (QC): Implementation of machine vision systems on production lines to instantly detect coating imperfections or dimensional errors.

- Logistics and Route Optimization: AI minimizes transportation costs and delivery times for large, bulky panel shipments to remote construction sites.

- Predictive Maintenance: Applied to roll-forming equipment to reduce unexpected downtime and maintain high manufacturing throughput.

- Installation Planning Simulation: AI tools simulate complex panel layouts to minimize cuts and waste on site, optimizing installation efficiency.

DRO & Impact Forces Of Exposed Fastener Panels Market

The Exposed Fastener Panels Market is primarily driven by the robust expansion of non-residential construction, particularly in the industrial and agricultural sectors, where cost efficiency, speed of erection, and durability are paramount requirements. Restraints include the rising competition from aesthetically superior concealed fastener systems in high-end commercial projects, fluctuating raw material costs (steel and aluminum), and environmental regulations promoting higher insulation standards that occasionally favor integrated panel systems. Opportunities are centered on developing advanced coating technologies (e.g., solar-reflective paints) to improve energy performance, expanding adoption in rapidly urbanizing regions of APAC and MEA, and utilizing exposed panels in modular construction methods which prioritize rapid assembly. The cumulative impact of these forces suggests a stable yet competitive growth trajectory, where material innovation and supply chain efficiency will be critical determinants of market share and profitability over the forecast period.

Segmentation Analysis

The Exposed Fastener Panels Market is segmented based on Material Type, Application, and Thickness, providing a detailed view of demand dynamics across various end-use sectors. Material type segmentation reveals the continued dominance of steel panels due to their superior strength and cost-effectiveness, although aluminum panels are gaining traction in areas requiring enhanced corrosion resistance, such as coastal or highly industrialized zones. Application segmentation clearly delineates the high-volume demand originating from the Industrial sector (warehouses, factories) versus the higher-specification requirements typical of the Commercial sector (retail, offices). Thickness segmentation reflects functional requirements, with thicker gauges preferred for load-bearing roofing structures and thinner gauges suitable for non-structural wall cladding or fascia elements. Understanding these segments is crucial for manufacturers to tailor their production capabilities and marketing efforts effectively.

- Material Type

- Steel (Galvanized, Galvalume)

- Aluminum

- Copper

- Others (e.g., Zinc)

- Application

- Commercial Construction

- Industrial Construction

- Agricultural Buildings

- Residential (Niche)

- Thickness

- Thin Gauge (26 Gauge and Thinner)

- Standard Gauge (24 and 22 Gauge)

- Heavy Gauge (20 Gauge and Thicker)

- Profile Type

- R-Panel (PBR/PBU)

- Corrugated Panels

- Through-Fastened Standing Seam

Value Chain Analysis For Exposed Fastener Panels Market

The value chain for the Exposed Fastener Panels Market begins with the upstream sourcing of primary raw materials, predominantly flat rolled steel (coils) and aluminum sheets, which are supplied by large integrated steel mills and aluminum producers. This stage is characterized by high capital intensity and significant sensitivity to global commodity price fluctuations, directly influencing the final cost structure of the panels. The midstream involves core manufacturing processes, including cleaning, coating (applying primers and specialized topcoats like PVDF), roll forming, and cutting, where manufacturers employ advanced machinery to convert raw coils into finished panel profiles. Efficiency in this segment, driven by automation and energy management, is key to maintaining competitive pricing and high-quality output necessary for long-term warranties.

The downstream distribution channels are multifaceted, primarily utilizing direct sales to major contractors for large projects, and indirect channels through regional distributors, specialized roofing supply houses, and building material retailers for smaller commercial or residential jobs. Direct channels facilitate customization and closer relationship management, crucial for high-specification projects. Indirect channels, conversely, provide broader market penetration and inventory availability, which is essential for the high-volume, quick-turnaround nature of many industrial and agricultural construction projects. Installers and specialized subcontractors represent the final stage, playing a critical role in project success, as proper installation is vital for weatherproofing and panel longevity.

Interactions between chain elements are heavily regulated by specifications, standards, and warranties. Manufacturers provide extensive technical documentation and certifications to architects and contractors, ensuring product suitability. The dominance of indirect distribution highlights the importance of strong logistics networks capable of handling long, specialized panel shipments efficiently. Digital transformation is increasingly influencing the downstream segment, with online platforms and Building Information Modeling (BIM) tools facilitating easier product specification and procurement, gradually streamlining the traditional, often fragmented supply structure and improving collaboration between manufacturers, distributors, and installers.

Exposed Fastener Panels Market Potential Customers

The primary customers and end-users of Exposed Fastener Panels are large general contractors and specialized metal building constructors focusing on the construction of industrial, commercial, and agricultural facilities. In the industrial sector, buyers include developers of logistics hubs, warehousing complexes, and heavy manufacturing plants, valuing the panels for their rapid deployment, low lifecycle cost, and high durability against physical and environmental stresses. Commercial customers, such as owners and developers of retail centers, schools, and institutional buildings, seek panels that offer a balance of aesthetic appeal (color, profile) and structural longevity, often adhering to stricter fire and wind uplift standards. Agricultural end-users, including farm owners and agribusinesses, prioritize cost-effectiveness and resistance to harsh environmental conditions specific to livestock and storage structures.

A secondary, yet growing, customer base includes residential homeowners and builders involved in specialized projects such as metal barndominiums, detached garages, or rustic residential roofing. While traditional housing often favors concealed systems, the exposed panels appeal to those seeking a modern, durable, or industrial look. Moreover, the replacement and retrofitting market represents a continuous revenue stream, where building owners and facility managers of aging structures purchase exposed fastener panels for cost-effective restoration and upgrade of existing metal roofs and walls, driven by necessary maintenance cycles and insurance requirements. Key decision-makers in large projects typically include procurement managers, project engineers, and architects who specify materials based on performance criteria, budget constraints, and compliance requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 11.8 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kingspan Group, NCI Building Systems (now Cornerstone Building Brands), Metal Sales Manufacturing Corporation, Petersen Aluminum Corporation, Drexel Metals, ATAS International, Berridge Manufacturing Company, MBCI, Firestone Building Products, Carlisle Companies Incorporated, GreenSpan, Alcoa, CertainTeed, Sheffield Metals, Tamko Building Products, Allied Building Products, Coated Metals Group (CMG), New Millennium Building Systems, Tuff-Rib Metals. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Exposed Fastener Panels Market Key Technology Landscape

The technological landscape of the Exposed Fastener Panels Market is predominantly defined by advancements in coating chemistry, roll-forming precision, and digital integration. The most critical technology remains the application of high-performance architectural coatings, such as Polyvinylidene Fluoride (PVDF or Kynar 500), Siliconized Modified Polyester (SMP), and specialized weathering films. These coatings are essential for protecting the metal substrate from UV radiation, acid rain, and general atmospheric corrosion, significantly extending the life cycle of the product and maintaining aesthetic integrity. Recent innovations focus on cool roof technologies, incorporating pigments that reflect solar heat, thereby reducing a building's cooling loads and contributing to LEED certification compliance. The continuous coil coating process requires precise temperature and thickness controls, often utilizing sophisticated sensors and computer numeric control (CNC) systems to ensure uniformity and adherence to strict color specifications, crucial for quality assurance in large-scale projects.

Manufacturing technology relies heavily on advanced, high-speed roll-forming lines. These lines must maintain extremely tight tolerances across long panel lengths (often exceeding 50 feet) while forming complex profiles rapidly. Key technological drivers here include quick-change tooling systems, which allow manufacturers to efficiently switch between different panel profiles (e.g., R-Panel to Corrugated) with minimal downtime, improving production flexibility. Furthermore, integrated digital measurement systems ensure the accuracy of rib spacing and depth, vital for proper panel nesting and installation. The precision afforded by modern roll-forming equipment allows for the use of lighter gauge materials without sacrificing structural integrity, driving material efficiency and cost reduction across the market segment.

Beyond the core manufacturing, ancillary technologies related to fastening systems and sealants are paramount. Innovations include enhanced washer designs and self-drilling screws that offer superior sealing capacity and resistance to thermal movement and wind uplift forces, minimizing the risk associated with visible penetrations. Moreover, the adoption of Building Information Modeling (BIM) software is transforming the specification process, allowing architects and contractors to model exposed fastener systems in 3D, calculate material quantities precisely, and visualize aesthetic outcomes before fabrication commences. This digital integration reduces costly errors on site, improves project scheduling, and facilitates complex project management, establishing a critical technological link between design, fabrication, and installation, especially for high-volume orders.

Regional Highlights

- North America (US and Canada): This region represents a mature yet high-value market, characterized by strict building codes, particularly concerning wind uplift and fire resistance. The demand is driven by commercial and industrial renovation cycles and a strong focus on energy efficiency. The US market emphasizes high-quality coatings (PVDF) and compliance with green building standards (e.g., LEED). Standardization in panel profiles and robust distributor networks ensure consistent material supply. The US remains a leader in technology adoption concerning high-speed manufacturing and coating application expertise.

- Europe (Germany, UK, France): Europe showcases a diverse market, with demand being strongly influenced by rigorous environmental regulations and architectural preferences that often favor high-quality, long-life metal systems. While concealed fastener systems are preferred in high-end urban construction, exposed panels maintain strong presence in agricultural, industrial, and logistics sectors across Central and Eastern Europe due to cost-performance benefits. The focus here is increasingly on panel recyclability and minimal environmental impact during manufacturing.

- Asia Pacific (APAC) (China, India, Southeast Asia): APAC is the most dynamic and fastest-growing region globally, primarily fueled by massive infrastructure investment, rapid industrialization, and explosive growth in warehousing and logistics facilities, especially in China and India. Cost is a major purchasing criterion, driving high-volume demand for standard steel exposed fastener panels. The market faces challenges related to quality consistency and adherence to international installation standards, but offers significant growth opportunities driven by burgeoning urbanization and manufacturing capacity expansion.

- Latin America (LATAM): The LATAM market, while smaller in scale than APAC, shows steady growth driven by mining infrastructure, light industrial construction, and agricultural expansion (Brazil, Mexico). Market stability is often challenged by economic volatility, leading to sensitivity in raw material procurement. Local manufacturers often focus on standard corrugated profiles due to simpler manufacturing requirements and high acceptance within the regional construction practices.

- Middle East and Africa (MEA): Demand in the MEA region is dictated by massive government-led mega-projects, especially in the Gulf Cooperation Council (GCC) states, and the need for materials that withstand extreme heat, intense UV exposure, and high salinity (coastal areas). This necessitates specialized, thick-gauge panels with superior reflective and corrosion-resistant coatings. The African market is nascent but promises future growth, focusing initially on low-cost solutions for light industrial and agricultural warehousing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Exposed Fastener Panels Market.- Kingspan Group

- Cornerstone Building Brands (formerly NCI Building Systems)

- Metal Sales Manufacturing Corporation

- Petersen Aluminum Corporation

- Drexel Metals

- ATAS International

- Berridge Manufacturing Company

- MBCI

- Firestone Building Products (part of Holcim)

- Carlisle Companies Incorporated

- GreenSpan

- Alcoa Corporation

- CertainTeed (Saint-Gobain)

- Sheffield Metals International

- Tamko Building Products

- AEP Span (A division of ASC Profiles)

- Bridger Steel

- Coated Metals Group (CMG)

- New Millennium Building Systems

- S-5! (Fastening Solutions Provider)

Frequently Asked Questions

Analyze common user questions about the Exposed Fastener Panels market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between exposed and concealed fastener panels?

Exposed fastener panels are attached directly through the face of the panel into the substrate, leaving the fastener heads visible. They are typically more cost-effective and faster to install. Concealed fastener panels hide the fasteners beneath the panel lip or overlap, offering superior aesthetics and often better weather resistance due to reduced penetration points, but requiring specialized installation techniques.

Which material dominates the exposed fastener panel market?

Prepainted and galvanized steel panels dominate the market due to their excellent strength-to-cost ratio, widespread availability, and versatility in various applications, particularly high-volume industrial and agricultural construction where durability and economy are prioritized over premium aesthetics.

What is the typical lifespan of an exposed fastener panel system?

The lifespan heavily depends on the metal substrate and the quality of the protective coating. High-quality systems utilizing PVDF coatings on Galvalume steel can offer performance warranties exceeding 40 years, while basic SMP coatings typically provide 20 to 30 years of functional life before significant fading or substrate corrosion necessitates replacement or recoating.

How do exposed fastener panels contribute to cool roofing?

Manufacturers utilize specialized solar-reflective coatings, often included in PVDF formulations, which reflect a significant portion of solar energy away from the building. This reduces the heat absorbed by the roof structure, lowering the building’s internal temperature and decreasing energy consumption related to air conditioning, qualifying them for "Cool Roof" status.

Is the Exposed Fastener Panels Market influenced by DIY trends?

Yes, while large industrial projects drive volume, the market segment for simpler profiles (like corrugated) is increasingly influenced by DIY and small agricultural/residential shed builders due to the panels' ease of cutting, handling, and installation compared to traditional roofing or siding materials, making them accessible for owner-built projects.

The detailed analysis of the market dynamics reveals a robust and foundational segment of the construction materials industry, characterized by high volume, cost efficiency, and critical structural applications. The continued growth in warehousing and industrial logistics globally ensures sustained demand, counteracting the aesthetic preferences favoring concealed systems in niche architectural markets. Manufacturers must prioritize supply chain resilience and coating innovation to maintain competitive advantage in a market increasingly sensitive to both material cost volatility and long-term environmental performance requirements. The geographic shift toward APAC highlights the necessity for localized production and distribution strategies to capture emerging opportunities in rapidly developing economies, cementing the exposed fastener panel as an indispensable solution for durable, rapid construction worldwide.

Future market evolution will likely involve greater integration with modular construction techniques, leveraging the panel’s inherent rapid assembly characteristics. Furthermore, advancements in fastener technology—specifically those that mitigate thermal bridging and enhance water tightness while remaining exposed—will define product differentiation. Sustainability pressures will also necessitate clearer documentation of embodied carbon and recyclability metrics, pushing the industry toward more circular economic models. Ultimately, the stability of the exposed fastener panels market is rooted in its proven performance and cost-effectiveness, securing its role as the workhorse of industrial and agricultural construction for the foreseeable future, even as digital tools revolutionize design and fabrication processes.

The competitive landscape requires strategic investment in regional distribution capabilities, particularly in the fast-growing regions of Southeast Asia and Latin America, where rapid urbanization demands immediate and scalable building solutions. Companies that can effectively manage raw material price hedging and offer comprehensive, long-term warranties on their coating systems will achieve superior market positioning. Technological adoption focused on AI in production planning and predictive quality control will further solidify operational efficiencies, transforming the exposed fastener segment from a purely commodity product toward a high-performance engineered system, capable of meeting modern construction requirements related to resilience, speed, and overall lifecycle value.

Market penetration into non-traditional segments, such as highly customized residential or specialized infrastructure projects (e.g., sound barriers, temporary facilities), offers incremental growth pathways. Successful market players are those who can balance the need for high-volume, low-cost standard profiles with the flexibility to offer customized colors, textures, and dimensions required for architecturally demanding projects. This dual strategy ensures both maximum market coverage and the ability to capture higher margins in specialized applications, ensuring portfolio robustness against cyclical fluctuations in major construction sectors. The interplay between regulatory standards, material science, and construction practices will continue to shape the trajectory of this essential building component market.

The detailed breakdown across material types shows that while aluminum is gaining favor for premium, corrosion-sensitive coastal areas due to its lightweight and inherent resistance, steel remains the foundational element due to its superior strength and lower cost base. Manufacturers are exploring hybrid panel designs that utilize different materials or layered compositions to optimize performance characteristics without significantly increasing the overall complexity or cost of installation. This innovation pathway, focusing on enhanced thermal break features and integrated sealing solutions, represents a key area of research and development expenditure for leading market participants striving to maintain relevance against competing technologies.

Regarding application trends, the Industrial segment’s demand is often counter-cyclical to residential and commercial construction in certain economies, providing a stabilizing factor for the market during economic downturns. The need for large, easily constructible industrial shells—driven by e-commerce fulfillment centers and reshoring of manufacturing—offers a reliable demand floor. Furthermore, the specialized agricultural segment, particularly storage for crops and equipment, mandates materials that are easy to clean, highly durable against impacts, and resistant to chemicals, requirements which exposed fastener metal panels meet effectively and economically.

In terms of regulatory impact, the increasing focus on stringent building envelope performance, especially related to air and moisture barriers, places pressure on exposed fastener systems, traditionally viewed as less effective than concealed systems in meeting ultra-high performance standards. Manufacturers are responding by developing sophisticated ancillary products like high-performance seam sealants and improved clip designs, effectively turning the exposed fastener system into a more resilient building envelope solution. This push towards enhanced performance without losing the cost advantage is central to the long-term competitive strategy within the market, ensuring compliance with evolving green building mandates across all major geographic regions.

The competitive environment is characterized by a mix of large global building material conglomerates and specialized regional metal fabricators. The global players leverage scale, extensive distribution networks, and R&D budgets focused on coating innovations and process automation. Regional players, conversely, often compete effectively on lead times, highly localized customer service, and the ability to meet unique regional code requirements promptly. Mergers and acquisitions remain a consistent feature of this market, as larger entities seek to consolidate regional distribution strength and integrate specialized coating or profiling technologies, aiming for a broader geographical footprint and enhanced product offering diversity.

Finally, the long-term outlook for Exposed Fastener Panels is intrinsically linked to global population growth, urbanization rates, and the necessary expansion of logistical and manufacturing infrastructure worldwide. As economies continue to develop, the demand for foundational, robust, and economically viable building materials will persist. Therefore, while high-end architectural applications may favor aesthetic alternatives, the core industrial and large-scale utility segments guarantee stable, persistent demand for these proven and effective metal panel systems, reinforcing the market’s projected growth trajectory through 2033.

The integration of smart manufacturing principles, often termed Industry 4.0, is becoming standard practice in the Exposed Fastener Panel fabrication process. This involves using interconnected systems for real-time monitoring of production variables, optimizing material usage, and performing preemptive maintenance on machinery. Such technological adoption ensures minimal downtime and superior product uniformity, which is vital when delivering high volumes of precision-cut panels for time-sensitive construction schedules. The investment in these digital manufacturing technologies is high but yields significant returns in reduced waste, improved labor efficiency, and enhanced customer satisfaction through reliable product delivery.

Furthermore, the market benefits from a shift away from traditional roofing materials (like built-up roofs or asphalt shingles) in certain commercial sectors toward metal panels, even with exposed fasteners, due to the superior longevity, resistance to fire, and low maintenance characteristics of metal. This material substitution trend, driven by lifecycle cost analysis rather than initial capital outlay, provides a consistent tailwind for market expansion, particularly in regions prone to severe weather events where resilience is a primary concern for building owners and insurers. The performance data backing these claims is robust, contributing significantly to material specification decisions.

In terms of global trade, the market is subject to various trade tariffs and duties on steel and aluminum, which necessitate flexible sourcing and manufacturing strategies. Companies must navigate complex international supply chains, often requiring strategically located manufacturing plants or assembly hubs near major consuming markets (e.g., Southeast Asia, Eastern Europe) to mitigate the effects of trade restrictions and high logistics costs associated with transporting large, bulky panels over vast distances. Supply chain sophistication is, therefore, a key differentiator in determining profitability and market competitiveness in the global arena.

The specialization within fastening solutions is a micro-trend that holds macroeconomic importance. While the fasteners are exposed, their performance is paramount. Innovations in specialized coatings on the fasteners themselves, coupled with advanced washer materials (e.g., EPDM rubber compounds with enhanced UV and temperature stability), ensure that the weakest link in the system—the point of penetration—does not compromise the long-term weather tightness of the roof or wall. This continuous improvement in ancillary components is crucial for supporting the extended warranties offered by panel manufacturers, thereby maintaining client confidence in the overall system integrity.

Finally, market research indicates a growing niche demand for specialty metals such as copper and zinc exposed fastener panels. Although significantly higher in cost, these materials are specified for highly bespoke architectural projects where unique patinas, exceptional corrosion resistance, and specific aesthetic longevity are non-negotiable requirements. While representing a minor segment by volume, these specialty metals contribute disproportionately to the market's total value, pushing the boundaries of design and material application within the broader exposed fastener category, demonstrating the capacity for the market to cater to premium as well as high-volume needs.

The ongoing push for resilient and sustainable construction methods globally is intrinsically linked to the future prospects of the exposed fastener panels market. Due to their high recycled content potential and 100% recyclability at the end of their service life, metal panels align well with circular economy principles. This inherent sustainability advantage over many non-metal cladding systems positions the market favorably in jurisdictions adopting strict environmental building criteria. The transparency and durability of metal as a construction material are powerful selling points that resonate with increasingly environmentally conscious clients and developers.

The role of regulatory bodies in standardizing testing methods for wind uplift resistance, fire rating, and thermal performance is critical for market maturity. Compliance with standards set by organizations like the ASTM (American Society for Testing and Materials) and FM Approvals (Factory Mutual) is mandatory for large-scale commercial and industrial insurance eligibility. Manufacturers actively invest in laboratory testing and certification processes, providing architects and engineers with the verifiable data necessary to confidently specify exposed fastener panels in high-stakes projects, further solidifying their position as reliable building components.

Education and training within the construction workforce regarding proper installation techniques for exposed fastener systems remain essential for product performance. While installation is generally simpler than for concealed systems, improper fastening techniques (e.g., over-tightening or incorrect placement) can compromise weather sealing and panel longevity. Leading manufacturers frequently offer certified installer programs and detailed technical guides, addressing this critical interface between product quality and on-site execution, thus maintaining brand reputation and minimizing warranty claims related to installation errors.

Digital tools are increasingly bridging the gap between design and manufacturing. Customized online configurators allow contractors and distributors to select panel profiles, colors, lengths, and accessories, generating immediate quotes and CAD drawings. This digitalization streamlines the highly customized nature of metal fabrication, reduces processing errors, and dramatically shortens lead times, moving the exposed fastener market toward a more responsive and 'on-demand' manufacturing model, which is a major competitive advantage in the fast-paced construction industry of the 21st century.

In summary, the market outlook is characterized by resilience and adaptation. While facing competition from aesthetically advanced alternatives, the exposed fastener panel segment’s core value proposition—durability, speed, and cost-efficiency—ensures its fundamental role in global industrial and utility construction. Strategic investments in coating chemistry, automation, and supply chain logistics will determine success, enabling manufacturers to capitalize on the sustained global demand for robust and long-lasting building enclosures throughout the 2026-2033 forecast period and beyond.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager