Exterior Industrial Doors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436756 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Exterior Industrial Doors Market Size

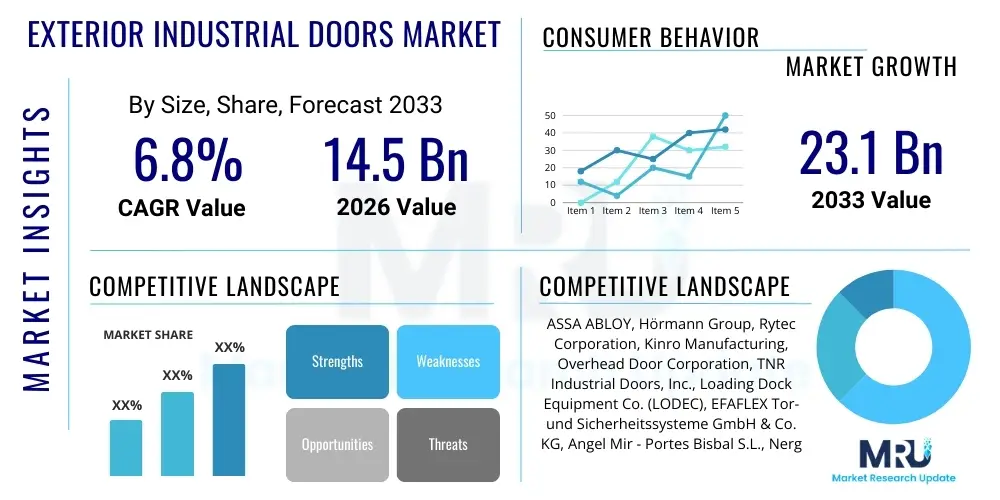

The Exterior Industrial Doors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $14.5 Billion in 2026 and is projected to reach $23.1 Billion by the end of the forecast period in 2033.

Exterior Industrial Doors Market introduction

The Exterior Industrial Doors Market encompasses a wide array of heavy-duty door systems designed specifically for commercial, industrial, and specialized environments. These doors, which include high-speed doors, roller shutters, sectional overhead doors, and hangar doors, serve critical functions related to climate control, security, energy efficiency, and operational speed. Unlike standard commercial doors, industrial doors must withstand extreme operational cycles, harsh weather conditions, and high-impact scenarios, making durability and reliable performance paramount. The primary application sectors driving demand include logistics and warehousing, manufacturing facilities, pharmaceuticals, cold storage, and large infrastructure projects, where efficient material flow and robust security are non-negotiable operational requirements. The increasing complexity of global supply chains and the rapid expansion of e-commerce necessitate faster and more reliable door solutions.

Product sophistication within this market is continually advancing, moving beyond basic physical barriers to integrated system components. Modern exterior industrial doors frequently incorporate advanced features such as automatic sensors, integrated safety systems (e.g., light barriers), and high-efficiency thermal insulation to minimize heat loss in temperature-sensitive applications. Furthermore, the push for operational efficiency is driving the adoption of high-speed door technologies, which drastically reduce opening and closing times, thereby optimizing traffic flow, minimizing cross-contamination risks in sensitive areas, and significantly lowering HVAC operational costs by limiting exposure to exterior environments. The design philosophy is shifting towards modular, easily maintainable systems that offer extended lifespans under continuous heavy use.

Key driving factors accelerating market growth include stringent regulatory mandates regarding energy conservation in industrial buildings, the global boom in large-scale warehousing construction fueled by digitalization, and heightened demand for enhanced security measures against unauthorized access and industrial espionage. Additionally, the replacement cycle for legacy industrial doors, often driven by new standards for worker safety (e.g., EN standards in Europe or OSHA requirements in North America), provides a steady underlying demand stream. The structural benefits these doors offer—such as improved logistical throughput, enhanced facility aesthetics, and significant energy savings—make them essential capital expenditures rather than mere operational expenses for businesses focused on long-term sustainability and profitability.

Exterior Industrial Doors Market Executive Summary

The Exterior Industrial Doors Market is characterized by robust business trends centered on automation, sustainability, and customization. Major manufacturers are heavily investing in developing smart door systems integrated with IoT capabilities, allowing for remote monitoring, predictive maintenance, and seamless integration with existing Warehouse Management Systems (WMS). This technological shift addresses the industrial need for minimized downtime and optimized operational flow. Furthermore, there is a pronounced trend towards sustainability, with companies prioritizing lightweight, durable materials and high thermal performance to meet global green building certifications. Competition remains high, driven by differentiation in service quality, maintenance contracts, and the ability to provide highly customized solutions for specialized industrial applications like cleanrooms or explosion-proof environments.

Regionally, the market exhibits varied growth trajectories. Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by massive investments in manufacturing expansion, urbanization, and the development of modern logistics parks in countries like China, India, and Southeast Asia. North America and Europe, while being mature markets, continue to demonstrate stable growth, primarily driven by the modernization and retrofitting of existing facilities, regulatory compliance requirements related to fire safety and energy efficiency, and the sustained growth of the cold chain logistics sector. The shift towards automated distribution centers in Western economies necessitates the continuous upgrading of exterior door infrastructure capable of handling autonomous vehicle traffic and high-volume cycles reliably.

In terms of segment trends, the High-Speed Doors segment is experiencing the most significant momentum due to its direct correlation with logistics efficiency and energy saving mandates. Material-wise, steel and aluminum remain dominant, but composite materials are gaining traction, particularly for applications requiring superior corrosion resistance or reduced weight. Application-wise, the warehousing and logistics segment remains the primary revenue generator, though specialized industrial sectors such as food and beverage processing, pharmaceuticals, and automotive assembly plants are becoming increasingly important due to their strict requirements for hygiene, controlled environments, and advanced safety features. This segmentation indicates a move toward highly specialized and value-added product offerings rather than standardized general-purpose doors.

AI Impact Analysis on Exterior Industrial Doors Market

User inquiries regarding AI's impact on the Exterior Industrial Doors Market frequently revolve around predictive maintenance capabilities, enhanced security features, and the integration of doors into smart factory ecosystems. Users are primarily concerned with how AI can minimize expensive downtime, which is critical in automated industrial environments, and how machine learning algorithms can detect subtle performance degradation long before a mechanical failure occurs. There is significant interest in using computer vision and AI processing embedded in door systems to enhance safety protocols, such as accurately distinguishing between personnel, forklifts, and autonomous mobile robots (AMRs), adjusting opening speeds or preventing closures based on real-time environmental analysis. Furthermore, potential customers seek confirmation on whether AI-driven systems can optimize energy consumption by learning facility traffic patterns and adjusting insulation or heating settings proactively.

The primary influence of Artificial Intelligence in this sector manifests in optimizing operational reliability and security. AI algorithms are increasingly being used to analyze vast streams of operational data—including cycle counts, motor temperature, vibration metrics, and speed consistency—to create highly accurate models for Remaining Useful Life (RUL) estimation for critical components like springs, motors, and bearings. This shift from calendar-based maintenance schedules to condition-based, predictive maintenance drastically reduces unexpected failures, thereby increasing the overall equipment effectiveness (OEE) of industrial facilities. The implementation of digital twins for complex door systems, powered by AI, allows facility managers to simulate various operational loads and environmental stresses virtually, ensuring optimal configuration before physical deployment.

Moreover, AI is transforming the security landscape of exterior industrial access points. By integrating AI-powered video analytics with door controls, systems can perform sophisticated access verification, identifying anomalies such as unauthorized loitering, unusual vehicles, or attempts to tamper with the door mechanism, providing alerts far superior to traditional sensor arrays. This proactive security layer is essential for critical infrastructure and high-value manufacturing environments. In the short term, AI primarily enhances monitoring and maintenance; however, the long-term trend involves using AI to dynamically manage traffic flow across multiple doors in a facility, coordinating speeds and schedules with internal logistics systems to achieve maximum throughput and energy efficiency across the entire building envelope.

- Enhanced Predictive Maintenance: AI models analyze sensor data (vibration, temperature, cycle counts) to forecast component failure, drastically reducing unplanned downtime.

- Optimized Energy Management: Machine learning algorithms learn facility traffic patterns and environmental conditions to modulate door operation, minimizing energy leakage.

- Advanced Safety Systems: AI-driven computer vision systems accurately classify objects (personnel, vehicles, AMRs) in the door path, customizing safety responses.

- Integration with Smart Factories: Seamless communication with WMS, MES, and other industrial automation platforms for synchronized material flow.

- Real-Time Security Analytics: AI identifies suspicious activities, tampering attempts, or unauthorized access patterns at exterior entry points.

- Automated Diagnostics and Troubleshooting: AI assists technicians by interpreting complex error codes and recommending precise repair procedures.

DRO & Impact Forces Of Exterior Industrial Doors Market

The dynamics of the Exterior Industrial Doors Market are shaped by a strong combination of factors: Drivers pushing for adoption, Restraints limiting pervasive growth, and Opportunities for future development, all synthesized into critical Impact Forces. The market is primarily driven by the global expansion of e-commerce and subsequent infrastructure spending on mega-warehousing and advanced logistics hubs, necessitating high-speed, durable, and large-format exterior doors. Compounding this driver is the global regulatory pressure towards increasing energy efficiency in commercial buildings, forcing older facilities to upgrade to thermally superior door systems. However, market growth is constrained by the high initial capital investment required for automated and specialized door systems, coupled with potential restraints related to the complexity of installation and the need for specialized technical skills for maintenance. Despite these restraints, opportunities abound in developing emerging markets, integrating advanced IoT security features, and expanding specialized offerings for high-growth sectors like cold chain logistics and controlled environment agriculture (CEA).

Key drivers include the imperative for improved operational safety and efficiency in industrial settings. Modern industrial doors incorporate enhanced safety features like emergency stops, light curtains, and built-in redundancy, responding to stricter OSHA and European safety standards. This regulatory push often mandates the replacement of older, non-compliant equipment. Additionally, the increasing trend towards manufacturing automation and the use of autonomous vehicles (AGVs/AMRs) within facilities requires exterior door systems that can operate seamlessly and reliably without human intervention, maintaining high cycle speeds while ensuring worker protection. The convergence of these operational and safety requirements establishes a persistent baseline demand for high-quality, technologically integrated doors.

Conversely, market growth faces obstacles, predominantly the economic sensitivity of industrial construction projects to macroeconomic fluctuations. A slowdown in commercial real estate or manufacturing capital expenditure directly impacts large-scale door procurement. Furthermore, the longevity and extended operational life of existing, older door systems often delays replacement decisions, particularly among small and medium-sized enterprises (SMEs) that view modern door systems as prohibitively expensive capital expenditure. Addressing these restraints requires manufacturers to focus on flexible financing models, offering modular upgrades, and demonstrating a compelling Return on Investment (ROI) through documented energy savings and productivity gains. Successfully navigating these market pressures allows manufacturers to capitalize on the overarching impact forces of digitalization and sustainability which dictate long-term industry direction.

Segmentation Analysis

The Exterior Industrial Doors Market is systematically segmented based on product type, operational mechanism, material utilized, and primary end-user application, providing a granular view of demand dynamics and niche market opportunities. Analyzing these segments is critical for manufacturers to tailor their production capabilities and marketing strategies effectively. The core segmentation often begins with the product type, differentiating between doors designed for high frequency (e.g., high-speed fabric or PVC doors) and those prioritized for robust security and insulation (e.g., steel sectional doors or heavy rolling shutters). Operational mechanisms further segment the market by manual, motorized, and fully automated (sensor-activated) systems, reflecting varying levels of required efficiency and investment across industrial facilities.

Material segmentation reveals preferences based on specific application requirements: steel is prevalent where security and impact resistance are primary, aluminum is favored for lightweight, corrosion-resistant applications, and flexible materials like PVC or specialized fabrics dominate the high-speed and cleanroom segments. This material diversification allows manufacturers to address varied environmental challenges, from extreme cold in freezer logistics to high moisture in food processing plants. Geographically, segmentation helps identify key regional differences in regulatory environments and construction standards, influencing local demand for fire-rated versus high-insulation door variants.

The end-user segmentation is the most telling of market dynamics, with logistics and warehousing consistently dominating due to throughput demands. However, specialized sectors like pharmaceutical manufacturing require cleanroom-compliant doors, while automotive assembly often demands large, highly automated overhead systems. This detailed segmentation highlights the necessity for highly customizable solutions, where features like high cycle life, hermetic sealing, or specific explosion-proof certifications become the decisive competitive advantages for specialized vendors targeting high-value industrial niches, driving the overall market towards sophistication and specialized engineering.

- By Product Type:

- Sectional Overhead Doors

- Rolling Shutters (Roller Doors)

- High-Speed Doors (Fabric/PVC)

- Hangar Doors

- Folding Doors

- Sliding Doors (Heavy Duty)

- By Material:

- Steel

- Aluminum

- Fiberglass and Composites

- PVC/Fabric

- By Operation Mechanism:

- Manual

- Motorized (Standard)

- Fully Automated (Sensor/Loop Detectors)

- By End-Use Application:

- Warehousing and Logistics

- Manufacturing (Automotive, Heavy Machinery)

- Food & Beverage Processing and Cold Storage

- Pharmaceutical and Healthcare

- Aerospace and Aviation

- Construction and Mining

Value Chain Analysis For Exterior Industrial Doors Market

The value chain for the Exterior Industrial Doors Market initiates with upstream activities encompassing raw material sourcing and component manufacturing. Upstream analysis focuses on securing high-quality, stable supplies of steel, aluminum, advanced plastics (PVC/polycarbonate), specialized motor drives, and electronic controls. Fluctuations in commodity prices, particularly steel, directly impact the profitability of door manufacturers. Strategic partnerships with specialized component suppliers for reliable, high-cycle motors and control systems are crucial, as these components dictate the long-term reliability and operational speed of the final product. Efficiency at this stage is achieved through vertical integration or long-term contractual sourcing agreements that mitigate supply chain volatility and ensure adherence to stringent material quality specifications required for industrial-grade performance.

Mid-stream activities involve the core manufacturing processes: design engineering, fabrication, assembly, and quality assurance. Differentiation often occurs here through specialized design capabilities, particularly for custom projects like large hangar doors or hermetically sealed cold storage doors. Manufacturers invest heavily in automated fabrication equipment to ensure precision and speed. The assembly process is often tailored based on the door type, with high-speed doors requiring precise fabric welding and control system integration, while sectional doors focus on panel insulation and structural integrity. Downstream analysis focuses critically on installation, maintenance, and service provision, which are essential value-added steps.

The distribution channel is predominantly mixed, relying on both direct sales and specialized indirect distribution networks. Direct channels are typically utilized for large, custom industrial projects involving major corporations, where direct consultation and engineering support are necessary. Indirect channels involve authorized dealers, specialized industrial equipment distributors, and installation contractors who often integrate door systems into larger construction projects. The service component, including mandatory post-installation maintenance and emergency repair services, forms a significant and high-margin part of the downstream value chain. This necessitates continuous training of certified technicians to handle complex electrical and mechanical systems, ensuring customer satisfaction and maximizing product lifecycle.

Exterior Industrial Doors Market Potential Customers

The potential customers for Exterior Industrial Doors are diverse but fundamentally share the need for reliable, high-throughput, secure, and energy-efficient access solutions for their facilities. The dominant customer base includes operators of massive logistics hubs and distribution centers, ranging from third-party logistics (3PL) providers to large e-commerce giants. These customers prioritize high-speed doors with exceptional cycle life to manage relentless vehicle and personnel traffic flow efficiently, seeking to minimize time lost during loading and unloading operations. Their purchasing decisions are driven by total cost of ownership (TCO), speed of operation, and integration capability with automated internal systems.

Another major segment comprises the heavy manufacturing sector, specifically automotive assembly plants, aerospace facilities, and heavy machinery producers. For these buyers, the doors must often be extremely large, highly durable, and capable of withstanding industrial environments (e.g., welding sparks, heavy dust). Security and environmental protection are key factors, especially in areas where climate control is necessary for precision manufacturing or where valuable assets are stored. These customers often require highly specialized safety sensors and durable construction materials like heavy-gauge steel or highly reinforced aluminum.

Specialized industry customers represent a high-value niche, including food and beverage processing facilities, pharmaceutical manufacturers, and cold chain logistics providers. These end-users demand doors that meet strict hygienic standards (e.g., FDA or HACCP compliance), featuring smooth, easy-to-clean surfaces, hermetic seals to maintain pressure differentials, and corrosion resistance. For cold storage, the essential requirement is maximizing thermal insulation while ensuring high-speed operation to prevent temperature spikes. These sophisticated buyers are willing to invest in premium solutions that guarantee regulatory compliance and significantly reduce operational energy waste, making product certification a critical purchasing criterion.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $14.5 Billion |

| Market Forecast in 2033 | $23.1 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ASSA ABLOY, Hörmann Group, Rytec Corporation, Kinro Manufacturing, Overhead Door Corporation, TNR Industrial Doors, Inc., Loading Dock Equipment Co. (LODEC), EFAFLEX Tor- und Sicherheitssysteme GmbH & Co. KG, Angel Mir - Portes Bisbal S.L., Nergeco SAS, Albany Door Systems (now part of ASSA ABLOY), Rite-Hite Holding Corporation, Gandhi Automations Pvt. Ltd., Chase Doors, Entrematic Group AB, Industrial Door Company, TMI, LLC, V-SIKAR Industrial Door, Butzbach GmbH, Dortek Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Exterior Industrial Doors Market Key Technology Landscape

The technology landscape in the Exterior Industrial Doors Market is rapidly evolving, driven by the demand for speed, safety, and integration into the broader Industrial Internet of Things (IIoT). A core technological advancement is the development of ultra-high-speed actuators and intelligent motor controls, often utilizing variable frequency drives (VFDs). VFDs allow for precise control over acceleration and deceleration, minimizing wear and tear on mechanical components while maximizing operational speed. This technology is critical for high-cycle applications where doors may open and close hundreds of times daily. Furthermore, materials science innovation is crucial, with manufacturers utilizing specialized, high-tenacity fabrics (like reinforced PVC or vinyl) and insulated composite panels that offer superior thermal barriers compared to traditional metal construction, directly addressing energy efficiency mandates.

Safety and sensor technology represent another critical area of innovation. Modern industrial doors incorporate multi-layered safety systems, including advanced laser scanners, light curtains, and radar sensors, which provide superior detection capabilities compared to older pressure-sensitive edges or photocells. These intelligent sensors can differentiate between personnel, forklifts, and objects, enabling adaptive response mechanisms—such as slowing down instead of completely stopping—to maintain flow while preventing accidents. The increasing adoption of vision-based systems utilizing AI is further enhancing safety by predicting trajectory and potential collisions before they occur, drastically improving the safety profile of high-traffic industrial zones.

Connectivity and digital integration define the cutting edge of the market. Key technology includes integrated controllers capable of IP networking, allowing doors to communicate seamlessly with building management systems (BMS), security networks, and WMS. Remote diagnostics and cloud-based monitoring platforms enable manufacturers to offer service contracts based on predictive analytics, optimizing maintenance schedules and ensuring maximum uptime. This technological shift positions the industrial door not merely as a barrier, but as a crucial data-generating node within the smart factory or distribution center ecosystem, providing valuable insights into facility throughput and flow efficiency.

Regional Highlights

Geographical market analysis reveals distinct growth patterns and maturity levels across key regions, fundamentally influenced by economic development, regulatory frameworks, and industrial concentration. North America, encompassing the United States and Canada, represents a highly mature but robust market, dominated by the rapid expansion of e-commerce fulfillment centers and significant investment in cold chain infrastructure. Demand here is characterized by a strong preference for high-quality, high-cycle, and energy-efficient sectional and high-speed doors. The strict safety standards enforced by regulatory bodies drive consistent modernization and replacement of older equipment, ensuring sustained, stable growth in the region, particularly focusing on sophisticated automation integration.

Europe stands as another major market, defined by stringent energy performance regulations (e.g., EPBD directives) and a high concentration of sophisticated manufacturing and pharmaceutical industries. This regulatory environment mandates high thermal insulation performance, driving demand for insulated sectional doors and specialized hermetic sealing systems. Furthermore, European markets exhibit a strong early adoption rate for innovative technologies, including integrated IoT diagnostics and AI-powered predictive maintenance services. Germany, France, and the UK are core revenue contributors, often leading in the implementation of customized door solutions tailored for complex cleanroom or ATEX-certified environments.

Asia Pacific (APAC) is unequivocally the engine of global market growth. Driven by rapid industrialization, massive infrastructure development, and relocation of global manufacturing bases, countries like China, India, and Vietnam are experiencing explosive demand for all types of industrial doors. The establishment of vast logistics parks and special economic zones fuels the need for cost-effective, durable rolling shutters and high-volume sectional doors. While price sensitivity remains a factor, increasing focus on modernizing supply chain logistics in major economies like India and Southeast Asia is boosting the uptake of high-speed doors and advanced automation solutions, positioning APAC to surpass established markets in overall volume growth within the forecast period.

- North America: Stable growth driven by e-commerce logistics and cold storage expansion. Strong emphasis on safety compliance and high-efficiency systems.

- Europe: High growth in specialized sectors (Pharma, Automotive). Market driven by strict energy efficiency mandates and early adoption of smart, interconnected door systems.

- Asia Pacific (APAC): Highest growth rates fueled by rapid industrialization, urbanization, and massive logistics infrastructure investments in China and India.

- Latin America (LATAM): Developing market with increasing demand linked to local manufacturing growth and import substitution strategies. Infrastructure upgrades are boosting initial adoption.

- Middle East and Africa (MEA): Growth concentrated in GCC nations due to large-scale construction projects (logistics parks, aviation hubs) and oil & gas related industrial facilities. Demand is specialized, focusing on environmental durability against dust and heat.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Exterior Industrial Doors Market.- ASSA ABLOY

- Hörmann Group

- Rytec Corporation

- Kinro Manufacturing

- Overhead Door Corporation

- TNR Industrial Doors, Inc.

- Loading Dock Equipment Co. (LODEC)

- EFAFLEX Tor- und Sicherheitssysteme GmbH & Co. KG

- Angel Mir - Portes Bisbal S.L.

- Nergeco SAS

- Albany Door Systems (now part of ASSA ABLOY)

- Rite-Hite Holding Corporation

- Gandhi Automations Pvt. Ltd.

- Chase Doors

- Entrematic Group AB

- Industrial Door Company

- TMI, LLC

- V-SIKAR Industrial Door

- Butzbach GmbH

- Dortek Ltd.

- Teckentrup GmbH & Co. KG

- Miba AG

Frequently Asked Questions

Analyze common user questions about the Exterior Industrial Doors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high adoption rate of high-speed industrial doors?

The primary driver is the necessity for optimizing operational efficiency and minimizing energy loss in high-throughput industrial environments like logistics and cold storage facilities. High-speed doors drastically reduce the time the exterior aperture is open, improving climate control and accelerating material flow.

How do Exterior Industrial Doors contribute to a facility's overall energy efficiency?

These doors contribute significantly through superior insulation materials, robust sealing mechanisms, and the use of high-speed operation (often enabled by VFDs) to limit exposure to external temperatures, reducing the strain and operational costs associated with HVAC and refrigeration systems.

Which industrial segments demand the most specialized exterior door solutions?

The pharmaceutical, food and beverage, and cold chain logistics sectors require the most specialized solutions. These segments demand features such as hermetic seals, corrosion resistance, washdown compatibility, and precise environmental control to meet stringent hygiene and regulatory standards.

What role does digitalization play in the maintenance of modern industrial doors?

Digitalization enables predictive maintenance through integrated sensors and IoT connectivity. This technology allows for real-time monitoring of operational metrics, utilizing AI to forecast component wear and scheduling maintenance precisely, thereby maximizing uptime and operational reliability.

How do global supply chain fluctuations affect the pricing of industrial doors?

Global supply chain volatility, particularly in the steel and aluminum markets, directly impacts the pricing structure of industrial doors. Manufacturers must manage commodity price swings, often leading to adjustments in final product cost or strategic sourcing agreements to stabilize input expenditures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager