Exterior Wall Putty Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438516 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Exterior Wall Putty Powder Market Size

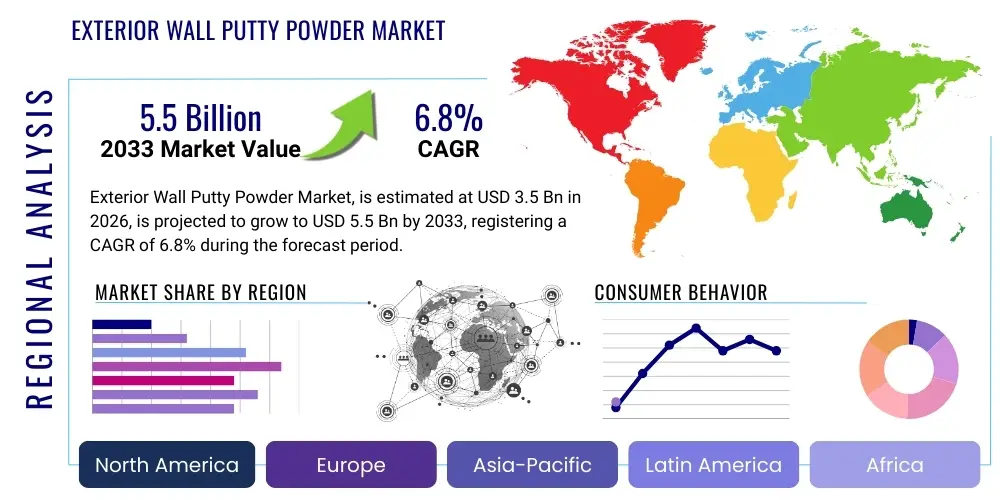

The Exterior Wall Putty Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.5 Billion by the end of the forecast period in 2033. This substantial growth trajectory is primarily fueled by accelerated infrastructure development across emerging economies, coupled with increasing consumer awareness regarding the aesthetic and protective qualities that exterior finishes provide to modern buildings. The demand is particularly robust in the residential and commercial sectors, where longevity and resistance to harsh environmental conditions are paramount design considerations.

The valuation reflects a sustained shift towards high-quality, polymer-modified putty powders that offer superior adhesion, crack resistance, and water repellency compared to traditional cementitious mixtures. Market participants are increasingly focusing on research and development to introduce specialized formulations, such as acrylic-based and ready-mix varieties, which reduce application time and enhance overall construction efficiency. Furthermore, stringent building codes in developed regions mandating the use of weather-resistant and non-toxic construction materials are creating a captive market for premium exterior wall putty products.

Exterior Wall Putty Powder Market introduction

The Exterior Wall Putty Powder Market encompasses specialized construction materials used as a base coat or leveling layer on external vertical surfaces before the final paint application. These materials are formulated primarily from white cement, polymers (like redispersible polymer powder - RDP), mineral fillers, and chemical additives designed to enhance workability, durability, and waterproofing characteristics. The core product function is to provide a smooth, uniform surface that masks minor undulations, pinholes, and cracks inherent in concrete or plastered walls, thereby optimizing the performance and aesthetic appeal of the subsequent paint system. Key applications span across residential buildings, commercial complexes, institutional structures, and industrial facilities requiring robust external finishes capable of withstanding diverse climatic pressures.

The primary benefits driving market adoption include enhanced substrate protection against moisture penetration, resistance to alkali attack from the underlying wall material, and a significant improvement in the longevity of the topcoat paint. By ensuring a uniform surface absorption rate, exterior putty prevents patchy appearance and uneven color development, which are common issues when painting directly onto rough plaster. Major driving factors for market expansion include rapid urbanization, large-scale government investments in affordable housing projects, technological advancements leading to superior polymer modifications, and a growing emphasis on green building materials that offer low Volatile Organic Compound (VOC) emissions.

Exterior Wall Putty Powder Market Executive Summary

The global Exterior Wall Putty Powder Market is experiencing vigorous expansion, propelled predominantly by surging construction activity in the Asia Pacific region and the persistent demand for high-performance building envelope solutions in established markets like North America and Europe. Key business trends involve intense competition focused on product differentiation through specialized polymer additives, emphasizing features such as extreme weather resistance, anti-carbonation properties, and extended shelf life. Strategic mergers, acquisitions, and regional capacity expansion are prominent moves by leading players aiming to capture market share, particularly in high-growth developing economies where large infrastructure projects are prevalent. Environmental regulatory compliance is steering innovation toward sustainable, low-dust, and eco-friendly formulations, setting the stage for increased adoption of premium acrylic-based putties over conventional cement variants.

Regionally, Asia Pacific maintains its dominance, driven by massive urbanization rates in China, India, and Southeast Asian nations, alongside significant governmental spending on smart city development and vertical residential construction. North America and Europe demonstrate stable, albeit slower, growth, characterized by a high preference for specialized, quick-drying, and high-polymer content products used primarily in repair, renovation, and premium construction segments. Segmentation trends highlight the Polymer Putty category gaining traction due to its superior flexibility and crack-bridging capabilities, making it indispensable for structures subjected to minor structural movements or thermal stresses. The Residential application segment remains the largest consumer, but the Commercial sector is witnessing faster growth owing to the increasing construction of high-rise commercial buildings and retail spaces demanding flawless and durable facades.

AI Impact Analysis on Exterior Wall Putty Powder Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Exterior Wall Putty Powder Market frequently revolve around optimizing supply chain logistics, predictive maintenance, automated quality control in manufacturing, and enhancing material formulation precision. Users are keen to understand how AI algorithms can predict raw material price volatility (especially for polymers and specialized additives), automate inventory management to minimize waste, and streamline distribution routes to construction sites, thereby reducing lead times. Furthermore, there is strong interest in using machine learning models for analyzing performance data from various product batches under real-world weather conditions to iteratively refine formulations for maximum durability and environmental resilience, ensuring consistency and meeting complex specifications required by modern architecture.

- AI-driven predictive analytics optimize raw material procurement, mitigating costs associated with polymer and cement fluctuations.

- Machine learning algorithms enhance quality control processes, identifying microscopic inconsistencies in powder particle size and blending ratios during manufacturing.

- AI deployment in advanced robotics for automated packaging and palletizing increases efficiency and reduces human error in production lines.

- Predictive maintenance models for manufacturing equipment minimize downtime, ensuring continuous supply of high-demand putty formulations.

- Integration of AI in Construction Management platforms helps track material usage rates on site, optimizing inventory levels of exterior putty.

- AI analyzes historical performance data related to weather exposure to recommend optimal putty types for specific geographical climates.

DRO & Impact Forces Of Exterior Wall Putty Powder Market

The Exterior Wall Putty Powder Market is strategically shaped by compelling drivers (D), significant restraints (R), and latent opportunities (O), creating complex impact forces. Primary drivers include the global construction boom, particularly in Asia Pacific and the Middle East, coupled with rising disposable incomes that fuel demand for aesthetically pleasing and high-durability housing solutions. The increasing adoption of high-performance polymer-modified putties, driven by their superior crack resistance and water repellency, further amplifies market growth. However, the market faces significant restraints, notably the volatile pricing of key raw materials such as polymers (RDP) and white cement, which directly impact manufacturing costs and product affordability. The cyclical nature of the construction industry and potential labor shortages for application also pose challenges, especially in regions reliant on manual labor for large-scale surface preparation.

Opportunities abound in developing specialized products tailored for niche applications, such as high-flexibility putties for seismic zones or antimicrobial formulations for humid climates. Furthermore, expanding distribution networks into Tier II and Tier III cities in emerging economies, alongside strategic partnerships with large construction conglomerates, presents substantial avenues for market penetration. The major impact forces stem from regulatory pressures demanding lower VOC content and sustainable production methods, forcing manufacturers to innovate rapidly. Economic downturns exert restraining impact, delaying large capital projects, while technological advancements in formulation chemistry exert a positive impact, continually raising the performance benchmark and market acceptance of premium products.

Segmentation Analysis

The Exterior Wall Putty Powder Market is rigorously segmented based on product type, application, and composition, allowing manufacturers and analysts to accurately target specific consumer needs and regional dynamics. The segmentation by product type generally differentiates between ordinary cement-based putties, which are cost-effective but offer lower performance, and specialized polymer-modified putties, which dominate the high-end segments due to superior bonding strength, flexibility, and waterproofing capabilities. Application segmentation separates demand across residential, commercial, and industrial construction, with residential projects representing the largest volume consumption globally. Understanding these segments is crucial for strategic pricing and distribution, ensuring products meet the technical specifications and budgetary constraints of various construction verticals.

- By Product Type:

- Ordinary Putty (Standard Cement Based)

- Polymer Putty (High-Performance Modified Putties, including Acrylic and RDP-based)

- By Application:

- Residential (Individual homes, multi-story housing)

- Commercial (Office buildings, retail complexes, hospitality)

- Industrial (Factories, warehouses, infrastructure facilities)

- By Composition:

- White Cement Based

- Acrylic Based

- Gypsum Based (Limited Exterior Use, sometimes blended)

Value Chain Analysis For Exterior Wall Putty Powder Market

The value chain for the Exterior Wall Putty Powder Market begins with the upstream procurement of essential raw materials, primarily white cement, calcite powder, specialized mineral fillers, and chemical additives, most critically the redispersible polymer powders (RDPs) and cellulose ethers. The quality and stable sourcing of these raw materials are pivotal, as variations directly impact the final product's performance attributes such as adhesion, water resistance, and workability. Manufacturers, positioned centrally in the value chain, undertake complex blending and processing operations, investing heavily in automated mixing plants to ensure homogeneous composition and compliance with quality standards. Efficiency in manufacturing and bulk purchasing of raw materials are key determinants of profit margins in this phase.

The downstream segment involves an extensive and often complex distribution network that spans across importing agents, national distributors, regional wholesalers, and local retailers or building material stores. Due to the product’s weight and bulk, logistical costs are significant, making strategic location of manufacturing units and optimization of transport highly crucial. Direct sales channels, where manufacturers supply large volumes directly to major construction companies or government infrastructure projects, bypass several layers of intermediation, offering better control over pricing and delivery schedules. Conversely, indirect channels leverage the established reach of hardware stores and paint dealers to service the fragmented, high-volume residential and small-scale commercial construction segments.

Exterior Wall Putty Powder Market Potential Customers

The primary customers and end-users for Exterior Wall Putty Powder are entities involved in the construction and renovation of external building structures, demanding materials that enhance durability and facade aesthetics. This core group includes residential builders and real estate developers responsible for large housing projects, ranging from affordable housing schemes to premium residential complexes. These customers prioritize bulk pricing, consistent quality, and certifications that meet local building codes. A secondary, yet significant, customer base consists of commercial infrastructure developers constructing high-rise offices, shopping malls, and institutional buildings, who typically demand specialized, high-performance polymer putties that can endure extreme weather exposure and offer specific aesthetic finishes.

Additionally, painting contractors and specialized plastering application firms represent crucial buyers, as they utilize the putty on a project-by-project basis and influence material selection based on ease of application and finishing results. DIY homeowners involved in self-renovation or minor repair work also form a small but growing segment, usually procuring products through retail channels. Finally, government agencies and public works departments undertaking infrastructure projects, such as bridges, utility buildings, and public housing maintenance, are large-volume institutional buyers focusing heavily on longevity, fire safety ratings, and adherence to public sector tender specifications, making them high-value targets for established manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Asian Paints, Sika AG, Nippon Paint, Berger Paints, AkzoNobel, BASF, Pidilite Industries, UltraTech Cement, Walplast Products Pvt. Ltd., The Sherwin-Williams Company, Fosroc International, Duobond, Baumit, Myk Arment, Mapei |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Exterior Wall Putty Powder Market Key Technology Landscape

The technological landscape in the Exterior Wall Putty Powder Market is defined by continuous innovation in chemical and material science, focusing on enhancing product performance and sustainability. A key area of development is the utilization of advanced polymer chemistry, specifically the incorporation of highly specialized Redispersible Polymer Powders (RDPs) and Ethylene-Vinyl Acetate (EVA) copolymers. These additives significantly improve the flexibility, water resistance, and adhesion strength of the putty, drastically reducing the occurrence of surface cracks, especially in areas prone to thermal expansion or structural shifts. Furthermore, manufacturers are employing sophisticated mixing and particle size reduction technologies during the production phase to ensure optimal homogeneity, which translates to smoother application and better final finishing quality on site.

Another crucial technological advancement involves the development of hybrid formulations that combine the beneficial properties of cementitious bases with acrylic emulsions, creating ready-to-use paste putties that minimize preparation time and mess at the construction site. This shift caters to the increasing demand for convenience and speed in large-scale construction projects. Environmentally driven innovations are also critical, leading to the incorporation of low-VOC (Volatile Organic Compound) additives and the use of sustainably sourced mineral fillers. Future technology development is expected to focus on nanotechnology integration to create self-healing putties and formulations offering enhanced air purification or thermal insulation properties, aligning the market with global green building standards.

Regional Highlights

The regional dynamics of the Exterior Wall Putty Powder Market exhibit significant variances driven by economic development, climate conditions, and construction regulations.

- Asia Pacific (APAC): Dominates the global market in terms of volume consumption, driven by colossal population growth, rapid urbanization, and massive governmental and private investments in residential and commercial infrastructure, particularly in India, China, and Southeast Asian nations. This region sees high demand for cost-effective, durable putties resistant to monsoon climates.

- North America: Characterized by stable, value-driven growth. The focus here is on renovation, repair, and high-quality premium construction, favoring specialized acrylic and polymer-modified putties known for their longevity, ease of application, and compliance with stringent environmental standards (low-VOC).

- Europe: Exhibits mature market characteristics with a strong emphasis on sustainability and energy efficiency. Demand is concentrated on technically advanced putties that integrate insulation properties and meet strict EU building codes regarding material toxicity and environmental impact. Germany, the UK, and France are key consumers, primarily through refurbishment projects.

- Middle East and Africa (MEA): Emerging as a high-growth region fueled by large-scale infrastructure megaprojects (e.g., in UAE, Saudi Arabia) and high demand for products capable of withstanding extreme heat, sandstorms, and high salinity environments, demanding specialized heat-resistant and highly adhesive formulations.

- Latin America: Showing steady growth, driven by residential construction activity in Brazil and Mexico. The market is price-sensitive but is slowly transitioning towards better quality polymer-based products as disposable incomes rise and construction standards improve.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Exterior Wall Putty Powder Market.- Asian Paints

- Sika AG

- Nippon Paint

- Berger Paints

- AkzoNobel

- BASF

- Pidilite Industries

- UltraTech Cement

- Walplast Products Pvt. Ltd.

- The Sherwin-Williams Company

- Fosroc International

- Duobond

- Baumit

- Myk Arment

- Mapei

- J.K. Cement Ltd.

- Birla White (Unit of Birla Corporation Ltd.)

- ParexGroup

- Ardex GmbH

- Saint-Gobain Weber

Frequently Asked Questions

Analyze common user questions about the Exterior Wall Putty Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Exterior and Interior Wall Putty?

Exterior wall putty is formulated with higher concentrations of specialized polymers, such as RDPs and acrylics, ensuring superior water resistance, adhesion, and flexibility to withstand external factors like temperature fluctuations, UV radiation, and rain, which interior putties generally lack.

Which region dominates the Exterior Wall Putty Powder Market in terms of consumption?

The Asia Pacific (APAC) region currently holds the largest share of the market volume, driven by unprecedented levels of urbanization, massive government investment in infrastructure, and continuous residential construction activity across countries like China and India.

What are the key raw materials influencing the cost of exterior putty?

The primary cost drivers are white cement (the bulk base material) and high-performance chemical additives, specifically Redispersible Polymer Powders (RDPs) and other proprietary binders, which are crucial for achieving the desired crack resistance and waterproofing properties.

How is the market addressing sustainability and environmental concerns?

Manufacturers are heavily investing in R&D to develop low-VOC (Volatile Organic Compound) and formaldehyde-free formulations, utilizing sustainable fillers, and optimizing production processes to reduce energy consumption, aligning products with global green building certification standards.

Is Polymer Putty replacing traditional cement-based exterior formulations?

Polymer-modified putties are rapidly gaining market share, particularly in high-end and demanding structural applications, due to their superior performance characteristics, although traditional cement-based putties remain relevant in price-sensitive segments and basic construction due to their low cost.

Exterior Wall Putty Powder Market Analysis: Growth Drivers, Segment Trends, and Key Players

The Exterior Wall Putty Powder Market is witnessing robust expansion, projected to achieve a 6.8% CAGR through 2033, reaching USD 5.5 Billion. This growth is intrinsically linked to global urbanization, especially the massive construction boom across APAC countries like India and China, and the persistent demand for high-durability, weather-resistant building materials in mature markets. Exterior putty serves as a critical preparatory layer, enhancing the longevity and finish quality of external facades, making it indispensable in modern construction. Key product types include ordinary cement-based putty and premium polymer-modified putty, with the latter accelerating market value due to its superior flexibility and waterproofing capabilities.

Market dynamics are heavily influenced by the volatile pricing of petrochemical derivatives, which form essential polymer additives (RDPs), posing a challenge for manufacturers. However, technological innovations, including the development of low-VOC and quick-drying formulations, present significant opportunities. Regional leadership belongs to Asia Pacific, while North America and Europe focus on specialized, high-performance segments driven by stringent environmental and building regulations. Leading companies like Asian Paints, Sika AG, and AkzoNobel are strategically focusing on geographical expansion and product differentiation to maintain competitive edge.

Market Drivers and Opportunities Deep Dive

The acceleration of global urbanization remains the single most powerful driver for the Exterior Wall Putty Powder Market. As urban populations swell, especially across Southeast Asia, Africa, and Latin America, the need for high-density residential and commercial infrastructure escalates proportionately. Governments in these regions are actively initiating large-scale housing projects and smart city developments, which mandate the consistent use of façade finishing materials. This sustained demand provides a guaranteed consumption pipeline for exterior wall putty, shifting market focus from basic functionality to high-durability and protective aesthetics. The sheer scale of construction in countries like India, with ambitious targets for affordable housing, ensures that the volume segment of the market will continue its rapid upward trajectory throughout the forecast period.

Furthermore, the growing architectural preference for high-quality, seamless, and long-lasting exterior finishes significantly contributes to market value. Modern architects and builders recognize that the aesthetic outcome and protective lifespan of expensive exterior paints are fundamentally dependent on the quality of the substrate preparation provided by the putty. Consequently, there is a substantial uptick in the adoption of specialized polymer-modified putties that offer crack-bridging properties, superior alkali resistance, and inherent waterproofing characteristics. These premium formulations command higher prices and improve profit margins for manufacturers, driving overall market growth and investment in polymer technology research. The competitive advantage increasingly lies with firms that can deliver certified products guaranteeing performance under extreme climate variability.

In addition to infrastructure growth, the increasing global awareness regarding energy efficiency and building envelope integrity presents a latent opportunity. Exterior walls are critical components in maintaining a building's thermal performance. Future formulations of exterior putty are expected to incorporate additives that enhance thermal insulation properties or reflect solar radiation, thereby contributing directly to reduced energy consumption in heating and cooling. This trend aligns perfectly with global environmental mandates and offers a pathway for manufacturers to position their products as crucial components of sustainable, green building construction. The convergence of material science, environmental regulation, and consumer demand for durable, energy-efficient homes will unlock new, high-value market segments.

Market Restraints and Challenges Analysis

Despite robust growth drivers, the Exterior Wall Putty Powder Market faces considerable headwinds, primarily stemming from the volatility of raw material costs. White cement and the specialized petrochemical-based polymers (RDPs, EVA) used for modification are subject to significant price fluctuations influenced by global energy prices, geopolitical instability, and supply chain disruptions. Since these materials constitute a substantial portion of the production cost, unpredictable pricing makes effective production planning and stable pricing strategies challenging for manufacturers. Smaller and regional players, in particular, struggle to absorb these cost shocks, leading to margin erosion and potential supply bottlenecks, thereby restraining overall market consistency.

Moreover, the construction industry's inherent dependence on macroeconomic health and governmental policy cycles acts as a significant restraint. Exterior putty demand is directly tied to new construction and large-scale renovation projects. Economic downturns, high interest rates, or sudden changes in local zoning laws can trigger a slowdown in building activity, causing an immediate slump in putty consumption. The cyclical nature of the industry requires manufacturers to maintain flexible production capacities and diversified product portfolios to buffer against these periodic market contractions. Regulatory restraints related to material composition, such as increasingly strict environmental regulations limiting VOC content, also impose compliance costs and necessitate continuous, expensive reformulation efforts, acting as a barrier to entry for non-compliant materials.

A persistent, albeit localized, challenge is the lack of standardized application practices and skilled labor, particularly in developing economies. The performance of exterior putty is heavily reliant on proper surface preparation and correct application thickness. Poor execution due to unskilled labor or shortcut practices can lead to premature failure, cracking, and blistering, ultimately tarnishing the product reputation and increasing warranty claims. Manufacturers must allocate significant resources towards applicator training and education programs, which adds to operational overhead. Overcoming the widespread variability in application quality across different markets remains a critical task to ensure customer satisfaction and long-term market acceptance of premium, high-performance putty products.

In-Depth Segmentation Breakdown

Product Type: Polymer Putty Dominance

The Exterior Wall Putty Powder Market is experiencing a definitive shift in preference from Ordinary Putty to Polymer Putty, reflecting the industry’s increasing focus on durability and performance assurance. Ordinary putty, typically consisting primarily of white cement and basic fillers, remains attractive due to its low cost and ease of availability, making it suitable for price-sensitive bulk construction segments, particularly in emerging economies. However, its major drawbacks—low flexibility, susceptibility to cracking, and limited waterproofing capabilities—are leading to its gradual replacement in high-value projects.

Polymer Putty, formulated with highly effective additives such as RDPs and acrylic binders, offers significantly enhanced performance metrics. Its key advantage lies in high tensile strength, superior crack bridging capacity, and exceptional adhesion to various substrates, including concrete, plaster, and even pre-cast panels. These features are critical for exterior surfaces exposed to dynamic weather conditions and structural movements. The adoption rate of polymer putty is skyrocketing globally, driven by commercial and premium residential builders seeking materials that minimize maintenance cycles and extend the lifespan of the external paint system. This segment is expected to outpace the growth of ordinary putty substantially, commanding premium pricing reflective of its technical superiority.

Application: Residential and Commercial Dynamics

The Residential segment historically accounts for the largest market share, fueled by the continuous need for new housing and renovation projects globally. This segment encompasses everything from small individual homes to large, multi-story apartment complexes. Demand is characterized by large volume purchases where cost-efficiency remains a significant factor, but there is a clear upward trend towards using better quality, polymer-modified products even in standard housing, recognizing the long-term benefits of structural protection and aesthetic quality. The renovation sub-segment within residential application provides stable, continuous demand, independent of new construction cycles.

Conversely, the Commercial application segment, which includes offices, retail spaces, hotels, and hospitals, is experiencing the fastest rate of growth. Commercial structures often demand the highest level of finishing quality, stringent safety ratings (e.g., fire resistance), and long-term facade stability due to their high visibility and exposure. Projects in this category rely heavily on specialized, high-performance polymer putties that guarantee a flawless, smooth finish suitable for specialized architectural coatings. The requirements for institutional and hospitality construction—where maintaining a pristine exterior is crucial for brand image—ensure that this segment remains a key focus for manufacturers developing high-end, differentiated products.

Competitive Landscape and Strategic Initiatives

The global Exterior Wall Putty Powder Market is characterized by a mix of large multinational chemical and coatings conglomerates and strong regional players. Competition is fierce, primarily centered on product innovation, geographical reach, and strategic pricing. Multinational giants like Sika AG, AkzoNobel, and BASF leverage their extensive research capabilities and global supply chains to introduce specialized, high-tech formulations, often focusing on sustainability features, quick-drying times, and superior durability under specific climatic extremes.

Regional leaders, particularly in Asia Pacific, such as Asian Paints, Pidilite Industries, and UltraTech Cement, compete effectively by optimizing distribution networks and achieving significant economies of scale. These companies benefit from strong brand recognition and established relationships with local contractors and retailers. Their strategy often involves maintaining a diverse portfolio that ranges from cost-effective cementitious putties for mass-market consumption to premium polymer products, ensuring they capture demand across the entire price spectrum. Recent strategic moves include vertical integration to control raw material sourcing and increased investment in digital tools for construction professionals, enhancing product specification and application guidance. Successful market penetration increasingly relies on offering bundled solutions that integrate putty with compatible primers and topcoats, providing a complete system guarantee to the end-user.

Furthermore, mergers and acquisitions remain a key strategy for market consolidation and rapid technology absorption. Companies acquire smaller, innovative firms specializing in advanced polymer technology or those possessing robust regional distribution channels, allowing for immediate expansion into new geographical areas without lengthy infrastructure development. The focus on quality assurance and certifications (e.g., ISO, national building standard compliance) is non-negotiable, acting as a crucial differentiator in winning large governmental and commercial tenders. Manufacturers must continually adapt their products to the increasingly stringent sustainability and fire safety requirements being imposed by global regulatory bodies, ensuring long-term competitiveness in a rapidly evolving construction materials market.

Future Outlook and AEO Focus

The future outlook for the Exterior Wall Putty Powder Market remains highly positive, underpinned by sustained global population growth and the inevitable requirement for urban renewal and expansion. The market trajectory indicates a strong shift towards high-value, functional coatings that provide not only aesthetic finishing but also genuine protective benefits. Future growth will be particularly concentrated in the Polymer Putty segment, driven by the lifecycle costing advantages it offers over conventional products, justifying the higher initial investment for property owners and developers.

From an AEO (Answer Engine Optimization) and GEO (Generative Engine Optimization) perspective, market content must focus on providing concise, authoritative answers regarding performance metrics, application suitability (e.g., "best putty for monsoon climate"), and environmental impact ("low VOC exterior putty"). Search queries are increasingly specific and solution-oriented. Therefore, content marketing strategies must prioritize detailed case studies, technical data sheets, and comparison guides that clearly delineate the benefits of specialized formulations (e.g., crack-bridging technology vs. standard filler). The dominance of APAC means that localized, multi-lingual content targeting regional construction practices will be crucial for capturing long-tail search traffic and maintaining visibility against regional market leaders.

Strategic success will depend on manufacturers’ ability to integrate digital tools, such as AI-powered formulation prediction and sophisticated supply chain management, to maintain product consistency and competitive pricing. The adoption of pre-mixed, ready-to-use exterior putty pastes, while currently a niche, is expected to grow significantly due to labor productivity gains, representing a key technological pivot point. Overall, the market is poised for continued innovation, driven by the dual pressures of environmental compliance and the increasing global demand for durable, aesthetically superior external building finishes that contribute positively to the built environment's resilience and longevity.

Detailed Analysis of Composition Segments

White Cement Based Putty

White Cement Based Exterior Putty remains the cornerstone of the market in terms of volume and accessibility. Its formulation relies heavily on white Portland cement, combined with fine mineral fillers like calcium carbonate, and basic organic additives for workability and water retention. This composition offers excellent bonding strength to common substrates like cement plaster and concrete. Its primary appeal lies in its low cost and wide availability, making it the preferred choice for mass housing projects and regions where budget constraints are paramount. It provides a solid, durable base layer that effectively smoothes out surface irregularities, preparing the wall for subsequent coats of paint or texture.

However, the inherent rigidity of cement-based putties means they are susceptible to hairline cracks caused by minor structural movement or thermal expansion/contraction, particularly in climates with significant temperature swings. They also offer limited water resistance compared to advanced polymer versions, often requiring the addition of specialized waterproofing compounds during application. Continuous market pressure is forcing manufacturers to subtly enhance even these basic formulations by incorporating low percentages of polymer additives to marginally improve their resistance to cracking and water ingress without significantly elevating the production cost, maintaining their competitiveness against pure polymer alternatives.

Acrylic Based Putty

Acrylic Based Putty, often sold in ready-mix paste form, represents the premium, high-performance end of the exterior wall putty market. These products use acrylic emulsions as the primary binder instead of cement, providing vastly superior elasticity, flexibility, and crack-bridging capabilities. This makes them ideal for external surfaces that are prone to movement or require a highly durable, flexible finish that can withstand harsh weathering without degradation. The high-polymer content ensures excellent water repellency and resistance to alkali attacks from the underlying plaster, significantly extending the lifespan of the entire wall coating system.

The convenience of ready-to-use acrylic putty significantly contributes to its adoption, particularly in markets with high labor costs, as it eliminates the need for on-site mixing and reduces application time. While the initial material cost of acrylic-based putties is substantially higher than cementitious powders, contractors and homeowners are increasingly recognizing the long-term value derived from reduced maintenance and superior aesthetic longevity. The primary technological focus in this segment involves improving the breathability of the film while maintaining waterproofing qualities and reducing tackiness to minimize dust accumulation on the surface.

Market Impact of Regulatory Environment

Regulatory frameworks, encompassing environmental protection, building codes, and safety standards, exert profound influence over the Exterior Wall Putty Powder Market, compelling continuous innovation and reshaping competitive dynamics. Governments globally are imposing stricter limits on the permissible levels of Volatile Organic Compounds (VOCs) in construction chemicals. This mandate stems from increasing public health concerns related to indoor and outdoor air quality, forcing manufacturers to reformulate products, transitioning away from solvent-based additives toward water-based and low-VOC polymer systems. Compliance with standards such as those set by the EPA in North America or REACH in Europe is non-negotiable for market access, particularly in developed economies, thereby favoring companies with substantial R&D capacity for chemical engineering.

Furthermore, national and international building codes often dictate specific performance criteria related to fire resistance, thermal insulation, and adherence to seismic resistance guidelines. In regions prone to earthquakes or extreme weather, codes may explicitly require the use of flexible, crack-bridging putties to maintain structural integrity and prevent facade failures. These regulatory requirements elevate the technical specifications required for exterior putty, driving the market towards polymer-rich, certified products. Manufacturers who proactively gain international certifications and align their portfolios with green building standards, such as LEED or BREEAM, gain a significant competitive advantage when bidding for large governmental and institutional construction projects, further solidifying the trend toward premium, high-specification products.

Logistics and Distribution Channel Analysis

The efficiency of logistics and the structure of distribution channels are critical factors determining the success and reach of exterior wall putty manufacturers. Due to the product’s nature—heavy, bulky powder bags—freight costs represent a significant portion of the total delivered price. Consequently, manufacturers strategically locate production facilities close to key raw material sources (cement plants) or major consumption hubs (large metropolitan construction centers) to minimize transportation expenses and optimize inventory levels. Effective inventory management is paramount to prevent moisture absorption and subsequent product deterioration during storage and transit, necessitating robust packaging and controlled warehousing environments throughout the supply chain.

Distribution primarily occurs through a hybrid model. Large infrastructure projects and commercial developers are serviced directly by the manufacturer or through dedicated project distribution divisions, allowing for precise control over pricing, delivery schedules, and technical support. This channel is crucial for large-volume sales. Conversely, the highly fragmented residential and small-scale renovation market is served via an extensive indirect network comprising master distributors, regional wholesalers, and thousands of local hardware and paint retailers. Success in the indirect channel hinges on maintaining strong relationships with dealers, ensuring timely stock replenishment, and providing attractive trade schemes. The penetration of e-commerce for construction materials is nascent but growing, primarily facilitating information exchange and order placement rather than physical delivery due to the product's weight and bulk.

The Role of Technological Adhesion Enhancers

Technological advancement in the exterior wall putty market is heavily focused on the science of adhesion, which is fundamental to product performance. Adhesion enhancers, predominantly specialty polymers and chemical additives, are meticulously engineered to improve the bonding between the putty layer and the diverse range of substrates found in external construction, including rough plaster, concrete, and sometimes even fiber cement boards. Cellulose ethers, for instance, are widely used not only for their water retention properties—crucial for curing—but also for their role in improving the initial tackiness and workability of the wet mix, ensuring a uniform application thickness and preventing sagging.

The introduction of high-purity, hydrophobic polymers is a major innovation. These polymers chemically modify the putty matrix, creating a dense, less porous structure that significantly reduces water absorption and moisture migration into the wall. This dual functionality—superior bonding plus effective waterproofing—is what differentiates premium exterior putties. Ongoing research is exploring bio-based or synthetic polymers that can achieve these critical performance benchmarks while simultaneously reducing the reliance on petrochemical feedstocks, aligning with broader industry goals for sustainable material production. The effective incorporation of these enhancers is proprietary knowledge, giving technologically advanced manufacturers a distinct competitive edge in the high-performance segment.

Market Influence of Weather Resistance

Exterior Wall Putty Powder products are functionally defined by their resistance to weathering elements, which is a crucial factor influencing purchasing decisions in all geographies. The performance required varies significantly by region; for instance, products used in coastal areas must exhibit extremely high resistance to salt corrosion and humidity, whereas those in desert regions must withstand intense UV radiation and extreme thermal cycling. The quality of weathering resistance directly correlates with the polymer content and the type of mineral fillers used in the formulation.

UV stability is achieved through specialized additives that prevent the polymer binder from degrading and becoming brittle under prolonged solar exposure, thereby protecting the underlying wall material from premature failure. Similarly, formulations designed for cold climates must maintain flexibility at low temperatures to prevent thermal shock cracking. Manufacturers often perform accelerated weathering tests, simulati

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager