External Fixation Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432376 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

External Fixation Products Market Size

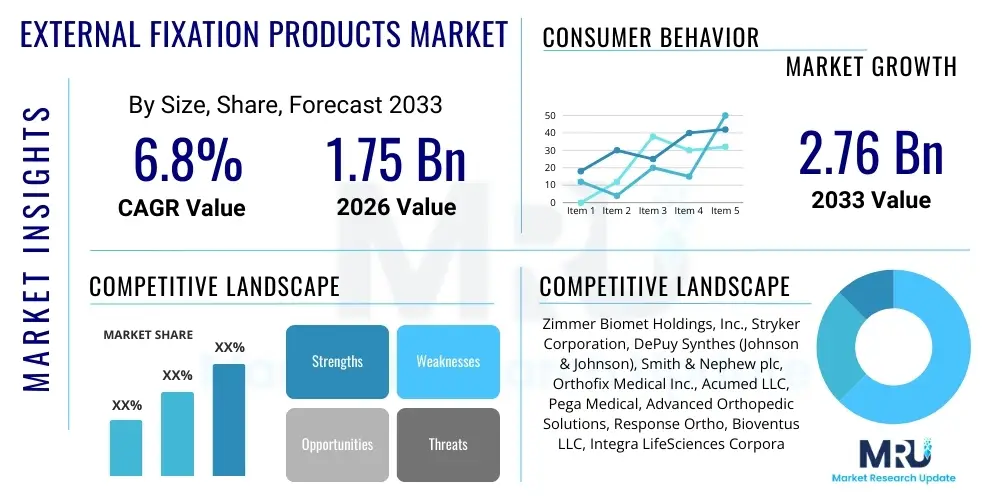

The External Fixation Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.75 Billion in 2026 and is projected to reach USD 2.76 Billion by the end of the forecast period in 2033.

External Fixation Products Market introduction

The External Fixation Products Market encompasses a range of medical devices utilized primarily in orthopedic surgery to stabilize bone fractures, correct deformities, and facilitate limb lengthening procedures. These devices involve the placement of pins or wires through the skin and muscle into the bone, which are then connected to an external frame or apparatus. This method provides immediate, rigid support without necessitating extensive internal exposure of the fracture site, making it particularly valuable for managing complex, open, or severely contaminated fractures, as well as providing temporary stabilization before definitive internal fixation or reconstruction can be performed. The key advantage lies in its adjustability and ability to allow surgeons to monitor and manage soft tissues surrounding the injury effectively, reducing the risk of infection and promoting better patient outcomes in critical trauma cases.

Major applications for external fixation products span trauma care, elective orthopedic procedures, and reconstructive surgery. In trauma, they are indispensable for damage control orthopedics (DCO), especially in polytrauma patients or those with severe soft tissue compromise, such as high-energy open tibial fractures. Beyond trauma, these devices are extensively used in elective procedures like Ilizarov techniques and hexapod systems for limb lengthening and complex angular or torsional deformity correction. The inherent stability and flexibility of modern external fixators, including unilateral, circular, and hybrid systems, allow for controlled micromotion which can accelerate bone healing (callus formation), depending on the clinical requirement. The continuous evolution of materials, such as lightweight carbon fiber components, has significantly improved patient compliance and reduced imaging interference, further solidifying the role of external fixation as a foundational technology in modern orthopedics.

Driving factors for market growth include the escalating global incidence of road traffic accidents and sports injuries, which necessitate immediate and robust stabilization solutions. Furthermore, the rising prevalence of musculoskeletal disorders and bone deformities, especially in geriatric populations, increases the demand for reconstructive surgeries utilizing sophisticated external fixation systems. Technological advancements, such as the integration of digital planning software and the introduction of advanced materials (e.g., biocompatible coatings and absorbable components), are enhancing the precision and efficacy of these devices. The growing adoption of advanced hybrid and circular fixators (like hexapods) that offer multi-planar correction capabilities is also contributing substantially to the market's expansion, particularly in emerging healthcare economies where trauma volumes are high and access to specialized orthopedic care is improving.

External Fixation Products Market Executive Summary

The External Fixation Products Market is characterized by steady growth driven predominantly by increasing trauma incidence globally and advancements in sophisticated deformity correction techniques. Business trends indicate a strong focus on innovation in lightweight, modular, and radiolucent materials, primarily carbon fiber, to enhance ease of use for surgeons and improve patient comfort and imaging quality. Strategic mergers and acquisitions remain a consistent feature, as large orthopedic device manufacturers seek to integrate specialized expertise in circular and hybrid fixation systems, thereby consolidating market share and expanding their product portfolios to cover a broader range of complex orthopedic indications. Furthermore, there is a distinct business shift toward providing complete solution packages, including fixators, surgical planning software, and educational support, catering to the growing need for specialized orthopedic centers to manage complex trauma and reconstruction cases efficiently. Pricing pressure, particularly in basic unilateral fixators, remains a competitive challenge, pushing manufacturers to differentiate through advanced systems and superior clinical evidence.

Regionally, North America and Europe maintain leading positions due to established healthcare infrastructure, high reimbursement rates for advanced procedures, and rapid adoption of cutting-edge technologies like computer-assisted correction platforms. However, the Asia Pacific (APAC) region is projected to exhibit the highest CAGR during the forecast period. This accelerated growth in APAC is attributable to vast, untapped patient pools, increasing disposable incomes leading to better access to private healthcare, and significant improvements in hospital infrastructure in populous nations such as China and India. Latin America and the Middle East & Africa (MEA) are also demonstrating encouraging growth, fueled by rising awareness of modern orthopedic treatments and heavy investment in trauma centers, although regulatory hurdles and inconsistent reimbursement policies sometimes impede market penetration of the most premium products.

Segmentation trends highlight the circular external fixator segment, particularly the hexapod and frame systems used for complex deformity correction and limb reconstruction, as the fastest-growing category due to their superior capability for gradual and precise multi-plane adjustments. By application, the trauma segment continues to dominate market revenue due to the high volume of acute fracture stabilizations required globally. Conversely, by material, the shift towards composite materials, specifically carbon fiber, is a defining trend, overtaking traditional stainless steel and titanium in many high-end applications due to weight reduction and enhanced imaging compatibility. Hospitals remain the primary end-user segment, although specialized orthopedic clinics focusing on limb lengthening and reconstruction are increasingly important, demanding specialized, high-margin products that facilitate complex, long-term care management.

AI Impact Analysis on External Fixation Products Market

Common user questions regarding AI's impact on external fixation products often revolve around pre-operative planning accuracy, robotic assistance during pin placement, and predictive analytics for post-operative complication risk, particularly non-union or infection. Users frequently inquire if AI can reduce surgical variability and improve the precision of complex frame assembly (especially circular fixators), thereby shortening operative time and improving long-term functional outcomes. Key concerns focus on the integration cost, regulatory clearance for AI-assisted diagnostic or predictive tools, and data privacy when utilizing large datasets of fracture images and patient metrics for algorithmic training. There is a high expectation that AI will standardize treatment protocols, moving beyond basic stabilization to highly personalized, biomechanically optimized fixation strategies.

- AI-Enhanced Pre-operative Planning: Algorithms analyze 3D CT/X-ray data to generate optimal pin placement trajectories, frame configuration, and distraction schedules for complex deformity correction, minimizing surgical time and enhancing accuracy.

- Predictive Outcome Modeling: AI systems process patient-specific factors (e.g., age, comorbidities, fracture type) to predict the likelihood of complications (non-union, infection) post-external fixation, enabling proactive intervention strategies.

- Robotic Assistance in Placement: Integration of robotic arms guided by real-time imaging and AI planning to execute highly precise placement of fixation pins and wires, reducing potential nerve or vessel damage.

- Optimized Inventory and Supply Chain: AI-driven demand forecasting specific to trauma center needs, ensuring immediate availability of diverse external fixation components during high-volume periods.

- Digital Frame Management: AI analyzing continuous data from wearable sensors (if integrated) to monitor patient limb load and bone movement, providing feedback for fine-tuning frame adjustments remotely.

- Improved Diagnostic Imaging Interpretation: AI assisting radiologists and orthopedic surgeons in quickly and accurately assessing fracture severity and soft tissue status, crucial for selecting the appropriate external fixator type.

DRO & Impact Forces Of External Fixation Products Market

The market is significantly driven by the increasing incidence of high-energy trauma globally, necessitating immediate stabilization through external fixators, particularly in polytrauma settings where damage control orthopedics is essential. Restraints primarily include the high cost associated with advanced external fixation systems, potential complications such as pin tract infection and non-compliance among patients requiring prolonged fixation periods, and the need for specialized surgical skills. Opportunities lie in developing advanced bio-absorbable fixators that negate the need for a second removal surgery and expanding market penetration in rapidly developing economies. These dynamics result in a moderate to high impact force, where the necessity of external fixation in critical care outweighs incremental costs, but successful market uptake hinges on mitigating infection risks and improving patient acceptance through technological innovation.

The primary driver is the demographic shift towards an aging global population, which correlates with an increased incidence of fragility fractures requiring stable, often temporary, fixation. Furthermore, continuous advancements in materials science, particularly the utilization of carbon fiber for its lightweight, strength, and radiolucency, significantly enhance the product offering and surgeon acceptance. These positive forces are countered by restraints, notably the intense regulatory scrutiny associated with novel implantable devices and the substantial training required for surgeons and nursing staff to manage complex circular and hexapod fixators effectively. Reimbursement challenges, particularly in healthcare systems focusing on cost containment, can restrict the adoption of premium, cutting-edge external fixation solutions, favoring older, less expensive designs.

Opportunities are substantial in leveraging digital technologies for surgical planning and patient monitoring. The development of customized, 3D-printed jigs or components for highly irregular fractures and deformities presents a niche but high-value opportunity. Additionally, addressing the restraint of pin tract infection through novel anti-microbial coatings or pin design improvements could significantly enhance the appeal of external fixation across all applications. The net impact of these forces suggests sustained market expansion, predominantly fueled by undeniable clinical necessity in trauma and the ongoing innovation aimed at improving safety and efficacy, especially in complex orthopedic reconstruction cases, thus maintaining robust growth momentum.

Segmentation Analysis

The External Fixation Products Market is intricately segmented across product type, application, material, and end-user, reflecting the diverse clinical requirements in trauma and reconstructive orthopedics. Product type segmentation distinguishes between the various forms of fixators—monolateral/unilateral systems for basic fracture management, circular systems (like Ilizarov) for complex bone transport and deformity correction, and hybrid systems which combine elements of both. Application segmentation differentiates between trauma (the dominant segment), deformity correction (the fastest growing), and limb lengthening. Understanding these segments is crucial for manufacturers to tailor their R&D and marketing efforts, focusing on high-growth areas such as specialized hexapod systems and lightweight material applications within reconstructive surgery, while maintaining a strong presence in the high-volume trauma market.

- By Product Type:

- Monolateral/Unilateral Fixators

- Circular Fixators (e.g., Ilizarov, Taylor Spatial Frame)

- Hybrid Fixators

- Accessories (Pins, Wires, Clamps, Rods)

- By Application:

- Trauma/Fracture Fixation

- Deformity Correction

- Limb Lengthening and Bone Transport

- Arthrodesis and Joint Stabilization

- By Material:

- Carbon Fiber Fixators

- Stainless Steel Fixators

- Titanium Fixators

- By End User:

- Hospitals

- Specialty Orthopedic Clinics

- Ambulatory Surgical Centers (ASCs)

Value Chain Analysis For External Fixation Products Market

The value chain for the External Fixation Products Market is highly structured, beginning with complex upstream activities involving raw material procurement, particularly specialized medical-grade alloys (titanium, stainless steel) and advanced composites (carbon fiber). Critical upstream functions include precise material processing, component manufacturing (pins, rods, clamps), and stringent quality control compliant with international medical device standards (ISO 13485, FDA/CE regulations). Manufacturers often invest heavily in R&D to enhance biomechanical properties, reduce weight, and integrate features like anti-microbial coatings. The direct distribution channel involves manufacturers selling directly to major hospital systems and large trauma centers, allowing for greater control over training and pricing. The indirect channel utilizes distributors, crucial for reaching smaller clinics and geographically remote markets, though this adds complexity and margin layers.

Midstream activities focus on assembly, sterilization, and packaging. Due to the modular nature of external fixators, manufacturing processes must ensure interchangeability and precision fit among components. The efficiency of the supply chain management is paramount, particularly for trauma products where immediate availability is non-negotiable. Downstream activities encompass the actual surgical usage and post-sale support. This includes providing extensive surgeon education and training programs (especially for complex circular and hexapod systems), maintaining instrument sets, and offering clinical support to manage potential complications like pin tract infections. Effective downstream services are a significant differentiator, often influencing purchasing decisions by orthopedic departments.

Direct sales are preferred by major global players for high-volume, high-value contracts with tertiary care hospitals, ensuring direct communication regarding product updates and clinical feedback. However, the indirect distribution channel remains essential in markets where local market knowledge and logistical capabilities are needed. Distributors typically manage inventory for regional hospitals and clinics, bearing the risk of obsolescence and local regulatory nuances. The trend is moving towards integrated supply chains, often digitally managed, to ensure seamless logistics from manufacturing floor to the operating room, maintaining sterility and minimizing lead times for critical trauma devices.

External Fixation Products Market Potential Customers

The primary customers for external fixation products are medical institutions that manage high volumes of orthopedic trauma and complex reconstructive cases. Hospitals, particularly large university-affiliated medical centers and specialized trauma units, represent the largest and most critical segment due to their capacity to handle severe fractures, polytrauma, and urgent surgical interventions, which frequently necessitate immediate external stabilization before definitive fixation. These institutions require a wide range of fixator types, from basic temporary unilateral systems to advanced, customized circular and hybrid frames, often procured through large, multi-year tender contracts based on volume and comprehensive service agreements.

Secondary, yet rapidly growing, customer segments include specialty orthopedic clinics focused exclusively on limb deformity correction, limb lengthening, and chronic orthopedic conditions. These clinics often require specialized, high-margin products like advanced hexapod systems and specialized ancillary equipment, where precision and long-term patient compliance are paramount. Surgeons in these settings act as key opinion leaders, driving the adoption of innovative, patient-specific external fixation technologies. These facilities typically purchase through indirect distribution channels or directly from specialized vendors focusing on reconstructive orthopedics, valuing clinical training and application support highly over basic cost savings.

Ambulatory Surgical Centers (ASCs) also represent an emerging market segment, primarily for less complex applications such as stable fractures managed temporarily or minor deformity corrections performed on an outpatient basis. As ASCs expand their surgical scope, their demand for standardized, easy-to-use external fixators will increase. Furthermore, procurement departments and group purchasing organizations (GPOs) act as crucial gatekeepers, defining purchasing preferences based on standardization, cost-effectiveness, and proven clinical outcomes, making them pivotal potential customers in the purchasing decision matrix for all external fixation suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.75 Billion |

| Market Forecast in 2033 | USD 2.76 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zimmer Biomet Holdings, Inc., Stryker Corporation, DePuy Synthes (Johnson & Johnson), Smith & Nephew plc, Orthofix Medical Inc., Acumed LLC, Pega Medical, Advanced Orthopedic Solutions, Response Ortho, Bioventus LLC, Integra LifeSciences Corporation, Globus Medical Inc., DJO Global, Inc., WishBone Medical, Inc., ExsoMed Corporation, B Braun Melsungen AG, Citieffe S.r.l., TASARIM MEDIKAL A.S., Merete GmbH, OsteoRemedies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

External Fixation Products Market Key Technology Landscape

The technological landscape of the External Fixation Products Market is rapidly evolving, moving beyond simple metallic frames toward sophisticated, modular systems that integrate advanced materials and digital tools. A crucial development is the pervasive adoption of carbon fiber composites. These materials offer superior strength-to-weight ratios compared to traditional stainless steel or titanium, significantly improving patient comfort during prolonged wear and, more critically, minimizing artifacts in follow-up radiological and MRI examinations, which is essential for monitoring bone healing progress. Furthermore, the modularity trend allows surgeons to rapidly assemble customized frame constructs intraoperatively, adapting to highly variable fracture patterns and patient anatomies, thereby streamlining the surgical process, especially in emergent trauma settings.

A second major technological thrust is the advancement in computerized deformity planning and correction software. Systems like the Taylor Spatial Frame (TSF) utilize hexapod geometry and specialized software to calculate precise strut adjustments needed for multi-planar deformity correction. This technology minimizes human error and significantly improves the accuracy and predictability of limb lengthening and correction procedures, transitioning the process from art to science. These software platforms are increasingly being integrated with 3D printing capabilities, allowing for the pre-fabrication of patient-specific jigs or even custom components, enhancing the surgical workflow and potentially reducing the total duration of external fixation required by achieving initial goals more accurately.

The third pivotal area of innovation focuses on mitigating pin tract complications, which remain the most common complication associated with external fixation. This involves the development of specialized pin designs (e.g., hydroxyapatite-coated pins to enhance bone-pin interface stability) and the application of anti-microbial coatings, such as silver or antibiotic-loaded cements, to the pin tracts. Future technologies are exploring the integration of bio-absorbable materials for temporary fixation components, aiming to eliminate the need for the device removal surgery. Simultaneously, smart fixators incorporating micro-sensors to monitor load-bearing and bone healing parameters are emerging, promising to offer real-time data to clinicians, optimizing the gradual removal or adjustment process based on objective physiological metrics.

Regional Highlights

The global External Fixation Products Market exhibits distinct regional dynamics shaped by healthcare spending, trauma infrastructure, and regulatory environments.

- North America (Dominant Revenue Share): The region, particularly the United States, holds the largest market share due to high levels of healthcare expenditure, robust reimbursement policies for complex orthopedic procedures, and rapid adoption of premium, advanced technologies, including hexapod systems and carbon fiber frames. The presence of major market leaders and a high incidence of sports and road traffic trauma contribute significantly to sustained demand.

- Europe (Mature Market with High Specialization): Europe is characterized by stringent quality standards (MDR) and a strong focus on clinical outcomes. Western European countries demonstrate high utilization of external fixation, particularly in specialized centers for limb reconstruction and deformity correction. Germany, the UK, and France are key contributors, favoring innovative, clinically proven devices.

- Asia Pacific (Highest Growth Trajectory): APAC is anticipated to register the fastest growth rate, fueled by improving healthcare access, rising volumes of road accidents, and increasing medical tourism. Economic powerhouses like China and India are investing heavily in establishing advanced trauma care networks. While price sensitivity exists, the demand for both basic unilateral fixators and high-end circular systems is accelerating dramatically.

- Latin America (Growing Infrastructure): Brazil and Mexico are leading the adoption curve in Latin America, driven by urbanization and increased trauma incidents. The market growth is hampered slightly by fragmented healthcare systems and variable import duties, but governmental initiatives to modernize trauma care offer significant market opportunities.

- Middle East and Africa (MEA - Emerging Opportunities): Growth in MEA is concentrated in the Gulf Cooperation Council (GCC) countries due to high per capita income and state-of-the-art medical facilities. Investment in specialized hospitals and a growing expatriate population requiring advanced orthopedic treatment contribute to the gradual expansion of the external fixation market in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the External Fixation Products Market.- Zimmer Biomet Holdings, Inc.

- Stryker Corporation

- DePuy Synthes (Johnson & Johnson)

- Smith & Nephew plc

- Orthofix Medical Inc.

- Acumed LLC

- Pega Medical

- Advanced Orthopedic Solutions

- Response Ortho

- Bioventus LLC

- Integra LifeSciences Corporation

- Globus Medical Inc.

- DJO Global, Inc.

- WishBone Medical, Inc.

- ExsoMed Corporation

- B Braun Melsungen AG

- Citieffe S.r.l.

- TASARIM MEDIKAL A.S.

- Merete GmbH

- OsteoRemedies

Frequently Asked Questions

Analyze common user questions about the External Fixation Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the External Fixation Products Market?

The market growth is primarily driven by the escalating global incidence of severe orthopedic trauma resulting from road accidents and sports injuries, necessitating immediate stabilization. Additionally, advancements in limb reconstruction surgery techniques, coupled with the increasing prevalence of musculoskeletal deformities in the aging population, boost the demand for precise and adjustable external fixation systems, particularly carbon fiber and circular fixators.

Which type of external fixator system is expected to witness the highest growth rate?

Circular external fixator systems, including advanced hexapod frames (e.g., Taylor Spatial Frame), are anticipated to demonstrate the highest growth rate. This is due to their superior capability for multi-planar deformity correction, precise limb lengthening, and bone transport procedures, offering high adjustability and accurate computational planning essential for complex reconstructive orthopedics.

What key technological advancements are shaping the future of external fixation products?

Key technological advancements include the pervasive shift towards lightweight, radiolucent carbon fiber materials to improve imaging and patient comfort, the integration of AI and specialized software for sophisticated pre-operative planning and frame calculation, and the development of anti-microbial coatings and specialized pin designs to drastically reduce the common complication of pin tract infection.

What is the main restraint impacting the widespread adoption of external fixation products?

The main restraint is the high risk of complications, predominantly pin tract infection (PTI), which necessitates rigorous postoperative management and specialized patient care, increasing healthcare costs. Furthermore, the complexity and steep learning curve associated with advanced circular and hybrid systems restrict their utilization to specialized orthopedic surgeons, limiting broader adoption in general trauma centers.

Which geographical region provides the most significant growth opportunities for external fixation products?

The Asia Pacific (APAC) region presents the most substantial growth opportunities. This is attributed to massive population bases, rapidly expanding healthcare infrastructure in major economies like China and India, increasing governmental investment in trauma centers, and a growing consumer ability to afford private, specialized orthopedic care, driving robust volume growth across all fixator segments.

The External Fixation Products Market, fundamentally tied to trauma and reconstructive orthopedics, demonstrates inherent stability combined with focused innovation. The clinical necessity for these devices in damage control orthopedics ensures a constant base demand, regardless of broader economic fluctuations. However, the trajectory of growth is heavily dependent on the continuous improvement of product efficacy, primarily through addressing the perennial challenge of pin tract infection and enhancing patient compliance. Manufacturers are increasingly realizing that merely providing hardware is insufficient; successful market leadership now requires comprehensive solutions that bundle precise fixation systems with advanced digital planning tools, educational resources, and potentially, remote monitoring capabilities. This shift towards a holistic approach, often utilizing AI for better patient-specific outcomes, is pivotal for capturing the high-value segment of complex deformity correction and limb reconstruction, which promises higher margins and faster adoption rates than the standardized trauma segment.

Competitive dynamics within the market are characterized by a few global giants (Stryker, DePuy Synthes, Zimmer Biomet, Smith & Nephew) holding dominant positions across the spectrum of orthopedic devices, supplemented by specialist companies (like Orthofix and Acumed) focusing intensely on high-performance trauma and specialized extremity fixators. This segmentation creates a dual market structure where large players leverage their massive distribution networks for volume sales, while specialists compete fiercely on innovation and niche expertise, particularly in the circular and hybrid fixator categories. To maintain competitiveness, companies are investing in lightweight materials, aiming for frames that are less burdensome for the patient and more versatile for the surgeon, thereby expanding the potential duration and scope of external fixation treatment. Consolidation remains likely, particularly as technology platforms become more complex and require substantial R&D investment, favoring those with robust financial backing.

Looking ahead towards 2033, the market's performance will be strongly influenced by the penetration rate of advanced systems in emerging economies. As healthcare spending rises in APAC and Latin America, the demand is expected to shift gradually from basic unilateral fixators to more sophisticated, premium circular systems necessary for correcting congenital and acquired deformities prevalent in these regions. Regulatory environments, particularly the implementation of stricter medical device regulations (such as the EU MDR), will necessitate significant compliance efforts from manufacturers, potentially slowing product launches but ultimately ensuring higher quality and safety standards across the globe. The integration of 3D printing for customization and bio-absorbable components will mark the next major phase of technological evolution, potentially streamlining treatment protocols by eliminating the need for frame removal procedures, thus driving long-term clinical acceptance and market expansion beyond current expectations.

Further analysis of the market reveals specific trends within the product segments. The accessories segment, encompassing various specialized pins, wires, clamps, and connecting rods, while often overlooked, is critical for operational efficiency and standardization. The continuous innovation in pins, focusing on features like self-drilling, self-tapping tips, and enhanced bone grip without thermal necrosis, directly influences surgical outcomes and complication rates. Similarly, the growing use of specialized components to address unique challenges, such as small bone fixation in the wrist or foot, expands the clinical utility of external fixation beyond major long bones. This constant demand for high-quality, specialized accessories ensures a steady, essential revenue stream for manufacturers, reinforcing the market’s reliance on reliable, precision-engineered components across all surgical settings, from emergency trauma to intricate elective procedures.

The application segment focused on deformity correction is experiencing remarkable growth, driven by an increased understanding of complex bone biology and advancements in computer-assisted planning. Conditions such as congenital pseudarthrosis, clubfoot, and severe limb length discrepancies are increasingly being managed using external fixators, particularly the dynamic, multi-axis correction frames. This shift is supported by improved surgical training and greater availability of software tools that enable surgeons to model the correction path with unprecedented accuracy. The long-term nature of deformity correction treatment means that patient compliance and comfort—features enhanced by carbon fiber and lightweight designs—are paramount, directly influencing product choice and market share within this high-value application area.

The end-user segment analysis confirms that Hospitals, especially large trauma centers, will maintain their dominance as primary procurement entities due to their mandate to manage acute trauma volumes. However, the rising specialization in orthopedic care is fueling the growth of Specialty Orthopedic Clinics. These clinics often focus on procedures that allow for long-term patient follow-up, such as limb lengthening, which requires specialized expertise and the adoption of the latest, most advanced external fixation technologies. Manufacturers are increasingly tailoring their sales and educational efforts to cater to these specialty centers, recognizing their influence as key opinion leaders and their tendency to adopt premium products rapidly, driving innovation at the high end of the market spectrum.

In summary, the External Fixation Products Market is poised for stable and technologically driven growth. The confluence of demographic changes leading to increased trauma incidence, sophisticated material science innovations (carbon fiber, bio-absorbable options), and the integration of digital health tools (AI planning, smart fixators) will define the competitive landscape through 2033. Success in this market demands not only high-quality, reliable hardware but also comprehensive support ecosystems, ensuring that complex orthopedic procedures are executed with precision, minimal complication rates, and optimal patient recovery profiles across diverse global healthcare environments.

The need for reliable temporary stabilization in polytrauma settings, known as damage control orthopedics (DCO), cannot be overstated as a foundational driver. External fixators allow surgeons to manage life-threatening injuries first, deferring definitive bone surgery until the patient is physiologically stable. This essential role in critical care provides a resilient revenue base, particularly for unilateral fixators used for immediate joint-spanning applications. Conversely, the restraint imposed by high complication rates, especially pin tract infection (PTI), forces a substantial investment by manufacturers into prophylactic solutions. These solutions range from anti-microbial pin coatings to complex patient education initiatives aimed at improving hygiene compliance, underscoring the market's dependence on product safety enhancements to facilitate wider clinical trust and long-term patient acceptance, particularly in multi-staged treatment plans common in limb reconstruction.

The opportunity landscape is significantly bolstered by the untapped potential within pediatric orthopedics and highly specialized extremity trauma. Pediatric applications, especially for congenital deformities and fracture management in growing bones, require unique, small-scale fixators and specialized protocols, representing a niche market with strong growth prospects due to increased focus on early intervention. Furthermore, the development of anatomically contoured frames for complex joints like the ankle, wrist, and elbow allows external fixation to address injuries previously managed less effectively, expanding the scope of indications. Capitalizing on these specialized niches requires robust collaboration between industry researchers and specialized orthopedic surgeons, ensuring that product development is highly targeted and clinically relevant, differentiating offerings in an otherwise competitive market space defined by major global trauma portfolios.

The impact forces are fundamentally skewed towards the necessity and efficacy of external fixation. Despite the complexities and costs, external fixation often represents the optimal or only viable solution in cases involving severe soft tissue injury, massive bone loss, or high infection risk. The recent COVID-19 pandemic highlighted the critical nature of adaptable surgical solutions, where external fixators provided a robust, often less invasive, option compared to traditional internal fixation, particularly when operating room resources were strained. This intrinsic clinical value stabilizes the market against external economic shocks, prioritizing quality and functional outcome over simple cost minimization, thereby supporting premium pricing for high-performance carbon fiber and advanced digital systems crucial for addressing the most challenging orthopedic injuries globally.

The shift in materials science is perhaps the most visible technological driver. While traditional steel and titanium systems remain reliable and cost-effective for basic stabilization, the demand for radiolucency is pushing the market rapidly toward advanced carbon fiber. This material not only eliminates beam-hardening artifacts during radiographic follow-up, which is vital for assessing fracture healing and bone gap filling, but also significantly reduces the weight carried by the patient, improving mobility and reducing skin irritation. Furthermore, research into bio-absorbable polymers is opening pathways for creating fixation components (e.g., pins or temporary clamps) that slowly degrade after bone healing is achieved, thereby streamlining the patient journey and reducing costs associated with subsequent removal surgeries, addressing a major patient dissatisfaction point and creating a substantial market differentiator for early adopters of this technology.

Digitalization extends beyond basic pre-operative planning to encompass sophisticated intraoperative guidance systems. Augmented Reality (AR) and Virtual Reality (VR) tools are beginning to emerge, allowing surgeons to overlay pre-planned pin trajectories and frame geometries onto the patient’s limb in real-time during surgery. This integration promises to dramatically increase the accuracy of pin placement, avoiding critical neurovascular structures and enhancing the biomechanical integrity of the final construct, especially important in complex pelvic or spinal fixation applications where external stabilizers might be used as adjuncts. Such precision engineering, coupled with computer-assisted calibration tools, reduces the inherent variability associated with manual frame assembly, ensuring predictable clinical outcomes and increasing confidence in the surgical technique.

The overall market ecosystem is therefore moving toward "smart orthopedics." This paradigm shift involves instruments that are not merely passive stabilizers but active data collectors and communicators. Future fixators may incorporate embedded sensors capable of measuring parameters such as interfragmentary motion, strain, temperature, and pH, allowing surgeons to remotely monitor the healing environment. This capability would enable personalized, data-driven decisions regarding frame adjustments or the initiation of weight-bearing protocols. This technological convergence—materials, software, and remote monitoring—is creating a highly valuable, differentiated product category that justifies premium pricing and solidifies the essential role of external fixation in the orthopedic care pathway, ensuring long-term market vitality and addressing the core need for predictable, safe bone healing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager