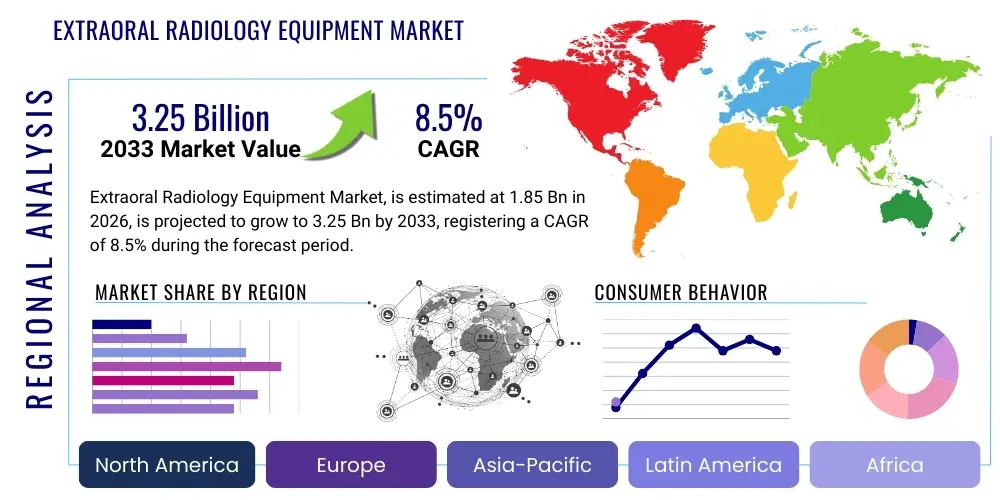

Extraoral Radiology Equipment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439552 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Extraoral Radiology Equipment Market Size

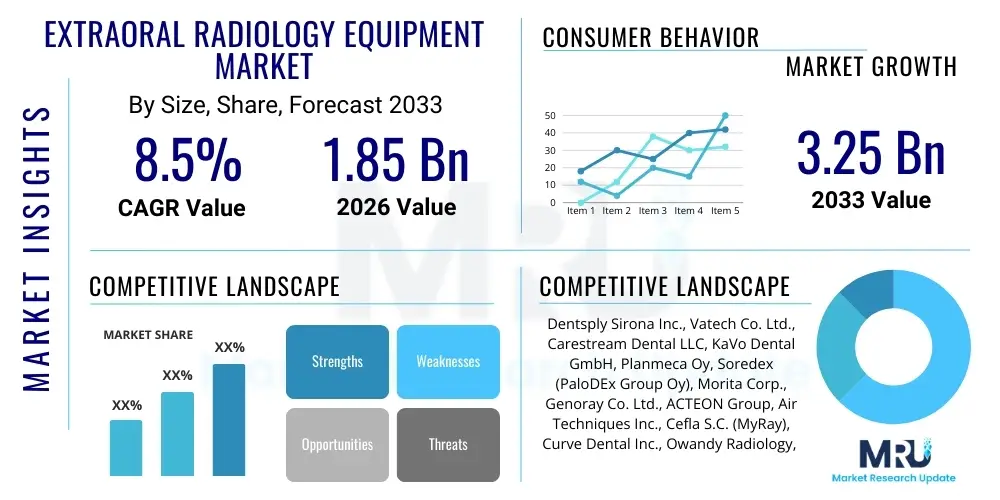

The Extraoral Radiology Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.85 billion in 2026 and is projected to reach USD 3.25 billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by continuous technological advancements, an escalating global prevalence of dental and oral health issues, and a rising awareness among patients and dental professionals regarding the benefits of advanced diagnostic imaging. The increasing adoption of digital dentistry workflows and the growing demand for precise treatment planning across various dental specialities are further propelling market growth.

Extraoral Radiology Equipment Market introduction

The Extraoral Radiology Equipment Market encompasses a sophisticated range of medical devices designed to capture comprehensive radiographic images of the head, neck, and dento-maxillofacial region from outside the patient's mouth. These systems are indispensable tools in modern dentistry, oral surgery, and maxillofacial diagnostics, offering a broad perspective that intraoral imaging cannot provide. The primary objective of these technologies is to facilitate accurate diagnosis, meticulous treatment planning, and effective monitoring of patient progress for a multitude of dental and craniofacial conditions. The product portfolio typically includes panoramic X-ray systems, cephalometric X-ray systems, and Cone Beam Computed Tomography (CBCT) scanners, each serving distinct diagnostic purposes with varying levels of detail and three-dimensional rendering capabilities.

Major applications for extraoral radiology equipment span across orthodontics for growth and development analysis, implantology for precise surgical planning, oral and maxillofacial surgery for complex procedures, endodontics for root canal treatment assessment, and general dentistry for comprehensive patient evaluations and pathology detection. These technologies enable dental professionals to visualize impacted teeth, assess bone density, analyze temporomandibular joint (TMJ) disorders, detect cysts and tumors, and identify various dental anomalies with unparalleled clarity. The versatility and diagnostic depth offered by these systems make them crucial assets in enhancing patient care and treatment outcomes across diverse clinical settings.

The benefits associated with extraoral radiology equipment are numerous and significant. They provide broad anatomical coverage, allowing for a holistic assessment of the oral and craniofacial structures, often with a single exposure. This reduces the need for multiple intraoral radiographs, thereby optimizing patient comfort and workflow efficiency. Furthermore, modern extraoral systems incorporate advanced features such as dose reduction technologies, enhanced image processing capabilities, and integration with digital dental platforms, which collectively improve diagnostic accuracy and streamline clinical operations. Key driving factors for this market include the global increase in dental diseases, a growing aging population requiring complex dental care, rising aesthetic concerns driving demand for cosmetic dentistry, and continuous innovation in imaging technology, including the integration of artificial intelligence for enhanced diagnostic precision and automated workflows.

Extraoral Radiology Equipment Market Executive Summary

The Extraoral Radiology Equipment Market is currently experiencing dynamic business trends characterized by a strong emphasis on digital transformation, integration of advanced analytics, and a strategic shift towards comprehensive digital dentistry solutions. Manufacturers are increasingly focusing on developing user-friendly interfaces, ergonomic designs, and compact systems that offer enhanced portability and flexibility for a wider range of clinical environments. There is a growing trend towards consolidation within the industry, with key players engaging in mergers, acquisitions, and strategic partnerships to expand their product portfolios, geographic reach, and technological capabilities. Furthermore, the market is witnessing a surge in demand for subscription-based software services and cloud-based image management solutions, reflecting a broader shift from traditional hardware sales to a more integrated service-oriented model, providing clinics with greater scalability and cost-efficiency.

Regional trends indicate a varied but generally upward trajectory across the globe. North America and Europe, as mature markets, continue to be significant revenue generators, driven by high adoption rates of advanced imaging technologies, robust healthcare infrastructure, and a strong emphasis on preventive and cosmetic dentistry. These regions are characterized by a continuous cycle of equipment upgrades and the integration of cutting-edge innovations. Conversely, the Asia Pacific (APAC) region is emerging as the fastest-growing market, propelled by increasing dental tourism, improving healthcare expenditure, rising awareness about oral health, and a large underserved population demanding modern dental treatments. Latin America and the Middle East & Africa (MEA) are also demonstrating substantial growth potential, albeit from a lower base, as dental care infrastructure develops and economic conditions improve, leading to greater investment in advanced diagnostic tools.

Segmentation trends within the extraoral radiology equipment market reveal distinct patterns. The Cone Beam Computed Tomography (CBCT) segment is projected to exhibit the highest growth rate, primarily due to its superior three-dimensional imaging capabilities crucial for intricate procedures like implant placement, orthodontics, and maxillofacial surgery. There is a growing preference for multi-functional units that combine panoramic, cephalometric, and CBCT imaging capabilities into a single device, optimizing space and investment for dental practices. From an end-user perspective, private dental clinics and specialized practices continue to be the largest consumers, driven by the increasing number of independent practitioners investing in advanced diagnostics. Simultaneously, dental hospitals and academic institutions are steadily expanding their adoption, particularly for research, training, and complex case management, further solidifying the diverse application landscape of these sophisticated imaging systems.

AI Impact Analysis on Extraoral Radiology Equipment Market

The integration of Artificial Intelligence (AI) into the Extraoral Radiology Equipment Market is a transformative force, addressing common user questions related to diagnostic accuracy, workflow efficiency, and predictive capabilities. Dental professionals frequently inquire about how AI can assist in the automated detection of pathologies, improve image quality, reduce human error in diagnosis, and streamline the entire imaging workflow. Concerns also revolve around the reliability and validation of AI algorithms, the ethical implications of automated decision-making, potential job displacement, and the learning curve associated with adopting new AI-powered systems. Users expect AI to not only enhance diagnostic precision but also to reduce operational costs and personalize treatment planning, ultimately elevating the standard of patient care through intelligent insights and optimized processes, while maintaining strict data security and privacy protocols.

- Automated Detection of Pathologies: AI algorithms can rapidly identify and highlight subtle lesions, caries, bone loss, and other abnormalities in extraoral radiographs, often surpassing the detection capabilities of the human eye alone. This leads to earlier diagnosis and more effective intervention strategies.

- Enhanced Image Quality and Reconstruction: AI-powered image processing techniques reduce noise, artifacts, and scattering, leading to clearer and more diagnostically useful images. This is particularly beneficial in CBCT where improved reconstruction algorithms enhance detail and reduce patient radiation exposure.

- Precision in Treatment Planning: AI can assist in complex treatment planning, such as orthodontic movement simulations, optimal implant placement based on bone density and anatomical structures, and surgical guides. It provides predictive analytics to forecast treatment outcomes and identify potential complications.

- Workflow Optimization and Efficiency: AI automates routine tasks like image registration, segmentation of anatomical structures, and reporting, thereby significantly reducing the time spent by clinicians on manual analysis. This allows dental professionals to focus more on patient interaction and complex decision-making.

- Reduction in Diagnostic Errors: By providing a second, objective opinion, AI acts as a reliable assistant to clinicians, cross-referencing findings and minimizing the chances of misdiagnosis or missed pathologies, thus improving overall diagnostic confidence and patient safety.

- Personalized Patient Care: AI enables the creation of highly individualized treatment plans by analyzing vast amounts of patient data, identifying unique anatomical characteristics, and predicting responses to different therapeutic approaches, leading to more tailored and effective interventions.

- Predictive Maintenance and System Performance: AI can monitor the performance of extraoral radiology equipment, predict potential malfunctions before they occur, and optimize maintenance schedules, leading to reduced downtime and extended operational lifespan of devices.

- Radiographic Reporting and Documentation: AI can generate comprehensive and standardized radiographic reports, automatically populating findings and measurements, which significantly streamlines documentation processes and ensures consistency across patient records.

DRO & Impact Forces Of Extraoral Radiology Equipment Market

The Extraoral Radiology Equipment Market is profoundly influenced by a complex interplay of drivers, restraints, opportunities, and their collective impact forces. A primary driver is the accelerating pace of technological advancements, particularly in Cone Beam Computed Tomography (CBCT) and digital imaging, which offer superior diagnostic capabilities, lower radiation doses, and faster image acquisition times. The increasing global prevalence of dental diseases, including periodontal diseases, dental caries, and malocclusions, necessitates precise diagnostic tools for effective treatment. Furthermore, the rising aesthetic consciousness among populations worldwide is fueling demand for cosmetic dentistry procedures like implants and orthodontics, which heavily rely on extraoral imaging for planning and execution. The growing geriatric population, often presenting with complex dental needs, also contributes significantly to the demand for advanced diagnostic equipment, underscoring a continuous upward pressure on market growth due to these intrinsic demands and technological push factors.

Despite the strong growth drivers, several restraints pose challenges to market expansion. The high initial capital investment required for extraoral radiology equipment, particularly advanced CBCT scanners, can be a significant barrier for smaller dental clinics and practitioners, especially in developing regions with limited budgets. Stringent regulatory frameworks and varying reimbursement policies across different countries add layers of complexity for manufacturers and end-users, affecting market entry and adoption rates. Additionally, concerns regarding radiation exposure, though minimized by modern technology, persist among some patient populations and healthcare providers, requiring continuous education and adherence to ALARA (As Low As Reasonably Achievable) principles. The shortage of skilled professionals trained in operating and interpreting advanced extraoral images also presents a hurdle, slowing down the adoption of newer, more sophisticated systems and impacting operational efficiency in some regions.

Opportunities within the Extraoral Radiology Equipment Market are abundant and diverse, promising sustained innovation and growth. Emerging economies, with their vast underserved populations and developing healthcare infrastructures, represent significant untapped markets where increasing disposable incomes and improving dental awareness can drive substantial adoption of extraoral systems. The integration of extraoral radiology with other digital dental technologies, such as Computer-Aided Design/Computer-Aided Manufacturing (CAD/CAM) and 3D printing, offers synergistic benefits for creating highly customized prosthetics and surgical guides, enhancing treatment precision and patient outcomes. The burgeoning field of teledentistry and remote diagnostics also presents a compelling opportunity, enabling specialists to interpret images and consult with patients from a distance, expanding access to care. Furthermore, continuous innovation in software solutions, particularly those leveraging artificial intelligence for automated diagnostics and treatment planning, is set to unlock new value propositions, improving efficiency and accuracy while creating entirely new service models and strengthening the market's long-term trajectory.

Segmentation Analysis

The Extraoral Radiology Equipment Market is comprehensively segmented based on various critical parameters, including product type, application, and end-user. This multi-faceted segmentation provides a granular understanding of market dynamics, enabling stakeholders to identify high-growth areas and tailor strategies effectively. The product type segmentation differentiates between various types of imaging modalities, each serving specific diagnostic needs with distinct technological capabilities. Application segmentation categorizes the market based on the clinical areas where these devices are predominantly utilized, reflecting the diverse diagnostic demands across different dental specialties. Finally, end-user segmentation highlights the primary purchasers and operational environments, ranging from private practices to large institutional settings, thereby illustrating the diverse adoption landscape and purchasing behaviors within the market. This detailed breakdown is crucial for targeted market analysis and strategic planning.

- By Product Type:

- Panoramic X-ray Systems: Widely used for general diagnostic purposes, providing a broad view of the entire mouth, including teeth, jaws, and surrounding structures. They are essential for detecting impacted teeth, jaw bone abnormalities, and periodontal disease.

- Cephalometric X-ray Systems: Primarily utilized in orthodontics and oral surgery to assess the skeletal and dental relationships of the face and skull. These systems provide precise measurements for treatment planning and monitoring growth patterns.

- Cone Beam Computed Tomography (CBCT) Scanners: Offer three-dimensional images with high spatial resolution, invaluable for complex procedures such as dental implant planning, endodontic analysis, TMJ assessment, and detection of subtle pathologies. They provide detailed anatomical information that 2D images cannot capture.

- Hybrid Systems: Devices combining multiple modalities (e.g., panoramic, cephalometric, and CBCT) into a single unit, offering versatility and optimizing space for dental practices. These systems are increasingly popular for their comprehensive diagnostic capabilities.

- By Application:

- Orthodontics: Diagnosis of malocclusion, assessment of jaw growth and development, treatment planning for braces and aligners, and monitoring tooth movement. Cephalometric and CBCT imaging are critical here.

- Implantology: Precise planning of dental implant placement, assessment of bone density and quality, identification of anatomical landmarks, and post-operative evaluation. CBCT is indispensable for these procedures.

- Oral & Maxillofacial Surgery: Diagnosis of fractures, tumors, cysts, and other complex pathologies, planning for surgical extractions, reconstructive surgery, and temporomandibular joint disorders. Detailed 3D imaging is crucial.

- Endodontics: Detection of root canal anatomy, identification of periapical lesions, assessment of root fractures, and planning for complex root canal treatments. CBCT offers superior visualization for these intricate procedures.

- General Dentistry: Comprehensive oral examinations, detection of early-stage pathologies, assessment of wisdom teeth, and general patient screening. Panoramic X-rays are foundational for general practice.

- Periodontics: Evaluation of bone loss, assessment of periodontal disease progression, and planning for periodontal surgeries.

- By End-User:

- Dental Hospitals & Clinics: Large institutions and private practices that serve a broad patient base and require a full suite of imaging capabilities for various specialties. These are the primary consumers of extraoral radiology equipment.

- Diagnostic Imaging Centers: Dedicated facilities specializing in medical imaging services, often partnering with dental practices to provide advanced diagnostic capabilities like CBCT.

- Academic & Research Institutes: Universities and research centers use these devices for educational purposes, training future dental professionals, and conducting research on new diagnostic techniques and treatment modalities.

- Ambulatory Surgical Centers: Facilities offering outpatient surgical procedures, including oral surgeries, where extraoral imaging is essential for pre-operative planning and post-operative assessment.

Value Chain Analysis For Extraoral Radiology Equipment Market

The value chain for the Extraoral Radiology Equipment Market is a complex ecosystem, beginning with the upstream suppliers of critical raw materials and components. This segment involves companies providing specialized X-ray tubes, digital sensors (CMOS, CCD, flat panel detectors), high-precision mechanical parts, advanced electronic circuitry, and sophisticated software components. These suppliers are crucial as the quality and innovation of their products directly impact the performance, reliability, and imaging capabilities of the final extraoral radiology equipment. Relationships with these upstream providers are often long-term and strategic, necessitating rigorous quality control, adherence to medical device standards, and continuous research and development to integrate the latest advancements in materials science and electronics, ensuring a robust foundation for the complex assembly processes that follow.

Moving downstream, the value chain encompasses the manufacturing, assembly, and integration of these components into complete extraoral radiology systems by original equipment manufacturers (OEMs). This stage involves intricate engineering, software development for image acquisition and processing, and stringent testing to meet regulatory approvals and performance benchmarks. Once manufactured, the equipment proceeds through various distribution channels to reach the end-users. These channels include direct sales forces employed by major manufacturers, a network of authorized distributors, and specialized dental equipment dealers. Direct sales teams often cater to large dental hospital groups, academic institutions, and government tenders, offering comprehensive support and customized solutions. Conversely, distributors and dealers typically serve independent dental clinics and smaller practices, providing localized sales, installation, training, and ongoing technical support, acting as crucial intermediaries in market penetration and customer relationship management.

Both direct and indirect distribution models play vital roles in the market. Direct sales offer manufacturers greater control over branding, pricing, and customer service, fostering direct relationships with key clients and facilitating immediate feedback for product improvement. This model is often preferred for high-value, technologically advanced systems and for strategic accounts where a deep understanding of customer needs is paramount. Indirect channels, through distributors and dealers, allow manufacturers to leverage existing networks, local market expertise, and established customer bases, particularly in geographically diverse or emerging markets. These partners are instrumental in providing regional accessibility, after-sales service, and technical assistance, which are critical for customer satisfaction and long-term market presence. The efficiency and effectiveness of these distribution networks significantly influence market reach, brand perception, and ultimately, the widespread adoption of extraoral radiology equipment across various end-user segments.

Extraoral Radiology Equipment Market Potential Customers

The primary potential customers and end-users of extraoral radiology equipment are diverse, spanning the entire spectrum of dental and maxillofacial healthcare providers. At the forefront are private dental clinics and specialized dental practices, which constitute the largest segment of purchasers. These include general dentists seeking comprehensive diagnostic capabilities, orthodontists requiring precise cephalometric and panoramic imaging for treatment planning, implantologists who rely heavily on CBCT for surgical accuracy, and oral surgeons managing complex cases such as impacted teeth, jaw fractures, and pathology. The increasing prevalence of independent dental practices globally, driven by a growing demand for personalized dental care, makes this segment a critical target for manufacturers and distributors, focusing on equipment that offers diagnostic versatility, ease of use, and a strong return on investment.

Another significant customer segment comprises large dental hospitals and multi-specialty healthcare facilities. These institutions often serve a broader patient base with a wider array of complex dental and craniofacial conditions, necessitating a comprehensive suite of advanced imaging equipment. Dental hospitals also play a crucial role in training and research, requiring state-of-the-art systems for educational purposes and the development of new diagnostic and treatment protocols. Their purchasing decisions are often influenced by the ability of equipment to integrate with existing hospital information systems, provide high throughput, and offer advanced features for diverse clinical scenarios. Furthermore, government-funded healthcare initiatives and public health clinics in various regions are increasingly investing in extraoral radiology equipment to expand access to advanced dental diagnostics for underserved populations.

Diagnostic imaging centers, which are dedicated facilities focused solely on providing advanced medical imaging services, represent another vital customer group. These centers often collaborate with dental practices that may not possess their own extraoral radiology equipment, particularly high-cost CBCT scanners. By offering specialized imaging services, these centers allow smaller practices to access cutting-edge diagnostics without the substantial capital outlay. Additionally, academic and research institutes form a critical niche market, utilizing extraoral radiology equipment for both student education and innovative research projects. These institutions are often early adopters of new technologies, playing a pivotal role in validating and advancing the field, influencing future purchasing trends and standards of care across the broader dental community. The diverse needs of these customer segments necessitate a versatile product offering and tailored marketing strategies from market players.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 3.25 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dentsply Sirona Inc., Vatech Co. Ltd., Carestream Dental LLC, KaVo Dental GmbH, Planmeca Oy, Soredex (PaloDEx Group Oy), Morita Corp., Genoray Co. Ltd., ACTEON Group, Air Techniques Inc., Cefla S.C. (MyRay), Curve Dental Inc., Owandy Radiology, J. Morita USA Inc., Yoshida Dental Mfg. Co. Ltd., FONA Dental s.r.o., NewTom (Cefla Medical Equipment), Ray America Inc., Apteryx Imaging Inc., Belmont Dental Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Extraoral Radiology Equipment Market Key Technology Landscape

The Extraoral Radiology Equipment Market is defined by a rapidly evolving technological landscape, driven by the continuous pursuit of enhanced image quality, reduced radiation exposure, and improved diagnostic capabilities. Cone Beam Computed Tomography (CBCT) remains at the forefront, offering highly detailed three-dimensional imaging that has revolutionized diagnosis and treatment planning in numerous dental specialties. Innovations in CBCT include faster scan times, smaller focal spots for sharper images, and adaptive dose control mechanisms that optimize radiation levels based on the patient's anatomy and diagnostic needs. Furthermore, advancements in digital sensor technology, such as complementary metal-oxide-semiconductor (CMOS) and charge-coupled device (CCD) detectors, have significantly improved image resolution and dynamic range, enabling clinicians to visualize subtle anatomical details with greater clarity and precision, moving away from traditional film-based radiography entirely.

The integration of artificial intelligence (AI) and machine learning (ML) algorithms is profoundly transforming the technological landscape, offering significant improvements in image processing, diagnostic accuracy, and workflow efficiency. AI-powered software can automatically detect and highlight pathologies such as caries, bone loss, and periodontal disease, reducing the burden on human interpretation and minimizing diagnostic errors. Beyond detection, AI is increasingly being used for automated cephalometric tracing, precise tooth segmentation, and even predictive analytics for treatment outcomes in orthodontics and implantology. Another critical area of technological advancement is dose reduction techniques, including pulsed X-ray emission, region-of-interest (ROI) imaging, and iterative reconstruction algorithms, all aimed at minimizing patient exposure to radiation while maintaining diagnostic image quality, addressing long-standing patient safety concerns and aligning with regulatory guidelines.

Beyond core imaging technologies, the market is witnessing significant strides in connectivity, software integration, and patient management solutions. Picture Archiving and Communication Systems (PACS) and vendor-neutral archives (VNAs) facilitate seamless integration of extraoral radiographs with electronic health records (EHRs) and practice management software, creating comprehensive digital workflows. Cloud-based imaging solutions are gaining traction, offering secure storage, remote access, and collaborative diagnostic capabilities, which are particularly beneficial for multi-site practices and teledentistry applications. Furthermore, the convergence of extraoral radiology with other digital dental technologies like CAD/CAM systems and 3D printing allows for end-to-end digital solutions, from diagnosis and treatment planning to the fabrication of prosthetics and surgical guides. These interconnected technologies are creating a more efficient, precise, and patient-centric dental care environment, driving the future direction of the extraoral radiology equipment market.

Regional Highlights

- North America: This region holds a significant share of the extraoral radiology equipment market, primarily driven by early adoption of advanced dental technologies, a robust healthcare infrastructure, and a high prevalence of dental diseases. The United States and Canada are key contributors, characterized by strong consumer awareness, high disposable incomes, and a large number of dental professionals keen on integrating cutting-edge diagnostic tools. Continuous investments in research and development, coupled with a focus on digital dentistry and the rising demand for cosmetic dental procedures, further cement North America's position as a leading market for advanced extraoral imaging solutions.

- Europe: Europe represents a mature market with a strong emphasis on regulatory compliance, quality standards, and technological innovation. Countries such as Germany, the UK, France, and Italy are significant contributors, propelled by an aging population with increasing dental care needs, well-established healthcare systems, and growing investment in digital dental clinics. The region is also at the forefront of implementing advanced AI-driven diagnostic solutions and dose-reduction technologies, reflecting a commitment to both diagnostic precision and patient safety. Collaborative research initiatives and government funding for dental health programs also play a crucial role in market development.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market for extraoral radiology equipment during the forecast period. This rapid expansion is attributed to a massive underserved population, increasing healthcare expenditure, rising dental tourism, and a growing awareness about oral health among the populace. Emerging economies like China and India are witnessing significant investments in modernizing dental infrastructure, expanding the number of dental clinics, and adopting advanced imaging technologies. The increasing prevalence of dental issues, combined with a burgeoning middle class and favorable government initiatives to improve healthcare access, creates immense opportunities for market players in this dynamic region.

- Latin America: The Latin American market for extraoral radiology equipment is experiencing steady growth, driven by improving economic conditions, expanding access to dental care, and a rising demand for cosmetic and restorative dental procedures. Countries such as Brazil, Mexico, and Argentina are leading this growth, with increasing investments in private dental practices and a growing adoption of digital dental technologies. While cost remains a significant factor, the long-term benefits of precise diagnostics and improved patient outcomes are encouraging dental professionals to upgrade their imaging capabilities, leading to a gradual but consistent market expansion across the region.

- Middle East and Africa (MEA): The MEA region presents a developing market with considerable growth potential, particularly in the Middle Eastern countries like Saudi Arabia and UAE, where increasing healthcare spending and the development of state-of-the-art medical and dental facilities are key drivers. The African continent, while facing infrastructural challenges, shows emerging opportunities in urban centers where private dental clinics are adopting modern diagnostic equipment. The rising awareness about dental health, coupled with government initiatives to enhance healthcare services and the growing trend of medical tourism, are gradually contributing to the expansion and sophistication of the extraoral radiology equipment market in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Extraoral Radiology Equipment Market.- Dentsply Sirona Inc.

- Vatech Co. Ltd.

- Carestream Dental LLC

- KaVo Dental GmbH

- Planmeca Oy

- Soredex (PaloDEx Group Oy)

- Morita Corp.

- Genoray Co. Ltd.

- ACTEON Group

- Air Techniques Inc.

- Cefla S.C. (MyRay)

- Curve Dental Inc.

- Owandy Radiology

- J. Morita USA Inc.

- Yoshida Dental Mfg. Co. Ltd.

- FONA Dental s.r.o.

- NewTom (Cefla Medical Equipment)

- Ray America Inc.

- Apteryx Imaging Inc.

- Belmont Dental Inc.

Frequently Asked Questions

Analyze common user questions about the Extraoral Radiology Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is extraoral radiology equipment and why is it important in dentistry?

Extraoral radiology equipment consists of devices like panoramic X-rays, cephalometric X-rays, and CBCT scanners that image areas of the head and neck from outside the mouth. It is crucial for dentistry because it provides a comprehensive view of the entire dento-maxillofacial region, enabling detailed diagnosis, precise treatment planning for orthodontics, implants, and oral surgery, and detecting pathologies that intraoral X-rays might miss, significantly enhancing patient care and outcomes.

What are the latest technological advancements in the extraoral radiology equipment market?

The latest advancements include advanced Cone Beam Computed Tomography (CBCT) with ultra-low dose protocols and faster scan times, integrated Artificial Intelligence (AI) for automated image analysis, pathology detection, and treatment planning, enhanced digital sensors for superior image quality, and seamless integration with digital dental workflows, CAD/CAM systems, and cloud-based platforms for improved efficiency and collaboration.

How does Artificial Intelligence (AI) impact the future of extraoral radiology?

AI is profoundly impacting extraoral radiology by enhancing diagnostic accuracy through automated detection of anomalies, optimizing image quality, streamlining workflows by automating routine tasks like segmentation and reporting, and enabling more precise and personalized treatment planning with predictive analytics. It promises to reduce human error, improve efficiency, and elevate the standard of dental diagnostics, leading to better patient outcomes and more informed clinical decisions.

What are the primary drivers and restraints affecting the extraoral radiology equipment market?

Key drivers include technological advancements (especially CBCT and AI), the increasing global prevalence of dental diseases, a growing geriatric population requiring complex dental care, and rising demand for cosmetic dentistry. Major restraints involve the high initial cost of equipment, stringent regulatory requirements, concerns about radiation exposure, and a shortage of skilled professionals trained in advanced imaging interpretation, which can impede wider adoption.

Which regions are key players in the extraoral radiology equipment market, and what are their growth prospects?

North America and Europe are mature markets with high adoption rates, driven by advanced infrastructure and continuous innovation. The Asia Pacific (APAC) region is projected to be the fastest-growing market due to increasing healthcare expenditure, rising dental awareness, and a large underserved population. Latin America and MEA show significant growth potential as dental infrastructure develops and economic conditions improve, facilitating greater investment in modern diagnostic equipment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager