Extreme Pressure Lubricant Additives Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436618 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Extreme Pressure Lubricant Additives Market Size

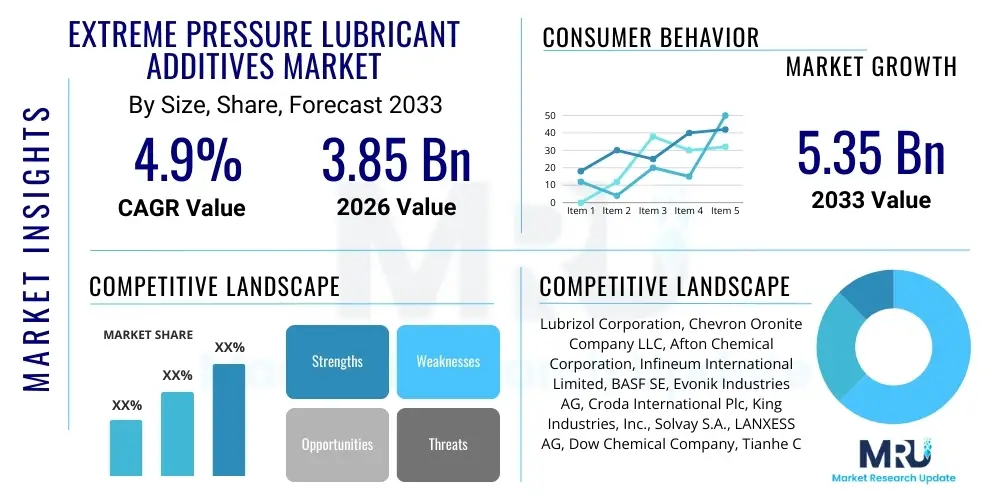

The Extreme Pressure Lubricant Additives Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.85% between 2026 and 2033. The market is estimated at USD 3.85 Billion in 2026 and is projected to reach USD 5.35 Billion by the end of the forecast period in 2033.

Extreme Pressure Lubricant Additives Market introduction

Extreme Pressure (EP) lubricant additives are crucial chemical compounds intentionally blended into lubricating oils and greases to prevent catastrophic welding or seizure of moving metal parts operating under conditions of high load, elevated temperature, and low sliding speed, where conventional hydrodynamic lubrication fails. These additives, primarily sulfur-, phosphorus-, and chlorine-based compounds (though chlorine use is diminishing), react chemically with the metal surface at high frictional temperatures, forming a protective, sacrificial film. This film possesses a lower shear strength than the base metal, effectively preventing direct metal-to-metal contact and significantly reducing wear and friction under boundary lubrication regimes.

The core function of EP additives is indispensable across heavy industries. They find extensive application in critical components such as industrial gearboxes, automotive transmissions (manual and hypoid gears), metalworking fluids (cutting and stamping), and marine propulsion systems. The performance enhancement provided by these additives—including improved load-carrying capacity, enhanced thermal stability, and extended component lifespan—directly translates into reduced maintenance costs and greater operational efficiency for end-users. As machinery becomes more compact and operates under increasingly severe conditions, the demand for high-performance, tailored EP additive packages rises proportionately, driving innovation in ashless and environmentally compliant formulations.

Major driving factors fueling this market include the global expansion of heavy manufacturing, infrastructure development requiring robust construction equipment, and the relentless advancement in automotive technology demanding smaller, lighter, and more powerful drivetrains. Furthermore, the increasing adoption of automated and specialized machinery in sectors like mining and power generation mandates lubricants capable of withstanding extreme mechanical stresses. The ongoing shift toward advanced synthetic and semi-synthetic base oils further necessitates compatible, high-efficacy EP additive chemistries designed to maximize overall lubricant performance while adhering to stringent global health, safety, and environmental standards.

Extreme Pressure Lubricant Additives Market Executive Summary

The global Extreme Pressure (EP) Lubricant Additives market is characterized by a significant transition toward sustainable and high-performance chemistries, moving away from conventional sulfurized olefins and heavily chlorinated paraffins due to environmental pressures. Business trends indicate a robust investment in ashless phosphorus compounds, particularly for industrial applications, and the development of multi-functional additives that combine anti-wear, anti-oxidant, and EP properties within a single component. Strategic partnerships between additive manufacturers and major lubricant blenders are intensifying, focused on co-developing optimized formulations for next-generation machinery, especially within the rapidly evolving electric vehicle (EV) segment where specific EP requirements differ substantially from internal combustion engine (ICE) vehicles.

Regionally, the Asia Pacific (APAC) continues its dominance, driven by massive industrialization and infrastructural projects in China, India, and Southeast Asian nations, leading to unprecedented demand for lubricants in manufacturing, construction, and mining sectors. North America and Europe, while mature markets, are leading the charge in regulatory compliance and technological innovation, primarily focusing on biodegradable and low-toxicity EP solutions. The stringent enforcement of REACH regulations in Europe and evolving API standards globally are forcing manufacturers to reformulate products, favoring safer chemistries like zinc-free dithiophosphates and specific nitrogen-containing compounds to meet performance specifications without compromising environmental integrity.

Segment trends reveal that the Automotive sector remains the largest consumer, necessitated by the need for superior protection in hypoid gears and limited-slip differentials, though industrial applications, especially in power generation and heavy machinery, exhibit the highest growth trajectory due to increased operational severity. By product type, sulfur-phosphorus combinations remain pivotal due to their cost-effectiveness and dual functionality, but the fastest growth is observed in specialty non-toxic or bio-based EP additives, responding to the demand for sustainable industrial lubricants. Consolidation among major suppliers is noticeable, aiming to leverage scale, enhance raw material sourcing stability, and optimize complex global supply chains to maintain competitive pricing and technological edge.

AI Impact Analysis on Extreme Pressure Lubricant Additives Market

User queries regarding the impact of Artificial Intelligence (AI) on the Extreme Pressure Lubricant Additives Market often center on optimization, predictive capabilities, and material discovery. Key concerns revolve around how AI can accelerate the formulation process, moving beyond traditional trial-and-error methods, and whether machine learning (ML) models can predict additive performance under extreme conditions with greater accuracy than current physical testing protocols. Users are specifically keen on AI's ability to screen thousands of potential molecular structures rapidly, identify novel, high-performing, and environmentally friendly EP chemistries (such as non-sulfur or bio-derived compounds), and optimize the synergistic interaction between various additive components (dispersants, detergents, anti-wear agents) within a complex lubricant matrix. Furthermore, there is significant interest in using AI/ML to analyze real-time operational data from machinery (IoT sensors) to predict lubricant degradation rates, thereby optimizing additive replenishment schedules and reducing unnecessary consumption and waste, leading to substantial cost savings and enhanced sustainability in industrial operations.

- AI-driven Formulation Optimization: Machine learning algorithms rapidly analyze chemical properties and performance data, significantly reducing the time required to develop new EP additive packages and optimizing blend ratios for specific applications.

- Predictive Performance Modeling: AI models predict the anti-scuffing and anti-wear capabilities of new additive chemistries under extreme temperature and pressure conditions, minimizing costly and time-consuming physical bench testing.

- Sustainable Material Discovery: Generative AI assists in identifying novel molecular structures for bio-based or ashless EP additives, accelerating the shift toward environmentally compliant solutions.

- Supply Chain and Inventory Management: AI optimizes raw material procurement, predicting demand fluctuations for sulfur, phosphorus, and other chemical intermediates, ensuring stable supply lines for manufacturers.

- Real-Time Quality Control: AI-powered analytical tools monitor batch consistency and purity of additive production in real-time, ensuring stringent quality standards are met before blending.

- Predictive Lubricant Maintenance: Integration of AI with IoT sensors in machinery predicts the remaining useful life of the lubricant (and its additives), allowing for precision maintenance rather than time-based scheduled changes, maximizing additive efficiency.

DRO & Impact Forces Of Extreme Pressure Lubricant Additives Market

The market dynamics of Extreme Pressure Lubricant Additives are governed by a complex interplay of robust industrial demand, stringent global regulatory frameworks, and technological advancements focusing on sustainability. Driving forces include the continuous growth of heavy machinery production globally, particularly in emerging economies, and the miniaturization trend in automotive components which demands higher power density and, consequently, greater stress resistance from lubricants. The persistent need for enhanced operational efficiency and extended component life across sectors like mining, steel production, and wind energy further reinforces the demand for high-performance EP solutions. Simultaneously, the growing popularity of electric vehicles, while potentially reducing overall engine lubricant demand, introduces specialized needs for thermal management and compatibility with electrical components, requiring novel, non-conductive EP chemistries, presenting a new demand driver.

Restraints primarily revolve around environmental concerns and the volatility of raw material pricing. The shift away from sulfur- and chlorine-based additives due to their environmental persistence and toxicity issues imposes significant R&D costs and formulation challenges on manufacturers. Furthermore, key raw materials, such as specific phosphorus compounds and chemical intermediates, are often commodity-priced, leading to unpredictable fluctuations in manufacturing costs which can compress profit margins for additive suppliers. The high cost associated with qualifying new additive packages in industrial equipment and meeting diverse international regulatory requirements (e.g., European CLP, US EPA) acts as a barrier to entry for smaller players and slows down the introduction of innovative, greener solutions.

Opportunities for growth are concentrated in the development and commercialization of bio-based and ashless EP additives, which align with circular economy principles and increasingly strict environmental mandates. The growing demand for specialized lubricants tailored for wind turbine gearboxes, requiring additives capable of functioning reliably over very long service intervals and wide temperature fluctuations, represents a lucrative niche. Moreover, the burgeoning requirements of e-mobility—including specialized gear and bearing lubrication for high-speed electric axles— necessitate a complete paradigm shift in additive chemistry, offering first-mover advantages to companies capable of quickly developing compatible, high-dielectric EP packages. Impact forces are currently dominated by the "Environmental Regulation Push," compelling immediate reformulation, and the "Industrial Modernization Pull," requiring increasingly severe-duty performance.

Segmentation Analysis

The Extreme Pressure Lubricant Additives market is extensively segmented based on the chemical composition of the additive, the specific application where the lubricant is utilized, and the end-use industry driving the demand. Segmentation by type is critical, as it dictates the performance profile, cost, and regulatory status of the resulting lubricant. The market traditionally relies heavily on sulfur-containing compounds (such as sulfurized olefins and sulfurized fats), followed closely by phosphorus-containing compounds (like dithiophosphates and phosphites), and, to a lesser extent, nitrogenous compounds, which are gaining traction as high-performance, ashless alternatives. The primary function of this segmentation is to categorize products based on their reactivity and thermal stability, determining suitability for different boundary lubrication conditions encountered in automotive and industrial settings.

Application-based segmentation divides the market into automotive lubricants and industrial lubricants, each presenting unique challenges. Automotive applications, which include engine oils, gear oils, and automatic transmission fluids (ATFs), are highly standardized and performance-driven, requiring robust EP performance in compact spaces, especially in hypoid gears. Industrial applications, encompassing metalworking fluids, turbine oils, and hydraulic fluids, require extreme customization based on the specific operational environment, load, and temperature profiles of machinery in sectors like mining, power generation, and steel production. The trend toward high-shear, long-drain interval industrial fluids is particularly influencing the demand for thermally stable, non-corrosive EP additives.

Geographically, the segmentation highlights uneven global demand, with Asia Pacific exhibiting the highest growth due to rapid industrial expansion, contrasted with the regulatory-driven demand in mature markets like North America and Europe, which prioritize sustainability and low-toxicity profiles. Understanding these segmentations allows manufacturers to strategically allocate resources for R&D, focusing on compliance in regulated zones and scaling production for high-volume, growth-centric regions, ensuring optimal market penetration across diverse technological and regulatory landscapes.

- By Type:

- Sulfur-Based Additives (Sulfurized Hydrocarbons, Sulfurized Fats)

- Phosphorus-Based Additives (Phosphate Esters, Phosphites)

- Sulfur-Phosphorus Additives (Zinc Dialkyldithiophosphates (ZDDPs) - multifunction)

- Chlorine-Based Additives (Declining due to regulation)

- Molybdenum-Based Additives (Secondary EP/Friction Modifiers)

- Bio-based and Ashless Additives

- By Application:

- Automotive Gear Oils

- Industrial Gear Oils

- Metalworking Fluids (Cutting Oils, Drawing Compounds)

- Transmission and Hydraulic Fluids

- Greases

- By End-Use Industry:

- Automotive and Transportation

- Heavy Manufacturing (Steel, Cement)

- Mining and Construction

- Marine and Offshore

- Power Generation (Wind Turbines, Thermal Plants)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LAMEA)

- Middle East and Africa (MEA)

Value Chain Analysis For Extreme Pressure Lubricant Additives Market

The value chain for Extreme Pressure Lubricant Additives is fundamentally structured around chemical synthesis, formulation complexity, and specialized distribution channels. Upstream analysis focuses on the sourcing and processing of core chemical intermediates, primarily sulfur compounds, phosphorus derivatives (like P2S5 for ZDDP synthesis), and natural or synthetic feedstocks for bio-based options. Key upstream suppliers include large chemical producers providing these high-purity raw materials. Price volatility and stability of these foundational chemicals are critical factors influencing the production costs of the final additives. Quality control at this stage is paramount, as impurities can severely compromise the effectiveness and stability of the resultant lubricant package.

The core manufacturing stage involves complex chemical reactions and blending processes carried out by major additive producers. These companies invest heavily in R&D to synthesize proprietary molecules and create customized additive packages tailored to specific OEM performance specifications and environmental mandates. Post-production, the additives enter the downstream segment, where they are typically sold in concentrated form to lubricant blenders (oil companies and independent formulators). The blenders then combine these EP additive packages with base oils (mineral, semi-synthetic, or synthetic) and other performance boosters (dispersants, anti-oxidants) to produce finished lubricants sold under their brand names.

Distribution channels for EP additives are segmented into direct and indirect routes. Major, integrated oil companies often purchase directly from leading additive manufacturers through long-term contracts. Indirect channels involve specialty chemical distributors who provide smaller lubricant blenders and industrial end-users with smaller volumes, offering technical support and localized inventory management. The final product (the finished lubricant) is then distributed to end-users (OEMs, industrial maintenance facilities, automotive retailers) via specialized logistics networks. Technical service and performance warranty support provided by additive manufacturers and blenders are essential components of the downstream value proposition, especially for mission-critical industrial applications.

Extreme Pressure Lubricant Additives Market Potential Customers

The primary customers for Extreme Pressure Lubricant Additives are entities involved in the formulation and utilization of high-performance lubricants designed for heavy-duty, high-stress mechanical systems. The largest group of immediate customers consists of major oil companies and independent lubricant blenders, such as ExxonMobil, Shell, BP, and specialized lubricant manufacturers, who purchase large volumes of additive concentrates to formulate their branded industrial and automotive oils. These customers demand consistent quality, technical data supporting performance claims, and regulatory assurance regarding the composition of the additive packages they incorporate into their finished products for global distribution.

Downstream, the ultimate buyers and end-users are the industrial sectors and automotive original equipment manufacturers (OEMs). Automotive OEMs, including manufacturers of heavy trucks, passenger vehicles, and construction equipment (e.g., Caterpillar, Volvo, Daimler), are crucial, as they often issue specific performance standards and approvals (e.g., API, ACEA, and proprietary OEM specifications) that dictate the type and quality of EP additives required for their transmissions, axles, and drivetrains. This sector requires additives that enhance fuel economy, increase power transfer efficiency, and ensure component longevity under severe operating cycles, making them high-value customers for specialized EP additive formulations.

Furthermore, major industrial consumers represent a vast pool of potential customers. This includes large-scale mining operations requiring robust gear oils for excavators and haul trucks, steel mills needing specialized greases for rolling elements, and power generation facilities, particularly wind farms, which demand sophisticated EP additives for large, heavily loaded turbine gearboxes with mandatory extended service intervals. These industrial buyers seek performance additives that guarantee operational uptime and minimize the Total Cost of Ownership (TCO) associated with lubricant consumption and machinery maintenance, often leading to long-term contracts based on proven field performance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.85 Billion |

| Market Forecast in 2033 | USD 5.35 Billion |

| Growth Rate | 4.85% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lubrizol Corporation, Chevron Oronite Company LLC, Afton Chemical Corporation, Infineum International Limited, BASF SE, Evonik Industries AG, Croda International Plc, King Industries, Inc., Solvay S.A., LANXESS AG, Dow Chemical Company, Tianhe Chemicals Group, Shamrock Chemical Company, PMC Specialties Group, Vanderbilt Chemicals, LLC, Clariant AG, Dover Chemical Corporation, Sinopec Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Extreme Pressure Lubricant Additives Market Key Technology Landscape

The technology landscape for Extreme Pressure Lubricant Additives is undergoing rapid evolution, primarily driven by the need for superior performance under increasingly harsh conditions and mandatory adherence to lower environmental footprints. The most significant shift involves moving away from conventional sulfur- and chlorine-based compounds toward multifunctional, ashless, and environmentally benign alternatives. Research is heavily focused on developing sophisticated phosphorus-based chemistries, such as novel substituted phosphites and phosphate esters, which offer excellent EP and anti-wear properties without contributing to ash formation, making them suitable for modern exhaust after-treatment systems in both automotive and industrial sectors. Furthermore, hybrid formulations that integrate various chemistries to achieve a synergistic effect—combining friction modification with extreme pressure protection—are becoming standard practice, necessitating deep molecular understanding and advanced tribological testing methodologies to validate performance.

A burgeoning area of innovation involves the use of nanotechnology in additive formulation. Nano-lubricants, incorporating materials like tungsten disulfide (WS2) or specific carbon allotropes (e.g., functionalized graphene or carbon nanotubes), act as solid boundary lubricants. When dispersed effectively within the fluid, these nanoparticles can significantly enhance the load-carrying capacity and reduce friction, particularly at high contact pressures and temperatures. While still facing challenges related to long-term stability and cost-effective dispersal, nano-additives represent a frontier technology capable of pushing the performance envelope beyond what traditional organometallic or organic EP compounds can achieve. This pursuit is particularly relevant for highly stressed applications like aerospace mechanisms and high-speed gearing systems where conventional film thickness is minimal.

Another crucial technological focus is the development of synthetic and bio-based EP precursors. Bio-based additives derived from renewable sources, such as modified vegetable oils or specific fatty acid derivatives, are gaining market share, especially in applications where leakage or environmental contamination risk is high (e.g., marine or agricultural sectors). These bio-lubricants must meet performance parity with their mineral oil counterparts, necessitating novel chemical modification techniques to ensure they possess adequate thermal and oxidative stability, in addition to requisite EP characteristics. Compliance with ISO 15380 (Hydraulic Fluids) and similar standards is crucial, pushing formulators to invest in advanced synthesis processes and comprehensive toxicological testing to ensure market acceptance and regulatory clearance for these sustainable, yet highly demanding, additive technologies.

Regional Highlights

The global Extreme Pressure Lubricant Additives market exhibits distinct regional dynamics shaped by industrial maturity, regulatory frameworks, and developmental pace. Asia Pacific (APAC) stands out as the primary growth engine, fueled by rapid urbanization, massive investment in infrastructure (roads, railways, power plants), and the robust expansion of the region's manufacturing and automotive industries. Countries like China and India represent immense demand centers for lubricants used in construction, mining, and heavy manufacturing, driving high-volume consumption of EP additives. Furthermore, the region is witnessing increasing adoption of higher-specification lubricants as industrial practices modernize, transitioning from basic mineral oils to high-performance synthetic blends, thereby increasing the value realized per unit of additive consumed.

North America remains a critical market characterized by stringent performance requirements and a focus on specialized, high-margin applications. The region's demand is driven by advanced manufacturing (aerospace, precision engineering), the oil and gas extraction industry, and a mature automotive sector that mandates compliance with strict environmental standards (e.g., low sulfur and ash content). Innovation in North America is centered on developing advanced chemical compounds that improve energy efficiency and extend drain intervals, often leveraging proprietary intellectual property and complex synthetic base stocks to achieve superior EP performance in extreme operating environments.

Europe represents a highly mature but regulatory-intensive market, where demand growth is steady but heavily influenced by environmental legislation such as REACH and various EU directives promoting biodegradability and reducing human toxicity. This regulatory environment has accelerated the displacement of conventional, environmentally questionable additives in favor of high-cost, high-performance, and compliant alternatives, including bio-based esters and highly specialized ashless phosphorus compounds. European manufacturers often lead in the adoption of sustainable formulations for wind turbine gear oils and marine lubricants, positioning the region at the forefront of green chemistry adoption within the EP additive domain.

- Asia Pacific (APAC): Highest market share and growth rate, driven by manufacturing output, infrastructural spending, and rising vehicle production in China and India.

- North America: Mature market focused on premium, high-specification products for heavy-duty commercial vehicles and specialized industrial uses (mining, energy). Emphasis on energy efficiency and long-life formulations.

- Europe: Growth is primarily innovation-led and compliance-driven. Strong regulatory pressure pushes manufacturers toward bio-compatible, low-toxicity, and ashless EP solutions for industrial and automotive sectors (e.g., low-SAPS compliance).

- Latin America (LAMEA): Moderately growing market linked to commodity production (mining, agriculture, oil extraction). Demand is cost-sensitive but gradually shifting toward higher-performance industrial lubricants.

- Middle East and Africa (MEA): Growth tied to significant oil & gas extraction activities and infrastructure projects. Demand centers around robust performance in high-temperature operating conditions for heavy machinery and industrial gearing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Extreme Pressure Lubricant Additives Market.- The Lubrizol Corporation

- Chevron Oronite Company LLC

- Afton Chemical Corporation

- Infineum International Limited

- BASF SE

- Evonik Industries AG

- Croda International Plc

- King Industries, Inc.

- Solvay S.A.

- LANXESS AG

- Dow Chemical Company

- Tianhe Chemicals Group

- Shamrock Chemical Company

- PMC Specialties Group

- Vanderbilt Chemicals, LLC

- Clariant AG

- Dover Chemical Corporation

- Sinopec Corp.

- Eni S.p.A. (Additive Division)

- Wuhan Chuyuan Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Extreme Pressure Lubricant Additives market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are Extreme Pressure (EP) Lubricant Additives and why are they necessary?

EP lubricant additives are chemical compounds added to lubricants to prevent the seizure or welding of metal surfaces under severe operating conditions involving high loads, low speeds, and high contact pressure, where the oil film alone cannot prevent metal-to-metal contact (boundary lubrication). They chemically react with the metal surface to form a sacrificial protective layer.

How are environmental regulations impacting the formulation of EP additives?

Stringent environmental regulations (such as REACH and evolving API/ACEA standards) are forcing manufacturers to transition away from traditional sulfur, chlorine, and heavy metal-containing additives. This shift accelerates R&D toward developing ashless, phosphorus-based, and bio-based EP compounds that offer high performance with lower toxicity and improved biodegradability to ensure regulatory compliance.

Which chemical types dominate the Extreme Pressure Additives market?

The market is predominantly dominated by sulfur-phosphorus combinations, specifically sulfurized olefins and zinc dialkyldithiophosphates (ZDDPs). However, there is a rapidly growing segment for specialized ashless additives, including various organic phosphate esters and sulfur-free derivatives, particularly for use in modern automotive and environmentally sensitive industrial applications.

What is the role of EP additives in Electric Vehicles (EVs) versus traditional ICE vehicles?

In traditional ICE vehicles, EP additives are critical for the engine, transmission, and hypoid gears. In EVs, they are vital for the gearbox and reduction gears (e-axles). EV EP additives require specific properties, including high oxidative stability, excellent thermal management, and, critically, non-conductivity to prevent electrical system interference, driving demand for specialized, non-metallic EP chemistries.

Which geographical region shows the highest growth potential for EP lubricant additives?

Asia Pacific (APAC) exhibits the highest growth potential, primarily driven by rapid industrialization, massive infrastructure development, and expanding automotive manufacturing base in countries like China, India, and Southeast Asia, leading to increasing demand across manufacturing and heavy machinery sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager