Extruded Activated Carbon Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433876 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Extruded Activated Carbon Market Size

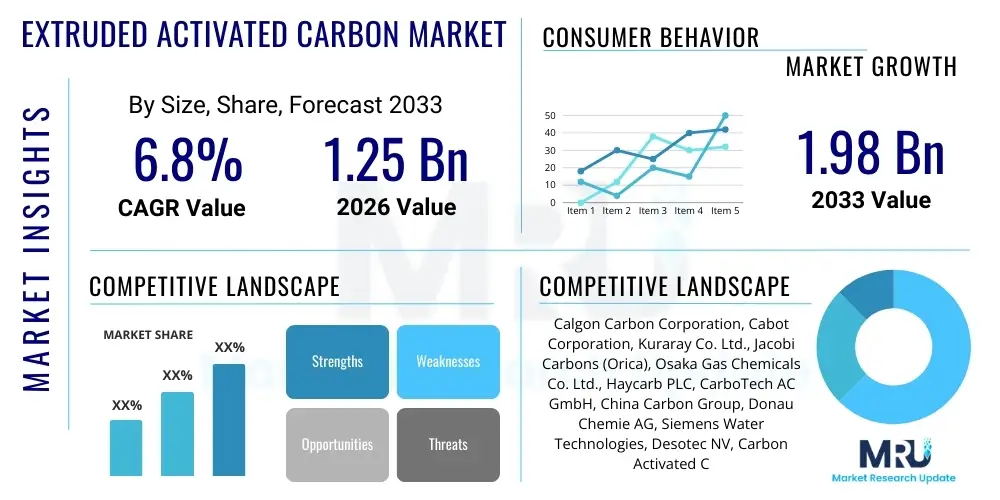

The Extruded Activated Carbon Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $1.98 Billion by the end of the forecast period in 2033.

Extruded Activated Carbon Market introduction

Extruded activated carbon (EAC), often referred to as pelletized carbon, is produced by binding powdered activated carbon with a binder and extruding the mixture into cylindrical shapes ranging typically from 0.8 mm to 5 mm in diameter. This specific shape provides low dust content, high mechanical strength, and a high packing density, making it highly suitable for gas-phase applications, including solvent recovery, air purification, and automotive emission control. The unique manufacturing process allows for meticulous control over the pore structure, optimizing the adsorption capacity for specific molecular weights and concentrations, which is critical in sophisticated industrial processes.

The primary applications driving the demand for extruded activated carbon include environmental remediation, specifically in volatile organic compound (VOC) removal from industrial exhaust streams, and in highly sensitive applications such as medical gas purification and respiratory protection. Furthermore, the robust physical structure of extruded carbon minimizes pressure drop in deep bed filtration systems, offering operational efficiencies superior to granular or powdered forms in continuous flow reactors. The growing stringency of environmental regulations worldwide, particularly concerning industrial air emissions and mercury removal from power plant flue gas, substantially bolsters market penetration.

Key benefits of using extruded activated carbon center around its excellent kinetic properties, high surface area to volume ratio, and predictable flow characteristics. Driving factors for market expansion include the rapid industrialization in the Asia Pacific region, increasing focus on water treatment infrastructure development globally, and the consistent demand from the automotive sector for evaporative emission control (ECC) canisters. The material's resilience to attrition and thermal regeneration also offers long-term cost efficiencies for large-scale industrial consumers.

Extruded Activated Carbon Market Executive Summary

The Extruded Activated Carbon Market is characterized by robust growth primarily fueled by global commitments to cleaner air standards and enhanced solvent recovery protocols across the chemical and petrochemical industries. Current business trends indicate a strong move toward specialized, customized extruded products, such as impregnated activated carbon, designed to target specific contaminants like hydrogen sulfide (H₂S) or ammonia, moving away from generic products. Strategic mergers and acquisitions are shaping the competitive landscape, with major players integrating backward to secure consistent supply of high-quality raw materials, predominantly coconut shell and wood, which provide optimal pore distribution for extrusion.

Regionally, Asia Pacific (APAC) stands as the dominant and fastest-growing market, largely due to rapid expansion in manufacturing sectors, heavy investment in municipal wastewater treatment, and the implementation of stringent air quality mandates in countries like China and India. North America and Europe maintain significant market shares, driven by established regulatory frameworks such as the U.S. EPA guidelines and the EU's Industrial Emissions Directive, necessitating continuous carbon replacement in large industrial facilities. Latin America and MEA are emerging markets, showing accelerated demand linked to oil and gas processing activities and urbanization leading to increased potable water treatment needs.

Segment trends reveal that the Gas Phase Application segment holds the largest market share, directly attributed to its extensive use in air pollution control and automotive vapor recovery systems. Within raw material segmentation, coal-based extruded carbon remains foundational due to its cost-effectiveness, though the demand for environmentally superior coconut shell-based EAC is rapidly increasing, particularly in high-purity applications. End-user analysis highlights the Municipal Water Treatment sector and the Industrial Air Purification sector as the primary growth engines, requiring high-abrasion resistance and reproducible pore structure offered by extruded forms.

AI Impact Analysis on Extruded Activated Carbon Market

Analysis of common user questions regarding AI's influence on the Extruded Activated Carbon Market reveals key themes centered around optimizing production efficiency, enhancing predictive maintenance of adsorption systems, and developing smarter, tailored carbon products. Users frequently inquire about AI's role in fine-tuning the extrusion process—specifically maintaining consistent particle size and mechanical strength—to reduce batch variability. Furthermore, there is strong interest in how machine learning algorithms can predict carbon exhaustion rates in large industrial scrubbers based on real-time sensor data, enabling precise regeneration or replacement schedules, thereby minimizing operational downtime and maximizing adsorbent lifecycle value.

The integration of artificial intelligence and machine learning models offers transformative potential in refining the manufacturing of extruded activated carbon. AI-driven process control can analyze complex variables such as binder consistency, extrusion pressure, and activation temperature simultaneously, leading to significantly tighter quality control over pore size distribution and surface chemistry. This level of precision facilitates the creation of highly specialized carbons tailored for niche applications, such as ultra-low concentration contaminant removal. Moreover, AI is crucial in supply chain management, optimizing raw material sourcing and predicting demand fluctuations across diverse geographical end-markets.

In the application domain, AI algorithms are being deployed within intelligent monitoring systems to interpret massive datasets generated by air quality monitors and gas chromatographs linked to carbon beds. This integration enables proactive decision-making. Instead of relying on manual sampling or fixed replacement schedules, AI predicts optimal service intervals, ensuring regulatory compliance is maintained with maximum efficiency. This paradigm shift from reactive to predictive usage increases the effective lifespan of extruded carbon products, impacting overall total cost of ownership (TCO) for industrial consumers.

- AI optimizes extrusion parameters (pressure, temperature, binder ratio) for enhanced mechanical strength and controlled porosity.

- Machine learning predicts carbon bed saturation and exhaustion rates, enabling highly accurate predictive maintenance cycles.

- AI assists in sourcing sustainable raw materials by modeling availability and quality variations across global suppliers.

- Robotic process automation (RPA) powered by AI enhances quality assurance through automated visual inspection of extruded pellets.

- Advanced analytics supports the development of novel carbon recipes by correlating manufacturing inputs with specific contaminant removal performance outputs.

DRO & Impact Forces Of Extruded Activated Carbon Market

The Extruded Activated Carbon market is significantly influenced by powerful global forces centered on environmental protection mandates and industrial efficiency requirements. Key drivers include stringent governmental regulations targeting mercury emissions, sulfur oxides (SOx), nitrogen oxides (NOx), and VOCs, which necessitate high-performance purification media like EAC. Restraints predominantly involve the volatile pricing of raw materials (coal and coconut shell), which is tied to global energy and agricultural commodity markets, alongside the high capital investment required for establishing or expanding activated carbon production facilities. Opportunities emerge from the rising adoption of specialized impregnated carbons for tailored abatement solutions and the burgeoning demand from the energy storage sector, particularly in supercapacitors where activated carbon plays a pivotal role.

Impact forces currently shaping the market dynamics include the increasing push for circular economy practices, urging manufacturers to develop more energy-efficient regeneration and reactivation technologies for spent extruded carbons, reducing dependency on virgin material. Furthermore, the technological shift toward solvent-free manufacturing and low-VOC paints, while potentially reducing the overall demand for large-scale solvent recovery carbon, simultaneously creates demand for smaller, highly efficient carbon filters in niche purification processes. The competitive rivalry is intense, compelling continuous investment in R&D to improve abrasion resistance and adsorption kinetics, offering differentiated products based on surface chemistry modification.

The equilibrium between supply chain stability and escalating global environmental consciousness defines the market's trajectory. Successfully navigating the complexities of raw material sourcing—balancing cost-effectiveness of coal versus the superior environmental profile of bio-based materials—is critical for sustained growth. The overriding impact force remains the legislative mandate for clean air and water, creating a persistent, non-negotiable demand baseline for high-quality adsorbent materials, of which extruded activated carbon is a leading form due to its structural and aerodynamic advantages.

Segmentation Analysis

The Extruded Activated Carbon market is meticulously segmented based on raw material, application, and end-user industry to provide a comprehensive understanding of diverse market dynamics and consumption patterns. Segmentation allows manufacturers to tailor their product offerings, focusing on specific pore structure optimization necessary for different operational environments, such as high-temperature gas purification or low-concentration water treatment. The dominant segmentation factor remains the application type, differentiating between large-volume uses like air pollution control and niche, high-value uses like pharmaceutical grade purification. The choice of raw material fundamentally dictates the pore geometry, which in turn defines the suitability of the extruded carbon for a specific contaminant removal task.

- By Raw Material:

- Coal-based

- Coconut Shell-based

- Wood-based

- Others (Petroleum coke, Peat)

- By Application:

- Gas Phase Applications (Air Purification, Solvent Recovery, Automotive Emission Control)

- Liquid Phase Applications (Water Treatment, Chemical Purification, Food & Beverage Processing)

- By End-User Industry:

- Municipal Water Treatment

- Industrial Air Purification (Power Plants, Chemical Industry, Refineries)

- Automotive

- Pharmaceutical and Food Processing

- Oil and Gas

- Mining

- By Impregnation Type:

- Standard Extruded Carbon

- Impregnated Extruded Carbon (e.g., Iodine, Potassium Permanganate, Sulfur)

Value Chain Analysis For Extruded Activated Carbon Market

The value chain for extruded activated carbon begins with the procurement of raw carbonaceous feedstocks (upstream activities), primarily coal, coconut shells, and wood. Upstream efficiency centers on securing consistent, high-quality, and cost-effective supplies, as the properties of the raw material directly influence the final carbon's pore structure and ash content. The subsequent manufacturing process involves crushing, screening, blending with a binder (often molasses or pitch), extrusion into pellets, and finally, thermal activation (carbonization and steam activation). Optimizing the extrusion and activation stages is crucial for achieving high mechanical strength and desirable adsorption capacity, which constitutes the core manufacturing value addition.

The midstream component involves the processing, quality control, and specialized modification (such as chemical impregnation) of the extruded carbon to suit specific application requirements, followed by packaging and inventory management. Distribution channels, forming the crucial downstream link, are multifaceted. Direct sales are common for large industrial end-users (e.g., major power companies or refinery groups) requiring bespoke product specifications and bulk delivery. Indirect channels utilize specialized distributors, chemical suppliers, and filtration system integrators, particularly targeting smaller municipal or commercial clients.

The effectiveness of the distribution network relies heavily on managing logistics for bulky, low-density material and providing technical support related to carbon bed design and saturation monitoring. End-user consumption dictates the value realization; high-value applications like pharmaceutical purification tolerate premium pricing, whereas commodity uses like basic municipal water treatment prioritize cost-efficiency and volume. The reverse logistics segment, involving the collection and reactivation of spent carbon, is increasingly important, adding a critical layer of sustainability and cost recovery to the overall value chain model.

Extruded Activated Carbon Market Potential Customers

Potential customers for extruded activated carbon are diverse and span several critical infrastructure and industrial sectors where contaminant removal and fluid purification are mandatory operational requirements. The largest purchasing segment comprises municipal authorities and utility companies investing in potable water purification and wastewater treatment facilities, where EAC is valued for its ability to remove taste, odor, and micropollutants such as per- and polyfluoroalkyl substances (PFAS) and pharmaceutical residues. These buyers prioritize long operational lifecycles and high resistance to abrasion during backwashing processes.

The second major consumer group consists of large industrial complexes, including petrochemical refineries, power generation facilities (especially those utilizing coal), and chemical manufacturing plants. These customers rely on extruded impregnated carbon for flue gas desulfurization, mercury capture, and volatile organic compound (VOC) abatement to comply with strict environmental air quality permits. For these buyers, high selectivity for specific gaseous pollutants and thermal stability during regeneration are paramount considerations.

Furthermore, the automotive industry represents a substantial and consistent buyer base, utilizing extruded carbon pellets within evaporative emission control (ECC) systems and fuel vapor recovery canisters. Other significant end-users include producers in the food and beverage industry for decolorization and purification processes, the mining sector for gold recovery (though less common for extruded than granular, specialized extruded forms are used), and companies manufacturing safety equipment, such as gas masks and respiratory filters, which demand extremely high-purity, low-dust carbon products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $1.98 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Calgon Carbon Corporation, Cabot Corporation, Kuraray Co. Ltd., Jacobi Carbons (Orica), Osaka Gas Chemicals Co. Ltd., Haycarb PLC, CarboTech AC GmbH, China Carbon Group, Donau Chemie AG, Siemens Water Technologies, Desotec NV, Carbon Activated Corp., CECA (Arkema Group), Puragen Activated Carbons, Active Carbon Technology, Chemviron Carbon, Filox Co. Ltd., ADA Carbon Solutions, Norit (Cabot Corporation), Evoqua Water Technologies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Extruded Activated Carbon Market Key Technology Landscape

The technology landscape for extruded activated carbon is defined by innovations in pellet formation, binder utilization, and activation methods aimed at enhancing mechanical stability and adsorption kinetics. A critical area of technological focus is the development of advanced binder systems that improve the structural integrity of the pellets without significantly blocking micropores or macro-pores, which could reduce adsorption efficiency. Manufacturers are increasingly utilizing thermosetting resins or specialized organic binders instead of traditional pitches or starches to achieve higher crush strength and attrition resistance, particularly vital for pressure swing adsorption (PSA) and thermal regeneration processes where carbon integrity is frequently challenged.

Another significant technological advancement lies in the precise control of the activation furnace environment. Modern facilities employ rotary kilns or multiple-hearth furnaces integrated with sophisticated sensor technology to modulate steam injection rates, residence time, and temperature profiles. This precision is essential for tuning the carbon’s internal pore structure—optimizing the ratio of micropores (for small molecules like VOCs) to mesopores (for larger molecules and faster diffusion)—to tailor the carbon for high-performance applications like mercury removal from flue gas or solvent recovery. Furthermore, the development of continuous extrusion technologies minimizes energy usage and maximizes throughput compared to batch processes.

Chemical impregnation represents a rapidly evolving niche technology. Impregnated extruded carbons utilize surface modification techniques, often involving metal oxides or specialized halogens (e.g., iodine, sulfur), to chemically react with contaminants rather than merely adsorbing them. This chemisorption capability significantly enhances the removal efficiency for problematic compounds like hydrogen sulfide, mercury, and ammonia, which standard carbons struggle to handle effectively. Research is heavily focused on making these chemical coatings more durable, regenerable, and environmentally benign to widen their applicability in diverse industrial contexts, ensuring the long-term viability of high-value EAC products.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand, supply, and regulatory environment for the Extruded Activated Carbon Market, with APAC dominating global consumption due to rapid industrial growth and severe pollution challenges.

- Asia Pacific (APAC): Leading market in terms of volume and growth rate. Driven by mass infrastructure projects, aggressive implementation of air and water pollution control measures (especially in China and India), and massive growth in the manufacturing and automotive sectors requiring emission controls and solvent recovery.

- North America: Mature market characterized by stringent EPA regulations (e.g., MATS rule for mercury emissions). High demand stems from coal-fired power plants, municipal water treatment systems (facing emerging contaminant challenges like PFAS), and a robust automotive sector requiring advanced evaporative emission control systems.

- Europe: Growth is moderately stable, supported by the EU’s Green Deal and Circular Economy policies. High adoption of advanced technologies for chemical purification, pharmaceutical manufacturing, and the widespread use of thermal reactivation facilities to reduce carbon footprint and costs. Focus on specialized impregnated carbons for industrial safety and niche applications.

- Latin America (LAMEA): Emerging market primarily driven by expansion in the mining sector (gold recovery) and increasing investment in clean water access for growing urban populations. Market growth is sensitive to macroeconomic stability and foreign direct investment in infrastructure projects.

- Middle East and Africa (MEA): Growth is tied heavily to the expansion of the oil and gas sector (requiring gas purification and sulfur removal), and large-scale desalination and water reuse projects. Demand for high-quality, corrosion-resistant extruded carbon is high due to harsh operational environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Extruded Activated Carbon Market.- Calgon Carbon Corporation (a Kuraray company)

- Cabot Corporation

- Kuraray Co. Ltd.

- Jacobi Carbons (Orica)

- Osaka Gas Chemicals Co. Ltd.

- Haycarb PLC

- CarboTech AC GmbH

- China Carbon Group

- Donau Chemie AG

- Siemens Water Technologies (Now part of Evoqua)

- Desotec NV

- Carbon Activated Corp.

- CECA (Arkema Group)

- Puragen Activated Carbons

- Active Carbon Technology

- Chemviron Carbon (Calgon Carbon)

- Filox Co. Ltd.

- ADA Carbon Solutions

- Norit (Cabot Corporation)

- Evoqua Water Technologies

Frequently Asked Questions

Analyze common user questions about the Extruded Activated Carbon market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of extruded activated carbon over granular activated carbon (GAC)?

Extruded activated carbon (EAC) offers superior benefits primarily in gas-phase applications due to its uniform, cylindrical shape, which results in lower pressure drop across deep beds and higher mechanical strength. This uniformity minimizes dusting and attrition during handling and regeneration, optimizing performance in high-flow gas streams like air pollution control systems and automotive canisters.

How does the choice of raw material affect the performance of extruded activated carbon?

The raw material fundamentally determines the pore structure. Coal-based EAC offers a good balance of macro- and mesopores, suitable for general industrial purification. Coconut shell-based EAC features a high proportion of micropores, making it ideal for adsorbing small, low-molecular-weight molecules such as VOCs and achieving high-purity standards required in pharmaceutical applications.

Which end-user segment drives the highest demand for extruded activated carbon?

The Industrial Air Purification sector, including chemical manufacturing, refineries, and power generation facilities, currently drives the highest demand. This consumption is mandated by increasingly stringent global regulations on industrial emissions, requiring robust and specialized extruded carbons for the removal of SOx, NOx, mercury, and volatile organic compounds.

What role does chemical impregnation play in the extruded activated carbon market?

Chemical impregnation transforms standard EAC into a chemisorption medium, enhancing its ability to specifically target and neutralize contaminants that are difficult to physically adsorb, such as hydrogen sulfide (H₂S), ammonia, and siloxanes. This specialized capability is crucial for high-value applications in nuclear ventilation and municipal wastewater off-gas scrubbing.

What are the key technological challenges currently facing EAC manufacturers?

Manufacturers face challenges in balancing the need for sustainable, bio-based raw materials with consistent quality and competitive pricing. Key technical hurdles include improving energy efficiency during the steam activation process and developing novel binder systems that maximize mechanical strength without compromising the accessibility of the carbon's internal surface area for adsorption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager