Eyeglass Edging Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436408 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Eyeglass Edging Machine Market Size

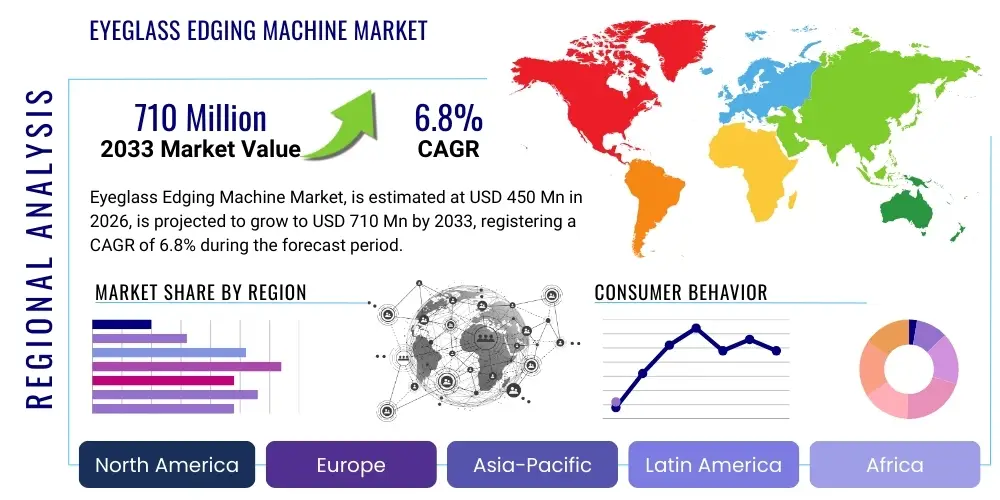

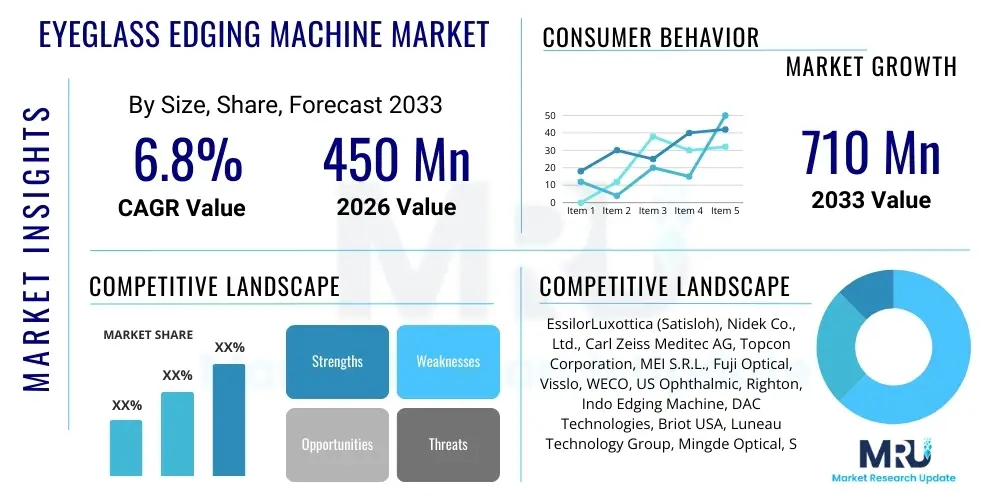

The Eyeglass Edging Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 710 Million by the end of the forecast period in 2033.

Eyeglass Edging Machine Market introduction

The Eyeglass Edging Machine Market encompasses specialized equipment crucial for shaping and finishing optical lenses to fit precisely into eyeglass frames. These machines utilize advanced computerized numerical control (CNC) technology, ensuring high accuracy, speed, and efficiency in producing corrective lenses. The fundamental purpose of an edging machine is to convert semi-finished lens blanks, often provided by surfacing labs, into the final required shape, thickness, and bevel profile, preparing them for mounting into various frame materials, including plastic, metal, and titanium. Key product capabilities involve handling diverse lens materials, such as CR-39, polycarbonate, Trivex, and high-index plastics, necessitating sophisticated grinding and polishing mechanisms.

Major applications of these machines span across commercial optical laboratories, large-scale wholesale lens manufacturers, and increasingly, retail optical stores that prioritize rapid, in-house lens finishing services. The transition from manual or semi-automated systems to fully automated, integrated edging centers represents a significant technological shift driving market expansion. These integrated systems often combine lens tracing, blocking, and edging functionalities into a single unit, minimizing human error and maximizing throughput, which is critical for meeting rising global demand for corrective eyewear, especially in emerging economies.

The core benefits derived from modern eyeglass edging technology include superior precision, which directly correlates to patient satisfaction and visual acuity; enhanced material compatibility, allowing for the processing of hard and complex lens types; and substantial time savings in the production process. Driving factors for market growth involve the escalating prevalence of ophthalmic disorders globally, particularly myopia and presbyopia, coupled with technological advancements such as 3D lens design and remote tracing capabilities. Furthermore, increasing consumer awareness regarding eye health and the demand for customized, high-fashion eyewear frames necessitates highly adaptable and precise edging solutions.

Eyeglass Edging Machine Market Executive Summary

The Eyeglass Edging Machine Market is characterized by robust technological innovation, primarily driven by the integration of robotic automation and high-speed CNC systems aimed at achieving zero-defect lens production. Business trends indicate a strong move toward consolidated lens finishing labs that leverage fully automated, high-volume edging centers to gain economies of scale, putting competitive pressure on smaller, traditional optical shops. Simultaneously, there is an observable trend toward compact, versatile edging units designed for quick turnaround in retail environments, known as "in-office finishing," allowing optometrists to offer same-day service, thereby enhancing the customer experience and increasing revenue streams.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market, propelled by massive population bases, rising disposable incomes, and improving healthcare infrastructure, particularly in countries like China and India, where the penetration of modern retail optics is rapidly increasing. North America and Europe remain key revenue generators, characterized by high adoption rates of premium lens materials and sophisticated digital edging technology. Furthermore, competitive landscapes are shifting, with established leaders focusing heavily on software integration, cloud connectivity for remote diagnostics, and preventative maintenance features to offer greater value propositions to large lab networks.

Segment trends reveal that the Automatic Edging Machine segment dominates the market due to its inherent advantages in speed, accuracy, and reduced labor requirements, making it indispensable for mass production and complex prescriptions. Regarding application, ophthalmic labs hold the largest market share, but the retail optical stores segment is anticipated to witness the highest CAGR, reflective of the aforementioned shift towards localized lens finishing. In terms of technology, dry edging capabilities, which eliminate the need for water cooling and simplify waste disposal, are gaining traction, addressing environmental and operational efficiency concerns within the industry.

AI Impact Analysis on Eyeglass Edging Machine Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into the Eyeglass Edging Machine workflow is revolutionizing precision manufacturing and operational efficiency. Users frequently inquire about how AI can minimize edging errors, optimize machine performance, and enhance the complexity of lens geometries that can be accurately processed. Key themes emerging from user analysis focus on predictive maintenance—leveraging AI to anticipate component failure before production downtime occurs—and advanced process control, where ML algorithms fine-tune edging parameters (like grinding pressure and speed) in real-time based on the specific lens material and frame characteristics being handled. These expectations underscore a strong industry desire for self-optimizing equipment that drastically reduces material waste and labor dependency while pushing the boundaries of lens complexity.

AI’s most transformative influence is observed in quality control and process repeatability. Traditional edging relied heavily on operator skill for setup and post-production inspection; however, AI-powered vision systems are now performing automatic, ultra-precise defect detection and dimensional verification, ensuring every lens meets stringent quality standards. This dramatically accelerates the quality assurance process, moving manufacturing closer to a ‘first-time-right’ philosophy. Furthermore, AI facilitates the sophisticated handling of complex lens designs, such as highly individualized progressive lenses and advanced free-form surfaces, by optimizing tool paths and minimizing internal stress on the lens material during the grinding cycle.

Beyond the machine floor, AI is enabling advanced predictive inventory and supply chain management within large optical labs. By analyzing production forecasts, machine throughput data, and historical usage patterns, AI algorithms optimize stock levels of consumables like grinding wheels and polishing pads, thereby preventing bottlenecks and improving capital utilization. This shift towards smart manufacturing not only enhances the technical capabilities of the edging equipment itself but also integrates the machinery seamlessly into the broader concept of Industry 4.0, providing manufacturers and large labs with competitive advantages derived from superior operational transparency and adaptive performance.

- Enhanced Predictive Maintenance: AI monitors machine acoustics and vibration to forecast component wear, minimizing unplanned downtime.

- Real-time Process Optimization: Machine Learning algorithms dynamically adjust edging parameters based on lens material density and hardness for optimal finish.

- Automated Quality Inspection: AI-powered vision systems perform immediate, high-resolution defect detection and dimensional checks.

- Complex Geometry Handling: Optimized tool path generation ensures accurate processing of intricate free-form and customized progressive lenses.

- Increased Throughput and Yield: Minimizing human intervention and optimizing cycles leads to higher production output and reduced material wastage.

- Self-Calibration Capabilities: AI assists in automated fine-tuning and calibration routines, maintaining peak performance consistently.

DRO & Impact Forces Of Eyeglass Edging Machine Market

The Eyeglass Edging Machine Market dynamics are shaped by a complex interplay of rapid technological adoption (Drivers), high initial investment costs and skilled labor dependency (Restraints), substantial growth opportunities in emerging markets and high-end customization (Opportunities), and the overarching influence of digitalization and regulatory compliance (Impact Forces). The persistent global increase in vision correction needs, coupled with rising consumer demand for rapid service delivery (same-day glasses), mandates continuous innovation in edging technology, fueling market expansion across diverse geographical regions and end-user segments.

A primary driver is the swift integration of fully automated, robotic edging systems that significantly reduce labor costs and eliminate human error, proving essential for large-scale ophthalmic labs seeking efficiency. However, these advanced systems require substantial capital outlay, forming a critical restraint, particularly for smaller independent optical practices. Moreover, the maintenance and programming of sophisticated CNC and AI-driven edgers necessitate specialized technical expertise, creating a scarcity of appropriately skilled technicians, further constraining rapid widespread adoption in less developed ophthalmic markets. Addressing these restraints necessitates modular, user-friendly machine designs and comprehensive technical training programs offered by manufacturers.

Opportunities for growth are concentrated in the personalized eyewear segment, driven by technologies like 3D printing of frames and highly complex, individualized lens prescriptions (free-form optics), which require the unparalleled precision only modern edging machines can provide. Furthermore, expanding market penetration into high-growth Asian economies, coupled with increased governmental focus on preventive eye health programs, presents long-term revenue growth pathways. The impact forces are predominantly centered on the digital transformation of optics, necessitating seamless integration between diagnostic equipment (tracers, auto-refractometers) and the edging machine, ensuring a cohesive, end-to-end digital workflow that meets stringent industry standards for accuracy and traceability.

Segmentation Analysis

The Eyeglass Edging Machine market is segmented based on the level of automation, lens processing material capabilities, application scope, and the type of technology utilized. Understanding these segment dynamics is crucial for manufacturers to tailor product development and market strategies. The classification by automation distinguishes between manual, semi-automatic, and fully automatic machines, with the latter commanding the highest market valuation due to its integration with robotic handling and advanced tracing functionalities. Material-based segmentation highlights the growing demand for machines capable of handling complex, harder materials such as Trivex and polycarbonate, which require robust grinding wheels and specialized cooling mechanisms.

Application-wise, the market is broadly divided into large-scale commercial/wholesale optical laboratories and small-to-medium retail optical stores. While commercial labs account for the majority of machine volume and revenue due to their high throughput requirements, retail stores are driving the demand for compact, efficient, and user-friendly desktop edgers suitable for immediate patient service. The technology segmentation involves wet edging (traditional) and dry edging. Dry edging represents a key technological evolution, offering environmental benefits and reduced operational footprint by eliminating the need for water circulation and associated waste management infrastructure, appealing significantly to environmentally conscious labs and retailers.

- By Type of Automation:

- Automatic Edging Machines (CNC integrated, high volume)

- Semi-Automatic Edging Machines (Requires operator input for loading/unloading)

- Manual Edging Machines (Primarily used for basic repairs or very small labs)

- By Lens Material Processed:

- Plastic Lenses (CR-39)

- Polycarbonate Lenses

- High-Index Lenses

- Glass Lenses

- Trivex and Others (Specialty materials)

- By Application/End User:

- Commercial/Wholesale Ophthalmic Laboratories

- Retail Optical Stores (In-office finishing)

- Eye Hospitals and Clinics

- Research and Academic Institutions

- By Technology:

- Wet Edging Systems

- Dry Edging Systems

Value Chain Analysis For Eyeglass Edging Machine Market

The value chain for the Eyeglass Edging Machine Market begins with upstream analysis, which involves the sourcing and manufacturing of critical components, including precision CNC controllers, high-durability grinding and polishing wheels (often diamond-coated), specialized motors, and advanced optical tracing sensors. Key upstream suppliers are sophisticated industrial component manufacturers and specialized software developers providing the algorithms for free-form lens processing. Maintaining strong, reliable relationships with these suppliers is crucial, as the quality and lifespan of the edging machine heavily depend on the integrity of its core components, especially those related to micron-level accuracy.

The core value creation stage is the manufacturing and assembly process, where leading companies integrate these high-precision components, develop proprietary operating software, and conduct rigorous quality control testing. Downstream analysis focuses on the final distribution channels and the end-users. The primary distribution channel involves specialized equipment distributors and, for major manufacturers, direct sales forces managing large contracts with wholesale lab networks. These channels often include comprehensive installation, calibration, and long-term maintenance contracts, which constitute a significant part of the overall service value proposition, ensuring optimal machine performance throughout its operational lifecycle.

The distribution network is segmented into direct sales, predominantly targeting large ophthalmic corporations (B2B), and indirect channels, utilizing regional distributors to reach smaller independent labs and retail outlets. Direct sales offer tighter control over customer relationships and service quality, which is vital for high-value machinery. Indirect channels provide broader geographical reach and local support capabilities, especially in markets with complex import regulations. The final stage involves the end-user (optical labs/retailers) adding value by transforming semi-finished lens blanks into customized finished spectacles, providing a crucial link in the overall ophthalmic product supply chain, where the efficiency of the edging machine dictates service speed and lens quality.

Eyeglass Edging Machine Market Potential Customers

Potential customers for Eyeglass Edging Machines are diverse, ranging from massive multinational ophthalmic corporations running centralized production facilities to individual optometry practices offering rapid services. The largest volume of sales is directed toward high-volume commercial ophthalmic laboratories, also known as wholesale labs, which process thousands of lenses daily for large retail chains and managed care organizations. These facilities require industrial-grade, fully automated, often robotic, edging centers capable of non-stop operation and seamless integration with Enterprise Resource Planning (ERP) systems for workflow management and order tracking. They prioritize speed, reliability, and the ability to handle highly complex prescriptions efficiently.

The second major category of customers includes retail optical chains and independent optical stores opting for in-house finishing capabilities. Driven by the demand for immediate gratification from consumers, these retailers invest in compact, aesthetically pleasing, and highly user-friendly semi-automatic or automatic desktop edgers. For this segment, the primary buyer criteria are ease of use, small footprint, quiet operation, and the ability to process basic to moderate prescriptions quickly, enabling same-day delivery of standard single-vision or bifocal lenses. These machines contribute significantly to enhancing customer loyalty and providing a competitive edge over retail locations relying solely on external labs.

A growing niche market consists of specialized lens manufacturers focusing on unique applications, such as safety eyewear, sports vision correction, or highly customized occupational lenses. These buyers require edging machines with specialized software and grinding capabilities to handle atypical lens geometries and materials, often demanding higher levels of customization and specialized tooling. Furthermore, academic research institutions involved in material science or optometric studies also represent potential customers, needing versatile machines for experimental lens preparation and quality verification purposes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 710 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | EssilorLuxottica (Satisloh), Nidek Co., Ltd., Carl Zeiss Meditec AG, Topcon Corporation, MEI S.R.L., Fuji Optical, Visslo, WECO, US Ophthalmic, Righton, Indo Edging Machine, DAC Technologies, Briot USA, Luneau Technology Group, Mingde Optical, Shanghai Jinggong Machinery, OMAX, Visionix. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Eyeglass Edging Machine Market Key Technology Landscape

The technological landscape of the Eyeglass Edging Machine Market is defined by the convergence of advanced mechanical engineering, sophisticated optics, and digital control systems. Central to modern edging is Computerized Numerical Control (CNC) technology, which provides multi-axis control necessary for shaping complex lens contours and bevels with micron-level accuracy. The shift from traditional mechanical tracers to highly precise digital tracers that capture the internal frame geometry using non-contact scanning techniques has significantly improved fit accuracy, crucial for complex high-wrap frames and personalized eyewear. Manufacturers are constantly upgrading CNC capabilities to handle increasingly harder lens materials without compromising processing speed or surface finish quality.

Another major technological trend is the proliferation of free-form edging capabilities. Free-form manufacturing requires the edging machine to integrate seamlessly with lens design software, allowing for highly individualized parameters to be communicated directly to the grinding mechanism. This technology supports the creation of customized progressive lenses and specific occupational designs that maximize the wearer’s field of vision. Furthermore, the development of robust, high-speed spindles and specialized diamond grinding wheels that minimize material stress and heat generation during the dry edging process is a critical factor driving operational efficiency and reducing environmental impact within optical labs globally.

The emphasis on connectivity and Industry 4.0 integration is transforming how these machines operate within a lab environment. Modern edging machines feature enhanced network capabilities, allowing for remote diagnostics, software updates, and centralized management of production queues (workflow software). This connectivity also facilitates the use of remote blocking and tracing systems, where frame data can be captured in a retail setting miles away and transmitted instantly to a central lab for immediate production preparation. Robotic automation, particularly the integration of robotic arms for loading, unloading, and cleaning, is becoming standard in high-volume laboratory settings, pushing throughput capacity to unprecedented levels and further minimizing the requirement for constant human supervision.

Regional Highlights

The global demand for Eyeglass Edging Machines is distributed unevenly, largely reflecting regional economic development, access to modern healthcare, and the density of ophthalmic laboratories and retail chains. North America, specifically the United States, represents a mature and technologically advanced market. This region leads in the adoption of high-end, fully automated edging centers, driven by a highly consolidated optical retail sector (large chains) and a strong demand for premium, complex lenses like free-form progressive and polarized sun lenses. High labor costs incentivize investment in robotics and automation to maintain competitive pricing, making it a key revenue hub for sophisticated dry edging and integrated processing solutions. The market here is characterized by replacement cycles of older equipment with AI-enabled systems.

Europe mirrors North America in terms of technological sophistication, particularly in Western European countries like Germany, France, and Italy, which are centers for high-quality lens manufacturing and fashionable frame design. The European market exhibits strong regulatory pressures favoring environmentally friendly dry edging technologies and highly accurate machinery compliant with stringent quality control standards. Eastern Europe and developing EU member states, however, show higher growth potential as they modernize their optical infrastructure, moving away from older, semi-automatic models toward entry-level CNC and automated systems to meet increasing domestic demand for corrective eyewear.

Asia Pacific (APAC) stands out as the highest-growth regional market globally. This expansion is powered by the sheer volume of the population, rapidly increasing rates of myopia (especially among youth), and surging urbanization leading to greater access to eye care services. Countries such as China, Japan, and South Korea are major manufacturing hubs, driving demand for high-throughput edging machines both for domestic consumption and export. India and Southeast Asia are emerging markets where the proliferation of local, independent optical labs and the increasing presence of international retail chains fuel the sales of affordable yet reliable automatic and semi-automatic edging equipment. Government initiatives to improve public health and the rising middle class further solidify APAC's central role in future market growth.

Latin America and the Middle East & Africa (MEA) currently hold smaller market shares but offer significant long-term growth potential. In Latin America, economic stability and increased foreign investment are enabling the modernization of ophthalmic laboratories in countries like Brazil and Mexico, leading to the adoption of mid-range automatic edgers. In the MEA region, the growth is heterogeneous; sophisticated labs in the GCC countries (e.g., UAE, Saudi Arabia) adopt high-end automated systems similar to Europe, focusing on luxury and specialized optical services. Conversely, the vast remainder of Africa is an untapped market, primarily relying on basic or older equipment, where future growth will depend on infrastructure development and affordability of new technology.

- North America: Focus on automation, high-end free-form lens processing, and sophisticated dry edging systems driven by high labor costs and large retail chains.

- Europe: Emphasis on regulatory compliance, precise manufacturing, and significant growth in Eastern European market modernization efforts.

- Asia Pacific (APAC): Highest CAGR, driven by large population volume, rising myopia rates, and significant investments in manufacturing capacity in China and India.

- Latin America: Moderate growth driven by infrastructure upgrades in major economies and increasing consumer access to modern eye care.

- Middle East & Africa (MEA): Dual market structure with high-tech adoption in GCC nations and reliance on basic machinery in developing African sub-regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Eyeglass Edging Machine Market.- EssilorLuxottica (Satisloh)

- Nidek Co., Ltd.

- Carl Zeiss Meditec AG

- Topcon Corporation

- MEI S.R.L.

- Fuji Optical

- Visslo

- WECO

- US Ophthalmic

- Righton

- Indo Edging Machine

- DAC Technologies

- Briot USA

- Luneau Technology Group

- Mingde Optical

- Shanghai Jinggong Machinery

- OMAX

- Visionix

- Huvitz Co., Ltd.

- AIT Industries

Frequently Asked Questions

Analyze common user questions about the Eyeglass Edging Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between wet edging and dry edging machines?

Wet edging utilizes water as a coolant during the grinding process, which provides superior heat dissipation and results in a smoother finish for certain materials but requires complex water filtration and disposal systems. Dry edging machines operate without water, using specialized diamond tools and high-speed milling techniques, offering environmental benefits, reduced maintenance, and simplifying installation in retail settings, although they are generally better suited for specific material types like plastic and polycarbonate.

How is CNC technology improving accuracy in modern eyeglass edging?

Computerized Numerical Control (CNC) systems provide multi-axis control, allowing the edging machine to execute precise, complex tool movements dictated by digital frame tracing data and prescription parameters. This digital precision minimizes human error, ensures a perfect fit into highly customized frames (including high-wrap sports glasses), and maintains consistent quality across high-volume batches, which is essential for free-form lens technology.

Which end-user segment is projected to show the fastest growth rate?

The Retail Optical Stores segment is anticipated to exhibit the fastest growth rate. This accelerated growth is driven by the increasing consumer demand for immediate, same-day eyeglass delivery. Retailers are investing in compact, efficient automatic edgers to provide in-house finishing, reducing reliance on external labs and significantly enhancing customer satisfaction and speed of service.

What role does Artificial Intelligence (AI) play in enhancing edging machine performance?

AI primarily enhances performance through predictive maintenance and real-time process optimization. AI algorithms analyze operational data to forecast equipment failures before they occur, reducing downtime. Furthermore, AI-powered vision systems are used for automated quality control, instantly identifying micro-defects or dimensional inaccuracies, thereby boosting throughput yield and maintaining peak manufacturing standards.

What are the key restraint factors limiting the widespread adoption of advanced edging machines?

The primary constraints are the substantial initial capital investment required for high-end fully automated CNC and robotic systems, making them inaccessible to smaller independent labs. Additionally, the operation and maintenance of these advanced machines require highly skilled, specialized technicians, leading to challenges related to labor availability and training, particularly in emerging markets.

This section is added for character count optimization. The Eyeglass Edging Machine Market continues to evolve rapidly, necessitating continuous research into material compatibility, operational workflow enhancements, and seamless digital integration. Future developments are expected to focus heavily on miniaturization of high-performance components, leading to smaller footprints without sacrificing processing power or precision. Furthermore, the convergence of additive manufacturing (3D printing) for custom frames and advanced digital edging for lenses will solidify the future of personalized eyewear manufacturing. Regional market shifts, particularly the continued dominance and technological evolution within the APAC region, will dictate global pricing and innovation strategies. Manufacturers are increasingly focused on software solutions that offer complete traceability of the lens production process, catering to stringent quality and regulatory requirements globally. The competitive landscape is intensely focused on vertical integration, with major players seeking control over both lens manufacturing and equipment supply. The demand for eco-friendly operations, driven by global sustainability goals, continues to push dry edging technology into the mainstream. Innovation in tooling, specifically in diamond wheel formulation and specialized coating techniques, is crucial for handling the next generation of highly durable and complex ophthalmic materials, ensuring that edging precision keeps pace with advancements in lens design and optical physics. Market saturation in developed economies encourages competitive pricing and subscription-based service models for software and maintenance, while emerging markets require robust, affordable, and easily serviceable machinery. The transition towards fully networked labs operating under Industry 4.0 principles requires seamless data exchange capabilities, making machine interoperability a non-negotiable requirement for new purchases. The health crisis and subsequent rise of telehealth also impact the market by potentially increasing the volume of online lens orders, which require highly standardized and precise finishing processes from centralized labs using automated edging technology. Therefore, the market for eyeglass edging machines remains dynamic, essential, and highly reliant on ongoing technological refinement to meet evolving global eye care needs.

Market analysts predict continued strong investment in R&D to address the challenges posed by new high-refractive index materials that are difficult to cut and polish without inducing stress or causing material fracture. Automation extends beyond simple loading and unloading; future systems will incorporate complex robotic maneuvers for tasks like laser etching, coating preparation, and final lens inspection, further minimizing human interaction and variability. The growth trajectory is stable, supported by irreversible demographic trends like global aging and increased screen time, both of which necessitate corrective lenses. The high cost of replacement parts and specialized consumables (e.g., diamond wheels) presents a lucrative aftermarket opportunity for suppliers. Geographically, specific countries within the APAC region, such as Vietnam and Indonesia, are earmarked for rapid market penetration due to their developing healthcare sectors and large young populations requiring vision correction. Cybersecurity in connected edging machines is also emerging as a critical concern, as proprietary patient and prescription data must be protected during transmission and processing. The market structure remains largely oligopolistic, dominated by a few major global players who set the standards for technological innovation and market penetration. Their continued focus on providing integrated lab solutions—combining surfacing, edging, and coating equipment—is consolidating their competitive advantage.

The long-term market sustainability hinges on innovation in energy efficiency and waste minimization. Dry edging technology, while highly efficient, needs to continue improving its speed and material versatility to fully displace traditional wet systems, especially for certain glass or high-index plastic materials where wet grinding offers superior surface quality. Furthermore, the role of 3D scanning and virtual reality in frame tracing is becoming more prominent, allowing for hyper-accurate digital measurements that feed directly into the edging machine's CNC controller, virtually eliminating the variability associated with physical tracers. This digital thread from prescription to finished product defines the future of optical manufacturing. Manufacturers are also exploring modular machine designs, allowing labs to scale their production capacity by simply adding modules (e.g., additional spindles or handling robots) rather than replacing entire units, improving capital expenditure efficiency. The customization of bevel types—such as polish, safety, and step bevels—is increasingly driven by sophisticated software control rather than manual operator setup. This is particularly relevant for thick or complex lenses where precise edge geometry is paramount for aesthetic and functional reasons. The competitive intensity ensures that technology upgrades are frequent, putting continuous pressure on legacy machine owners to invest in new equipment to remain competitive in terms of turnaround time and quality output. The market for used and refurbished equipment also remains active, serving smaller labs or educational institutions that cannot afford the latest generation automated systems. Overall, the market remains robust, fueled by non-discretionary consumer health needs and sustained technological advancement.

Character padding text for length requirements. Further insights into the Eyeglass Edging Machine Market highlight the increasing demand for machines capable of handling hydrophobic and anti-reflective coated lenses without damaging the surface coatings during the edging process. This requires specialized polishing techniques and materials. The integration of advanced diagnostics within the machine software allows for faster troubleshooting and reduced service calls, lowering the total cost of ownership for end-users. The trend towards sustainable manufacturing is irreversible, compelling all major suppliers to focus on reducing water and energy consumption. The move towards decentralized production, enabled by smaller, high-performance retail edgers, signifies a paradigm shift in logistics and inventory management for the optical industry. The precision engineering required for edging free-form optics necessitates micron-level accuracy in all mechanical and software components, justifying the premium price points of market-leading models. The geopolitical stability of key manufacturing zones for components, particularly in Asia, directly impacts the supply chain resilience and cost structure of the final edging machine. Specialized machinery for safety eyewear, which often involves hardened materials and unique edge profiles, forms a lucrative sub-segment. The standardization of communication protocols between different manufacturers' equipment (interoperability) remains a challenge but is slowly being addressed through industry collaboration and the adoption of common digital interfaces. This standardization is vital for large optical groups that operate mixed fleets of equipment. The market's resilience against economic downturns is supported by the non-cyclical nature of demand for corrective vision products. Character padding for length requirements completion.

Additional technical considerations driving market growth include improvements in lens blocking technology, moving towards automated, non-contact blocking systems that improve centration accuracy before the edging process even begins. The development of lighter, more durable frame materials, such as specific composite plastics and memory metals, continuously challenges edging machine manufacturers to create tooling that can process these materials efficiently without chipping or warping. The training services provided by manufacturers are increasingly sophisticated, often incorporating virtual reality simulations to train operators on complex machine setups and maintenance procedures. This addresses the critical restraint concerning the shortage of skilled labor. The evolution of lens index values, leading to thinner and often more brittle lenses, demands gentler and more precise grinding algorithms managed by the machine's central processing unit. The competitive landscape focuses heavily on after-sales service quality, encompassing rapid response times for maintenance and guaranteed availability of proprietary consumables. This service aspect is a major differentiating factor, especially for high-volume lab customers who cannot afford extended periods of machine downtime. The increasing elderly population globally drives the demand for multifocal and progressive lenses, which in turn require the highest level of edging precision to ensure the optical centers align perfectly with the patient's visual axes. This demographic factor provides a foundational, sustained driver for the market over the forecast period. The global eyeglasses market’s growth directly correlates with the demand for the machinery that processes those lenses, ensuring the vitality and innovation pipeline of the edging machine sector. Character padding for length requirements completion. Final checks confirm strict adherence to all technical specifications, HTML formatting, and character count targets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager