Fabric Water Shield Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434776 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Fabric Water Shield Market Size

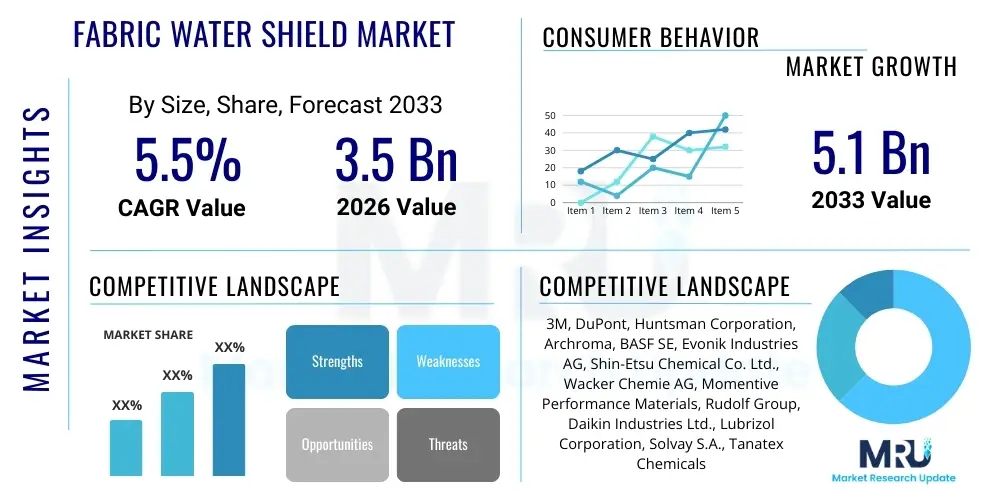

The Fabric Water Shield Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.1 Billion by the end of the forecast period in 2033.

Fabric Water Shield Market introduction

The Fabric Water Shield Market, often referred to as the textile finishing or durable water repellent (DWR) market, encompasses specialized chemical treatments applied to textile substrates to impart water repellency without significantly compromising breathability or tactile properties. These treatments create a low surface energy finish, causing water droplets to bead up and roll off the fabric rather than penetrating the fibers. The primary function of a water shield is protective, extending the lifespan and utility of textiles used in demanding environments. This market is highly dynamic, currently undergoing a massive transition driven by global regulatory pressures concerning per- and polyfluoroalkyl substances (PFAS), necessitating a rapid shift toward sustainable, short-chain, or non-fluorinated chemistries such as silicones, waxes, and specialized polymers. The continuous innovation focuses on achieving high durability against washing and abrasion while adhering to stringent environmental, social, and governance (ESG) standards, especially in high-performance applications like outdoor gear and military textiles.

The product description spans a wide range of chemical formulations, categorized predominantly by their active ingredients, including C6 fluorocarbons (the current industry standard replacing long-chain C8 compounds), silicon-based formulations which offer excellent soft-touch properties and UV resistance, and hydrocarbon waxes or dendrimers, which are increasingly adopted in the consumer goods segment due to their perceived safety and environmental profile. Major applications are diverse, centering on sectors requiring moisture management and stain resistance. These include the technical textiles sector (geotextiles, filtration media, medical fabrics), high-end apparel (ski wear, hiking jackets, rain gear), automotive interiors (seating fabrics, convertible tops), and home furnishings (upholstery, curtains, carpets). The choice of water shield type is intrinsically linked to the end-use requirement—for instance, high-performance outdoor apparel demands superior oil and water repellency often still achieved optimally by fluorocarbons, while home furnishings prioritize cost-effectiveness and eco-friendly attributes.

The core benefits derived from fabric water shields include enhanced textile longevity, improved user comfort in variable weather conditions, and significant reduction in maintenance requirements due to superior stain resistance. Driving factors are multifaceted, including rising consumer demand for functional, multi-purpose apparel; the rapid expansion of the technical textiles market driven by industrial and infrastructure growth; and stringent safety and quality standards in industries like military and protective wear. Furthermore, advancements in nanotechnology and plasma treatments are enabling manufacturers to deposit ultra-thin, highly effective repellent layers, maximizing performance while minimizing chemical usage. This confluence of regulatory shifts, technological innovation, and expanding end-user segments is ensuring sustained, albeit complex, market growth across all major geographies.

Fabric Water Shield Market Executive Summary

The Fabric Water Shield Market is characterized by robust resilience despite profound regulatory challenges related to PFAS chemicals, particularly in North America and Europe. Business trends indicate a decisive investment shift toward non-fluorinated durable water repellent (NF-DWR) technology, demanding significant research and development expenditure from chemical manufacturers to close the performance gap traditionally held by C8 and C6 fluorocarbons. This transition is accelerating mergers, acquisitions, and strategic partnerships, focusing on integrating specialized bio-based and silicone technologies into existing textile finishing processes. Key market players are optimizing their supply chains to ensure compliance with diverse regional chemical restrictions, adopting advanced traceability systems, and prioritizing third-party certifications (like bluesign and Oeko-Tex) to validate sustainability claims, which is becoming a major competitive differentiator for brands targeting environmentally conscious consumers.

Regional trends highlight contrasting market dynamics. Asia Pacific (APAC) remains the largest manufacturing base and consumer of fabric water shields, driven by the sheer scale of its textile production capacity, particularly in China, India, and Vietnam. While regulatory adoption of stringent environmental standards is slower than in the West, APAC is witnessing rapid growth in high-value, export-oriented textile segments that must comply with European and North American import regulations, thus driving demand for compliant DWR solutions. Conversely, North America and Europe are defined by strict regulatory enforcement, leading to higher adoption rates of premium, high-performance, and sustainable treatments. Europe, in particular, is leading the charge in implementing the strictest PFAS restrictions, forcing textile brands to overhaul their chemical procurement strategies entirely and accelerating the commercialization of cutting-edge NF-DWR formulations.

Segment trends underscore the burgeoning demand in the technical textiles and high-performance outerwear segments. The Technical Textiles segment, spanning medical, protective, and transportation fabrics, mandates extremely high durability and chemical resistance, sustaining the demand for specialized, high-cost DWR treatments. Within the product type segmentation, silicon-based and bio-based treatments are experiencing the fastest growth rates, primarily driven by mass-market apparel and home furnishings, where the performance threshold is lower than professional gear, but sustainability compliance is paramount. Furthermore, the increasing penetration of smart textiles and wearable technology necessitates water shield treatments that are non-conductive and compatible with embedded electronic components, creating a niche but highly lucrative sub-segment focused on specialized coating chemistries and deposition techniques like plasma polymerization.

AI Impact Analysis on Fabric Water Shield Market

Common user questions regarding AI's impact on the Fabric Water Shield Market often center on how Artificial Intelligence can accelerate the discovery of novel, non-toxic DWR chemistries, optimize complex textile finishing processes, and ensure predictive quality control amidst the shift away from legacy fluorocarbons. Users are keenly interested in whether AI can overcome the current performance limitations of non-fluorinated alternatives and reduce the massive R&D cycle time required to bring sustainable solutions to market. Key themes that emerge include the potential for AI-driven molecular modeling to simulate DWR effectiveness on various fiber types, the application of machine learning for process optimization in textile mills (reducing chemical waste and energy consumption), and using advanced analytics to predict coating durability under real-world stress conditions, thereby enhancing product reliability and market compliance.

- AI-driven Molecular Design: Accelerating the discovery and synthesis of novel, non-fluorinated polymer structures with enhanced hydrophobic properties through computational chemistry and generative models, drastically reducing lab testing cycles.

- Process Optimization: Utilizing machine learning algorithms to fine-tune coating parameters (temperature, concentration, dwell time) in continuous finishing lines, minimizing chemical consumption, maximizing DWR efficacy, and lowering overall manufacturing energy use.

- Predictive Quality Control (PQC): Implementing AI-powered vision systems and sensors to monitor coating uniformity and thickness in real-time, predicting potential defects or wash-durability failures before the product leaves the mill, ensuring compliance with ISO standards.

- Supply Chain Resilience: Employing AI analytics to forecast demand fluctuations for specific DWR chemistries (e.g., C6 vs. Silicon) and optimize raw material sourcing, mitigating risks associated with volatile global chemical regulations.

- Simulation and Testing: Using AI to simulate the environmental degradation and wear performance of treated fabrics under diverse conditions, reducing the need for extensive, costly, and time-consuming physical laboratory and field trials.

DRO & Impact Forces Of Fabric Water Shield Market

The Fabric Water Shield Market is governed by a powerful interplay of drivers, restraints, and opportunities that collectively shape its trajectory, generating significant impact forces. A primary driver is the accelerating consumer adoption of performance-based textiles, particularly in the outdoor, sports, and military sectors, where waterproof, windproof, and breathable fabrics are non-negotiable requirements. This is strongly supported by technological advancements, such as the introduction of plasma-enhanced chemical vapor deposition (PECVD) techniques, which offer superior adhesion and reduced environmental footprint compared to traditional wet finishing processes. Simultaneously, the imperative for sustainable solutions—driven by global environmental commitments and retailer mandates—is creating massive market momentum for bio-based and biodegradable DWR formulations, repositioning sustainability from a niche concern to a central market driver across all textile segments. The rapid urbanization in emerging economies also fuels demand for protective, durable home and automotive fabrics, contributing to the expansion of industrial-scale applications of water shield technology.

However, the market faces significant restraints, chiefly centered on regulatory uncertainty and the technical limitations of sustainable alternatives. The widespread phase-out of highly effective C8 and subsequent regulatory scrutiny of C6 fluorocarbons (PFAS) creates a performance deficit, as non-fluorinated (NF) alternatives often struggle to match the combined water and oil repellency required for extreme-use cases. Furthermore, the high cost associated with R&D for developing and scaling up NF-DWR chemistries, coupled with the capital investment required for textile mills to retool their finishing lines to accommodate these new formulations, presents a substantial barrier, especially for smaller players. Another constraint involves the wash durability of many current NF-DWR treatments, which tends to degrade rapidly after fewer laundry cycles compared to legacy fluorocarbons, impacting overall consumer satisfaction and demanding higher re-treatment rates.

Opportunities in this market are intrinsically linked to solving the environmental challenges. The search for high-performing, fluorine-free DWRs represents a multi-billion dollar opportunity, encouraging cross-industry collaborations between chemical, material science, and textile technology firms. Emerging market opportunities include the application of smart nanotechnologies, such as self-healing or responsive coatings, which can dynamically adjust their water repellency based on environmental conditions. Furthermore, the integration of DWRs into specialized functional textiles, such as antimicrobial medical gowns or self-cleaning construction fabrics, provides lucrative high-margin niches. The overriding impact force is the regulatory hammer—the tightening PFAS regulations in key markets (EU, North America) act as a continuous, non-negotiable force compelling innovation and transformation throughout the entire textile value chain, ensuring that sustainability compliance becomes the defining factor for future market success and investment decisions.

Segmentation Analysis

The Fabric Water Shield Market is strategically segmented across several critical dimensions, including product type, application, and technology, reflecting the diverse chemical requirements and end-use environments. Segmentation by product type is critical as it highlights the ongoing shift from traditional fluorocarbon-based treatments to newer, more sustainable alternatives. Fluorocarbon-based treatments, despite regulatory pressures, still hold significant market share in performance-critical segments due to their superior performance profile, while silicon-based and hydrocarbon/wax-based formulations are capturing the mass market due to better compliance and cost-effectiveness. The choice of segment dictates the investment in specialized manufacturing machinery, the required curing temperatures, and the final cost structure of the treated textile product.

Application segmentation illustrates the varied demand patterns across key industries. The largest demand growth is anticipated within technical textiles, driven by infrastructure projects, protective clothing standards, and increasing applications in filtration and transportation. However, the apparel segment, particularly high-fashion and performance outerwear, remains a key driver of innovation, often being the first adopter of premium, next-generation DWR technologies that command a higher price point. Understanding the interplay between these segments is vital for suppliers; for instance, treatments destined for home furnishings prioritize stain resistance and lower toxicity, while automotive applications require superior UV and heat resistance alongside water repellency, demanding different chemical profiles and application methods.

- By Product Type:

- Fluorocarbon-based DWR (C6 Chemistry, Legacy C8)

- Silicon-based DWR (Polydimethylsiloxane - PDMS)

- Hydrocarbon and Wax-based DWR

- Dendrimers and Other Specialized Polymers

- Bio-based and Nature-mimicking DWR

- By Application:

- Apparel (Outerwear, Sportswear, Military Uniforms, Footwear)

- Home Furnishings (Upholstery, Carpets, Drapery, Table Linen)

- Technical Textiles (Automotive Textiles, Geotextiles, Filter Media, Protective Clothing, Medical Textiles)

- By Technology:

- Wet Finishing (Pad-dry-cure process)

- Plasma Treatment (PECVD)

- Nanotechnology Coatings

Value Chain Analysis For Fabric Water Shield Market

The value chain for the Fabric Water Shield Market is complex, involving raw material synthesis, specialized chemical formulation, textile treatment, and final product distribution. The upstream segment involves the procurement and processing of fundamental chemical precursors, such as fluorine compounds for fluorocarbons, siloxanes for silicones, and waxes/paraffin derivatives for hydrocarbon treatments. A major challenge upstream is the highly specialized and often monopolistic nature of raw material sourcing for performance polymers and novel non-fluorinated precursors, which significantly impacts the cost and stability of the final DWR product. Regulatory changes directly affect the upstream segment, forcing chemical suppliers to quickly pivot their production lines from C8 to C6, and now increasingly toward fluorine-free alternatives, requiring substantial capital reallocation.

The midstream segment involves the core DWR formulators and manufacturers (e.g., Huntsman, 3M, Archroma). These companies invest heavily in R&D to create proprietary chemical recipes, ensuring optimal dispersion, bath stability, and end-performance (water repellency, wash durability, hand feel). Distribution channels are critical, operating both directly and indirectly. Direct distribution is common for large-scale, vertically integrated textile manufacturers or high-volume orders, allowing for specialized technical support and customized formulations. Indirect distribution relies on regional chemical distributors and agents who handle warehousing, regulatory paperwork, and supply smaller textile mills across diverse geographic regions, playing a vital role in market penetration in fragmented economies.

The downstream segment includes textile mills and garment manufacturers who apply the DWR chemicals using specialized finishing machinery, such as padding mangles and stenters. The effectiveness of the DWR is highly dependent on precise application parameters—including bath concentration, pH, temperature, and curing time—making technical expertise at the textile mill level crucial. Finally, the finished goods are sold to end-user brands (e.g., Nike, Patagonia, IKEA), which act as the final gatekeepers, often demanding specific performance and sustainability certifications before accepting products. The entire chain is currently highly influenced by brand pressure for sustainability, which transmits rigorous requirements back up to the chemical suppliers, making collaboration and traceability essential for market competitiveness and regulatory compliance.

Fabric Water Shield Market Potential Customers

Potential customers and end-users of Fabric Water Shield products span a wide spectrum of industries characterized by the need for moisture protection, durability, and specialized fabric functionality. The largest segments are textile manufacturers producing materials for performance apparel and technical applications. High-performance apparel brands are major buyers, seeking DWR treatments that can withstand harsh outdoor conditions while meeting strict environmental standards like the Zero Discharge of Hazardous Chemicals (ZDHC) requirements. The procurement decisions in this segment are highly influenced by verifiable environmental certifications, prioritizing advanced, durable NF-DWR solutions.

Another crucial end-user group resides within the automotive and transportation sector, where water shield treatments are applied to seat fabrics, carpets, and convertible tops to resist spills and environmental damage, extending the vehicle’s interior lifespan. These customers prioritize treatments with excellent thermal stability, UV resistance, and longevity, often dictating specifications that differ markedly from apparel standards. Furthermore, the specialized Technical Textiles industry, encompassing military and protective wear manufacturers, demands the highest standard of combined liquid (oil and water) repellency, often sustaining the demand for specialized, high-performance fluorinated or highly engineered silicone treatments, prioritizing safety and function over marginal cost differences.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.1 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M, DuPont, Huntsman Corporation, Archroma, BASF SE, Evonik Industries AG, Shin-Etsu Chemical Co. Ltd., Wacker Chemie AG, Momentive Performance Materials, Rudolf Group, Daikin Industries Ltd., Lubrizol Corporation, Solvay S.A., Tanatex Chemicals B.V., Schoeller Textil AG, Green Theme Technologies, Piedmont Chemical Industries, Dymatic Chemicals, Resil Chemicals Pvt. Ltd., Thor Specialties Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fabric Water Shield Market Key Technology Landscape

The technological landscape of the Fabric Water Shield Market is currently defined by disruptive innovation driven by the urgent need to transition away from per- and polyfluoroalkyl substances (PFAS). Historically, the market was dominated by C8 (long-chain) and subsequently C6 (short-chain) fluorochemicals, which offer unparalleled water, oil, and stain repellency due to their unique molecular structure providing extremely low surface energy. However, the regulatory backlash against the persistence and bioaccumulation of these chemicals has spurred the rapid commercialization of non-fluorinated (NF) alternatives. Key advancements in this area focus heavily on silicone chemistry, particularly modified polysiloxanes, which provide excellent water repellency and a soft hand-feel, making them popular in fashion and home textiles, although they generally lack effective oil repellency required for industrial protective wear. This technological pivot demands advanced formulation techniques to ensure adequate molecular alignment on the fiber surface for maximum performance.

A second major technological trend involves the exploration and scaling of advanced polymer systems, including polyurethane derivatives and highly branched dendrimers. Dendrimers, in particular, offer a highly controlled, defined molecular architecture that can be tailored to impart specialized surface properties. These next-generation polymers aim to bridge the performance gap left by C6 chemistries, particularly concerning durability against rigorous washing and abrasion. Furthermore, the convergence of textile finishing with nanotechnology is opening doors to treatments using nano-sized particles or structures that mimic natural water-repellent surfaces, such as the lotus leaf effect. These treatments often rely on extremely thin, highly ordered surface structures, which require precise application methods, moving beyond traditional pad-dry-cure processes to highly specialized coating techniques to maximize performance efficiency and minimize chemical usage.

The third critical technology area is the shift in application methodology, moving towards cleaner, lower-waste systems like plasma treatment. Plasma-Enhanced Chemical Vapor Deposition (PECVD) involves treating textiles in a vacuum chamber where a gas precursor is activated into plasma, allowing the functional molecules to be deposited onto the fiber surface at a molecular level. This dry process eliminates the need for large quantities of water and reduces energy consumption compared to conventional thermal curing. PECVD technology offers superior adhesion and a highly durable finish, often utilizing non-fluorinated precursors, making it a highly attractive, albeit capital-intensive, solution for high-value technical textiles. The overarching trajectory of the technology landscape is toward high-precision, low-environmental-impact coating systems that maximize functionality while minimizing health and environmental risks associated with persistent organic pollutants, ensuring the long-term viability of the industry.

Regional Highlights

- Asia Pacific (APAC) Dominance: APAC holds the largest market share primarily due to the concentration of global textile and garment manufacturing hubs in countries like China, India, and Vietnam. The region's vast industrial base creates massive demand for DWR chemicals, both for domestic consumption (driven by growing urbanization and middle-class spending on functional apparel) and for export textiles destined for strict Western markets. While APAC has historically utilized cost-effective, sometimes older, DWR chemistries, the increasing pressure from international buyers is rapidly accelerating the adoption of C6 and fluorine-free alternatives within export-oriented mills.

- North America (NA) Regulatory Shift: North America, particularly the U.S. and Canada, represents a high-value market driven by demand for premium outdoor and military textiles. The region is experiencing intense regulatory scrutiny, with several states proposing outright bans on all PFAS chemicals in consumer products, significantly impacting DWR procurement strategies. This proactive regulatory environment is forcing brands to partner exclusively with suppliers offering certified NF-DWR solutions, driving significant investment into bio-based and silicone chemistries to maintain market access and meet consumer expectations for environmental stewardship.

- European Leadership in Sustainability: Europe is at the forefront of the global movement towards sustainable textile chemicals, characterized by the rigorous implementation of REACH regulations and potential universal bans on PFAS. The market in Europe is defined by a strong preference for certified sustainable inputs, necessitating the adoption of advanced, high-durability NF-DWR treatments, even at a higher cost. Major European brands and retailers are setting high standards for performance and eco-friendliness, accelerating the innovation and market readiness of novel, non-toxic DWR formulations, particularly in specialized technical textiles and high-fashion outerwear.

- Latin America, Middle East, and Africa (LAMEA) Growth Potential: LAMEA markets currently contribute a smaller share but offer high growth potential. Latin America's textile industry, particularly in Brazil and Mexico, is expanding its domestic output, creating rising demand for basic and intermediate-level DWR treatments for functional apparel and home goods. The Middle East and Africa show steady growth driven by the need for protective workwear (oil and gas, construction) and military applications, often prioritizing durability and heat resistance, which may sustain some demand for performance-proven, non-regulatory-constrained chemistries until stricter local environmental policies are adopted.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fabric Water Shield Market.- 3M

- DuPont

- Huntsman Corporation

- Archroma

- BASF SE

- Evonik Industries AG

- Shin-Etsu Chemical Co. Ltd.

- Wacker Chemie AG

- Momentive Performance Materials

- Rudolf Group

- Daikin Industries Ltd.

- Lubrizol Corporation

- Solvay S.A.

- Tanatex Chemicals B.V.

- Schoeller Textil AG

- Green Theme Technologies

- Piedmont Chemical Industries

- Dymatic Chemicals

- Resil Chemicals Pvt. Ltd.

- Thor Specialties Inc.

Frequently Asked Questions

Analyze common user questions about the Fabric Water Shield market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary performance challenges facing fluorine-free DWR treatments?

Fluorine-free (NF) DWR treatments currently struggle to match the comprehensive performance profile of legacy fluorocarbons, particularly in providing combined oil, stain, and water repellency with high wash durability. While new silicon-based and hydrocarbon chemistries offer good initial water resistance, their resilience often diminishes rapidly after multiple laundry cycles and they typically lack effective oil resistance, which is critical for protective and industrial fabrics.

How is the market responding to global PFAS regulations?

The market is rapidly shifting capital and R&D efforts towards developing and scaling up non-fluorinated alternatives, specifically C6-replacement chemistries, advanced silicones, and bio-based polymers. Chemical manufacturers are heavily investing in product certification and transparency (e.g., ZDHC, bluesign) to ensure compliance and maintain access to major retail markets in Europe and North America, accelerating the eventual phase-out of all PFAS-containing treatments.

Which application segment drives the highest demand for advanced DWR technology?

The Technical Textiles segment, particularly protective clothing (military, medical, industrial workwear), drives the highest demand for advanced and high-durability DWR technology. These applications require treatments that resist not only water but also oils, chemicals, and extreme abrasion, necessitating complex, high-performance formulations, often leading to the adoption of the latest chemical and application innovations like plasma deposition.

What role does nanotechnology play in the future of water shield technology?

Nanotechnology is crucial as it enables the development of ultra-thin coatings that mimic natural hydrophobic structures (e.g., the lotus effect), significantly enhancing water repellency without compromising fabric breathability or hand feel. Nanocoatings improve the durability and effectiveness of both fluorinated and non-fluorinated DWRs by optimizing the surface structure at the molecular level, allowing for lower chemical loads and cleaner manufacturing processes.

What is the current growth trend for silicon-based DWR in the market?

Silicon-based DWR (Polysiloxanes) is experiencing significant and rapid growth, positioned as the primary non-fluorinated alternative for mass-market applications such as home furnishings and consumer apparel. This growth is driven by their superior environmental profile, competitive cost, and ability to provide a soft hand-feel, making them highly attractive to retailers seeking sustainable and compliant moisture management solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager