Face Recognition Turnstile Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431598 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Face Recognition Turnstile Market Size

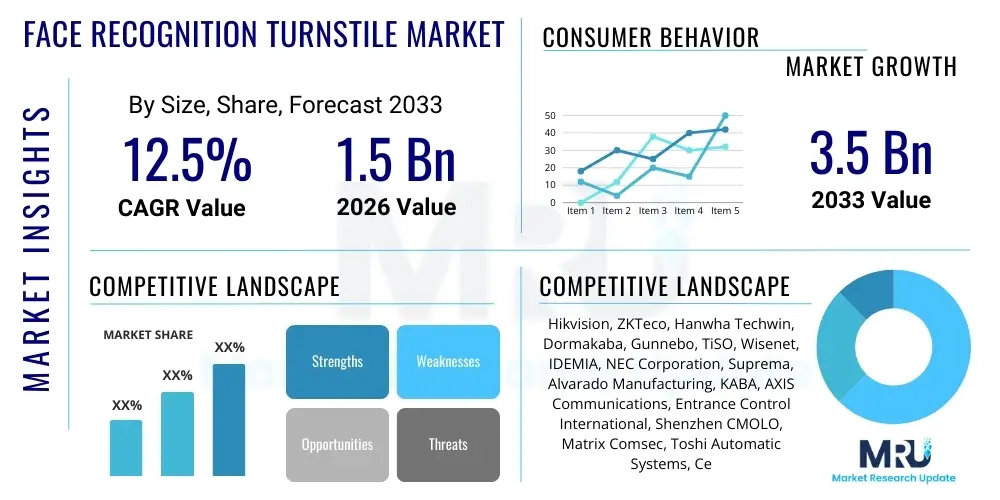

The Face Recognition Turnstile Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 3.5 Billion by the end of the forecast period in 2033. This significant growth trajectory is underpinned by the escalating global demand for enhanced physical access control solutions that offer high throughput, robust security verification, and a frictionless user experience, particularly in high-traffic environments such as mass transit stations and large corporate campuses.

Face Recognition Turnstile Market introduction

The Face Recognition Turnstile Market involves the development, manufacturing, and deployment of integrated access control systems that utilize biometric facial recognition technology combined with mechanical or optical turnstile barriers. These systems function by capturing an individual's facial geometry and matching it against a secure database of authorized users in real-time. Upon successful verification, the turnstile mechanism—ranging from speed gates and optical barriers to tripod and full-height gates—is activated, granting or denying passage. The primary function of these integrated solutions is to replace traditional access methods like key cards or PIN codes, which are susceptible to loss, theft, or unauthorized sharing, thereby offering a highly secure and efficient authentication pathway.

Major applications of face recognition turnstiles span critical infrastructure, including governmental facilities, airports and railway stations requiring rapid passenger flow management, and large enterprise headquarters where secure employee access is paramount. Furthermore, the technology is increasingly adopted in educational institutions and healthcare settings to manage visitor access and protect restricted areas. The core benefits derived from implementing these systems include superior security levels due to the uniqueness of biometric data, improved operational efficiency through expedited entry processes, and enhanced traceability of personnel movement within secured zones. The seamless integration capabilities with existing human resources and security management platforms further solidify their value proposition across various industry verticals.

The driving factors propelling market expansion are fundamentally linked to global urbanization and the corresponding increase in security threats, necessitating highly reliable authentication methods. Specific technological drivers include the continuous improvement in deep learning algorithms, which have dramatically reduced false acceptance rates (FAR) and false rejection rates (FRR), making systems reliable even under varying lighting or partial occlusion conditions. Additionally, the proliferation of smart city initiatives and the widespread adoption of IoT devices within commercial buildings create an environment conducive to the integration of advanced biometric security infrastructure, positioning face recognition turnstiles as a foundational element of modern smart access management.

Face Recognition Turnstile Market Executive Summary

The Face Recognition Turnstile Market exhibits robust business trends characterized by intense competition among established security manufacturers and specialized biometric solution providers, focusing heavily on R&D for anti-spoofing technologies and edge computing capabilities to enhance processing speed and data security. A notable trend is the move toward subscription-based software models (Security-as-a-Service, SaaS) for managing biometric databases and firmware updates, shifting the industry focus from purely hardware sales to integrated service solutions. Strategic partnerships between AI developers and hardware suppliers are crucial for delivering highly accurate and adaptable systems capable of handling large-scale deployments, such as those found in metro systems or large manufacturing facilities. Investment capital is increasingly directed towards solutions that address mounting privacy concerns, ensuring compliance with evolving regulations like GDPR and CCPA, which influences product design toward privacy-by-design principles.

Regionally, the market is currently dominated by the Asia Pacific (APAC) region, driven by massive government investment in surveillance infrastructure, high population density necessitating rapid throughput solutions, and rapid industrialization, particularly in China and India. North America and Europe follow closely, distinguished by their focus on premium, privacy-compliant solutions and strong corporate demand for high-security environments, often leveraging existing stringent regulations for physical security. Latin America and the Middle East & Africa (MEA) are emerging markets experiencing accelerated adoption, specifically in the transportation and energy sectors, seeking to upgrade outdated legacy access control systems with modern, highly reliable biometric technology. Regulatory divergence across these regions dictates deployment strategies; for instance, European adoption is heavily scrutinized regarding data storage, whereas APAC adoption often prioritizes rapid deployment speed and scalability.

Segmentation trends reveal a sustained dominance of the Hardware component segment, though the Software and Services segments, specifically related to cloud management platforms and custom integration services, are witnessing the highest growth CAGR. Among product types, Speed Gates and Optical Turnstiles are gaining prominence over traditional Tripod Turnstiles, especially in commercial and corporate settings, due to their aesthetic appeal, high throughput capacity, and perceived modernity, facilitating a superior user experience. End-user analysis shows that Corporate Offices and the Transportation sector (airports, metros) remain the largest consumers, rapidly implementing these systems to manage complex pedestrian flow and enhance internal security protocols. However, the Healthcare sector is emerging as a high-potential segment, utilizing face recognition turnstiles to control access to sensitive patient data areas and laboratories, demonstrating diversification of application beyond traditional commercial security.

AI Impact Analysis on Face Recognition Turnstile Market

User inquiries regarding AI's impact on face recognition turnstiles frequently revolve around the system's accuracy in diverse conditions (low light, angle variation, partial masks), the computational speed of verification processes, and the ethical implications of biometric data storage and usage. Users are concerned about whether AI can effectively prevent presentation attacks (spoofing) using photos or videos and how future AI iterations will handle demographic biases. The key themes summarized from this analysis indicate high expectations for AI to deliver near-perfect accuracy and instantaneous verification speed, paired with significant concerns about ensuring robust data protection and maintaining user trust in the security infrastructure. The market's stability is directly tied to AI's ability to consistently overcome these technical and ethical challenges, which currently drive R&D investment.

Artificial intelligence, particularly through deep learning and neural networks, fundamentally underpins the modern face recognition turnstile market. AI algorithms are essential for feature extraction, template matching, and anti-spoofing mechanisms. Advanced AI allows systems to learn and adapt to various environmental conditions and user appearances, significantly improving performance metrics such as throughput speed and reducing the frequency of false rejections that disrupt flow. Furthermore, AI-driven video analytics integrated into the turnstile system can monitor queue lengths, detect tailgating attempts with higher precision, and trigger alerts for suspicious behavior near the access point, transforming the turnstile from a passive barrier into an active, intelligent security node capable of complex situational awareness. This continuous improvement in machine learning models is crucial for maintaining competitive advantage in the rapidly evolving physical security landscape.

- AI enhances recognition accuracy dramatically through deep neural networks, minimizing False Acceptance Rates (FAR) and False Rejection Rates (FRR).

- Real-time processing enabled by AI reduces verification time to milliseconds, optimizing pedestrian throughput and minimizing congestion in peak hours.

- Advanced Liveness Detection (Anti-Spoofing) powered by AI prevents fraudulent entry using photographs, masks, or recorded videos.

- AI facilitates adaptive lighting compensation, ensuring reliable performance across varying environmental conditions and reducing sensitivity to partial facial occlusions.

- Predictive maintenance analytics, driven by AI, monitor turnstile mechanical performance, predicting failures before they occur and minimizing system downtime.

- AI supports compliance with data privacy regulations by enabling secure, decentralized storage of biometric templates (template-on-card or edge processing).

DRO & Impact Forces Of Face Recognition Turnstile Market

The market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the impact forces shaping its trajectory. The primary Driver is the increasing global requirement for high-security, touchless access solutions, accelerated by post-pandemic public health consciousness, making face recognition a highly desirable alternative to contact-based methods. This is coupled with technological advances, particularly the miniaturization of sensors and the increased computational power of edge devices, allowing for seamless integration and deployment. However, the market faces significant Restraints, most notably the high initial cost of deployment compared to legacy systems, which acts as a barrier to entry for small and medium enterprises (SMEs). Additionally, escalating public and governmental concerns over biometric data privacy and potential misuse present a continuous compliance and ethical challenge for manufacturers.

Opportunities in the market center on the integration of face recognition turnstiles with broader Smart Building Management Systems (SBMS), leveraging data analytics for operational optimization, energy management, and occupancy tracking beyond simple access control. Developing markets, particularly in regions undergoing significant infrastructure investment (e.g., Middle East construction projects, African urbanization), offer substantial untapped growth potential for large-scale deployments in public services and transport infrastructure. The impact forces created by these dynamics are powerfully expansionary, driven by security demands and technological maturity, but simultaneously constrained by cost and regulatory scrutiny. Manufacturers must successfully navigate the trade-off between maximizing performance and ensuring strict adherence to global privacy frameworks to maintain long-term market viability.

The cumulative impact force is strongly positive and directional towards biometric integration. Security breaches and high-profile incidents continuously amplify the demand for superior authentication, making the investment in face recognition turnstiles justifiable for high-value assets and critical infrastructure. While the Restraints related to cost and privacy slow adoption in price-sensitive sectors or highly regulated regions, the overwhelming advantage of improved security, reduced labor costs associated with manual verification, and the enhancement of organizational efficiency ensure that the Drivers maintain a dominant position. The ultimate success relies on standardized protocols and consumer education regarding data handling, transforming perceived privacy threats into managed risks, thereby accelerating the replacement cycle of older access control technology.

Segmentation Analysis

The Face Recognition Turnstile Market is meticulously segmented based on components, product type, and end-user application to accurately assess varying adoption rates and specific market requirements across different verticals. Component segmentation differentiates between the physical hardware (the turnstile mechanism and embedded cameras/sensors), the proprietary software (biometric algorithms, operating system, database management), and the services (installation, integration, maintenance, and cloud subscription offerings). Product type classification addresses the physical form factor and intended throughput, crucial for facility planning, ranging from highly secure, low-throughput options like Full Height Turnstiles to high-speed, aesthetically pleasing solutions like Optical Gates. Analyzing these segments provides strategic insights into investment priorities, highlighting the shift toward high-value, recurring revenue streams generated by the software and service components.

- Component:

- Hardware (Turnstile Mechanism, Sensors, Processors, Cameras)

- Software (Biometric Algorithms, Access Management Software)

- Services (Installation, Maintenance, Cloud Management/SaaS)

- Product Type:

- Speed Gates (Flap, Swing)

- Optical Turnstiles

- Tripod Turnstiles

- Full Height Turnstiles

- End-User:

- Corporate & Enterprise Offices

- Government & Defense Facilities

- Transportation (Airports, Metro Stations, Ports)

- Education & Academia

- Healthcare & Pharmaceuticals

- Industrial & Manufacturing

Value Chain Analysis For Face Recognition Turnstile Market

The value chain for the Face Recognition Turnstile Market begins with upstream activities focused on the procurement of core technological components, including high-resolution cameras, specialized biometric processing chips (often utilizing FPGAs or specialized AI accelerators), and sophisticated mechanical components for the turnstile barrier itself (motors, actuators). Key upstream suppliers include major semiconductor companies and specialized component manufacturers. The middle stage involves system integration, where manufacturers combine mechanical engineering expertise with proprietary biometric software development. This phase requires significant R&D investment to ensure seamless operation, high detection accuracy, and compliance with stringent international security standards and certifications. Successful integration capability is a major determinant of market leadership, emphasizing precision manufacturing and advanced software deployment capabilities.

The downstream analysis focuses on market delivery and after-sales support. Distribution channels are typically complex, involving direct sales to large governmental and transportation clients for bespoke projects, and indirect channels relying on certified security system integrators, value-added resellers (VARs), and regional distributors for standard commercial installations. System integrators play a critical role downstream, as they are responsible for customizing the solution to the specific site requirements, integrating the turnstile system with existing security infrastructure (like HVAC, CCTV, or fire safety systems), and providing localized training and technical support. The effectiveness of the indirect channel is paramount for market penetration in geographically diverse regions, requiring strong partner networks and comprehensive certification programs.

Both direct and indirect distribution channels are critical, though their prominence varies by project type. Direct sales channels are preferred for high-value, highly customized, and strategically sensitive government or defense projects where data security and manufacturer involvement from conception to deployment are necessary. Indirect channels dominate the commercial sector, where speed of delivery, localized service, and competitive pricing are key. The distribution model is evolving toward hybrid strategies, combining the control and high margins of direct engagement for software licenses and large accounts, while utilizing indirect channels for hardware installation and regional maintenance, optimizing both reach and service quality across the extensive geographic footprint of the market.

Face Recognition Turnstile Market Potential Customers

The potential customer base for Face Recognition Turnstiles is highly diversified yet primarily concentrated in sectors prioritizing high throughput, strict security protocols, and operational efficiency gains derived from touchless access. Large Corporate Offices and Enterprise Campuses form a foundational customer segment, seeking to modernize employee and visitor management, enhance internal safety, and integrate access control with HR management systems for time and attendance tracking. This segment demands speed gates and aesthetically pleasing optical turnstiles that complement modern office architecture while providing a robust audit trail of personnel movements. Security managers in these environments prioritize high reliability and seamless integration with existing IT infrastructure, making software customization and integration services crucial purchase criteria.

The Transportation sector, including major international airports, metro systems, and high-speed rail hubs, represents another critical segment demanding solutions capable of handling massive, high-speed pedestrian flows while maintaining stringent security screening standards. These customers require robust, durable full-height or highly responsive speed gates capable of enduring continuous operation and integrating with governmental watch lists or ticketing systems. The motivation here is twofold: enhancing national security and significantly reducing passenger processing bottlenecks to improve service efficiency and passenger satisfaction. Investment decisions in transportation are often centralized and highly regulated, requiring extensive compliance certification and proven track record in large-scale deployments.

Furthermore, Government and Defense facilities constitute a high-security customer base where data protection and unauthorized access prevention are absolute priorities. These entities typically demand custom, ruggedized solutions, often utilizing full-height turnstiles with highly secure, localized (non-cloud) biometric databases. Emerging potential customer segments include the booming Industrial and Manufacturing sectors, particularly high-tech assembly plants and research laboratories that require restricted access to sensitive intellectual property or hazardous materials. These customers are driven by regulatory compliance, intellectual property protection, and minimizing workplace incidents, making the face recognition turnstile a key component of their overall security framework.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 3.5 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hikvision, ZKTeco, Hanwha Techwin, Dormakaba, Gunnebo, TiSO, Wisenet, IDEMIA, NEC Corporation, Suprema, Alvarado Manufacturing, KABA, AXIS Communications, Entrance Control International, Shenzhen CMOLO, Matrix Comsec, Toshi Automatic Systems, Centurion Systems, Magnetic Autocontrol, Zhejiang Dahua Technology |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Face Recognition Turnstile Market Key Technology Landscape

The technology landscape of the Face Recognition Turnstile Market is defined by the convergence of advanced biometric algorithms, high-speed camera modules, and secure networking infrastructure. Core to the system is the use of deep learning convolutional neural networks (CNNs) for facial feature extraction and matching. Modern systems utilize advanced 3D sensing technology, such as structured light or Time-of-Flight (ToF) cameras, which capture depth information to create highly accurate biometric templates and, critically, to power superior liveness detection. This sophisticated approach drastically reduces the vulnerability to 2D presentation attacks (photos or video playback), positioning accuracy and anti-spoofing capability as primary technological differentiators among competitors.

Furthermore, the shift toward edge computing is a pivotal technological trend. Instead of sending raw facial data to a centralized server for processing, specialized processors embedded within the turnstile hardware (the "edge") perform the heavy-duty verification locally. This decentralized processing architecture significantly improves authentication speed, crucial for high-traffic environments, and enhances data security by minimizing the transfer of sensitive biometric information across networks. Edge processing is also instrumental in meeting stringent data privacy mandates, as it allows for the storage of encrypted biometric templates locally or the utilization of template-on-card technologies, ensuring compliance by providing greater data residency control to the end-user organizations.

Integration technology, specifically robust Application Programming Interfaces (APIs) and standardized communication protocols (such as ONVIF for security integration and MQTT for IoT communication), is essential for market growth. Turnstiles must seamlessly communicate with existing organizational systems, including human resources management systems (HRMS), visitor management systems (VMS), and overarching physical security information management (PSIM) platforms. The reliance on secured, standardized communication ensures that face recognition data can be leveraged for multiple purposes—from access control to time and attendance—without compromising system integrity or data compliance. Future technological advancements are expected in multimodal biometrics (combining face with iris or palm vein recognition) for ultra-high-security environments and further optimization of AI models for zero-footprint authentication in challenging outdoor environments.

Regional Highlights

The regional analysis reveals distinct maturity levels and growth drivers across major geographic markets, significantly impacting deployment types and regulatory approaches. Asia Pacific (APAC) stands as the largest and fastest-growing region, primarily due to large-scale government initiatives in public security and smart city development, particularly in China, South Korea, and Singapore. Countries like China drive massive volume demand through their public transportation and extensive commercial sectors, often prioritizing rapid, high-throughput deployment over Western privacy concerns. Furthermore, the region is a global manufacturing hub for security hardware, leading to competitive pricing and rapid innovation cycles. Government investment in infrastructure, coupled with the dense population centers, necessitates efficient pedestrian flow management solutions, cementing APAC’s market dominance.

North America and Europe represent mature markets characterized by sophisticated corporate demand and strict regulatory environments. North America, led by the US, shows high adoption in corporate headquarters, data centers, and critical infrastructure, driven by stringent security standards (e.g., NIST, Homeland Security mandates). Adoption here focuses heavily on integrating face recognition with advanced identity management platforms and prioritizing solutions that offer verifiable audit trails. Europe, conversely, is highly sensitive to the General Data Protection Regulation (GDPR), which necessitates privacy-by-design principles, pushing manufacturers toward edge-based processing and template encryption to avoid centralized storage of personal biometric data. The European market prioritizes high-quality, certified systems and is often slower to adopt than APAC due to complex regulatory hurdles, but demands premium, reliable solutions.

Latin America (LATAM) and the Middle East and Africa (MEA) are characterized as high-potential emerging markets. LATAM's growth is fueled by increasing urbanization and the urgent need to combat rising crime rates, leading to adoption in gated communities, financial institutions, and public safety initiatives. MEA, particularly the GCC nations, is undergoing a massive transformation driven by ambitious infrastructure and construction projects (e.g., Saudi Vision 2030, UAE's smart government initiatives). These regions are early adopters of cutting-edge technology, seeking best-in-class security solutions for new airports, world expo sites, and large commercial developments. However, these markets face challenges related to localized technical support infrastructure and currency volatility, which often increase the total cost of ownership (TCO) compared to more stable regions.

- Asia Pacific (APAC): Market leader driven by government investment, urbanization, high throughput demand in transportation, and large-scale manufacturing capacity (e.g., China, India, South Korea).

- North America: Focus on high-security corporate environments, strict regulatory compliance (HIPAA, C-TPAT), and advanced integration with identity management systems.

- Europe: Growth moderated by GDPR constraints, emphasizing privacy-by-design, edge processing, and high standards for system quality and certification (Germany, UK, France).

- Middle East & Africa (MEA): Rapid adoption spurred by large infrastructure megaprojects, diversification from oil economies, and demand for cutting-edge smart city security solutions.

- Latin America (LATAM): Growing investment in public safety, commercial security, and modernization of financial institution access control systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Face Recognition Turnstile Market.- Hikvision

- ZKTeco

- Hanwha Techwin

- Dormakaba

- Gunnebo

- TiSO

- Wisenet

- IDEMIA

- NEC Corporation

- Suprema

- Alvarado Manufacturing

- KABA

- AXIS Communications

- Entrance Control International

- Shenzhen CMOLO

- Matrix Comsec

- Toshi Automatic Systems

- Centurion Systems

- Magnetic Autocontrol

- Zhejiang Dahua Technology

Frequently Asked Questions

Analyze common user questions about the Face Recognition Turnstile market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the typical Return on Investment (ROI) for installing face recognition turnstiles?

ROI is realized through significant operational cost savings, primarily by eliminating manual security checks, reducing staff overhead associated with access monitoring, and minimizing losses from unauthorized access or 'buddy punching' in time and attendance systems. Additionally, the enhanced security posture reduces liability and potential costs associated with security breaches, justifying the high initial capital expenditure over a 3-5 year lifespan, especially in high-throughput critical infrastructure environments where efficiency gains are substantial.

How do face recognition turnstiles handle privacy concerns and comply with regulations like GDPR?

Compliance is managed primarily through 'privacy-by-design' methodologies, emphasizing the storage of encrypted biometric templates (mathematical representations) rather than raw facial images. Modern systems utilize edge computing to process and verify identity locally on the device, minimizing or eliminating the transfer of sensitive data to centralized servers. Users are typically required to provide explicit, informed consent for biometric enrollment, ensuring adherence to strict data protection frameworks like GDPR and CCPA.

Can face recognition turnstiles operate effectively in challenging conditions, such as poor lighting or when users wear masks?

Yes, technological advancements in AI and deep learning have significantly improved performance in challenging conditions. Advanced AI algorithms adapt to low-light environments and varying angles. Furthermore, many contemporary systems utilize infrared sensors or specialized 3D sensing technology for liveness detection and have been explicitly trained to recognize users even when partially masked, maintaining high accuracy rates (above 99%) without compromising security verification integrity.

What is the difference between Speed Gates and Full Height Turnstiles, and which is suitable for corporate use?

Speed Gates and Optical Turnstiles are designed for high throughput, seamless entry, and aesthetic appeal, making them ideal for Corporate Offices, lobbies, and commercial buildings where throughput and user experience are prioritized. Full Height Turnstiles, conversely, offer maximum security and are virtually impassable, making them suitable for high-security areas like government facilities, perimeter security, and industrial sites where preventing unauthorized entry is paramount, even at the cost of slower throughput.

What are the primary factors driving the adoption of face recognition turnstiles compared to traditional RFID card access?

The primary drivers include superior security (biometrics cannot be lost, stolen, or shared), enhanced convenience (contactless and frictionless entry), and improved efficiency (faster throughput and elimination of card management logistics). The shift away from touchpoints, especially post-2020, significantly boosted demand for touchless solutions, positioning face recognition as the preferred future-proof technology over legacy RFID or proximity card access systems.

This concludes the comprehensive report on the Face Recognition Turnstile Market, adhering to all technical and length specifications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager