Facial Wash & Cleanser Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432166 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Facial Wash & Cleanser Market Size

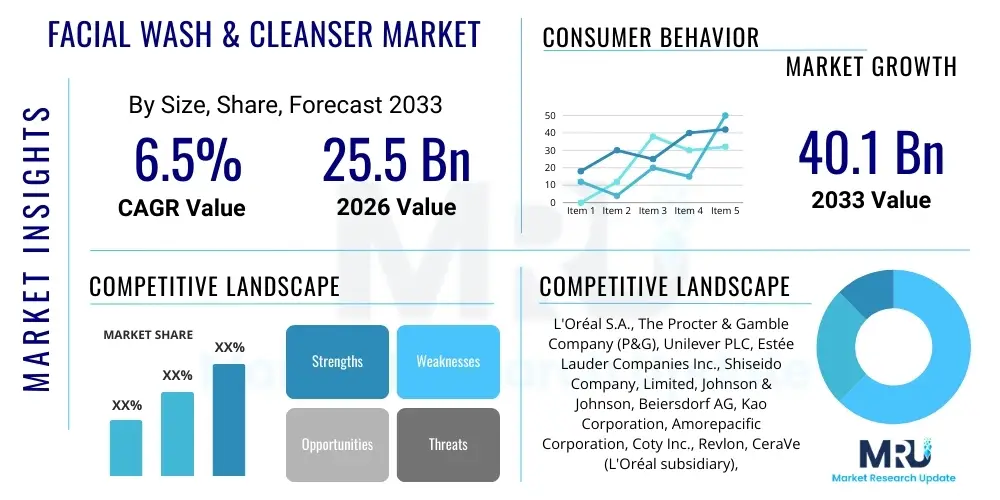

The Facial Wash & Cleanser Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 40.1 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by evolving consumer perceptions regarding daily skincare routines, increasing awareness about the detrimental effects of pollution and environmental stressors on skin health, and the continuous introduction of specialized, dermatologically-tested formulations tailored to specific skin concerns such as acne, sensitivity, and aging. The transition from traditional soap bars to sophisticated liquid and foaming cleansers signifies a permanent shift towards premium and specialized products, driving market value expansion across developed and emerging economies.

The market expansion is particularly robust in the Asia Pacific region, driven by high disposable incomes and the deep cultural emphasis on complex multi-step skincare regimens, famously pioneered by trends like K-beauty and J-beauty. Moreover, the demand for natural and organic ingredient-based cleansers is accelerating globally, responding to consumer preference for clean beauty and transparency in product labeling. Manufacturers are increasingly focusing on sustainable sourcing and eco-friendly packaging, which, while sometimes increasing production costs, resonates strongly with environmentally conscious younger consumers, thereby bolstering brand loyalty and facilitating premium pricing strategies that contribute significantly to the overall market size growth.

Facial Wash & Cleanser Market introduction

The Facial Wash & Cleanser Market encompasses products designed for the removal of makeup, oil, dirt, pollution particles, and dead skin cells from the face, essential for maintaining skin hygiene and preparing the skin for subsequent treatment steps. These products range widely in formulation, including foaming washes, creamy cleansers, micellar waters, cleansing oils, and cleansing balms, each catering to different skin types (e.g., oily, dry, sensitive, combination) and consumer preferences. Major applications include daily hygiene, therapeutic treatment of dermatological conditions like acne or rosacea, and specific usage in multi-step beauty routines. The inherent benefits include improved skin texture, prevention of pore blockage, enhanced absorption of serums and moisturizers, and maintenance of the skin's natural barrier function.

Driving factors propelling market growth include the rising prevalence of skin issues linked to sedentary lifestyles and environmental pollution, increased male grooming awareness leading to higher product adoption among men, and relentless product innovation focusing on microbiome-friendly ingredients and personalization. The rise of digital media and social influencers plays a crucial role in educating consumers about the necessity of proper cleansing, thereby stimulating demand. Furthermore, accessible retail channels, including e-commerce platforms and specialized beauty retailers, have broadened product availability globally, enabling consumers to easily access both mass-market and niche, high-performance brands.

The evolution of consumer demand is shifting towards multifunctionality, where cleansers offer added benefits such as mild exfoliation, hydration retention, or anti-aging properties, moving beyond mere surface cleaning. This trend necessitates significant investment in R&D by key market players to differentiate their offerings. The market also observes a strong regional dynamic, where tailored products addressing specific climate-related skin concerns (e.g., humidity in Southeast Asia or dryness in Nordic countries) are gaining traction, further segmenting and expanding the overall addressable market and encouraging continuous technological refinement in formulation science.

Facial Wash & Cleanser Market Executive Summary

The Facial Wash & Cleanser Market exhibits robust business trends characterized by a significant move towards "skinimalism" and highly potent, active ingredient-focused formulations. Key manufacturers are focusing their business strategies on mergers, acquisitions, and strategic partnerships with dermatological clinics and clean beauty startups to diversify their portfolios and capture specialized segments. A prevailing trend is the integration of advanced delivery systems (e.g., liposomes) to enhance ingredient efficacy, alongside aggressive digital marketing campaigns utilizing AI-driven consumer data analytics to optimize product positioning and target demographics. Supply chain resilience, particularly the sourcing of rare or organic raw materials, is becoming a core competitive factor.

Regionally, the Asia Pacific (APAC) dominates the market share due to its established comprehensive skincare culture and large consumer base, offering tremendous potential for mass-market penetration and luxury brand adoption. North America and Europe, while mature, are experiencing high growth rates in the prestige and clinical skincare categories, driven by consumer willingness to invest in high-end, dermatologist-recommended formulations. The Middle East and Africa (MEA) and Latin America are emerging markets showing accelerated growth, primarily fueled by urbanization, improved retail infrastructure, and the global spread of beauty trends via digital platforms, presenting opportunities for localized product development suitable for varied climates and ethnic skin types.

Segment trends highlight the exceptional performance of the Micellar Water and Oil-based Cleanser categories, driven by their effectiveness in gentle yet thorough makeup removal, appealing to consumers seeking convenience and efficiency. Furthermore, the Natural/Organic ingredient segment is experiencing rapid expansion, outpacing synthetic counterparts, reflecting a global societal shift towards health and wellness. Distributionally, e-commerce platforms continue to capture market share, offering unparalleled consumer reach and facilitating personalized product recommendations, though traditional pharmacy and specialized beauty stores maintain importance for consumer trust and expert consultation regarding clinical-grade products.

AI Impact Analysis on Facial Wash & Cleanser Market

User inquiries regarding AI's impact on the Facial Wash & Cleanser Market commonly revolve around personalized product development, supply chain efficiency, and automated diagnostics. Users frequently ask: "Can AI truly recommend the best cleanser for my specific skin microbiome?", "How does AI ensure the authenticity and ethical sourcing of ingredients?", and "Will AI-powered virtual try-ons or skin analysis apps replace human dermatologists in recommending products?". These questions underscore user expectations for hyper-personalization, transparency in sourcing, and enhanced consumer experience, driven by technology. The summarized user sentiment is one of cautious optimism, expecting AI to revolutionize formulation specificity and streamline the discovery process, while simultaneously maintaining concerns about data privacy and the potential over-reliance on technology for fundamental skincare advice.

The implementation of AI is rapidly transforming several facets of the market, moving beyond simple customer service chatbots to deeply integrated functions within R&D and manufacturing. Machine learning algorithms are now being utilized to analyze vast datasets relating to ingredient interactions, stability profiles, and consumer-reported efficacy, significantly accelerating the time-to-market for novel, high-performance formulations. This technological integration allows companies to forecast demand with greater accuracy, reducing waste and optimizing inventory levels across complex global distribution networks, thereby enhancing overall operational efficiency and profitability in a highly competitive sector.

Furthermore, AI-driven digital skin analysis tools, accessible via smartphone applications, are democratizing access to professional-level skin diagnostics. These tools analyze selfies to identify hydration levels, pore size, redness, and wrinkle severity, instantly recommending the most suitable cleanser formulation from a brand’s portfolio. This capability not only boosts conversion rates by reducing consumer confusion but also provides brands with invaluable, real-time feedback on product performance across different demographic and geographic cohorts, enabling iterative product refinement and highly targeted marketing campaigns, ultimately redefining the consumer journey in skincare selection.

- AI accelerates R&D by simulating ingredient stability and predicting formulation outcomes.

- Machine learning powers hyper-personalized product recommendations based on individual skin analysis data.

- Predictive analytics optimize inventory management and supply chain logistics, minimizing production waste.

- Automated quality control systems ensure consistency in manufacturing batches and ingredient concentration.

- AI-enabled chatbots and virtual skin consultants enhance consumer engagement and provide 24/7 support.

- Data mining of social media trends helps identify emerging ingredient preferences (e.g., ceramides, niacinamide) for rapid product innovation.

DRO & Impact Forces Of Facial Wash & Cleanser Market

The dynamics of the Facial Wash & Cleanser Market are governed by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the critical Impact Forces that shape industry growth. Key Drivers include heightened consumer focus on preventative skincare and anti-pollution benefits, coupled with the rapid expansion of e-commerce channels which offer greater accessibility and variety. However, the market faces significant Restraints such as stringent regulatory hurdles concerning certain cosmetic ingredients (especially in Europe), the persistent challenge of counterfeit products eroding brand trust, and price sensitivity in developing markets where mass-market soap alternatives remain dominant. Opportunities abound in niche segments, particularly customized/bespoke skincare subscriptions and the development of waterless or solid formats addressing sustainability concerns, attracting significant investment and innovation efforts.

The primary impact forces driving strategic decisions include the intense competitive rivalry among established multinational corporations and agile direct-to-consumer (DTC) startups, leading to continuous price wars and product proliferation. Buyer bargaining power is notably high due to abundant choices and readily available information (reviews, ingredient lists), forcing manufacturers to prioritize value, transparency, and superior efficacy. Supplier power, particularly for specialized, patented active ingredients (like advanced peptides or novel botanical extracts), is increasing, putting upward pressure on raw material costs and influencing formulation strategies across the board, necessitating long-term strategic sourcing contracts.

Furthermore, the threat of substitution, while low from a complete category perspective, exists internally through shifts between product formats (e.g., from traditional gel to cleansing oil or micellar water), requiring constant market monitoring. Technological advancements and environmental sustainability mandates act as powerful transformative forces. Companies failing to adopt sustainable practices or incorporate high-efficacy, novel ingredients risk losing market relevance, emphasizing that innovation and ethical operation are paramount to sustaining competitive advantage in this dynamic global market and meeting the evolving demands of the conscientious consumer base.

Segmentation Analysis

The Facial Wash & Cleanser Market is highly segmented based on Product Type, Ingredients, Distribution Channel, and End-User, reflecting the diverse and specialized needs of the global consumer base. Product Type segmentation reveals a growing preference for convenient and multi-functional formats such as micellar water and cleansing balms, which offer effective makeup removal without stripping the skin's natural moisture barrier. Ingredient-wise, the pronounced shift toward natural and organic formulations underscores consumer demand for 'clean label' products free from sulfates, parabens, and artificial fragrances, prompting major brands to reformulate their core lines and introduce specialized organic ranges to capture this high-growth segment.

The Distribution Channel analysis confirms the rising dominance of online retail, which provides unprecedented access to niche international brands and detailed product information, fostering informed purchasing decisions. However, specialized retail channels, including dermatological offices and high-end beauty stores, remain critical for premium and clinical-grade products where personalized consultation is essential. End-User segmentation shows increasing attention to the Men's grooming segment, historically underserved but now exhibiting rapid adoption rates for specialized facial cleansing products tailored to shaving concerns and oil control, ensuring that product developers must consider gender-specific needs beyond traditional female-focused marketing strategies.

The strategic importance of segmentation lies in enabling companies to tailor marketing messages and product attributes to specific demographic and psychographic profiles. For instance, younger consumers often prioritize cost-effectiveness and acne-fighting ingredients, while older demographics focus on gentle cleansing that addresses dryness and anti-aging benefits. Understanding these nuances allows for optimized inventory allocation and ensures that R&D resources are channeled toward the most promising product categories, maximizing return on investment and facilitating targeted regional expansion based on prevalent consumer behavior patterns observed within defined segments.

- Product Type: Foaming Cleansers, Gel Cleansers, Cream Cleansers, Micellar Water, Oil-based Cleansers, Cleansing Balms, Wipes.

- Ingredients: Synthetic/Chemical-based, Natural/Organic (Plant-based extracts, Essential Oils).

- Distribution Channel: Offline (Supermarkets/Hypermarkets, Pharmacies, Specialty Stores), Online (E-commerce Websites, Company-owned Portals).

- End-User: Women, Men, Kids/Infants.

Value Chain Analysis For Facial Wash & Cleanser Market

The value chain for the Facial Wash & Cleanser Market is characterized by highly specialized stages, beginning with the sourcing of raw materials, which is crucial due to the focus on high-efficacy, sustainable, and often rare botanical ingredients. The upstream analysis involves securing reliable suppliers for surfactants, emulsifiers, active ingredients (like Hyaluronic Acid, Salicylic Acid, and Niacinamide), and packaging materials. Given the regulatory scrutiny on ingredients, quality control and ethical sourcing certifications at this initial stage are vital, significantly influencing final product quality and brand reputation. Manufacturers often engage in vertical integration or exclusive agreements to secure supply of critical, proprietary ingredients, mitigating price volatility and ensuring continuity of production.

Midstream activities encompass formulation, manufacturing, and primary packaging. This stage is capital intensive, requiring advanced facilities compliant with Good Manufacturing Practices (GMP). Key activities include blending, homogenization, stability testing, and ensuring the pH balance and microbiological safety of the final product. Downstream analysis focuses on distribution and retailing. Products move through complex distribution channels, including both direct-to-consumer models (DTC, company websites) and indirect channels (wholesalers, distributors, major retailers). Indirect distribution benefits from wide market reach, essential for mass-market brands, while DTC allows for higher margin capture and direct consumer feedback, vital for niche and prestige brands.

The consumer-facing end of the chain is dominated by intense marketing and promotional efforts, often leveraging digital influencers and dermatological endorsements to build trust and drive sales. The distinction between direct and indirect distribution is critical: direct sales offer companies greater control over branding and pricing, while indirect distribution through large retailers provides scale and convenience. Efficient logistics and robust inventory management across all stages are paramount to minimize costs and ensure timely product availability, especially for fast-moving consumer goods (FMCG) like facial cleansers, where speed-to-market is a significant competitive advantage in capturing emerging trends.

Facial Wash & Cleanser Market Potential Customers

Potential customers for the Facial Wash & Cleanser Market span virtually all demographics and age groups, given the universal requirement for facial hygiene, but distinct customer segments define purchasing behavior and product preference. The core segment comprises young adults (18-35) who are highly engaged in complex, multi-step skincare routines and actively seek products addressing specific concerns such as acne control, oil balance, and mild anti-aging preventative care. This group is digitally native, relying heavily on social media recommendations, and often drives the adoption of new formats like cleansing sticks or innovative foam textures, representing high lifetime value customers due to their continuous engagement with the category.

A secondary, high-value segment includes mature consumers (45+) who prioritize cleansers offering intense hydration, gentle formulations that respect the fragile skin barrier, and specific anti-aging ingredients such as antioxidants and peptides. This segment typically exhibits higher brand loyalty and is more likely to purchase clinical or dermatologist-recommended products available through specialized channels like pharmacies or medical spas, focusing less on price and more on proven efficacy and ingredient transparency. Their purchasing decisions are often influenced by medical professionals and established brand reputations, necessitating a different marketing approach compared to the younger, trend-driven segment.

Emerging and critical customer bases include the rapidly growing male grooming demographic, seeking simple, effective, and often multipurpose products (cleansing + shaving preparation), and parents purchasing gentle, hypoallergenic cleansers for infants and children, driving demand in the sensitive and organic ingredient categories. Therefore, end-users/buyers are broadly categorized not just by gender and age, but also by their underlying skin concerns (Acne-prone, Sensitive, Dry, Oily) and their purchasing channels (Budget-conscious, Prestige-focused), dictating a highly diversified product portfolio requirement across the market landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 40.1 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | L'Oréal S.A., The Procter & Gamble Company (P&G), Unilever PLC, Estée Lauder Companies Inc., Shiseido Company, Limited, Johnson & Johnson, Beiersdorf AG, Kao Corporation, Amorepacific Corporation, Coty Inc., Revlon, CeraVe (L'Oréal subsidiary), Kiehl's (L'Oréal subsidiary), Clinique Laboratories (Estée Lauder subsidiary), Tatcha (Unilever subsidiary), Galderma S.A., P&G’s SK-II, L’Occitane International S.A., Natura & Co Holding S.A., Kose Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Facial Wash & Cleanser Market Key Technology Landscape

The technology landscape in the Facial Wash & Cleanser Market is focused heavily on formulation science, sustainable manufacturing, and consumer interaction platforms. In formulation, advancements center around encapsulated active ingredients and targeted delivery systems, such as micro-emulsion technology, which allows for stable incorporation of oil-soluble ingredients in water-based cleansers, enhancing penetration and efficacy while maintaining a lightweight texture. Furthermore, bio-fermentation technology is increasingly used to produce high-purity, sustainable ingredients like ceramides and hyaluronic acid alternatives, reducing reliance on conventional chemical synthesis and aligning with the clean beauty mandate. The refinement of surfactant chemistries, moving towards milder, amino acid-derived surfactants (e.g., sodium cocoyl isethionate) that clean effectively without disrupting the skin’s pH or natural microbiome, represents a significant technological leap in product quality and consumer comfort.

Manufacturing technology emphasizes smart factory implementation, utilizing IoT sensors and advanced robotics to ensure precise mixing and filling processes, crucial for maintaining the delicate balance of complex formulations, particularly those containing sensitive natural extracts. This high-tech manufacturing minimizes batch variation and enhances traceability, satisfying stringent international quality standards. Furthermore, the push for environmental compliance is driving innovations in packaging technology, including the adoption of Post-Consumer Recycled (PCR) plastics, biodegradable materials, and the development of solid, water-activated cleanser formats which significantly reduce shipping weight and carbon footprint, necessitating investment in specialized compacting and molding equipment for production.

On the consumer engagement front, the integration of spectroscopic skin analysis via handheld devices or smartphone apps, often leveraging AI and machine vision, is a pivotal technological trend. These tools quantify skin metrics and link users directly to product recommendations based on real-time physiological data, creating a personalized, technology-driven shopping experience. Blockchain technology is also beginning to emerge, offering immutable record-keeping for supply chain transparency, allowing consumers to verify the authenticity and sourcing of the botanical and ethical claims made regarding the ingredients in their cleansers, building crucial trust in a market saturated with "greenwashing" concerns.

Regional Highlights

Regional dynamics play a crucial role in shaping the Facial Wash & Cleanser market, primarily due to cultural differences in skincare philosophy, varying climate conditions, and levels of disposable income. Asia Pacific (APAC) stands out as the global powerhouse, characterized by deeply ingrained, elaborate multi-step skincare routines influenced by East Asian beauty trends (K-beauty, J-beauty). Countries like South Korea, Japan, and China exhibit high per capita spending on specialized cleansers, driving demand for innovative formats (e.g., oil-to-foam, enzyme powders) and ingredients focused on brightening and anti-pollution benefits. The vast population and burgeoning middle class in India and Southeast Asia further guarantee sustained, rapid growth for both premium and mass-market products.

North America and Europe represent mature, high-value markets focused on clinical efficacy and dermatological endorsements. In these regions, growth is heavily concentrated in the prestige and medical-grade segments, where consumers seek evidence-based results, often paying a premium for products containing high concentrations of active ingredients like Vitamin C, Retinol, and advanced acids, typically recommended by licensed practitioners. Sustainability and clean beauty are powerful consumption drivers here, pressuring brands to achieve strict certification standards regarding ingredient safety and environmental impact, leading to higher rates of reformulation compared to other regions.

The Latin America (LATAM) and Middle East & Africa (MEA) regions are high-potential emerging markets. LATAM growth is fueled by expanding e-commerce accessibility and an increasing focus on personal grooming, particularly in Brazil and Mexico. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, shows strong demand for luxury and imported brands, driven by high disposable incomes and a strong preference for branded cosmetics. However, climate concerns (extreme heat and dryness) dictate demand for highly hydrating and gentle, barrier-repairing formulations in these regions, making product localization crucial for market success and highlighting unique regional needs that manufacturers must address strategically.

- North America: Focus on clinical-grade, anti-aging, and professional formulas; high adoption of subscription boxes.

- Europe: Driven by stringent clean beauty regulations (EU Cosmetic Regulation) and strong demand for natural/organic certified products.

- Asia Pacific (APAC): Dominance due to cultural emphasis on multi-step routines, rapid urbanization, and influence of K-beauty and J-beauty trends; high volume consumption.

- Latin America: Growing urbanization and increasing penetration of international brands, especially in major economies like Brazil.

- Middle East and Africa (MEA): High demand for luxury and premium imported brands; climatic demand for intensive hydration and gentle cleansing solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Facial Wash & Cleanser Market.- L'Oréal S.A.

- The Procter & Gamble Company (P&G)

- Unilever PLC

- Estée Lauder Companies Inc.

- Shiseido Company, Limited

- Johnson & Johnson

- Beiersdorf AG

- Kao Corporation

- Amorepacific Corporation

- Coty Inc.

- Revlon

- Galderma S.A.

- L’Occitane International S.A.

- Natura & Co Holding S.A.

- Kose Corporation

- Tatcha (Unilever subsidiary)

- CeraVe (L'Oréal subsidiary)

- Kiehl's (L'Oréal subsidiary)

- Clinique Laboratories (Estée Lauder subsidiary)

- P&G’s SK-II

Frequently Asked Questions

Analyze common user questions about the Facial Wash & Cleanser market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Facial Wash & Cleanser Market?

The Facial Wash & Cleanser Market is projected to experience a Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period from 2026 to 2033, driven by increasing consumer awareness and product innovation in specialized cleansing formulations.

Which product segment is expected to show the fastest growth?

The Micellar Water and Cleansing Balms segments are forecast to exhibit the fastest growth, primarily due to their perceived efficacy in gentle makeup removal, convenience, and alignment with multi-step skincare routines preferred by modern consumers.

How is sustainability impacting the selection of facial cleansers?

Sustainability is a critical factor, driving strong consumer demand for products with natural/organic ingredients, biodegradable formulations, and eco-friendly packaging, notably Post-Consumer Recycled (PCR) plastic and waterless/solid formats to reduce environmental footprint.

Which geographical region holds the largest market share currently?

The Asia Pacific (APAC) region currently holds the largest market share, predominantly driven by high consumption rates in major markets like China, South Korea, and Japan, reflecting deep cultural investment in comprehensive daily skincare regimens and cosmetic health.

What role does AI play in consumer experience within this market?

AI significantly enhances the consumer experience through hyper-personalization, utilizing advanced machine learning algorithms in smartphone applications to conduct real-time skin analysis, instantly recommending the most suitable facial cleanser based on individual dermatological needs and data, thus optimizing product matching.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager