Facility Management Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435048 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Facility Management Services Market Size

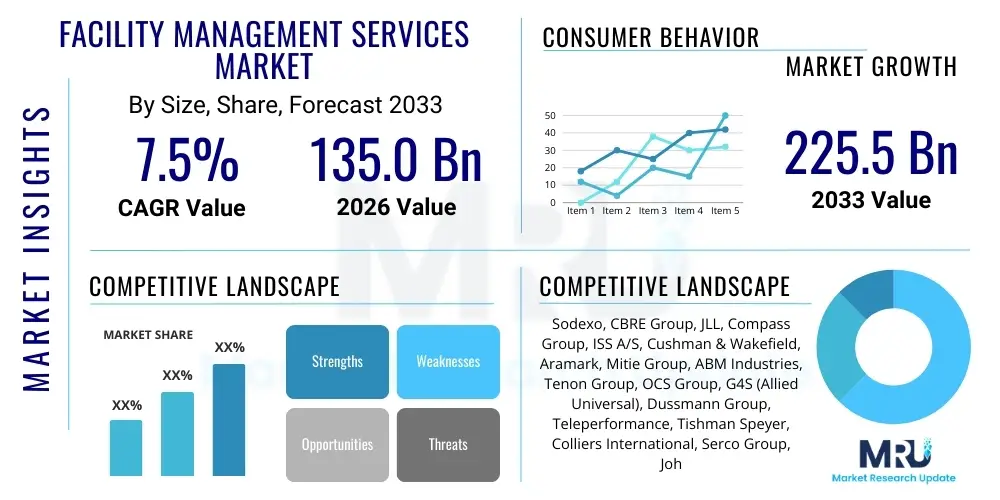

The Facility Management Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $135.0 billion in 2026 and is projected to reach $225.5 billion by the end of the forecast period in 2033.

Facility Management Services Market introduction

The Facility Management (FM) Services market encompasses a broad range of professional services designed to ensure the functionality, comfort, safety, and efficiency of buildings and grounds, infrastructure, and real estate. These services are critical for organizations seeking to optimize operational expenditure (OpEx) while maintaining core business focus. FM services are broadly categorized into hard services (related to the physical structure and engineering systems, such as HVAC, electrical, and plumbing maintenance) and soft services (related to the building occupants and environment, such as cleaning, security, catering, and waste management). The increasing complexity of modern building systems, coupled with stringent regulatory requirements concerning energy efficiency and sustainability, has driven the outsourcing trend, fueling market expansion globally. Furthermore, the push towards integrated facility management (IFM), where a single vendor manages both hard and soft services, is reshaping competitive dynamics and enhancing efficiency for end-users.

Major applications of facility management services span across nearly all industry verticals, including commercial offices, retail centers, manufacturing plants, healthcare facilities, and educational institutions. The core benefit derived from utilizing these services is the optimization of non-core processes, allowing organizations to allocate resources more effectively to strategic initiatives. FM outsourcing translates directly into reduced overheads, predictable maintenance costs, improved compliance, and enhanced workplace productivity and employee satisfaction. The integration of advanced technologies like the Internet of Things (IoT) and Building Information Modeling (BIM) is transforming service delivery, moving operations from reactive repairs to predictive maintenance models, thereby maximizing asset lifespan and minimizing downtime.

The primary driving factors for the sustained growth of this market include rapid urbanization and subsequent infrastructural development, particularly in emerging economies of the Asia Pacific region. Additionally, corporate focus on cost containment and standardization across multi-site operations strongly encourages the adoption of outsourced, scalable FM solutions. Government mandates regarding green building certifications and energy performance standards necessitate specialized expertise in resource management, which larger FM providers are uniquely positioned to deliver. The growing awareness among businesses regarding the strategic value of workspace optimization, coupled with the rising demand for healthier and safer workplaces post-pandemic, continues to be a crucial market accelerator.

Facility Management Services Market Executive Summary

The global Facility Management Services market is undergoing significant transformation characterized by the rapid adoption of technology, a decisive shift toward integrated service models, and heightened demand for sustainable and resilient operations. Business trends highlight increasing merger and acquisition activity among leading service providers, aimed at expanding geographic footprint and enhancing technological capabilities, particularly in areas like smart building management systems and real-time operational analytics. The focus remains on delivering scalable, personalized, and efficient IFM solutions that promise superior service level agreements (SLAs) and improved return on assets (ROA) for clients. Regulatory pressures concerning ESG (Environmental, Social, and Governance) compliance are shaping service offerings, making energy management and sustainability consulting crucial components of modern FM contracts.

Regionally, North America and Europe maintain maturity, driven by sophisticated technology adoption and well-established outsourcing practices, with strong emphasis on regulatory adherence and workplace experience. Asia Pacific, however, is emerging as the fastest-growing region, propelled by massive construction booms in commercial and industrial sectors, alongside increasing foreign direct investment requiring standardized global FM practices. Latin America and MEA show promising growth driven by infrastructure projects and the industrialization of resource-rich economies, although adoption rates lag due to fragmented local markets and varying regulatory frameworks. The trend toward decentralization of operations and the rise of hybrid work models necessitate FM solutions that prioritize remote monitoring and flexible space utilization, creating new avenues for specialized service providers.

Segment trends reveal that the Integrated Facility Management (IFM) segment is gaining market share rapidly, favored by large enterprises seeking holistic cost management and streamlined vendor relationships. Hard FM services, specifically technical maintenance and asset lifecycle management, continue to hold the largest value share due to the complexity and capital intensity of modern infrastructure systems. Within the end-user segmentation, the Commercial and Industrial sectors remain dominant consumers, though the Healthcare and IT & Telecom sectors are experiencing exponential growth due to their mission-critical environments requiring stringent uptime guarantees and specialized technical upkeep. Furthermore, the trend of implementing IoT sensors and cloud-based platforms is driving the software and technology component of the market, enabling predictive capabilities that are fundamentally redefining maintenance strategies.

AI Impact Analysis on Facility Management Services Market

User inquiries regarding the integration of Artificial Intelligence (AI) into Facility Management Services center primarily around themes of automation, predictive maintenance efficacy, security enhancements, and the potential displacement of manual labor. Common concerns relate to data privacy, the initial investment cost for implementing sophisticated AI-driven Building Management Systems (BMS), and the necessary upskilling of existing FM staff to manage and interpret AI outputs. Users expect AI to move beyond simple rule-based automation to deliver true predictive operational insights, such as anticipating equipment failure before human observation, optimizing energy consumption in real-time based on occupancy patterns, and streamlining complex service ticketing processes. There is a high expectation that AI will standardize operational excellence across geographically dispersed portfolios and reduce the reliance on ad-hoc or calendar-based maintenance schedules, ultimately leading to significant cost savings and improved asset performance. The consensus is that AI will elevate the strategic role of FM professionals from maintenance coordinators to data-driven asset managers.

The transformative effect of AI on FM manifests primarily in optimizing energy consumption and improving operational efficiency through data fusion from diverse sources—IoT sensors, weather data, and enterprise resource planning (ERP) systems. AI algorithms can analyze occupant behavior and environmental factors to dynamically adjust HVAC, lighting, and ventilation systems, leading to substantial energy savings and reduced carbon footprint. Furthermore, AI enhances security and surveillance capabilities through advanced video analytics, detecting anomalies and unauthorized access more reliably than traditional systems, while simultaneously optimizing staff deployment. The deployment of AI-powered chatbots and virtual assistants is also streamlining communication, automating routine service requests, and reducing response times for facility users, contributing to a superior occupant experience.

AI adoption facilitates the transition toward condition-based and predictive maintenance models, dramatically reducing unexpected downtime and prolonging asset life. Machine learning algorithms analyze historical performance data and operational variances to predict the exact time an asset is likely to fail, allowing maintenance intervention precisely when required, rather than relying on time-intensive preventative schedules. This shift minimizes maintenance costs, reduces inventory requirements for spare parts, and maximizes operational uptime—a critical requirement for mission-critical facilities like data centers and hospitals. While implementation requires substantial upfront investment in data infrastructure and integration, the long-term ROI derived from predictive capabilities is positioning AI as a mandatory component for future-proofed facility management contracts.

- AI-driven Predictive Maintenance: Forecasts equipment failure using sensor data, minimizing unplanned outages and maximizing asset utilization.

- Energy Optimization: Uses machine learning to dynamically adjust HVAC and lighting based on real-time occupancy and external conditions, yielding significant energy savings.

- Operational Efficiency: Automates routine tasks like work order generation, scheduling, and service request routing, improving technician productivity.

- Enhanced Security: Implements advanced video analytics and anomaly detection for superior monitoring of large facilities and improved access control.

- Occupant Experience Management: Deploys AI chatbots and digital twins to personalize environment settings and streamline communication for tenants.

- Data Integration and Reporting: Fuses disparate data sources (BMS, IoT, ERP) to provide holistic, actionable insights into portfolio performance and compliance.

DRO & Impact Forces Of Facility Management Services Market

The Facility Management Services market dynamics are shaped by potent drivers (D), significant restraints (R), and compelling opportunities (O), creating complex impact forces. The primary drivers include the global trend of outsourcing non-core activities to achieve operational efficiency, the increasing complexity of regulatory and compliance standards (especially environmental and safety regulations), and rapid technological advancements, such as the maturation of IoT, BIM, and AI, which necessitate specialized maintenance expertise. These drivers are fundamentally accelerating the shift from in-house management toward comprehensive, performance-based, outsourced contracts. Furthermore, the imperative for companies to achieve high standards of sustainability and energy performance is favoring large, sophisticated FM providers capable of delivering detailed ESG reporting and optimization strategies.

Conversely, the market faces several restraining factors. High initial capital investment required for implementing advanced Facility Management Software (FMS) and integrating smart building technologies often deters smaller organizations. Concerns surrounding data security, privacy breaches, and the reliability of interconnected systems present implementation hurdles, particularly when relying on cloud-based solutions. Moreover, the lack of standardization across different geographic regions regarding technical codes and labor regulations complicates multinational contract execution. A significant restraint is the persistent shortage of skilled technicians proficient in maintaining highly complex, technologically integrated building systems, which can limit the quality and speed of service delivery, potentially impacting client satisfaction and contract renewals.

Opportunities abound, centering on the immense potential of Integrated Facility Management (IFM), which offers clients streamlined single-point accountability and maximized cost efficiencies, becoming the preferred model for large, multi-site organizations. The growing focus on occupant well-being (Health, Safety, and Environment - HSE) and the post-pandemic need for flexible, resilient workplaces present major opportunities for providers offering specialized services like air quality monitoring and flexible space management. Additionally, untapped growth potential exists in emerging markets, driven by exponential industrialization and commercial development. Providers specializing in niche areas, such as managing critical infrastructure for data centers, pharmaceuticals, and highly automated manufacturing, are uniquely positioned to capitalize on these high-growth, high-value contracts. These interacting forces collectively influence contract duration, pricing strategies, and the competitive positioning of vendors.

Segmentation Analysis

The Facility Management Services market is highly fragmented and analyzed across several critical dimensions, including service type, sourcing, industry vertical, and geographic region. Understanding these segments is vital for vendors to tailor their offerings and for end-users to select the appropriate delivery model. The categorization by service type distinguishes between maintenance-centric hard services, people-centric soft services, and the increasingly popular integrated model. Hard services, focusing on assets like mechanical and electrical systems, typically involve higher contractual values due to the specialized engineering required, whereas soft services are crucial for maintaining the daily functionality and aesthetics of the workspace environment.

Sourcing analysis defines how services are managed: either through an in-house team, providing maximum control but often higher fixed costs, or through outsourcing, which leverages external expertise, economies of scale, and specialized technologies. The outsourcing segment is dominant and continues to grow as organizations prioritize core competencies. Furthermore, the market is differentiated by industry vertical, reflecting the distinct requirements of each sector. For instance, the healthcare segment requires strict compliance with hygiene and regulatory standards, while the IT and telecom sector demands zero-downtime maintenance protocols for critical infrastructure. This granular segmentation allows market participants to develop specialized solutions and marketing strategies that resonate with the unique operational challenges of targeted end-users.

- By Service Type

- Hard Facility Management Services (HVAC, Electrical Systems, Plumbing, Fire Safety, Building Fabric Maintenance)

- Soft Facility Management Services (Cleaning, Security, Catering, Landscaping, Waste Management, Pest Control)

- Integrated Facility Management (IFM)

- Other Services (Energy Management, Project Management, Consulting)

- By Sourcing

- In-house

- Outsourced (Single-service, Bundled Service, Integrated Service)

- By Industry Vertical (End-User)

- Commercial (Office Spaces, Corporate Campuses)

- Industrial (Manufacturing, Logistics, Warehousing)

- Infrastructure (Airports, Railways, Public Utilities)

- Government and Public Sector

- Healthcare (Hospitals, Clinics)

- Retail (Shopping Centers, Malls)

- IT and Telecom (Data Centers, Communication Infrastructure)

Value Chain Analysis For Facility Management Services Market

The value chain for Facility Management Services starts with the upstream segment, which involves the sourcing of critical inputs necessary for service delivery. This includes the procurement of advanced technological components (IoT sensors, specialized FMS software, security systems), raw materials (cleaning agents, maintenance supplies), and, crucially, skilled human capital (certified engineers, technicians, security personnel). Relationships with technology vendors, specialized equipment manufacturers, and robust staffing agencies are foundational in the upstream segment. Efficiency at this stage is measured by optimizing procurement costs, ensuring the supply of high-quality, sustainable materials, and guaranteeing the availability of specialized, certified labor resources capable of handling complex integrated systems.

The downstream segment focuses on the delivery of the services to the end-user, involving strategic planning, system integration, service execution, and performance monitoring. Distribution channels for FM services are typically direct, involving long-term contracts established directly between the service provider and the client organization. However, indirect channels sometimes involve property management firms or real estate consultants acting as intermediaries who bundle FM services into broader real estate management packages. Effective downstream execution relies heavily on the quality of the FM technology platform used for scheduling, tracking, and reporting, ensuring compliance with predefined SLAs. The trend toward Integrated FM minimizes fragmentation in the distribution channel, moving toward a single, unified service interface for the client.

Key value drivers throughout the chain include leveraging technology for predictive maintenance, achieving economies of scale through centralized procurement, and enhancing customer satisfaction through proactive service delivery and rigorous performance reporting. Successful FM companies manage the complexity inherent in the chain by integrating disparate services seamlessly and investing heavily in software platforms that provide clients with transparency and real-time data insights. Direct distribution channels are highly favored as they enable personalized relationship management and facilitate quicker adaptation to evolving client requirements, particularly concerning ESG targets and workplace experience enhancements. Optimization across the entire chain determines the provider's competitive edge and profitability.

Facility Management Services Market Potential Customers

Potential customers for Facility Management Services are organizations across all industry sectors that operate physical infrastructure, ranging from single high-rise commercial buildings to vast, multi-site global corporate portfolios. The ideal customers are those facing high operational complexity, stringent regulatory demands, and a strategic need to optimize capital expenditure versus operating expenditure. Large multinational corporations (MNCs) are prime targets, as they require standardized, cross-border IFM solutions that ensure consistency, compliance, and efficiency across different jurisdictions. Organizations in sectors where system uptime is mission-critical, such as data centers, financial institutions, and hospitals, represent high-value customers who prioritize specialized technical expertise and guaranteed performance metrics over simple cost reduction.

Beyond the traditionally dominant commercial real estate sector, there is burgeoning demand from the public sector and infrastructure organizations, including governmental bodies, educational institutions, and public utility companies, which are increasingly seeking outsourced solutions to manage aging infrastructure and address budgetary constraints. Retail chains and large logistic operators also represent significant customer segments, requiring robust security, cleaning, and maintenance protocols tailored to high-traffic environments and vast warehouse spaces. The strategic decision for these potential buyers hinges on balancing the cost-benefit analysis of outsourcing against maintaining internal expertise and control. As regulatory burdens increase and technology advances, the compelling value proposition of outsourcing specialized FM expertise continues to attract even highly conservative organizations.

Specific end-users actively seeking advanced FM solutions are those undergoing digital transformation or those heavily investing in smart building technologies. These organizations require FM partners who can manage complex integrated systems, interpret big data generated by IoT devices, and implement predictive strategies effectively. Facility owners focused on achieving sustainability certifications (like LEED or BREEAM) also constitute key potential customers, as they need FM providers capable of delivering detailed energy management reporting, waste minimization programs, and continuous optimization of building performance to maintain certification status. Ultimately, any organization prioritizing asset longevity, operational resilience, employee well-being, and demonstrable cost savings is a strong candidate for adopting comprehensive FM services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $135.0 Billion |

| Market Forecast in 2033 | $225.5 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sodexo, CBRE Group, JLL, Compass Group, ISS A/S, Cushman & Wakefield, Aramark, Mitie Group, ABM Industries, Tenon Group, OCS Group, G4S (Allied Universal), Dussmann Group, Teleperformance, Tishman Speyer, Colliers International, Serco Group, Johnson Controls, Siemens, IBM |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Facility Management Services Market Key Technology Landscape

The technological landscape of the Facility Management Services market is rapidly evolving, driven by the shift towards digitalization and data-centric operations. Central to this transformation is the adoption of advanced Facility Management Software (FMS) platforms, encompassing Computer-Aided Facility Management (CAFM) and Integrated Workplace Management Systems (IWMS). These systems provide centralized control over assets, maintenance schedules, space utilization, and service request management. Furthermore, the integration of Building Information Modeling (BIM) throughout the building lifecycle allows FM professionals to access comprehensive digital representations of physical assets, enhancing planning accuracy and optimizing lifecycle maintenance strategies, moving beyond traditional paper-based documentation.

The Internet of Things (IoT) represents a foundational technological pillar, involving the deployment of millions of interconnected sensors that monitor performance parameters such as temperature, humidity, energy consumption, and equipment vibration in real-time. This continuous data stream fuels predictive maintenance models powered by Artificial Intelligence (AI) and Machine Learning (ML). These AI/ML algorithms analyze aggregated sensor data to identify anomalies and predict impending failures, enabling just-in-time repairs and drastically improving uptime. The use of robotics for tasks like advanced cleaning, security patrolling, and remote inspection is also gradually increasing, particularly in large industrial and commercial environments, improving efficiency and reducing the exposure of human workers to hazardous tasks.

Cloud computing infrastructure is essential for hosting the vast amounts of data generated by smart buildings and enabling accessibility and scalability for global FM portfolios. Mobile applications designed for both service technicians (for work order management) and facility occupants (for service requests and environment personalization) are critical for improving responsiveness and end-user satisfaction. The maturity of these integrated technologies—from the physical sensors (IoT) to the analytical layer (AI) and the centralized management platform (IWMS)—is defining the modern competitive landscape, favoring providers who can effectively leverage this digital ecosystem to deliver measurable performance improvements and superior operational visibility.

Regional Highlights

- North America: Market Maturity and Technological Leadership

North America currently holds a significant share of the global FM services market, characterized by high adoption rates of outsourced services, especially among large corporations in the U.S. and Canada. The region benefits from stringent regulatory frameworks concerning safety, energy efficiency, and environmental compliance, which necessitate specialized FM expertise. The market here is highly mature, dominated by major global players offering Integrated Facility Management (IFM) contracts. Key growth drivers include the massive presence of data centers requiring complex hard FM services and the early adoption of advanced technologies such as IWMS, AI-driven energy management systems, and sophisticated predictive maintenance protocols. The focus is increasingly shifting towards optimizing the occupant experience and ensuring compliance with evolving ESG reporting standards.

- Europe: Focus on Sustainability and Regulatory Compliance

The European FM market is highly competitive and well-established, with countries like the UK, Germany, and France leading the adoption curve. This region is distinguished by its strong emphasis on sustainability and circular economy principles, driven by landmark EU directives and national green building standards. Demand for energy performance contracting and facility optimization to meet net-zero carbon goals is exceptionally high. The trend of bundling hard and soft services into comprehensive IFM packages is pronounced, particularly in the Nordic countries and Western Europe, where labor costs are high, favoring efficiency through consolidation and digitalization. Technological integration, particularly in using BIM for operational efficiency and IoT for portfolio management, is a key regional highlight, supported by sophisticated national infrastructures.

- Asia Pacific (APAC): Fastest Growing and Infrastructure-Driven Expansion

APAC is projected to be the fastest-growing market during the forecast period, fueled by rapid urbanization, massive infrastructure development, and a booming commercial real estate sector, especially in emerging economies like China, India, and Southeast Asian nations. While the market historically favored fragmented single-service providers, the influx of multinational companies is accelerating the demand for standardized, global IFM models. Key growth drivers include the rapid construction of industrial parks, logistics hubs, and smart cities. Challenges include varying regulatory environments and the need for significant localization in service delivery. However, the region presents immense opportunity for both local and international providers who can scale operations rapidly and integrate digital platforms tailored to large, high-density environments.

- Latin America (LATAM): Emerging Market Potential and Industrialization

The FM market in Latin America is still developing but shows strong potential, primarily driven by industrial growth, foreign investment in manufacturing, and expansion of the commercial sector in countries like Brazil, Mexico, and Chile. The market is often characterized by a greater prevalence of soft FM services initially, followed by the adoption of hard FM as assets age and technical complexity increases. Regulatory and economic instability can be restraints, leading organizations to seek flexible, scalable outsourced contracts. The opportunity lies in providing basic standardization and introducing proven technological solutions that improve transparency and operational consistency across fragmented local portfolios.

- Middle East and Africa (MEA): Large-Scale Project Momentum

Growth in the MEA region is strongly tied to large government-backed infrastructure projects, smart city initiatives (e.g., in Saudi Arabia and UAE), and the continuous expansion of the oil & gas and hospitality sectors. The market demands high-specification, reliable services, often leveraging advanced security technologies and robust maintenance protocols due to extreme environmental conditions. The focus is on large, integrated contracts awarded to global players capable of managing massive, multi-use developments. Digital transformation, especially the adoption of smart building technologies, is a crucial differentiator, positioning MEA as a region prioritizing cutting-edge solutions for rapid, large-scale deployment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Facility Management Services Market.- Sodexo

- CBRE Group

- JLL

- Compass Group

- ISS A/S

- Cushman & Wakefield

- Aramark

- Mitie Group

- ABM Industries

- Tenon Group

- OCS Group

- G4S (Allied Universal)

- Dussmann Group

- Teleperformance

- Tishman Speyer

- Colliers International

- Serco Group

- Johnson Controls

- Siemens

- IBM

Frequently Asked Questions

Analyze common user questions about the Facility Management Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Integrated Facility Management (IFM) and why is it preferred by large corporations?

IFM consolidates all hard and soft FM services under a single contract and vendor, offering unified management, standardized processes, and a single point of accountability. Large corporations prefer IFM because it drives economies of scale, significantly reduces administrative overhead, and ensures consistent quality and compliance across expansive, multi-regional portfolios, leading to higher operational efficiency.

How does the Internet of Things (IoT) influence facility maintenance strategies?

IoT sensors collect real-time data on asset performance, occupancy, and environmental conditions. This data enables a critical shift from reactive or time-based preventative maintenance to sophisticated predictive maintenance. By analyzing sensor data, FM providers can anticipate equipment failure and schedule repairs precisely when needed, minimizing downtime and optimizing resource allocation.

Which industry vertical demonstrates the fastest growth potential for specialized FM services?

The IT and Telecom sector, particularly the Data Center segment, exhibits the fastest demand growth for specialized FM services. Data centers require highly resilient and complex hard FM solutions with stringent Service Level Agreements (SLAs) regarding uptime, cooling, and power management. Providers specializing in mission-critical environments are leveraging this high-value, high-growth opportunity.

What are the primary challenges restraining market growth in emerging economies?

Primary challenges include highly fragmented local service markets, the lack of standardization in regulatory frameworks, and insufficient investment in necessary digital infrastructure required for sophisticated FMS platforms. Additionally, a shortage of locally available technicians trained in modern, complex building automation systems limits service quality and scalability.

What role does sustainability play in modern Facility Management contracts?

Sustainability is now a core requirement. Modern FM contracts frequently mandate services focused on minimizing environmental impact, including advanced energy management, water conservation, and certified waste management programs. FM providers are tasked with helping clients achieve green building certifications and meet corporate Environmental, Social, and Governance (ESG) reporting objectives.

Why is outsourcing becoming the predominant sourcing model over in-house management?

Outsourcing allows organizations to focus resources exclusively on core business activities while leveraging the specialized expertise, technology, and economies of scale offered by professional FM providers. It also converts unpredictable capital expenditures into predictable operating expenses and ensures adherence to increasingly complex global compliance standards, making it the financially and strategically superior option for most large entities.

How is digital twin technology being utilized within facility management?

Digital twin technology creates a virtual replica of a physical facility, allowing managers to simulate operational changes, test maintenance scenarios, and monitor real-time performance without impacting the live environment. This greatly enhances predictive analysis, space planning efficiency, and the optimization of energy system controls, leading to more informed and less disruptive decision-making.

What is the significance of the post-pandemic focus on air quality within FM services?

The post-pandemic era has elevated indoor air quality (IAQ) from a comfort factor to a health necessity. FM services now include advanced monitoring, ventilation optimization (HVAC adjustments based on CO2 levels and occupancy), and filtration system upgrades. Providers specializing in resilient building systems and real-time IAQ reporting are addressing this critical new tenant and employee welfare requirement.

How do Facility Management Services contribute to asset lifecycle management?

FM services contribute by extending the operational lifespan of physical assets (HVAC units, elevators, structural components) through proactive and predictive maintenance. By minimizing wear and tear, reducing unplanned failures, and providing data-driven insights into asset health, FM optimizes replacement cycles and maximizes the Return on Investment (ROI) of building infrastructure over its entire lifespan.

What defines the upstream segment of the FM services value chain?

The upstream segment involves the strategic procurement and supply of foundational resources, including technology components (like advanced sensors and FMS licenses), maintenance materials, and, most crucially, the acquisition and retention of highly skilled and certified labor forces (engineers, technicians, and specialized contractors). Efficiency here dictates cost structure and service quality downstream.

In which region are Integrated Workplace Management Systems (IWMS) seeing the highest adoption rates?

North America and Western Europe demonstrate the highest adoption rates for IWMS. This is driven by their market maturity, the prevalence of large corporate campuses managing vast real estate portfolios, and a strong corporate culture emphasizing space utilization analytics and regulatory compliance reporting, necessitating centralized software solutions.

How are mergers and acquisitions affecting the competitive landscape of the FM market?

M&A activities are leading to market consolidation, allowing large global players to quickly expand their geographical reach, acquire specialized technical capabilities (especially in digital services and critical infrastructure), and achieve greater economies of scale. This trend often results in fewer, larger providers capable of offering comprehensive, standardized global IFM contracts.

What challenges do FM providers face regarding data privacy and security?

As FM systems become highly digitized and interconnected (BMS, IoT), providers face increasing challenges in securing vast amounts of sensitive operational and occupancy data from cyber threats. Compliance with international data protection regulations (like GDPR) and ensuring the integrity and confidentiality of client data are critical hurdles that necessitate robust cybersecurity infrastructure.

Why is the retail sector a rapidly evolving end-user for FM services?

The retail sector, facing intense pressure from e-commerce, is prioritizing store environment and customer experience. FM services support this by ensuring optimal store functionality, rapid maintenance response times, reliable security, and high standards of cleanliness, all crucial for maintaining foot traffic and brand image across diverse store formats and locations.

How do governments act as both restraints and drivers in the FM market?

Governments act as drivers through mandates for energy efficiency, stringent safety codes, and large-scale public infrastructure projects requiring outsourced management. They act as restraints through complex and fragmented local labor laws and procurement processes that can complicate service delivery for multinational FM providers seeking operational standardization.

What constitutes the core function of Hard Facility Management Services?

Hard FM services relate directly to the physical structure and fixed assets of a building. Their core function is to ensure the building’s essential structural and mechanical systems—such as HVAC, electrical wiring, plumbing, and structural integrity—are maintained, legally compliant, and operating safely and efficiently throughout their intended lifecycle.

How does the facility management market cater to the rise of hybrid work models?

FM services adapt to hybrid work by focusing on flexible space utilization analysis, enhanced cleaning protocols for fluctuating occupancy, and 'smart office' technology implementation (like desk booking systems and personalized environmental controls). This ensures efficient management of dynamically changing space needs and superior amenity support for varying levels of office attendance.

What differentiates facility management from property management?

Property management focuses on the financial, legal, and occupancy aspects of real estate (e.g., leasing, tenant relations, rent collection). Facility management focuses on the operational performance and physical maintenance of the building and its services (e.g., security, maintenance, utilities, cleaning) to ensure the building is functional and supports the core business activities within.

Explain the concept of 'Servitization' within the Facility Management industry.

Servitization is the business model shift where manufacturers or technology providers integrate their product offerings with continuous, performance-based services. In FM, this means equipment manufacturers not only sell their products (like elevators or HVAC systems) but also contractually guarantee and manage their maintenance and optimal performance over their lifespan, charging based on outcome rather than just the service delivery input.

What are the primary advantages of utilizing robotic systems in facility maintenance?

Robotic systems offer advantages in safety, consistency, and efficiency. They can handle repetitive tasks (like floor cleaning or security patrolling) with unwavering quality, operate in hazardous environments, and cover large areas rapidly, often contributing to reduced labor costs and allowing human staff to focus on more complex, decision-intensive maintenance tasks.

How does expertise in energy management create a competitive advantage for FM providers?

Energy management expertise is a significant advantage because energy costs are often the largest variable operating expense for facilities. Providers who can guarantee measurable reductions in energy consumption through optimization strategies, smart technologies, and favorable utility contract negotiation offer a clear, quantifiable ROI, highly valued by cost-conscious clients aiming for sustainability targets.

What is the role of BIM in modern Facility Management operations?

Building Information Modeling (BIM) provides a centralized, accurate digital model of the building and its assets, including all technical specifications, warranties, and maintenance histories. In FM, BIM aids in space management, planning complex repairs, optimizing asset placements, and integrating seamlessly with CAFM systems to ensure precise and timely maintenance throughout the asset lifecycle.

Why is staff upskilling essential for successful AI and IoT integration in FM?

As systems become technologically advanced, FM staff require new skills to manage, operate, and interpret the data outputs from AI algorithms and IoT networks. Upskilling is essential to prevent technology from being underutilized, ensuring technicians can perform complex diagnostics, manage integrated systems, and maintain high standards of service quality in a digital environment.

How does facility management support corporate resilience and disaster recovery?

FM services support resilience by implementing robust preventative maintenance, redundant system checks, and comprehensive disaster recovery plans. Providers ensure critical systems remain operational during disruptions (e.g., power failures, extreme weather) and manage quick post-disaster recovery, minimizing business interruption and protecting core assets and human capital.

What is the current trend regarding the contract duration in the FM market?

There is a growing trend towards longer-term contracts (often 5 to 10 years, particularly for IFM) between clients and providers. This allows the provider to amortize their initial investment in technology and specialized training, while the client benefits from predictable pricing, stable service delivery, and the strategic commitment required for long-term asset optimization and sustainability programs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager