Factory Automation & Industrial Controls Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433267 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Factory Automation & Industrial Controls Market Size

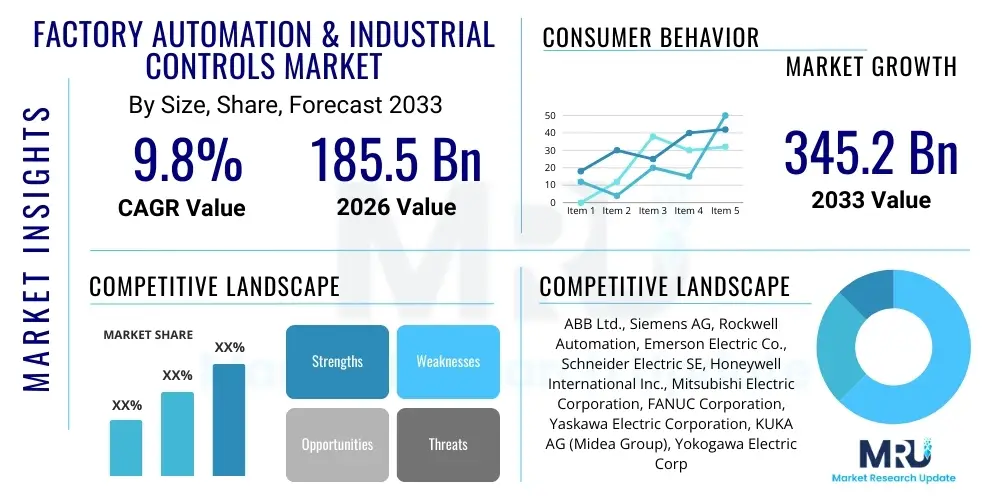

The Factory Automation & Industrial Controls Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at $185.5 Billion in 2026 and is projected to reach $345.2 Billion by the end of the forecast period in 2033.

Factory Automation & Industrial Controls Market introduction

The Factory Automation & Industrial Controls Market encompasses the hardware and software solutions designed to optimize and manage manufacturing processes, minimizing human intervention, enhancing precision, and increasing production throughput. Core products driving this market include Programmable Logic Controllers (PLCs), Distributed Control Systems (DCS), Supervisory Control and Data Acquisition (SCADA) systems, Industrial Robotics, Human-Machine Interfaces (HMIs), and advanced sensing devices. These technologies are crucial for realizing the vision of Industry 4.0, which emphasizes connectivity, real-time data exchange, and cyber-physical systems integration across the entire operational technology (OT) and information technology (IT) stack. The implementation of automation solutions allows manufacturing facilities to achieve unprecedented levels of efficiency, reduce operational expenditure, and maintain consistently high product quality, particularly in highly regulated or complex production environments such as automotive, pharmaceuticals, and semiconductor manufacturing.

The primary benefit derived from factory automation is the enhancement of operational resilience and flexibility. Modern industrial control systems allow manufacturers to rapidly reconfigure production lines in response to fluctuating market demands or customized product specifications, a phenomenon often referred to as 'mass customization.' Furthermore, automated systems excel in environments that are hazardous or repetitive, thereby improving worker safety and freeing up human capital for complex, creative problem-solving tasks. The market’s current trajectory is strongly influenced by the global shortage of skilled industrial labor and the continuous pressure on manufacturing firms, especially those based in high-wage economies, to maintain cost competitiveness through technological superiority.

Major applications span both discrete manufacturing (e.g., electronics assembly, packaging) and process industries (e.g., oil and gas, chemicals, food and beverage). Key driving factors include the rapid adoption of Industrial Internet of Things (IIoT) architectures, the decreasing cost of high-performance sensors and computing power, and governmental mandates across several key nations pushing for the digitalization of domestic manufacturing capabilities. The market is transitioning from isolated, proprietary control systems towards open, interoperable platforms that facilitate seamless data sharing and integration with enterprise resource planning (ERP) systems, enabling holistic business optimization.

Factory Automation & Industrial Controls Market Executive Summary

The Factory Automation & Industrial Controls Market is experiencing robust expansion, fundamentally driven by the global imperative for sustainable, highly efficient manufacturing (Industry 4.0). Business trends emphasize the shift from centralized control toward decentralized, edge-based architectures, necessitating greater investment in secure, reliable industrial networking infrastructure, particularly 5G integration for high bandwidth and low latency communications within factory floors. Furthermore, there is a clear migration toward subscription-based software and services models (Automation-as-a-Service), allowing smaller enterprises to access sophisticated control capabilities without prohibitive upfront capital investment. Supply chain resilience, following recent global disruptions, has accelerated the adoption of localized, highly automated production centers, boosting demand for agile robotics and modular manufacturing solutions.

Regional trends indicate that Asia Pacific (APAC) remains the dominant region in terms of both consumption and manufacturing capacity, fueled by massive government investments in smart manufacturing initiatives in countries like China, Japan, and South Korea, particularly within the electronics and automotive sectors. North America and Europe, while having higher technology maturity, focus heavily on modernization and retrofitting existing brownfield sites with advanced control systems and cybersecurity enhancements to protect critical operational technology (OT) assets. The most critical segments driving market value are Industrial Robotics, due to continuous advancements in collaborative robots (cobots) and AI-driven vision systems, and the burgeoning Machine Vision segment, which is essential for quality control in high-precision manufacturing processes such as semiconductor fabrication.

Segment trends reveal a significant divergence in growth rates. Traditional PLC/DCS hardware is growing steadily but facing margin compression due to commoditization and virtualization efforts. In contrast, advanced software segments, including Manufacturing Execution Systems (MES) and industrial AI/ML platforms designed for predictive maintenance and operational optimization, are exhibiting high double-digit growth. The convergence of IT and OT networks (IT/OT Convergence) is a defining segment trend, creating both substantial opportunities for comprehensive system integrators and significant challenges related to data harmonization, network security, and standardization across disparate industrial protocols. Manufacturers are increasingly seeking integrated solutions rather than disparate components, favoring vendors who can offer a complete ecosystem from sensor to cloud.

AI Impact Analysis on Factory Automation & Industrial Controls Market

Common user questions regarding AI's influence in the Factory Automation & Industrial Controls Market frequently revolve around practical deployment challenges, return on investment (ROI) calculation, and the security implications of integrating intelligent algorithms into operational technology (OT) systems. Users often inquire about how AI transitions from merely offering predictive analytics to enabling true prescriptive control—that is, systems autonomously deciding and executing optimal adjustments without human override. Key concerns center on the reliability and interpretability of complex machine learning models (the 'black box' problem) when applied to mission-critical processes, as regulatory compliance demands clear traceability of control decisions. Furthermore, significant attention is placed on data governance, specifically how to secure the massive volumes of sensor data required to train these sophisticated models, and the perceived threat of AI replacing skilled technicians versus acting as a powerful augmentation tool.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming industrial control paradigms, moving them from reactive or preventative models to proactive, cognitive operational frameworks. AI algorithms are particularly valuable in processing unstructured and high-volume data streams generated by IIoT sensors, providing deep insights into asset health, energy consumption patterns, and product quality anomalies that traditional rule-based systems overlook. This capability is paramount for implementing highly effective predictive maintenance schedules, drastically reducing unplanned downtime, which is the single largest cost driver in capital-intensive industries. Cognitive automation is enabling smarter decision-making on the factory floor, allowing machines to dynamically adjust parameters—such as speed, temperature, and pressure—in real-time to maintain peak efficiency despite environmental or material variability.

This transformative shift, however, requires substantial upfront investment in modernizing legacy control infrastructure and developing specialized talent capable of deploying and managing industrial AI applications. Successful AI adoption necessitates a robust, low-latency industrial network (often leveraging 5G and edge computing) to ensure that processing and control decisions occur instantaneously where the data is generated. The ethical and operational challenge of establishing clear boundaries between human oversight and automated AI control remains a critical point of focus for system developers and end-users alike, striving to maximize autonomous operation while maintaining safety and compliance standards.

- Enhanced Predictive Maintenance: AI models analyze vibration, temperature, and current data to forecast equipment failure with high accuracy.

- Optimized Process Control: Machine Learning algorithms continuously fine-tune control loops, minimizing waste and maximizing energy efficiency.

- Cognitive Robotics: AI-driven vision systems and path planning enable robots to handle highly variable tasks and collaborate safely with humans (Cobots).

- Improved Quality Assurance: Deep learning models automatically detect subtle defects in real-time, significantly surpassing human inspection capabilities.

- Autonomous Decision Making: Systems utilize reinforced learning to make complex operational choices in dynamic industrial environments.

- Cybersecurity Enhancement: AI detects anomalous network behavior indicative of cyber threats within the sensitive OT environment.

- Digital Twin Simulation: AI enhances the fidelity and predictive power of digital twin models used for process optimization and virtual commissioning.

DRO & Impact Forces Of Factory Automation & Industrial Controls Market

The Factory Automation & Industrial Controls Market is highly dynamic, governed by powerful drivers related to global economic competition and technological maturity, while simultaneously facing significant adoption hurdles. Key drivers include the widespread governmental push, such as Germany's Industry 4.0 and China's Made in China 2025, promoting national industrial digitalization, coupled with the escalating cost of manual labor, which makes automation the financially superior long-term strategy for operational sustainability. The opportunity landscape is vast, particularly in retrofitting brownfield sites with IIoT and cloud connectivity, alongside the emerging potential of integrating 5G networks and advanced machine vision technologies into existing control systems, offering new paradigms for data handling and real-time control.

Restraints primarily stem from the substantial capital expenditure required for initial system deployment, particularly for small and medium-sized enterprises (SMEs), and the pervasive challenge of integrating heterogeneous, often proprietary, legacy systems (brownfield compatibility) with modern, open-architecture platforms. The shortage of skilled personnel proficient in integrating and maintaining converged IT/OT infrastructure represents a critical limiting factor. Furthermore, the increasing connectivity introduces heightened cybersecurity risks; industrial control systems (ICS) must be rigorously protected against sophisticated cyber threats, demanding continuous investment in defense and monitoring solutions, which adds complexity and cost.

Impact forces are centered on competitive pressure and technological disruption. The increasing capability of collaborative robots is disrupting traditional industrial robot markets, making automation accessible to smaller batch production. Simultaneously, the proliferation of low-cost sensors and edge processing capabilities is democratizing advanced analytics. The primary impact force is the necessity for vendors to transition from hardware sales to offering outcome-based service models (servitization), integrating advanced software, data analytics, and continuous support to ensure long-term customer value, thereby altering traditional vendor-customer relationships and accelerating market consolidation among system integrators with strong software competencies.

Segmentation Analysis

The Factory Automation & Industrial Controls Market is comprehensively segmented across components, types, control systems, and end-use industries, reflecting the broad spectrum of technological solutions required by modern manufacturing. Components, including sensors, controllers, and communication devices, form the technological bedrock, while types delineate the operational capability, such as fixed or flexible automation. Control systems, ranging from PLCs utilized for discrete, localized tasks to sophisticated DCS employed in continuous process operations, define the complexity and scale of automation applied. The detailed segmentation by end-use industry highlights tailored solutions for sectors like automotive, which demands precision and speed, pharmaceuticals, requiring rigorous validation, and heavy industries like Oil & Gas, demanding extreme reliability and safety in hazardous environments, allowing vendors to target specific vertical market needs effectively.

- Component:

- Sensors (Proximity, Temperature, Vision)

- Controllers (PLC, PAC, IPC)

- Industrial Robots (Articulated, SCARA, Delta, Collaborative)

- Actuators and Drives

- Communication Systems (Industrial Ethernet, Fieldbus, Wireless)

- Human Machine Interface (HMI)

- Type:

- Fixed Automation

- Flexible Automation

- Integrated Automation

- Control System:

- Distributed Control System (DCS)

- Supervisory Control and Data Acquisition (SCADA)

- Manufacturing Execution System (MES)

- Product Lifecycle Management (PLM)

- End-Use Industry:

- Automotive

- Food & Beverage

- Pharmaceutical & Biotechnology

- Semiconductor & Electronics

- Oil & Gas

- Chemicals

- Aerospace & Defense

- Power Generation

Value Chain Analysis For Factory Automation & Industrial Controls Market

The value chain for Factory Automation & Industrial Controls begins with upstream activities dominated by specialized component manufacturers (semiconductors, raw sensors, basic communication modules) who provide critical technological building blocks. This segment is highly fragmented, with intense competition focused on precision, miniaturization, and ruggedness suitable for industrial environments. Moving downstream, the middle segment involves system and software developers who integrate these components into functional control systems (PLCs, DCS, SCADA software) and develop the specialized application programming necessary for specific industrial tasks. This stage is characterized by intellectual property ownership and the creation of proprietary industrial platforms (e.g., Siemens TIA Portal or Rockwell Automation Logix Platform).

Distribution channels are multifaceted, utilizing both direct and indirect models. For large-scale, complex projects involving entirely new factory builds (greenfield), major automation vendors (e.g., ABB, Schneider Electric, Emerson) typically employ a direct sales model, working closely with engineering, procurement, and construction (EPC) firms and providing comprehensive service and installation support. Conversely, indirect distribution, involving specialized industrial distributors and certified system integrators, is crucial for serving small and medium-sized enterprises (SMEs), selling replacement parts, and executing brownfield upgrades. These integrators play a vital role in providing local expertise, customization, and after-sales support, bridging the gap between sophisticated vendor technology and the end-user's specific operational requirements.

The final stage involves the end-users and post-deployment service provision. Downstream analysis reveals that value creation heavily relies on robust after-market services, including software updates, predictive maintenance contracts, training, and operational support. The increasing prevalence of software-defined automation means that recurring service revenue streams are becoming significantly more important than initial hardware sales. Vendors who successfully offer integrated digital services, such as remote monitoring and cloud-based analytics, capture higher long-term value within this ecosystem, fundamentally shifting the traditional transactional relationship to a partnership focused on continuous operational improvement and uptime guarantees.

Factory Automation & Industrial Controls Market Potential Customers

Potential customers for Factory Automation & Industrial Controls solutions are broadly classified into two major categories: discrete manufacturers and process industries, each with unique requirements and purchasing drivers. Discrete manufacturers, including the automotive, electronics, and aerospace sectors, are typically focused on enhancing precision, optimizing assembly processes, and achieving flexibility for custom product runs. These buyers frequently require advanced robotics (especially collaborative robots for human interaction), high-speed machine vision systems for quality verification, and modular PLC/PAC architectures that can be quickly reconfigured to address rapid product lifecycle changes and volatile market demands. Their key procurement criteria emphasize integration ease, scalability, and adherence to stringent industry-specific standards like ISO certifications for traceability.

Process industries, encompassing Oil & Gas, Chemicals, Pharmaceuticals, and Food & Beverage, prioritize safety, regulatory compliance, and system reliability given the continuous nature of their operations. These customers are the primary buyers of Distributed Control Systems (DCS) and SCADA, demanding highly robust, redundant, and fault-tolerant control architectures to manage variables such as temperature, flow, and pressure across extensive geographical or operational footprints. For pharmaceutical manufacturers, validation and compliance (e.g., FDA 21 CFR Part 11) are non-negotiable, necessitating specialized MES and batch control systems. In hazardous environments like Oil & Gas, intrinsic safety and cyber resilience are paramount purchasing factors, driving demand for specialized intrinsically safe HMIs and advanced process safety systems.

Furthermore, small to medium-sized enterprises (SMEs) represent a rapidly expanding customer base, particularly those looking to leverage automation to compete with larger global players. Their purchasing behavior is distinct, often favoring scalable, cost-effective solutions like smaller collaborative robots (cobots) and cloud-based Manufacturing Execution Systems (MES) delivered as a service. These customers often rely heavily on local system integrators for turn-key deployment and operational maintenance, seeking solutions that minimize high initial capital outlay and technical complexity, making ease of deployment and user-friendliness critical differentiators in winning their business.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.5 Billion |

| Market Forecast in 2033 | $345.2 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, Rockwell Automation, Emerson Electric Co., Schneider Electric SE, Honeywell International Inc., Mitsubishi Electric Corporation, FANUC Corporation, Yaskawa Electric Corporation, KUKA AG (Midea Group), Yokogawa Electric Corporation, OMRON Corporation, General Electric (GE), Bosch Rexroth AG, Delta Electronics, Inc., Keyence Corporation, Cognex Corporation, Endress+Hauser Group Services AG, Fuji Electric Co., Ltd., National Instruments Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Factory Automation & Industrial Controls Market Key Technology Landscape

The technological landscape of Factory Automation & Industrial Controls is undergoing rapid transformation, largely centered on the operationalization of the Industrial Internet of Things (IIoT). This involves deploying sophisticated sensor networks and high-bandwidth communication protocols like Industrial Ethernet and the imminent rollout of 5G, which provides the low latency and massive device density required for real-time control applications across large factory environments. Crucially, the move towards modular and software-defined automation, epitomized by technologies such as virtualization of control functions and the use of open platform communications (OPC UA) standards, is facilitating greater interoperability between diverse vendor equipment, which was previously a significant barrier to holistic system optimization. This open approach is essential for achieving the flexibility demanded by modern manufacturing processes.

Edge computing represents a paradigm shift in data processing within the industrial domain. Instead of relying solely on centralized cloud resources, critical data processing and control loop execution are migrating to the network edge, closer to the machines and sensors. This decentralization dramatically reduces latency, ensuring that time-sensitive decisions—such as emergency shutdowns or instantaneous robotic adjustments—can be made reliably and securely on-premise, independent of cloud connectivity issues. Technologies like micro-PLCs integrated with advanced processing capabilities and machine learning inference engines are driving this trend. This localized intelligence not only boosts operational speed but also addresses growing concerns regarding data residency and security by keeping sensitive operational data within the secure factory perimeter.

Two other critical technologies are Machine Vision and Digital Twin implementation. Advanced Machine Vision systems, utilizing high-resolution cameras and AI-driven deep learning models, are now standard for high-precision inspection, guidance, and quality control, particularly in semiconductor, electronics, and complex assembly lines, far exceeding the speed and accuracy of traditional vision algorithms. Concurrently, Digital Twins—virtual replicas of physical assets, processes, or entire factories—are leveraged for process optimization, predictive maintenance simulation, and virtual commissioning. These twins are continuously updated with real-time sensor data and enhanced by sophisticated simulation and AI modeling, allowing manufacturers to test changes, train operators, and optimize throughput without risking disruption to the actual production line, thereby reducing time-to-market and commissioning costs substantially.

Regional Highlights

- Asia Pacific (APAC): Dominates the market both in revenue and growth rate, primarily driven by massive government investments in smart factory initiatives (e.g., China's transition from volume to quality manufacturing) and the rapid expansion of the consumer electronics and automotive manufacturing sectors across Southeast Asia. China and South Korea are key markets for high-end robotics and semiconductor fabrication automation.

- North America: Characterized by high technological maturity and robust adoption of advanced solutions like IIoT, MES, and predictive analytics. The focus is heavily on modernizing aging infrastructure (brownfield sites), energy efficiency, and leveraging automation to counteract high labor costs, particularly strong in the aerospace, pharmaceuticals, and oil and gas sectors.

- Europe: A mature market defined by strong standardization efforts (e.g., standardization related to Industry 4.0 architecture) and stringent regulatory environments. Germany leads in adopting highly sophisticated and specialized automation equipment, focusing heavily on precision engineering and sustainable manufacturing practices, with high uptake of collaborative robotics and decentralized control systems.

- Latin America (LATAM): Exhibits moderate growth, concentrated in resource-based industries (mining, energy, agriculture) and automotive assembly in Mexico and Brazil. Market growth is often volatile, dependent on foreign direct investment and commodity prices, but shows increasing demand for scalable SCADA and basic automation components for operational safety and efficiency improvements.

- Middle East and Africa (MEA): Primarily driven by substantial investments in the Oil & Gas, petrochemical, and large-scale infrastructure projects. Key demand lies in robust Distributed Control Systems (DCS) and safety instrumented systems (SIS) required for high-reliability, mission-critical operations, with emerging demand for automation in logistics and renewable energy sectors in the UAE and Saudi Arabia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Factory Automation & Industrial Controls Market.- ABB Ltd.

- Siemens AG

- Rockwell Automation, Inc.

- Emerson Electric Co.

- Schneider Electric SE

- Honeywell International Inc.

- Mitsubishi Electric Corporation

- FANUC Corporation

- Yaskawa Electric Corporation

- KUKA AG (Midea Group)

- Yokogawa Electric Corporation

- OMRON Corporation

- General Electric (GE)

- Bosch Rexroth AG

- Delta Electronics, Inc.

- Keyence Corporation

- Cognex Corporation

- Endress+Hauser Group Services AG

- Fuji Electric Co., Ltd.

- National Instruments Corporation (now part of Emerson)

Frequently Asked Questions

Analyze common user questions about the Factory Automation & Industrial Controls market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high growth rate of the Factory Automation market?

The primary driver is the widespread global adoption of Industry 4.0 principles, necessitating end-to-end connectivity, real-time data analytics, and flexible manufacturing capabilities, coupled with increasing global labor costs making automation economically essential for maintaining competitive advantage.

How is IT/OT convergence impacting industrial control systems?

IT/OT convergence facilitates unified data access and management across the operational floor and enterprise systems, enabling advanced functions like cloud-based performance monitoring, predictive maintenance, and streamlined supply chain integration, though it introduces significant cybersecurity and standardization challenges.

What role do Collaborative Robots (Cobots) play in modern factory automation?

Cobots are crucial for flexible automation and human-robot collaboration, allowing for safe, easy integration into existing production lines without extensive safeguarding. They address high-mix, low-volume production needs and are rapidly being adopted by SMEs due to their ease of programming and lower footprint.

What are the key cybersecurity concerns within the Operational Technology (OT) domain?

Key concerns involve protecting critical infrastructure from sophisticated cyber threats such as ransomware and unauthorized control access, given that legacy industrial systems were not designed with modern security protocols. Solutions focus on network segmentation, continuous monitoring, and secure remote access protocols for Industrial Control Systems (ICS).

Which end-use industry holds the largest market share for factory automation?

The Automotive industry traditionally holds the largest share due to its reliance on high-volume, precision manufacturing processes, though the Semiconductor and Electronics sector is exhibiting the fastest growth due to the immense demand for rapid capacity expansion and stringent quality control requirements for microchip production.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager