FACTS Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435442 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

FACTS Devices Market Size

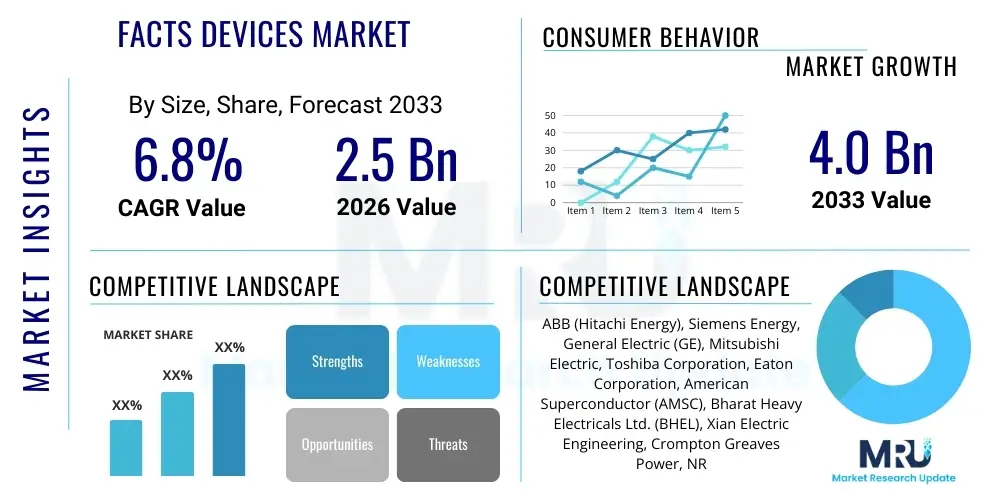

The FACTS Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 4.0 Billion by the end of the forecast period in 2033.

FACTS Devices Market introduction

The Flexible AC Transmission Systems (FACTS) Devices Market encompasses advanced power electronics-based controllers designed to enhance the performance, stability, and control of AC transmission grids. FACTS devices manage power flow, improve transient stability, and optimize voltage profiles within existing transmission infrastructure, thereby mitigating bottlenecks and delaying the need for costly new transmission line construction. These systems are crucial components in modern smart grids, enabling transmission system operators (TSOs) to operate their networks closer to their thermal limits while maintaining operational reliability and security. The core benefit derived from these devices is the ability to instantaneously manage reactive power and impedance, facilitating greater power transfer capabilities and ensuring grid resilience against disturbances.

Major applications of FACTS devices span across enhancing power transfer capacity in long-distance corridors, dampening power oscillations, controlling loop flows, and improving the quality of power supplied, particularly in networks heavily integrated with volatile renewable energy sources. Specific devices such as Static VAR Compensators (SVC), Static Synchronous Compensators (STATCOM), Thyristor Controlled Series Compensators (TCSC), and Unified Power Flow Controllers (UPFC) cater to different grid control requirements, ranging from shunt compensation for voltage control (SVC, STATCOM) to series compensation for power flow manipulation (TCSC, UPFC). The versatility of these applications makes FACTS technology indispensable for utilities striving for operational efficiency and robustness in dynamic grid environments.

The market growth is primarily driven by the global imperative to upgrade aging power infrastructure and the rapid integration of intermittent renewable energy sources, such as solar and wind power, into transmission systems. These renewables introduce significant variability, requiring dynamic compensation tools like FACTS devices to stabilize the grid and manage fluctuating power flows efficiently. Furthermore, increasing urbanization and industrialization necessitate reliable and high-quality power delivery, pushing TSOs to invest in sophisticated control technologies. The economic benefit of maximizing the use of existing transmission assets, rather than incurring significant capital expenditure on new lines, serves as a compelling financial driver for the adoption of FACTS solutions worldwide.

FACTS Devices Market Executive Summary

The FACTS Devices market is characterized by robust growth driven by escalating demands for grid stability and the widespread global transition towards renewable energy integration. Key business trends include a significant shift towards Voltage Source Converter (VSC)-based technologies, particularly STATCOMs, due to their superior dynamic performance and smaller physical footprint compared to traditional line-commutated technologies like SVCs. Furthermore, strategic partnerships and mergers among major electrical equipment manufacturers and grid automation specialists are accelerating the development of hybrid and modular FACTS solutions, tailored for easier deployment and scalability in diverse operational environments. The imperative to digitalize transmission assets is also catalyzing demand for smart FACTS devices equipped with advanced monitoring, diagnostics, and communication capabilities compatible with modern Supervisory Control and Data Acquisition (SCADA) and Energy Management Systems (EMS).

Segment trends indicate that the series compensation segment, notably TCSC and TSSC, is gaining traction in areas where power flow control across lengthy transmission corridors is critical, especially in regions like North America and Asia Pacific with extensive cross-country grids. However, the shunt compensation segment, dominated by STATCOMs, maintains the largest market share owing to its fundamental role in rapid voltage support, which is essential for managing the volatility introduced by large-scale wind and solar farms. Component-wise, the demand for high-power semiconductor components, such as Insulated Gate Bipolar Transistors (IGBTs) and Thyristors, remains high, forming the core technological bottleneck and innovation focus within the manufacturing supply chain. Utilities are increasingly prioritizing medium-voltage FACTS installations for distribution-level reactive power management to enhance localized grid quality.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, primarily fueled by massive infrastructure expansion projects in China, India, and Southeast Asian nations that require dynamic power system stabilization to support rapid industrial growth and electrification efforts. North America and Europe represent mature markets, where growth is driven less by capacity expansion and more by grid modernization, asset replacement, and the need to integrate ambitious renewable energy targets mandated by regulatory frameworks. Latin America and the Middle East & Africa (MEA) are emerging markets, showing steady adoption rates as developing nations invest in improving the reliability of their nascent or existing transmission networks to accommodate rising energy consumption and reduce transmission losses.

AI Impact Analysis on FACTS Devices Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and FACTS devices predominantly revolve around how AI can enhance the performance, predictive maintenance, and operational lifespan of these complex controllers. Common questions center on utilizing machine learning (ML) algorithms for optimal reactive power scheduling, anticipating grid instabilities before they necessitate traditional reactive intervention, and automating the precise tuning of FACTS control parameters under highly dynamic load conditions. Users are particularly concerned with the potential for AI to optimize the massive capital investment in FACTS equipment by ensuring maximum operational uptime and minimizing component stress through intelligent, proactive control adjustments, moving beyond traditional proportional-integral-derivative (PID) control schemes towards data-driven, adaptive strategies.

The implementation of AI/ML algorithms offers a transformative potential for the FACTS devices market by enabling sophisticated predictive diagnostics and anomaly detection. Traditional monitoring systems often rely on threshold alarms, whereas AI can analyze multivariate sensor data from the FACTS hardware (e.g., thermal signatures, voltage harmonics, switching patterns) to predict component failure probability hours or days in advance. This shift from reactive or time-based maintenance to predictive, condition-based maintenance significantly lowers operational costs, reduces unscheduled downtime, and enhances the overall return on investment for utility owners. Furthermore, AI-driven control models can learn the complex, non-linear dynamics of large interconnected power systems, allowing FACTS devices to respond optimally and instantaneously to system disturbances, far surpassing the capabilities of static, pre-programmed control logic.

Moreover, AI is playing a critical role in the planning and placement of FACTS devices within the transmission network. Advanced simulation and optimization tools powered by ML can analyze vast datasets concerning historical load profiles, system vulnerabilities, and renewable generation forecasts to determine the optimal type, rating, and location of new FACTS installations. This strategic planning capability ensures that capital expenditure is directed towards solutions that yield the maximum possible enhancement in grid stability and transfer capacity. Ultimately, the integration of AI transforms FACTS devices from highly effective control hardware into intelligent, self-optimizing grid assets, crucial for managing the complex, decentralized, and variable energy landscape of the future grid.

- AI enables predictive maintenance scheduling by analyzing component health data.

- Machine learning optimizes reactive power dispatch and voltage profile management dynamically.

- Neural networks facilitate faster and more accurate fault detection within the FACTS hardware.

- AI-powered simulation tools optimize the strategic placement and sizing of new FACTS installations.

- Intelligent control algorithms enhance transient stability by providing adaptive damping control.

- AI improves cybersecurity posture by monitoring and detecting anomalous communication patterns in SCADA interfaces.

DRO & Impact Forces Of FACTS Devices Market

The FACTS Devices Market is influenced by a dynamic interplay of Drivers, Restraints, Opportunities, and macro Impact Forces. Key drivers include the overwhelming global need for grid modernization and the imperative to accommodate large volumes of distributed and intermittent renewable energy sources, which necessitate advanced dynamic control mechanisms to maintain power quality and system security. Restraints primarily involve the substantial initial capital investment required for procurement and installation of high-power electronic equipment, coupled with the complexity associated with integrating these advanced controllers into legacy grid infrastructure and training specialized technical personnel. Opportunities are concentrated in the development of modular, hybrid, and smart FACTS solutions compatible with digital grid environments, offering enhanced flexibility and remote management capabilities, particularly in developing economies prioritizing infrastructure build-out.

The dominant driving factor is the escalating concern over grid congestion and the demand for increased power transfer capacity without constructing new transmission lines, a financially prohibitive and often regulatory-challenging process. FACTS devices provide a cost-effective alternative by dynamically controlling system parameters, unlocking latent capacity within existing infrastructure. Furthermore, increasing regulatory mandates worldwide, aiming for high penetration levels of non-dispatchable renewables (e.g., offshore wind farms requiring stable connection points), significantly boost the adoption of STATCOMs and SVCs for voltage stability. The increasing frequency and severity of extreme weather events also drive demand, as utilities seek FACTS devices to rapidly stabilize systems following major disturbances, improving overall grid resilience and operational security.

Significant restraints also shape the market trajectory. The high cost of power electronic valves, especially IGBTs, and the requirement for specialized infrastructure (e.g., cooling systems, protection schemes) contribute to high upfront expenditure, making deployment challenging for cash-constrained utilities. Additionally, the complex technical nature of FACTS devices necessitates highly specialized engineering expertise for commissioning, operation, and maintenance, often leading to a shortage of qualified personnel. The impact forces acting on the market include fluctuating commodity prices affecting manufacturing costs, geopolitical shifts influencing cross-border energy trade requiring refined power flow control, and technological breakthroughs in semiconductor materials (e.g., Silicon Carbide – SiC) that promise smaller, more efficient, and potentially more cost-effective FACTS devices in the long term, fundamentally altering market competitiveness and device performance envelopes.

Segmentation Analysis

The FACTS Devices Market is comprehensively segmented based on the type of compensation (shunt, series, combined), the technology utilized (VSC-based, Thyristor-based), and the specific end-user application (electric utilities, railways, industrial). This segmentation is crucial for understanding the market dynamics, as different technological variants cater to distinct power system needs. For instance, high-speed, dynamic voltage stabilization required for large wind farms necessitates VSC-based STATCOMs (shunt compensation), whereas regulating power flow across regional interconnectors typically involves TCSC (series compensation). The electric utility segment remains the dominant end-user, but increasing industrial automation and the need for localized power quality improvements in sectors like mining and metals processing are expanding the scope for smaller, specialized FACTS applications.

- By Compensation Type:

- Shunt Compensation (e.g., SVC, STATCOM)

- Series Compensation (e.g., TCSC, TSSC)

- Combined Compensation (e.g., UPFC, IPFC)

- By Technology:

- Voltage Source Converter (VSC) Based

- Thyristor Based (Line-Commutated)

- By Component:

- Power Electronics (IGBTs, Thyristors)

- Control and Protection Systems

- Capacitors and Reactors

- Harmonic Filters

- By Application/End-User:

- Electric Utilities (Transmission & Distribution)

- Industrial (Heavy Manufacturing, Oil & Gas)

- Railways and Traction Systems

Value Chain Analysis For FACTS Devices Market

The value chain for the FACTS Devices Market is complex, involving several distinct stages from upstream raw material sourcing to downstream installation and lifelong maintenance services. The upstream analysis focuses heavily on the procurement of specialized high-power semiconductor components, such as high-voltage IGBT modules, high-current thyristors, and sophisticated cooling systems. Manufacturers rely heavily on a specialized pool of semiconductor and electronics suppliers, making component cost and technological advancement in power electronics a significant factor dictating the final cost and performance characteristics of the FACTS device. Specialized raw materials, including high-grade copper, aluminum for conductors, and advanced dielectrics for capacitors, are also crucial inputs, subjected to global commodity price volatility.

Midstream activities involve the design, manufacturing, assembly, and rigorous testing of the FACTS equipment. This stage is dominated by large, established electrical engineering conglomerates that possess the requisite intellectual property and manufacturing scale. Due to the custom-engineered nature of most high-voltage FACTS installations, significant emphasis is placed on highly specialized design and simulation capabilities to ensure system compatibility with the client's existing grid infrastructure. Quality control, especially concerning the reliability and thermal management of the power electronic valves, is paramount, influencing the long-term operational costs and life expectancy of the device. Modular design concepts and standardization efforts are increasingly influencing the manufacturing processes to improve lead times and reduce site-specific engineering needs.

Downstream analysis encompasses distribution, installation, commissioning, and crucial post-sales services. The distribution channel is primarily direct, involving direct sales teams and engineering firms working in close collaboration with utilities and TSOs, given the highly customized nature of large FACTS projects. Indirect channels may be utilized for smaller, standard low-to-medium voltage compensation solutions. Post-sales support, including system monitoring, software upgrades, predictive maintenance contracts, and spare parts supply, constitutes a major revenue stream. The successful commissioning and integration into the utility’s SCADA system require deep domain expertise, often provided by the original equipment manufacturer (OEM) or specialized system integrators, reinforcing the importance of long-term service agreements in the market structure.

FACTS Devices Market Potential Customers

The primary and largest segment of potential customers for FACTS devices comprises electric utilities, specifically Transmission System Operators (TSOs) and Distribution System Operators (DSOs). TSOs are the fundamental buyers, utilizing high-voltage FACTS devices (e.g., STATCOMs, TCSC, UPFC) to manage bulk power flow across regional and national transmission grids, ensure transient stability, and integrate remote generation sources like massive hydroelectric dams or offshore wind farms. Their purchasing decisions are driven by regulatory compliance, grid reliability targets, and the necessity to increase the power capacity of aging transmission infrastructure without facing regulatory approval delays or the high costs associated with physical expansion. DSOs, on the other hand, are increasingly investing in smaller, modular FACTS solutions for localized voltage support and power quality improvement at the sub-transmission and distribution level, particularly in areas with high penetration of localized solar PV or electric vehicle charging infrastructure.

Another significant customer segment is heavy industry, particularly those sectors characterized by high and rapidly fluctuating power demands, such as mining operations, steel manufacturing (arc furnaces), metals processing, and large chemical plants. These industrial customers often generate significant reactive power demand and harmonic distortion, which can negatively impact the quality of power drawn from the utility grid and damage internal equipment. They deploy smaller-scale, dedicated industrial FACTS devices, primarily industrial STATCOMs or specific active power filters, to mitigate these issues, ensure compliance with utility power quality standards, and enhance the efficiency and stability of their internal electrical networks, protecting sensitive machinery from voltage flicker and transients.

Furthermore, entities involved in specialized energy infrastructure, such as railway and traction systems, constitute a growing customer base. High-speed rail networks, in particular, require reliable and high-quality AC power supply, which can be severely impacted by the highly variable and pulsed loads inherent to electric train operation. FACTS devices are used in these scenarios to compensate for power quality issues, stabilize the supply voltage, and ensure efficient power transfer along the traction line. Other specialized buyers include operators of major international power interconnections and large independent power producers (IPPs) that must guarantee the quality and stability of the power they inject into the utility grid, often utilizing FACTS as a mandatory component for grid connection compliance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB (Hitachi Energy), Siemens Energy, General Electric (GE), Mitsubishi Electric, Toshiba Corporation, Eaton Corporation, American Superconductor (AMSC), Bharat Heavy Electricals Ltd. (BHEL), Xian Electric Engineering, Crompton Greaves Power, NR Electric, Hyosung Heavy Industries, China Electric Power Research Institute (CEPRI), CG Power and Industrial Solutions, RXPE, Grid Solutions (GE), Hyundai Electric, TBEA |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

FACTS Devices Market Key Technology Landscape

The technology landscape of the FACTS Devices market is primarily defined by the evolution from conventional line-commutated, thyristor-based devices to advanced self-commutated, Voltage Source Converter (VSC)-based systems. Thyristor-based technology, exemplified by the Static VAR Compensator (SVC) and Thyristor Controlled Series Compensator (TCSC), remains relevant due to its proven reliability, lower complexity, and lower relative cost for high-power applications, particularly where ultra-fast response times are not the absolute critical requirement. However, these systems have inherent limitations in controlling both active and reactive power simultaneously and generally require large passive components, which results in larger physical footprints and susceptibility to harmonic generation.

The transition toward VSC technology, largely utilized in Static Synchronous Compensators (STATCOMs) and Unified Power Flow Controllers (UPFCs), represents the leading edge of innovation. VSC-based systems offer significantly superior dynamic performance, providing faster response times and the unique capability to regulate voltage independently of the AC system parameters. Crucially, they utilize high-speed power electronic switches, predominantly IGBTs, enabling continuous voltage control and the ability to inject or absorb both leading and lagging reactive power with precision. This superior performance is critical for integrating renewable energy and managing transient stability in modern, highly stressed grids, leading to VSC technology capturing increasing market share, despite the higher initial component cost.

Emerging technological trends further shape the market, including the development of hybrid FACTS configurations that combine the cost-effectiveness and robustness of thyristor technology with the dynamic capabilities of VSC technology to achieve optimized performance. Furthermore, advancements in wide-bandgap semiconductors, specifically Silicon Carbide (SiC) and Gallium Nitride (GaN), hold immense promise for the future of FACTS devices. These materials allow for higher switching frequencies, increased thermal stability, and reduced component size, leading to smaller, more efficient, and lighter FACTS solutions. Alongside hardware innovation, software advancements in control systems and cybersecurity protocols are crucial, ensuring that these complex controllers can be securely and optimally managed within the interconnected smart grid environment.

Regional Highlights

- Asia Pacific (APAC): APAC is the global frontrunner in terms of market growth, driven by massive investments in new transmission infrastructure, particularly in China and India, to support rapidly industrializing economies and extensive renewable energy programs. These regions require FACTS devices not only for grid stabilization but also for increasing the efficiency of long-distance transmission corridors, making devices like TCSC and STATCOM highly demanded.

- North America: This mature market focuses heavily on grid modernization, replacement of aging assets, and ensuring system reliability against natural disasters. High penetration of intermittent renewables (wind farms in the US Midwest, solar in California) drives strong demand for high-speed dynamic compensation solutions, primarily VSC-based STATCOMs, to meet stringent NERC reliability standards.

- Europe: Driven by ambitious decarbonization mandates and the build-out of transnational supergrids (especially in the North Sea region for offshore wind), Europe exhibits high demand for advanced FACTS solutions. Emphasis is placed on cross-border power flow control and damping inter-area oscillations, frequently requiring highly sophisticated devices like UPFC to maximize power transfer capability across interconnected systems.

- Latin America: Growth is steady, fueled by investments in modernizing power systems in countries like Brazil and Mexico. The need to integrate new generation sources and manage the long transmission distances often associated with remote hydro and mining operations makes FACTS technology crucial for improving operational stability and minimizing transmission losses.

- Middle East & Africa (MEA): This region is an emerging market where investment is concentrated in GCC countries focusing on massive power generation capacity additions and developing robust transmission links to handle peak loads (driven by air conditioning). The focus is on robust, high-reliability solutions to handle high ambient temperatures and rapid load changes, primarily SVCs and STATCOMs for voltage stability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the FACTS Devices Market.- Hitachi Energy (formerly ABB Power Grids)

- Siemens Energy

- General Electric (GE)

- Mitsubishi Electric Corporation

- Toshiba Corporation

- Eaton Corporation

- American Superconductor (AMSC)

- Bharat Heavy Electricals Ltd. (BHEL)

- NR Electric Co., Ltd.

- Hyosung Heavy Industries

- CG Power and Industrial Solutions

- Xian Electric Engineering Co., Ltd.

- Sichuan Electric Power Technology (RXPE)

- TBEA Co., Ltd.

- China Electric Power Research Institute (CEPRI)

- Fuji Electric Co., Ltd.

- Hyundai Electric Co., Ltd.

- Crompton Greaves Power and Industrial Solutions Ltd.

- ZPE Systems Inc.

- Ritz Power Systems GmbH

Frequently Asked Questions

Analyze common user questions about the FACTS Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of STATCOM (VSC-based) over SVC (Thyristor-based) technology?

The primary advantage of the Static Synchronous Compensator (STATCOM) is its superior dynamic response time and the ability to control voltage and reactive power independent of the transmission system voltage level. STATCOMs utilize Voltage Source Converters (VSCs) and high-speed IGBTs, allowing for faster, continuous reactive power adjustment compared to the step-wise control and reliance on system voltage inherent in traditional Thyristor-based SVCs. This makes STATCOMs highly effective for managing volatile renewable energy integration.

How do FACTS devices contribute to the integration of renewable energy sources into the existing grid?

FACTS devices are crucial for renewable energy integration by providing dynamic reactive power support and voltage stabilization necessary to counteract the intermittency and inherent voltage fluctuation of wind and solar power generation. Devices like STATCOMs can rapidly absorb or inject reactive power to maintain grid stability and voltage profiles, thereby ensuring that large-scale renewable farms can reliably connect and transfer power across the transmission network without disrupting system reliability.

Which geographical region is expected to demonstrate the highest growth rate in the FACTS Devices Market, and why?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by extensive governmental initiatives in China, India, and Southeast Asia focused on massive infrastructure development, increasing electrification, and substantial investment in large-scale renewable energy projects. These factors necessitate the deployment of FACTS technology to enhance the capacity and stability of rapidly expanding transmission grids.

What are the main factors restraining the wider adoption of FACTS devices by electric utilities?

The main restraining factors include the extremely high initial capital expenditure (CapEx) required for the procurement, installation, and integration of FACTS devices, particularly high-power, customized solutions. Additionally, the complexity of the technology demands highly specialized engineering expertise for operation, commissioning, and long-term maintenance, which represents a significant operational challenge and investment for many utility operators globally.

Can FACTS devices effectively control active power flow, and which device type is specifically used for this purpose?

Yes, certain advanced FACTS devices can effectively control active power flow. The Unified Power Flow Controller (UPFC) is the most versatile device, capable of simultaneously and independently controlling all three transmission parameters: series impedance, shunt reactive power, and phase angle. This allows the UPFC to precisely regulate active power transfer across a transmission line, optimizing loop flows and ensuring efficient power delivery paths.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager