FAKRA Connectors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435060 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

FAKRA Connectors Market Size

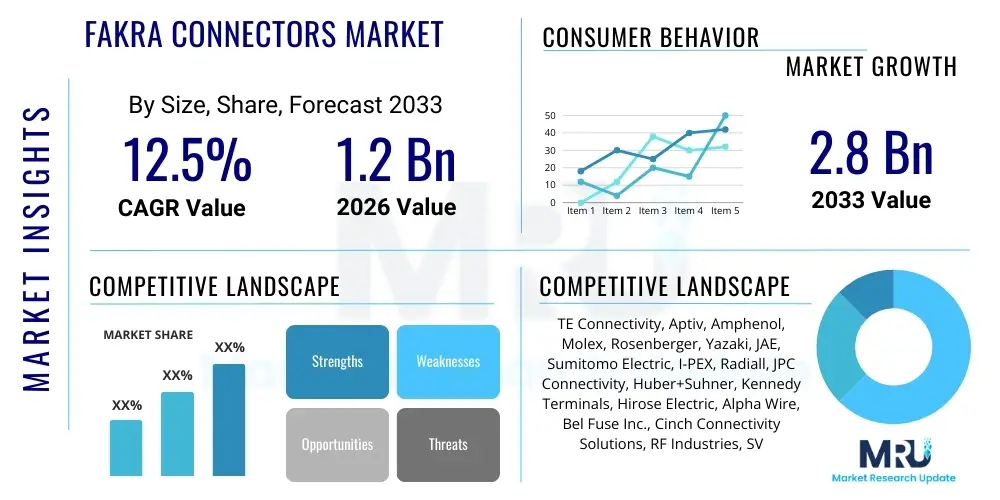

The FAKRA Connectors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033.

FAKRA Connectors Market introduction

The FAKRA (Fakhrasadi) connector standard, derived from the German DIN 72594 standard, is a crucial component primarily utilized in automotive applications for high-frequency signal transmission. These connectors are designed with a plastic housing featuring internal locking mechanisms and standardized color coding, ensuring incorrect mating is virtually impossible, which is essential in complex vehicle architectures. Their robust design provides excellent vibration and temperature resistance, making them ideal for challenging automotive environments, particularly for integrating advanced telematics, navigation systems, and security sensors. The inherent standardization of FAKRA allows for interchangeability among different suppliers, driving its widespread adoption across global automotive manufacturing supply chains. This foundation of reliable, standardized high-frequency connectivity underpins the next generation of connected and autonomous vehicles.

FAKRA connectors are fundamentally applied across key vehicular systems that demand reliable, secure high-speed data and radio frequency (RF) transfer. Major applications include Global Navigation Satellite System (GNSS) antennas, radio antennas (AM/FM, DAB), telematics modules (eCall, emergency services), and increasingly, advanced driver-assistance systems (ADAS) like surround-view cameras, radar, and Lidar systems which require high-speed video and sensor data transfer. The shift toward Electric Vehicles (EVs) and sophisticated infotainment displays, which often incorporate multiple high-resolution screens and require consistent connectivity for over-the-air (OTA) updates, further accelerates the demand for FAKRA connectors capable of handling higher bandwidths, such as those supporting the latest Automotive Ethernet standards.

The primary driving factor behind market expansion is the accelerated proliferation of connected car technology and the mandated incorporation of advanced safety features globally. Governments in North America and Europe continue to push regulatory initiatives requiring features like ADAS functionalities (e.g., automatic emergency braking, lane keep assist), all of which rely heavily on robust, shielded RF connectors like FAKRA. Furthermore, the increasing complexity of in-vehicle communication networks, necessitated by the introduction of domain and zonal architectures, favors standardized, reliable connector types that can support data rates up to 10 Gbps and beyond, ensuring minimal signal degradation and maximum system reliability across various climatic conditions.

FAKRA Connectors Market Executive Summary

The FAKRA Connectors Market demonstrates vigorous growth, propelled primarily by macro business trends centered on automotive electrification and the rapid scaling of Level 2 and Level 3 autonomous driving capabilities. Key business strategies observed include strategic partnerships between connector manufacturers and Tier 1 automotive suppliers to co-develop miniaturized, high-performance connectors tailored for space-constrained vehicle designs. The trend toward high-data-rate applications, specifically for uncompressed video feeds from multiple high-definition cameras, mandates the transition from traditional FAKRA to enhanced versions, often incorporating high-speed data (HSD) interfaces within the FAKRA housing, thereby ensuring signal integrity while maintaining the established mechanical features and ease of assembly. Cost optimization through automated manufacturing processes remains a critical focus for maintaining competitive pricing amidst rising raw material costs, particularly copper and specialized plastics.

Regionally, Asia Pacific (APAC), particularly China, Japan, and South Korea, stands out as the fastest-growing market segment, driven by soaring automotive production volumes, aggressive investments in electric vehicle infrastructure, and rapid domestic adoption of sophisticated infotainment systems. Europe maintains a mature, yet steadily expanding market, heavily influenced by stringent EU safety regulations and the early adoption of V2X (Vehicle-to-Everything) communication technologies, which heavily rely on highly reliable antenna systems connected via FAKRA. North America continues to be a crucial market, defined by strong demand for high-end luxury vehicles equipped with comprehensive ADAS packages and sophisticated telematics, necessitating premium, error-free connectivity solutions. Manufacturers are prioritizing localization strategies in APAC to mitigate supply chain risks and cater to region-specific technological demands.

Segment trends reveal a pronounced shift towards the High-Speed Data (HSD) FAKRA connector type, moving beyond traditional single-coaxial cable applications. This segment dominates revenue growth due to the pervasive requirement for Automotive Ethernet integration within domain controllers and sensor hubs. By application, ADAS and Safety Systems represent the largest and most dynamic segment, outpacing traditional Infotainment applications, as the data volume generated by radar, LiDAR, and camera systems grows exponentially. Furthermore, in terms of vehicle type, the commercial vehicle segment, encompassing logistics and fleet management systems reliant on GPS and telematics, shows robust secondary growth, demanding ruggedized, standard FAKRA solutions suitable for heavy-duty operational environments.

AI Impact Analysis on FAKRA Connectors Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the FAKRA Connectors Market overwhelmingly focus on two main themes: data bandwidth requirements imposed by AI-driven systems and the role of AI in connector manufacturing quality and testing. Users are primarily concerned with whether existing FAKRA standards can handle the massive, continuous data streams generated by Level 4 and Level 5 autonomous vehicles, where AI models process Terabytes of sensor data in real-time. The collective expectation is that AI's implementation mandates a shift towards extremely high-speed interfaces (e.g., FAKRA supporting 25 Gbps or more) and that AI algorithms applied in predictive maintenance will reduce connector failure rates, thereby increasing overall vehicle safety and reliability. Users are keen to understand how manufacturers are leveraging AI in quality control to detect micro-defects in connectors during the assembly phase, ensuring flawless performance necessary for safety-critical AI systems.

The implementation of AI in autonomous vehicles translates directly into a hardware requirement for high-reliability, high-throughput connectivity, placing FAKRA connectors at the epicenter of this technological shift. AI processing units (APUs) require instantaneous, lossless data feeds from dozens of sensors (cameras, radar, lidar). If a connector fails or introduces latency, the AI system’s ability to make safe, real-time decisions is compromised. Consequently, AI acts as a forcing function, accelerating the demand for premium, next-generation FAKRA variants (such as the FAKRA IV or Mini-FAKRA standards) that offer enhanced shielding, tighter tolerances, and improved thermal management to support the dense computing modules powered by AI. This sustained need for data fidelity is the most significant impact AI has on the FAKRA product roadmap.

- AI-Driven Data Overload: Increased resolution and frame rates of automotive cameras, necessitated by AI vision algorithms, demand FAKRA connectors capable of gigabit-plus transmission speeds, pushing adoption of shielded differential pair cabling.

- Predictive Maintenance Enhancement: AI algorithms analyze operational data from vehicle sensors to predict potential connector degradation or failure, allowing for proactive maintenance and reducing the risk of sudden system outage in autonomous functions.

- Manufacturing Quality Control: AI-powered machine vision systems are employed on assembly lines for immediate, high-precision inspection of FAKRA components, ensuring connector pin alignment, seating depth, and crimp quality exceed conventional manual inspection standards.

- Optimized Design and Simulation: AI is used in electromagnetic simulation and thermal modeling during the connector design phase to optimize impedance matching and minimize signal loss at extremely high frequencies required for advanced radar systems.

- Autonomous Vehicle Architecture Shift: The move towards centralized or zonal compute architectures, driven by the need to efficiently manage AI processing, requires complex multi-port FAKRA hubs and cable assemblies, rather than simple point-to-point connections.

DRO & Impact Forces Of FAKRA Connectors Market

The FAKRA Connectors Market is primarily driven by the mandatory integration of sophisticated ADAS features and the expansion of the connected vehicle ecosystem globally. Restraints predominantly revolve around the complexity of integrating diverse high-speed protocols into a standardized FAKRA form factor and the inherent challenge of ensuring backward compatibility as new standards emerge. Opportunities are abundant, specifically in the burgeoning Vehicle-to-Everything (V2X) communication sector and the requirement for miniaturized connectors in compact EV architectures. These dynamics establish a high-impact force environment, where technological innovation in material science and shielding effectiveness dictates market leadership and the pace of new product rollout across the automotive supply chain.

Key drivers include the proliferation of 5G infrastructure, enabling higher bandwidth connectivity for OTA updates and real-time mapping services, which requires high-reliability antenna connections utilizing FAKRA. Furthermore, consumer demand for advanced in-cabin experiences, including streaming services and augmented reality features, drives the necessity for robust multimedia interfaces, often standardized via FAKRA. However, the market faces significant restraints related to standardization fragmentation; while FAKRA provides physical interoperability, the underlying communication protocols (like HSD, USCAR, or various Automotive Ethernet standards) can vary, posing integration challenges for Tier 1 suppliers. High tooling costs and the need for zero-defect production in safety-critical applications also restrain smaller entrants.

Opportunities for growth are concentrated in emerging technologies such as automated valet parking and remote driving capabilities, which require massive real-time data exchange, thereby increasing the density and quality specifications for connectors. The transition to zonal electronic/electrical (E/E) architectures in vehicles simplifies wiring harnesses but concentrates data processing, necessitating more complex, multi-coaxial FAKRA assemblies and headers integrated directly into zonal control units. The impact forces are characterized by high regulatory pressure (mandating reliable connectivity for safety systems), strong technological substitution threat (from non-FAKRA standardized connectors or wireless alternatives for low-speed data), and moderate supplier power due to specialized manufacturing requirements and intellectual property governing connector design and quality.

Segmentation Analysis

The FAKRA Connectors Market is segmented based on critical performance attributes and functional applications, allowing for precise tracking of adoption rates across different vehicle segments and technological tiers. The segmentation by Type (Standard FAKRA, FAKRA HSD, Mini-FAKRA) clearly demonstrates the transition towards solutions that support high-speed data transmission, crucial for ADAS and next-generation infotainment systems. Application segmentation highlights the dominance of the ADAS and Safety Systems segment, reflecting the industry's focus on functional safety. Geographic segmentation confirms the APAC region’s emerging dominance in volume production, juxtaposed with the high technological sophistication demanded by North American and European markets.

- By Type:

- Standard FAKRA (Single Coaxial)

- FAKRA HSD (High-Speed Data)

- Mini-FAKRA (FAKRA II / USCAR 30)

- FAKRA IV (Next Generation)

- By Application:

- Infotainment & Multimedia (Radio, TV, Navigation)

- Telematics & Security (GPS, eCall, OTA updates)

- ADAS & Safety Systems (Camera, Radar, Lidar, Sensor Interfaces)

- Antenna Modules (V2X, Satellite Radio)

- By Vehicle Type:

- Passenger Vehicles (Sedans, SUVs, Hatchbacks)

- Commercial Vehicles (Trucks, Buses, Heavy Duty)

- Electric Vehicles (EVs and Hybrid Vehicles)

Value Chain Analysis For FAKRA Connectors Market

The FAKRA connector value chain begins with the procurement of highly specialized raw materials, primarily copper alloys for the contacts, specialized polymers (often engineering plastics like PBT or LCP) for the housing and coding keys, and shielding materials (e.g., gold or nickel plating). Upstream activities are characterized by specialized suppliers who must meet stringent material quality and thermal stability requirements mandated by the automotive sector. Connector manufacturers focus on precision stamping, injection molding, and automated assembly, often involving complex crimping and soldering processes to ensure consistent impedance matching and reliable signal transmission up to 6 GHz. This stage requires significant capital investment in highly automated, zero-defect production lines to achieve the necessary volumes and quality required by Tier 1 automotive clients.

Midstream activities involve the integration of individual FAKRA connectors into complete cable assemblies and harnesses, typically executed by Tier 2 and Tier 1 suppliers. These assemblies are crucial as FAKRA performance is highly dependent on the quality of the cable and the termination process. The distribution channel is heavily skewed towards an indirect model, where connector manufacturers supply high volumes directly to Tier 1 automotive system integrators (e.g., those manufacturing infotainment units, telematics control units, or sensor modules). These Tier 1 suppliers then integrate the assemblies into larger sub-systems before delivering them to the Original Equipment Manufacturers (OEMs).

Downstream activities involve the final integration of the sub-systems by vehicle OEMs during the assembly process. The aftermarket segment, though smaller, also utilizes FAKRA connectors for replacement parts, retrofit navigation systems, and advanced diagnostics equipment. Direct sales are rare and usually limited to small volume specialty applications or prototype development. The dominance of the indirect channel emphasizes the strong relationship and long certification cycles required between connector manufacturers and the major Tier 1 automotive suppliers (e.g., Bosch, Continental, Aptiv), making market entry challenging without established OEM credentials. This structured value chain ensures high quality control but also creates bottlenecks during rapid technological shifts, such as the adoption of Automotive Ethernet.

FAKRA Connectors Market Potential Customers

The primary end-users and customers for FAKRA connectors are deeply embedded within the global automotive supply chain, segmented into distinct tiers based on their role in vehicle production and aftermarket support. Automotive OEMs represent the ultimate consumer of the technology, dictating specifications and requiring stringent quality standards; however, they typically purchase the finished sub-systems containing the connectors. Therefore, the immediate potential customers are the Tier 1 suppliers who integrate FAKRA connectors into safety-critical modules, requiring large volumes, consistent quality, and customized connector configurations designed to fit specific vehicle platforms and protocols.

Tier 1 automotive suppliers are the most critical customer segment, including major integrators specializing in chassis, interior, and electronics systems. These customers require complex FAKRA solutions, often multi-port configurations and hybrid connectors combining power and data, for integration into domain controllers, centralized gateways, and advanced sensor housings. Their purchasing decisions are driven by factors such as miniaturization capabilities, demonstrated reliability under extreme conditions (temperature, vibration), and the ability of the connector supplier to meet strict regulatory compliance standards (e.g., USCAR, AEC-Q200 equivalent). Strategic focus on these customers ensures market penetration across multiple vehicle models and global regions.

Secondary, yet growing, customer segments include telematics and fleet management solution providers, particularly those supporting commercial vehicles, who require ruggedized FAKRA connections for prolonged operational periods and severe usage environments. Additionally, specialized aftermarket service providers and high-end automotive repair shops constitute potential customers, albeit focused on lower volume, higher margin replacement and upgrade connectors. The ongoing evolution towards software-defined vehicles necessitates continuous procurement of specialized FAKRA connectors for connectivity modules that facilitate complex software updates and diagnostics over high-speed links.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TE Connectivity, Aptiv, Amphenol, Molex, Rosenberger, Yazaki, JAE, Sumitomo Electric, I-PEX, Radiall, JPC Connectivity, Huber+Suhner, Kennedy Terminals, Hirose Electric, Alpha Wire, Bel Fuse Inc., Cinch Connectivity Solutions, RF Industries, SV Microwave, ITT Cannon |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

FAKRA Connectors Market Key Technology Landscape

The technological landscape of the FAKRA Connectors market is primarily defined by the relentless pursuit of higher data throughput, reduced size, and enhanced electromagnetic compatibility (EMC). A key area of innovation is the shift towards shielded twisted pair (STP) solutions integrated within the FAKRA housing, facilitating the deployment of Automotive Ethernet (100BASE-T1, 1000BASE-T1) standards over FAKRA HSD interfaces. This integration allows for the seamless transfer of non-RF digital data, crucial for ADAS sensors and display streams, while utilizing the robust mechanical properties of the standardized FAKRA form factor. Furthermore, advancements in specialized plating and material science are necessary to minimize insertion loss and maximize return loss at the higher frequencies now being used for 77 GHz radar systems, ensuring signal integrity across the connector interface.

Miniaturization is another crucial technological trend, leading to the development and increased adoption of Mini-FAKRA (also known as FAKRA II or USCAR 30). These smaller connectors are necessary to accommodate the increasing number of antennas and sensor connections in modern vehicles without overwhelming limited real estate, particularly in rearview mirror housings and compact antenna modules. The technology focuses on maintaining the impedance consistency and high-frequency performance of standard FAKRA while significantly reducing the footprint and weight. Additionally, there is intense development in automated assembly techniques, utilizing advanced robotics and precision testing equipment to ensure the exact impedance control and shielding effectiveness required for next-generation ADAS applications, where manufacturing defects are intolerable due to safety implications.

A critical technological evolution involves the development of hybrid FAKRA solutions that combine multiple functions within a single housing, moving beyond pure coaxial functionality. These hybrid designs integrate coaxial contacts for RF signals, power contacts for device operation (e.g., heated cameras), and differential data pair contacts (HSD) for high-speed digital communications. This approach simplifies the cable harness structure, reduces complexity during vehicle assembly, and minimizes the risk of installation errors. Future technological advancements are centered on migrating towards the FAKRA IV standard, supporting ultra-high-speed interfaces necessary for autonomous driving domain controllers and anticipating the requirements of V2X communication based on cellular V2X (C-V2X) technology, requiring connectivity solutions that are certified for extremely high reliability and extended operational lifecycles.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market in terms of production volume and anticipated growth rate, driven primarily by China’s massive EV market and high-volume automotive manufacturing bases in Japan, South Korea, and India. Regulatory push for localized ADAS features and the rapid penetration of sophisticated infotainment systems in mass-market vehicles are key growth catalysts. The region is seeing rapid adoption of Mini-FAKRA solutions due to vehicle size constraints and cost-efficiency considerations.

- North America: Characterized by high technological sophistication and demand for premium features. Growth is concentrated in luxury and high-performance vehicle segments that are early adopters of Level 3 autonomy. The primary focus here is on FAKRA HSD and high-quality shielded solutions to support advanced sensor fusion architectures and 5G telematics, driven by aggressive R&D spending by domestic OEMs.

- Europe: A mature market with stable growth influenced heavily by stringent EU regulations regarding vehicle safety (e.g., mandatory eCall systems) and emissions standards, which indirectly push for lightweight components like Mini-FAKRA. Europe is a leader in V2X communication trials and adoption of Automotive Ethernet, ensuring sustained high demand for next-generation, high-reliability FAKRA and HSD variants.

- Latin America (LATAM): Exhibits moderate growth, primarily tied to local automotive production and the gradual introduction of advanced safety features. Market demand is skewed towards standard and cost-effective FAKRA connectors for basic telematics, GPS, and radio applications, with slower adoption rates for high-end ADAS connectivity solutions compared to developed regions.

- Middle East and Africa (MEA): Represents the smallest but emerging market, driven by investments in smart city infrastructure and growing vehicle fleet sizes in the GCC nations. The challenging environmental conditions (extreme heat and dust) necessitate specialized, robust FAKRA connectors designed for maximum ingress protection and temperature resistance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the FAKRA Connectors Market.- TE Connectivity

- Aptiv

- Amphenol

- Molex

- Rosenberger

- Yazaki

- JAE (Japan Aviation Electronics Industry, Ltd.)

- Sumitomo Electric Industries, Ltd.

- I-PEX Co., Ltd.

- Radiall

- JPC Connectivity

- Huber+Suhner

- Kennedy Terminals

- Hirose Electric Co., Ltd.

- Alpha Wire

- Bel Fuse Inc.

- Cinch Connectivity Solutions

- RF Industries

- SV Microwave

- ITT Cannon

Frequently Asked Questions

Analyze common user questions about the FAKRA Connectors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of FAKRA connectors over traditional RF connectors in automotive applications?

The primary advantage of FAKRA (Fakhrasadi) connectors is their standardized, keyed, and color-coded plastic housing, which provides guaranteed mechanical alignment, positive locking, and prevents mismating. This robust design ensures vibration resistance and reliable high-frequency performance (up to 6 GHz) essential for safety-critical automotive environments and facilitates streamlined, error-free assembly on high-volume production lines.

How do FAKRA HSD connectors differ from standard FAKRA connectors?

FAKRA HSD (High-Speed Data) connectors are designed specifically for differential signal transmission, utilizing shielded twisted pair (STP) cables to handle non-RF data protocols like USB and Automotive Ethernet (e.g., 100BASE-T1 or 1000BASE-T1) at speeds up to 10 Gbps. Standard FAKRA connectors are optimized exclusively for single coaxial (RF) signals, such as GPS or AM/FM radio antenna feeds.

Which market segment drives the highest growth rate for FAKRA connector adoption?

The ADAS (Advanced Driver-Assistance Systems) and Safety Systems segment drives the highest growth rate. The proliferation of complex sensor suites, including high-resolution cameras, radar, and LiDAR, demands robust, high-bandwidth connectivity for sensor data processing, accelerating the uptake of specialized FAKRA HSD and Mini-FAKRA variants globally.

What impact does vehicle electrification have on FAKRA connector demand?

Vehicle electrification (EVs/HEVs) positively impacts demand by necessitating higher complexity in in-vehicle communication systems for battery management, diagnostics, and high-end thermal control, all of which require reliable data connectivity. Additionally, EVs often incorporate sophisticated, connected infotainment systems and rely heavily on FAKRA for V2X and telematics, further boosting market volume.

Are there technological threats or alternatives to FAKRA connectors in the automotive industry?

While FAKRA remains the dominant standard for coaxial RF connectivity, the primary technological threat comes from advanced high-speed digital connectors (such as customized proprietary standards used for multi-gigabit backbones) and, in certain low-speed applications, emerging wireless technologies. However, for critical, standardized high-frequency links, FAKRA’s entrenched position and standardized mechanical interface provide a significant competitive barrier.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager