Fall Protection Equipment and System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431820 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Fall Protection Equipment and System Market Size

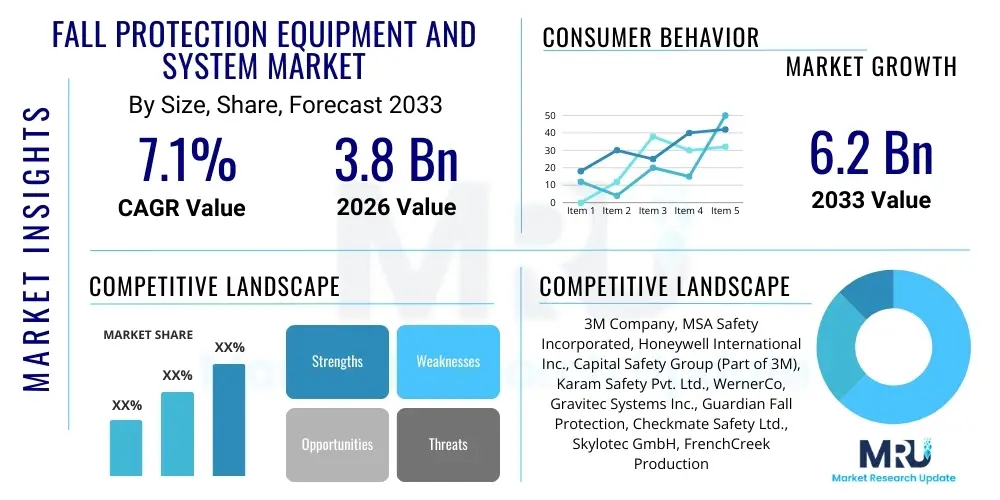

The Fall Protection Equipment and System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.1% CAGR between 2026 and 2033. The market is estimated at USD 3.8 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

Fall Protection Equipment and System Market introduction

The Fall Protection Equipment and System Market encompasses a comprehensive range of products and engineered solutions designed to protect workers from injuries or fatalities resulting from falls from height. This market includes essential Personal Fall Protection Systems (PFPS) such as full-body harnesses, energy-absorbing lanyards, self-retracting lifelines (SRLs), and anchors, as well as complex Engineered Fall Protection Systems (EFPS) involving horizontal and vertical lifeline systems, guardrails, and netting. The primary objective of these systems is strict compliance with stringent international safety standards enforced by bodies like OSHA (Occupational Safety and Health Administration), ANSI (American National Standards Institute), and the European Agency for Safety and Health at Work (EU-OSHA). Market growth is intrinsically linked to rising awareness of occupational safety, increasing complexity of industrial and infrastructure projects requiring high-altitude work, and escalating liability associated with workplace accidents, driving mandatory adoption across key sectors.

Major applications of fall protection equipment span highly regulated and hazardous environments, including the heavy construction sector (residential, commercial, and infrastructure development), oil and gas (onshore and offshore drilling rigs, refineries), general industry (manufacturing facilities, warehouses, shipyards), utilities (telecom towers, power generation facilities, wind farms), and mining operations. The inherent risk associated with working at elevated levels dictates the necessity of reliable and certified protection gear. The benefits derived from implementing these advanced systems are multifaceted, extending beyond immediate worker safety to include improved operational efficiency, reduced insurance premiums, avoidance of costly regulatory fines, and enhancement of corporate social responsibility profiles. Furthermore, the technological advancements focusing on lightweight materials, improved ergonomics, and integrated smart technologies are continuously elevating the market's value proposition.

Driving factors for sustained market expansion include massive global governmental investments in infrastructure refurbishment and new construction, particularly in rapidly urbanizing regions like the Asia Pacific. The mandatory requirement for regular inspection, maintenance, and replacement of aging or damaged fall protection equipment also contributes significantly to recurring revenue streams. Furthermore, the shift from basic passive systems (like guardrails) to sophisticated active systems (PFPS and EFPS) due to evolving work methods and high-risk task environments provides impetus for higher value sales. The market’s resilience is also supported by the increasing global enforcement mechanisms that penalize non-compliance severely, compelling organizations, regardless of size, to prioritize investment in certified and modern fall protection solutions to safeguard their workforce.

Fall Protection Equipment and System Market Executive Summary

The Fall Protection Equipment and System Market is characterized by robust growth, driven primarily by escalating global regulatory pressures mandating safer working practices across construction, industrial manufacturing, and energy sectors. Key business trends indicate a definitive move toward integrated solutions, where manufacturers offer end-to-end safety portfolios encompassing training, inspection, custom engineered systems, and digital tracking capabilities (e.g., RFID-enabled harnesses). Companies are focusing heavily on product differentiation through enhanced comfort, durability, and user-friendliness, recognizing that worker compliance is vital for effectiveness. Strategic acquisitions and vertical integration among top-tier manufacturers are reshaping the competitive landscape, aiming to achieve scale and expand geographical reach, particularly into emerging markets where safety standards are rapidly maturing.

Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market, propelled by unprecedented levels of public and private investment in massive infrastructure projects, coupled with the introduction of stricter local safety codes mirroring Western standards. North America and Europe, while mature, maintain dominance in terms of technological adoption, driven by the replacement cycle of existing equipment and the rapid integration of smart safety technologies (IoT and sensors) into Personal Protective Equipment (PPE). Latin America and the Middle East and Africa (MEA) are emerging as significant opportunity zones, largely due to major investments in oil and gas infrastructure, mining expansion, and urbanization projects, which necessitate reliable and certified fall protection solutions tailored for extreme operating environments.

Segment trends highlight the burgeoning demand for Self-Retracting Lifelines (SRLs) and engineered anchor systems, which offer superior mobility and safety performance compared to traditional lanyards. The Personal Fall Protection System (PFPS) segment remains the largest due to its widespread applicability across diverse end-users, but the Engineered Fall Protection System (EFPS) segment is exhibiting the highest growth rate, reflecting the industry's shift towards permanent, fixed, and customized safety infrastructure for routine access tasks. Furthermore, the utilities sector, specifically encompassing wind energy maintenance and telecommunications tower installation, is demonstrating accelerated adoption, demanding specialized, high-performance equipment capable of withstanding harsh weather conditions and prolonged use, thereby influencing product development towards specialized ruggedized designs.

AI Impact Analysis on Fall Protection Equipment and System Market

User queries regarding AI's influence in the Fall Protection market predominantly revolve around three critical areas: predictive failure detection, automation of compliance monitoring, and the enhancement of real-time hazard assessment. Users seek confirmation on whether AI can move fall protection from a reactive measure to a proactive safety infrastructure. The key themes include how AI-driven analytics can interpret data from IoT sensors embedded in harnesses and lifelines to predict equipment fatigue or potential failure before mandated inspection intervals are reached, thereby reducing catastrophic risk. Concerns also focus on the accuracy and reliability of AI algorithms in complex construction environments (e.g., distinguishing between a deliberate movement and an actual hazardous fall scenario) and the integration challenges of new smart systems with legacy safety infrastructure. Expectations are high for AI to reduce human error in compliance—automatically verifying harness connection points, calculating safe distance clearances, and generating instant violation reports, ultimately creating an 'always-on' safety officer.

- AI-enabled predictive maintenance: Utilizing machine learning algorithms to analyze usage patterns and environmental stress data from smart harnesses and SRLs, predicting when components require servicing or replacement, moving beyond time-based inspection protocols.

- Real-time hazard recognition and alerting: Deployment of AI-powered camera systems on worksites that monitor worker behavior, identifying non-compliance (e.g., failure to tie off, working outside designated zones) and initiating immediate audible or digital alerts to supervisors and the individual worker.

- Automated incident reporting and data logging: AI processing of accelerometer and gyroscope data from PPE to accurately log the time, location, and force of a fall event, streamlining post-incident investigation and regulatory reporting processes.

- Optimized safety training and simulation: Use of AI to analyze historical incident data and create hyper-realistic virtual reality (VR) training simulations tailored to site-specific hazards, improving muscle memory and decision-making under stress.

- Enhanced inventory and asset management: AI tracking of PPE deployment, location, and certification status across vast project sites, ensuring only compliant and certified equipment is in active use and reducing administrative burden.

DRO & Impact Forces Of Fall Protection Equipment and System Market

The market dynamics are governed by a complex interplay of stringent governmental regulations, technological innovation, capital costs, and awareness levels. The primary drivers (D) include the mandatory enforcement of international safety standards (OSHA, European Directives) and the subsequent rise in awareness regarding the financial and human costs associated with occupational falls, compelling companies to invest proactively. Opportunities (O) are concentrated in the integration of smart technology (IoT, RFID) into PPE, enabling sophisticated asset management and real-time safety monitoring, alongside the rapid expansion of niche high-growth sectors such as wind energy installation and large-scale industrial facility maintenance, which demand bespoke, high-performance fall protection solutions. However, significant restraints (R) persist, notably the high initial cost associated with engineered fall protection systems, particularly for small and medium enterprises (SMEs), and challenges related to inadequate safety training in some developing regions, leading to improper equipment use and reducing overall system effectiveness.

The impact forces shaping the competitive environment are pronounced, reflecting moderate to high barriers to entry due to the necessity of rigorous product certification (e.g., CE, ANSI, CSA) and the capital intensity of specialized manufacturing processes. Supplier power remains moderate, influenced by the global pricing of key raw materials like specialized textiles (Kevlar, nylon) and high-strength metals used in anchoring components; however, large manufacturers maintain negotiating leverage due to high volume procurement. Buyer power is moderate to high, particularly among large construction conglomerates and governmental procurement agencies, who demand customized bulk solutions and favorable terms. The threat of substitutes is relatively low, as regulatory requirements strictly mandate specific types of certified equipment for height work, making substitution with non-certified or less effective alternatives illegal and risky. Competitive rivalry is high, characterized by intense differentiation efforts based on ergonomics, durability, and value-added services such as training and lifecycle management, rather than simple price competition.

Furthermore, external societal and economic impact forces play a vital role. Demographic trends, specifically the aging workforce in developed economies, necessitate more comfortable and easy-to-use fall protection gear, influencing design ergonomics. Simultaneously, the global push toward sustainable practices is driving manufacturers to explore greener materials and processes in PPE production. The legal impact force is perhaps the most significant, as increasingly strict liability laws hold employers directly responsible for workplace injuries, making investment in the most reliable fall protection systems a legal imperative rather than a discretionary operational expenditure, thereby ensuring continuous market uptake regardless of short-term economic fluctuations.

Segmentation Analysis

The Fall Protection Equipment and System Market is strategically segmented based on product type, system type, and end-user industry to provide a granular view of demand dynamics and growth pockets. This segmentation reflects the varied operational requirements across industrial landscapes, ranging from standardized personal gear necessary for intermittent tasks (e.g., maintenance crews) to complex, fixed systems required for continuous high-altitude operations (e.g., aircraft maintenance hangars or industrial roofing). The complexity of the regulatory environment necessitates specialized product variations, leading to distinct market behaviors within each sub-segment. Analysis of these segments is crucial for manufacturers to tailor their R&D efforts, distribution strategies, and pricing models to address specific user needs effectively, such as designing lightweight harnesses for long-duration use in hot climates or high-capacity anchors for multi-user systems on large construction sites, thereby maximizing market penetration.

- By Product Type:

- Harnesses (Full-Body Harnesses, Positioning Harnesses)

- Lanyards (Shock-Absorbing Lanyards, Non-Shock Lanyards)

- Self-Retracting Lifelines (SRLs) and Fall Limiters

- Anchorage Connectors (Temporary, Permanent, Specialized)

- Rescue and Descent Devices

- Accessories (Ropes, Carabiners, Connecting Devices)

- By System Type:

- Personal Fall Protection Systems (PFPS)

- Engineered Fall Protection Systems (EFPS) (Horizontal/Vertical Lifelines, Guardrails, Netting)

- By End-User:

- Construction (Residential, Commercial, Infrastructure)

- Oil & Gas (Upstream, Midstream, Downstream)

- Mining

- Utilities (Power Generation, Transmission, Telecommunications)

- General Industry (Manufacturing, Warehousing, Transportation)

- Aerospace and Defense

Value Chain Analysis For Fall Protection Equipment and System Market

The value chain for fall protection equipment begins with the Upstream Analysis, which involves the sourcing of critical raw materials. This segment is characterized by the procurement of high-tenacity synthetic fibers (nylon, polyester, UHMWPE) for webbing and ropes, and specialized, high-strength forged steel and aluminum alloys for crucial metallic components such such as buckles, D-rings, carabiners, and anchor points. Quality control at this stage is paramount, as the integrity of the raw materials directly determines the ultimate load-bearing capacity and certification status of the final product. Key activities include material testing, compliance verification, and establishing robust supply contracts to mitigate commodity price volatility, ensuring a continuous supply of certified raw materials capable of meeting rigorous safety and durability standards required by international standardization bodies.

The manufacturing and Midstream segment is complex and highly regulated, focusing on precision engineering, stitching, assembly, and exhaustive quality assurance testing. Unlike general PPE, fall protection components require specialized machinery for automated or semi-automated stitching patterns that guarantee strength, followed by individual component testing to ensure compliance with standards like ANSI Z359 or EN 361. Distribution Channel strategy involves both direct and indirect routes. Direct distribution is common for large, customized engineered systems or governmental contracts, allowing manufacturers to maintain tight control over installation and post-sales servicing. Indirect distribution, utilizing specialized industrial safety distributors and regional dealers, dominates the sale of standardized PFPS components like harnesses and lanyards, leveraging the distributor's regional reach and deep understanding of local compliance requirements and inventory needs, ensuring efficient market access.

The Downstream Analysis involves the final end-users and the essential post-sale service ecosystem. This includes installation and certification of engineered systems, comprehensive user training programs, mandatory periodic equipment inspection, and repair services. Direct and Indirect channels play different roles here; direct channels often provide specialized technical training and long-term service contracts for complex installations, whereas indirect channels (distributors) often handle immediate inventory requirements and basic user guidance. The critical element downstream is the provision of lifecycle management services, including RFID tracking systems that monitor equipment usage, inspection dates, and retirement schedules, ensuring continuous regulatory compliance and worker safety throughout the equipment’s operational life.

Fall Protection Equipment and System Market Potential Customers

The primary cohort of potential customers for fall protection equipment and systems consists of organizations that routinely require personnel to work at elevations exceeding 6 feet, making compliance mandatory. This includes large-scale Engineering, Procurement, and Construction (EPC) firms involved in high-rise building development, bridge construction, and major infrastructural repairs. These customers often seek integrated, high-volume solutions, prioritizing bulk certification, comprehensive training packages, and equipment designed for heavy-duty, multi-shift use under diverse environmental conditions. Their purchasing decisions are heavily influenced by supplier capacity to manage global logistics and provide documentation that satisfies strict contractual safety clauses, positioning them as high-value, long-term procurement partners.

A second significant customer base lies within the industrial maintenance and utilities sectors, encompassing providers of telecommunications infrastructure, power generation companies (especially wind and solar farms), and heavy manufacturing plants. These entities require highly specialized and durable equipment for repetitive, routine access tasks, such as tower climbing harnesses, specialized rescue devices for confined spaces, and permanently installed lifeline systems on turbine nacelles or rooftop access points. For these customers, reliability, weather resistance, and reduced downtime are critical purchasing criteria. They often opt for Engineered Fall Protection Systems (EFPS) that minimize setup time and maximize worker efficiency while ensuring continuous safety compliance during complex maintenance protocols.

Furthermore, government and public sector entities, including transportation authorities (bridges, rail maintenance), military installations, and municipal infrastructure departments, constitute a highly stable and regulated customer segment. Their procurement process is often governed by strict long-term tenders and emphasizes adherence to domestic certification standards and proven product longevity. While their volumes might fluctuate, their loyalty to specific, certified suppliers is high once a system is integrated. The focus here is on robust, standardized equipment designed for easy integration with existing assets and a low total cost of ownership over an extended service life, highlighting the diverse yet consistently compliance-driven nature of the fall protection market’s customer ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 7.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, MSA Safety Incorporated, Honeywell International Inc., Capital Safety Group (Part of 3M), Karam Safety Pvt. Ltd., WernerCo, Gravitec Systems Inc., Guardian Fall Protection, Checkmate Safety Ltd., Skylotec GmbH, FrenchCreek Production, P&P Safety, Safewaze Inc., Rigid Lifelines Inc., Pure Safety Group, DBI-SALA, Protecta, Elk River Safety Products, Malta Dynamics, FallTech. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fall Protection Equipment and System Market Key Technology Landscape

The technological evolution within the Fall Protection market is increasingly focused on smart integration, material science advancements, and ergonomic design to enhance worker compliance and system reliability. A primary technological trend involves the integration of the Internet of Things (IoT) and Radio Frequency Identification (RFID) technology directly into Personal Fall Protection Systems (PFPS), notably harnesses and lanyards. This allows for automated asset tracking, ensuring that only certified and up-to-date equipment is deployed on a worksite. IoT sensors can monitor critical parameters such as the number of minor impacts (wear and tear), environmental conditions (UV exposure, temperature extremes), and real-time usage metrics. This digital integration moves safety management from manual record-keeping to a proactive, data-driven system, minimizing the risk of using compromised or expired gear and significantly streamlining inspection protocols to optimize safety expenditure.

Further advancements are prominent in material engineering, concentrating on developing lighter yet stronger webbing and metallic components. Manufacturers are utilizing advanced synthetic fibers, such as high-modulus polyethylene (HMPE), which offer superior cut resistance and strength-to-weight ratios compared to traditional nylon and polyester. This focus addresses the common worker complaint regarding the bulkiness and weight of safety gear, which often leads to non-compliance. Similarly, the use of specialized aluminum alloys in anchor points and connectors reduces overall system weight without sacrificing critical structural integrity. These ergonomic improvements, driven by material science, are essential for sectors where workers must wear equipment for extended periods, such as in telecommunications, wind energy, and complex industrial maintenance settings, thereby directly enhancing comfort and acceptance.

The development of engineered systems is also leveraging digital technologies like Building Information Modeling (BIM) and digital twin technology. For large construction or industrial facilities, fall protection system designers are using these tools to model hazard zones and design customized horizontal and vertical lifeline systems virtually before physical installation. This not only ensures optimal placement and compliance with clearance requirements but also reduces installation time and costly on-site modifications. Furthermore, specialized devices, such as self-retracting lifelines (SRLs) are incorporating faster, smoother braking mechanisms that minimize the impact forces experienced by the worker during a fall arrest, adhering to stricter regulatory requirements that prioritize the reduction of impact force to survivable levels, showcasing a combination of mechanical precision and regulatory compliance driving innovation.

Regional Highlights

- North America (NA): This region represents a mature, high-value market segment characterized by the most stringent regulatory landscape, primarily driven by OSHA and ANSI standards. The U.S. and Canada maintain high rates of equipment replacement due to mandatory inspection protocols and strong enforcement mechanisms. Demand is dominated by sophisticated engineered systems for infrastructure modernization and large-scale commercial construction, alongside a significant uptake of smart PPE integrated with IoT for compliance verification and asset management. The region acts as a bellwether for technological adoption, readily implementing advanced training methods and data-driven safety management platforms to mitigate substantial legal liabilities associated with workplace injuries.

- Europe: Characterized by diverse national safety cultures unified under broad EU directives (like EN standards), the European market emphasizes ergonomic design, sustainability in manufacturing, and high certification standards (CE marking). Germany, the UK, and France are key contributors, driven by manufacturing, energy (especially offshore wind farms), and industrial maintenance. The market exhibits a strong preference for localized, specialized suppliers capable of providing comprehensive service packages, including equipment supply, installation, and rigorous mandatory user training tailored to specific national regulatory interpretations and specialized industrial demands.

- Asia Pacific (APAC): The APAC region is the primary engine of market growth, driven by massive urbanization, exponential growth in infrastructure development (e.g., China's belt and road, India's infrastructure push), and rapid industrialization across Southeast Asia. While regulatory enforcement historically varied, major economies are quickly adopting internationally recognized safety standards, creating vast new demand for certified fall protection equipment. The market is highly price-sensitive but is rapidly shifting towards quality due to foreign investment standards and increasing local government oversight, favoring manufacturers who can provide certified products at competitive price points and establish strong local distribution networks.

- Latin America: Market growth is steady, concentrated largely in key industrial centers such as Brazil and Mexico, driven by mining operations, oil and gas exploration, and large-scale public works projects. The region often relies on imports of certified equipment from North American and European manufacturers. Challenges include fragmented regulatory enforcement and varying degrees of safety consciousness among smaller contractors, requiring manufacturers to invest heavily in localized awareness campaigns and robust educational outreach programs to ensure proper product usage and compliance uptake, fostering long-term market stability.

- Middle East and Africa (MEA): Growth in MEA is fueled by monumental construction projects (e.g., Saudi Vision 2030, UAE development) and extensive oil and gas activities. Demand is high for heavy-duty, climate-resistant equipment capable of operating reliably in extreme temperatures and harsh desert environments. The region places a premium on international certification (e.g., ANSI, CE) due to the presence of large multinational construction and energy firms. Market uptake is cyclical, tied directly to the execution timeline of major national development plans and fluctuating oil prices, emphasizing reliable supply chain logistics and specialized consultancy services for complex safety installations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fall Protection Equipment and System Market.- 3M Company

- MSA Safety Incorporated

- Honeywell International Inc.

- Karam Safety Pvt. Ltd.

- WernerCo

- Gravitec Systems Inc.

- Guardian Fall Protection

- Checkmate Safety Ltd.

- Skylotec GmbH

- FrenchCreek Production

- P&P Safety

- Safewaze Inc.

- Rigid Lifelines Inc.

- Pure Safety Group

- DBI-SALA (a 3M brand)

- Protecta (a 3M brand)

- Elk River Safety Products

- Malta Dynamics

- FallTech

- Latchways (a MSA Safety brand)

Frequently Asked Questions

Analyze common user questions about the Fall Protection Equipment and System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What regulatory standards primarily govern the use and certification of fall protection equipment?

The market is primarily governed by regional and international standards including OSHA (Occupational Safety and Health Administration) in the US, ANSI (American National Standards Institute) specifically the Z359 series, and the European EN standards (e.g., EN 361 for full-body harnesses). Compliance with these standards is mandatory for product certification and safe usage across most high-risk industries globally, driving product design and inspection cycles.

How is technological advancement influencing the safety and effectiveness of fall protection gear?

Technology is significantly improving safety through the integration of smart features such as IoT sensors and RFID chips into harnesses and lifelines. These technologies enable real-time asset tracking, automated inspection scheduling, monitoring of equipment usage data, and immediate identification of potential equipment failure or non-compliance, transitioning safety management towards proactive, data-driven strategies for enhanced effectiveness.

Which end-user segment is exhibiting the fastest growth in the demand for engineered fall protection systems?

The Utilities sector, particularly segments related to the installation and maintenance of renewable energy infrastructure such as wind turbine farms and complex telecommunication towers, is demonstrating the fastest growth. These sectors require specialized, permanently installed Engineered Fall Protection Systems (EFPS) that provide safe access for routine maintenance tasks in highly exposed and often remote high-altitude environments.

What is the typical lifespan or replacement cycle for standard personal fall protection equipment (PFPS)?

While specific lifespans vary by manufacturer and material, most manufacturers recommend a maximum service life of 5 to 10 years for components like harnesses and lanyards, even if unused. However, regulatory standards mandate immediate replacement if the equipment has been involved in a fall arrest incident, shows signs of damage, or fails mandatory periodic inspections, which typically occur at least every 6 to 12 months.

What is the primary difference between Personal Fall Protection Systems (PFPS) and Engineered Fall Protection Systems (EFPS)?

PFPS are individual, portable systems (harnesses, lanyards, SRLs) used by single workers for temporary tasks. EFPS, conversely, are customized, fixed safety infrastructures (horizontal or vertical lifeline tracks, custom guardrails, and fixed anchors) designed and certified by engineers for permanent installation on specific structures, often supporting multiple users simultaneously and tailored for routine access points.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager