Famciclovir API Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431643 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Famciclovir API Market Size

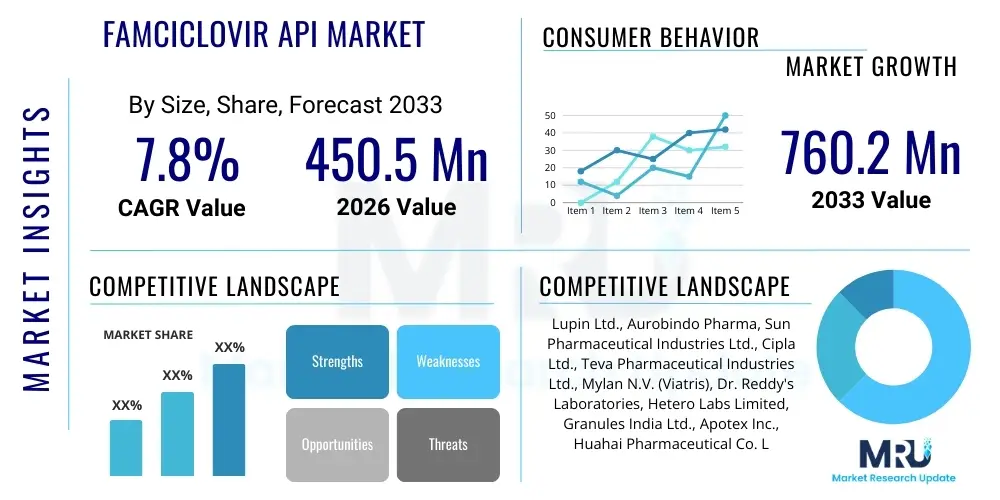

The Famciclovir API Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 760.2 Million by the end of the forecast period in 2033.

The steady expansion is primarily attributed to the high prevalence and recurrence rates of herpes infections globally, necessitating consistent antiviral treatment regimens. Famciclovir, as a highly effective prodrug of penciclovir, maintains a strong therapeutic position in the management of Herpes Zoster (shingles) and Herpes Simplex Virus (HSV) infections. The increasing longevity of the global population, particularly the growth in the geriatric segment which is more susceptible to VZV reactivation, serves as a fundamental driver supporting stable volume demand for the API throughout the forecast period.

Despite facing competition from alternative antiviral agents such as Acyclovir and Valacyclovir, Famciclovir's favorable dosing schedule and established clinical efficacy underpin its market persistence. The market size calculation reflects both the volume dynamics, largely driven by generic substitution and expansion in emerging economies, and the pricing environment, which is subject to periodic pressure from intense competition among Asia-Pacific-based bulk API manufacturers. Strategic procurement decisions by major formulation companies, aimed at securing compliant and cost-effective supplies, heavily influence the market valuation.

Famciclovir API Market introduction

Famciclovir Active Pharmaceutical Ingredient (API) is a synthetic nucleoside analog, specifically the diacetyl ester of 6-deoxy-penciclovir, which serves as a crucial prodrug. Following oral administration, Famciclovir is rapidly and extensively metabolized into its active form, penciclovir, which acts by selectively inhibiting viral DNA polymerase. This mechanism arrests viral DNA synthesis and replication, proving highly effective against herpes group viruses, including HSV-1, HSV-2, and VZV. The API is essential for the manufacture of prescription oral medications used across various clinical settings due to its superior bioavailability compared to some older generations of antiviral agents.

Major applications of Famciclovir API span the therapeutic management of primary and recurrent genital herpes infections, the treatment of acute herpes zoster (shingles), and the suppression of recurrent herpes labialis (cold sores). Its established safety profile and effectiveness in reducing the duration of painful symptoms and accelerating lesion healing are significant benefits that reinforce its clinical utility. Furthermore, Famciclovir is often prescribed prophylactically to prevent viral recurrence in immunocompromised patients, such as those undergoing cancer therapy or organ transplantation, thereby extending its application scope beyond acute treatment.

The market is primarily driven by the rising incidence and increasing awareness of herpes infections worldwide, coupled with the favorable market conditions created by the patent expiration of the originator drug, opening significant opportunities for generic manufacturers. Technological advancements in synthesis processes, focusing on chiral resolution and impurity control, also support the market by improving API quality and manufacturing efficiency. These dynamics collectively ensure a strong and consistent global demand for high-quality Famciclovir API, positioning it as a backbone component in anti-herpetic pharmacotherapy.

Famciclovir API Market Executive Summary

The Famciclovir API market's executive summary highlights a landscape characterized by robust generic competition and critical reliance on Asian manufacturing capabilities. Business trends are dominated by aggressive pricing strategies adopted by large-scale producers in India and China, who are continuously optimizing synthesis routes to maximize cost-efficiency and maintain high volume output. This environment pushes Western pharmaceutical companies towards strategic outsourcing and detailed supplier quality audits to manage both cost pressures and regulatory compliance. Consolidation among Contract Development and Manufacturing Organizations (CDMOs) is also emerging as a key trend, aiming to offer integrated services from intermediate supply to final API packaging and regulatory filing.

Regionally, a clear divergence exists between consumption and production centers. Asia Pacific (APAC) serves overwhelmingly as the global manufacturing hub, leveraging lower operational costs and large industrial capacities, facilitating worldwide distribution. Conversely, North America and Europe remain the primary revenue generators due to high per capita healthcare spending, established insurance mechanisms, and stringent demand for highly purified, cGMP-compliant API. Emerging markets, particularly in Latin America and the Middle East, exhibit above-average growth rates, driven by expanding government initiatives focused on providing subsidized or essential medicines, thereby increasing the overall global consumption base.

Segment trends reveal that the Pharmaceutical Grade (cGMP compliant) segment commands the highest value share, mandatory for regulatory approvals in major Western markets. Application-wise, the treatment of Herpes Zoster remains a dominant segment due to the severity of shingles and its heightened prevalence in the aging demographic. The market is overwhelmingly segmented towards oral solid dosages, reflecting patient preference for convenience and established pharmaceutical manufacturing lines. The overarching market trajectory suggests continued volume growth coupled with moderated value appreciation due to persistent price pressure within the commoditized generic API sector.

AI Impact Analysis on Famciclovir API Market

Stakeholder interest in the application of Artificial Intelligence (AI) within the specialized Famciclovir API sector centers primarily on process intensification and supply chain resilience. Common user inquiries revolve around how machine learning can be leveraged to refine complex multi-step chemical synthesis, aiming to enhance product yield, minimize the formation of genotoxic impurities, and reduce overall manufacturing energy consumption. There is also significant focus on utilizing predictive analytics for better management of global API supply chains, addressing critical concerns such as geopolitical risks and sudden demand fluctuations which historically impact generic drug availability. Users expect AI tools to move beyond simple data analysis, providing actionable insights into real-time quality control and enabling autonomous optimization of reactor parameters, ensuring consistency across large production batches crucial for regulated markets.

- AI integration in synthesis planning, predicting optimal solvent systems and reaction conditions to achieve maximum conversion rates of key intermediates to Famciclovir.

- Deployment of advanced analytics for real-time monitoring of Critical Quality Attributes (CQAs) via Process Analytical Technology (PAT), reducing batch failure rates.

- Machine learning models utilized for predictive maintenance of specialized API manufacturing equipment, minimizing unplanned downtime and securing production schedules.

- Enhancement of global supply chain logistics through AI-driven risk mapping and demand forecasting, ensuring stability in Famciclovir API inventory levels.

- Acceleration of regulatory document generation and review processes (e.g., DMF updates) using Natural Language Processing (NLP) tools for compliance assurance.

DRO & Impact Forces Of Famciclovir API Market

The market dynamics for Famciclovir API are shaped by a strong interplay of consistent clinical demand, intense competitive rivalry, and evolving regulatory mandates. Primary drivers include the demographic shift toward an older population globally, increasing the susceptible cohort for VZV infections, and the mandatory need for effective antiviral prophylaxis in immunosuppressed patients. The established therapeutic efficacy of Famciclovir, coupled with its relatively low cost in generic form, ensures its continued adoption over newer, often more expensive, alternatives. These inherent demand factors provide a solid floor for market stability and moderate growth irrespective of economic cycles.

Major restraints on market value growth stem predominantly from the high degree of commoditization achieved by the API. The presence of numerous large-scale generic manufacturers, particularly in Asia, has led to intense price erosion and margin compression, challenging profitability for less efficient producers. Furthermore, strict regulatory scrutiny, especially in regions like the EU and US, concerning trace impurities (such as nitrosamines) imposes substantial compliance costs for upgrading facilities and implementing advanced testing protocols, acting as a barrier to entry and a continuous cost burden for incumbents.

Opportunities in the Famciclovir API market are centered around process innovation and strategic vertical integration. Manufacturers who can successfully implement sustainable green chemistry techniques or continuous manufacturing processes stand to gain a competitive edge by achieving both cost reduction and environmental compliance. The development of specialized delivery systems, such as improved prodrug derivatives or formulations that enhance patient compliance (e.g., once-a-day dosing), presents avenues for differentiation. Key impact forces are the regulatory requirement for high cGMP standards, which filters out non-compliant suppliers, and the clinical indispensability of the drug, guaranteeing sustained procurement volumes across the globe.

Segmentation Analysis

The Famciclovir API market segmentation provides a granular view of supply and demand across various functional and quality parameters essential for pharmaceutical formulation. Segmentation by application allows stakeholders to track demand patterns between acute treatments (shingles) and suppressive therapies (recurrent herpes), reflecting differences in prescribed duration and dose concentration. Segmentation by grade is paramount, differentiating the high-value, stringently regulated Pharmaceutical Grade required for final drug products from Research Grade API used in early-stage development, directly impacting pricing strategies and target customer base.

Further delineation is achieved through segmentation by formulation type, where oral solid dosages dominate due to the convenience of tablets and capsules for outpatient treatment, minimizing the market footprint of alternative liquid or suspension formulations. The emerging segmentation based on the synthesis method, differentiating between traditional chemical synthesis and potentially cleaner, enzymatic routes, highlights technological shifts aimed at improving purity profiles and manufacturing sustainability. This structured segmentation is critical for producers to align their manufacturing capacities and regulatory filings with the specific requirements of major consumption regions.

- By Application:

- Herpes Zoster (Shingles) Treatment

- Herpes Simplex Virus (HSV) Treatment (Genital Herpes, Cold Sores)

- Prophylaxis in Immunocompromised Patients

- By Grade:

- Pharmaceutical Grade (cGMP Compliant)

- Research Grade

- By Formulation Type:

- Oral Solid Dosages (Tablets, Capsules)

- Suspensions and Liquid Formulations

- By End-User:

- Generic Drug Manufacturers

- Innovator/Branded Pharmaceutical Companies

- Contract Development and Manufacturing Organizations (CDMOs)

Value Chain Analysis For Famciclovir API Market

The value chain for Famciclovir API begins with intensive upstream chemical processing, involving the procurement and sophisticated synthesis of key starting materials (KSMs) and complex chemical intermediates. This upstream stage is crucial as the quality and cost-effectiveness of these precursors directly dictate the final API attributes and overall production costs. Primary chemical suppliers, often specialized, must ensure their KSMs meet strict purity requirements to avoid introducing hard-to-remove impurities later in the process. Manufacturers are increasingly focused on dual-sourcing KSMs to mitigate supply chain disruptions and price volatility.

The core midstream activity is the multi-step chemical conversion of intermediates into crude Famciclovir, followed by extensive purification, crystallization, drying, and micronization processes. This stage demands adherence to Current Good Manufacturing Practices (cGMP), sophisticated reaction management systems, and high levels of operational control. The efficiency of the purification process is a major differentiator in the market, determining the final API grade and compliance with Pharmacopeial standards (USP, EP, JP). In-house or third-party analytical testing labs play a vital role in validating batch quality before release.

Downstream activities involve the packaging, regulatory filing (Drug Master Files - DMFs), and distribution of the finished Famciclovir API to end-user pharmaceutical formulation companies. Distribution channels are largely direct when supplying major generic players or innovator companies under long-term supply agreements, facilitating direct quality communication and technical support. Indirect channels, often utilizing regional specialized distributors, are employed to reach smaller markets or manage complex local regulatory requirements. Regulatory compliance documentation is paramount at this stage, governing market access in highly regulated regions.

Famciclovir API Market Potential Customers

The primary segment of potential customers for Famciclovir API consists of global and regional generic drug manufacturers. These companies are driven by the need for high-volume, cost-effective API supplies to compete in the crowded post-patent market for antiviral medications. Their purchasing decisions are highly sensitive to unit price, bulk capacity, and the supplier's capability to provide comprehensive regulatory documentation, including well-maintained and cross-referenced Drug Master Files (DMFs) with the FDA, EMA, and other national health authorities. Reliability in supply and proven batch consistency are non-negotiable requirements for this segment, forming the foundation of long-term partnerships.

A secondary, yet highly critical, customer base includes large, multinational pharmaceutical corporations, including those who may market branded generic versions or are exploring novel formulations or combination products. These buyers prioritize API suppliers who adhere to the highest international quality standards (e.g., EU GMP), offer highly specialized technical support, and demonstrate exceptional supply chain integrity. While volume requirements may sometimes be lower than those of pure generic players, these customers often demand custom synthesis capabilities, specialized particle sizing, and superior impurity profiles, translating into higher value procurement contracts.

Furthermore, Contract Development and Manufacturing Organizations (CDMOs) act as significant intermediaries and potential customers. CDMOs purchase Famciclovir API on behalf of their clients, which range from small biotech firms to major pharmaceutical companies, for formulation development and commercial manufacturing. Their requirements are focused on flexibility, speed, and the supplier's ability to seamlessly integrate into their quality management systems. Finally, public health agencies and international NGOs that manage essential drug lists often purchase Famciclovir API indirectly through large distributors or tender processes to ensure affordable access to antiviral treatment in resource-limited settings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 760.2 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lupin Ltd., Aurobindo Pharma, Sun Pharmaceutical Industries Ltd., Cipla Ltd., Teva Pharmaceutical Industries Ltd., Mylan N.V. (Viatris), Dr. Reddy's Laboratories, Hetero Labs Limited, Granules India Ltd., Apotex Inc., Huahai Pharmaceutical Co. Ltd., Hubei Biocause Pharmaceutical Co. Ltd., CSPC Pharmaceutical Group Limited, Lianyungang Xingang Pharmaceutical Co. Ltd., Divi's Laboratories Ltd., Piramal Pharma Solutions, Pfizer CentreOne, Glenmark Pharmaceuticals Limited |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Famciclovir API Market Key Technology Landscape

The technological advancement in the Famciclovir API market is primarily focused on optimizing the multi-step chemical synthesis route inherited from the original innovation. Manufacturers invest heavily in sophisticated process chemistry to improve atom economy, reduce the number of synthesis steps, and enhance chiral purity, which is critical for the drug's efficacy and regulatory compliance. High-pressure liquid chromatography (HPLC) purification systems and precision crystallization techniques are standard practices, ensuring the final API product meets the stringent specifications for minimal residual solvents and controlled particle size distribution (PSD), vital for subsequent tablet compression and dissolution performance.

A major area of technological differentiation involves the implementation of continuous manufacturing techniques, such as flow chemistry, replacing traditional batch processing. Continuous manufacturing offers superior control over reaction exotherms, enhanced safety profiles, and consistently higher product quality, reducing batch-to-batch variability—a significant requirement in a highly regulated market like Famciclovir API. Furthermore, this approach facilitates a smaller manufacturing footprint and potentially lower operational expenditures, providing a crucial competitive advantage in terms of cost structure.

In addition to manufacturing process technology, the adoption of Process Analytical Technology (PAT) tools represents a key technological push. Integrating spectroscopic methods (e.g., Near-Infrared or Raman spectroscopy) directly into the synthesis pipeline allows for real-time monitoring of critical process parameters. This technology minimizes the need for time-consuming, off-line quality checks, accelerating release times, and enabling automated feedback loops for immediate correction of deviations. The combined application of advanced analytical validation and continuous processing is defining the leading edge of Famciclovir API production technology, focused on efficiency and regulatory excellence.

Regional Highlights

Regional dynamics play a crucial role in shaping the Famciclovir API market, primarily distinguishing between high-volume manufacturing hubs and high-value consumption centers. Asia Pacific (APAC) stands out as the undisputed leader in API production, dominated by major economies like India and China. Manufacturers in these countries possess the necessary infrastructure, economies of scale, and chemical expertise to produce high-quality APIs at globally competitive prices. This region supplies the majority of generic drug producers worldwide, making it central to global supply chain stability. The ability of APAC suppliers to maintain compliant DMFs with international regulators is the foundation of their market strength.

North America and Europe constitute the core demand markets in terms of revenue, driven by established healthcare systems, high prescription rates for antiviral treatments, and mandatory insurance coverage. Demand in these regions is extremely sensitive to quality assurance, requiring API suppliers to demonstrate absolute adherence to cGMP and successful completion of rigorous facility audits. The market uptake here is highly influenced by the generic penetration rates and the ongoing need for continuous treatment protocols for chronic viral infections, ensuring sustained high-value procurement.

Latin America (LATAM) and the Middle East & Africa (MEA) are characterized as high-growth potential regions. Improved healthcare spending, increased governmental focus on combating infectious diseases, and expanding pharmaceutical markets are boosting the consumption of essential medicines like Famciclovir. While pricing sensitivity is higher in these regions, suppliers who can navigate complex import regulations and provide locally tailored supply solutions are expected to capture significant future market share, diversifying the global revenue map beyond the established Western markets.

- Asia Pacific (APAC): Leads in global supply capacity, driven by cost-efficient production in India and China; high domestic consumption growth expected.

- North America: Largest revenue contributor globally, characterized by high pharmaceutical expenditure and stringent demand for cGMP and US FDA-compliant API.

- Europe: Key consumer region where demand is governed by the European Medicines Agency (EMA) standards and a sophisticated network of pharmaceutical distributors.

- Latin America (LATAM): Emerging market showing significant promise due to healthcare modernization and increasing access to essential generic antiviral treatments.

- Middle East and Africa (MEA): Growth driven by government health initiatives, particularly for managing opportunistic infections in vulnerable populations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Famciclovir API Market.- Lupin Ltd.

- Aurobindo Pharma

- Sun Pharmaceutical Industries Ltd.

- Cipla Ltd.

- Teva Pharmaceutical Industries Ltd.

- Mylan N.V. (Viatris)

- Dr. Reddy's Laboratories

- Hetero Labs Limited

- Granules India Ltd.

- Apotex Inc.

- Huahai Pharmaceutical Co. Ltd.

- Hubei Biocause Pharmaceutical Co. Ltd.

- CSPC Pharmaceutical Group Limited

- Lianyungang Xingang Pharmaceutical Co. Ltd.

- Divi's Laboratories Ltd.

- Piramal Pharma Solutions

- Pfizer CentreOne

- Glenmark Pharmaceuticals Limited

Frequently Asked Questions

Analyze common user questions about the Famciclovir API market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Famciclovir API Market?

The primary factor is the persistent and recurrent global incidence of Herpes Zoster (shingles) and Herpes Simplex Virus infections, particularly among the growing geriatric and immunocompromised populations, ensuring continuous clinical need for antiviral treatments.

Which geographical region dominates the manufacturing of Famciclovir API?

The Asia Pacific (APAC) region, specifically India and China, dominates the manufacturing volume due to extensive chemical infrastructure, low operational costs, and established expertise in large-scale generic API production complying with international standards.

What are the major restraints affecting the growth of the Famciclovir API market value?

Intense price erosion due to fierce generic competition and the high capital expenditure required to meet increasingly strict regulatory mandates regarding impurity profiling and cGMP compliance are the major restraints on market value appreciation.

How does Famciclovir API compare to other antiviral APIs like Acyclovir?

Famciclovir is a prodrug of penciclovir, generally offering superior oral bioavailability and more convenient dosing schedules (e.g., twice daily) compared to Acyclovir, making it a preferred option for certain recurrent infections.

What technological trends are emerging in Famciclovir API production?

Emerging trends include the adoption of continuous manufacturing techniques (flow chemistry) and the integration of Process Analytical Technology (PAT) for real-time quality control, aimed at increasing efficiency, purity, and compliance while lowering production costs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager