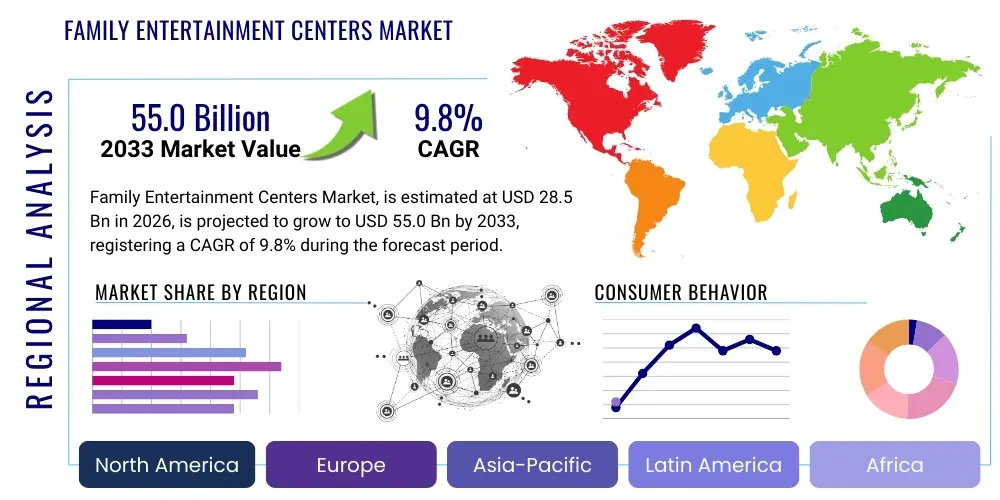

Family Entertainment Centers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437251 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Family Entertainment Centers Market Size

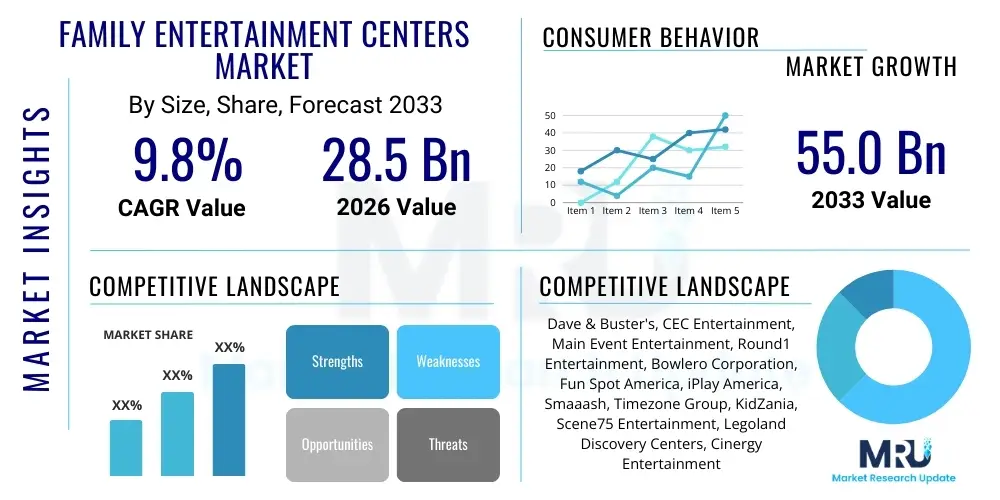

The Family Entertainment Centers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at $28.5 Billion in 2026 and is projected to reach $55.0 Billion by the end of the forecast period in 2033.

Family Entertainment Centers Market introduction

The Family Entertainment Centers (FEC) Market encompasses establishments designed to provide leisure and entertainment activities for families, targeting groups often characterized by parents and children. These centers offer a diverse range of attractions, including arcade games, indoor playgrounds, bowling alleys, mini-golf, laser tag, virtual reality (VR) experiences, and food and beverage services. The central value proposition of FECs lies in offering a safe, convenient, and multi-generational recreational experience under one roof, positioning them as essential social hubs, particularly in urban and suburban environments where dedicated outdoor recreational space may be limited or weather-dependent. The product description of modern FECs increasingly integrates technology, moving beyond traditional amusement to include high-tech, location-based entertainment (LBE) that caters to the digitally savvy consumer.

Major applications of FECs extend beyond general family outings; they are crucial venues for birthday parties, corporate team-building events, school excursions, and social gatherings. The key benefits driving consumer demand include the provision of shared, quality family time, safe environments for physical and social development of children, and high replay value through diverse activity offerings. Moreover, FECs offer a significant economic benefit by providing local employment and stimulating regional tourism.

The primary driving factors accelerating market expansion include the rising disposable incomes across developing economies, particularly in Asia Pacific, coupled with the global shift towards the ‘experiential economy.’ Consumers are increasingly prioritizing spending on experiences over material goods. Furthermore, rapid urbanization necessitates centralized leisure options, while technological advancements such as affordable and high-fidelity virtual and augmented reality (VR/AR) are constantly refreshing FEC offerings, maintaining consumer interest, and enabling higher revenue per guest through premium, immersive experiences.

Family Entertainment Centers Market Executive Summary

The Family Entertainment Centers Market is experiencing a rapid evolution characterized by significant digital transformation and diversification of revenue streams. Key business trends indicate a strong focus on enhancing the customer journey through integrated digital platforms, including online ticketing, personalized marketing campaigns, and loyalty programs that leverage data analytics to maximize repeat visits and customer lifetime value. There is a noticeable shift towards smaller, urban-centric FEC formats that require lower initial capital investment but offer high-tech, specialized activities like eSports lounges and VR arcades, contrasting with the traditional large-scale centers. Furthermore, sustainability and wellness are emerging factors, influencing center design to include healthier food options and environmentally friendly operational practices, reflecting broader consumer societal values.

Geographically, the Asia Pacific region is the dominant growth engine, driven by burgeoning middle classes, high population density, and significant investment in retail and entertainment infrastructure, particularly in countries like China and India. North America and Europe, while representing mature markets, are focusing on upgrading existing facilities, implementing advanced cashless payment systems, and integrating innovative intellectual properties (IPs) through licensing agreements to maintain market relevance and competitive edge. Regional trends also highlight regulatory nuances, with varying levels of safety standards and operating permits impacting expansion strategies across continents.

Segmentation trends reveal substantial growth in the VR/AR activity type segment, demonstrating consumers’ appetite for immersive, digitally enhanced experiences. Furthermore, there is a distinct segmentation shift based on facility size, where micro-FECs (less than 5,000 sq. ft.) are rapidly penetrating shopping malls and high-street locations, providing accessible entertainment solutions. Revenue generation is increasingly balanced across ticket sales, food and beverage (F&B), and merchandise, reflecting operators’ strategic efforts to diversify income streams and mitigate reliance solely on gate admission. The end-user segment continues to be dominated by families with children (9-12 years), but centers are increasingly tailoring offerings to attract young adults (18-25 years) through sophisticated social gaming environments.

AI Impact Analysis on Family Entertainment Centers Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Family Entertainment Centers Market predominantly center on how AI can personalize the guest experience, streamline operational efficiency, and potentially transform activity offerings. Users are keenly interested in predictive analytics for managing crowd flow, optimizing staffing schedules based on real-time demand, and utilizing machine learning algorithms to recommend tailored activity bundles or F&B offers to individual guests, thus maximizing spending and satisfaction. A key concern often revolves around the perceived threat of AI replacing human interaction, particularly in guest services, and the need for a balance between automation and maintaining the welcoming, personal atmosphere characteristic of family venues. There is also significant anticipation regarding AI's role in creating dynamically adjusting, highly immersive, and responsive game environments that enhance the uniqueness of LBE compared to in-home gaming.

- AI-Powered Personalization: Utilizing data analytics to offer customized game recommendations, dynamic pricing models, and targeted food and beverage promotions, significantly boosting per-capita spending.

- Operational Efficiency: Implementing AI for predictive maintenance of arcade machines and rides, optimizing cleaning schedules, and automating complex tasks like inventory management and demand-based staffing.

- Enhanced Guest Safety: Deployment of computer vision and AI monitoring systems for real-time crowd management, identifying safety hazards, and rapidly responding to emergencies, thereby minimizing liability risks.

- Immersive Content Creation: Using generative AI tools to rapidly create novel game content, dynamically adjusting difficulty levels, or generating unique scenarios for VR/AR experiences, increasing replay value.

- Customer Service Automation: Integration of AI chatbots and virtual assistants for reservation handling, FAQ responses, and preliminary troubleshooting, freeing up human staff for higher-touch interactions.

DRO & Impact Forces Of Family Entertainment Centers Market

The Family Entertainment Centers market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively influence market growth potential and operational profitability. The primary drivers include the expanding culture of social interaction and out-of-home entertainment consumption, supported by rising discretionary spending on leisure activities, particularly in emerging economies. The technological imperative, driven by the continuous innovation in VR, AR, and interactive digital attractions, forces market expansion by regularly introducing novel consumer experiences that cannot be replicated at home. Furthermore, demographic shifts, such as increasing urbanization and the desire for convenient, safe recreational spaces for families, solidify the market's foundational demand. These factors create a sustained pressure for operators to innovate and scale their offerings to capture diverse consumer segments.

However, market growth is significantly restrained by high initial capital investment requirements for advanced equipment, complex insurance mandates, and the substantial operational costs associated with maintaining large physical facilities, utilities, and specialized technical staff. Competition from low-cost, high-convenience in-home entertainment options, such as sophisticated gaming consoles and streaming services, poses a constant competitive threat, demanding that FECs continuously justify their premium pricing through superior, exclusive experiential value. Regulatory hurdles concerning safety certifications, zoning laws, and child protection standards also add layers of complexity and cost to the business model, particularly for international expansion.

Opportunities for future expansion are abundant, centered around the strategic adoption of next-generation technology, notably integrating eSports arenas and dedicated multi-purpose social hubs that cater to young adults and professional gamers. Strategic partnerships with major media franchises (IP licensing) allow FECs to offer exclusive, highly desirable themed experiences, creating unique selling propositions. The market also presents significant opportunity in the untapped corporate segment through focused team-building packages and venue rentals. Impact forces such as Porter’s Five Forces indicate strong bargaining power of suppliers (especially specialized technology providers) and high threat of substitutes (in-home entertainment), necessitating operational excellence and differentiated offerings to maintain profitability and market share.

Segmentation Analysis

The Family Entertainment Centers market is comprehensively segmented based on several critical factors including facility size, revenue source, activity type, and end-user demographics, providing a granular view of market structure and commercial viability across different niches. Understanding these segments is crucial for investors and operators to tailor their strategies, ranging from selecting optimal facility locations—be it large suburban centers or smaller urban micro-centers—to developing specific pricing and service models targeted at distinct customer groups. The segmentation clearly illustrates the shift toward specialized, high-revenue-generating activities like competitive eSports and sophisticated location-based VR, signaling a maturing market moving beyond reliance on traditional coin-operated arcades and soft play areas.

- By Facility Size:

Small FECs (< 5,000 sq. ft.): These are typically micro-centers often located within malls or retail complexes, focusing on high-tech, high-throughput activities like VR pods or eSports stations. Their low footprint allows for quick deployment and lower overheads.

Medium FECs (5,000 – 15,000 sq. ft.): These constitute the traditional neighborhood FEC model, offering a balanced mix of activities such as mini-bowling, laser tag, and expansive arcade floors, often serving as birthday party venues.

Large FECs (> 15,000 sq. ft.): These mega-centers are destination venues, featuring major attractions like indoor amusement rides, full-scale water features, high ropes courses, and multiple dining options, drawing visitors from a wider regional radius.

- By Revenue Source:

Entry Fees/Ticket Sales: Revenue generated directly from admission, encompassing time-play passes, all-day wristbands, or specific ride/activity tickets.

Food & Beverage (F&B): Sales derived from onsite dining, quick-service concessions, and catering services for events, often representing a significant profit center.

Merchandise Sales: Income from branded goods, toys, prize redemption, and party supplies.

Advertisements/Sponsorships: Revenue generated from digital signage, naming rights, or sponsored activities within the venue.

- By Activity Type:

Arcade Games/Video Games: Traditional coin-operated games, redemption games, and simulators.

Activity Areas (e.g., Laser Tag, Bowling, Mini Golf): Structured, participatory activities requiring dedicated infrastructure.

Virtual and Augmented Reality (VR/AR) Entertainment: Immersive, high-tech experiences often location-based and networked.

Play Zones/Soft Play: Dedicated areas for younger children, often involving padded equipment and supervised activities.

- By End User:

Families with Children (0-8 Years)

Families with Children (9-12 Years)

Teenagers (13-17 Years)

Young Adults/Others (18+ Years, including corporate groups)

Value Chain Analysis For Family Entertainment Centers Market

The value chain for the Family Entertainment Centers market begins with the upstream suppliers, who are critical in providing the core physical and technological assets. This stage involves manufacturers of specialized amusement equipment (rides, bowling machinery), developers of arcade and redemption games, and increasingly, high-tech providers specializing in VR/AR hardware and immersive content software. Strong supplier relationships are essential for quality control, maintenance, and accessing the latest innovation, which dictates the novelty factor necessary to attract consumers. The development phase also includes specialized construction and theme design services focused on creating engaging and durable environments that adhere to strict safety standards. The ability to source durable, engaging, and unique attractions efficiently minimizes initial capital expenditure and long-term maintenance overheads.

The midstream segment involves the FEC operators themselves, focusing on venue management, facility maintenance, human resource training, and crucial operational activities like F&B preparation and inventory control. Operational efficiency, driven by sophisticated management software for ticketing and resource scheduling, determines profitability. Downstream activities are heavily focused on customer acquisition and retention, encompassing targeted marketing (digital and traditional), sales of party packages and corporate events, and managing the overall guest experience, including safety and personalized service. The quality of the downstream interaction directly translates into positive word-of-mouth marketing and repeat business.

Distribution within the FEC sector is primarily direct-to-consumer, as the venue itself is the consumption point. However, indirect distribution channels play a role in promoting the venue, including partnerships with hotels, tourism agencies, and local community groups, which drive traffic to the center. Technological distribution, such as online booking portals and mobile applications, serves as a crucial indirect channel for reservations and prepaid activity purchases. Effective distribution relies heavily on maximizing venue utilization during peak times and creating compelling reasons for off-peak visits, often through dynamic pricing and promotional bundles.

Family Entertainment Centers Market Potential Customers

The primary customer base for Family Entertainment Centers is diverse, centered predominantly around families seeking structured, shared recreational experiences outside the home. The core segment consists of parents with children aged 6 to 12, as this group highly values multi-activity venues that cater to varying age levels, providing both physical play for younger children and arcade or technology-driven entertainment for tweens. These families are high-frequency users, particularly on weekends and during school holidays, and are the main drivers of F&B and party package sales, prioritizing safety and convenience.

A rapidly growing segment comprises teenagers and young adults (13-25 years), who are increasingly drawn to high-immersion activities such as eSports, advanced VR simulations, and social gaming environments that facilitate group interaction and competition. FECs that successfully integrate sophisticated technology and modern aesthetic design, often branded as ‘social gaming lounges’ or ‘competitive entertainment venues,’ effectively capture this segment, which is less focused on soft play but highly driven by competitive fun and sharing experiences on social media.

Additionally, the corporate sector represents a lucrative, albeit secondary, potential customer segment. Businesses utilize FECs for team-building exercises, company celebrations, and networking events, valuing the relaxed, engaging environment that fosters collaboration. These potential customers often require exclusive venue rental, comprehensive catering services, and tailored activities, leading to higher average transaction values. Targeting these diverse end-users requires differentiated marketing messages and facility design that can seamlessly transition between family, social, and professional events.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $28.5 Billion |

| Market Forecast in 2033 | $55.0 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dave & Buster's, CEC Entertainment, Main Event Entertainment, Round1 Entertainment, Bowlero Corporation, Fun Spot America, iPlay America, Smaaash, Timezone Group, KidZania, Scene75 Entertainment, Legoland Discovery Centers, Cinergy Entertainment, The Funplex, Lucky Strike Entertainment, GameWorks, Splitsville Luxury Lanes, Incredible Pizza Company, Zero Latency, Sandbox VR |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Family Entertainment Centers Market Key Technology Landscape

The core technology landscape in the Family Entertainment Centers market is defined by continuous digital integration aimed at enhancing immersion, operational efficiency, and customer management. Virtual Reality (VR) and Augmented Reality (AR) systems are central to this transformation. Location-Based VR (LBVR) offers high-fidelity, shared group experiences that surpass home VR capabilities, utilizing advanced motion platforms, haptic feedback suits, and expansive, free-roam tracking technologies. This allows FECs to command premium pricing for unique, exclusive content. Similarly, AR is utilized to overlay digital elements onto physical environments, enhancing activities like mini-golf or bowling with interactive, gamified features without requiring full enclosure or dedicated hardware per user. These immersive technologies are essential for attracting the young adult demographic and maintaining competitive differentiation against the increasingly sophisticated home gaming market.

Beyond the core entertainment offerings, sophisticated operational technologies are driving profitability. Cashless payment and card swipe systems have become ubiquitous, replacing traditional tokens and allowing operators to track customer spending patterns meticulously, enabling personalized marketing and loyalty programs. These integrated systems facilitate seamless transactions across games, F&B, and merchandise, minimizing staff handling of cash and accelerating throughput. Furthermore, the adoption of specialized FEC management software, often cloud-based, integrates ticketing, point-of-sale (POS), resource scheduling, and Customer Relationship Management (CRM) tools. This technological backbone allows for dynamic pricing based on time of day or demand, optimizing capacity utilization and revenue generation during traditionally slow periods.

The future technology trajectory focuses heavily on gamification platforms and Location-Based Services (LBS). Gamification involves applying game design elements to non-game contexts, such as rewarding loyalty members with digital achievements or personalized offers through a dedicated mobile app, extending the FEC experience outside the physical venue. LBS technology, powered by Wi-Fi or Bluetooth beacons, provides real-time data on guest movement and dwell times, enabling sophisticated heat mapping. This data is critical for optimizing facility layout, identifying underutilized attractions, and deploying staff proactively to high-traffic areas, thereby directly impacting both guest satisfaction and operational safety standards.

Regional Highlights

Market expansion and innovation in the Family Entertainment Centers sector exhibit distinct regional characteristics influenced by economic maturity, consumer culture, and regulatory frameworks.

- North America (NA): Represents a mature and highly competitive market, characterized by large facility sizes and high adoption rates of technology like VR and sophisticated cashless systems. The region focuses heavily on brand consolidation (through acquisitions) and integrating F&B offerings to drive ancillary revenue. Key growth areas include eSports venues and social gaming concepts targeting Millennials and Gen Z.

- Europe: The market is fragmented but highly innovative, with a strong emphasis on niche, high-quality, and themed entertainment, often centered around licensed intellectual property. Central and Western Europe exhibit high spending on leisure, driving demand for premium, immersive experiences. Regulatory standards, particularly regarding safety and accessibility, are stringent, influencing facility design and operational practices.

- Asia Pacific (APAC): The fastest-growing region globally, fueled by massive urbanization, increasing disposable incomes in countries like China, India, and Southeast Asia, and a vast, young population demographic. APAC growth is characterized by the rapid expansion of FEC chains into Tier 2 and Tier 3 cities, adopting diverse formats from indoor theme parks to mall-based micro-centers. Investment in high-tech attractions is substantial to appeal to the digitally native consumer.

- Latin America (LATAM): Growth is steady, driven primarily by Mexico and Brazil. The market focuses on affordable entertainment options and traditional FEC models, with gradual adoption of advanced digital technology. Economic stability challenges can sometimes affect consumer discretionary spending, necessitating flexible pricing strategies.

- Middle East and Africa (MEA): Marked by significant investment in luxury retail and leisure infrastructure, particularly in the UAE and Saudi Arabia. The market features large-scale, climate-controlled indoor centers, often integrated into mega-malls, catering to year-round demand for high-end entertainment and luxury family experiences.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Family Entertainment Centers Market.- Dave & Buster's

- CEC Entertainment (Chuck E. Cheese)

- Main Event Entertainment

- Round1 Entertainment

- Bowlero Corporation

- Fun Spot America

- iPlay America

- Smaaash

- Timezone Group

- KidZania

- Scene75 Entertainment

- Legoland Discovery Centers (Merlin Entertainments)

- Cinergy Entertainment

- The Funplex

- Lucky Strike Entertainment

- GameWorks

- Splitsville Luxury Lanes

- Incredible Pizza Company

- Zero Latency

- Sandbox VR

Frequently Asked Questions

Analyze common user questions about the Family Entertainment Centers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current growth trend in the Family Entertainment Centers (FEC) Market?

The primary driver is the global shift toward the experiential economy, where consumers prioritize spending on shared, out-of-home experiences over material goods. This is coupled with technological innovation, particularly the integration of Location-Based Virtual Reality (LBVR) and Augmented Reality (AR), which offer unique, high-quality entertainment that cannot be replicated by in-home devices, thereby sustaining high visitor demand and premium pricing opportunities.

How significant is the role of technology, specifically VR/AR, in modern FEC operations?

Technology is highly significant, acting as a core differentiator. VR/AR entertainment attracts the lucrative teenage and young adult segments by offering high-immersion, social, and competitive experiences. Operationally, technology facilitates cashless systems, personalized marketing through data analytics, and operational efficiency tools for staffing and predictive maintenance, directly impacting profitability and customer flow management.

Which geographical region exhibits the highest growth potential for FEC market expansion?

The Asia Pacific (APAC) region currently demonstrates the highest growth potential. This growth is underpinned by rapidly expanding middle-class populations, significant investment in retail and leisure infrastructure, and high rates of urbanization, particularly in nations like China, India, and Indonesia. These factors create a massive, untapped consumer base with increasing discretionary spending capacity for leisure activities.

What are the main challenges facing FEC operators in mature markets like North America and Europe?

Major challenges include intense competition from low-cost, high-convenience in-home entertainment (console gaming, streaming), high initial capital costs for facility upgrades (especially for VR/AR integration), and stringent operational costs related to insurance, real estate, and utility expenses. Mature markets require constant innovation and unique IP licensing to maintain relevance and combat substitution threats effectively.

What role does Food and Beverage (F&B) play in the overall revenue structure of a Family Entertainment Center?

F&B is a critical component of the FEC business model, often serving as a major profit center with high margins. Beyond supplementing admission revenue, quality F&B offerings extend the average guest visit duration, increase per-capita spending, and are essential for maximizing the value of lucrative event catering, such as birthday parties and corporate bookings, significantly contributing to the overall financial viability of the center.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager