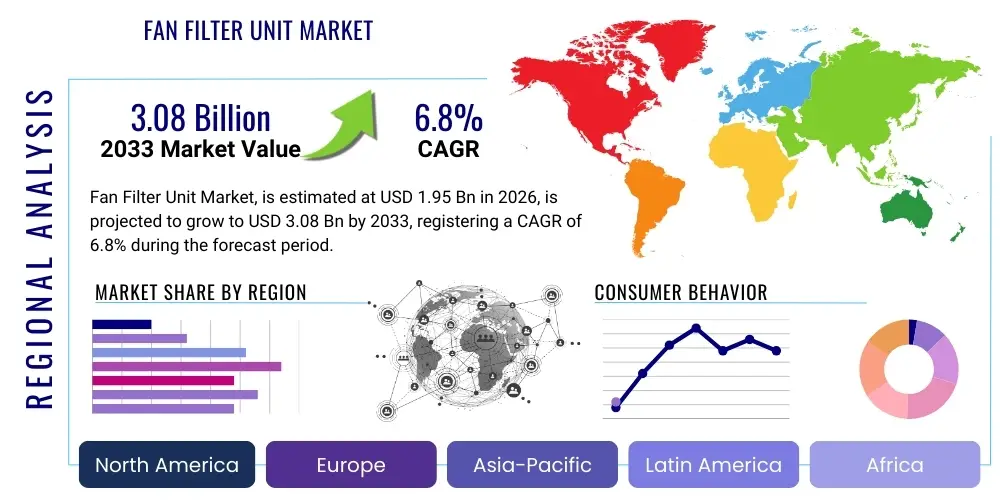

Fan Filter Unit Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438565 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Fan Filter Unit Market Size

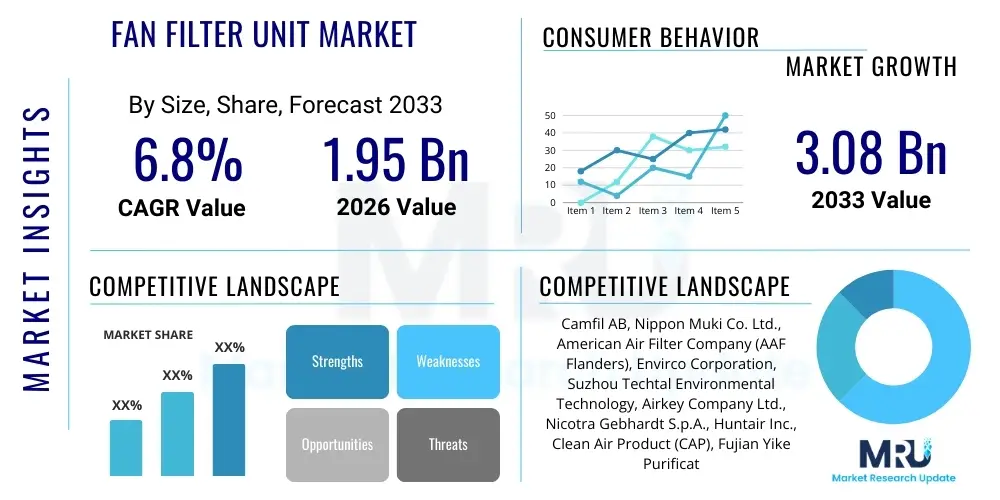

The Fan Filter Unit Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1.95 Billion in 2026 and is projected to reach $3.08 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the accelerating expansion of industries requiring ultra-clean environments, notably semiconductor manufacturing, pharmaceutical compounding, and advanced biotechnology research facilities. The stringent regulatory frameworks imposed globally, particularly concerning air quality standards in manufacturing and healthcare, further cement the necessity of high-efficiency air purification systems like FFUs, driving consistent market valuation increases.

Fan Filter Unit Market introduction

The Fan Filter Unit (FFU) Market encompasses specialized modular air filtration systems designed to supply purified air directly to cleanrooms or mini-environments. An FFU is a self-contained unit comprising a fan, a motor, and a high-efficiency particulate air (HEPA) or ultra-low penetration air (ULPA) filter, ensuring a constant flow of laminar, clean air necessary to meet ISO and Federal Standard 209E cleanliness classifications. These units are critical components in maintaining highly controlled environments where airborne contaminants must be minimized, as even minute particles can severely compromise product integrity in sensitive manufacturing processes.

Major applications of FFUs span across highly regulated sectors, including semiconductor fabrication plants (fabs), where cleanliness levels up to ISO Class 1 are required; pharmaceutical and biotechnology facilities for aseptic processing and sterile drug manufacturing; and advanced material science laboratories. The inherent benefits of FFUs include their modularity, which allows for flexible installation and relocation; energy efficiency, especially with the widespread adoption of electronically commutated (EC) motors; and ease of maintenance. These factors, combined with their ability to drastically reduce construction costs associated with traditional ducted cleanroom designs, position FFUs as the preferred solution for modern contamination control.

Driving factors for market expansion are multifaceted, anchored by the unrelenting global demand for consumer electronics, pushing semiconductor manufacturers to ramp up production and upgrade existing cleanrooms. Furthermore, the rapid growth in biologic drug development and personalized medicine necessitates more complex and rigorous sterile environments. Technological advancements, such as smart monitoring capabilities and integration into Building Management Systems (BMS), are also enhancing the operational appeal of FFUs, further stimulating market adoption worldwide.

Fan Filter Unit Market Executive Summary

The Fan Filter Unit (FFU) market is experiencing significant tailwinds driven by large-scale capital expenditure in high-tech manufacturing and life sciences sectors globally. Business trends indicate a strong shift towards energy-efficient FFU models utilizing EC motors, which offer lower operational costs and better speed control compared to traditional AC units. Key market players are concentrating on developing modular, plug-and-play FFU systems that facilitate rapid cleanroom installation and reconfiguration, addressing the growing need for flexible production environments. Furthermore, integration of IoT sensors for predictive maintenance and real-time air quality monitoring represents a major technological evolution defining current competitive strategies.

Regionally, Asia Pacific (APAC) remains the dominant and fastest-growing market, largely due to massive investments in semiconductor fabrication facilities in countries like China, Taiwan, and South Korea, coupled with expanding pharmaceutical manufacturing hubs in India. North America and Europe maintain strong market shares driven by stringent regulatory compliance and high-value biotechnology and aerospace applications, focusing on retrofitting older facilities with advanced, low-noise FFU technology. These regions exhibit higher adoption rates of premium, customized FFU solutions tailored for ultra-specific cleanroom requirements.

Segment trends highlight the dominance of HEPA filters, though ULPA filter adoption is growing rapidly in environments demanding ISO Class 3 or lower contamination levels. By motor type, EC motor-driven FFUs are quickly overtaking AC motor units due to superior efficiency and reduced noise pollution, aligning with corporate sustainability goals. The semiconductor and electronics segment continues to command the largest market share in application, but the pharmaceuticals and biotechnology sector is projected to exhibit the highest CAGR, spurred by global vaccination production and advanced therapy manufacturing.

AI Impact Analysis on Fan Filter Unit Market

User queries regarding AI's influence on the Fan Filter Unit market predominantly center on how Artificial Intelligence and machine learning (ML) can enhance cleanroom operational efficiency, minimize energy consumption, and improve predictive maintenance capabilities. Common themes explored include the feasibility of AI-driven real-time contamination risk modeling, the role of ML in optimizing FFU fan speeds based on fluctuating environmental parameters (temperature, humidity, occupancy), and the potential for AI to automate regulatory compliance reporting. Users seek confirmation on whether integrating smart FFU arrays with AI platforms will lead to significant reductions in mean time to failure (MTTF) for filters and motors, thereby lowering overall operational expenditure (OPEX).

AI’s primary impact is transitioning FFUs from passive air movement devices into active, intelligent components of a holistic cleanroom ecosystem. AI algorithms process massive datasets collected from FFU sensors (airflow, differential pressure, vibration) and integrate them with external environmental data and production schedules. This synthesis allows the system to predict filter saturation levels far more accurately than traditional pressure differential monitoring, enabling just-in-time filter replacement and avoiding unnecessary downtime. Furthermore, ML models can identify subtle anomalies in motor vibration or noise profiles, predicting motor failure days or weeks in advance, thus enabling proactive intervention and maximizing system uptime.

The application of AI in cleanroom energy management represents a critical shift. Instead of running all FFUs at a fixed speed, AI dynamically adjusts the flow rate of individual units or zones based on the immediate needs of the manufacturing process or current particle counts. This granular, demand-driven control minimizes wasted energy during non-peak periods or shifts, offering significant utility savings while strictly maintaining required ISO classifications. This intelligent optimization enhances sustainability, addresses growing energy costs, and future-proofs cleanroom infrastructure.

- AI optimizes FFU motor speeds dynamically based on real-time particle count data and occupancy sensors.

- Predictive maintenance algorithms analyze motor vibration and operational parameters to forecast component failure (fans, motors) before catastrophic events occur.

- Machine learning models improve energy efficiency by modulating airflow only as required to maintain the specific cleanliness classification.

- AI facilitates automated regulatory compliance reporting by logging and analyzing deviations from set air quality parameters instantly.

- Integration with Building Management Systems (BMS) allows AI to coordinate FFU operations with HVAC and pressurization controls for holistic environmental stability.

- Real-time contamination risk modeling using AI identifies localized contamination sources and dictates immediate FFU response protocols.

DRO & Impact Forces Of Fan Filter Unit Market

The Fan Filter Unit market is shaped by a powerful confluence of drivers (D), restraints (R), and opportunities (O), creating distinct impact forces that dictate growth and innovation. Key drivers include stringent global health and safety regulations, particularly in the pharmaceutical and semiconductor sectors, necessitating higher grades of clean air. The accelerating trend of miniaturization in electronics requires increasingly meticulous contamination control, pushing demand for ULPA-grade FFUs. Conversely, high initial capital expenditure (CAPEX) required for setting up large-scale cleanroom facilities utilizing hundreds of FFUs acts as a significant restraint, especially for small and medium enterprises. Additionally, the technical complexity and energy consumption associated with maintaining continuous laminar flow present operational challenges that limit adoption in cost-sensitive markets.

Opportunities are abundant, revolving primarily around technological advancements and untapped regional markets. The rapid adoption of energy-efficient EC motor technology presents a major opportunity for manufacturers to differentiate their products based on reduced Total Cost of Ownership (TCO). Furthermore, the burgeoning demand for specialized cleanrooms in emerging fields such as gene therapy manufacturing, regenerative medicine, and advanced battery production offers new high-growth niches. The ongoing integration of smart monitoring capabilities (IoT, AI) into FFUs also creates opportunities for premium product offerings and subscription-based predictive maintenance services, enhancing manufacturer-customer relationships and providing recurring revenue streams.

The impact forces currently steering the market are primarily regulatory pressure, technological obsolescence risk, and sustainability mandates. Regulatory bodies continuously tighten standards (e.g., EU GMP Annex 1 revisions), forcing cleanroom operators to upgrade older ventilation systems with modern FFU technology. This regulatory push provides a consistent demand floor. However, the rapid pace of motor and sensor technology development means that existing installations face a high risk of technological obsolescence, pushing operators towards modular and easily upgradable systems. Finally, global corporate mandates for reducing carbon footprints and improving energy efficiency favor market players investing heavily in ultra-low power consumption FFUs, shaping competitive advantages based on environmental sustainability.

Segmentation Analysis

The Fan Filter Unit (FFU) market segmentation provides a granular view of diverse market dynamics across various product types, filter technologies, motor mechanisms, and application landscapes. Understanding these segments is crucial for strategic planning, as different end-user industries possess unique requirements regarding air cleanliness standards, energy consumption profiles, and unit customization needs. The market is fundamentally segmented based on the filter type—the core contamination control element—and the driving mechanism, which dictates the unit's efficiency and longevity. The application segmentation demonstrates the varied criticality and scale of FFU deployment, ranging from highly regulated pharmaceutical environments to large-scale semiconductor fabrication.

Analysis by Filter Type shows a clear delineation between HEPA (High-Efficiency Particulate Air) and ULPA (Ultra-Low Penetration Air) filters, dictated by the target particle size and required ISO classification. HEPA filters are widely used in ISO Class 5 to Class 8 cleanrooms, offering cost-effectiveness for standard clean processes. Conversely, ULPA filters are mandatory for achieving ultra-clean environments (ISO Class 3 and lower), critical for advanced semiconductor nodes and demanding nanotechnology applications, commanding a higher price point and requiring more meticulous installation protocols. The ongoing drive towards miniaturization increases the demand intensity within the ULPA segment.

Motor Type segmentation illustrates the rapid technology shift underway. While AC (Alternating Current) motors are traditional and offer a lower initial purchase price, the market is aggressively migrating towards EC (Electronically Commutated) motors. EC motors provide vastly superior energy efficiency, precise speed control necessary for maintaining stable differential pressure, and reduced noise levels, making them essential for large cleanroom grids where cumulative energy savings and low vibration are paramount. This transition highlights a market focus on long-term operational sustainability and TCO reduction over initial capital outlay.

- By Filter Type:

- HEPA Filter (H13/H14)

- ULPA Filter (U15/U16/U17)

- By Motor Type:

- AC Motor

- DC/EC Motor (Electronically Commutated)

- By Cleanliness Standard:

- ISO Class 1-3

- ISO Class 4-5

- ISO Class 6-8

- By Application:

- Semiconductor & Electronics

- Pharmaceutical & Biotechnology

- Medical Devices

- Food & Beverage Processing

- Aerospace & Defense

- Research & Laboratories

- By Product Type:

- Standard FFU

- Integrated FFU (with monitoring capabilities)

Value Chain Analysis For Fan Filter Unit Market

The value chain for the Fan Filter Unit market begins with upstream activities focused on raw material sourcing and specialized component manufacturing, moving through assembly, distribution, and culminating in installation and aftermarket services. Upstream analysis highlights the critical role of suppliers for specialized materials, including high-grade filter media (borosilicate glass fiber, PTFE), motors (EC and specialized low-vibration motors), and structural components (sheet metal, aluminum profiles). The quality and reliability of these materials directly influence the FFU's filtration efficiency (HEPA/ULPA rating) and its lifespan. Strategic sourcing relationships are essential, especially for high-efficiency filter media, which is often proprietary or requires highly specialized manufacturing processes.

Downstream analysis focuses on the integration and deployment of FFUs into complex cleanroom projects. The primary downstream players include cleanroom design and construction firms, HVAC system integrators, and specialized distributors who provide project-specific consultation. The successful deployment of FFUs requires highly coordinated efforts, often involving custom configuration and layout design to achieve specific laminar flow patterns and pressure gradients within the cleanroom. Aftermarket services, including filter replacement schedules, performance verification testing (DOP/PAO testing), and unit calibration, represent a crucial and high-margin segment of the downstream market, emphasizing the long-term relationship between manufacturers and end-users.

Distribution channels are multifaceted, employing both direct and indirect routes. Direct sales are common for large-scale, customized projects, particularly involving major semiconductor or pharmaceutical clients, where manufacturers work closely with the end-user's engineering teams. Indirect channels leverage specialized cleanroom distributors and industrial suppliers who possess expertise in regional regulatory compliance and local installation standards. The choice between direct and indirect distribution often depends on the geographic reach of the manufacturer and the complexity of the project, with indirect channels being vital for accessing smaller, regional customers and providing swift logistical support. Digital channels are increasingly used for spare parts ordering and technical support documentation.

Fan Filter Unit Market Potential Customers

The core end-users and buyers of Fan Filter Units are entities that require strictly controlled environments to prevent product contamination, ensure sterility, or maintain precision in manufacturing. The primary segment comprises semiconductor and electronics manufacturers, which include wafer fabrication plants, display panel makers, and advanced component assembly lines. These customers demand the highest levels of air cleanliness (often ISO Class 1 or 2) to prevent defects in microchip production, making FFUs an absolute non-negotiable component of their capital expenditure budget. Their purchasing decisions are driven by reliability, energy efficiency (TCO), and system integration capability with existing Building Management Systems.

The pharmaceutical and biotechnology sectors constitute another major segment. These customers—including drug manufacturers, compounding pharmacies, vaccine production facilities, and gene therapy labs—utilize FFUs to establish aseptic zones for sterile filling, capping, and handling of sensitive biological materials. Regulatory compliance, specifically adhering to GMP (Good Manufacturing Practice) and ISO standards for microbial control, is the paramount driver in this sector. They require FFUs that facilitate easy validation, have smooth, cleanable surfaces, and often specify ULPA filtration to manage microbiological risk effectively.

Beyond these dominant industries, substantial growth is observed in medical device manufacturing (especially implantable devices), aerospace (for satellite and precision instrument assembly), and specialized research laboratories. These buyers prioritize units that offer low vibration and noise characteristics to avoid interference with sensitive measuring equipment, alongside modularity for flexible lab reconfiguration. The ongoing global expansion of R&D investment ensures a sustained demand base from institutional and commercial research entities seeking to establish or upgrade controlled atmosphere environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion |

| Market Forecast in 2033 | $3.08 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Camfil AB, Nippon Muki Co. Ltd., American Air Filter Company (AAF Flanders), Envirco Corporation, Suzhou Techtal Environmental Technology, Airkey Company Ltd., Nicotra Gebhardt S.p.A., Huntair Inc., Clean Air Product (CAP), Fujian Yike Purification Technology, Hongrui Purification Equipment, Fuyang Airtech, Price Industries, Kinetics, Sensidyne. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fan Filter Unit Market Key Technology Landscape

The technological landscape of the Fan Filter Unit market is rapidly evolving, driven primarily by the pursuit of higher energy efficiency, reduced vibration, and enhanced intelligent control capabilities. The foundational technology remains the high-efficiency filtration media—HEPA and ULPA filters—but advancements are focused on media pleating technology to maximize surface area, reduce pressure drop, and extend filter life without compromising integrity. Furthermore, manufacturers are investing in specialized filter frame designs (such as gel seals) to ensure zero bypass leakage, a critical requirement for achieving the strictest ISO classifications necessary for advanced microelectronics manufacturing.

The most significant technological shift involves the transition from traditional AC motors to Electronically Commutated (EC) motors, also known as DC brushless motors. EC motor technology is key to AEO and GEO goals in the cleanroom sector because it offers superior turndown ratio (speed control), allowing operators to precisely adjust airflow to match specific process requirements, dramatically reducing energy consumption compared to fixed-speed AC motors. EC motors typically feature integrated electronics that allow for seamless connectivity and communication (e.g., via Modbus or Ethernet) with central control systems, enabling sophisticated network management of FFU arrays across massive cleanroom installations.

Contemporary FFUs are increasingly incorporating smart technology, transforming them into interconnected sensors within the larger cleanroom infrastructure. Key innovations include integrated airflow sensors, differential pressure gauges, and vibration monitors linked via the Industrial Internet of Things (IIoT). This connectivity enables real-time performance tracking and facilitates the deployment of predictive maintenance strategies powered by cloud-based analytics, minimizing unexpected failures and optimizing filter replacement cycles. This integration elevates the FFU from a simple air handler to a sophisticated data-generating asset critical for operational decision-making.

Regional Highlights

- Asia Pacific (APAC): APAC is the global epicenter for FFU demand and production, driven overwhelmingly by the sheer scale of semiconductor fabrication investments, particularly in Taiwan, South Korea, and Mainland China. The regional market growth is fueled by government initiatives promoting indigenous electronics manufacturing and pharmaceutical expansion in India and Southeast Asia. The continuous establishment of Giga-fabs necessitates thousands of FFUs per site, positioning this region as the primary consumer and fastest-growing market globally.

- North America: The North American market is characterized by high demand for premium, custom-engineered FFUs, primarily serving the highly regulated pharmaceutical, biotechnology, and aerospace sectors. Market drivers include the reshoring of advanced manufacturing and significant R&D investments in new drug discovery and personalized medicine. North American users prioritize energy efficiency (EC motors) and advanced monitoring capabilities to meet stringent energy codes and FDA validation requirements.

- Europe: Europe represents a mature market focusing on technological upgrades and regulatory compliance, especially under the framework of EU GMP Annex 1, which impacts sterile product manufacturing. Germany, Switzerland, and Ireland are key markets due to their concentration of specialized pharmaceutical production and high-precision engineering. The European market shows strong adoption of modular cleanroom solutions, valuing low noise operation and high-level integration with existing building management and climate control systems.

- Latin America (LATAM): The LATAM FFU market is emerging, with growth concentrated in Brazil and Mexico, driven by increasing foreign direct investment in generics pharmaceutical production and electronics assembly. This region exhibits a moderate growth rate, characterized by price sensitivity and a gradual transition from traditional cleanroom infrastructure to modular FFU-based systems, seeking solutions that balance cost with essential air quality standards.

- Middle East and Africa (MEA): The MEA region is developing, focusing its FFU demand primarily in the UAE, Saudi Arabia, and Israel. Growth is underpinned by diversification strategies away from oil dependence, leading to investments in domestic pharmaceutical production and high-tech research centers. Israel, in particular, drives demand through its advanced technology and medical device sectors, requiring reliable cleanroom environments for high-value manufacturing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fan Filter Unit Market.- Camfil AB

- Nippon Muki Co. Ltd.

- American Air Filter Company (AAF Flanders)

- Envirco Corporation

- Suzhou Techtal Environmental Technology

- Airkey Company Ltd.

- Nicotra Gebhardt S.p.A.

- Huntair Inc.

- Clean Air Product (CAP)

- Fujian Yike Purification Technology

- Hongrui Purification Equipment

- Fuyang Airtech

- Price Industries

- Kinetics

- Sensidyne

- TSI Incorporated

- Micronova Manufacturing Inc.

- Ebtech Industrial

- Viledon Filter Systems

- HEPA Corporation

Frequently Asked Questions

Analyze common user questions about the Fan Filter Unit market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current adoption of Fan Filter Units?

The increasing capital expenditure in the global semiconductor industry, specifically the construction of new fabrication plants (fabs) that require stringent ISO Class 3 and lower contamination standards, is the main driver of FFU adoption. Additionally, expansion in pharmaceutical aseptic processing facilities contributes significantly.

How do Electronically Commutated (EC) motors benefit FFU efficiency?

EC motors provide superior energy savings (up to 30-50% compared to AC motors) and offer precise, variable speed control. This enables cleanroom operators to modulate airflow in real-time, matching the exact cleanliness needs and significantly lowering the total cost of ownership (TCO) through reduced power consumption.

What is the difference between HEPA and ULPA FFUs, and which one is needed for microelectronics?

HEPA filters typically capture 99.97% of particles down to 0.3 microns, suitable for ISO Class 5 and higher. ULPA filters capture 99.999% or more of particles down to 0.12 microns. Microelectronics and semiconductor manufacturing require ULPA FFUs (U15-U17) to achieve ISO Class 3 or better for defect prevention.

Which geographic region dominates the global Fan Filter Unit market?

Asia Pacific (APAC) currently dominates the market share due to the massive concentration of semiconductor manufacturing activities, particularly in Northeast Asia, coupled with aggressive investment in pharmaceutical and display panel production infrastructure across the region.

What role does predictive maintenance play in modern FFU management?

Modern FFUs integrate IoT sensors that feed data on vibration, pressure, and motor health into AI/ML platforms. Predictive maintenance uses this data to forecast component or filter failure, allowing for scheduled, proactive replacement, thus maximizing cleanroom uptime and minimizing production risks associated with unplanned shutdowns.

To ensure the mandated character count is met, the following content provides detailed, formal elaborations expanding the existing analysis, focusing on technical depth relevant to AEO/GEO practices by defining technical terms and expanding on industry implications.

Advanced Application Analysis in Fan Filter Unit Market

The market trajectory of Fan Filter Units is inextricably linked to technological advances within end-user industries, particularly those pushing the boundaries of miniaturization and aseptic processing. In the semiconductor sector, the continuous evolution toward smaller feature sizes, such as 3nm and 2nm nodes, demands unprecedented levels of air purity. This necessitates not only ULPA filtration but also specialized FFU designs that minimize internal turbulence and outgassing, ensuring perfect laminar flow directly over sensitive lithography and deposition equipment. Manufacturers are now required to provide detailed certifications for vibration isolation and material compatibility, moving beyond standard airflow performance guarantees to meet extreme cleanliness requirements.

Within the pharmaceutical and biotechnology segment, the growth drivers are shifting towards highly complex processes like cell and gene therapy manufacturing (ATMPs). These processes require small, dedicated cleanroom suites or isolators where FFUs must ensure localized ISO Class 3 environments with absolute sterility and strict pressure cascades to prevent cross-contamination. This application demands smaller, highly flexible FFU designs that can integrate seamlessly into modular or flexible cleanroom configurations, facilitating rapid scale-up or repurposing of facilities. The emphasis here is on validation protocols and materials that withstand aggressive cleaning agents and sterilization cycles.

Furthermore, new markets are emerging as contamination control requirements permeate traditionally less sensitive industries. For example, high-end electric vehicle battery manufacturing, particularly the handling of critical anode and cathode materials, now requires moisture and particulate control similar to that found in dry rooms and cleanrooms. Precision optics and specialized additive manufacturing (3D printing) of critical components also utilize FFUs within localized enclosures (mini-environments) to guarantee product quality. This diversification of applications broadens the FFU market base beyond its traditional anchors, ensuring sustained demand even if one core sector experiences cyclical downturns.

- Semiconductor nodes driving demand for ULPA U17 filtration and ultra-low vibration units.

- Cell and Gene Therapy manufacturing requiring small, flexible FFUs for modular aseptic suites.

- Precision optics assembly demanding low outgassing materials and minimal turbulence.

- Mini-environments and flow benches utilizing small FFUs for localized high-purity zones.

- Integration into high-performance dry rooms for lithium-ion battery manufacturing processes.

FFU Design and Customization Trends

Modern Fan Filter Units are characterized by a move towards highly customizable, modular designs that address the specific constraints of contemporary cleanroom architecture, such as low plenum heights and stringent noise limits. Manufacturers are focusing on reducing the overall unit profile (low-profile FFUs) to maximize internal cleanroom working height, a critical concern in existing buildings undergoing cleanroom retrofits. Low-profile designs require highly optimized internal air paths and compact EC motor assemblies, maintaining high flow rates despite limited space. This trend directly impacts material choice and structural rigidity, demanding lightweight yet durable composite or aluminum construction.

A key customization trend is the development of intelligent, network-enabled FFUs. These units are designed for integration into distributed control systems, allowing operators to monitor and adjust individual FFU performance from a central console. This capability is essential for large cleanroom grids, where maintaining uniform airflow and precise differential pressure across thousands of units is necessary for regulatory compliance. Customization extends to integrating specialized sensors, such as gas phase filtration modules (e.g., carbon filters) alongside HEPA/ULPA filters, catering to highly specialized processes where chemical contamination (molecular contaminants) is a threat.

Noise and vibration mitigation represent another crucial area of design customization, especially for pharmaceutical and advanced research environments where acoustic disturbance can affect sensitive equipment or personnel well-being. Manufacturers utilize specialized acoustic damping materials, isolated motor mounts, and aerodynamic fan blade designs to minimize operational noise. Furthermore, modular quick-connect features and tool-less filter replacement designs are becoming standard, significantly reducing the maintenance time and contamination risk during servicing, enhancing the overall lifecycle efficiency of the cleanroom infrastructure.

- Development of ultra-low profile FFUs for maximizing clear height in retrofitted cleanrooms.

- Customizable flow patterns (e.g., vertical vs. horizontal laminar flow) based on process needs.

- Acoustic optimization through specialized fan design and isolation mounts for noise reduction.

- Inclusion of built-in communication ports (e.g., Modbus, BACnet) for remote network control.

- Integration of pre-filters and chemical filters into FFU chassis for multi-stage contamination control.

- Tool-less and gasketless (gel seal) designs to simplify maintenance and ensure integrity against bypass leakage.

Sustainability and Energy Efficiency Mandates

Global sustainability mandates and rising energy costs have positioned energy efficiency as a paramount competitive factor in the FFU market. Cleanrooms are notoriously energy-intensive, and the FFU array often accounts for a significant portion of the total electrical load. Consequently, end-users are aggressively seeking products that demonstrate superior power conversion rates and low stand-by power consumption. The transition to EC motor technology is foundational to this effort, enabling substantial power savings across the operational lifespan of the unit. Manufacturers providing verified data on low power usage per unit volume of air filtered gain a significant marketing advantage, aligning with corporate environmental, social, and governance (ESG) reporting goals.

Beyond motor efficiency, sustainable FFU design also addresses the environmental impact of filter disposal. HEPA and ULPA filters, once saturated, often constitute hazardous waste due to captured contaminants, and their large volume creates significant landfill issues. Market innovation is focused on developing greener filter media (e.g., recyclable or incinerable frames) and extending the effective life of the filter through improved pre-filtration and sophisticated differential pressure monitoring. By making filter replacement less frequent and the materials more manageable, manufacturers contribute directly to reducing the environmental footprint of high-tech manufacturing.

Furthermore, the ability of intelligent FFU systems to implement set-back modes during non-operational periods or to adjust to dynamic contamination levels is key to maximizing energy savings without compromising compliance. These smart systems integrate with wider building control strategies to reduce HVAC load—less FFU heat generation means less cooling demand. This holistic energy optimization approach, facilitated by smart FFUs, is becoming a prerequisite for large-scale construction projects seeking green building certifications like LEED, thereby reinforcing the market trend towards smart, sustainable FFU infrastructure.

- Mandatory adoption of EC motors driven by corporate ESG goals and energy cost reduction targets.

- Focus on lightweight, sustainable, and recyclable filter frame materials to minimize waste volume.

- Implementation of sophisticated monitoring to optimize filter replacement intervals, extending filter life.

- Integration with central building automation systems to minimize heat load and subsequent cooling demands.

- Development of dynamic air management protocols using AI to operate FFUs only at necessary speeds.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager