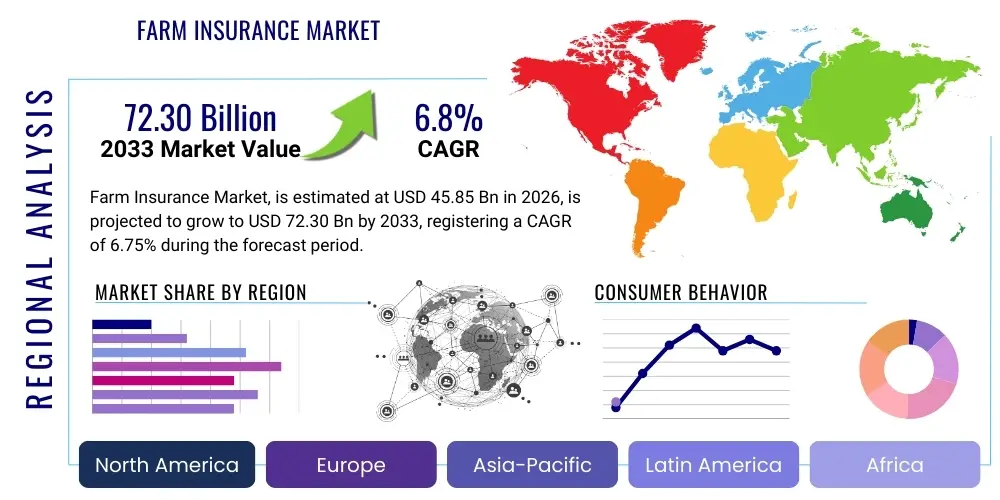

Farm Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436226 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Farm Insurance Market Size

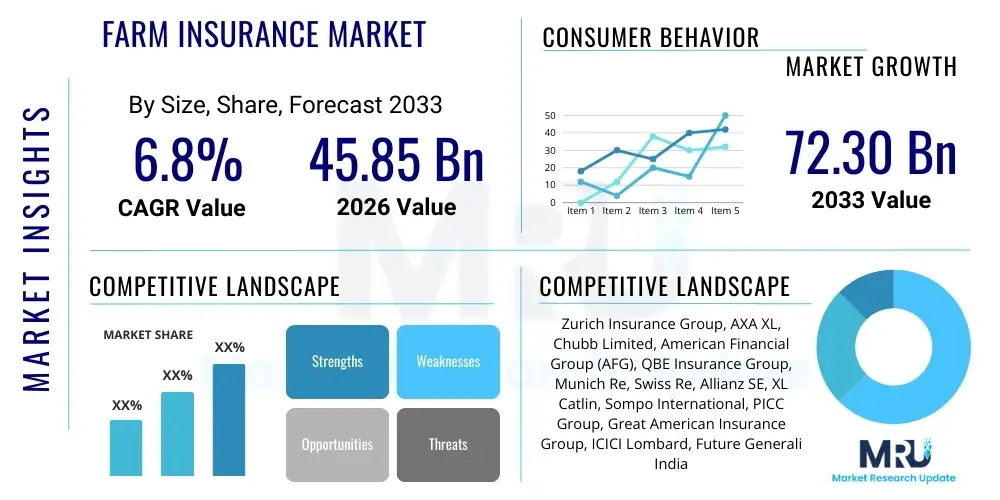

The Farm Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.75% between 2026 and 2033. The market is estimated at USD 45.85 Billion in 2026 and is projected to reach USD 72.30 Billion by the end of the forecast period in 2033.

Farm Insurance Market introduction

The Farm Insurance Market encompasses a specialized range of insurance products designed to protect agricultural producers, farmers, and related entities against financial losses stemming from natural disasters, volatile market prices, disease outbreaks, equipment failure, and liability risks inherent in farming operations. This comprehensive coverage is crucial for ensuring the financial stability and resilience of the global agricultural sector, acting as a vital risk mitigation tool against factors largely beyond the farmer's control, such as extreme weather events driven by climate change and geopolitical supply chain disruptions. The complexity of modern farming, involving advanced machinery, large property holdings, and intricate contractual obligations, necessitates sophisticated insurance solutions tailored to specific regional and crop-based risks.

Farm insurance products typically include crop insurance, livestock mortality coverage, farm property and equipment insurance, and agricultural liability policies. Crop insurance, often supported or subsidized by government schemes in major agricultural economies, protects against losses due to drought, floods, pests, and yield shortfalls. Livestock insurance safeguards against the financial impact of disease, accidents, or market downturns affecting herds and poultry. The major applications of farm insurance involve stabilizing farm income, facilitating access to agricultural credit (as lenders often require adequate coverage), and promoting sustainable farming practices by reducing the economic fear of catastrophic failure. The product description emphasizes customizability, allowing farmers to select coverage levels that align with their specific risk exposure and investment levels.

The primary benefits driving market demand include enhanced risk transfer mechanisms, regulatory compliance in regions mandating certain coverage types, and increased operational continuity post-disaster. Driving factors are predominantly the accelerating frequency and severity of climate-related perils, necessitating robust disaster relief mechanisms. Furthermore, the increasing adoption of advanced farming technologies, such as precision agriculture tools, requires insurance products that specifically cover high-value technological assets and the potential systemic risks associated with digitized farming, propelling market innovation towards parametric and index-based insurance models that offer faster and more transparent payouts.

Farm Insurance Market Executive Summary

The Farm Insurance Market is characterized by robust growth, driven primarily by increasing climate volatility and expanding government support for agricultural risk management across developed and emerging economies. Key business trends include a significant shift toward technology-enabled underwriting, utilizing remote sensing and artificial intelligence to enhance risk modeling accuracy and expedite claims settlements. Insurers are actively integrating data from drones, satellite imagery, and IoT devices to offer hyper-localized coverage, moving away from generalized area yield programs. This technological integration is fostering collaboration between agri-tech startups and traditional insurance carriers, leading to the rapid proliferation of parametric insurance products, which link payouts directly to predefined indices like rainfall levels or temperature variations, thereby reducing moral hazard and administrative costs.

Regionally, North America and Europe continue to hold dominant market shares, largely due to established regulatory frameworks, high rates of farm mechanization, and comprehensive public-private partnership schemes supporting crop insurance. However, the Asia Pacific region is demonstrating the highest growth trajectory, spurred by rapid population growth, increased focus on food security, and government initiatives in large agricultural nations like India and China to expand insurance penetration among smallholder farmers. Latin America is also emerging as a critical market, particularly for livestock and export-oriented crop insurance, driven by modernization of farming techniques and increased global trade integration. Regional trends also show a move towards multi-peril policies that bundle various risks under a single premium structure.

Segmentation trends highlight that Crop Insurance remains the largest segment by premium volume, dominating the market due to the essential nature of protecting staple food production. Within this segment, Multi-Peril Crop Insurance (MPCI) is highly favored due to its broad coverage against multiple yield-reducing events. Concurrently, the Farm Liability Insurance segment is experiencing faster proportional growth, reflecting heightened consumer awareness regarding food safety, environmental damage caused by farm runoff, and occupational health and safety regulations for farm laborers. Insurers are developing specialized liability policies that cover risks associated with genetically modified organisms (GMOs) and digital farming data breaches, reflecting the evolving legal and ethical landscape of modern agriculture.

AI Impact Analysis on Farm Insurance Market

Analysis of common user questions reveals a strong focus on how Artificial Intelligence can revolutionize the accuracy and speed of farm insurance processes, moving away from historical data reliance to real-time predictive modeling. Users frequently inquire about the feasibility of AI models to accurately predict localized, micro-climate-driven perils, such as flash droughts or localized hailstorms, which traditional models often miss. A prevalent theme is the expectation that AI should facilitate immediate, automatic claims payouts, minimizing the financial uncertainty and waiting periods currently faced by farmers following a loss event. Concern also centers on the transparency and accessibility of the data powering these AI models, ensuring fairness, particularly for smaller farming operations.

The consensus expectation is that AI will significantly enhance risk assessment by integrating vast, disparate datasets, including high-resolution satellite imagery, soil health metrics, historical climate patterns, and commodity price forecasts. This holistic view allows insurers to move beyond generalized risk pools to highly individualized, dynamic risk profiles for each farm or even specific fields within a farm, enabling truly personalized policy pricing and encouraging best practice adoption through incentivization. Furthermore, AI is expected to dramatically streamline the claims adjustment process. By utilizing deep learning algorithms to detect and quantify damage from remote sensing data, the need for costly, slow, and subjective physical inspections is reduced, leading to faster response times and significantly improved farmer satisfaction during critical post-loss periods.

However, the implementation of AI introduces new challenges, prominently around data governance and algorithmic bias. If training data reflects historical biases against certain geographic regions or demographics, the resulting policies could unintentionally exacerbate existing inequalities. Therefore, ongoing user discussions stress the necessity of rigorous ethical oversight and explainable AI (XAI) frameworks within the farm insurance sector. Successfully harnessing AI requires substantial investment in infrastructure, cybersecurity measures to protect sensitive farm operational data, and the upskilling of insurance personnel to manage and interpret sophisticated model outputs, positioning AI as a transformative force in underwriting, fraud detection, and customer relationship management.

- Enhanced Predictive Modeling: AI leverages machine learning to forecast localized weather and disease outbreaks with greater accuracy than conventional statistical models.

- Automated Claims Processing: Computer vision (CV) analyzes satellite and drone imagery to verify crop damage and calculate loss severity instantly, triggering rapid claim payments.

- Dynamic Policy Pricing: AI algorithms integrate real-time IoT data on soil moisture, fertilizer application, and equipment usage to offer flexible, usage-based insurance premiums.

- Fraud Detection and Prevention: AI identifies anomalous claim patterns or discrepancies between reported losses and monitored farm activity, substantially reducing fraudulent payouts.

- Development of Parametric Products: AI facilitates the creation of complex index-based insurance products linked to precise environmental triggers, enabling instant, transparent settlements.

DRO & Impact Forces Of Farm Insurance Market

The Farm Insurance Market is principally driven by the undeniable increase in global climate variability, which translates directly into higher risks of catastrophic losses from events such as prolonged droughts, intense flooding, and unseasonal temperature fluctuations. Governments worldwide recognize the systemic threat this poses to food security and farm livelihoods, consequently increasing subsidies and mandatory participation requirements in crop and livestock insurance programs, particularly in developing economies seeking to stabilize rural incomes. The ongoing technological evolution in agriculture, involving heavy investments in specialized machinery and high-yielding seeds, also demands greater financial protection, pushing farmers towards comprehensive risk coverage. These drivers collectively amplify the demand for diverse and sophisticated insurance products.

Key restraints, however, often impede market penetration, especially among smallholder farmers. The high cost of premiums, particularly in high-risk zones where climate change impacts are most severe, often makes comprehensive insurance economically prohibitive without substantial government assistance. Furthermore, a significant knowledge gap persists in many emerging markets regarding the specific benefits and complex terms of insurance policies, leading to low adoption rates. Operational restraints include the challenges of accurate risk assessment and claims verification in remote or underdeveloped agricultural areas, where reliable weather monitoring infrastructure and historical data are sparse. The lack of standardized data collection across global farming sectors also complicates the development of scalable insurance solutions, requiring bespoke approaches that increase administrative complexity.

Opportunities for growth are abundant and centered on innovation. The widespread adoption of index-based (parametric) insurance represents a major opportunity, simplifying policies and dramatically accelerating the payout process by eliminating the need for traditional field assessments. Integrating Internet of Things (IoT) sensors, drones, and advanced spatial analytics offers insurers the capacity to micro-segment risk and offer highly precise policies, broadening accessibility and fairness. The impact forces acting on the market are high, characterized by the external force of climate change demanding adaptive strategies, governmental policies providing foundational support, and competitive technological pressures pushing carriers towards digitalization and personalized product offerings. These forces necessitate continuous adaptation in product design and delivery channels to meet the evolving needs of the global agricultural community.

Segmentation Analysis

The Farm Insurance Market is broadly segmented based on the type of coverage required, the nature of the farm asset insured, and the distribution channel utilized. This segmentation reflects the highly heterogeneous nature of the agricultural industry, which ranges from large-scale industrial farming of staple crops to specialized organic and niche livestock operations. Understanding these segments is crucial for insurers to tailor risk models and develop relevant product offerings. The dominant segment remains Crop Insurance, reflecting its foundational role in safeguarding global food supply chains and its heavy reliance on government subsidy programs designed to encourage uptake.

Further segmentation differentiates between the primary assets requiring protection: crops, livestock, farm property, and farm liability. Crop insurance is typically divided into Multi-Peril Crop Insurance (MPCI), covering a wide array of natural hazards, and specific peril policies, such as hail or named-peril frost coverage. The increasing sophistication of farming operations is driving growth in the Farm Property and Equipment segment, which covers high-value assets like automated irrigation systems, tractors, and processing facilities. Segmentation by distribution channel shows a strong reliance on specialized agents and brokers who possess deep agricultural expertise, although direct digital sales channels are expanding rapidly, particularly for simpler, parametric products aimed at tech-savvy farmers.

- By Coverage Type:

- Crop Insurance (MPCI, Named Peril, Revenue Protection)

- Livestock Insurance (Mortality, Transit, Disease Outbreak)

- Farm Property Insurance (Structures, Machinery, Inventory)

- Farm Liability Insurance (Product Liability, Environmental Liability, Employer’s Liability)

- By Farm Type:

- Horticulture and Permanent Crops (Fruits, Vineyards, Nut Trees)

- Arable Farming (Grains, Oilseeds, Cereals)

- Aquaculture and Fisheries

- Livestock and Dairy Farming

- By Distribution Channel:

- Agencies and Brokers (Traditional Channels)

- Bancassurance

- Direct Digital Channels

- By Policy Nature:

- Traditional Indemnity Insurance

- Parametric/Index-Based Insurance

Value Chain Analysis For Farm Insurance Market

The value chain for the Farm Insurance Market is complex, involving multiple specialized stakeholders working from upstream data sourcing and risk modeling to downstream policy servicing and claims resolution. Upstream analysis focuses heavily on data providers, which include satellite imagery companies (e.g., geospatial analytics firms), meteorological services, soil testing laboratories, and agricultural technology (AgriTech) companies that supply IoT sensor data. These data sources are crucial for actuaries and underwriters to accurately quantify and price agricultural risk. Key activities in the upstream segment include sophisticated risk accumulation modeling, utilizing catastrophe models (Cat Models) specifically adapted for climate perils, and developing predictive analytical tools that define the bounds of insurable risks.

Midstream activities are dominated by primary insurers and reinsurers. Primary insurers develop and market the specific farm insurance products, manage underwriting, and handle customer relationships, often relying on specialized agricultural brokers for sales and advisory services. Reinsurers play a vital role in providing capacity and stabilizing the market, absorbing large, systemic risks (like regional droughts or widespread disease outbreaks) that individual insurers cannot bear alone. The distribution channel is bifurcated into direct and indirect methods. Indirect channels, predominantly specialized agricultural insurance brokers and agents, remain the most utilized route, leveraging their deep relationships and understanding of local farming practices to match farmers with appropriate coverage.

Downstream activities center on claims handling, loss adjustment, and settlement. This phase is increasingly influenced by technology, with drones and geospatial analysis replacing traditional physical loss adjusters in many cases, leading to more efficient claims processing. The involvement of government regulatory bodies is also critical throughout the value chain, as they often dictate policy structure, subsidize premiums, and enforce participation, particularly in the crop insurance segment. The integration of technology throughout the value chain, from automated underwriting (midstream) to algorithmic claims settlement (downstream), is enhancing efficiency and transparency, while the relationship between upstream data providers and midstream carriers defines the accuracy and affordability of the final product.

Farm Insurance Market Potential Customers

Potential customers for farm insurance span the entire spectrum of agricultural producers, ranging from individual smallholder farmers operating subsistence or small commercial plots to massive multinational agribusiness corporations managing thousands of hectares. The core end-users, or buyers, are typically the farm operators themselves, who seek to protect their investments in crops, livestock, and infrastructure against unforeseen events. For small to medium-sized enterprises (SMEs) in agriculture, insurance is primarily a tool for income stability and continuity, ensuring their ability to replant crops or replace lost animals following a disaster, thereby securing their livelihood and preventing indebtedness.

In addition to individual operators, large corporate farms and integrated agribusinesses represent a significant customer segment with complex insurance needs. These entities require comprehensive coverage that includes specialized risks such as political risk (for international operations), supply chain disruption, environmental liability related to large-scale waste management or chemical usage, and protection for high-value processing equipment and inventory. Furthermore, financial institutions, such as commercial banks and agricultural lenders, often act as indirect consumers, as they mandate adequate farm insurance coverage as a prerequisite for extending loans, ensuring the collateral (crops or land) remains protected, thus mitigating their own credit risk exposure.

Other vital potential customers include agricultural cooperatives, which purchase blanket policies to cover their membership base, and entities involved in specialized high-value agriculture, such as vineyards, fisheries, and vertical farms, each requiring highly tailored policies addressing unique risks (e.g., temperature control failures in controlled environment agriculture). The growing segment of customers focused on sustainable and organic farming also demands specialized insurance products that cover the higher capital investment and often greater susceptibility to certain environmental risks associated with these farming methods, pushing insurers to innovate and create niche, targeted offerings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.85 Billion |

| Market Forecast in 2033 | USD 72.30 Billion |

| Growth Rate | 6.75% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zurich Insurance Group, AXA XL, Chubb Limited, American Financial Group (AFG), QBE Insurance Group, Munich Re, Swiss Re, Allianz SE, XL Catlin, Sompo International, PICC Group, Great American Insurance Group, ICICI Lombard, Future Generali India Insurance, Tokio Marine Holdings, Mapfre S.A., Generali Group, CNA Financial, Travelers Companies, Federal Crop Insurance Corporation (FCIC) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Farm Insurance Market Key Technology Landscape

The Farm Insurance Market is undergoing a rapid technological transformation, fundamentally shifting from paper-based, generalized risk assessment to highly dynamic, data-driven underwriting and claims processing. The foundational technology powering this shift is geospatial intelligence, which relies on high-resolution remote sensing data collected via satellites (e.g., Sentinel, Landsat) and low-altitude Unmanned Aerial Vehicles (UAVs or drones). This data provides critical insights into field-level conditions, crop health indices (like NDVI), and accurate land boundary mapping, drastically improving the precision of policy issuance and loss verification. These technologies enable insurers to monitor environmental conditions in real-time, moving risk assessment from historical averages to current probabilities.

The integration of advanced analytics, specifically Machine Learning (ML) and Artificial Intelligence (AI), forms the second critical pillar of the technology landscape. AI models process massive streams of raw data—weather forecasts, soil moisture readings from IoT sensors, and historical yield data—to predict the probability and severity of loss events with unprecedented accuracy. This capability is vital for actuaries developing complex parametric policies, where payouts are triggered automatically when predefined indices are breached. Furthermore, AI-powered computer vision is being deployed in claims management, analyzing drone footage or satellite imagery to quantify damage severity (e.g., percentage of hail damage to a specific field) without requiring costly physical inspections.

Complementary technologies include the use of Internet of Things (IoT) sensors deployed directly in fields to gather granular data on microclimates, humidity, and pest infestation levels, allowing for proactive risk mitigation advice and highly personalized premiums. Blockchain technology is also gaining traction, particularly for its application in creating "smart contracts" for parametric insurance. These blockchain contracts execute claims automatically and transparently when external data oracles confirm the trigger condition has been met, eliminating disputes and enhancing trust among farmers, regulators, and insurers. Collectively, these technologies are reducing operational costs for carriers, increasing transparency for farmers, and expanding the insurability of traditionally high-risk agricultural areas.

Regional Highlights

- North America (NA): Dominates the global market, driven largely by the heavily subsidized Multi-Peril Crop Insurance (MPCI) program in the United States, managed through public-private partnerships. The region features high agricultural mechanization, sophisticated risk modeling, and a strong regulatory environment supporting crop and livestock insurance penetration. Key growth areas include specialized insurance for high-value specialty crops and protection against complex weather events like derechos and polar vortices.

- Europe: Characterized by stringent food safety standards and complex regulatory environments (e.g., Common Agricultural Policy support). European markets show high adoption of farm property and liability insurance, driven by high labor costs and complex environmental legislation. Innovation is focused on integrating satellite data for pan-European agricultural monitoring and developing climate-resilient insurance products tailored to vineyards and specialized food production.

- Asia Pacific (APAC): Expected to exhibit the fastest Compound Annual Growth Rate (CAGR) due to vast, underserved smallholder farmer populations in countries like India, China, and Indonesia. Market expansion is propelled by aggressive government initiatives (e.g., PMFBY in India) to subsidize premiums and expand digital outreach. Key challenges involve managing the fragmentation of land holdings and integrating micro-insurance models effectively using mobile technology and localized risk indices.

- Latin America: A dynamic market characterized by rapid growth in large-scale commercial farming for export-oriented commodities (soybeans, beef, sugar). Demand is high for livestock mortality insurance and specialized coverage against market price volatility and currency fluctuations. The region is quickly adopting parametric insurance solutions to manage widespread drought and flood risks that affect large, contiguous farming areas.

- Middle East and Africa (MEA): Represents an emerging market with significant reliance on agriculture, often facing extreme aridity and water scarcity risks. Market penetration is low but growing, supported by pilot programs using index-based insurance targeting risks specific to rainfall deficits and heat stress. Development is highly dependent on governmental capacity building, international development aid, and reliable climate data infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Farm Insurance Market.- Zurich Insurance Group

- AXA XL

- Chubb Limited

- American Financial Group (AFG)

- QBE Insurance Group

- Munich Re

- Swiss Re

- Allianz SE

- XL Catlin

- Sompo International

- PICC Group (The People's Insurance Company of China)

- Great American Insurance Group

- ICICI Lombard General Insurance

- Future Generali India Insurance

- Tokio Marine Holdings

- Mapfre S.A.

- Generali Group

- CNA Financial Corporation

- Travelers Companies Inc.

- Federal Crop Insurance Corporation (FCIC) / RMA (Risk Management Agency)

Frequently Asked Questions

Analyze common user questions about the Farm Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Parametric Farm Insurance and why is it growing?

Parametric farm insurance pays out automatically based on predefined, measurable triggers (like specific rainfall levels or temperature thresholds) rather than actual assessed damage. It is growing rapidly because it offers objectivity, transparency, and significantly speeds up claim settlements, enhancing cash flow stability for farmers after a major weather event.

How is climate change impacting the affordability and availability of farm insurance?

Climate change increases the frequency and severity of catastrophic weather events, leading to higher systemic risk for insurers. This volatility often results in escalating premium costs and necessitates increased government subsidies or the development of more sophisticated, granular risk modeling using AI and satellite data to maintain affordability and market availability.

What role do satellites and drones play in modern farm insurance underwriting?

Satellites and drones provide high-resolution, unbiased geospatial data used for detailed risk assessment, precise field boundary mapping, and real-time monitoring of crop health (via indices like NDVI). This technology drastically improves the accuracy of underwriting, supports fraud detection, and facilitates rapid, remote loss verification, replacing costly physical inspections.

Which segment holds the largest share in the Farm Insurance Market?

The Crop Insurance segment holds the largest market share globally. This dominance is primarily driven by the fundamental need to protect staple food production and is heavily supported by widespread government subsidy programs, particularly Multi-Peril Crop Insurance (MPCI) schemes in major agricultural economies.

What is the primary challenge to farm insurance adoption in emerging markets?

The primary challenge is the combination of low financial literacy regarding complex policies, the prohibitive cost of premiums for smallholder farmers without subsidies, and the lack of reliable, high-quality historical climate data infrastructure necessary for accurate risk pricing and policy development.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager