Fashion Apparel PLM Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432745 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Fashion Apparel PLM Software Market Size

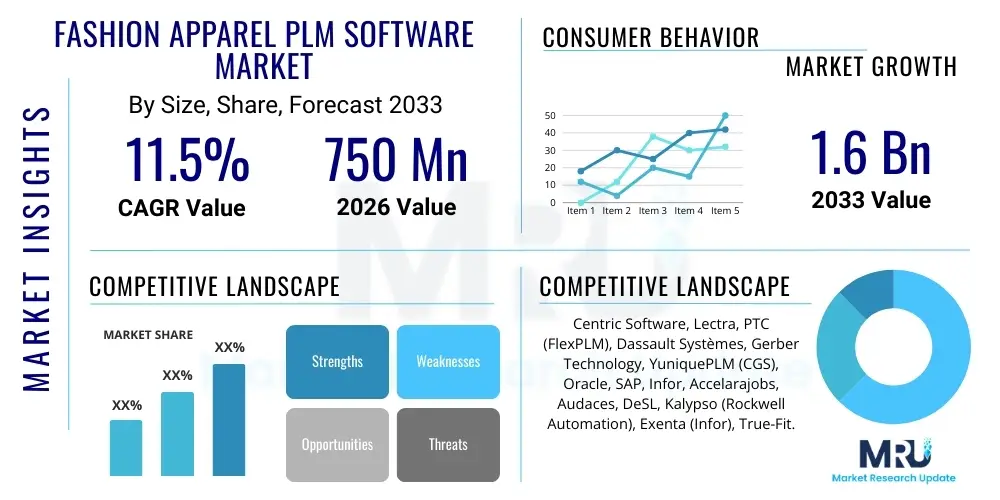

The Fashion Apparel PLM Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 750 Million in 2026 and is projected to reach USD 1.6 Billion by the end of the forecast period in 2033.

Fashion Apparel PLM Software Market introduction

The Fashion Apparel Product Lifecycle Management (PLM) software market encompasses specialized digital solutions designed to manage the entire lifecycle of a garment, from conceptualization and design through manufacturing, supply chain management, and retail. This critical enterprise system provides a unified source of truth for all product data, enabling apparel companies to streamline complex workflows, accelerate time-to-market, and ensure product quality and compliance across global operations. Driven by the imperative for faster fashion cycles and increased consumer demand for personalization, PLM software facilitates seamless collaboration between designers, product developers, sourcing teams, and suppliers, moving away from disparate spreadsheets and legacy systems toward integrated digital platforms.

PLM systems are highly instrumental in addressing the core challenges of the modern apparel industry, particularly the need for supply chain transparency and adherence to stringent sustainability mandates. Key functionalities include assortment planning, material management, technical specification development (Tech Packs), 3D virtual prototyping, and supplier collaboration portals. These features significantly reduce the reliance on physical samples, cutting down costs, development time, and environmental waste. The implementation of PLM software is no longer a luxury but a fundamental necessity for businesses aiming to maintain competitive advantage in a rapidly evolving, consumer-driven landscape, particularly those managing diverse product lines and complex international sourcing networks.

Major applications of Fashion PLM span across haute couture, fast fashion, sportswear, and private label manufacturing sectors. The primary benefits include optimized product costing, improved fit accuracy through digital tools, enhanced trend analysis integration, and superior risk management associated with global sourcing. Key driving factors accelerating market adoption involve the rapid growth of e-commerce necessitating rapid product drop capabilities, the widespread digitization of manufacturing processes (Industry 4.0), and the urgent requirement for end-to-end visibility in response to consumer demand for ethical and sustainable supply chains. These drivers emphasize speed, efficiency, and compliance as core tenets of modern apparel manufacturing.

- Product Description: Integrated software solutions managing the entire lifecycle of fashion apparel products, including ideation, design, development, sourcing, manufacturing specifications, compliance, and costing.

- Major Applications: Design and Creative Direction, Merchandising and Assortment Planning, Technical Design and Prototyping, Global Sourcing and Procurement, and Quality Assurance.

- Benefits: Reduced Time-to-Market, Enhanced Collaboration, Lower Sampling Costs, Improved Data Accuracy, and Streamlined Regulatory Compliance.

- Driving Factors: Rise of Fast Fashion and Micro-Seasons, Demand for Supply Chain Transparency, Growth in 3D Prototyping Adoption, and Digital Transformation Initiatives.

Fashion Apparel PLM Software Market Executive Summary

The Fashion Apparel PLM Software Market is experiencing robust growth fueled primarily by the digital imperative sweeping across the global retail and manufacturing sectors. Business trends indicate a significant shift from on-premise solutions towards cloud-based and Software-as-a-Service (SaaS) models, offering scalability, lower upfront costs, and faster implementation crucial for small to mid-sized enterprises (SMEs). Strategic mergers and acquisitions among core PLM vendors are leading to highly consolidated and integrated offerings that incorporate advanced technologies like 3D visualization, material lifecycle management (MLM), and sustainability tracking modules. The focus remains heavily on providing solutions that integrate seamlessly with Enterprise Resource Planning (ERP) systems and digital asset management (DAM) platforms, creating a holistic digital product creation ecosystem necessary for omnichannel fulfillment strategies.

Regionally, North America and Europe maintain dominance, driven by early technology adoption, the presence of major fashion houses, and strict regulatory standards pertaining to product safety and environmental impact, which necessitates sophisticated tracking capabilities inherent in advanced PLM systems. However, the Asia Pacific (APAC) region is projected to register the highest CAGR, propelled by the massive expansion of textile and apparel manufacturing hubs (e.g., China, Vietnam, India) and the increasing domestic consumer base demanding international fashion standards. Manufacturers in APAC are heavily investing in PLM to enhance operational efficiency, reduce reliance on manual processes, and meet the complex sourcing requirements of Western brands, positioning the region as both a major producer and a rapidly emerging consumer market for these digital tools.

Segmentation trends highlight the increasing significance of the cloud deployment segment due to its flexibility and accessibility, aligning perfectly with the dispersed global supply chains of the apparel industry. Furthermore, segmenting by enterprise size shows accelerated adoption among large enterprises initially, but SMEs are quickly catching up, particularly those specializing in niche or direct-to-consumer (DTC) brands, realizing that PLM is essential for managing rapid growth and maintaining product consistency. Key segment growth areas include specialized modules focusing on sustainable material documentation and detailed compliance reporting, reflecting the industry's shift towards circular economy models and mandatory reporting requirements.

AI Impact Analysis on Fashion Apparel PLM Software Market

Common user questions regarding AI's influence on Fashion Apparel PLM revolve primarily around automation capabilities, predictive analytics for trend forecasting, and the integration of large language models (LLMs) for streamlining technical documentation creation. Users are concerned about how AI will enhance product development speed without compromising creative input, seeking clarity on whether AI can accurately recommend materials, calculate optimal costing based on predictive supplier performance, and autonomously generate detailed technical specifications (Tech Packs) by analyzing initial design sketches. The overarching expectation is that AI integration will transform PLM from a mere data repository into a truly intelligent decision-making engine capable of preemptively identifying supply chain risks, optimizing material usage for sustainability goals, and tailoring assortment plans based on real-time consumer data, thereby profoundly accelerating the entire design-to-shelf cycle.

- AI-driven trend forecasting capabilities integrated into initial design phases, predicting successful silhouettes, colors, and material combinations.

- Automated generation of detailed technical specifications and grading rules using computer vision analysis of 3D prototypes, reducing manual data entry errors.

- Predictive costing and margin analysis based on real-time raw material market fluctuations and historical supplier performance data.

- Optimization of sample management by identifying where 3D virtual samples are sufficient versus mandatory physical samples, powered by AI accuracy assessment.

- Enhanced sustainability tracking through AI algorithms that verify material provenance and calculate environmental impact scores across the supply chain.

- Intelligent workflow routing and task prioritization within the PLM system, ensuring critical development milestones are met efficiently.

DRO & Impact Forces Of Fashion Apparel PLM Software Market

The market is predominantly driven by the critical need for speed and accuracy in the apparel product development cycle, often referred to as the 'race to retail,' where reducing time-to-market is a core competitive differentiator. This urgency is exacerbated by the rise of hyper-personalized and micro-seasonal fashion trends, requiring brands to launch numerous collections annually rather than just the traditional two. PLM software, by digitizing the entire development process, serves as the fundamental tool enabling this rapid iteration and scale. Furthermore, the mandatory need for transparency and traceability, particularly concerning ethical sourcing, forced labor laws, and environmental compliance, acts as a significant external pressure pushing non-adopters toward integrated PLM solutions that can meticulously document every step of the garment's journey from fiber to store shelf. The economic benefits derived from eliminating costly physical sampling and reducing material waste further amplify the driver forces, appealing directly to financial stakeholders.

Restraints, however, pose challenges, particularly the high initial implementation costs and the substantial change management resistance within legacy organizations. Many traditional apparel manufacturers still rely on decades-old paper-based or rudimentary spreadsheet systems, and transitioning to a complex, integrated PLM platform requires significant financial investment, extensive training, and a complete overhaul of established operational protocols. Moreover, data harmonization across globally distributed supply chains presents a major technical hurdle, as integrating the PLM system with disparate ERPs, warehouse management systems (WMS), and supplier platforms often leads to integration complexity and data incompatibility issues, delaying the realization of promised return on investment (ROI). The perceived complexity and the required internal IT expertise sometimes deter smaller or regional fashion brands from adopting advanced systems.

Opportunities for growth are abundant, primarily centered on technological advancements such as the deepening integration of 3D design software (e.g., CLO3D, Browzwear) directly into PLM workflows, making virtual prototyping standard practice rather than an optional add-on. Another major opportunity lies in expanding service offerings for niche segments, such as technical textiles, protective gear, and footwear, where product complexity demands specialized PLM features for material performance and regulatory compliance. The push toward the circular economy is generating immense opportunity for PLM providers to develop modules that specifically track product longevity, repairability, and material recycling potential. The impact forces indicate that the market momentum is strong, driven by digitization and sustainability mandates, ensuring that despite initial investment hurdles, PLM adoption will accelerate globally due to the undeniable operational efficiencies and compliance requirements.

Segmentation Analysis

The Fashion Apparel PLM Software Market is structurally segmented based on deployment model, enterprise size, application type, and product specialization, reflecting the diverse operational needs within the global apparel industry. The deployment model segmentation, differentiating between cloud and on-premise solutions, currently shows the highest dynamism, with cloud deployments rapidly gaining dominance due to their flexibility, scalability, and subscription-based pricing models, which lowers the barrier to entry for smaller firms. Analysis by enterprise size confirms that large enterprises remain the primary revenue generator due to their complex supply chains and large user base, yet the high growth rate projected for the SME segment indicates that tailored, cost-effective SaaS solutions are effectively penetrating this previously underserved market, leveraging cloud-native architectures to provide enterprise-grade functionalities.

- By Deployment Model:

- On-Premise

- Cloud (SaaS)

- By Enterprise Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Application:

- Design and Product Development

- Supply Chain Management

- Costing and Sourcing

- Quality and Compliance Management

- By Product Type (Apparel Vertical):

- Ready-to-Wear (RTW)

- Sports Apparel and Performance Wear

- Accessories and Footwear

- Technical Textiles

- By Functionality:

- Material Lifecycle Management (MLM)

- 3D/Virtual Prototyping Integration

- Collection and Assortment Planning

Value Chain Analysis For Fashion Apparel PLM Software Market

The value chain for Fashion Apparel PLM software begins with upstream analysis, focusing on the core activities of research and development (R&D) and product design by software vendors. This stage involves deep industry collaboration to understand evolving apparel needs, such as new textile standards, sustainability metrics, and advanced 3D visualization capabilities. Vendors invest heavily in modular architecture development to ensure their PLM platforms can integrate advanced features like AI-driven design tools and seamless connectivity with physical manufacturing technologies (e.g., smart factories). Key upstream dependencies include hardware infrastructure providers (especially for cloud services) and specialized software partners who provide critical components like CAD/CAM tools or materials databases, ensuring the PLM solution remains technologically cutting-edge and fully compatible with industry-standard design tools.

The midstream component of the value chain involves the customization, implementation, and integration services provided by the software vendor and, more frequently, by third-party implementation partners and system integrators (SIs). Given the complexity and heterogeneity of fashion supply chains, implementation is a high-value activity, requiring expert consultation to tailor the PLM workflow to the client's specific business processes, whether they are a vertical retailer or a multi-brand sourcing agent. Training and ongoing technical support are also critical midstream elements, ensuring that end-users, from designers to sourcing managers, can effectively utilize the system to derive maximum value. This phase determines the success rate and overall ROI for the apparel company, making reliable integration crucial.

Downstream analysis focuses on the distribution channels and end-user adoption. Distribution is primarily managed through direct sales (vendor-to-large enterprise) and indirect channels utilizing value-added resellers (VARs) and industry-specific partners, particularly for targeting SMEs in varied geographical locations. Direct channels are vital for large, complex deployments requiring bespoke contracts and high-touch consulting, while indirect channels provide market reach and localized support, particularly in emerging markets like Southeast Asia and Latin America. The end-users—apparel manufacturers, retailers, and brand owners—drive demand by requiring solutions that enhance speed, sustainability, and cross-functional visibility, thereby completing the value chain loop and signaling continuous requirements for feature enhancements and specialized modules.

Fashion Apparel PLM Software Market Potential Customers

The primary end-users and buyers of Fashion Apparel PLM software are vertically integrated apparel retailers and fashion brand owners, ranging from high-street fast fashion chains to luxury goods manufacturers. These entities require PLM to centrally manage their collections, ensuring design integrity and consistency across various product lines and global regions. For brand owners, the software is essential for maintaining brand equity by standardizing quality assurance, rigorously controlling material usage, and ensuring that all products meet specific consumer safety and labeling regulations across their target markets. The ability to manage complex seasonal drop schedules and coordinate thousands of SKUs across multiple vendors makes PLM an indispensable operational backbone for this customer group.

A second significant customer segment comprises contract manufacturers and original equipment manufacturers (OEMs/ODMs) specializing in apparel and textile production. While they may not own the final brand, these businesses utilize PLM to streamline their operational processes, improve quoting accuracy, manage material inventories efficiently, and, crucially, interface digitally with their brand clients. Adoption in this segment is increasingly driven by mandates from large global brands that require their suppliers to use compatible PLM or digital collaboration tools to ensure seamless data exchange, thereby standardizing processes like tech pack modifications, sample approval workflows, and compliance documentation required for export markets.

The emerging potential customer base includes smaller, direct-to-consumer (DTC) fashion startups and niche specialty apparel companies (e.g., sustainable fashion brands, custom uniform providers). These customers, previously underserved due to cost barriers, are now adopting scalable, cloud-based PLM solutions to manage rapid growth without excessive operational overhead. For these companies, PLM provides the necessary foundation to professionalize their supply chain management, enforce transparency in sourcing, and rapidly scale their product development capabilities to compete effectively against established industry giants, leveraging the system’s ability to manage small-batch production and personalized fulfillment models.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750 Million |

| Market Forecast in 2033 | USD 1.6 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Centric Software, Lectra, PTC (FlexPLM), Dassault Systèmes, Gerber Technology, YuniquePLM (CGS), Oracle, SAP, Infor, Accelarajobs, Audaces, DeSL, Kalypso (Rockwell Automation), Exenta (Infor), True-Fit. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fashion Apparel PLM Software Market Key Technology Landscape

The technological evolution of Fashion Apparel PLM software is centered on creating a highly visual, integrated, and predictive digital twin environment for products. A fundamental technology is the integration of high-fidelity 3D design and simulation tools, moving beyond basic CAD functionalities. This allows designers to immediately visualize material draping, fit, and texture in a virtual environment, significantly reducing the necessity for physical samples from five or six rounds down to one or two. Key vendors are leveraging open Application Programming Interfaces (APIs) and microservices architectures to ensure their PLM platforms can seamlessly exchange complex data, such as material specifications and grading information, with leading industry 3D software providers. This transition to a 3D-centric workflow is drastically cutting development timelines and promoting better decision-making early in the product lifecycle, which is critical for meeting the rapid cycles of fast fashion.

Another crucial technological development involves the robust incorporation of cloud-native architectures, specifically Software-as-a-Service (SaaS) deployment models. This shift facilitates real-time global collaboration across geographically dispersed design and sourcing teams, removing traditional latency issues associated with on-premise solutions. SaaS PLM platforms enhance data accessibility and system scalability, allowing brands to rapidly adjust their user licensing based on seasonal demand or organizational growth without massive infrastructure investment. Furthermore, advanced Material Lifecycle Management (MLM) modules are gaining prominence, utilizing digital material passports (DMPs) powered by technologies such as blockchain or sophisticated database management to track and verify the sustainability credentials and performance attributes of raw materials, meeting the growing industry demand for verifiable environmental reporting.

The future technology landscape is heavily influenced by the adoption of Artificial Intelligence (AI) and Machine Learning (ML). These technologies are being deployed within PLM for sophisticated data mining and predictive analytics. Examples include AI algorithms analyzing historical sales data alongside current trend information to optimize initial assortment planning and automatically suggest material substitutions based on cost constraints or availability issues. ML is also enhancing quality control by analyzing supplier performance metrics and predicting potential production delays or quality lapses before they occur. Furthermore, vendors are focusing on developing user-friendly, mobile-optimized interfaces and utilizing augmented reality (AR) tools for virtual fit sessions and merchandising, making the complex PLM functionalities accessible and intuitive for non-technical users across the supply chain, ensuring high adoption rates and maximized system efficiency.

Regional Highlights

- North America: This region represents a mature and dominant market for Fashion Apparel PLM software adoption, characterized by a high concentration of global fashion brands, activewear companies, and technologically advanced retailers. The market growth here is driven less by initial adoption and more by the continuous replacement of legacy systems and the demand for highly specialized features, such as advanced predictive analytics and robust sustainability tracking modules necessary for adherence to stringent state and federal regulations. The focus is on integrating PLM with omnichannel retail strategies and optimizing inventory management through superior visibility into the product creation pipeline. The strong presence of major vendors like PTC and Centric Software contributes significantly to the market sophistication, leading to continuous investment in R&D tailored for the complex demands of the U.S. consumer market.

- Europe: The European market is characterized by a mix of high-end luxury fashion houses and sophisticated fast-fashion retailers, leading to diverse PLM requirements. Growth is strongly influenced by the EU Green Deal and upcoming legislative mandates focusing on product passports and mandatory supply chain due diligence, which necessitates PLM systems capable of detailed and auditable data collection regarding materials, production processes, and end-of-life management. Countries like Germany and Italy, hubs for high-quality manufacturing and luxury goods, prioritize solutions offering superior Material Lifecycle Management (MLM) and deep integration with highly technical manufacturing execution systems (MES). Cloud adoption is rapidly accelerating across Western Europe, particularly among mid-sized brands seeking cost-effective compliance solutions.

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing market globally, driven by two simultaneous factors: the massive expansion of the domestic middle-class consumer base in China and India, creating new local fashion powerhouses, and the region's established role as the world’s largest manufacturing hub. Manufacturers in countries like Vietnam, Bangladesh, and Indonesia are increasingly adopting PLM not just for operational efficiency but as a prerequisite for winning contracts from global brands that demand digital collaboration. The regional market is highly price-sensitive, boosting the demand for flexible, module-based SaaS solutions. The market dynamics are complex, requiring vendors to address fragmented logistics and varied regulatory environments across multiple nations within the region, emphasizing multi-language and multi-currency capabilities.

- Latin America (LATAM): The LATAM market is in an emergent growth phase, spurred by increasing investment in modernization by regional apparel giants, particularly in Brazil and Mexico. Economic volatility and the high costs of imported technology previously restrained growth, but localized PLM offerings and the increased availability of cloud infrastructure are lowering the entry barriers. Manufacturers are focusing on PLM adoption to optimize local supply chains, reduce dependence on manual labor, and improve design processes to better cater to regional consumer preferences. Growth is steady, driven by the need to compete with imported goods by ensuring faster product cycles and greater cost control through formalized digital workflows.

- Middle East and Africa (MEA): This region shows specialized growth, particularly in the UAE and Saudi Arabia, driven by ambitious government initiatives to diversify economies and establish domestic manufacturing capabilities, including luxury apparel and technical textiles. In the Middle East, high-end retail and custom luxury segments require PLM systems that can manage highly personalized orders and bespoke material handling. Adoption in Africa is slower but gaining traction among textile producers and emerging local fashion brands seeking to formalize and scale their operations. The market is highly reliant on international vendors providing localized implementation support due to limited regional IT expertise in specialized PLM systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fashion Apparel PLM Software Market.- Centric Software (Dassault Systèmes)

- Lectra (including Kubix Link)

- PTC (FlexPLM)

- Dassault Systèmes

- Gerber Technology (Part of Lectra)

- YuniquePLM (CGS)

- Oracle Corporation

- SAP SE

- Infor

- Accelarajobs

- Audaces

- DeSL

- Kalypso (Rockwell Automation)

- Exenta (Infor)

- True-Fit

- Tukatech

- Simparel (CGS)

- Adobe Inc. (Through integration platforms)

- WFX (Wings for Fashion)

- Style3D

Frequently Asked Questions

Analyze common user questions about the Fashion Apparel PLM software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Fashion Apparel PLM software and how does it benefit a brand's time-to-market?

Fashion Apparel PLM (Product Lifecycle Management) is an integrated system managing all product data from concept to retail. It benefits time-to-market by standardizing workflows, enabling concurrent development, facilitating real-time collaboration with suppliers globally, and dramatically reducing the need for costly and time-consuming physical samples through 3D visualization tools.

Is cloud-based PLM a more suitable option than on-premise PLM for fashion SMEs?

Yes, cloud-based (SaaS) PLM is generally preferred by fashion SMEs because it requires lower initial capital expenditure, offers rapid deployment, provides inherent scalability to support growth, and ensures automatic updates and maintenance, making advanced PLM functionality accessible without requiring extensive in-house IT infrastructure.

How is AI impacting the product development features within Fashion PLM systems?

AI is transforming PLM features by integrating predictive capabilities for trend forecasting, optimizing material selection based on performance and cost data, and automating the generation of technical specifications (Tech Packs). This shifts the PLM system from a data repository to an intelligent tool that accelerates design iteration and decision-making.

Which regions are driving the highest growth rates for PLM software adoption in the apparel sector?

The Asia Pacific (APAC) region is projected to exhibit the highest CAGR due to massive growth in domestic manufacturing capacities and increasing demands from global brands for digitized supply chain collaboration. North America and Europe remain key markets driven by replacement cycles and mandatory sustainability compliance requirements.

What key compliance challenges does modern Fashion PLM help apparel companies address?

Modern PLM systems are essential for managing increasingly strict compliance requirements, including tracking ethical sourcing (labor standards), ensuring adherence to environmental regulations (e.g., restricted substance lists, chemical management), and documenting material provenance for sustainability reporting and future circular economy mandates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager