Fashion Jewellery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432314 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Fashion Jewellery Market Size

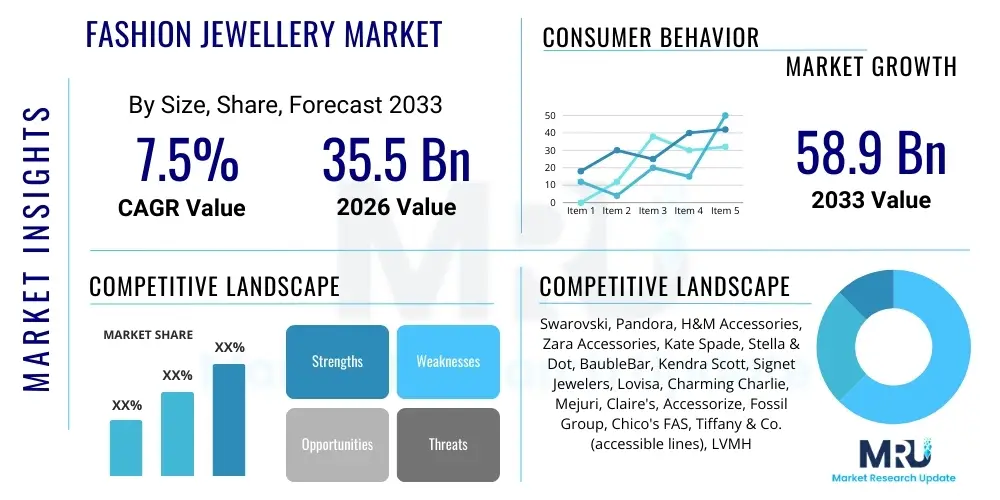

The Fashion Jewellery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $35.5 Billion USD in 2026 and is projected to reach $58.9 Billion USD by the end of the forecast period in 2033.

Fashion Jewellery Market introduction

The Fashion Jewellery Market, often referred to as costume or imitation jewellery, encompasses a broad range of personal adornments manufactured from non-precious materials, including base metals, alloys, plastics, glass, and synthetic stones. Unlike fine jewellery, which is valued for its intrinsic material worth, fashion jewellery derives its value primarily from design aesthetics, trend relevance, and accessibility. This segment caters to consumers seeking affordable, stylish accessories to complement diverse outfits and align with fast-changing style cycles. The product range is extensive, covering traditional items like necklaces, bracelets, earrings, and rings, alongside hair accessories and body piercing jewellery.

Major applications of fashion jewellery revolve around personal styling, gifting, and fulfilling specific accessory needs for social events or corporate settings. The primary benefits driving consumer adoption include low price points, allowing for frequent purchases and expansive collections, and the ability to closely mimic high-end designs without the substantial investment. Fashion jewellery serves as an essential component of the global fast fashion ecosystem, enabling retailers to quickly introduce seasonal collections and respond rapidly to consumer demand for novelty and variety. Its pervasive availability across various distribution channels, from luxury department stores to mass-market retailers and online platforms, solidifies its position in the consumer accessory landscape.

Key driving factors accelerating market expansion include the substantial growth in discretionary income among the middle-class population globally, especially in emerging economies of Asia Pacific. Furthermore, the pervasive influence of social media platforms and fashion bloggers dictates quick shifts in style trends, encouraging consumers to update their accessory wardrobes frequently. The increasing focus on self-expression and personalization, coupled with improvements in manufacturing technologies that allow for sophisticated designs using non-precious materials, further fuels market demand. The market dynamics are highly competitive, characterized by rapid product innovation and strong emphasis on branding and collaborations with influential fashion figures.

Fashion Jewellery Market Executive Summary

The global Fashion Jewellery Market exhibits dynamic growth, driven primarily by evolving consumer preferences for affordable luxury and the accelerated pace of the fast fashion industry. Key business trends indicate a significant shift towards e-commerce and direct-to-consumer (D2C) models, which allow brands to better control inventory, pricing, and customer experience, particularly vital in a sector characterized by rapid product turnover. Sustainability and ethical sourcing are emerging as critical differentiators, with consumer interest growing in materials that are recycled or responsibly produced, challenging the traditional reliance on mass-produced synthetic materials. The trend toward personalization, facilitated by digital tools and modular designs, is also capturing market share, allowing consumers to customize pieces to fit their unique aesthetic requirements.

Regionally, the Asia Pacific (APAC) market is projected to be the engine of growth, spurred by urbanization, rising disposable incomes in countries like China and India, and a burgeoning young population highly influenced by global fashion trends. North America and Europe, while mature markets, maintain robust demand, emphasizing designer collaborations and high-quality plating techniques to extend product life and appeal. In these regions, online sales penetration is highest, necessitating sophisticated logistics and return management systems. Conversely, emerging markets in Latin America and the Middle East and Africa (MEA) are seeing expansion, driven by the entry of international brands and the formalization of retail infrastructure, which broadens access to branded fashion accessories.

Segment trends reveal that the 'Earrings' and 'Necklaces' categories remain dominant product types due to their visibility and versatility, adapting easily to seasonal styles. In terms of material, metal alloys, particularly those used in hypoallergenic jewellery, are gaining traction, addressing consumer concerns related to skin sensitivity. The 'Women' segment holds the largest market share, though the 'Unisex' and 'Men's' fashion jewellery categories are experiencing faster growth, reflecting changing social norms and an increased acceptance of accessorizing across all genders. Distribution-wise, the online segment's growth significantly outpaces offline retail, benefiting from visual merchandising capabilities and the convenience of direct shopping, a trend further accelerated by global events promoting remote commerce.

AI Impact Analysis on Fashion Jewellery Market

User inquiries regarding the impact of Artificial Intelligence (AI) in the Fashion Jewellery Market frequently center on how technology can enhance personalization, optimize supply chains, and predict rapidly changing micro-trends. Consumers and industry stakeholders are keen to understand if AI can make fast fashion jewellery more sustainable by reducing overstocking and waste. Concerns often revolve around the potential for AI to homogenize design through data-driven recommendations, yet there is strong optimism about its ability to revolutionize customer experience through virtual try-ons and sophisticated style advisors. The core themes identified are efficiency, hyper-personalization, and data-driven design innovation.

AI's influence is transforming the Fashion Jewellery value chain, starting from conceptual design and extending through manufacturing and retail. Design houses are leveraging generative AI models to create novel patterns, material combinations, and visual aesthetics based on predictive analytics of current and future consumer demand, allowing designers to bypass lengthy manual trend forecasting. This adoption speeds up the ideation cycle, a critical factor in the quick-response nature of the fashion jewellery industry. Furthermore, AI-powered predictive maintenance in manufacturing facilities ensures minimal downtime, while robotic assembly is becoming increasingly common for high-volume production of standardized components, ensuring quality consistency.

In the consumer-facing domain, AI algorithms are crucial for enhancing e-commerce platforms. They drive tailored product recommendations, analyze customer behavior in real-time to adjust inventory levels across regional warehouses, and power sophisticated tools like virtual sizing and augmented reality (AR) try-ons. These technological advancements significantly reduce return rates—a major cost factor in online fashion retail—by improving customer confidence in fit and appearance before purchase. The implementation of AI in demand sensing also helps companies manage complexity associated with thousands of SKUs, ensuring that high-demand items are consistently in stock and minimizing inventory risk for low-demand, highly seasonal items.

- AI-driven trend forecasting accelerates new collection releases, minimizing time-to-market.

- Generative design tools assist in creating unique, customizable jewellery pieces quickly.

- Augmented Reality (AR) and Virtual Try-On features enhance the online shopping experience and reduce returns.

- Predictive analytics optimize inventory management, reducing waste and improving supply chain efficiency.

- Chatbots and personalized style consultants improve customer engagement and service resolution.

- AI-enabled quality control systems ensure high production standards even with non-precious materials.

DRO & Impact Forces Of Fashion Jewellery Market

The Fashion Jewellery Market is shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and external Impact Forces. The primary drivers include the continuous expansion of the global middle class, particularly in Asian markets, leading to increased discretionary spending on non-essential, lifestyle-enhancing products. Coupled with this is the accelerating rate of fashion cycles, driven by social media and celebrity endorsements, which necessitates frequent accessory updates. These factors collectively push consumers toward affordable, readily available fashion jewellery rather than expensive fine pieces.

However, the market faces significant restraints. Chief among these is the perception of low quality and poor durability often associated with non-precious materials, leading to concerns about short product lifespan and sustainability. Furthermore, the proliferation of counterfeit products, particularly in online marketplaces, damages brand equity, erodes consumer trust, and poses a major intellectual property challenge to established designers. Regulatory restrictions concerning material safety, such as the use of heavy metals (e.g., lead or cadmium) in certain regions, also impose compliance burdens on manufacturers, potentially limiting material sourcing options and increasing production costs.

The market is rich with opportunities, particularly in the realm of sustainable and ethically sourced materials. Consumers are increasingly willing to pay a premium for fashion jewellery made from recycled metals, bio-plastics, or eco-friendly alternatives. Digital transformation offers expansive growth pathways, including the refinement of D2C models and the integration of advanced personalization technologies, such as 3D printing for customized prototypes. Strategic collaborations between fashion jewellery brands and major entertainment franchises or digital influencers also provide fresh avenues for market penetration and brand visibility. The overall impact forces emphasize the shifting power dynamic from traditional retail to digital platforms and the rising consumer demand for corporate social responsibility (CSR) initiatives.

- Drivers: Rising disposable incomes, increasing influence of social media trends, product affordability and availability, rapid consumer adoption of new fashion aesthetics.

- Restraints: Issues related to product durability and perceived quality, prevalence of counterfeit goods, regulatory compliance regarding material safety, skin allergies associated with certain alloys.

- Opportunities: Focus on sustainable and eco-friendly materials, advancements in 3D printing and prototyping technologies, expansion through e-commerce platforms, growing demand for personalized and bespoke accessories.

- Impact Forces: Technological disruption (AI/AR), global economic stability impacting consumer spending, ethical consumerism movements, and competitive pressure from luxury brands entering the accessible segment.

Segmentation Analysis

The Fashion Jewellery Market segmentation provides a granular view of market dynamics based on material type, product category, distribution channel, and end-user demographics. Analyzing these segments is essential for brands to tailor their product offerings, marketing strategies, and geographic distribution efforts effectively. The diverse range of materials utilized, from inexpensive alloys to organic components like wood and shell, dictates pricing strategies and target audience appeal, differentiating mass-market products from those positioned as bridge jewellery. Understanding end-user preferences, especially the difference in demand between women, men, and unisex styles, allows for precise inventory forecasting and campaign targeting.

Product segmentation highlights which items drive the highest volume versus those generating premium value. While staple items like rings and earrings maintain steady demand, cyclical trends often elevate the importance of specific items, such as statement necklaces or layered bracelets, during particular fashion seasons. The shift in distribution channels is perhaps the most critical segmentation trend, with the online segment exhibiting explosive growth. The ability of online retailers to offer vast inventories, comparative pricing, and immersive digital experiences is capturing market share rapidly, compelling traditional brick-and-mortar stores to integrate omnichannel strategies to remain competitive.

Geographic segmentation is crucial, recognizing that regional consumer tastes, cultural aesthetics, and purchasing power vary significantly. For instance, Western markets often prioritize minimalist and delicate designs, while Asian and Middle Eastern markets often favor more ornate and statement-making pieces. Manufacturers must adapt production and sourcing strategies to meet these specific regional demands, leveraging localized marketing campaigns that resonate with cultural norms. The constant evolution within each segment underscores the need for continuous market intelligence to adapt to new materials, emerging consumer behaviors, and disruptive retail technologies.

- By Material:

- Metal Alloys (Brass, Copper, Zinc, Stainless Steel)

- Plastic and Acrylic

- Glass and Crystal (Non-Precious)

- Wood and Leather

- Ceramics and Clay

- Textile and Fabric

- By Product Type:

- Necklaces and Pendants

- Earrings (Studs, Hoops, Danglers)

- Bracelets and Bangles

- Rings

- Hair Accessories

- Brooches and Pins

- Body Piercing Jewellery

- By Distribution Channel:

- Offline (Specialty Stores, Department Stores, Hypermarkets/Supermarkets)

- Online (E-commerce Portals, Direct Brand Websites)

- By End-User:

- Women

- Men

- Unisex

Value Chain Analysis For Fashion Jewellery Market

The value chain of the Fashion Jewellery Market begins with upstream activities focused on raw material sourcing and design conceptualization. Upstream analysis involves securing base metals, synthetic stones, plastics, and other non-precious materials. Efficiency at this stage is crucial, as the low-cost nature of the final product demands bulk purchasing and standardized material quality assessment. Design input, now heavily augmented by CAD/CAM and AI tools, transforms raw material concepts into manufacturing specifications. Key upstream decisions include material selection for desired aesthetics, cost optimization, and adherence to safety regulations regarding elements like nickel content. The efficiency of upstream logistics directly dictates the market responsiveness.

Midstream activities encompass manufacturing and assembly. This involves casting, stamping, plating (often with rhodium or gold flash), polishing, and final assembly. Unlike fine jewellery, fashion jewellery often relies on high-volume, automated processes to maintain low unit costs. Quality control checkpoints are essential, focusing particularly on plating longevity and stone setting integrity. Following manufacturing, the product moves to downstream activities, which are dominated by warehousing, inventory management, and distribution. Given the seasonal nature and high volume of SKUs, efficient inventory management systems are paramount to minimize obsolescence and maximize shelf life during the relevant fashion season.

The distribution channel is segmented into direct and indirect routes. Direct distribution involves brand-owned stores (both physical and online D2C platforms), offering high margin potential and direct customer data access. Indirect distribution utilizes third-party specialty retailers, department stores, mass merchants, and multi-brand e-commerce platforms like Amazon or Zalando. This indirect route provides broader market reach but involves shared margins and less control over the final presentation. The growth of online platforms dictates that supply chains must be optimized for direct-to-consumer fulfillment, emphasizing packaging, rapid shipping, and streamlined return processes, which define customer satisfaction and loyalty in the highly competitive downstream environment.

Fashion Jewellery Market Potential Customers

The primary end-users and potential buyers of fashion jewellery span a wide demographic range, dictated more by lifestyle and fashion inclination than purely by economic status. The dominant customer base remains fashion-conscious women aged 16 to 45 who view accessories as essential components of their rotating wardrobe, seeking variety and trend alignment over intrinsic material value. These buyers are highly responsive to social media marketing, influencer endorsements, and fast-fashion brand collaborations, making purchasing decisions frequently to keep up with seasonal micro-trends. Affordability allows this segment to experiment widely with styles, colors, and sizes, driving volume sales for the entire market.

A rapidly expanding customer segment includes younger, Gen Z consumers who prioritize self-expression, customization, and ethical sourcing. This cohort often purchases unisex or gender-neutral styles and is particularly receptive to brands that offer transparency regarding manufacturing processes and use sustainable materials. They are digitally native, relying heavily on platforms like TikTok and Instagram for inspiration, and prefer purchasing through D2C websites or curated online marketplaces that align with their personal values. This segment drives the demand for modular and personalized jewellery options, reflecting a desire for uniqueness without high costs.

Another crucial customer segment involves consumers who utilize fashion jewellery to complement formal or professional attire for specific, infrequent occasions, such as weddings, corporate events, or holiday parties. These buyers seek pieces that mimic the look of fine jewellery, focusing on quality finishes (like realistic stone settings and premium plating) and classic designs, valuing visual impact and perceived luxury at an accessible price point. The gifting market also constitutes a substantial portion of potential customers, where fashion jewellery serves as a popular, thoughtful, and inexpensive gift option across various consumer holidays and personal milestones.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $35.5 Billion USD |

| Market Forecast in 2033 | $58.9 Billion USD |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Swarovski, Pandora, H&M Accessories, Zara Accessories, Kate Spade, Stella & Dot, BaubleBar, Kendra Scott, Signet Jewelers, Lovisa, Charming Charlie, Mejuri, Claire's, Accessorize, Fossil Group, Chico's FAS, Tiffany & Co. (accessible lines), LVMH (costume division), Pura Vida, Alex and Ani |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fashion Jewellery Market Key Technology Landscape

The Fashion Jewellery Market relies heavily on several key technologies to maintain rapid production cycles, achieve complex designs at low cost, and enhance customer experience. Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM) software are foundational, enabling designers to quickly prototype and refine intricate designs suitable for mass production. These tools ensure precision and consistency across thousands of units, which is essential for maintaining brand quality standards despite using lower-cost materials. Furthermore, advanced metal forming and casting techniques, including injection molding for non-metallic parts and refined electroplating processes, are crucial for achieving durable, high-quality finishes that mimic precious metals and reduce allergic reactions.

Additive manufacturing, specifically 3D printing technology (such as Stereolithography (SLA) and Digital Light Processing (DLP)), is increasingly deployed, particularly in the prototyping phase and for producing unique, personalized small batches. 3D printing significantly shortens the sample production timeline, allowing brands to test market response to new designs quickly before committing to expensive mass tooling. For customer engagement, Augmented Reality (AR) technology, delivered via smartphone applications and e-commerce websites, allows users to virtually "try on" jewellery, integrating the products into a live camera feed. This technological adoption tackles the inherent challenge of selling visual, tactile products online, increasing conversion rates and drastically minimizing product returns due to mismatch expectations.

Beyond design and customer interaction, sophisticated Enterprise Resource Planning (ERP) and Supply Chain Management (SCM) systems are indispensable for handling the high SKU volume, fragmented supply chains, and dynamic inventory needs characteristic of the fashion jewellery industry. These systems integrate demand forecasting (often leveraging AI), logistics, and sales data to ensure materials are sourced just-in-time and finished goods are distributed efficiently across multiple global channels, both physical and digital. The adoption of robust encryption and cybersecurity measures is also critical for protecting proprietary design data and customer payment information in the high-volume e-commerce segment.

Regional Highlights

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by explosive economic growth in countries like India and China, resulting in a large, aspirational consumer base with increasing disposable incomes. Cultural affinity for ornamentation and rapid penetration of global fashion trends through social media fuel continuous demand for stylish, affordable accessories. Manufacturing capabilities are also heavily concentrated here, providing cost efficiencies.

- North America: A mature and dominant market characterized by high consumer spending on fashion and strong influence from celebrity culture and digital media. The region shows high adoption rates of e-commerce for jewellery purchases and a strong market for specialized niche segments, including men's fashion jewellery and sustainable brands. Consumer preferences lean toward brand recognition and quality finishes.

- Europe: This region exhibits diverse national tastes, ranging from the minimalist Scandinavian style to the ornate Italian aesthetics. Demand is stable, driven by established fashion houses and specialty retailers. Sustainability regulations are stringent here, compelling brands to innovate in non-toxic and ethically sourced materials, positioning Europe as a leader in eco-friendly fashion jewellery innovation.

- Latin America (LATAM): Growth is steady, primarily driven by Brazil and Mexico, where a young population and rising urbanization increase access to organized retail and global brands. Economic volatility presents a challenge, making affordability a key factor, thus favoring the fashion jewellery segment over fine jewellery.

- Middle East and Africa (MEA): While the Gulf Cooperation Council (GCC) countries maintain a strong fine jewellery tradition, the fashion jewellery market is expanding rapidly, appealing to expatriate populations and younger consumers seeking affordable options for everyday wear. Retail infrastructure development and the entrance of global fast fashion chains facilitate market access.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fashion Jewellery Market.- Swarovski

- Pandora

- H&M Accessories

- Zara Accessories

- Kate Spade

- Stella & Dot

- BaubleBar

- Kendra Scott

- Signet Jewelers (through subsidiaries)

- Lovisa

- Charming Charlie

- Mejuri

- Claire's

- Accessorize (Monsoon Accessorize)

- Fossil Group

- Chico's FAS (Soma and White House Black Market accessories)

- Pura Vida

- Alex and Ani

- Tanishq (through low-cost brands)

- Shein Accessories

Frequently Asked Questions

Analyze common user questions about the Fashion Jewellery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Fashion Jewellery Market?

The Fashion Jewellery Market is anticipated to exhibit a Compound Annual Growth Rate (CAGR) of 7.5% during the forecast period from 2026 to 2033, driven by fast fashion trends and increased consumer accessibility.

Which material segment holds the largest market share in fashion jewellery?

Metal Alloys, particularly stainless steel and plated brass, currently dominate the market share due to their versatility, low cost, and improved hypoallergenic properties in modern manufacturing techniques.

How is e-commerce influencing the distribution of fashion jewellery?

E-commerce is the fastest-growing distribution channel, primarily due to the convenience of virtual try-on technologies (AR), vast product selection, competitive pricing, and the ability for D2C brands to connect directly with consumers globally.

What role does AI play in fashion jewellery design and inventory management?

AI is utilized for predictive trend forecasting to guide design processes, ensuring relevance and speeding up product launches. In inventory, AI optimizes stock levels across regions, minimizing overstocking and improving supply chain responsiveness.

What are the main regional growth drivers for the fashion jewellery market?

The Asia Pacific (APAC) region is the key growth driver, supported by rising middle-class disposable incomes, urbanization, and the strong cultural adoption of accessories in countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager