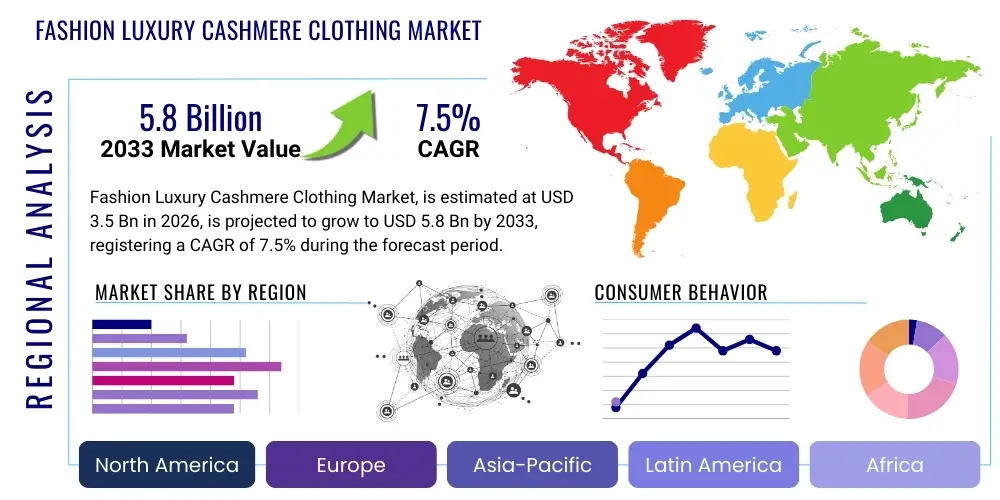

Fashion Luxury Cashmere Clothing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434778 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Fashion Luxury Cashmere Clothing Market Size

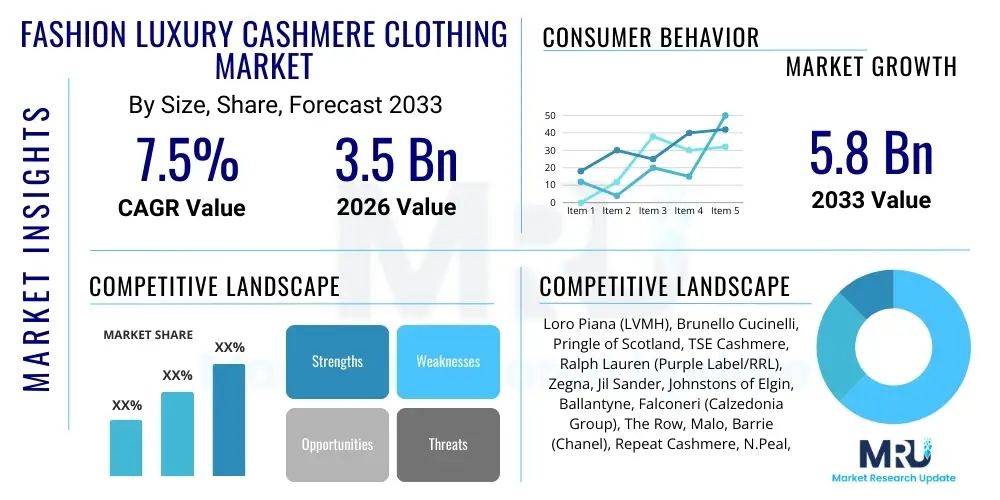

The Fashion Luxury Cashmere Clothing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $3.5 Billion in 2026 and is projected to reach $5.8 Billion by the end of the forecast period in 2033.

Fashion Luxury Cashmere Clothing Market introduction

The Fashion Luxury Cashmere Clothing Market encompasses high-end apparel and accessories made from the ultra-fine undercoat fiber of the Cashmere goat, characterized by superior quality, ethical sourcing, intricate craftsmanship, and premium pricing. This segment serves a discerning clientele that values longevity, sustainability, and sophisticated design over fast fashion trends. Products range from bespoke coats and tailored knitwear to exclusive scarves and loungewear, often produced by vertically integrated luxury houses that control the process from raw fiber collection in origin countries like Mongolia and Inner Mongolia to final retail. The market introduction phase emphasizes brand heritage, material provenance, and meticulous processing techniques that enhance the inherent softness and durability of the fiber.

Major applications of luxury cashmere clothing span ready-to-wear collections for both men and women, focusing heavily on outerwear, sweaters, and essential wardrobe staples that function as investment pieces. Key benefits driving consumer demand include exceptional thermal insulation without bulk, hypoallergenic properties, unmatched softness (measured in microns, often 14–16 $\mu$m for luxury grades), and the prestigious association with high-status brands. The intrinsic scarcity and difficulty in obtaining high-grade raw cashmere fiber inherently limit supply, contributing to the perceived luxury and maintaining high market valuation. The market thrives on the consumer trend toward "quiet luxury," where brand presence is subtle, quality is paramount, and pieces are designed for timeless elegance rather than transient seasonal trends.

Driving factors propelling this market include the sustained growth in disposable income among high-net-worth individuals (HNWIs) globally, particularly in emerging economies in Asia Pacific. Furthermore, increased consumer awareness regarding sustainable and traceable fashion choices boosts the appeal of luxury cashmere brands committed to ethical animal husbandry and environmentally friendly processing. Technological advancements in knitting, such as 3D seamless garment production, are optimizing manufacturing efficiency and reducing material waste, enabling brands to offer innovative designs while maintaining fiber integrity. The expansion of exclusive direct-to-consumer (DTC) luxury e-commerce platforms also facilitates greater global reach and brand control, overcoming geographical barriers inherent in high-street luxury retail.

- Product Scope: High-grade knitwear, outerwear, accessories, and bespoke luxury apparel utilizing cashmere fibers typically below 16 microns in diameter.

- Key Benefits: Superior warmth-to-weight ratio, ultimate softness, hypoallergenic qualities, and high perceived material investment value.

- Primary Drivers: Global increase in HNWIs, focus on sustainable and traceable luxury materials, and expansion of controlled omnichannel retail experiences.

- Major Applications: Ready-to-wear men’s and women’s clothing, specialized travel wear, and home textiles (luxury blankets).

Fashion Luxury Cashmere Clothing Market Executive Summary

The Fashion Luxury Cashmere Clothing Market is demonstrating resilience and strategic growth, predominantly characterized by a strong shift toward supply chain transparency and digital integration. Business trends indicate major luxury houses are investing heavily in vertical integration, controlling sourcing to processing to mitigate risks associated with raw material volatility and ensure ethical practices, which are critical for maintaining brand equity in the luxury space. The competitive landscape is defined by established European luxury giants alongside specialized artisanal producers, all focused on leveraging digital platforms to enhance the bespoke shopping experience and articulate their sustainability narratives. Mergers and acquisitions remain focused on securing exclusive access to high-quality raw fiber sources or acquiring advanced textile manufacturing capabilities.

Regionally, the Asia Pacific (APAC) market, spearheaded by China and South Korea, is the most significant growth engine, fueled by rapid wealth accumulation and a strong cultural affinity for status-driven luxury goods. Europe remains the innovation and consumption hub, particularly in countries like Italy and the UK, which host many of the world's most renowned luxury cashmere processors and designers. North America sustains a mature market, driven primarily by replacement cycles and the demand for high-quality, durable investment pieces. Strategic regional trends include customizing product offerings (e.g., lightweight cashmere suitable for warmer climates) and adapting retail presence to reflect local high-net-worth demographics and shopping preferences.

Segment trends highlight the continued dominance of the women’s wear category, though men's luxury cashmere is experiencing faster year-over-year growth due to increased focus on high-end work-from-home attire and elevated casual wear. From a distribution perspective, the online segment is witnessing explosive growth, driven by the COVID-19 pandemic acceleration of digital commerce and the implementation of sophisticated virtual try-on and personalized stylist services. Product segmentation favors sweaters and knitwear as core revenue drivers, followed closely by high-value coats and jackets. The market is also seeing rising demand for recycled and sustainably certified cashmere products, indicating a segment maturation where ethical criteria now significantly influence purchasing decisions alongside quality and brand name.

AI Impact Analysis on Fashion Luxury Cashmere Clothing Market

User queries regarding the influence of Artificial Intelligence (AI) in the luxury cashmere sector primarily revolve around ensuring authenticity, optimizing highly customized production runs, and enhancing the exclusive digital customer journey. Consumers and industry professionals seek assurance that AI can verify the provenance of ultra-fine fibers—a critical factor justifying premium prices—and prevent counterfeiting. Furthermore, there is strong interest in how AI tools, particularly predictive analytics, can minimize overproduction and waste by accurately forecasting niche luxury demand, aligning with the industry's ethical and sustainability goals. The integration of AI for hyper-personalized recommendations and virtual styling sessions is also a central theme, as luxury clients expect highly tailored, seamless online and in-store interactions that preserve the exclusivity associated with high-touch sales.

AI is strategically employed to revolutionize inventory management in this capital-intensive sector, allowing brands to implement just-in-time manufacturing for bespoke or limited-edition items, thereby reducing storage costs and minimizing the risk of obsolescence. Machine learning algorithms analyze complex sales data, macroeconomic indicators, and even social media sentiment to forecast demand variations across different styles and colors months in advance, essential for planning raw fiber procurement cycles which are inherently slow. This predictive capability is vital for managing the delicate balance between scarcity (to maintain luxury appeal) and availability (to meet HNW customer expectations).

In customer relationship management (CRM), AI tools enhance the personalized experience crucial for luxury sales. AI-powered chatbots and virtual assistants provide 24/7 personalized concierge services, handling specific inquiries about material care, sourcing, and pre-orders. Furthermore, computer vision and deep learning are being integrated into quality control processes during manufacturing, identifying minute flaws in knitting or material texture that human eyes might miss, ensuring only the highest standard garments reach the market. The net effect of AI implementation is a more efficient, verifiable, and personalized luxury experience.

- Supply Chain Optimization: AI models forecast fiber price volatility and predict optimal procurement timing, mitigating raw material cost risks.

- Authenticity and Traceability: Blockchain integrated with AI verifies the origin of cashmere (farm to finished product), combating counterfeit goods and ensuring ethical sourcing claims are verifiable.

- Demand Forecasting: Predictive analytics enhance inventory management for seasonal and limited-edition items, reducing waste inherent in traditional fashion cycles.

- Hyper-Personalization: AI analyzes individual luxury client preferences and purchase history to offer tailored product recommendations and styling advice via virtual platforms.

- Manufacturing Efficiency: Automated quality control using computer vision detects defects in knitting and weaving with high precision, ensuring superior garment quality.

DRO & Impact Forces Of Fashion Luxury Cashmere Clothing Market

The Fashion Luxury Cashmere Clothing Market is shaped by a critical interplay of internal and external forces. Key drivers include the exponential increase in global wealth, particularly in Asian markets, and a simultaneous consumer shift towards conscious consumption, favoring high-quality, durable, and ethically produced textiles. Opportunities are emerging through the adoption of circular economy models, such as high-end recycling programs for cashmere garments and the development of innovative hybrid fibers that retain luxury feel while enhancing durability or reducing environmental footprint. However, the market faces significant restraints, including the extreme price sensitivity and volatile supply of raw cashmere fiber, which is susceptible to climate change impacts affecting goat populations and grazing lands, alongside persistent issues related to fiber adulteration and sophisticated counterfeiting rings that undermine brand trust.

Drivers are primarily socioeconomic and cultural. The "quiet luxury" aesthetic has solidified cashmere as the ultimate symbol of understated wealth, boosting demand for minimally branded, high-quality staple pieces. Furthermore, technological drivers, such as advanced seamless knitting machinery and sustainable dyeing techniques, enable manufacturers to create innovative products that justify premium pricing. Opportunities center on expanding into niche segments, such as luxury baby wear and specialized home furnishings, and leveraging blockchain technology not just for traceability but also for customer engagement, transforming the concept of ownership and offering lifetime guarantee programs tied to digital authentication.

Restraints are heavily linked to supply chain vulnerability. Geopolitical tensions in key sourcing regions (Mongolia, China) impact fiber availability and trade logistics. Maintaining the high ethical standards required by luxury clientele adds significant operational costs, which brands must absorb or pass on to consumers without eroding perceived value. These restraining forces necessitate significant upfront investment in sustainable infrastructure and transparent sourcing verification. The collective impact forces drive strategic decisions toward premiumization; brands must continually demonstrate superior value through verifiable quality, ethical provenance, and unmatched retail experience to overcome high manufacturing costs and supply chain instability.

Segmentation Analysis

The Luxury Cashmere Clothing Market is segmented based primarily on product type, end-user, and distribution channel, reflecting diverse consumption patterns and strategic retail positioning. Product segmentation distinguishes between core knitwear (sweaters, cardigans), high-value outerwear (coats, jackets), and essential accessories (scarves, hats). End-user segmentation recognizes the distinct design and consumption habits of Men, Women, and Children, with Women's wear typically representing the largest share. Distribution segmentation is crucial, differentiating between traditional offline channels (brand boutiques, department stores, specialty retailers) and rapidly expanding online channels (DTC e-commerce platforms and third-party luxury online retailers), with brands focusing on omnichannel strategies to ensure brand consistency and service quality across all touchpoints.

- By Product Type

- Sweaters & Cardigans

- Coats & Jackets

- Scarves & Wraps

- Other Accessories (Hats, Gloves, Socks)

- Home Furnishings (Blankets, Throws)

- By End User

- Men

- Women

- Children

- By Distribution Channel

- Offline Retail

- Brand-Owned Boutiques

- Department Stores

- Specialty Retailers

- Online Retail

- E-commerce Brand Websites (DTC)

- Luxury Multi-Brand E-tailers (e.g., Net-a-Porter)

- Offline Retail

- By Fiber Quality/Grade

- Pure Cashmere (100%)

- Cashmere Blends (Luxury Grades)

- Recycled Cashmere

Value Chain Analysis For Fashion Luxury Cashmere Clothing Market

The value chain for luxury cashmere is highly complex and begins with intensive upstream processes focused on the raw material supply, primarily sourced from Inner Mongolia, Mongolia, and China. Upstream analysis involves ethical animal husbandry, meticulous collection of the fine undercoat fiber during the molting season, and initial grading and sorting. Success at this stage relies heavily on long-term relationships with nomadic herders and implementing certified ethical sourcing standards (e.g., Responsible Cashmere Standard). Many top luxury brands are increasingly adopting vertical integration, acquiring or forming exclusive partnerships with combing and spinning facilities to ensure control over fiber quality, purity, and traceability from the moment of shearing.

The midstream focuses on manufacturing—converting raw fiber into high-quality yarn, dyeing, and then knitting or weaving into finished garments. This stage requires significant investment in advanced technology, such as specialized Italian spinning mills known for achieving the finest micron counts and modern 3D knitting machines that minimize cutting waste. Distribution channels, forming the crucial downstream component, are rigorously managed to protect brand exclusivity and pricing integrity. Direct channels, including flagship stores and proprietary e-commerce sites, allow brands maximum control over the customer experience, brand storytelling, and margin retention, often incorporating personalized services.

Direct distribution strategies dominate the ultra-luxury segment, leveraging curated, high-touch retail environments (boutiques) that reinforce the brand's heritage and quality assurance. Indirect distribution, involving exclusive partnerships with globally renowned luxury department stores (e.g., Harrods, Bergdorf Goodman) and select high-end multi-brand e-tailers, provides broader access to international HNW clientele. Control is maintained through stringent visual merchandising requirements and carefully limited inventory allocations. This dual channel approach ensures high visibility while preserving the perception of scarcity, crucial for maintaining the premium pricing structure essential to the market's luxury positioning.

Fashion Luxury Cashmere Clothing Market Potential Customers

Potential customers for the Fashion Luxury Cashmere Clothing Market are primarily categorized as High-Net-Worth Individuals (HNWIs) and Ultra-High-Net-Worth Individuals (UHNWIs) globally, characterized by significant disposable income and a preference for investment pieces over temporary fashion. The core demographic typically falls between 35 and 65 years old, highly educated, professionally established, and residing in major metropolitan and wealth centers across North America, Western Europe, and Asia Pacific. These buyers are not price-sensitive but are highly sensitive to authenticity, ethical provenance, and perceived lasting value, viewing luxury cashmere not merely as clothing but as a tangible asset that retains its elegance and functionality for decades.

Psychographically, these end-users are driven by intrinsic motivators, including the desire for comfort, quality assurance, and self-expression through sophisticated, understated luxury—aligning with the "stealth wealth" trend. They actively seek brands demonstrating leadership in sustainability, traceable supply chains, and superior craftsmanship, often favoring brands that offer lifetime maintenance or repair services. Buyers in this market segment are digitally engaged but also appreciate the traditional, high-touch service offered in exclusive physical boutiques, demanding a seamless integration between online research, personalized recommendations, and physical purchase or collection.

The emerging potential customer segment includes affluent millennials and Gen Z buyers who, while valuing luxury, place an even higher premium on verifiable social and environmental responsibility. This younger cohort utilizes digital platforms heavily for discovery and purchase but demands complete transparency regarding the fiber’s journey, favoring brands that explicitly detail their carbon footprint and animal welfare standards. For these buyers, luxury cashmere represents not just wealth but a conscious lifestyle choice, prompting brands to innovate packaging, delivery, and end-of-life recycling programs to capture this future revenue stream.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3.5 Billion |

| Market Forecast in 2033 | $5.8 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Loro Piana (LVMH), Brunello Cucinelli, Pringle of Scotland, TSE Cashmere, Ralph Lauren (Purple Label/RRL), Zegna, Jil Sander, Johnstons of Elgin, Ballantyne, Falconeri (Calzedonia Group), The Row, Malo, Barrie (Chanel), Repeat Cashmere, N.Peal, White + Warren, Cashmere by Chan Luu, Oyuna, Autumn Cashmere, Gobi Cashmere. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fashion Luxury Cashmere Clothing Market Key Technology Landscape

The technology landscape in the Fashion Luxury Cashmere Clothing Market is centered on enhancing fiber purity, optimizing production efficiency, and ensuring robust traceability, directly supporting the luxury claim of verifiable quality. Advanced textile technologies include the use of sophisticated sorting and combing machinery that meticulously separates ultra-fine fibers (14-16 $\mu$m) from coarser guard hairs, significantly improving the resulting yarn quality and softness, justifying higher market prices. Nano-technology applications are also gaining traction, primarily focused on treating cashmere fibers post-spinning to introduce enhanced properties like anti-pilling, increased resilience against abrasion, and resistance to water and stains, without compromising the natural breathability and luxurious hand-feel of the material. These technological investments are crucial for meeting the modern luxury consumer's expectation of durable, high-performance natural fibers.

Manufacturing efficiency is being revolutionized by specialized computer-aided design (CAD) and advanced knitting equipment. Full garment knitting technology, particularly 3D seamless knitting, allows for the production of entire cashmere sweaters or garments with minimal seams and virtually zero textile waste from cutting, aligning perfectly with sustainability objectives. This innovation not only streamlines production but also results in garments that offer superior fit and comfort. Furthermore, the adoption of sustainable and water-saving dyeing processes, such as digital printing or cold-pad-batch dyeing, reduces the environmental impact associated with traditional textile processing, enhancing the brand's sustainability credentials, a growing driver for luxury purchasing decisions.

Perhaps the most critical technological integration for market confidence is the implementation of blockchain and digital tracking solutions. These technologies allow brands to digitally map the entire journey of the cashmere fiber—from the certified farm gate and shearing process through spinning, dyeing, and garment construction. By assigning unique digital IDs (often utilizing QR codes or RFID tags embedded in the garment), brands provide immutable proof of provenance, directly addressing consumer concerns about authenticity and ethical sourcing. This robust traceability system effectively secures the luxury supply chain against fiber adulteration and counterfeiting, maintaining the intrinsic value and trust associated with high-end cashmere brands.

Regional Highlights

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by explosive wealth creation in China, India, and Southeast Asia. China is pivotal, acting both as the primary raw material source (Inner Mongolia) and the largest consumer market for luxury goods, especially among aspirational, younger HNWIs who prioritize internationally recognized brands and quality over price.

- Europe: Europe remains the heart of luxury design, manufacturing expertise (particularly Italy and Scotland), and high consumption. The market here is mature and focused on established heritage brands, traditional craftsmanship, and sustainability certifications. Italy serves as a critical hub for high-end processing and product innovation, setting global quality standards.

- North America: This region represents a stable, high-value market characterized by consumers seeking investment pieces and high-performance, durable garments. Demand is strong for casual luxury items, driven by the desire for comfort and quality in professional and leisure settings. Omnichannel presence and superior logistics are key competitive factors in this region.

- Middle East and Africa (MEA): Growth is concentrated in the Gulf Cooperation Council (GCC) countries, fueled by high disposable incomes. Demand focuses on exclusive, bespoke items, often purchased through high-end boutiques and private shopping experiences, valuing exclusivity and personalized service above all else.

- Latin America: This region presents nascent growth opportunities, primarily concentrated among affluent populations in Brazil and Mexico. Market growth is sensitive to local economic stability and relies heavily on international luxury brand penetration via key metropolitan retail hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fashion Luxury Cashmere Clothing Market.- Loro Piana (LVMH)

- Brunello Cucinelli

- Pringle of Scotland

- TSE Cashmere

- Ralph Lauren (Purple Label)

- Zegna

- Jil Sander

- Johnstons of Elgin

- Ballantyne

- Falconeri (Calzedonia Group)

- The Row

- Malo

- Barrie (Chanel)

- Repeat Cashmere

- N.Peal

- White + Warren

- Cashmere by Chan Luu

- Oyuna

- Autumn Cashmere

- Gobi Cashmere

Frequently Asked Questions

Analyze common user questions about the Fashion Luxury Cashmere Clothing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the key factor distinguishing luxury cashmere from standard cashmere?

The primary distinguishing factor is the fiber's micron count; luxury cashmere utilizes ultra-fine fibers, typically 14 to 16 microns or less, sourced from specific high-altitude regions, resulting in superior softness, lighter weight, and enhanced durability compared to standard grades.

How is sustainability addressed within the luxury cashmere supply chain?

Luxury brands address sustainability by implementing traceable supply chains (often using blockchain), ensuring ethical animal welfare practices for herding, utilizing eco-friendly dyeing processes, and launching circularity programs for recycling old cashmere garments.

Which region is driving the largest growth in the luxury cashmere market?

The Asia Pacific (APAC) region, specifically led by major economies such as China and South Korea, is driving the largest market growth due to increasing urbanization, rapid growth in HNW populations, and strong cultural demand for high-end fashion investments.

What is the role of technology like AI in maintaining cashmere authenticity?

AI and blockchain technology are crucial for authenticity, providing immutable digital records of the fiber's journey from the specific nomadic farm to the finished garment. This verification process combats counterfeiting and validates ethical and quality claims, justifying the premium price point.

Are recycled cashmere garments gaining traction in the luxury segment?

Yes, recycled and regenerated cashmere garments are rapidly gaining traction as luxury brands invest in advanced mechanical and chemical recycling techniques. This satisfies the growing consumer demand among HNW buyers for environmentally responsible and circular fashion alternatives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Fashion Luxury Cashmere Clothing Market Size Report By Type (Coats, Trousers, Dresses, Other), By Application (Children, Women, Men), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Fashion Luxury Cashmere Clothing Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Coats, Trousers, Dresses, Other), By Application (Children, Women, Men), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager