Fast Fashion Apparel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432492 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Fast Fashion Apparel Market Size

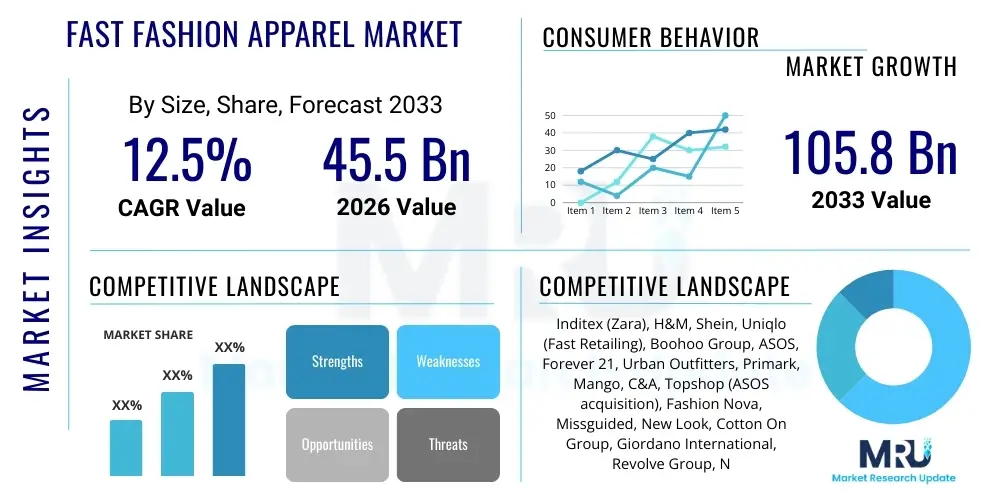

The Fast Fashion Apparel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 45.5 Billion in 2026 and is projected to reach USD 105.8 Billion by the end of the forecast period in 2033.

Fast Fashion Apparel Market introduction

The Fast Fashion Apparel Market encompasses the rapid design, production, distribution, and marketing of high-volume, trend-driven clothing at low prices, allowing consumers to frequently update their wardrobes in response to the latest styles seen on runways or social media platforms. This business model is fundamentally characterized by short product cycles and responsive supply chains, often taking inspiration from luxury brands or celebrity culture and quickly translating those concepts into affordable consumer goods within weeks, rather than traditional seasonal cycles. The core product description revolves around disposable fashion items, ranging from casual wear and accessories to specific niche seasonal garments, targeting primarily younger, trend-conscious consumers who prioritize variety and novelty over durability and timelessness.

Major applications of fast fashion products span across everyday clothing, event-specific attire, and specialty demographic segments such as athleisure, which has been rapidly integrated into the fast fashion cycle. Key benefits include democratization of style, making high-end aesthetics accessible to mass markets, and providing immediate gratification through rapid retail turnover. Furthermore, the constant introduction of new stock drives repeat customer visits and promotes high transactional frequency, underpinning the robust economic framework of this sector. The operational agility inherent in fast fashion provides a substantial competitive advantage by minimizing lead times and accurately matching inventory levels to immediate consumer demand signals.

Driving factors primarily include the pervasive influence of social media platforms, which accelerate trend diffusion and create instant demand for specific looks. Economic shifts, particularly among Millennials and Generation Z, who possess significant spending power but often seek value-based purchasing, also fuel market growth. Technological advancements in logistics, manufacturing automation, and data analytics further enable companies to compress the time from design to shelf, maintaining the low cost structure essential to the fast fashion paradigm. However, the industry continually faces complex challenges related to ethical sourcing and environmental sustainability, which are increasingly scrutinized by regulatory bodies and socially conscious consumers.

Fast Fashion Apparel Market Executive Summary

The Fast Fashion Apparel Market is experiencing a pivotal structural shift driven by hyper-digitalization and evolving consumer values. Current business trends indicate a significant pivot toward integrated omnichannel strategies, where e-commerce penetration continues to accelerate, complementing physical store footprints that are increasingly utilized for brand experience and rapid pickup/returns. Market leaders are intensely focused on optimizing their logistics networks, often adopting micro-fulfillment centers and advanced last-mile delivery solutions to maintain the core promise of speed. A critical trend involves the adoption of sophisticated inventory management systems leveraging predictive analytics to minimize overstocking—a notorious problem in the sector—and enhance product relevance across diverse geographic markets. Investment in sustainability rhetoric and circular economy initiatives, although often complex to implement at scale, is a key strategic imperative to mitigate reputational risk and appeal to an increasingly eco-aware consumer base.

Regional trends highlight Asia Pacific (APAC) as both the dominant production hub and the fastest-growing consumption market, particularly driven by large, youthful populations in countries like China and India who are quickly adopting Western fashion trends facilitated by localized e-commerce giants. North America and Europe, while mature markets, exhibit strong demand, but are simultaneously grappling with increasing regulatory pressures concerning waste management and labor practices, pushing brands to diversify supply chains away from single-source dependence. In emerging regions, the rise of domestic fast fashion brands tailored to regional cultural preferences and economic structures is intensifying competitive rivalry against established global players. Urbanization and increased disposable income across Latin America and the Middle East are also contributing to accelerated market expansion.

Segmentation trends reveal robust growth in the women’s apparel category, which traditionally serves as the primary driver of fashion cycles, though men’s fast fashion and children’s wear are also registering substantial expansion, especially within athleisure and leisurewear categories. Distribution channel analysis confirms the exponential growth of online sales, which now frequently surpass physical retail in growth metrics, driven by superior digital marketing capabilities and personalized shopping experiences. However, the offline segment remains crucial for immediacy, impulsive purchasing, and maintaining brand presence, leading to a synergistic coexistence between digital and physical platforms. Product segmentation shows consistent demand for tops, t-shirts, and seasonal accessories, items that offer maximum variety at minimal cost, perfectly aligning with the high-turnover model of fast fashion.

AI Impact Analysis on Fast Fashion Apparel Market

Common user questions regarding AI's impact on the Fast Fashion Apparel Market typically revolve around the speed of trend prediction, the ethics of data usage in personalization, and the potential displacement of human designers and factory workers. Users are deeply concerned about whether AI-driven hyper-efficiency will exacerbate environmental waste by encouraging even faster consumption cycles. They frequently inquire about the reliability of AI in forecasting niche market tastes and the practical application of algorithms in optimizing complex global supply chains. The analysis reveals a primary theme of expectation: users anticipate AI will solve inventory inefficiencies and personalization hurdles, but simultaneously express significant apprehension regarding the social and environmental consequences of unchecked algorithmic acceleration and resource utilization.

The implementation of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming the Fast Fashion value chain, moving beyond simple automation into complex decision-making processes. AI is now central to demand forecasting, where historical sales data, social media sentiment, meteorological information, and macroeconomic indicators are analyzed simultaneously to predict style popularity with unprecedented accuracy. This capability allows manufacturers to adjust production volumes in real-time, thereby minimizing the financial risks associated with overproduction and subsequent markdowns, a critical metric for maintaining profitability in a low-margin sector. Furthermore, AI-powered tools facilitate automated merchandising and dynamic pricing, optimizing product placement and sale timing across various digital touchpoints, significantly enhancing conversion rates.

In the design phase, generative AI tools are assisting human designers by rapidly generating new pattern iterations based on current trend data, drastically shortening the time from concept to production sample. On the consumer-facing side, AI drives highly sophisticated personalization engines, recommending specific garments and outfits based on individual browsing history, purchase patterns, and even uploaded body measurements, improving the overall online shopping experience and reducing return rates. The deployment of AI in quality control using computer vision also ensures high standards are maintained even under pressure of rapid production, strengthening the operational resilience of global fast fashion enterprises.

- Accelerated Trend Forecasting: Machine learning algorithms analyze social media chatter, visual cues, and competitive data to identify emerging styles weeks ahead of traditional methods.

- Optimized Inventory Management: Predictive analytics reduce stockouts and minimize overstocking by accurately modeling demand at the Stock Keeping Unit (SKU) level across global warehouses.

- Hyper-Personalization in Retail: AI-driven recommendation engines and virtual styling assistants enhance customer engagement and increase average transaction value (ATV).

- Supply Chain Resiliency: Real-time tracking and prescriptive analytics optimize logistics, identifying potential bottlenecks in sourcing and manufacturing workflows.

- Automated Quality Control: Computer vision systems rapidly inspect garments for defects on the production line, maintaining fast throughput without sacrificing quality standards.

- Generative Design Assistance: AI tools aid designers by creating quick prototypes and variations, dramatically cutting down the design cycle time.

DRO & Impact Forces Of Fast Fashion Apparel Market

The Fast Fashion Apparel Market is primarily driven by technological agility, restrained by mounting sustainability mandates, and finds expansive opportunities in underserved emerging economies, with the core impact force being the accelerating pace of digital and social media influence on consumer behavior. The rapid introduction of new styles, fueled by efficient logistics and globalized manufacturing capabilities, serves as the central economic driver, constantly refreshing the consumer desire for novelty. However, the inherent environmental costs associated with high material usage and short garment lifecycles pose a significant existential restraint, attracting increasing regulatory scrutiny, particularly in Europe. Opportunities abound in refining the supply chain through automation and leveraging virtual retail experiences to capture new demographics, while the fundamental impact force remains the instantaneous global dissemination of trends via digital platforms, which dictates market velocity.

Drivers: A paramount driver is the rising disposable income globally, particularly within developing nations, enabling higher frequency of discretionary purchases. Simultaneously, the ubiquity of high-speed internet and smartphone usage facilitates immediate access to global fashion trends, translating rapidly into purchase intent. Operationally, the refinement of global sourcing networks, particularly robust manufacturing infrastructure in Southeast Asia, provides cost advantages and scalable production capacity, enabling the low-price points crucial to the fast fashion model. Furthermore, the strategic application of big data and analytics allows companies to make highly informed production decisions, drastically reducing market reaction time and enhancing responsiveness to micro-trends, solidifying the market's dynamic nature. The constant product churn keeps the consumer perpetually engaged, ensuring high customer lifetime value through consistent transaction volume.

Restraints: Significant restraints revolve around ethical and environmental concerns, often leading to negative public relations and consumer boycotts. Labor rights issues in manufacturing countries, coupled with the massive textile waste generated by the short-lived nature of the products, create pressure from NGOs and governmental bodies for more transparent and sustainable practices. The market is also highly sensitive to shifts in raw material costs, particularly cotton and synthetic fibers, which can erode the thin profit margins characteristic of the sector. Moreover, the increasing market saturation in mature economies intensifies competition, forcing brands into aggressive price wars and increasing marketing expenditure, which acts as a financial constraint on overall margin expansion. The risk of intellectual property theft and rapid imitation also limits the longevity of any unique design advantage, demanding constant innovation.

Opportunities: Major opportunities exist in the circular economy movement, including investment in sophisticated textile recycling technologies, rental models, and resale platforms (re-commerce), which fast fashion companies can integrate to address sustainability concerns while opening new revenue streams. Geographic expansion into untapped markets in Africa and specific parts of Latin America, where digital adoption is soaring, offers pathways for substantial volume growth. Additionally, the customization and personalization of apparel using digital tools, mass customization techniques, and localized fulfillment strategies can elevate the customer experience beyond mere price competition. Strategic collaborations with technology firms to pilot innovative materials, such as bio-based or recycled fabrics, further presents a critical opportunity to future-proof the business model against evolving consumer and regulatory demands.

Impact Forces: The most potent impact force is the immediate and pervasive influence of social commerce and influencer marketing. Social media platforms transform niche trends into mass market phenomena overnight, drastically accelerating product obsolescence cycles. This force necessitates continuous adaptation of supply chain systems to handle volatility and rapid inventory shifts. Another key impact force is the changing regulatory landscape, especially the European Union’s initiatives related to product lifespan and waste management, which compels global players to adopt more rigorous reporting and end-of-life management strategies. Furthermore, the shift toward mobile-first purchasing behavior has necessitated massive investment in robust and intuitive mobile application development, fundamentally changing how consumers interact with fast fashion brands and driving the need for optimized mobile experiences as a prerequisite for market entry.

Segmentation Analysis

The Fast Fashion Apparel Market is meticulously segmented based on product type, end-user, and distribution channel to provide granular insights into consumer preferences and market dynamics. Product type segmentation, including categories such as outerwear, tops, bottoms, and accessories, helps in understanding specific demand drivers for different garment functionalities, with tops and dresses typically demonstrating the highest turnover rates due to their high visibility and low cost. The end-user analysis differentiates between men, women, and children, recognizing that women’s fashion often dictates the fastest cycle times and accounts for the largest market share, while the men’s segment shows accelerating growth driven by cultural shifts toward more casual and trendy menswear. Distribution channel segmentation is crucial, distinguishing between the rapidly expanding online segment, which offers logistical efficiency and personalization, and the essential offline segment, which provides physical interaction and immediate purchase fulfillment.

Understanding these segments allows market participants to tailor their inventory strategies and marketing campaigns effectively. For instance, the high elasticity of demand in the women's segment requires more frequent inventory updates and high-velocity supply chains, whereas the children's segment, while smaller, demands stricter adherence to safety and material quality standards. The geographical split of these segments is also vital; for example, online penetration levels vary drastically between highly digitalized markets in North America and Asia, compared to regions where traditional brick-and-mortar retail still dominates. The cross-analysis of these segments provides a clear framework for competitive positioning, allowing new entrants to identify specific niches, such as sustainable fast fashion for Gen Z, while established players focus on optimizing their dominant segments through cost leadership and scale advantages.

Continuous monitoring of segment performance, especially the interplay between online sales growth and the physical store presence (omnichannel integration), is critical for strategic decision-making. The increasing sophistication of data analytics enables brands to dynamically allocate resources based on granular segment performance, for example, increasing the allocation of premium materials to the women's outerwear segment in colder climates, or focusing digital marketing expenditure exclusively on high-conversion product types within the online channel. This precision targeting enhances return on investment (ROI) across the entire operational spectrum.

- Product Type:

- Outerwear (Coats, Jackets, Blazers)

- Tops (Shirts, Blouses, T-shirts, Knitwear)

- Bottoms (Trousers, Skirts, Shorts, Jeans)

- Dresses and Jumpsuits

- Accessories and Footwear

- End-User:

- Women

- Men

- Children

- Distribution Channel:

- Online Stores (E-commerce Websites, Mobile Applications)

- Offline Stores (Specialty Stores, Branded Outlets, Hypermarkets)

Value Chain Analysis For Fast Fashion Apparel Market

The Fast Fashion Value Chain is characterized by extreme efficiency and outsourcing, designed to maximize speed-to-market while minimizing costs. The upstream analysis begins with raw material sourcing, predominantly focusing on high-volume, low-cost synthetic materials (like polyester) and conventional cotton, sourced globally, often from markets like China, India, and Vietnam. Procurement decisions are heavily influenced by geopolitical stability and environmental compliance, though cost remains the overriding factor. Manufacturing is highly consolidated and outsourced, often utilizing large-scale contract manufacturers in developing economies to leverage lower labor costs and high-volume production capabilities. This stage is critical, requiring stringent quality control checks to ensure rapid turnover while maintaining minimum acceptable standards, a challenging balance given the accelerated production timelines.

The midstream phase involves highly sophisticated logistics and inventory management. Unlike traditional fashion, fast fashion relies on "test and repeat" production, where small batches are initially manufactured and rapidly scaled up only if consumer demand is validated through early sales data. Distribution channels are the nexus of efficiency; products move rapidly from manufacturing hubs to distribution centers, and increasingly, directly to customer fulfillment centers. The rise of centralized mega-warehouses and automated sortation systems is crucial for supporting the global distribution footprint of major players. Advanced IT infrastructure and Enterprise Resource Planning (ERP) systems coordinate this complex flow, ensuring inventory visibility across the entire network, reducing lead times from months to mere weeks.

Downstream analysis focuses on retailing and consumer engagement. Direct distribution through company-owned online platforms and mobile applications is increasingly dominant (direct-to-consumer or DTC), offering higher margins and direct access to valuable customer data. Indirect distribution through third-party e-commerce giants and specific multi-brand physical retailers also plays a role, particularly in regional market penetration. The final stage involves marketing, which is heavily reliant on digital media, influencer endorsements, and social media campaigns to create immediate buzz and drive traffic to both online and physical stores. Post-sale activities, particularly reverse logistics (handling high return rates) and managing product end-of-life, are becoming increasingly important due to sustainability pressures, requiring dedicated investment in sorting and recycling infrastructure.

Fast Fashion Apparel Market Potential Customers

Potential customers for the Fast Fashion Apparel Market are predominantly digital-native generations, primarily Millennials (aged 27-42) and Generation Z (aged 11-26), who exhibit a high degree of fashion consciousness combined with significant price sensitivity. These segments prioritize immediacy, variety, and the ability to frequently experiment with new looks without committing significant financial resources to expensive, durable garments. They are heavily influenced by social media trends, often seeking garments that mirror the styles promoted by micro and macro-influencers, and their purchasing decisions are frequently impulsive, driven by limited-time availability and perceived scarcity of highly trend-specific items. Geographic location also plays a role, with densely populated urban centers worldwide representing core markets where access to both digital and physical retail is optimized.

Beyond the core youth demographic, fast fashion also captures segments of middle-income consumers seeking budget-friendly workwear or seasonal staples, as well as consumers in emerging markets who are experiencing rapid economic ascent and viewing branded apparel as an accessible status symbol. These consumers value the aesthetic upgrade offered by fast fashion brands, allowing them to participate in global fashion narratives previously reserved for high-income groups. Their engagement is characterized by frequent visits to online platforms, high loyalty to brands that offer seamless digital experiences, and a willingness to purchase items quickly before they go out of stock, thereby perpetuating the fast-turnover cycle.

The ideal customer profile is someone highly connected, value-seeking, and culturally aware, who uses clothing as a form of self-expression and is comfortable with the concept of rapid obsolescence. Marketers strategically target these individuals using highly personalized digital advertisements and engaging content, ensuring the product lifecycle is as short as possible, from discovery on a social platform to delivery at their doorstep. The success of the fast fashion model hinges entirely on maintaining a constant, high-frequency transactional relationship with this dynamic, trend-responsive consumer base, making customer data acquisition and analysis a central business focus.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.5 Billion |

| Market Forecast in 2033 | USD 105.8 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Inditex (Zara), H&M, Shein, Uniqlo (Fast Retailing), Boohoo Group, ASOS, Forever 21, Urban Outfitters, Primark, Mango, C&A, Topshop (ASOS acquisition), Fashion Nova, Missguided, New Look, Cotton On Group, Giordano International, Revolve Group, Nasty Gal, Lulus Fashion Lounge |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fast Fashion Apparel Market Key Technology Landscape

The technology landscape supporting the Fast Fashion Apparel Market is defined by tools that facilitate extreme operational speed, data-driven decision-making, and enhanced customer experience. Central to this landscape are advanced supply chain management systems leveraging IoT (Internet of Things) for real-time tracking of goods from factory floor to retail shelf, ensuring unprecedented transparency and rapid response to unforeseen logistics challenges. This connectivity is paramount, enabling the "Just-in-Time" inventory model characteristic of the industry. Furthermore, the reliance on proprietary data lakes and powerful cloud computing infrastructures allows fast fashion giants to aggregate massive amounts of data—including clickstream data, sales history, and external trend indicators—providing the foundation for machine learning algorithms that dictate which styles are produced and in what volume.

In the consumer realm, digital technology is transforming how apparel is marketed and sold. Augmented Reality (AR) and Virtual Reality (VR) applications are increasingly utilized to offer virtual try-on experiences, mitigating one of the largest friction points in online clothing sales—the uncertainty of fit—thereby reducing return rates. The integration of highly sophisticated mobile applications, which offer seamless purchasing, personalized recommendations, and integration with loyalty programs, solidifies the mobile-first strategy adopted by leading brands. Moreover, companies are heavily investing in blockchain technology to enhance supply chain traceability, providing consumers with verifiable information about the origin and ethical compliance of their garments, addressing growing demands for transparency.

On the manufacturing side, automation and 3D printing technologies are gaining traction, although still relatively nascent in large-scale production. 3D printing is primarily used for rapid prototyping of accessories and complex components, drastically cutting sample production time and costs. Robotic sewing and cutting machines are being introduced to minimize labor input and increase throughput capacity in key manufacturing hubs. Crucially, the continued refinement of digital product creation (DPC) tools allows designers to collaborate globally on 3D models of garments, eliminating the need for multiple physical samples and further accelerating the design-to-market timeline, underscoring technology’s role as the primary enabler of the fast fashion business model.

Regional Highlights

The global Fast Fashion Apparel Market exhibits distinct regional dynamics driven by local consumption habits, regulatory environments, and manufacturing concentration.

- Asia Pacific (APAC): This region dominates the market both as the world's primary manufacturing base (China, Bangladesh, Vietnam) and as the largest, fastest-growing consumer market. Driven by immense, youthful populations, rising middle-class disposable income, and the rapid expansion of domestic e-commerce platforms (like Shein), APAC exhibits a robust demand structure. Countries like India and Indonesia are becoming critical consumption hubs, moving beyond solely being production sites. The focus here is on cost efficiency and speed, often facilitated by localized digital marketing strategies.

- Europe: Europe represents a mature but highly influential market, characterized by sophisticated consumers and increasingly stringent environmental regulations (e.g., the EU Strategy for Sustainable and Circular Textiles). While demand remains strong, particularly in Western Europe, the operational focus is shifting toward verifiable sustainability claims, ethical sourcing, and investment in circular models (resale, rental). Key markets include the UK, Germany, and Spain (home to Inditex).

- North America: North America is defined by high consumer spending power and advanced e-commerce penetration. The market is highly competitive, dominated by large-scale retailers and online-only players. Consumer behavior is heavily influenced by social media trends and celebrity culture, driving rapid inventory turnover. Logistical efficiency and seamless omnichannel experiences, including rapid shipping and easy returns, are crucial competitive differentiators in the US and Canadian markets.

- Latin America (LATAM): This region is an emerging high-growth area, marked by increasing digitalization and urbanization. Brazil and Mexico are leading the charge, with domestic and international brands competing to adapt their models to localized sizing and cultural preferences. Market growth is closely tied to improvements in local infrastructure and internet accessibility, though high import duties can sometimes restrain the full competitive force of global giants.

- Middle East and Africa (MEA): Growth is accelerating, particularly in the Gulf Cooperation Council (GCC) countries, fueled by high discretionary income and a young, fashion-conscious population. E-commerce adoption is soaring, though local cultural norms often necessitate adjustments in product lines (e.g., modest fashion). Africa presents long-term potential, though challenges related to logistics and economic instability remain factors influencing market entry strategies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fast Fashion Apparel Market.- Inditex (Zara)

- Hennes & Mauritz (H&M)

- Shein

- Uniqlo (Fast Retailing Co., Ltd.)

- Boohoo Group PLC

- ASOS Plc

- Forever 21

- Urban Outfitters, Inc.

- Primark (Associated British Foods plc)

- Mango

- C&A

- Gap Inc.

- Fashion Nova

- Missguided

- New Look

- Cotton On Group

- Giordano International Limited

- Revolve Group, Inc.

- Nasty Gal (Boohoo Group)

- Lulus Fashion Lounge Holdings, Inc.

Frequently Asked Questions

Analyze common user questions about the Fast Fashion Apparel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Fast Fashion Apparel Market?

The Fast Fashion Apparel Market is projected to exhibit a robust growth, estimated at a CAGR of 12.5% during the forecast period from 2026 to 2033, driven primarily by e-commerce expansion and high consumer demand for trendy, affordable items.

How is the adoption of Artificial Intelligence (AI) influencing the Fast Fashion supply chain?

AI significantly optimizes the Fast Fashion supply chain by providing highly accurate, real-time demand forecasting, enabling micro-batch production, minimizing waste from overstocking, and accelerating the design-to-shelf cycle through automated trend analysis.

Which geographical region holds the largest market share in the Fast Fashion Apparel Market?

The Asia Pacific (APAC) region currently dominates the market share due to its combined status as the world's largest manufacturing hub and an exponentially growing consumption base, fueled by rapid urbanization and high digital adoption.

What are the primary restraints affecting the future growth of the Fast Fashion industry?

The most significant restraints include mounting global pressure regarding sustainability, environmental degradation from textile waste, labor ethics concerns, and increasingly strict governmental regulations aimed at promoting circular economy models and product lifespan extension.

What distribution channels are expected to experience the fastest growth in this market?

The online stores segment, encompassing brand e-commerce websites and dedicated mobile applications, is projected to register the fastest growth, benefiting from personalized shopping experiences, robust logistics networks, and the consumer shift toward mobile-first purchasing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager