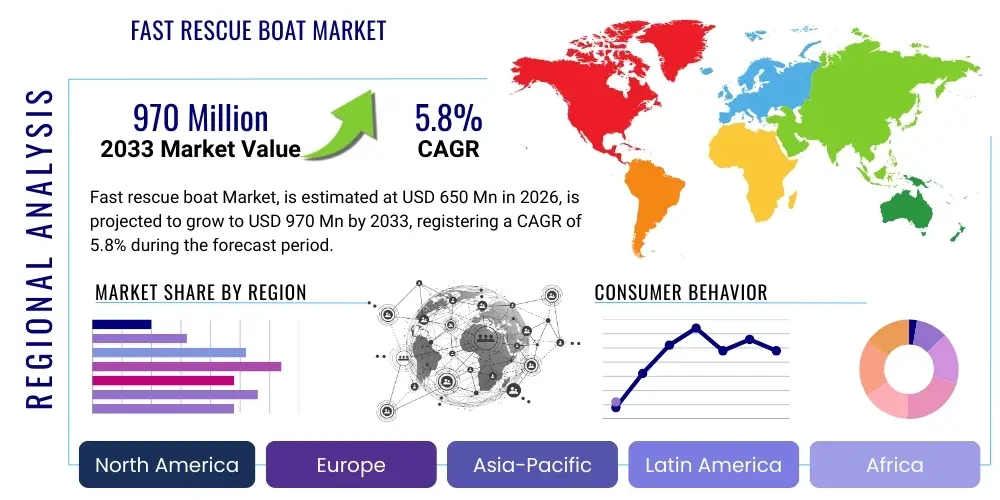

Fast rescue boat Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437503 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Fast rescue boat Market Size

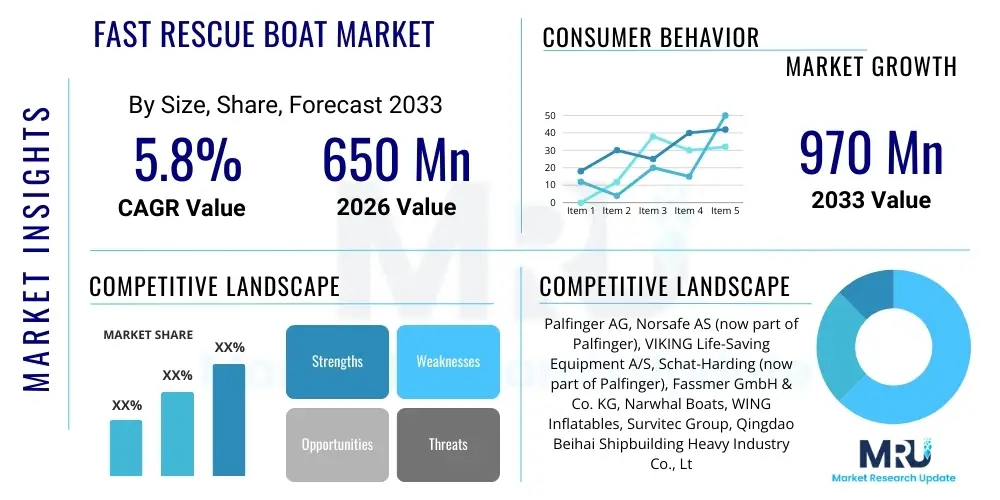

The Fast rescue boat Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $650 Million in 2026 and is projected to reach $970 Million by the end of the forecast period in 2033.

Fast rescue boat Market introduction

The Fast Rescue Boat (FRB) market encompasses the manufacturing, sales, and servicing of specialized, high-speed, highly maneuverable craft designed to swiftly recover persons in distress from the water and to marshal liferafts. These boats are essential components of maritime safety equipment, mandated globally by the International Maritime Organization’s (IMO) Safety of Life at Sea (SOLAS) convention for vessels like commercial ships, offshore platforms, and naval fleets. FRBs are distinct from conventional lifeboats due to their robust construction, enhanced speed capabilities (typically exceeding 20 knots), self-righting capacity, and advanced navigation and communication systems, making them vital for critical search and rescue (SAR) operations in challenging marine environments.

Major applications for FRBs span across the entire maritime economy, primarily driven by stringent safety regulations in the offshore oil and gas industry, growing naval modernization programs, and the expansion of the commercial shipping fleet, including large cruise ships and container vessels. The primary product features include rigid hull structures, often made of fiberglass or aluminum, powerful inboard or outboard engines (increasingly using waterjet propulsion for enhanced safety near survivors), and advanced recovery systems. The inherent benefits of these boats—rapid response time, reliability in adverse weather, and the ability to operate independently of the mother vessel for sustained periods—solidify their necessity in maritime operations globally, providing a crucial layer of preparedness beyond standard life-saving apparatus.

The key driving factors propelling market expansion include the continuous reinforcement of global maritime safety standards, necessitating the regular replacement and upgrade of existing fleet equipment to comply with the latest SOLAS amendments. Furthermore, the persistent growth in offshore exploration activities, particularly in deep-water and remote regions, inherently raises the demand for specialized rescue assets capable of rapid intervention. Technological advancements focused on increasing efficiency, durability, and operational range, such as hybrid propulsion systems and maintenance-free composite materials, are making newer FRB models highly attractive for fleet operators seeking improved operational performance and lower lifecycle costs, thereby sustaining the market’s steady growth trajectory through the forecast period.

Fast rescue boat Market Executive Summary

The Fast Rescue Boat market is characterized by stable demand fueled primarily by non-discretionary regulatory compliance and replacement cycles within the global maritime industry. Key business trends indicate a shift towards advanced materials, with composite hulls dominating new construction due to their superior strength-to-weight ratio and minimal maintenance requirements. Furthermore, manufacturers are increasingly integrating sophisticated navigation aids and remote monitoring systems to enhance operational reliability and comply with emerging digitalization trends in fleet management. The competitive landscape remains concentrated among a few global providers renowned for their certification expertise and service networks, focusing heavily on B2B relationships with major shipyards and fleet owners, ensuring consistent revenue streams driven by regulatory deadlines rather than purely economic cycles.

Segment trends reveal that the rigid hull segment maintains market dominance, valued for its stability and durability in high sea states, although the hybrid (rigid-inflatable) segment is demonstrating the highest growth potential, offering a favorable balance of stability and impact absorption suitable for diverse operational environments. Application-wise, the offshore segment, encompassing oil and gas installations and support vessels, remains the single largest consumer due to highly rigorous safety protocols governing remote operations. However, the naval defense application is expected to exhibit accelerated growth as global navies modernize their fleet readiness capabilities, necessitating robust and high-speed SAR assets tailored for military specifications, often involving specialized communications and robust hull protection features.

Geographically, Europe and the Asia Pacific region currently lead the market. Europe’s dominance is attributed to its mature shipbuilding industry, stringent adherence to EU maritime regulations, and a high concentration of key market players and certification bodies. Asia Pacific, conversely, represents the most significant growth market, driven by massive increases in commercial shipping traffic, rapid naval expansion by countries like China and India, and large-scale investment in offshore energy infrastructure across Southeast Asia. Regional trends point towards Latin America and the Middle East as emerging markets, spurred by increasing offshore exploration projects and the modernization of their respective coast guard and maritime patrol fleets, creating new procurement opportunities for specialized FRB manufacturers.

AI Impact Analysis on Fast rescue boat Market

User inquiries concerning AI's influence on the Fast Rescue Boat market frequently center on the potential for fully autonomous SAR operations, the enhancement of traditional boat capabilities through predictive maintenance, and the improvement of crew training efficiency. Key themes reveal user expectations regarding AI-driven navigational assistance for optimal route planning in distress situations, automated target detection using computer vision integrated with radar/sonar systems, and the implementation of AI to analyze operational data for predictive failure identification of critical components like engines and recovery systems. While fully autonomous FRBs face regulatory hurdles, users anticipate immediate integration of AI in decision support systems to minimize human error and drastically shorten response times during emergencies, ensuring compliance with future safety standards requiring maximum efficiency in life-saving procedures.

- AI-Powered Predictive Maintenance: Utilizing sensor data to forecast potential mechanical failures in engines or hull systems, minimizing downtime and increasing readiness.

- Enhanced Search Pattern Optimization: AI algorithms calculate the most efficient search grid based on real-time weather, current data, and distress location, significantly reducing search time.

- Autonomous Navigation Assistance: Providing real-time collision avoidance and optimal maneuvering suggestions, especially in high-traffic or adverse weather conditions.

- Automated Victim Detection (Computer Vision): Integrating AI with thermal and optical cameras to rapidly identify and track survivors in the water, even in low visibility.

- Crew Training Simulation: AI-driven simulators offering highly realistic emergency scenarios and personalized feedback for rescue boat operators.

- Regulatory Compliance Monitoring: AI systems track operational parameters to ensure the boat adheres to all mandated performance and safety standards during deployment.

DRO & Impact Forces Of Fast rescue boat Market

The FRB market dynamics are shaped by a strong reliance on regulatory drivers and technological innovation, counterbalanced by significant financial constraints and operational complexities. The primary driver is the mandatory compliance with global safety statutes, notably SOLAS, which guarantees consistent demand for certified vessels and scheduled replacements every 5 to 10 years, insulating the market from major economic downturns affecting other maritime sectors. Furthermore, sustained exploration and production activities in remote deep-sea locations mandate the deployment of advanced, long-range FRBs. Conversely, the high initial capital expenditure associated with purchasing certified, specialized equipment acts as a restraint, particularly for smaller vessel operators or fleets in developing nations. The specialized nature also leads to high maintenance and operational costs, requiring dedicated, highly trained personnel, which limits rapid market penetration by non-certified or lower-cost alternatives.

Significant market opportunities arise from the increasing development and adoption of autonomous and hybrid propulsion technologies. Autonomous FRBs, while currently constrained by regulation, present a long-term opportunity for enhanced efficiency and reduced personnel risk in high-risk zones. The immediate opportunity lies in hybrid and electric propulsion systems, which appeal to environmentally conscious operators seeking compliance with new emissions regulations while reducing fuel consumption. Furthermore, the extensive replacement cycle for older, legacy life-saving equipment installed prior to stricter SOLAS amendments provides a predictable, sustained demand wave over the next decade. Manufacturers leveraging modular design and smart connectivity features gain a competitive edge by offering lower total cost of ownership (TCO) solutions.

The impact forces influencing the market are high. Regulatory influence is extremely strong, as non-compliance immediately halts commercial operations, making FRB purchase a non-negotiable requirement. Technological forces are moderate but rapidly increasing, driven by the desire for enhanced safety features (e.g., advanced hull materials, better stability systems) and digitalization, compelling manufacturers to invest heavily in R&D. Economic instability presents a moderate restraint; while regulatory purchases must occur, operators may defer non-essential upgrades or opt for refurbished units if capital budgets are severely tightened. Overall, the market remains fundamentally robust, with regulatory momentum and safety imperatives significantly outweighing cost restraints, ensuring stable growth despite global economic volatility.

Segmentation Analysis

The Fast Rescue Boat market is segmented based on critical operational and structural characteristics, allowing for detailed analysis of demand drivers across various maritime sectors. Key segments include the type of hull construction (Rigid, Inflatable, and Rigid-Inflatable), which dictates durability and operational flexibility, and the application area (Offshore, Naval, Commercial Shipping), reflecting differences in regulatory requirements and usage intensity. Further segmentation by capacity and material composition (Fiberglass Reinforced Plastic, Aluminum) helps differentiate product offerings tailored to specific vessel sizes and environmental conditions. Understanding these segments is crucial for manufacturers to align production capabilities with sector-specific mandates and regional growth patterns, particularly the rising demand for high-capacity, durable boats in the expanding offshore and cruise line sectors.

- By Boat Type:

- Rigid Hull FRB (RHIB)

- Inflatable FRB

- Rigid-Inflatable FRB (RIB)

- By Material:

- Fiberglass Reinforced Plastic (FRP)

- Aluminum

- Other Composites

- By Application:

- Offshore Oil & Gas Installations (Platforms, FPSOs)

- Commercial Shipping (Tankers, Cargo Vessels, Bulk Carriers)

- Naval & Defense Vessels (Coast Guard, Warships)

- Passenger Vessels (Cruise Ships, Ferries)

- By Capacity:

- Up to 6 Persons

- 7 to 12 Persons

- Above 12 Persons

Value Chain Analysis For Fast rescue boat Market

The Fast Rescue Boat value chain begins with specialized upstream suppliers providing critical raw materials and components. This includes high-grade marine aluminum and specialized resins and glass fibers for composite hulls, high-reliability marine engines (diesel and gasoline), and advanced navigation and communication electronics. Due to the highly regulated nature of the end product, these suppliers must adhere to strict quality standards and certification processes (e.g., IMO, Classification Societies like DNV, Lloyd's Register). The complexity and specialization of these components result in moderate supplier bargaining power, as substitution options for certified parts are limited, ensuring quality inputs but potentially increasing production costs for original equipment manufacturers (OEMs).

The midstream segment is dominated by specialized FRB OEMs. These manufacturers focus heavily on design, integration, and obtaining regulatory approval (Type Approval) for the final product, which involves extensive testing of stability, speed, and self-righting capabilities. Distribution channels are typically direct B2B sales to large shipyards constructing new vessels or direct sales to fleet owners responsible for retrofitting and maintenance. Given the high value and safety-critical nature of FRBs, indirect distribution through general marine equipment distributors is less common; instead, sales often involve bespoke contracts, extensive pre-sale consultation, and post-installation service agreements. This direct model ensures regulatory compliance documentation is managed effectively and establishes long-term customer relationships centered on service and parts supply.

The downstream segment involves end-users (ship owners, offshore operators, navies) and the vital aftermarket segment. Aftermarket services, including mandatory periodic inspection, repair, refurbishment, and spare parts supply, represent a significant revenue stream. These services are often provided by the original manufacturer or highly specialized, certified service agents, as regulations require specific expertise for maintaining life-saving equipment. The end-users hold moderate bargaining power in the initial purchase phase but are captive to the OEM or certified service provider in the aftermarket due to proprietary parts and strict service protocols, highlighting the importance of lifecycle service agreements in the overall profitability of the FRB market.

Fast rescue boat Market Potential Customers

The primary end-users and buyers of Fast Rescue Boats are large, multinational entities operating within the maritime and offshore energy sectors, whose core operations necessitate strict adherence to international safety mandates. Commercial fleet operators, including those managing tankers, bulk carriers, and container ships, form a substantial customer base, driven entirely by the regulatory requirement to carry certified FRBs based on the vessel's size and operating region. This segment prioritizes reliability, ease of launching, and compliance documentation, often purchasing FRBs as part of new vessel construction specifications or during major overhaul cycles to ensure their entire fleet meets the latest SOLAS requirements, making procurement highly standardized and predictable.

The offshore oil and gas industry, encompassing owners of Floating Production Storage and Offloading (FPSO) units, drilling rigs, and offshore support vessels, constitutes the market segment with the most rigorous specifications and highest purchasing power. Due to the high-risk, remote nature of their operations, offshore customers demand FRBs with extended operational range, superior robust construction materials (often aluminum), and advanced recovery mechanisms suited for rougher seas. Furthermore, the naval and defense sector, including Coast Guards and national navies, represents a growing, specialized customer segment, requiring militarized versions of FRBs customized for high-speed intercept capabilities, enhanced communication security, and durable performance under extreme operational stress, often procured via large government defense contracts.

Finally, the passenger vessel segment, specifically large cruise lines and international ferry operators, represents another key customer group prioritizing high capacity and rapid deployment systems. These operators require FRBs capable of assisting a large number of life-saving appliances and survivors quickly. The inherent complexity and the need for seamless integration into the vessel’s launching systems mean that these high-value customers often require close collaboration with manufacturers from the design phase. Port authorities and terminal operators also form a smaller but distinct customer segment, utilizing FRBs for local search and rescue, pilot transfer assistance, and patrol duties within their jurisdictional waters, focusing on maneuverability and lower maintenance costs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $650 Million |

| Market Forecast in 2033 | $970 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Palfinger AG, Norsafe AS (now part of Palfinger), VIKING Life-Saving Equipment A/S, Schat-Harding (now part of Palfinger), Fassmer GmbH & Co. KG, Narwhal Boats, WING Inflatables, Survitec Group, Qingdao Beihai Shipbuilding Heavy Industry Co., Ltd., BSB Group, Maritime Partner AS, Targa (Botnia Marin), LOMOcean Design, Rescueboat.eu, HHI (Hyundai Heavy Industries), Jiangsu Jiaoyan Marine Equipment Co., Ltd., Zhejiang Lanyu Safety Equipment Co., Ltd., Survival Craft Inspectorate Ltd., FASSMER. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fast rescue boat Market Key Technology Landscape

The technological evolution within the Fast Rescue Boat market focuses primarily on enhancing operational reliability, speed, and crew safety under extreme conditions. One critical area is the material science used in hull construction. While fiberglass reinforced plastic (FRP) remains standard, the growing utilization of specialized composite materials and high-grade marine aluminum allows manufacturers to achieve lighter displacement and superior strength, directly translating to higher speeds and better fuel efficiency without compromising the structural integrity required for high-impact rescue operations. Furthermore, sophisticated manufacturing techniques, such as vacuum infusion processing for composite hulls, ensure consistent quality and reduce overall boat weight, improving the power-to-weight ratio critical for quick acceleration and maneuverability.

Propulsion technology is another rapidly evolving area. Traditional propeller-driven systems are often being replaced by waterjet propulsion systems, particularly in FRBs designed for operations near survivors or in shallow waters. Waterjets eliminate exposed propellers, significantly reducing the risk of injury to persons in the water while offering superior maneuverability at low speeds and faster overall response capabilities. Additionally, there is an increasing market focus on advanced engine management systems and, more recently, hybrid and electric propulsion configurations. Although full electric FRBs are limited by current battery technology range constraints, hybrid systems are being integrated to reduce carbon emissions and operational noise, meeting emerging environmental standards and enhancing communication during quiet search phases.

Integration of advanced electronics and navigation systems represents a significant technological leap. Modern FRBs are equipped with high-precision GPS, integrated thermal imaging cameras, specialized radar optimized for small target detection (like a person's head above water), and advanced communication suites that interface seamlessly with the mother vessel and broader SAR networks. Key advancements include self-righting systems that ensure the boat automatically recovers its upright position after capsizing, mandatory under SOLAS. Furthermore, the deployment systems, including davits and recovery cranes, are becoming increasingly automated and designed for deployment and retrieval in high sea states (up to Sea State 6), ensuring that the FRB remains a viable life-saving asset even when the mother ship is experiencing severe motion.

Regional Highlights

-

Asia Pacific (APAC) Market Growth and Dynamics:

The APAC region is projected to register the highest growth rate during the forecast period, primarily driven by explosive growth in maritime trade, massive port infrastructure development, and substantial increases in naval defense spending across major economies like China, India, South Korea, and Japan. The rapid expansion of container shipping fleets and the development of new deep-water offshore projects in the South China Sea and Southeast Asia necessitate corresponding investments in mandatory safety equipment, including FRBs. This region also features a concentration of world-leading shipyards, which often procure FRBs directly from local or certified global manufacturers during the new build process, ensuring sustained high-volume demand.

Compliance enforcement, while historically varied, is strengthening across the region, aligning with global standards, forcing older vessels to retrofit or replace non-compliant life-saving apparatus. This regulatory push, coupled with national strategies focused on securing sea lines of communication and enhancing coastal patrol capabilities (driving naval demand), cements APAC as the critical hub for future market expansion. Local manufacturing is also growing, though major procurement often favors established European and North American brands known for rigorous international certification standards, creating strong import opportunities.

-

Europe Market Maturity and Regulatory Enforcement:

Europe currently holds the largest market share, characterized by its mature shipbuilding industry, stringent safety regulations enforced by the European Union and member states, and a concentration of major FRB manufacturers (e.g., in Norway, Germany, and the UK). The market in Europe is dominated by the replacement cycle demand, as existing fleets regularly upgrade to meet the latest iterations of SOLAS and other regional directives focusing on environmental performance and crew comfort. European operators typically demand the highest specifications, including advanced navigation suites and hybrid propulsion options, driving technological innovation within this regional segment.

Strict port state control inspections across Europe ensure high levels of compliance, making FRB maintenance and certification a non-negotiable operational expenditure. Furthermore, the extensive offshore wind farm market in the North Sea and Baltic Sea contributes significantly to demand, as support vessels and maintenance platforms require certified rescue assets tailored to the unique demands of renewable energy infrastructure. The emphasis on high-quality service, long-term contracts, and adherence to classification society rules ensures market stability and sustained revenue streams from aftermarket services.

-

North America Market Focus on Defense and Offshore Energy:

The North American market, predominantly led by the United States and Canada, is driven by significant procurement needs from the Coast Guard and Navy for high-performance, ruggedized FRBs used in patrol, interdiction, and extensive SAR missions. Defense budgets allocate substantial funds for modernizing these assets, often requiring custom designs that meet specific military standards for robustness, speed, and communication interoperability. The offshore oil and gas industry in the Gulf of Mexico also represents a crucial demand source, necessitating highly durable boats capable of operating effectively in hurricane-prone environments.

While commercial shipping contributes to the market, the dominant factors are specialized defense requirements and the stringent safety mandates set by the Bureau of Safety and Environmental Enforcement (BSEE) for offshore operations. Manufacturers serving this region must navigate complex domestic procurement processes and often require specialized clearances, leading to high barriers to entry but offering lucrative, long-term contracts once secured. Innovation in North America is often geared towards autonomous capabilities and integration with wider government SAR network platforms.

-

Latin America, Middle East, and Africa (LAMEA) Emerging Demand:

The LAMEA region represents an emerging market segment with accelerating demand, spurred by rapid expansion of oil and gas production, particularly off the coasts of Brazil, Nigeria, and Saudi Arabia. Increased international shipping traffic through strategic routes like the Suez Canal and the development of new maritime hubs are bolstering commercial demand. Many countries in this region are also modernizing their naval and coast guard fleets to enhance maritime security and SAR capabilities, driving significant governmental procurement.

Growth here is heavily influenced by foreign investment in infrastructure and energy projects, which often require international safety standards to be met. While price sensitivity can be higher than in developed markets, the non-negotiable nature of safety compliance ensures market potential. Manufacturers typically focus on robust, reliable models that can withstand challenging operational environments and potentially face less sophisticated local maintenance capabilities, favoring simpler, durable designs with extensive global service networks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fast rescue boat Market.- Palfinger AG

- VIKING Life-Saving Equipment A/S

- Fassmer GmbH & Co. KG

- Maritime Partner AS

- Survitec Group

- Narwhal Boats

- WING Inflatables

- Schat-Harding (now part of Palfinger)

- Qingdao Beihai Shipbuilding Heavy Industry Co., Ltd.

- BSB Group

- Targa (Botnia Marin)

- LOMOcean Design

- Norsafe AS (now part of Palfinger)

- Survival Craft Inspectorate Ltd.

- Jiangsu Jiaoyan Marine Equipment Co., Ltd.

- Zhejiang Lanyu Safety Equipment Co., Ltd.

- HHI (Hyundai Heavy Industries)

- Holyhead Marine Services Ltd.

- Dolphin Shipyard

- Rescueboat.eu

Frequently Asked Questions

Analyze common user questions about the Fast rescue boat market and generate a concise list of summarized FAQs reflecting key topics and concerns.What regulations mandate the use of Fast Rescue Boats on commercial vessels?

The use of Fast Rescue Boats (FRBs) is primarily mandated by the International Maritime Organization’s (IMO) Safety of Life at Sea (SOLAS) convention, specifically Chapter III, which requires most ships and offshore installations to carry certified FRBs based on their size and operational requirements, ensuring rapid search and recovery capabilities.

What is the typical lifespan and replacement cycle for a Fast Rescue Boat?

The typical operational lifespan of a Fast Rescue Boat is 10 to 15 years, although regulatory replacement cycles are often dictated by mandatory 5-year inspections and the requirement for upgrades to comply with newer SOLAS amendments, driving predictable demand for refurbishment or new purchases.

How do Rigid-Inflatable Boats (RIBs) differ from standard rigid hull FRBs?

Rigid-Inflatable FRBs (RIBs) combine a solid, pre-formed hull (rigid) with inflatable buoyancy tubes around the perimeter. This hybrid design provides superior stability, excellent shock absorption, and enhanced safety during personnel recovery compared to purely rigid hull FRBs.

What are the key technological advancements driving current FRB design?

Key technological advancements include the widespread adoption of waterjet propulsion for enhanced safety and maneuverability, the use of advanced composite materials for lighter and stronger hulls, and the integration of AI-powered navigation and predictive maintenance systems.

Which application segment holds the largest share in the FRB market?

The Offshore Oil & Gas and Offshore Support Vessel segment holds the largest market share. This is due to the extreme safety requirements, remote operational locations, and high regulatory scrutiny placed on energy installations globally, mandating the use of the highest specification FRBs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager