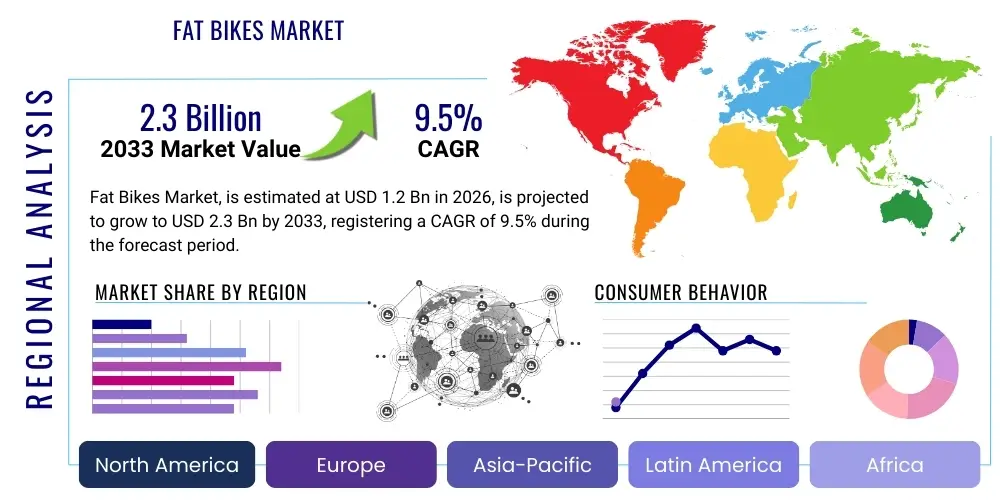

Fat Bikes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438083 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Fat Bikes Market Size

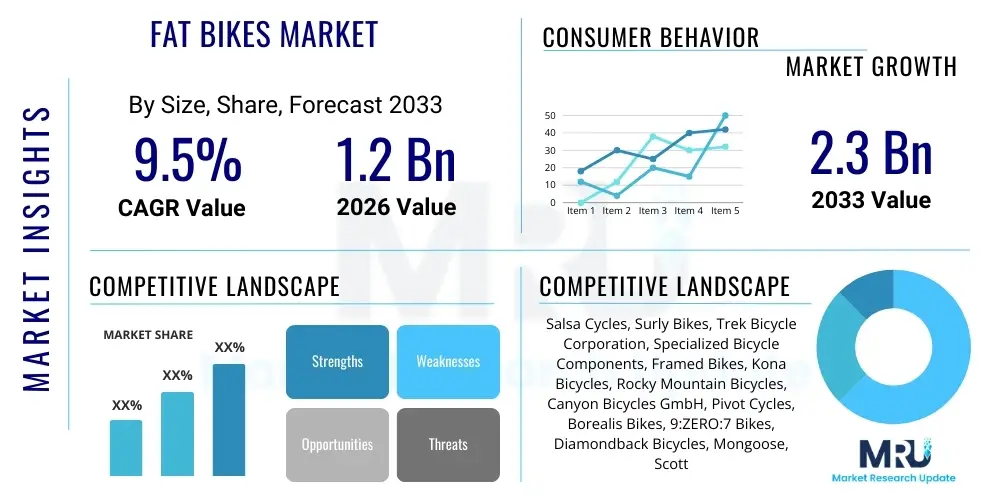

The Fat Bikes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.3 Billion by the end of the forecast period in 2033.

Fat Bikes Market introduction

The Fat Bikes Market encompasses the manufacturing, distribution, and sale of bicycles characterized by oversized tires (typically 3.8 inches or wider, often run at low inflation pressures) designed for optimal traction and flotation across soft, unstable terrains such as snow, sand, mud, and uneven trails. These specialized bicycles have evolved significantly from niche products to mainstream recreational and utility vehicles, driven primarily by the increasing consumer interest in extreme sports, adventure tourism, and year-round cycling capabilities, particularly in regions experiencing long winter seasons or expansive coastal environments. The unique design attributes, including robust frames (often aluminum or carbon fiber) and specialized components, allow fat bikes to traverse terrains inaccessible to conventional mountain bikes, making them popular among dedicated outdoor enthusiasts and casual riders seeking versatility.

Major applications of fat bikes include winter trail riding, beach cycling, bikepacking expeditions through varied landscapes, and use as utility vehicles for accessing remote locations where roads are non-existent or heavily degraded. The primary benefits derived from these bikes center on enhanced stability, superior grip, and improved comfort over rough surfaces due to the high-volume, low-pressure tires acting as natural suspension. This broadens the accessibility of cycling to challenging environments and extends the cycling season throughout the year, mitigating weather-related constraints that typically sideline conventional biking activities. The inherent durability and ruggedness also contribute to a lower maintenance profile in specific extreme conditions.

Driving factors fueling the market expansion include the rising disposable incomes in developed and rapidly developing economies, which facilitate increased spending on premium recreational equipment. Furthermore, the global proliferation of organized winter cycling events, fat bike specific races, and trail development initiatives tailored for these bikes contribute significantly to market visibility and consumer adoption. The continuous innovation in frame geometry, lightweight materials (like advanced carbon composites), and specialized gear systems designed to handle the specific demands of fat bike riding are also crucial in attracting technically discerning riders, ensuring sustained market growth across recreational and professional sectors.

Fat Bikes Market Executive Summary

The Fat Bikes Market is currently navigating a period of strong sustained growth, characterized by significant shifts in consumer preferences towards adventure cycling and all-weather recreational activities. Business trends indicate a robust focus on vertical integration among key manufacturers, optimizing supply chains to manage the increasing demand for specialized components, particularly oversized rims, durable drivetrains, and dedicated suspension systems suitable for these bikes. There is also a notable trend toward electrification, with electric fat bikes (E-Fat Bikes) emerging as a high-growth segment, addressing concerns related to the increased effort required to pedal standard fat bikes through dense terrain. Manufacturers are investing heavily in lightweight carbon fiber models to reduce overall weight and enhance performance, catering to the high-end enthusiast segment while maintaining competitive pricing for entry-level aluminum options.

Regionally, North America and Europe remain the dominant markets due to high cycling culture penetration, favorable climate conditions (extensive snowy regions), and well-established infrastructure supporting outdoor recreational activities and retail distribution. The Asia Pacific region, particularly countries like Japan, South Korea, and emerging markets in China and India, is poised for the fastest expansion, driven by urbanization leading to higher recreational spending and growing awareness of outdoor sports. Governments in these regions are increasingly promoting cycling as a sustainable mode of transport and recreation, which indirectly boosts the demand for specialized bicycles like fat bikes. Latin America and MEA are experiencing gradual growth, primarily centered around adventure tourism and specific geographical niches, such as desert riding.

Segmentation trends highlight the increasing dominance of the E-Fat Bikes segment, which provides accessibility to a wider demographic, including older riders and those with reduced physical capabilities, enabling them to enjoy challenging terrain. By application, the recreational segment holds the largest market share, but the bikepacking and adventure touring segment is demonstrating the highest growth velocity, reflecting the consumer shift towards multi-day, self-supported expeditions. The components segment is also expanding rapidly, driven by aftermarket customization and upgrades, particularly specialized tire technology offering variable tread patterns and enhanced durability to meet diverse environmental demands, further solidifying the market's trajectory.

AI Impact Analysis on Fat Bikes Market

User inquiries regarding AI's impact on the Fat Bikes Market primarily center on how artificial intelligence can enhance the riding experience, optimize design and manufacturing processes, and improve retail personalization. Common questions include: Can AI design lighter, stronger fat bike frames? How can AI optimize tire pressure and suspension settings in real-time for varied terrain? And, how will AI-driven predictive maintenance affect fat bike component longevity? The core themes reveal user expectations for AI to move beyond general manufacturing automation into direct product enhancement, creating smarter, more adaptable bicycles that dynamically adjust to environmental conditions, thereby maximizing rider comfort and performance while streamlining complex supply chain logistics and inventory management.

The integration of AI and machine learning (ML) is beginning to revolutionize the research and development phase of fat bike manufacturing. AI algorithms are used extensively in Finite Element Analysis (FEA) to simulate stress points and optimize frame geometry, allowing engineers to develop frames that are significantly lighter yet structurally rigid enough to withstand the extreme forces associated with riding on unstable surfaces. This computational approach drastically reduces the iteration cycle, leading to faster deployment of high-performance models and minimizing material waste. Furthermore, AI-driven demand forecasting is enabling retailers and manufacturers to accurately predict regional seasonality and specific consumer trends (e.g., preference for specific tire width or color schemes), ensuring optimal stocking levels and mitigating costly inventory surplus or shortages.

In terms of direct user experience, while nascent, AI applications are focusing on integrating smart sensor technology into fat bikes. These smart systems can monitor terrain type, gradient, and rider input (such as cadence and power output). ML models process this data to provide real-time recommendations or, in advanced E-Fat Bike systems, automatically adjust motor assist levels or even semi-active suspension firmness (if equipped) to maintain optimal efficiency and control. This shift transforms the bike from a mechanical device into a smart, adaptive piece of equipment, enhancing safety and performance across unpredictable environments, which is a critical necessity for off-road cycling.

- AI optimizes frame geometry and material utilization via FEA, leading to lighter, stronger frames.

- Machine Learning algorithms enhance supply chain management and predict regional demand fluctuations.

- Smart sensors integrated with AI offer real-time adjustment suggestions for tire pressure and gearing.

- AI-driven predictive maintenance monitors component wear, minimizing unexpected failures during remote rides.

- AI facilitates hyper-personalized marketing and recommendation systems for components and accessories.

- ML models analyze rider performance data to optimize training and energy expenditure in bikepacking.

- Advanced robotics, guided by AI vision systems, improves precision welding and assembly of specialized oversized frames.

DRO & Impact Forces Of Fat Bikes Market

The Fat Bikes Market is heavily influenced by a unique combination of positive and restrictive forces. Key drivers include the massive global movement toward health, wellness, and outdoor recreation, coupled with technological advancements leading to lighter components and accessible electric models. Restraints often revolve around the high initial cost of these specialized bicycles and associated accessories compared to standard mountain bikes, along with the perception that they are bulky or slow for paved road use. Opportunities are primarily centered on the untapped potential in adventure tourism, the growth of organized winter sports, and the integration of smart technologies. These factors interact to create a dynamic market environment where the impact forces necessitate continuous innovation in design and marketing strategy to overcome price sensitivity and expand market acceptance beyond niche enthusiasts.

Drivers (D) are predominantly structural. The rising popularity of adventure cycling, specifically bikepacking and extreme trail riding, provides a foundational demand base, as fat bikes excel in self-supported journeys across diverse terrains where traditional bikes fail. Furthermore, the accessibility provided by E-Fat Bikes, which neutralize the physical effort required to move heavy tires through snow or sand, has dramatically broadened the consumer base to include older riders and those seeking leisurely exploration. Effective marketing campaigns emphasizing the year-round utility and superior handling characteristics in adverse conditions further accelerate adoption, especially in regions with distinct seasonal changes, making them a premium, indispensable cycling investment.

Restraints (R) and Opportunities (O) create a critical tension. The high price point is a constant limiting factor, requiring manufacturers to continuously prove the value proposition through superior performance and longevity. Limited distribution channels in emerging markets also pose a challenge, though this simultaneously represents an opportunity for aggressive expansion and strategic partnerships with local retailers. The primary opportunity lies in developing highly specialized componentry (e.g., ultra-lightweight carbon rims, specialized cold-weather hydraulic systems) and leveraging the experiential economy by collaborating with tourism operators to position fat biking as a premier adventure activity, thereby converting casual interest into committed purchase intent.

Segmentation Analysis

The Fat Bikes Market segmentation provides crucial insight into consumer behavior, product preference, and high-growth areas, offering a detailed map for strategic business planning. The market is primarily dissected based on Product Type (Traditional/Acoustic Fat Bikes vs. E-Fat Bikes), Application (Recreational, Professional/Racing, Bikepacking/Adventure Touring), Material (Aluminum, Carbon Fiber, Steel), and Distribution Channel (Online vs. Offline Retail). Analyzing these segments reveals shifting consumer demands, particularly the rapid migration towards electric-assist models and the increasing demand for premium, lightweight carbon fiber frames in the professional and serious bikepacking segments. These segmentation metrics are vital for targeted product development and optimized market entry strategies across diverse geographical regions.

The transition toward E-Fat Bikes is perhaps the most defining segmental trend. While traditional fat bikes remain foundational, the electric variant addresses the key restraint of physical exertion, making challenging terrain accessible to a broader demographic, thereby maximizing revenue potential. Concurrently, the application segmentation highlights the burgeoning growth of bikepacking—a multi-day, self-supported cycling discipline—which demands high durability and reliability, thereby boosting demand for premium, purpose-built components like specialized racks and highly durable tires. Material segmentation dictates price points and performance characteristics, with aluminum dominating the entry-to-mid-level market, and carbon fiber capturing the performance-oriented, high-margin sector, reflecting clear tiers of consumer spending and usage intent.

From a distribution perspective, the market is witnessing robust growth in online sales channels, driven by the specialized nature of the product which often necessitates direct-to-consumer (D2C) models for better margin control and specialized consumer advice. However, traditional offline retail remains critical for hands-on experience, fitting, and immediate maintenance services. Strategic manufacturers often employ an omnichannel approach, integrating virtual consultations with localized dealer support to maximize reach and customer satisfaction. Understanding these granular segmentation dynamics is essential for market penetration and sustaining competitive advantage in a segment defined by specialized product requirements and highly engaged consumer communities.

- By Product Type:

- Traditional (Acoustic) Fat Bikes

- E-Fat Bikes (Electric Assist)

- By Application:

- Recreational Riding

- Professional Racing & Events

- Bikepacking & Adventure Touring

- Utility and Commuting (Niche)

- By Material:

- Aluminum Alloy

- Carbon Fiber Composite

- Steel and Titanium

- By Tire Size:

- 3.8 Inch - 4.5 Inch

- 4.6 Inch and Wider (e.g., 5.0 Inch)

- By Distribution Channel:

- Online Sales (E-commerce platforms, D2C websites)

- Offline Sales (Specialty Bicycle Stores, Sporting Goods Stores)

Value Chain Analysis For Fat Bikes Market

The value chain for the Fat Bikes Market begins with upstream activities focused on raw material sourcing and specialized component manufacturing, moving through assembly, distribution, and culminating in customer sales and post-sales service. Upstream analysis involves sourcing specialized materials such as high-grade aluminum, carbon fiber prepregs, and specialized rubber compounds for the oversized tires. Key component manufacturers focus on developing proprietary wide-hub systems, specialized bottom brackets, and durable wide-stance suspension forks, which are unique requirements for fat bikes. Efficiency at this stage is crucial, as the specialized nature of components often limits supplier options, making supply chain resilience a significant competitive factor.

The midstream phase involves the core manufacturing and assembly processes. Manufacturers often operate highly specialized facilities due to the unique geometry and dimensions of fat bike frames. Quality control focuses intensely on weld strength, frame alignment (especially concerning wheel clearance), and the integration of complex E-bike systems, where applicable. Optimized logistics for handling larger, bulkier components and finished products are necessary to maintain cost-effectiveness. The assembly stage requires specific tooling and skilled labor to ensure proper wheel truing and drivetrain setup optimized for low-speed, high-torque environments typically encountered during fat biking.

Downstream activities center on distribution and sales. The distribution channel is segmented into direct sales (online D2C) and indirect sales (through authorized dealers and specialty sports retailers). Direct sales allow manufacturers greater control over branding and pricing, while indirect channels provide localized expertise, professional fitting services, and crucial after-sales maintenance support. Specialty bicycle stores play a vital role, acting as crucial touchpoints for consumer education regarding tire pressure optimization and terrain suitability, which are often complex topics for new fat bike riders. The long-term success of the product relies heavily on the quality and availability of post-sales service, including warrantied frame repair and readily available replacement parts for proprietary components.

Fat Bikes Market Potential Customers

Potential customers for the Fat Bikes Market span a wide demographic spectrum, from high-performance athletes to casual recreational users, primarily unified by a desire for year-round cycling capability and the ability to traverse challenging, unstable terrain. The primary end-users, or buyers, are categorized into several distinct profiles: the Adventure Tourist/Bikepacker, who requires extreme durability and load-carrying capacity for multi-day expeditions; the Winter Enthusiast, who relies on the fat bike for recreation and access in snowy conditions; and the Coastal Rider, utilizing the bike for beach excursions where tire flotation is paramount. These users prioritize features like frame material strength, maximum tire clearance, and reliable, cold-weather component performance.

A rapidly expanding customer segment includes the older generation and individuals seeking lower-impact exercise, specifically attracted by E-Fat Bikes. E-assist models mitigate the strenuous physical demand of pushing the large tires, making challenging terrain accessible without excessive strain, thereby expanding the potential customer base significantly. This segment values comfort, ease of use, and battery range over absolute weight savings. Furthermore, institutional buyers, such as search and rescue teams, remote facility maintenance crews, and specialized military units operating in Arctic or deep snow regions, represent a niche but high-value customer base seeking robust utility and reliable performance in mission-critical environments, driven by operational requirements rather than recreation.

Finally, the growing community of urban and suburban commuters in regions prone to severe weather (heavy snow or intense rain) represents an emerging customer group. While fat bikes are not traditional commuters, their stability and resilience in adverse conditions make them appealing to those seeking an exceptionally stable and durable alternative to standard commuter bikes during winter months. Targeting these varied buyer personas requires highly differentiated marketing strategies, emphasizing performance specifications for the enthusiast segments and highlighting accessibility, safety, and all-weather utility for the recreational and commuting consumer bases.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.3 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Salsa Cycles, Surly Bikes, Trek Bicycle Corporation, Specialized Bicycle Components, Framed Bikes, Kona Bicycles, Rocky Mountain Bicycles, Canyon Bicycles GmbH, Pivot Cycles, Borealis Bikes, 9:ZERO:7 Bikes, Diamondback Bicycles, Mongoose, Scott Sports SA, Fezzari Bicycles, Charge Bikes, KHS Bicycles, Foes Racing, Intense Cycles, Yeti Cycles |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fat Bikes Market Key Technology Landscape

The technological landscape of the Fat Bikes Market is characterized by innovation focused on minimizing weight, maximizing durability, and enhancing drivetrain efficiency under extreme conditions. A key technological focus is the continuous refinement of frame materials. Manufacturers are increasingly utilizing advanced carbon fiber layup techniques to produce frames that maintain the necessary stiffness for efficient pedaling while drastically reducing the overall weight, overcoming one of the traditional drawbacks of fat bikes. Furthermore, proprietary hydroforming techniques for aluminum frames are yielding complex shapes that provide optimal strength-to-weight ratios at more accessible price points, broadening the market appeal.

Another pivotal area of technological advancement is in tire design and wheel technology. Given the dependency of fat bikes on tire performance, research is centered on developing tubeless-ready systems that allow riders to run extremely low pressures without the risk of pinch flats, maximizing flotation and traction. Tire manufacturers are introducing specialized rubber compounds optimized for sub-zero temperatures, preventing the tire from becoming brittle and losing grip. Moreover, specialized wheel componentry, including wider rim profiles (often 80mm to 100mm) and corresponding wide hubs (e.g., 170mm, 197mm rear spacing), necessitate continuous innovation in axle standards and component interface design to ensure reliability and compatibility across different frame architectures.

The fastest-growing technological segment involves E-Fat Bike integration. This includes advancements in high-torque mid-drive motors specifically tuned for the demanding resistance of large tires in soft terrain, optimizing power delivery and battery efficiency. Battery technology is also critical, focusing on increased energy density and improved cold-weather performance, as low temperatures drastically reduce typical lithium-ion battery effectiveness—a major constraint in typical fat bike riding environments. Furthermore, sophisticated electronic controls, often incorporating torque sensors and integrated gear shifting mechanisms, contribute to a seamless and intuitive rider experience, pushing E-Fat Bikes to the forefront of market adoption and technological advancement.

Regional Highlights

The Fat Bikes Market exhibits distinct regional consumption patterns and growth trajectories, heavily influenced by geographical climate, disposable income, and cycling infrastructure development. North America, encompassing the United States and Canada, represents the largest and most mature market. This dominance is attributed to the extensive presence of suitable terrain (deep snow in northern latitudes, expansive coastal areas), a deeply ingrained culture of outdoor recreation, and high consumer spending on specialized sporting goods. Key growth drivers here include the establishment of dedicated fat bike trails and increasing participation in organized events, driving demand for high-end, technologically advanced models, including both performance acoustic fat bikes and premium E-Fat bikes.

Europe holds the second-largest market share, with strong participation observed across Scandinavian countries, Switzerland, and the Alpine regions, where fat bikes are highly valued for winter utility and recreation. The European market, however, is heavily influenced by stringent regulations regarding E-bike power output and speed limits, impacting product development and consumer choice, particularly in urban areas. Western European countries are seeing a significant shift toward E-Fat bikes due to their use in adventure tourism and general utility, capitalizing on excellent cycling infrastructure, while Eastern Europe is emerging as a critical, high-potential market due to rising disposable incomes and expanding retail penetration.

The Asia Pacific (APAC) region is forecasted to register the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. While starting from a smaller base, growth is propelled by rapid urbanization, increased consumer discretionary spending on luxury and recreational goods in countries like China, Australia, and New Zealand, and a growing fascination with Western adventure sports culture. Latin America and the Middle East & Africa (MEA) present niche opportunities, mainly focused on specific geographical applications—desert riding in parts of the MEA and mountainous adventure tourism in Latin America. However, these regions face challenges related to logistics, high import duties, and nascent cycling infrastructure, requiring tailored distribution and pricing strategies.

- North America (Dominant Market): Strong outdoor culture, extensive winter environments, high adoption of premium E-Fat Bikes, robust specialized retail presence, especially in mountain states and Canadian provinces.

- Europe (Mature Market, Steady Growth): Driven by Scandinavian countries and Alpine regions; focused on utility and adventure; market constrained by stricter E-bike regulations but benefiting from established cycling tourism networks.

- Asia Pacific (Fastest Growing Market): Rapidly increasing disposable income, growing interest in adventure sports (China, Australia), and significant investment in outdoor recreational infrastructure, focusing on both imported and locally manufactured units.

- Latin America (Emerging Niche): Growth concentrated around adventure tourism, mountain biking communities, and specific geographic niches, requiring focus on affordability and durability.

- Middle East & Africa (Niche Utility): Minimal market share, growth primarily driven by desert sports (Middle East) and specialized institutional use (utility/patrol in specific African nations), requiring highly customized components for extreme heat and sand conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fat Bikes Market.- Salsa Cycles (A division of Quality Bicycle Products - QBP)

- Surly Bikes (Also QBP)

- Trek Bicycle Corporation

- Specialized Bicycle Components

- Framed Bikes

- Kona Bicycles

- Rocky Mountain Bicycles

- Canyon Bicycles GmbH

- Pivot Cycles

- Borealis Bikes

- 9:ZERO:7 Bikes

- Diamondback Bicycles

- Mongoose (A Dorel Sports brand)

- Scott Sports SA

- Fezzari Bicycles

- Charge Bikes (A Dorel Sports brand)

- KHS Bicycles

- Foes Racing

- Intense Cycles

- Yeti Cycles

Frequently Asked Questions

Analyze common user questions about the Fat Bikes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current demand acceleration for Fat Bikes globally?

The primary acceleration factors are the surging popularity of adventure cycling (bikepacking), the necessity for year-round utility in snowy or sandy environments, and technological advancements, particularly the widespread adoption of E-Fat Bikes which significantly expands accessibility to a wider demographic.

How do E-Fat Bikes compare to traditional (acoustic) Fat Bikes in market share and future growth?

While traditional fat bikes maintain a larger installed base, E-Fat Bikes are the fastest-growing segment, projected to capture a significantly higher share of future market revenue. Their ability to mitigate physical exertion on challenging terrain makes them highly attractive to recreational riders and commuters in severe climates.

Which geographical region offers the highest growth potential for Fat Bikes between 2026 and 2033?

The Asia Pacific (APAC) region, driven by countries like China and Australia, is expected to exhibit the highest Compound Annual Growth Rate (CAGR). This rapid growth is fueled by increasing disposable incomes and growing enthusiasm for high-end specialized outdoor recreational equipment.

What are the main financial and structural restraints affecting Fat Bikes Market expansion?

The main restraints are the relatively high initial purchase price compared to standard mountain bikes, which creates price sensitivity, and the structural challenge of limited specialized dealer knowledge and infrastructure for maintenance in emerging market territories.

What role does carbon fiber technology play in the premium segment of the Fat Bikes Market?

Carbon fiber is crucial for the premium segment as it directly addresses the issue of bike weight. Utilizing advanced carbon composite layup techniques allows manufacturers to produce extremely lightweight, high-performance frames that enhance agility and efficiency for serious racers and committed bikepackers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager