FCC Catalyst and Additives Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435681 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

FCC Catalyst and Additives Market Size

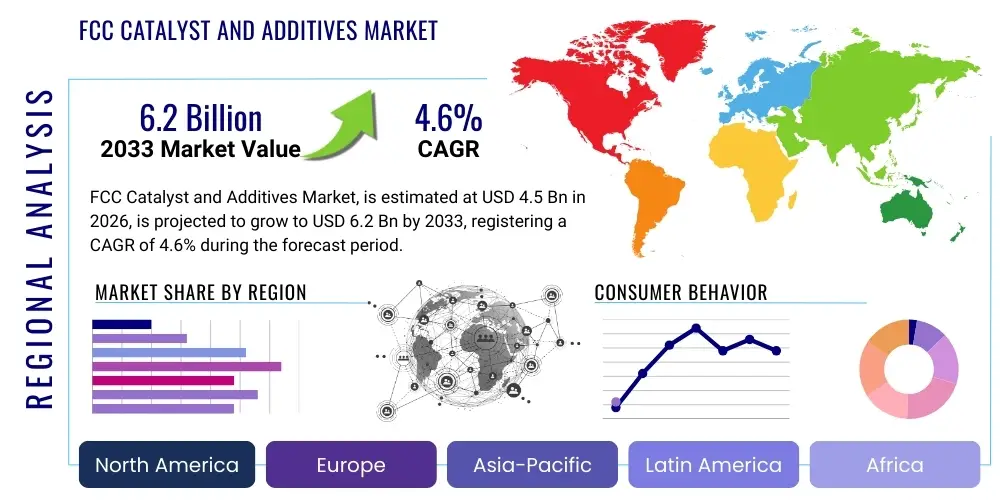

The FCC Catalyst and Additives Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.6% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

FCC Catalyst and Additives Market introduction

The Fluid Catalytic Cracking (FCC) Catalyst and Additives Market is integral to the downstream petroleum refining sector, serving as the cornerstone for converting heavy, complex hydrocarbon feedstocks into higher-value, lighter products such as gasoline, diesel, and light olefins. FCC catalysts, primarily composed of zeolite embedded in an amorphous matrix, facilitate the cracking reactions under high temperatures, optimizing yield patterns and improving product quality. The operational efficiency and profitability of modern refineries are heavily dependent on the performance characteristics of these catalysts, which must balance activity, selectivity, and stability under severe industrial conditions. The core function is maximizing the conversion rate while minimizing the production of less desirable byproducts, such as coke and dry gas.

FCC additives are specialized materials integrated with the primary catalyst package to address specific operational challenges, meet stringent environmental regulations, and further optimize product slate flexibility. These additives include components designed for sulfur oxides (SOx) and nitrogen oxides (NOx) reduction, carbon monoxide (CO) combustion promotion, and maximization of valuable light olefins (propylene and butenes). The application of these advanced additives allows refiners to process increasingly challenging crude oils, often characterized by higher metal and sulfur contents, while simultaneously complying with evolving global fuel quality standards and emission mandates. The market is characterized by continuous innovation aimed at enhancing hydrothermal stability and coke resistance.

Major applications of FCC catalysts and additives span across gasoline production (the dominant application), middle distillate maximization (such as diesel and jet fuel), and the increasing demand for propylene used in the petrochemical industry. The primary drivers for market growth include the rising global demand for transportation fuels, particularly in developing economies, the necessity for refiners to process heavier and sourer crude oil types due to shifting resource availability, and the pervasive global regulatory push for cleaner fuels (e.g., Euro VI and Tier 3 standards). The increasing complexity of refinery operations necessitates customized catalyst solutions that offer high activity and robustness, sustaining market demand.

FCC Catalyst and Additives Market Executive Summary

The FCC Catalyst and Additives Market is experiencing steady growth driven predominantly by the modernization of refinery infrastructure in the Asia Pacific region and the persistent global need for high-quality, low-sulfur transportation fuels. Business trends indicate a strong focus on strategic mergers, acquisitions, and technological partnerships among key market players to consolidate expertise in advanced zeolite synthesis and novel additive development, aiming to offer integrated, high-performance catalyst solutions. Furthermore, the shift towards utilizing heavier and non-conventional crude feedstocks is forcing refiners to adopt specialized additives for metals passivation and enhanced coke selectivity, thereby safeguarding operational longevity and efficiency. Environmental compliance remains a critical differentiator, pushing innovations in SOx and NOx reduction technologies.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive capacity expansions in China and India, coupled with the necessity for these economies to upgrade fuel quality standards rapidly. North America and Europe, while being mature markets, exhibit stable demand driven by the replacement of aged catalyst inventories and the adoption of high-performance additives designed for maximized light olefins production, aligning with the growing petrochemical integration trend. Latin America and the Middle East and Africa (MEA) are also showing promising growth, attributed to new refinery projects and capacity upgrades focused on energy independence and export potential, requiring robust, tailored catalyst systems capable of handling locally sourced crude slate variations.

Segment-wise, the FCC Additives segment is projected to witness the fastest growth rate, surpassing the core FCC Catalyst segment, largely owing to the expanding regulatory requirements concerning emissions (particularly sulfur and nitrogen compounds) and the refiners' need for flexible product maximization based on fluctuating market demand (e.g., maximizing propylene during petrochemical boom cycles or maximizing distillates during seasonal shifts). Within catalysts, the high-activity, high-stability zeolitic catalysts remain dominant, but the trend toward custom-engineered matrix components designed for improved pore structure and contaminant tolerance is highly pronounced, ensuring market dynamics are centered on specialized, value-added products rather than commoditized offerings.

AI Impact Analysis on FCC Catalyst and Additives Market

Common user questions regarding AI's influence in the FCC Catalyst and Additives market often revolve around predictive maintenance, optimization of catalyst loading and regeneration cycles, and the potential for AI to accelerate the discovery and synthesis of novel catalytic materials. Users are keenly interested in how machine learning algorithms can analyze vast datasets from refinery operating units (including temperature, flow rates, feedstock properties, and real-time catalyst performance metrics) to dynamically adjust additive injection rates and manage coke burn-off processes, thereby maximizing overall unit throughput and reducing unscheduled shutdowns. Key themes center on achieving 'smart refining' operations where AI minimizes the need for expert empirical judgment, leading to more precise, continuous process optimization and a reduction in catalyst consumption rates. Concerns often relate to data security, the required upfront investment in sensor technology, and the integration complexity with legacy Distributed Control Systems (DCS).

- AI algorithms enable highly precise modeling of reaction kinetics, optimizing FCC unit operating parameters dynamically for improved conversion efficiency.

- Predictive maintenance analytics, powered by AI, forecast catalyst deactivation rates, allowing refiners to schedule replacement or regeneration cycles optimally, maximizing runtime.

- Machine learning accelerates R&D by simulating molecular interactions and predicting the performance of new zeolite structures and additive compositions, shortening the discovery timeline.

- AI assists in feedstock quality prediction and management, helping refiners select the most appropriate catalyst/additive blend for variable or challenging crude oil inputs.

- Implementation of digital twins leverages AI to simulate various operational scenarios, reducing risk and energy consumption during process changes.

- Automated dosing systems, guided by real-time AI analysis of stack emissions and product quality, optimize the continuous injection of FCC additives (e.g., SOx traps) for immediate regulatory compliance.

- Enhanced process control through deep learning minimizes variability in product yields, contributing directly to increased refinery profitability and energy savings.

DRO & Impact Forces Of FCC Catalyst and Additives Market

The FCC Catalyst and Additives Market is driven primarily by the escalating demand for cleaner transportation fuels, the continuous evolution of global regulatory standards, and the increasing complexity of crude oil feedstocks being processed by refineries worldwide. Restraints include the high capital expenditure required for developing and implementing new catalyst technologies, the inherent cyclical nature of the refining industry which affects investment decisions, and the long turnaround times required for adopting entirely new catalyst platforms. Opportunities reside in leveraging digitalization and AI for advanced process optimization, targeting the burgeoning petrochemical segment (especially propylene maximization), and developing advanced additives for highly specific contaminant removal (e.g., trace metals and nitrogen). The key impact forces are the stringency of environmental mandates (pushing SOx/NOx reduction), the shift in the global demand mix toward lighter olefins, and the technological barrier to entry maintained by major catalyst providers.

- Drivers: Rising global demand for gasoline and petrochemical feedstocks; Stricter environmental regulations demanding lower-sulfur fuels; Trend towards processing heavier, sourer crudes requiring more robust catalysts; Continuous advancements in zeolite technology (e.g., USY and ZSM-5 integration).

- Restraints: High research and development costs associated with new catalytic materials; Volatility in crude oil prices and refining margins impacting purchasing decisions; Competition from alternative fuel sources and electric vehicles in the long term; Regulatory hurdles and approval times for new chemical compounds.

- Opportunities: Growing demand for propylene maximization additives; Focus on advanced catalyst recycling and regeneration technologies; Integration of digital tools for real-time catalyst performance monitoring; Expansion of refining capacity, particularly in the APAC region.

- Impact Forces: Government policy regarding emission standards (High Impact); Global economic health affecting transportation demand (Medium Impact); Technological maturity and proprietary knowledge of catalyst manufacturers (High Impact); Fluctuations in raw material prices (e.g., rare earth elements) (Medium Impact).

Segmentation Analysis

The FCC Catalyst and Additives Market is comprehensively segmented based on product type (catalysts vs. additives), primary catalyst material (e.g., zeolite, matrix), and application (gasoline, distillates, light olefins). Understanding these segmentations is critical for refiners seeking tailored solutions and for manufacturers aiming to optimize their product portfolios. The segmentation by product type is foundational, distinguishing between the high-volume core catalyst used for conversion and the lower-volume, higher-margin additives employed for specific enhancements or environmental mitigation. The growth dynamics within these segments often reflect immediate market needs, with additives generally experiencing faster uptake due to immediate regulatory pressure and flexibility.

Segmentation by material highlights the dominance of zeolite-based catalysts, specifically Ultra Stable Y (USY) zeolite, due to their superior acidity and surface area crucial for efficient cracking. However, the matrix component—the non-zeolitic binder material—is increasingly important for heat transfer, mechanical stability, and contaminant tolerance, driving innovation in clay and alumina formulations. Application segmentation clearly shows that the maximization of gasoline yield remains the largest application globally, though the fastest growing segment is the maximization of light olefins (propylene and butenes), reflecting the increasing integration between the refining and petrochemical sectors and the high market value commanded by these polymer building blocks.

The geographical segmentation underscores regional refining capacity and crude slate composition differences. APAC dominates in terms of volume due to capacity expansion, while North America and Europe focus intensely on specialty additives and performance optimization to handle complex blending requirements and meet stringent emissions targets. This layered segmentation allows for a detailed assessment of market maturity, technological adoption rates, and specific regulatory influences across various operational environments, providing a granular view of market demand drivers across the petroleum processing value chain.

- By Product Type:

- FCC Catalysts

- FCC Additives

- By Catalyst Material:

- Zeolite (USY, RE-Y, ZSM-5)

- Matrix/Clay

- By Additive Type:

- SOx Reduction Additives (SOx Traps)

- NOx Reduction Additives

- CO Combustion Promoters (COPs)

- Octane Enhancement Additives

- Metals Passivation Additives

- Light Olefins Maximization Additives (LOMAs)

- By Application:

- Gasoline Maximization

- Distillates (Diesel/Jet Fuel) Maximization

- LPG and Light Olefins Production

- Others (Fuel Oil Reduction)

- By Region:

- North America (NA)

- Europe (EU)

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For FCC Catalyst and Additives Market

The value chain for FCC catalysts and additives is complex, starting with the extraction and processing of raw materials such as rare earth elements (e.g., Lanthanum, Cerium), kaolin clay, alumina, and silica—the core components for zeolite and matrix manufacturing. The upstream segment is highly concentrated, relying on specialized chemical producers for high-purity inputs. The primary catalyst manufacturers then engage in sophisticated R&D and proprietary synthesis processes (zeolite crystallization, matrix preparation, and formulation mixing) to produce the finished catalyst and additive packages. This manufacturing phase represents significant value addition due to the necessity of proprietary technology and strict quality control to achieve desired performance characteristics like thermal and hydrothermal stability.

The midstream phase involves the specialized distribution channels. Given the technical nature and high volume/weight of the product, distribution often involves direct sales or highly specialized technical agents who provide engineering support and consultancy alongside the product delivery. Catalyst procurement is not merely a commodity purchase; it is a long-term technical partnership where the manufacturer works directly with the refiner's technical team to customize the catalyst solution for the specific feedstock and operational goals. Direct sales dominate for major players like Albemarle and W. R. Grace, ensuring direct control over quality and technical service delivery to the end-user refinery.

The downstream analysis focuses squarely on the end-users: the petroleum refining companies globally, ranging from large integrated majors to independent refiners. The ultimate success metric in the downstream phase is the effective integration of the catalyst/additive package into the Fluid Catalytic Cracking unit, leading to measurable improvements in yield, product quality, operational stability, and environmental compliance. The lifecycle extends beyond initial use to include handling, inventory management, spent catalyst disposal, or, increasingly, sophisticated regeneration and recycling programs, adding a circular economy dimension to the value chain, particularly influencing the costs and sustainability profiles of the final product.

FCC Catalyst and Additives Market Potential Customers

The potential customers for FCC catalysts and additives are exclusively operators of petroleum refining facilities equipped with Fluid Catalytic Cracking units. These customers range from multinational integrated energy companies (IOCs and NOCs) that manage massive global refining footprints to smaller, independent refiners focused on regional fuel supply. The primary motivation for these buyers is maximizing the value derived from every barrel of crude oil by efficiently converting low-value heavy components into high-demand transportation fuels and petrochemical feedstocks. Purchasing decisions are highly technical and are often made by specialized internal process engineering and procurement teams, heavily influenced by trial performance data, technical support reliability, and the capability of the catalyst supplier to meet complex regulatory requirements.

Within the refining sector, demand is segmented by the primary operational goal. Refiners in mature markets (North America, Europe) may prioritize additives for light olefins maximization (targeting petrochemical integration) or advanced SOx/NOx reduction (targeting emissions compliance). Conversely, refiners in rapidly growing markets (APAC, MEA) often prioritize the core catalyst package's ability to maximize gasoline yield and ensure robust operation when processing challenging, unconventional feedstocks high in contaminants like vanadium and nickel. Therefore, the catalyst suppliers must tailor their offerings—whether high-activity USY catalysts, robust matrix systems, or specialized metal passivation additives—to the specific strategic and regulatory imperatives of each customer group globally, highlighting the importance of customized, consultative selling in this market.

Specific end-user/buyer categories include governmental national oil companies (NOCs) such as Sinopec, Aramco, Petrobras, and major private multinational corporations like ExxonMobil, Shell, and TotalEnergies. Independent refiners such as Valero and Marathon Petroleum also represent substantial purchasing power. These buyers are continuously seeking innovative solutions that reduce their operational expenditure (OpEx) by extending catalyst life, minimize environmental penalties, and enhance flexibility to switch between product slates (e.g., from maximum gasoline to maximum distillates) in response to dynamic commodity prices. The procurement cycle is typically characterized by long-term contracts and highly detailed performance evaluations based on proprietary unit data.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | CAGR 4.6% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Albemarle Corporation, BASF SE, W. R. Grace & Co., Johnson Matthey PLC, Sinopec Catalyst Co. Ltd., China Petroleum & Chemical Corporation, Haldor Topsoe A/S, Clariant AG, Rezel Catalysts Corporation, JGC Catalysts and Chemicals Ltd., KNT Group, Criterion Catalysts & Technologies L.P., Axens SA, PQ Corporation, Zeochem AG, Intercat, Advanced Refining Technologies (ART), Filtra Catalysts, Petrochina, Kuwait Catalyst Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

FCC Catalyst and Additives Market Key Technology Landscape

The technological landscape of the FCC Catalyst and Additives market is dominated by advancements in molecular sieve science, primarily focusing on proprietary synthesis techniques for Ultra Stable Y (USY) zeolites and specialized ZSM-5 integration. USY zeolites remain the backbone, offering high activity and hydrothermal stability, essential for maintaining conversion efficiency under severe operating conditions. Current technology development emphasizes enhancing the accessible surface area and optimizing the pore structure to improve mass transfer kinetics, thereby increasing selectivity toward desired products like gasoline and light cycle oil while simultaneously minimizing the formation of undesirable coke. Innovation also centers on developing matrices that act as secondary cracking sites and buffers against catalyst poisoning from contaminants like alkali metals and heavy feed components, extending the catalyst's useful life within the reactor.

A major technological frontier is the refinement of shape-selective catalysts, most prominently ZSM-5, which is added to the primary catalyst to enhance the production of light olefins, particularly propylene. Advances in synthesizing highly dispersed, small crystal ZSM-5 particles embedded within the matrix ensure optimal diffusion and selectivity. Furthermore, the technology for environmental additives has seen rapid progress. For instance, SOx reduction additives utilize proprietary metal oxide formulations (often based on rare earth or magnesium compounds) integrated into the catalyst particle to chemically capture SOx emissions within the reactor before they exit the stack. Similarly, CO combustion promoters leverage noble metals (typically Platinum or Palladium) to ensure complete combustion of CO to CO2, minimizing air pollution and recovering heat energy.

The industry is also increasingly embracing digital technologies, moving beyond conventional material science. The implementation of Computational Fluid Dynamics (CFD) modeling allows manufacturers to simulate fluidization and reaction dynamics within the FCC reactor, enabling them to design catalyst particles with optimized density, size distribution, and attrition resistance. This simulation capability, coupled with AI-driven analytics, constitutes the next generation of catalyst development, allowing for the rapid testing of thousands of compositional variations virtually before physical synthesis. This integrated technological approach—combining advanced molecular design with rigorous process simulation—is crucial for maintaining a competitive edge and responding quickly to fluctuating regulatory and feedstock challenges faced by global refiners.

Regional Highlights

- Asia Pacific (APAC): Dominant Growth Hub: APAC is the largest and fastest-growing region in the FCC Catalyst and Additives market, primarily driven by massive increases in refining capacity, particularly in China, India, and Southeast Asian nations. The region's expanding middle class and industrial development translate directly into soaring demand for transportation fuels (gasoline and diesel). Furthermore, many refiners in APAC are upgrading existing facilities or constructing new, complex refineries designed to meet modern Euro and equivalent fuel quality standards, necessitating the increased use of high-performance catalysts and specialized SOx/NOx reduction additives. China’s push for petrochemical integration, maximizing propylene production from FCC units, significantly boosts the demand for ZSM-5-based additives.

- North America (NA): Focus on Specialization and Yield Optimization: North America represents a mature, high-value market characterized by stringent environmental enforcement and a strong focus on maximizing value-added products. Demand is stable, driven by catalyst replacement cycles and the necessity for refiners to maintain extremely high operating efficiency and reliability. The key regional trend is the adoption of advanced additives for flexibility, especially those maximizing light olefins to feed the burgeoning shale-gas-derived petrochemical sector, and maintaining low sulfur levels as mandated by Tier 3 gasoline standards. Innovation here is geared towards lifecycle optimization and reducing the environmental footprint of operations.

- Europe (EU): Regulatory Compliance and Distillate Maximization: The European market is highly governed by stringent EU environmental directives (e.g., Industrial Emissions Directive). The primary driver is the pervasive need for additives that ensure compliance, particularly SOx and NOx traps. Unlike NA, Europe often focuses on maximizing middle distillates (diesel and jet fuel) due to different regional demand patterns, necessitating specialized catalyst formulations designed for high selectivity toward heavier cuts rather than purely gasoline maximization. The shift towards sustainable aviation fuels (SAF) may also subtly influence future catalyst requirements, although FCC's role remains central to traditional fuel supply.

- Middle East & Africa (MEA): Capacity Expansion and Heavy Feedstock Processing: MEA is a significant region experiencing high capital investment in new, highly complex refineries (e.g., in Saudi Arabia and Kuwait). These facilities are specifically designed to process regionally abundant heavy and sour crude oils. This environment requires exceptionally robust, metal-tolerant FCC catalysts and specialized passivation additives (vanadium and nickel traps) to protect the catalyst structure from premature deactivation, ensuring operational continuity and enabling the region to become a major exporter of refined products.

- Latin America (LATAM): Modernization and Local Feedstock Challenges: The LATAM market, while facing periodic economic challenges, shows consistent demand driven by refinery modernization projects, particularly in Brazil and Mexico. Refiners often struggle with variable and sometimes difficult local crude oil slates, requiring customized catalysts offering high stability and tolerance for high coke production tendencies. The regional market growth is linked directly to governmental investment in upgrading local refining capacity to meet domestic fuel demand and minimize reliance on imports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the FCC Catalyst and Additives Market.- Albemarle Corporation

- BASF SE

- W. R. Grace & Co.

- Johnson Matthey PLC

- Sinopec Catalyst Co. Ltd.

- China Petroleum & Chemical Corporation

- Haldor Topsoe A/S (part of Topsoe)

- Clariant AG

- Rezel Catalysts Corporation

- JGC Catalysts and Chemicals Ltd.

- KNT Group

- Criterion Catalysts & Technologies L.P.

- Axens SA

- PQ Corporation

- Zeochem AG

- Intercat, Inc.

- Advanced Refining Technologies (ART)

- Filtra Catalysts and Chemicals Ltd.

- TotalEnergies (Affiliate involvement)

- Kuwait Catalyst Company

Frequently Asked Questions

Analyze common user questions about the FCC Catalyst and Additives market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an FCC catalyst in petroleum refining?

The primary function of an FCC catalyst is to facilitate the conversion of high-boiling, long-chain hydrocarbon molecules found in heavy crude oil fractions into lower molecular weight, higher-value products such as gasoline, LPG, and light olefins, enhancing the overall profitability and efficiency of the refining process.

How do environmental regulations impact the demand for FCC additives?

Stringent environmental regulations, particularly those limiting sulfur oxides (SOx) and nitrogen oxides (NOx) emissions, directly drive the demand for specialized FCC additives (e.g., SOx traps and NOx reduction catalysts) which must be integrated into the cracking unit to ensure the refined fuels and stack emissions comply with global standards like Euro VI and Tier 3.

Which geographical region is expected to lead market growth and why?

The Asia Pacific (APAC) region is projected to lead market growth due to significant investments in new refinery capacity expansion, coupled with the rapid adoption of higher fuel quality standards in major economies like China and India, increasing the overall consumption of both core catalysts and performance additives.

What is the role of ZSM-5 in FCC catalyst formulations?

ZSM-5 is a shape-selective zeolite additive used primarily to increase the yield of light olefins, specifically propylene and butenes, by selectively cracking straight-chain hydrocarbons. Its integration is critical for refiners seeking to maximize petrochemical feedstocks from their FCC units.

How do contaminants like vanadium and nickel affect catalyst performance?

Vanadium and nickel, often present in heavy feedstocks, act as catalyst poisons, primarily affecting the zeolite structure. These metals deposit on the catalyst surface, leading to accelerated deactivation, increased coke and hydrogen production, and necessitating the use of specialized metals passivation additives to protect the active sites.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- FCC Catalyst and Additives Market Statistics 2025 Analysis By Application (Vacuum Gas Oil, Residue, Other), By Type (FCC Catalyst, FCC Additives), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- FCC Catalyst and Additives Market Statistics 2025 Analysis By Application (Vacuum Gas Oil, Residue), By Type (FCC Catalyst, FCC Additives), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager