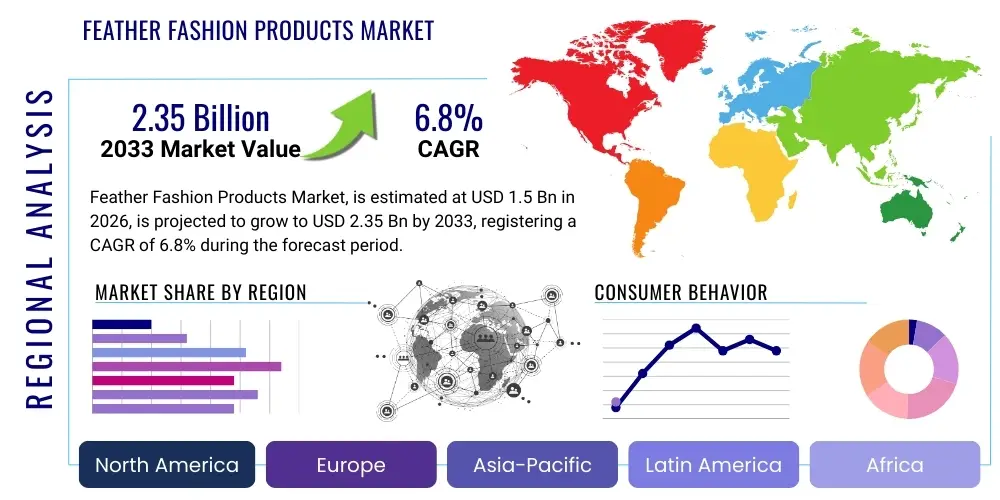

Feather Fashion Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434785 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Feather Fashion Products Market Size

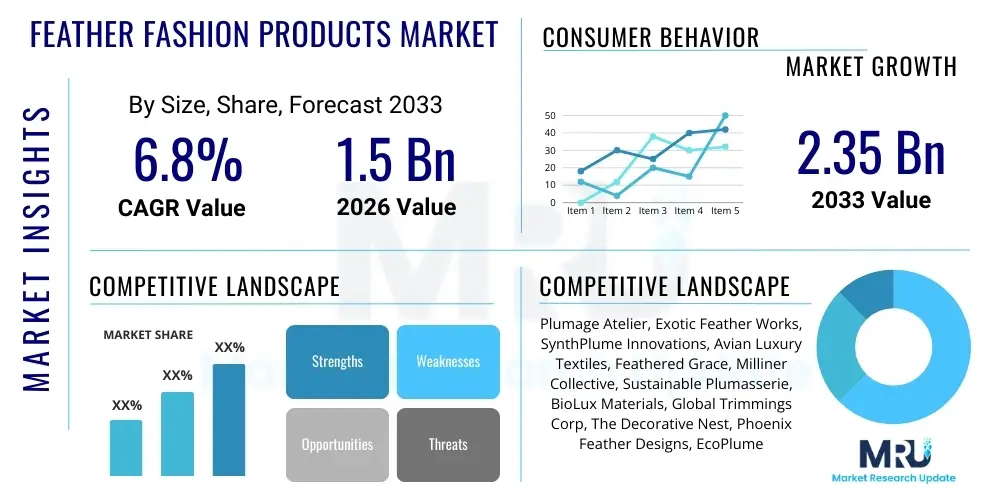

The Feather Fashion Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.35 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the persistent demand for luxury embellishments and the cyclical resurgence of decorative and voluminous aesthetics within haute couture and prêt-à-porter fashion lines. Despite significant headwinds concerning ethical sourcing and sustainability, the market maintains robust growth, particularly within niche, high-value segments.

Feather Fashion Products Market introduction

The Feather Fashion Products Market encompasses a diverse range of consumer goods utilizing decorative feathers, both natural and sustainably synthesized, across various applications including apparel, accessories, and specialized home furnishings. These products often serve as statement pieces, capitalizing on the luxurious texture, lightweight properties, and inherent visual drama provided by feathers. Historically associated with high fashion and ceremonial wear, the segment has expanded its reach into mainstream retail, driven by collaborations between designers and feather artisans, and supported by evolving production technologies that allow for greater diversity in color and durability.

Major applications of feather fashion products span evening wear (gowns, jackets), hats and millinery (fascinators), footwear, jewelry, and specialized crafts. The intrinsic value proposition of these products lies in their perceived uniqueness and craftsmanship, positioning them squarely within the aspirational and luxury consumer bracket. The rising prominence of social media platforms has significantly amplified the visibility of these highly photographic items, accelerating trend adoption and consumer interest in bespoke and customized feather pieces, thereby driving volume growth, particularly in the accessories sub-segment.

Key benefits derived from market participation include high profit margins for specialized manufacturers and designers, the preservation of traditional artisanal skills (such as plumassiers), and the ability to create visually distinctive and differentiated products in a highly saturated apparel sector. Driving factors are multifaceted, including the increasing disposable income in emerging economies, the influential power of celebrities and fashion icons showcasing feather embellishments, and technological advancements enabling ethically compliant and high-quality synthetic alternatives that mitigate supply chain risks associated with natural feather sourcing and animal welfare concerns.

Feather Fashion Products Market Executive Summary

The market demonstrated resilience post-pandemic, characterized by strong recovery in the luxury goods sector and a pronounced emphasis on experiential and high-impact fashion. Current business trends indicate a critical bifurcation: one path focuses intensely on certified, traceable, and ethically sourced natural feathers, commanding premium pricing; the other prioritizes cutting-edge synthetic and bio-engineered feather replacements, capitalizing on cost efficiency and regulatory compliance. E-commerce penetration is a dominant distribution trend, particularly for bespoke millinery and smaller accessories, allowing specialized artisans to access a global customer base efficiently. Furthermore, strategic collaborations between feather suppliers and major textile innovators are common, aiming to integrate feather aesthetics into sustainable material portfolios.

Regional trends highlight North America and Europe as the primary revenue generators, driven by established luxury markets, robust fashion industry infrastructure, and high consumer spending on designer goods. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest CAGR, propelled by the burgeoning affluence in countries like China and India, where cultural events and rapidly growing wedding markets demand opulent and embellished attire. Regulatory scrutiny regarding imports and exports of natural feather products remains tighter in European jurisdictions, pushing innovation towards sustainable domestic production and synthetic material development.

Segment trends reveal that the Accessories segment, particularly high-end millinery and feathered handbags, holds the largest market share due to its accessibility and lower investment threshold compared to full apparel items. The Synthetic Feather material segment is experiencing the fastest growth rate, fueled by improving texture and color fidelity, coupled with lower ethical controversy risks. Consumer preferences are shifting towards products marketed with transparent sustainability narratives, compelling brands across all segments to invest heavily in supply chain visibility and ethical certifications, which influences both pricing and market positioning strategies.

AI Impact Analysis on Feather Fashion Products Market

Common user inquiries concerning AI's role in the Feather Fashion Products Market primarily revolve around supply chain transparency, ethical sourcing verification, and rapid design customization. Users are keenly interested in how Artificial Intelligence can prevent the illicit trade of restricted feathers and ensure that declared natural materials meet stringent welfare standards. Furthermore, consumers and designers frequently ask whether AI-driven design tools can accelerate the development of synthetic feathers that perfectly mimic rare or protected natural textures, thereby mitigating environmental impact while maintaining aesthetic luxury. The key themes summarized from user questions reflect high expectations for AI to serve as a governance and innovation engine, moving the market toward fully ethical luxury production and highly personalized consumer experiences.

AI is already being deployed in trend forecasting by analyzing social media data, runway imagery, and consumer purchasing patterns to predict the specific feather colors, shapes, and applications that will be popular seasons in advance. This predictive capability minimizes waste and optimizes inventory management for producers dealing with volatile material supplies. Moreover, generative AI models are assisting designers in creating novel feather patterns and textures for synthetic materials, speeding up the material R&D process and offering unprecedented levels of customization for high-net-worth clients seeking exclusive, personalized items. Finally, AI algorithms enhance quality control by analyzing photographic evidence of sourcing conditions and verifying certification authenticity via complex digital document analysis.

The implementation of machine learning within operational logistics provides profound improvements in the ethical governance of natural feather supply chains. By utilizing computer vision and predictive analytics, companies can track materials from the source, identifying anomalies that might suggest non-compliance with international animal welfare regulations. This level of traceability builds critical consumer trust, especially important in a segment facing intense scrutiny. The integration of AI tools is thus transforming the feather fashion products sector from one reliant on opaque traditional sourcing methods to a highly sophisticated, data-driven, and ethically accountable luxury domain.

- AI enhances ethical supply chain transparency and auditing through blockchain integration and predictive analytics.

- Generative AI accelerates the design and optimization of synthetic feather structures and bio-engineered materials.

- AI-powered trend forecasting minimizes material waste by accurately predicting consumer demand for specific colors and styles.

- Computer vision systems improve quality control and material classification during manufacturing processes.

- Personalized AI styling recommendations boost sales of customized, high-margin feather accessories.

- Machine learning models aid in risk assessment related to regulatory compliance and material import restrictions.

DRO & Impact Forces Of Feather Fashion Products Market

The Feather Fashion Products Market is governed by a dynamic interplay of market forces, balancing high consumer desire for luxury and uniqueness against mounting ethical and environmental pressures. Driving factors include the cyclical nature of fashion trends emphasizing dramatic texture and ornamentation, robust growth in luxury consumer demographics globally, and the influential role of social media in disseminating high-fashion aesthetics quickly. These drivers maintain continuous demand, particularly in the occasion-wear and celebrity-driven markets. However, the market faces significant restraints, chiefly strict international regulations regarding the sourcing and trade of exotic bird feathers, strong advocacy by animal welfare organizations leading to consumer boycotts, and the inherent volatility and high cost associated with sourcing certified, ethical natural materials. These restraints force a constant need for innovation in synthetic alternatives.

Opportunities within this sector are centered on sustainable innovation and market expansion. The most promising opportunities involve developing advanced, biodegradable synthetic feather alternatives that replicate the lightness and texture of natural feathers without the ethical baggage. Furthermore, expanding the application scope beyond traditional apparel into luxury home decor and specialized performance wear presents untapped revenue streams. Companies focusing on full vertical integration, securing proprietary, certified ethical supply chains, or investing heavily in patentable bio-materials are positioned to capture significant future market share, establishing themselves as leaders in ethical luxury.

The impact forces influencing the market are high, notably the pressure from regulatory bodies like CITES (Convention on International Trade in Endangered Species of Wild Fauna and Flora) and shifting consumer ethics, which demand greater transparency. The substitution threat is substantial, driven by highly realistic faux fur and sequin alternatives, challenging the unique appeal of feathers. However, the bargaining power of buyers remains moderate to high, as feather products are discretionary luxury items, meaning consumers can easily defer purchases if pricing or ethical concerns arise. The collective influence of these forces compels market participants to adopt radical transparency and rapid technological adaptation to ensure long-term viability and growth.

- Drivers:

- Cyclical trends favoring flamboyant and textured fashion.

- Increasing disposable income globally, driving demand for luxury embellishments.

- Strong influence of celebrity culture and high-profile fashion events.

- Technological improvements in high-quality synthetic feather production.

- Restraints:

- Stringent environmental and animal welfare regulations (e.g., CITES).

- Volatile supply chain and high costs associated with certified ethical sourcing.

- Negative public perception and potential for consumer backlash against non-ethical products.

- Availability of realistic and lower-cost substitution materials (faux fibers).

- Opportunities:

- Development and commercialization of advanced, sustainable, and biodegradable synthetic feathers.

- Expansion into niche luxury segments such as bespoke interior design and artisanal crafts.

- Utilizing blockchain for 100% supply chain transparency and provenance verification.

- Targeting new consumer bases in rapidly urbanizing Asian and Middle Eastern markets.

- Impact Forces:

- High regulatory scrutiny and compliance costs.

- Moderate to high threat of substitution from other luxury materials.

- Strong pressure from NGOs and consumer advocacy groups demanding ethical standards.

Segmentation Analysis

The Feather Fashion Products Market is analyzed across critical segmentation axes: Product Type, Material, Distribution Channel, and End-User. This segmentation allows for precise targeting and strategic market penetration, recognizing that consumer behavior and regulatory pressures vary significantly between the high-volume accessory market and the bespoke apparel sector. The dominance of the accessories segment reflects its lower price point entry and versatility in integrating feathers into daily and semi-formal wear, appealing to a broader consumer demographic than full feathered apparel, which remains primarily confined to haute couture and special occasions.

In terms of materials, the clear distinction between Natural and Synthetic/Engineered feathers is critical. While natural materials command higher prices due to their intrinsic luxury and rarity (when ethically sourced), the Synthetic segment is rapidly gaining ground. This rapid shift is driven by sustainability mandates from major retailers, technological breakthroughs that enhance the look and feel of synthetic materials, and the need to future-proof supply chains against sourcing restrictions and ethical concerns. The growth trajectory of the synthetic segment indicates its eventual market dominance as production scales and quality fidelity improves.

Distribution is shifting aggressively towards online platforms, which benefit specialized, often boutique, feather fashion houses. Direct-to-consumer (D2C) online models allow for personalized customer service and customization features essential in the luxury space, reducing reliance on traditional, high-overhead physical retail spaces. Understanding these segmented dynamics is essential for stakeholders looking to optimize inventory, streamline ethical compliance, and tailor marketing messaging to specific consumer niches, such as ethically-conscious luxury buyers versus fast-fashion consumers seeking trend-driven, affordable embellishments.

- By Product Type:

- Apparel (Gowns, Jackets, Skirts)

- Accessories (Hats/Millinery, Jewelry, Handbags, Footwear)

- Home Decor and Furnishings (Specialized Trimmings, Lampshades)

- By Material:

- Natural Feathers (Ostrich, Marabou, Pheasant, sustainably sourced exotic)

- Synthetic/Engineered Feathers (Polymer-based, Bio-engineered fibers)

- By Distribution Channel:

- Online Retail (E-commerce Platforms, D2C Websites)

- Offline Retail (Specialty Stores, Department Stores, Luxury Boutiques)

- By End-User:

- Women

- Men (Limited application, primarily accessories and bespoke formal wear)

- Children (Costumes and novelty items)

Value Chain Analysis For Feather Fashion Products Market

The value chain for Feather Fashion Products is complex and highly specialized, beginning with upstream activities focused heavily on sourcing and preparation. For natural feathers, this involves ethical farming, collection, sanitation, and specialized dyeing and cutting processes, often requiring highly skilled labor (plumassiers). For synthetic materials, upstream involves petrochemical or bio-fiber manufacturing and sophisticated 3D modeling/printing of feather structures. Maintaining ethical compliance and quality control at this initial stage is paramount, as defects or ethical breaches here severely impact the final product's marketability and brand reputation, especially in the luxury sector.

Midstream activities involve the design, manufacturing, and assembly of the fashion product. This stage requires integrating the treated feathers with base textiles or accessory components, demanding precision craftsmanship. The distribution channel, representing the downstream analysis, involves both direct and indirect methods. Direct channels include brand flagship stores and proprietary e-commerce platforms, offering greater control over pricing and customer experience, crucial for luxury branding. Indirect channels, such as multi-brand department stores, specialized luxury wholesalers, and online marketplaces, provide broader market access but involve margin sharing and less control over the final presentation.

Effective value chain management is increasingly focused on traceability and circularity. Investments in systems that track feather provenance (using technologies like RFID or blockchain) from source to consumer are vital to substantiate ethical claims. The choice of distribution channel heavily influences the final pricing strategy and market positioning; direct sales typically support higher margins and build brand loyalty, while strong partnerships with reputable global luxury retailers validate the product's premium status. Optimizing this chain minimizes environmental impact, reduces material sourcing risks, and assures the consumer of the product's authenticity and ethical compliance.

Feather Fashion Products Market Potential Customers

The primary end-users and potential buyers of Feather Fashion Products are highly segmented, generally falling into the luxury consumer bracket seeking statement pieces for high-profile events. This segment includes affluent women (30-65) who regularly attend galas, red carpet events, and high-society functions, demanding bespoke gowns and millinery. These customers value exclusivity, brand heritage, and impeccable craftsmanship, often willing to pay significant premiums for ethically sourced or rare pieces. They are highly responsive to designer collaborations and limited-edition collections that offer unique aesthetic differentiation.

A second major customer group is the aspirational fashion consumer (20-40) who engages with fast-moving trends popularized on social media. This group primarily targets the accessories segment—feathered bags, shoes, or smaller trimmings—which offer a high fashion look at a relatively lower price point. They are generally less concerned with raw material provenance than the traditional luxury buyer, but they highly prioritize aesthetics, durability, and brand visibility. This demographic drives demand for high-quality, cost-effective synthetic feather products utilized in mainstream fashion lines.

Furthermore, niche markets such as theatrical production companies, specialized costume designers, and interior designers represent significant B2B customers. These buyers require bulk quantities, specific color matching, and guaranteed material consistency, often utilizing synthetic options for performance durability and safety compliance. Growth in the global wedding and formal events industry also positions attendees and bridal parties as consistent, high-volume seasonal buyers, particularly in regions like APAC and the Middle East where opulent formal wear is highly valued, creating sustained demand across various price points.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.35 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Plumage Atelier, Exotic Feather Works, SynthPlume Innovations, Avian Luxury Textiles, Feathered Grace, Milliner Collective, Sustainable Plumasserie, BioLux Materials, Global Trimmings Corp, The Decorative Nest, Phoenix Feather Designs, EcoPlume Solutions, Vogue Feathers, Aethelred Millinery, Custom Feather Craft, Elite Feather Source, Regal Trim Systems, Faux Feather Dynamics, Prima Accessories, Artful Plumage Studio |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Feather Fashion Products Market Key Technology Landscape

Technological innovation within the Feather Fashion Products market is crucial for addressing the dual pressures of ethical sourcing and aesthetic demands. One of the most significant advancements is the utilization of advanced bio-engineering and polymer science to create synthetic feathers that match the look, feel, and dynamic movement of natural plumes. High-resolution 3D printing and nanotechnology are being deployed to control the micro-structure of synthetic materials, enabling precise replication of barbule spacing and shaft thickness, which is vital for achieving the desired light reflection and drape. This allows manufacturers to offer cruelty-free alternatives that meet the high aesthetic standards of luxury fashion houses, thereby expanding the material supply base significantly.

Furthermore, digital technologies play an indispensable role in streamlining the design and supply chain processes. Computer-Aided Design (CAD) and digital prototyping reduce the need for physical samples and accelerate the customization process for bespoke orders, which is highly valued in the luxury segment. Crucially, the deployment of blockchain technology and secure digital ledger systems is transforming traceability. These systems provide immutable records of the provenance of natural feathers, verifying ethical certifications, date of collection, and species, thereby offering critical transparency to retailers and end consumers who prioritize sustainability and ethical compliance. This is a non-negotiable technological requirement for companies dealing with certified natural sources.

In manufacturing and processing, innovations focus on sustainable dyeing and treatment processes. Traditional feather preparation often involves harsh chemicals; however, contemporary technology focuses on utilizing eco-friendly, low-impact dyeing techniques, often leveraging plasma treatment or supercritical fluid dyeing to achieve vibrant colors without heavy metal contamination. These technologies not only reduce the environmental footprint but also enhance the longevity and colorfastness of both natural and synthetic products, adding a quality dimension crucial for maintaining the premium status of feather fashion items in the competitive global market.

Regional Highlights

- North America: This region holds a significant market share, characterized by high consumer expenditure on luxury fashion and strong cultural ties to high-profile events (e.g., Met Gala, film premieres) that drive demand for statement wear. The U.S. market is highly receptive to celebrity-influenced trends and is simultaneously the fastest adopter of ethically certified and sustainable luxury goods. Regulatory scrutiny, particularly at state levels regarding wildlife protection, forces manufacturers and importers to prioritize synthetic alternatives or fully traceable sources.

- Europe: Europe, particularly France and Italy, serves as the historical heart of haute couture and artisanal feather craftsmanship (plumasserie). The market here is defined by tradition, high quality standards, and intense regulatory oversight (e.g., EU wildlife trade regulations). While growth is steady, it is primarily driven by the export of ultra-luxury, bespoke items and a strong local market for millinery. Sustainability and traceability are regulatory mandates, not just consumer preferences.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region. Rapid urbanization, increasing middle-class affluence, and the cultural significance of opulent attire in large-scale social events (weddings, festivals) fuel exponential demand. China and India are major drivers. While the region is receptive to natural feathers, a growing awareness of Western sustainability standards is pushing brands toward high-end, locally produced synthetic alternatives and certified imports to meet evolving consumer expectations.

- Latin America (LATAM): The LATAM market, while smaller, exhibits high demand for vibrant, decorated fashion products, often utilizing domestically sourced feathers, particularly in carnival and cultural wear segments. The market is sensitive to economic volatility, but niche luxury players find success targeting high-net-worth individuals in Brazil and Mexico. Compliance with CITES is a major trade barrier for international suppliers operating in this region.

- Middle East and Africa (MEA): Demand is exceptionally high in the GCC countries for luxury, exclusive, and customized garments used in large social gatherings and high-status events. Customers prioritize exclusivity and dramatic visual impact, resulting in high average spending per transaction. The market relies heavily on imports of both high-end natural (often Ostrich) and sophisticated synthetic materials from European and Asian manufacturers. Ethical sourcing is increasingly becoming a point of differentiation among top luxury brands here.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Feather Fashion Products Market.- Plumage Atelier

- Exotic Feather Works

- SynthPlume Innovations

- Avian Luxury Textiles

- Feathered Grace

- Milliner Collective

- Sustainable Plumasserie

- BioLux Materials

- Global Trimmings Corp

- The Decorative Nest

- Phoenix Feather Designs

- EcoPlume Solutions

- Vogue Feathers

- Aethelred Millinery

- Custom Feather Craft

- Elite Feather Source

- Regal Trim Systems

- Faux Feather Dynamics

- Prima Accessories

- Artful Plumage Studio

Frequently Asked Questions

Analyze common user questions about the Feather Fashion Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards synthetic feathers in the fashion industry?

The primary driver is stringent global animal welfare legislation and increased consumer demand for ethically sourced, cruelty-free materials. Technological advancements allowing synthetic fibers to replicate the aesthetic and texture of natural feathers without ethical baggage also significantly accelerate this transition, offering supply chain stability.

How does the Feather Fashion Products Market ensure ethical sourcing and transparency?

Market leaders utilize advanced traceability systems, including blockchain technology and rigorous third-party certifications (e.g., CITES permits), to document the provenance of natural feathers from certified farms. This digital trail ensures compliance and provides consumers with verifiable evidence of ethical standards.

Which product segment holds the largest market share in Feather Fashion Products?

The Accessories segment, particularly millinery (hats and fascinators), feathered jewelry, and handbags, maintains the largest market share. This is attributed to the versatility of accessories, their broader appeal to consumers, and generally lower price points compared to full apparel items, driving higher sales volume.

What role does Artificial Intelligence play in feather fashion product development?

AI is crucial for optimizing trend forecasting, allowing manufacturers to predict popular styles and colors seasons in advance to reduce inventory waste. Furthermore, Generative AI models assist in designing complex, high-fidelity synthetic feather structures, accelerating sustainable material innovation.

What regulatory challenges significantly impact the Feather Fashion Products Market?

The market is highly impacted by international trade regulations, particularly the CITES treaty, which controls the import and export of specific bird species' feathers. Non-compliance leads to severe penalties, necessitating robust legal and ethical auditing systems for all materials entering the supply chain.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager