Feed Carbohydrate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434113 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Feed Carbohydrate Market Size

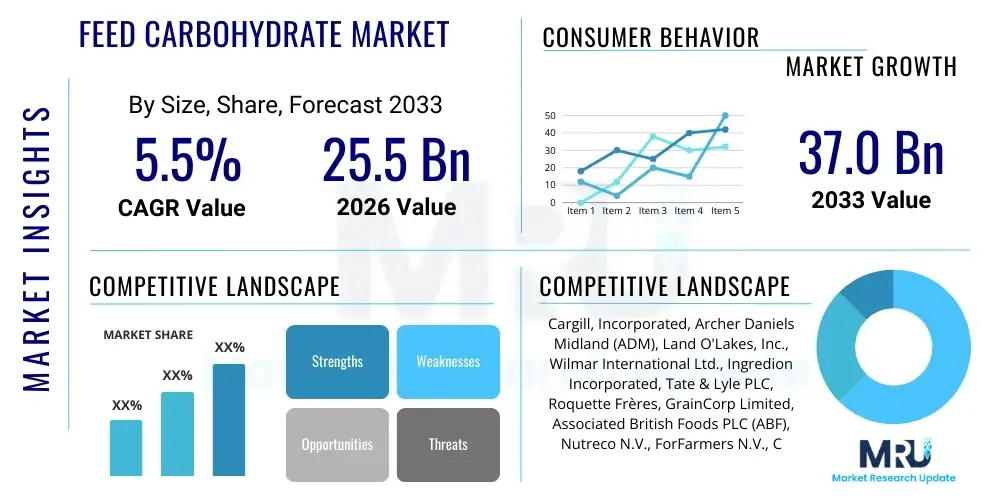

The Feed Carbohydrate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 37.0 Billion by the end of the forecast period in 2033.

Feed Carbohydrate Market introduction

The Feed Carbohydrate Market encompasses the commercial sector dedicated to the production and distribution of energy-providing nutrient sources crucial for livestock, poultry, and aquaculture diets. Carbohydrates, primarily sourced from agricultural staples like corn, wheat, barley, and specialized products such as starch, cellulose, and various sugars (e.g., lactose, molasses), constitute the most substantial component of animal feed formulations, often providing over 70% of the metabolized energy required for growth, reproduction, and maintenance. This market is intrinsically linked to global population dynamics, evolving dietary preferences favoring animal protein, and technological advancements in feed efficiency and precision nutrition. Key market stakeholders include agricultural commodity processors, specialized feed additive manufacturers, and large-scale integrated livestock operations prioritizing cost-effective and high-quality energy delivery.

Product complexity within the feed carbohydrate segment is increasing, moving beyond raw commodities to include processed and functional carbohydrates. Functional carbohydrates, such as oligosaccharides (e.g., fructans, mannan-oligosaccharides), are gaining prominence due to their demonstrable benefits in modulating gut microbiota, enhancing immune response, and improving nutrient absorption, which is critical in the context of global efforts to reduce antibiotic usage in animal husbandry. Major applications span the entire livestock industry, with poultry and swine being the largest consumption segments globally, driven by intensive farming practices. Aquaculture is emerging as a high-growth sector due to the unique nutritional requirements of aquatic species and the expansion of sustainable fish farming.

The core benefits derived from optimized feed carbohydrate usage include substantial improvements in feed conversion ratio (FCR), reduced production costs per unit of meat or dairy, and enhanced overall animal health and welfare. Key driving factors accelerating market expansion include the surging global demand for meat and dairy products, particularly in emerging economies like China, India, and Southeast Asia. Furthermore, regulatory shifts favoring non-medicated feeds and a sustained emphasis on precision feeding methodologies—which require detailed analysis and customized blending of energy sources—are fundamentally reshaping demand patterns and innovation investment across the value chain. Global trade patterns of primary agricultural inputs and increasing volatility in commodity markets also dictate pricing and sourcing strategies within this essential sector.

Feed Carbohydrate Market Executive Summary

The Feed Carbohydrate Market is experiencing robust growth fueled by irreversible global demographic trends and a significant focus on sustainable and efficient protein production. Business trends highlight a strong movement toward vertical integration among major feed producers and agricultural conglomerates, aimed at mitigating commodity price risks and securing stable supply chains. Investment is heavily directed towards R&D concerning novel carbohydrate sources, particularly those derived from agro-industrial byproducts (circular economy focus) and macroalgae, addressing both cost efficiency and environmental sustainability concerns. The trend toward customized feed formulations utilizing advanced analytical tools and smart farming technologies is driving demand for specific, highly bioavailable carbohydrate ingredients rather than simple bulk commodities. Furthermore, geopolitical instability impacting grain trade flows necessitates increased sourcing flexibility and regional processing capacities.

Regional trends indicate that the Asia Pacific (APAC) region remains the dominant and fastest-growing market, primarily due to its vast population base, rapidly increasing disposable incomes leading to higher per capita meat consumption, and the expansion of commercialized livestock farming. North America and Europe maintain leading positions in terms of technological adoption, focusing on high-value functional carbohydrates and adherence to stringent environmental and animal welfare regulations, which favor premium, precision-engineered feed ingredients. Latin America, particularly Brazil and Argentina, plays a critical role as a major exporter of carbohydrate raw materials (soy and corn), influencing global supply dynamics. These regional disparities dictate varied investment strategies, with emerging markets focusing on capacity expansion and developed markets emphasizing innovation in nutrient delivery systems.

Segment trends underscore the continued dominance of starch and starch derivatives in terms of volume, primarily serving the poultry and swine sectors. However, the high-growth segments are centered around functional carbohydrates, including non-starch polysaccharides (NSPs), which address specific gut health challenges, and specialized fermentation products. The aquaculture segment, while smaller in volume compared to terrestrial livestock, exhibits the highest value growth rate due to the specialized energy needs of aquatic species and the transition from reliance on marine-based feed to terrestrial alternatives. Within livestock, the growing focus on ruminant nutrition, optimizing rumen health through specific carbohydrate management to improve methane efficiency, is creating a specialized niche for high-fiber, low-digestible formulations that enhance enteric fermentation processes effectively.

AI Impact Analysis on Feed Carbohydrate Market

User queries regarding the impact of Artificial Intelligence (AI) on the Feed Carbohydrate Market primarily center on optimizing feed formulation for cost reduction and maximizing nutrient utilization. Users are concerned about how AI can stabilize input costs given high commodity price volatility, questioning its efficacy in predictive modeling for grain sourcing and supply chain resilience. A significant theme is the transition from static, NRC-based formulation to dynamic, precision nutrition models enabled by machine learning, which can adjust carbohydrate levels based on real-time factors like animal health metrics, environmental temperature, and specific genetic potential. Furthermore, users seek clarification on how AI tools can enhance the assessment of ingredient quality, particularly detecting variability in starch digestibility and mycotoxin contamination in carbohydrate raw materials, ensuring safer and more consistent feed outputs.

The core expectations revolve around AI’s ability to drive unprecedented efficiency in the complex process of feed ingredient blending. AI algorithms are increasingly being deployed to analyze vast datasets concerning global commodity prices, logistics costs, and nutritional composition variances, resulting in optimized least-cost formulation decisions that adapt minute-by-minute to market fluctuations. This capability transforms the traditional approach to ingredient purchasing, allowing companies to substitute high-cost ingredients with nutritionally equivalent, lower-cost carbohydrate sources without compromising animal performance. Predictive maintenance in feed production facilities and the optimization of energy consumption during carbohydrate processing (e.g., drying, milling) are also being significantly enhanced by AI-driven predictive modeling.

Ultimately, the impact of AI extends beyond simple formulation. It enables a holistic approach to animal production where carbohydrate management is integrated with farm-level data collected via IoT devices, such as animal activity monitors and environmental sensors. This data allows for hyper-customized feeding strategies (precision feeding) where the energy density provided by carbohydrates is precisely matched to the animal’s current physiological state, minimizing waste and maximizing growth potential. The long-term adoption of AI ensures higher standards of traceability and quality assurance across the carbohydrate supply chain, establishing a more transparent and resilient market structure that benefits both producers and consumers through safer and more sustainably produced animal protein.

- AI optimizes least-cost formulation by dynamically adjusting carbohydrate sources based on real-time price volatility and nutritional analysis.

- Machine learning improves predictive modeling for commodity sourcing, enhancing supply chain resilience against geopolitical and climatic shocks.

- Advanced analytics enhance quality control by rapidly identifying variability in starch and fiber content and potential contaminants in raw materials.

- AI-driven precision feeding systems tailor carbohydrate delivery to individual animal needs, maximizing Feed Conversion Ratio (FCR).

- Automation and predictive maintenance in feed processing leverage AI to improve energy efficiency during ingredient manufacturing.

DRO & Impact Forces Of Feed Carbohydrate Market

The dynamic interplay of Drivers, Restraints, and Opportunities fundamentally shapes the trajectory of the Feed Carbohydrate Market, creating a complex risk-reward environment for stakeholders. Key drivers include the relentless expansion of the global human population and the associated rise in demand for high-quality protein sources (meat, dairy, eggs), which directly translates into increased requirements for high-energy animal feed. Furthermore, the regulatory environment in developed regions is increasingly mandating the phase-out of traditional antibiotic growth promoters (AGPs), thereby accelerating the adoption of functional carbohydrates, such as prebiotics and specialty fibers, which support gut health and immune function naturally. This shift towards health-centric nutrition provides a stable growth catalyst.

However, the market faces significant restraints, most notably the high volatility and unpredictable pricing of major carbohydrate raw materials (e.g., corn, soybean meal, wheat) driven by climatic events, geopolitical conflicts, and global trade policies. This commodity risk translates directly into unpredictable operational costs for feed manufacturers, potentially squeezing profit margins. Additionally, the increasing societal pressure and regulatory focus on sustainable land use and competition between food, feed, and fuel (bioethanol production utilizing corn and sugarcane) present a structural restraint, limiting the potential supply expansion of traditional carbohydrate inputs. Consumer perception regarding genetically modified (GM) crops also imposes market access restrictions in certain geographies, complicating sourcing strategies for globally operating companies.

Opportunities for growth are concentrated in technological innovation and market expansion into underserved areas. Significant potential lies in developing and commercializing alternative carbohydrate sources derived from industrial waste streams (lignocellulosic biomass), food processing byproducts (brewer's spent grain, fruit pomace), or novel crops like high-yield cassava and algae. These innovations address both sustainability concerns and the pressure on traditional agricultural land. Moreover, the increasing adoption of aquaculture globally provides a high-growth niche, as aquatic feeds require specific, highly digestible carbohydrate profiles compared to terrestrial livestock. The market is also ripe for digitalization, leveraging big data and AI for hyper-efficient formulation, paving the way for differentiated, value-added products that command higher margins.

Segmentation Analysis

The Feed Carbohydrate Market is highly diverse, segmented primarily based on source, product type, form, livestock type, and geography. Understanding these segments is crucial for strategic market positioning and resource allocation, as different segments exhibit varying growth rates, price sensitivities, and regulatory requirements. The segmentation analysis highlights the fundamental differences in nutritional requirements across species and the technological barriers associated with processing various carbohydrate raw materials into digestible feed ingredients. The structure of this market reflects a strong hierarchy, with bulk commodity-derived sources dominating volume, while highly processed, functional derivatives drive value growth and innovation.

By product type, the market is broadly classified into Starch and Derivatives, Cellulose and Hemicellulose, Sugars (Molasses, Lactose), and Specialty Carbohydrates (e.g., Oligosaccharides). Starch remains the foundation, providing primary energy, whereas specialty carbohydrates are the fastest-growing segment due to their functional benefits related to animal health. Segmentation by form—Dry and Liquid—is determined by the application method and the final feed type (mash, pellet, or liquid feed). Dry forms (e.g., grains, meals) constitute the overwhelming majority, essential for pelleted feeds, while liquid forms, such as molasses, are widely used as binding agents, dust suppressants, and palatability enhancers, especially in ruminant feeds.

Livestock segmentation is arguably the most critical dimension, dictating specific formulation strategies. Poultry (broilers, layers) and Swine require highly digestible, non-fiber-intensive energy sources to maximize rapid growth rates, placing a premium on refined starch and simple sugars. Ruminants (cattle, sheep) rely heavily on complex carbohydrates and fiber for rumen fermentation, requiring balancing to optimize volatile fatty acid production. Aquaculture necessitates highly bioavailable carbohydrates that minimize post-prandial glucose peaks, driving demand for specialized processed starches and functional oligosaccharides. This detailed segmentation allows manufacturers to target specific nutritional challenges and formulate products that offer superior performance within defined biological parameters.

- By Type:

- Starch and Derivatives (Corn Starch, Wheat Starch, Potato Starch)

- Cellulose and Hemicellulose (Fiber sources, Non-Starch Polysaccharides)

- Sugars (Molasses, Lactose, Dextrose)

- Specialty Carbohydrates (Prebiotics, Oligosaccharides - MOS, FOS)

- By Source:

- Cereals (Corn, Wheat, Barley, Oats)

- Root Crops (Tapioca/Cassava, Potatoes)

- Byproducts (Bran, Brewers Grains, Beet Pulp)

- By Livestock:

- Poultry (Broilers, Layers, Turkeys)

- Swine (Sows, Piglets, Growers)

- Ruminants (Dairy Cattle, Beef Cattle)

- Aquaculture (Fish, Shrimp)

- Others (Pets, Equine)

- By Form:

- Dry

- Liquid

Value Chain Analysis For Feed Carbohydrate Market

The value chain of the Feed Carbohydrate Market initiates with upstream activities centered on agricultural commodity sourcing and processing. This stage involves the cultivation and harvesting of major crops such as corn, wheat, and soybeans, followed by primary industrial processing (milling, fractionation, and refining) to extract purified starches, fibers, and sugars. Upstream efficiency is crucial, as the cost and quality variability of raw agricultural inputs directly determine the final product cost and nutritional stability. Major players in this segment are large agribusinesses and global commodity traders who manage logistical complexities, international trade flows, and inventory risk associated with volatile soft commodity markets. Sustainable sourcing practices, including adherence to deforestation-free supply chains, are increasingly becoming a competitive differentiator at this foundational stage.

Midstream activities involve the specialized manufacturing and formulation of feed ingredients. This encompasses the enzymatic treatment of starches, fermentation processes to produce specialized sugars and oligosaccharides (functional carbohydrates), and the blending of various ingredients into final feed formulations. Feed mills act as the central distribution hub, purchasing bulk carbohydrates and combining them with proteins, fats, vitamins, and minerals. Distribution channels are varied: direct sales are common for large integrated livestock operations, allowing for customized delivery schedules and specifications. Indirect distribution involves wholesalers, distributors, and local feed retailers, particularly serving smaller farms and independent producers. The choice of channel depends heavily on regional market density, infrastructure quality, and the required level of technical support for complex formulations.

Downstream analysis focuses on the end-user—the commercial livestock farms and aquaculture operations—where the product is consumed. The performance of feed carbohydrates is measured by animal health outcomes, Feed Conversion Ratio (FCR), and overall profitability. The indirect impact includes technical advisory services provided by feed manufacturers, helping farmers optimize feeding regimes based on environmental and physiological factors. Market feedback regarding product efficacy, palatability, and stability drives innovation back upstream. The direct relationship is characterized by high volume, recurrent purchases, while the indirect relationship relies on effective marketing and robust third-party technical support to ensure proper utilization of specialized carbohydrate products. Traceability systems linking the final feed back to its agricultural origin are increasingly demanded by consumers and regulators.

Feed Carbohydrate Market Potential Customers

The primary consumers and end-users of feed carbohydrates are entities engaged in large-scale commercial animal protein production, where nutritional efficiency directly impacts economic viability. Large integrated feed manufacturers, often multinational conglomerates that own both feed mills and livestock production units, constitute the most significant buyer segment, demanding vast volumes of both bulk commodities (corn, wheat) and specialized ingredients (functional starches, oligosaccharides). These integrated operations require consistent quality and robust supply agreements to sustain their continuous production cycles and maintain precise nutritional targets across their global farming network. Their purchasing decisions are driven equally by cost optimization and technical performance.

Independent, commercial feed mills represent the second major customer base. These mills serve diverse regional markets, supplying feed to independent livestock and poultry farmers. Their purchasing behavior is highly sensitive to input price fluctuations and regional availability, leading them to frequently adjust formulations using least-cost optimization software. They require a diverse portfolio of carbohydrate ingredients—from high-energy starches to binding agents—to cater to various livestock species and feed types (pelleted, crumbled, mash). Technical support and reliable logistics are key factors influencing their supplier selection.

Beyond the core terrestrial livestock sector, the rapidly expanding aquaculture industry is a high-value potential customer segment. Aquaculture farms require highly digestible and specialized carbohydrate sources that minimize nutrient leaching in water and maximize energy uptake in fish and shrimp. Furthermore, specialized nutrition companies focusing on pet food, equine, and niche markets (such as insect farming feed) also represent growing segments, demanding highly refined, easily digestible, and often non-GMO or organic carbohydrate sources. These niche segments prioritize ingredient purity and functional benefits over sheer bulk volume, offering higher margin opportunities for innovative carbohydrate producers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 37.0 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cargill, Incorporated, Archer Daniels Midland (ADM), Land O'Lakes, Inc., Wilmar International Ltd., Ingredion Incorporated, Tate & Lyle PLC, Roquette Frères, GrainCorp Limited, Associated British Foods PLC (ABF), Nutreco N.V., ForFarmers N.V., CHS Inc., Bunge Limited, Green Plains Inc., CJ CheilJedang, Kemin Industries, Novozymes A/S, DuPont de Nemours, Inc., ADM Animal Nutrition, Lallemand Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Feed Carbohydrate Market Key Technology Landscape

The technological landscape in the Feed Carbohydrate Market is dominated by advancements aimed at increasing nutrient bioavailability, minimizing anti-nutritional factors, and optimizing the use of sustainable or low-cost raw materials. A core area of innovation is enzymatic hydrolysis and fermentation technology. Enzymes such as amylases, cellulases, and xylanases are crucial for breaking down complex non-starch polysaccharides (NSPs) found in inexpensive feedstuffs (like wheat bran or corn distiller's grains) into simpler, digestible sugars, thereby enhancing energy utilization in monogastric animals (swine and poultry). Fermentation technology is concurrently employed to produce highly purified functional carbohydrates, such as specific mannan-oligosaccharides (MOS) and fructooligosaccharides (FOS), which function as potent prebiotics to support gut integrity and immune response, serving as alternatives to medicinal feed additives.

Another significant technological trend involves precision processing techniques like micronization and extrusion, particularly for root crops (cassava/tapioca) and high-fiber grains. Extrusion, which applies high heat and pressure, gelatinizes starch, making it highly available for digestion, critical for aquaculture and young animal feeds that require maximum energy uptake with minimal intestinal distress. Micronization processes ensure uniformity in particle size, improving mixing efficiency and reducing segregation risk within the final feed blend. These physical treatments are vital for unlocking the full nutritional potential of carbohydrate sources that would otherwise be poorly utilized or contain harmful anti-nutritional factors if fed raw or minimally processed.

Furthermore, digital technologies and advanced analytical instruments are transforming quality assurance and supply chain management. Near-Infrared Reflectance (NIR) spectroscopy is now standard practice, offering rapid, non-destructive analysis of carbohydrate composition, moisture content, and digestibility parameters in incoming raw materials and outgoing feed products. Coupled with AI and IoT sensors on farms, these analytical tools facilitate the implementation of dynamic feeding programs. Future advancements are focusing on genetically engineering feed crops for higher starch digestibility and lower anti-nutritional factors, alongside the scaling up of novel carbohydrate production from sustainable sources like microalgae and bacteria-based biomass, utilizing closed-loop bioreactors for environmental control and yield consistency.

Regional Highlights

- Asia Pacific (APAC): APAC commands the largest share of the global market and is projected to exhibit the highest growth rate, driven primarily by China and Southeast Asian nations. This dominance stems from the massive, expanding consumer base demanding pork, poultry, and aquaculture products. The region is characterized by large-scale, often vertically integrated livestock industries and a simultaneous reliance on both locally sourced and internationally imported feed grains. The focus here is on securing high-volume, cost-effective carbohydrate supply, coupled with rapid adoption of functional ingredients to manage diseases in dense farming systems.

- North America: North America is a mature market defined by high technological sophistication and stringent regulatory standards. It is a major exporter of key carbohydrate sources (corn, soy). The market emphasizes precision nutrition, sustainability metrics, and the utilization of high-value functional carbohydrates to optimize animal welfare and production efficiency. Innovation is concentrated on AI-driven formulation software and advanced processing of agricultural byproducts (e.g., corn fermentation products) into specialized feed ingredients.

- Europe: Europe is characterized by strict environmental and welfare regulations, including a comprehensive ban on AGPs, which makes it a crucial market for specialty and functional carbohydrates (prebiotics, fermentable fibers). Growth is modest but highly focused on innovation, traceability, and ethical sourcing. The region heavily relies on imported ingredients but leads in the development of sustainable, locally sourced alternatives and circular economy solutions utilizing food and agricultural waste streams for feed.

- Latin America: This region, particularly Brazil and Argentina, is a powerhouse for primary carbohydrate production and export (corn, sugarcane, soy). The market acts as a key global supplier, benefiting from vast arable land and favorable climate conditions. Internal market growth is strong, driven by expanding beef and poultry industries. Investment focuses on large-scale logistics and processing infrastructure to efficiently handle commodity volumes for both domestic consumption and international trade.

- Middle East and Africa (MEA): MEA is a net importer of carbohydrate raw materials, facing challenges related to water scarcity and limited arable land. Market growth is primarily concentrated in the Gulf Cooperation Council (GCC) countries, driven by government initiatives to enhance food security and develop modern livestock and aquaculture sectors. Demand centers on shelf-stable, high-quality formulated feeds, often requiring imported ingredients to meet nutritional demands.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Feed Carbohydrate Market.- Cargill, Incorporated

- Archer Daniels Midland (ADM)

- Land O'Lakes, Inc.

- Wilmar International Ltd.

- Ingredion Incorporated

- Tate & Lyle PLC

- Roquette Frères

- GrainCorp Limited

- Associated British Foods PLC (ABF)

- Nutreco N.V.

- ForFarmers N.V.

- CHS Inc.

- Bunge Limited

- Green Plains Inc.

- CJ CheilJedang

- Kemin Industries

- Novozymes A/S

- DuPont de Nemours, Inc.

- ADM Animal Nutrition

- Lallemand Inc.

Frequently Asked Questions

Analyze common user questions about the Feed Carbohydrate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Feed Carbohydrate Market?

The market is primarily driven by accelerating global demand for animal protein, population growth, and the shift towards advanced precision feeding methods that optimize ingredient utilization and reduce production costs. Regulatory emphasis on gut health post-AGP bans also fuels demand for functional carbohydrates.

How does commodity price volatility affect the feed carbohydrate sector?

High volatility in commodity prices (corn, wheat) represents a significant restraint, forcing feed manufacturers to constantly adjust least-cost formulations. This volatility increases operational risk and necessitates robust supply chain management and hedging strategies to stabilize input costs.

Which type of carbohydrate ingredient is projected to show the highest growth?

Specialty or functional carbohydrates, particularly prebiotics like mannan-oligosaccharides (MOS) and fructooligosaccharides (FOS), are projected to show the highest value growth due to their role in enhancing animal immunity and gut health, directly supporting sustainable livestock production models.

How is technological innovation changing the sourcing of feed carbohydrates?

Innovation is focused on utilizing agro-industrial byproducts and developing sustainable alternatives like microalgae and insect-based derivatives. Technologies such as enzymatic hydrolysis and advanced processing methods (extrusion) are being used to unlock the nutritional value of lower-cost and sustainable raw materials.

Why is the Asia Pacific region the dominant market for feed carbohydrates?

APAC's dominance is attributed to its massive population base, rapid urbanization, and increasing per capita income, which collectively drive exponential growth in commercial livestock and aquaculture production, translating into the largest volume demand for feed energy sources globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager