Feed Grade Valine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433847 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Feed Grade Valine Market Size

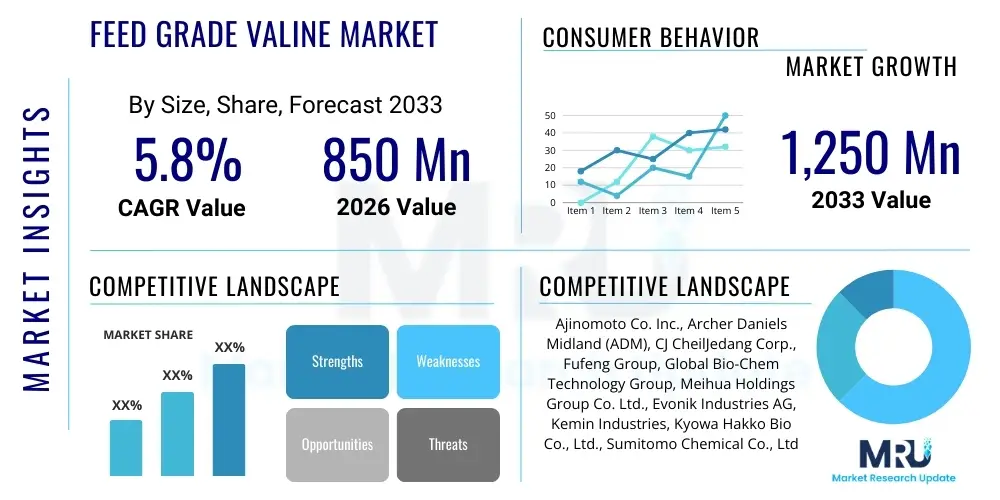

The Feed Grade Valine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,250 Million by the end of the forecast period in 2033.

Feed Grade Valine Market introduction

The Feed Grade Valine Market encompasses the production, distribution, and consumption of L-Valine utilized primarily as a functional additive in animal feed formulations. Valine is classified as an essential branched-chain amino acid (BCAA) crucial for livestock nutrition, specifically in swine, poultry, aquaculture, and ruminant diets. Its primary function is to optimize protein synthesis, improve nitrogen utilization efficiency, support muscle growth, and maintain robust immune function in animals. The commercial production of feed grade valine is predominantly achieved through microbial fermentation processes, ensuring high purity and bioavailability suitable for large-scale feed manufacturing operations globally. The increasing intensity of livestock farming and the continuous global push for enhanced feed efficiency drive the foundational demand for this essential nutrient.

Product description highlights Valine’s role in balancing amino acid profiles in low-protein diets. Modern feed producers are increasingly incorporating synthetic amino acids like valine to reduce reliance on expensive and variable protein sources such as soybean meal, thereby lowering overall feed costs while adhering to optimal nutritional specifications. This strategic shift is vital in areas where environmental regulations demand lower nitrogen excretion from livestock operations, positioning valine as an indispensable tool for sustainable animal production. Furthermore, maintaining proper ratios of branched-chain amino acids (leucine, isoleucine, and valine) is critical for preventing amino acid antagonism and ensuring maximum nutritional uptake and physiological performance in rapidly growing animals.

Major applications of feed grade valine are concentrated in the swine and poultry sectors, where intensive farming systems require precise dietary control for rapid weight gain and minimal feed conversion ratios. Valine supplementation ensures that genetic potential is fully realized, particularly during critical growth stages. Key benefits include improved average daily gain (ADG), enhanced feed efficiency (FCR), and strengthened immunity, leading to higher productivity and lower mortality rates in flocks and herds. The market is primarily driven by the expansion of global meat consumption, especially in developing economies, coupled with significant technological advancements in precision livestock nutrition and feed formulation software that identify and correct specific amino acid deficiencies efficiently.

Feed Grade Valine Market Executive Summary

The Feed Grade Valine market is experiencing robust growth fueled by technological advancements in microbial fermentation and the increasing need for sustainable animal protein production across Asia Pacific and Latin America. Key business trends include the consolidation of production capacity among major Asian manufacturers, leading to competitive pricing structures, and a growing focus on optimizing purity levels to meet stringent quality standards set by major international feed conglomerates. The shift towards reducing crude protein levels in diets to minimize environmental impact and reduce input costs reinforces the necessity of essential amino acid supplementation, establishing valine as a core component in modern, cost-effective formulations. Furthermore, strategic partnerships between amino acid producers and large integrated livestock operations are becoming prevalent, securing long-term supply agreements and driving market stability.

Regional trends indicate that Asia Pacific remains the largest consumption and production hub, primarily due to the massive scale of swine and poultry industries in China, India, and Southeast Asian nations. However, North America and Europe demonstrate mature market conditions characterized by high regulatory scrutiny regarding feed safety and sustainability, leading to premium pricing for traceable, high-quality valine sources. The European market, in particular, is driven by the 'Farm to Fork' strategy, which emphasizes nutrient efficiency and reduced antibiotic usage, indirectly boosting the demand for amino acids that support robust gut health and immune function. Emerging markets in Latin America, particularly Brazil and Argentina, are witnessing significant investment in modern livestock farming, translating into accelerated demand for all essential feed additives.

Segment trends highlight the dominance of the powder form (98.5% purity) due to its ease of incorporation into premixes and complete feeds, though the demand for granular and liquid forms is slowly rising for specialized applications. By livestock type, the poultry segment holds the largest market share, reflecting the rapid global expansion of broiler and layer production. However, the swine segment is exhibiting the fastest growth rate, propelled by the recovery of hog populations, especially in Asia, following disease outbreaks, and the adoption of high-efficiency diets to maximize sow productivity and piglet health. Furthermore, increasing research into the specific role of valine in aquaculture feeds is opening new, high-value avenues for market expansion, particularly concerning marine species requiring precise nutritional balances.

AI Impact Analysis on Feed Grade Valine Market

User queries regarding AI's impact on the Feed Grade Valine market frequently center on how machine learning algorithms optimize feed formulations, predict raw material price volatility, and enhance fermentation process control. Users are keen to understand if AI-driven precision nutrition will lead to more granular, variable demand for valine based on real-time animal performance data, potentially disrupting traditional bulk purchasing models. Concerns also revolve around the supply chain, asking whether predictive analytics can mitigate risks related to sudden supply shocks or changes in corn/sugar feedstock availability, which directly influence valine production costs. The common expectation is that AI will primarily drive efficiency, leading to less waste and highly customized nutritional strategies, thereby increasing the value proposition of high-purity feed amino acids.

The application of Artificial Intelligence and advanced data analytics is fundamentally transforming the consumption and manufacturing processes within the feed industry, directly influencing the valine market. AI-driven formulation software uses complex predictive models to precisely calculate the minimum effective dose of valine required for specific animal populations under varied environmental conditions, leading to optimized, variable inclusion rates rather than static standards. This precision minimizes over-supplementation, thereby improving cost-effectiveness for end-users. On the production side, AI and machine learning are being deployed in fermentation facilities to monitor, analyze, and adjust parameters such as temperature, pH, and microbial activity in real-time, significantly increasing fermentation yield, reducing batch variations, and lowering operational costs, consequently stabilizing the supply of feed grade valine.

- AI optimizes feed formulation models, ensuring precise valine inclusion based on genetic strain and environmental stressors, thereby maximizing feed conversion ratio (FCR).

- Predictive maintenance analytics deployed in fermentation plants reduce downtime, ensuring consistent, high-volume production of valine.

- Machine learning algorithms forecast raw material prices (e.g., molasses, glucose), enabling producers to hedge against cost volatility and maintain stable valine pricing.

- Advanced image analysis and IoT sensors monitor animal growth and health metrics in real-time, allowing for dynamic dietary adjustments that increase specific demand for essential amino acids like valine.

- AI-enhanced supply chain management improves logistics efficiency, reducing delivery lead times and minimizing inventory holding costs for both producers and large feed mill operators.

DRO & Impact Forces Of Feed Grade Valine Market

The Feed Grade Valine market is dynamically influenced by a synergistic combination of drivers, restraints, and opportunities that shape investment decisions and consumption trends globally. Primary drivers include the continuous expansion of the global livestock sector, particularly intensive poultry and swine farming, and the critical global imperative to enhance feed efficiency to meet escalating meat demand sustainably. This is coupled with the economic pressure on feed manufacturers to utilize least-cost formulation strategies, where substituting synthetic amino acids like valine for expensive intact proteins is vital. Conversely, the market faces restraints such as significant fluctuations in the prices of key raw materials (glucose, corn steep liquor) used in fermentation, and the highly concentrated manufacturing base in Asia, which exposes the global supply chain to geopolitical risks and trade barrier volatility.

Opportunities for market expansion are substantial, especially through the increasing application of valine in the aquaculture sector, where the nutritional requirements for rapid growth in high-value fish species are rigorously demanding. Furthermore, the development of new, more efficient fermentation strains and continuous process improvement methodologies offer producers a pathway to further reduce manufacturing costs and environmental footprint, creating a competitive advantage. The rising focus on animal welfare and reducing antibiotic usage across North America and Europe also presents a critical opportunity, as valine plays a vital role in supporting immune function and gut integrity, offering a nutritional solution to health challenges. Impact forces, such as changing government regulations concerning nitrogen excretion limits in agricultural runoff, mandate the use of precision nutrition, inherently boosting the demand for essential amino acids.

The interplay of these forces ensures sustained market progression. For example, while raw material price volatility acts as a restraint, the overriding driver of maximizing genetic potential in modern livestock strains necessitates the fixed inclusion of valine, mitigating significant demand reduction. Technological advancements, such as optimizing the L-valine isomer ratio through proprietary fermentation methods, serve as a significant opportunity, allowing manufacturers to differentiate their products in a commodity-driven market. The structural dependence of high-output livestock production on optimized nutrition means that market momentum, driven by global population growth and urbanization leading to higher protein consumption, is likely to absorb temporary economic shocks, maintaining a positive trajectory for market size and penetration.

Segmentation Analysis

The Feed Grade Valine market segmentation provides a granular view of consumption patterns, differentiating the market based on product form, livestock type, and geographical region. Understanding these segments is crucial for manufacturers to tailor production capacities and marketing strategies effectively. The market is primarily divided into forms—powder, liquid, and granular—with powder being the predominant choice due to its stability, ease of handling, and cost-effectiveness in large feed milling operations. Analyzing the livestock segments reveals the priority areas for high volume usage, namely swine and poultry, which collectively account for the majority of the market share, driven by rapid growth cycles and high-density production systems that require meticulously balanced diets for optimal performance.

Further segmentation by purity level often distinguishes between the standard 98.5% L-Valine grade and other specialty grades, although the former dominates the bulk feed market. Regional segmentation is vital, identifying high-growth areas like Asia Pacific, which dictates global supply dynamics, versus mature but premium markets like Europe. This comprehensive analysis allows stakeholders to accurately forecast demand shifts, anticipate regulatory impacts specific to regional farming practices, and capitalize on niche requirements, such as the growing demand for sustainable, non-GMO certified feed additives in specific European and North American sub-markets. The detailed breakdown of segments highlights the underlying nutritional science driving inclusion rates in different animal species based on their metabolic needs and protein accretion rates.

- By Form:

- Powder (Standard 98.5% Grade)

- Granular

- Liquid

- By Livestock Type:

- Poultry (Broilers, Layers, Turkeys)

- Swine (Sows, Weaners, Growers/Finishers)

- Aquaculture (Shrimp, Fish)

- Ruminants (Dairy Cattle, Beef Cattle)

- Other Animals (Pets, Horses)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Feed Grade Valine Market

The value chain for Feed Grade Valine begins with the upstream procurement of essential raw materials, predominantly carbohydrate sources such as glucose derived from corn, cassava, or molasses, along with nitrogen sources and minerals required for microbial fermentation. This upstream segment is highly sensitive to commodity market volatility, and operational efficiency relies heavily on robust supplier relationships and hedging strategies to secure consistent supply at competitive prices. The manufacturing stage, dominated by specialized producers employing advanced biotechnology and fermentation processes, converts these raw inputs into high-purity L-Valine. Key success factors at this stage include minimizing energy consumption, maximizing fermentation yield, and ensuring product consistency and purity through stringent quality control measures to comply with international feed safety standards.

Downstream analysis involves the distribution and final consumption of the product. The distribution channel is multifaceted, comprising direct sales to large integrated feed millers and livestock corporations, as well as sales through indirect channels via regional distributors, specialized feed additive traders, and nutritional consultants. The choice of channel is often dictated by the size of the end-user and geographical reach requirements. Large multinational feed manufacturers often prefer direct sourcing to ensure bulk purchasing efficiency and quality assurance. Smaller, regional mills rely on distributors for inventory management and technical support. The effectiveness of the downstream movement is crucial for maintaining the competitive edge, demanding efficient logistics, specialized storage (to prevent caking), and timely delivery to meet the demanding production schedules of the feed industry.

The end of the value chain focuses on the ultimate end-users—livestock farmers and integrators—who utilize the feed grade valine in optimized diets. The final value captured is realized through enhanced animal performance, characterized by improved feed conversion ratios and reduced mortality, leading to higher profitability. Direct engagement with end-users provides manufacturers with critical feedback on product performance and specific regional nutritional challenges, driving future product innovation. The interaction between technical sales teams and nutritionists is a critical component, translating scientific evidence into practical, cost-effective formulation advice. This integrated approach ensures that the high-quality product reaches the consumer efficiently and delivers its intended nutritional and economic benefits.

Feed Grade Valine Market Potential Customers

The primary customer base for feed grade valine consists of entities involved in the production of animal nutrition products and the industrial raising of livestock. The largest volume consumers are integrated feed millers and multinational animal nutrition companies (like Cargill, New Hope Group, and CP Group) that produce complete feeds, premixes, and supplements for various livestock sectors. These customers require high-purity, consistently available valine in large quantities and are highly sensitive to price fluctuations, often entering into long-term supply contracts to secure stable sourcing. Their purchasing decisions are driven by sophisticated nutritional modeling software which dictates precise amino acid inclusion levels to achieve targeted performance metrics.

Secondary but rapidly growing customer segments include large-scale, integrated livestock operations (swine and poultry integrators) that often bypass large commercial feed millers to produce their own customized feed mixes on-site. These operations value technical support, customized packaging, and just-in-time delivery services that minimize inventory risk and maximize the freshness of ingredients. Furthermore, specialized aquaculture farms, which rely on highly tailored and often expensive diets for high-density fish and shrimp farming, represent a high-value customer segment, prioritizing quality and specific isomer ratios required for marine species' unique metabolic pathways.

Finally, smaller, regional feed mills and specialty premix manufacturers constitute a fragmented but important customer segment, typically purchasing through distributors. These customers require smaller batch sizes and depend heavily on the marketing and technical expertise provided by the distributor to guide their product application and adherence to local regulatory standards. The expansion of these smaller players in emerging markets like Southeast Asia and Africa provides long-term growth potential, necessitating the continuous development of robust regional distribution networks to serve their specific logistical and volume requirements effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,250 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ajinomoto Co. Inc., Archer Daniels Midland (ADM), CJ CheilJedang Corp., Fufeng Group, Global Bio-Chem Technology Group, Meihua Holdings Group Co. Ltd., Evonik Industries AG, Kemin Industries, Kyowa Hakko Bio Co., Ltd., Sumitomo Chemical Co., Ltd., DSM Nutritional Products, Wuxi Jinghai Amino Acid Co., Ltd., Changzhou Qirui Amino Acid Co., Ltd., Hebei Donghua Chemical Group, Ningxia Eppen Biotech Co., Ltd., Pishon Pharma, Star Lake Bioscience, Adisseo, Novus International, Inc., TCI Chemicals (India) Pvt. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Feed Grade Valine Market Key Technology Landscape

The technological landscape of the Feed Grade Valine market is fundamentally defined by advancements in industrial biotechnology, specifically high-yield microbial fermentation processes. The transition from chemical synthesis methods, which often resulted in racemic mixtures, to highly specific L-Valine fermentation ensures the production of the biologically active isomer, maximizing nutritional efficacy in feed. Key technological focus areas include strain engineering, where genetic modification and mutagenesis are employed on organisms like Corynebacterium glutamicum or Escherichia coli to optimize valine biosynthetic pathways, overcoming feedback inhibition and significantly increasing metabolic flux towards the desired amino acid. Continuous efforts are directed toward utilizing more cost-effective and sustainable carbon sources, moving beyond conventional glucose towards alternative substrates, which enhances the economic viability and environmental profile of valine production globally.

Process optimization technology represents another critical area of innovation. Modern production facilities utilize advanced process control systems, incorporating sophisticated bioreactor designs and real-time monitoring sensors (e.g., spectrophotometers, dissolved oxygen probes) coupled with digital twins and advanced analytics. These technologies allow for dynamic adjustments of fermentation parameters such as nutrient supply, aeration, and pH level throughout the batch, resulting in predictable, high-purity yields (typically 98.5% or higher). Furthermore, downstream processing—including separation, purification, crystallization, and drying—has seen improvements aimed at reducing energy consumption and minimizing product loss, crucial for maintaining competitive pricing in this commodity market. Technologies that reduce the caking tendency of the final powder product, such as specialized granulation techniques, also hold commercial importance for ease of handling and shelf stability.

Beyond core manufacturing, the landscape is increasingly influenced by digitalization and sustainability technologies. Integration of Internet of Things (IoT) sensors and cloud-based data platforms allows for unprecedented transparency and traceability from the raw material source to the final feed mix, addressing growing consumer and regulatory demands for supply chain integrity. Sustainability innovations focus on utilizing waste streams from other industries (e.g., sugar production) as fermentation inputs and developing low-emission production practices. Furthermore, proprietary encapsulation and protective coating technologies are emerging for specialty feed applications, particularly for ruminants, ensuring that valine bypasses rumen degradation and is available for absorption in the small intestine, thereby extending the functional application scope of feed grade valine.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market both in terms of production volume and consumption capacity, driven by high-density poultry and swine populations in China, India, and Vietnam. This region is the primary source of competitive global supply, fueled by favorable manufacturing costs and continuous investment in large-scale fermentation facilities.

- North America: Characterized by mature, highly technical feed formulation practices and stringent quality assurance standards. Demand is stable, focused on maximizing genetic potential in broiler and swine herds, and driven by sophisticated, large-scale integrators who demand high-purity, consistent product supply, often coupled with technical service packages.

- Europe: Exhibits high value but lower volume growth compared to APAC. The market is heavily influenced by strict regulatory mandates emphasizing environmental sustainability (nitrogen reduction) and animal welfare, driving the adoption of precision feeding strategies that necessitate optimized valine inclusion to support low-protein diets and maintain strong immunity.

- Latin America: Represents a high-growth emerging market, particularly Brazil and Argentina, major global exporters of meat products. Rapid modernization of the livestock sector and significant expansion of aquaculture, especially tilapia and shrimp farming, are accelerating the demand for essential amino acids to enhance export competitiveness and production efficiency.

- Middle East and Africa (MEA): Currently holds the smallest share, but promising growth is observed, particularly in poultry production aimed at achieving regional food security goals. Investment in local feed milling infrastructure and improved animal husbandry practices are incrementally increasing the requirement for specialized feed additives like valine.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Feed Grade Valine Market.- Ajinomoto Co. Inc.

- CJ CheilJedang Corp.

- Evonik Industries AG

- Archer Daniels Midland (ADM)

- Fufeng Group

- Meihua Holdings Group Co. Ltd.

- Global Bio-Chem Technology Group

- Kyowa Hakko Bio Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- DSM Nutritional Products

- Wuxi Jinghai Amino Acid Co., Ltd.

- Changzhou Qirui Amino Acid Co., Ltd.

- Ningxia Eppen Biotech Co., Ltd.

- Hebei Donghua Chemical Group

- Adisseo (Bluestar Group)

- Kemin Industries

- Novus International, Inc.

- Star Lake Bioscience

- Nutreco N.V.

- Pishon Pharma

Frequently Asked Questions

Analyze common user questions about the Feed Grade Valine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of feed grade valine in livestock nutrition?

Feed grade valine is an essential branched-chain amino acid critical for optimizing muscle protein synthesis, improving feed conversion efficiency (FCR), supporting immune response, and maintaining nitrogen balance in animals, particularly swine and poultry, often used to balance diets low in crude protein.

How does the production process for feed grade valine impact its market price and availability?

Valine is primarily produced through advanced microbial fermentation, a process sensitive to the cost and availability of carbon sources (e.g., glucose, molasses). Fluctuations in agricultural commodity prices directly impact manufacturing costs, leading to price volatility in the final valine market, which is also influenced by high concentration among Asian producers.

Which livestock segment represents the largest consumer of feed grade valine globally?

The poultry segment, specifically broiler and layer production, represents the largest consuming segment due to the high intensity of production and the critical need for precise amino acid supplementation to achieve rapid, efficient growth and optimize performance parameters in high-throughput systems worldwide.

What major regulatory trend is driving increased demand for essential amino acids like valine in Europe?

European regulations, driven by sustainability goals and initiatives like the 'Farm to Fork' strategy, emphasize reducing nitrogen excretion from livestock. This necessity mandates the use of precision nutrition and synthetic amino acids, allowing feed mills to formulate lower crude protein diets while ensuring full nutritional adequacy, thereby boosting valine demand.

What technological advancements are shaping the future competitiveness of valine manufacturers?

Key technological drivers include strain engineering using genetic tools to increase fermentation yields, advanced AI and process automation for real-time monitoring and control of bioreactors, and innovations in downstream processing to reduce energy consumption and improve product purity and consistency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager