Feed Mill Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435215 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Feed Mill Market Size

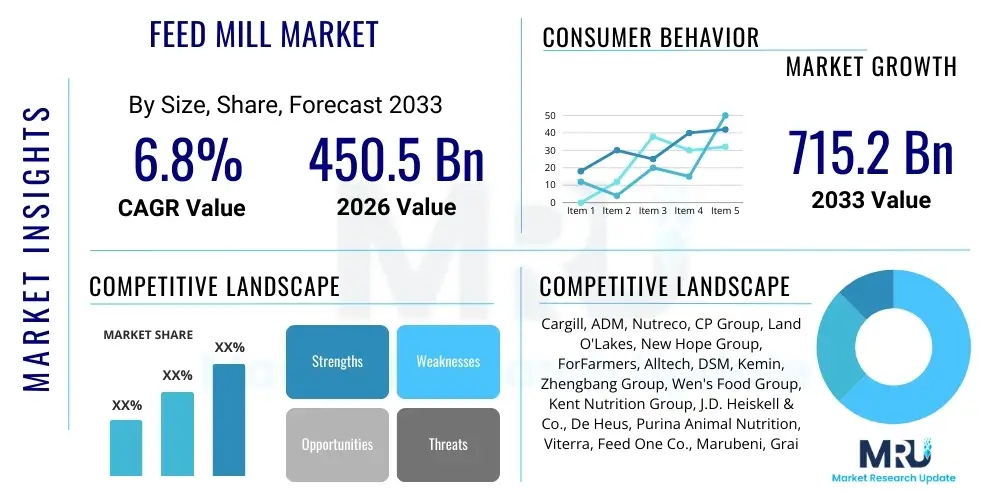

The Feed Mill Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450.5 Billion in 2026 and is projected to reach USD 715.2 Billion by the end of the forecast period in 2033. This consistent expansion is driven primarily by escalating global demand for animal protein, particularly in developing economies, coupled with increasing technological integration aimed at enhancing feed efficiency and ensuring animal health, thereby making feed production a highly critical component of the global food supply chain.

Feed Mill Market introduction

The Feed Mill Market encompasses the entire ecosystem involved in the commercial production of animal feed, ranging from raw material sourcing and processing to formulation, mixing, and pelletizing, culminating in distribution to livestock, poultry, and aquaculture producers. Feed mills manufacture scientifically balanced rations tailored to specific animal types and life stages, ensuring optimal nutrition, performance, and well-being. The primary products include complete feeds, supplements, and concentrates, formulated using key ingredients such as corn, soybean meal, oilseeds, vitamins, minerals, and specialized additives. These mills are essential industrial facilities that convert volatile agricultural commodities into stable, safe, and highly efficient nutritional products, serving as a critical intermediary link between crop production and meat/dairy/egg supply.

Major applications of feed mill products span intensive livestock farming systems globally, supporting the production of poultry (broilers and layers), swine, ruminants (cattle, sheep, goats), and aquaculture species. The benefits derived from utilizing high-quality manufactured feed include improved Feed Conversion Ratios (FCRs), reduced disease incidence through nutritional fortification, accelerated growth rates, and adherence to stringent food safety standards, which are increasingly mandated by consumers and regulatory bodies worldwide. Modern feed milling operations focus heavily on precision formulation to minimize waste and maximize nutrient utilization, aligning with global sustainability objectives while navigating complex raw material markets.

Key driving factors propelling the growth of the Feed Mill Market include rapid urbanization and rising disposable incomes in APAC and Latin America, leading to structural shifts in dietary patterns favoring protein-rich foods. Furthermore, the increasing global focus on animal welfare and the restriction of antimicrobial growth promoters (AGPs) necessitate the development and production of specialized functional feeds, such as those containing probiotics, prebiotics, and essential oils. The continuous need for operational efficiency, driven by volatile commodity prices and high energy costs, further pushes manufacturers toward adopting advanced automation technologies and data-driven formulation methods to maintain competitive pricing and supply chain resilience.

Feed Mill Market Executive Summary

The global Feed Mill Market is characterized by robust business trends centered on consolidation, technological sophistication, and a pronounced shift toward sustainable sourcing. Major market players are aggressively investing in smart manufacturing technologies, including advanced pellet quality control systems and energy-efficient grinding equipment, to enhance output consistency and reduce the environmental footprint of their operations. Strategic alliances, mergers, and acquisitions are frequent, allowing large multinational corporations to secure specialized ingredient supply chains and expand their geographical reach, particularly into high-growth Asian markets. Innovation in feed formulation is focused on replacing traditional ingredients with novel protein sources (e.g., insect meal, algae) to mitigate dependence on conventional crops, aligning with global efforts to diversify agricultural inputs and improve market resilience against commodity price shocks.

Regionally, the market exhibits divergent trends. Asia Pacific maintains the highest growth momentum, fueled by massive, centralized livestock production expansion in China, Vietnam, and India, and the burgeoning aquaculture sector. North America and Europe, while mature, are leading the shift towards premium and specialized feed segments, driven by strict regulatory frameworks concerning animal welfare, antibiotic usage, and traceability requirements. European feed mills, in particular, are focused on achieving stringent sustainability certifications, emphasizing responsibly sourced soy and local grain usage. Latin America shows significant potential, primarily due to the vast beef and poultry export markets in Brazil and Argentina, which require efficient, high-volume feed production capabilities to remain globally competitive.

Segmentation trends indicate a strong move toward functional and specialized feed segments. The Aquaculture segment is projected to grow fastest, stimulated by global governmental support for sustainable seafood production and advancements in specialized extruded pellet technology. Within animal types, the Poultry segment remains the largest volume consumer due to short production cycles and high global consumption rates. Ingredient segmentation highlights the increasing demand for advanced nutritional supplements and feed additives, such as gut health enhancers and non-antibiotic performance promoters, reflecting the industry's commitment to optimizing animal health and addressing consumer concerns regarding food safety and quality. The integration of digital tools for inventory management and blending precision is transforming the efficiency paradigm across all major segments.

AI Impact Analysis on Feed Mill Market

Common user questions regarding AI in the Feed Mill Market revolve around maximizing raw material utilization, ensuring consistent feed quality, predicting commodity price volatility, and automating complex formulation decisions. Users frequently ask: "How can AI optimize formulation costs given fluctuating ingredient prices?" and "What is the role of machine learning in preventing mycotoxin contamination in stored grains?" and "Can predictive analytics improve inventory management for perishable additives?" The general expectation is that AI will move the industry from reactive quality control and formulation to proactive, predictive nutritional management. Key themes emerging from these inquiries include the need for high-fidelity data capture from various stages of the milling process, the desire for autonomous optimization loops for energy usage in grinding and pelleting, and the critical requirement for AI models that can accurately forecast supply chain disruptions and ingredient availability in real-time.

The application of Artificial Intelligence is fundamentally transforming feed mill operations by introducing unparalleled levels of precision and efficiency. AI algorithms are now deployed in formulating optimal feed recipes, where they analyze thousands of potential ingredient combinations instantaneously, factoring in current market prices, nutritional constraints, and specific animal performance metrics, significantly reducing feed costs while maintaining nutrient density. Furthermore, machine learning models are utilized in quality assurance, performing real-time spectral analysis of incoming raw materials and finished products to detect contaminants, inconsistencies, and moisture variations that human inspection might miss, thereby guaranteeing product safety and quality consistency.

Beyond formulation and quality control, AI systems are instrumental in optimizing the operational expenditure of the mills themselves. Predictive maintenance algorithms analyze data streams from motors, mixers, and pelletizers to forecast equipment failure, allowing for scheduled maintenance rather than costly, unplanned downtime. This not only enhances overall throughput but also extends the operational life of highly specialized machinery. The adoption of AI also extends to intelligent supply chain planning, where systems forecast demand fluctuations based on seasonal trends, disease outbreaks, and macroeconomic indicators, ensuring just-in-time raw material procurement and minimizing storage losses, solidifying AI's role as an indispensable tool for maximizing profitability in a capital-intensive industry.

- AI-driven optimization of least-cost feed formulation (LCF).

- Predictive maintenance for critical milling equipment, reducing unplanned downtime.

- Real-time quality control and contamination detection using computer vision and spectroscopy.

- Enhanced inventory forecasting and risk management related to commodity price volatility.

- Automated regulation of energy-intensive processes like grinding and pelletizing.

- Development of highly specialized, customized nutritional programs based on granular farm data.

DRO & Impact Forces Of Feed Mill Market

The dynamics of the Feed Mill Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and strategic direction of the industry. Primary drivers include sustained growth in global population and increased per capita meat consumption, particularly poultry and pork, necessitating scaled-up, efficient feed production. Technological advancements in automation, precision feeding systems, and data analytics also serve as powerful catalysts, allowing mills to achieve unprecedented levels of FCR and operational efficiency. Conversely, the market faces significant restraints, chiefly characterized by the extreme volatility in raw material prices—driven by geopolitical tensions, adverse weather conditions, and energy market fluctuations—which compresses profit margins and complicates long-term financial planning for feed manufacturers globally. Additionally, the high capital expenditure required for establishing or modernizing large-scale, automated feed mills poses a barrier to entry, particularly for smaller, regional players seeking to compete with established multinational giants.

Significant opportunities exist in the shift towards specialized and value-added feed products. The global movement away from antibiotic usage in livestock has created a burgeoning demand for functional feed additives (e.g., probiotics, essential oils, and organic acids) that support gut health and immunity naturally. Furthermore, the rapid expansion of the aquaculture industry presents a fertile ground for innovation in sustainable fish feed formulations, often utilizing novel ingredients like insect protein or single-cell proteins, which offer diversification away from traditional marine-based ingredients like fishmeal. Manufacturers who can successfully integrate sustainable sourcing practices and achieve relevant environmental certifications will unlock significant market access, especially in highly regulated European and North American markets where consumer consciousness regarding environmental impact is high.

The impact forces within this market are predominantly regulatory and sustainability-driven. Global impact forces include increasing regulatory scrutiny regarding ingredient traceability, feed safety standards (e.g., HACCP implementation), and maximum residue limits (MRLs). These regulations compel mills to invest heavily in advanced quality management systems and transparent supply chains. The demand for sustainable protein production is perhaps the most defining impact force; buyers, retailers, and end-consumers are increasingly pressuring feed suppliers to verify the sustainable origins of ingredients, particularly soybean and palm products, forcing fundamental changes in procurement strategies. This sustainability imperative acts as a strong driver for technological adoption (e.g., utilizing big data to optimize resource use) while simultaneously acting as a restraint if sustainability compliance costs become prohibitively high, especially for mills operating in jurisdictions with less robust infrastructure.

Segmentation Analysis

The Feed Mill Market is structurally segmented based on crucial parameters including the type of animal fed, the primary ingredients used in formulation, and the physical form of the finished product. This multi-dimensional segmentation allows market participants to tailor their offerings precisely to diverse operational requirements and regional dietary needs. The analysis of these segments is vital for understanding competitive dynamics, resource allocation, and identifying the fastest-growing niches. The predominance of poultry production globally ensures its status as the largest segment, but strategic growth is increasingly concentrated in higher-value segments like aquaculture and specialized pet nutrition, which demand complex, precise formulations and advanced milling technologies.

Segmentation by Ingredient reveals the market's reliance on major agricultural commodities, dominated by cereals (corn, wheat, barley) and oilseed meals (soybean meal, canola meal). However, the Supplements and Additives category is experiencing accelerated growth, driven by functional requirements such as disease prevention, gut health improvement, and maximizing nutrient absorption in the absence of antibiotics. This shift signifies a move towards high-science nutrition within the feed industry. Furthermore, segmentation by Form highlights that Pellets are the most widely used format, especially for poultry and swine, due to their ease of handling, improved digestibility, reduced dust, and minimal nutrient segregation during transport, maximizing feed intake and efficiency at the farm level.

Geographically and demographically, the segmentation strategy must also account for varying levels of farming intensity. In developed markets, feed mills often focus on niche segments such as organic feed or non-GMO specified diets, reflecting consumer preferences. Conversely, mills in emerging markets prioritize volume and cost efficiency to support rapid growth in commercial farming operations. Understanding these nuanced demands across species, ingredient dependencies, and physical characteristics is central to formulating an effective market entry or expansion strategy, allowing companies to allocate R&D efforts toward optimizing complex processes like extrusion (for aquafeed) or specialized mixing (for medicated or functional feeds).

- By Animal Type:

- Poultry (Broilers, Layers, Turkeys)

- Swine (Hog, Piglets)

- Ruminants (Cattle, Dairy Cows, Sheep, Goats)

- Aquaculture (Fish, Shrimp)

- Others (Pet Food, Equine)

- By Ingredient:

- Cereals (Corn, Wheat, Barley)

- Oilseed Meal (Soybean Meal, Canola Meal)

- Supplements and Additives (Vitamins, Minerals, Amino Acids, Enzymes, Probiotics)

- Fats and Oils

- By Form:

- Pellets

- Mash

- Crumbles

- Others (Extruded, Liquid Feed)

Value Chain Analysis For Feed Mill Market

The Feed Mill Market value chain is intricate, commencing with upstream activities centered on raw material procurement, which is arguably the most critical and complex stage due to commodity price volatility and quality variability. Upstream analysis involves sourcing massive quantities of grains (like corn and wheat), protein sources (soybean meal), and micro-ingredients (additives, vitamins, minerals) from domestic and international agricultural markets. Mills often utilize sophisticated hedging strategies and long-term contracts to stabilize procurement costs, and the quality control systems at this stage, including mycotoxin screening and nutrient testing, are crucial to the final product integrity. The efficiency of the upstream segment is heavily reliant on global logistics and trade policies, linking agricultural production cycles directly to industrial output.

The midstream segment involves the core feed milling processes: raw material receiving, storage, cleaning, grinding, mixing, conditioning, and final processing (pelleting or extrusion). Modern feed mills are capital-intensive manufacturing facilities where optimization of energy usage, precise blending through computerized batching systems, and effective quality management are paramount to reducing operational costs and ensuring highly uniform nutritional output. Automation and data integration, often utilizing sensor technology and SCADA systems, are key to maximizing throughput and minimizing human error in this phase. The integrity of the pelletizing process, including the use of high-pressure steam conditioning, directly impacts feed stability and palatability.

Downstream activities focus on packaging, logistics, distribution, and direct sales to end-users (livestock farms, integrators, aquaculture facilities). Distribution channels are highly varied; large integrators often operate their own captive feed mills, while independent farms rely on direct sales from commercial mills or utilize intermediate distribution networks (e.g., dealers, agricultural cooperatives). The "last mile" efficiency, including specialized bulk feed trucks and precise delivery schedules, is essential for maintaining freshness and minimizing logistics costs. Furthermore, technical support and nutritional consulting services provided by the feed mill sales team add significant value downstream, helping customers optimize their feeding strategies and improve animal performance, solidifying the mill’s role as a strategic partner rather than just a supplier.

Feed Mill Market Potential Customers

The primary customers and end-users of the Feed Mill Market are highly industrialized, often integrated livestock production entities that require large volumes of consistent, high-quality nutrition to sustain large animal populations. These customers include large-scale poultry integrators, such as those operating contract farming models for broiler and layer production, who demand specialized starter, grower, and finisher rations tailored to genetic specifications. The swine industry, particularly in major producing regions like China, the US, and Europe, represents another significant customer base, often requiring specialized feeds focused on disease mitigation and rapid growth rates for piglets and market hogs. These industrial customers prioritize feed consistency, reliable supply, and competitive pricing, making long-term contractual relationships common.

The second major category of customers includes dairy and beef cattle operations, falling under the ruminant segment. While some large dairy farms mix their own Total Mixed Rations (TMRs), many rely on commercial feed mills for concentrates, mineral pre-mixes, and specialized high-protein supplements to balance farm-grown forages, optimizing milk yield and quality. For beef operations, feedlots are heavy consumers of finishing rations. The purchasing decisions in this segment are often driven by performance guarantees, nutritional consultation provided by the mill, and the complexity of managing variable forage quality, requiring highly sophisticated balancing products supplied by the feed industry.

The fastest-growing, highly specialized customer segment is the Aquaculture industry, encompassing producers of farmed fish (tilapia, salmon, catfish) and crustaceans (shrimp). These buyers demand highly specialized, extruded pellets that ensure optimal water stability and floatation/sinking characteristics, crucial for aquatic feeding environments. Furthermore, the increasing global focus on pet food, driven by humanization trends, establishes specialized pet food manufacturers as premium customers for highly precise and often organic or grain-free formulations. These diverse end-user segments collectively demonstrate that customers prioritize nutritional accuracy, verifiable traceability, and technological partnership over mere product commodity exchange.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Billion |

| Market Forecast in 2033 | USD 715.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cargill, ADM, Nutreco, CP Group, Land O'Lakes, New Hope Group, ForFarmers, Alltech, DSM, Kemin, Zhengbang Group, Wen's Food Group, Kent Nutrition Group, J.D. Heiskell & Co., De Heus, Purina Animal Nutrition, Viterra, Feed One Co., Marubeni, GrainCorp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Feed Mill Market Key Technology Landscape

The technological evolution within the Feed Mill Market is primarily driven by the imperative to increase efficiency, ensure product safety, and respond to environmental mandates. Central to this landscape is the widespread adoption of advanced process control and automation systems, often incorporating IoT (Internet of Things) sensors throughout the facility. These technologies enable precise monitoring and control of parameters such as batch weighing, mixing uniformity, particle size reduction during grinding, and temperature/moisture regulation during pelletizing. Computerized batching systems, integrated with Enterprise Resource Planning (ERP) software, minimize human error in formulation execution, ensuring that the finished feed accurately reflects the scientifically optimal recipe, which is critical for achieving target Feed Conversion Ratios (FCRs) and compliance with nutritional specifications.

A significant technological focus is placed on enhancing ingredient processing and quality assurance. High-efficiency hammer mills and roller mills are constantly being refined to achieve desired particle sizes while minimizing energy consumption, which is a major operating cost for mills. Furthermore, advanced pelletizing technology, including specialized dies and sophisticated conditioning equipment, is crucial for producing highly durable and uniform pellets, especially critical in aquafeed and high-volume poultry feed, where pellet integrity directly impacts animal acceptance and nutrient utilization. The integration of NIR (Near-Infrared Reflectance) spectroscopy and real-time vision systems allows for instant nutritional analysis of raw materials and finished products, dramatically speeding up quality checks and enabling real-time adjustments to formulation and processing parameters, moving away from time-consuming wet chemistry analysis.

Beyond the core machinery, the Feed Mill Market is rapidly embracing digitalization and data analytics. Cloud-based formulation software utilizes AI and machine learning to optimize least-cost formulation dynamically based on live commodity market feeds and local inventory levels, providing a competitive edge. Traceability technologies, such as blockchain and advanced RFID tagging, are being implemented to ensure full transparency of every ingredient from origin to consumption, addressing increasing regulatory and consumer demands for supply chain visibility and food safety compliance. These digital tools not only streamline operations but also provide critical data insights necessary for continuous improvement in energy efficiency, resource usage, and overall profitability across the entire milling operation.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing region in the global Feed Mill Market, primarily driven by China, India, and Southeast Asian nations. This rapid expansion is linked directly to explosive growth in concentrated animal farming operations, particularly swine and poultry, and robust governmental support for the aquaculture sector. China dominates regional production, characterized by large-scale, highly centralized feed manufacturing integrated with massive livestock enterprises. Key drivers include rising consumer incomes driving protein demand and substantial investment in modern, high-capacity feed mills to replace smaller, less efficient facilities, positioning APAC as the epicenter of global feed innovation and volume growth.

- North America: The North American market (dominated by the US and Canada) is mature but highly focused on specialization, premiumization, and technological integration. This region leads in the adoption of precision feeding technologies, advanced data analytics for farm management, and non-GMO/organic feed production. Regulatory compliance regarding feed safety (e.g., FSMA in the US) is stringent, compelling continuous investment in sophisticated quality control systems and full supply chain traceability. The market is concentrated among major global players (Cargill, ADM, Land O'Lakes), focusing heavily on optimizing feed efficiency for large-scale beef, dairy, and poultry integrators.

- Europe: The European market is characterized by high levels of regulation concerning animal welfare, environmental impact, and the strict ban on antibiotic growth promoters (AGPs). This forces feed manufacturers to be global leaders in functional feed development, utilizing complex formulations involving phytogenics and prebiotics. Europe emphasizes sustainable sourcing, with a strong focus on certified sustainable soy and local grain utilization, driven by consumer ethics and EU policies such as the Green Deal. Germany, France, and the Netherlands are key contributors, specializing in highly technical feed segments like premium pet food and specialized dairy nutrition, valuing quality and sustainability over pure volume.

- Latin America (LATAM): LATAM, specifically Brazil and Argentina, is a critical region due to its status as a major global exporter of beef, poultry, and soy. The Feed Mill Market here is rapidly expanding to support massive, export-oriented livestock industries, requiring high-throughput milling operations. The focus is on leveraging locally abundant raw materials (soy, corn) and achieving cost-efficiency to maintain competitiveness in global commodity meat markets. Investment is strong in modernizing logistics and milling infrastructure to handle vast quantities of agricultural inputs and outputs, positioning LATAM as a key growth area for raw material-centric feed production.

- Middle East and Africa (MEA): The MEA region presents unique challenges and opportunities, marked by reliance on imported raw materials (especially in the Middle East) and the necessity for climate-resilient feed solutions. Growth in Sub-Saharan Africa is driven by improving commercialization of livestock farming and government initiatives to enhance food security. In the Middle East, high disposable incomes support premium livestock sectors (e.g., dairy and camel farming), requiring specialized, often imported, feed formulas, with significant investment in localized processing facilities to secure supply chains against geopolitical volatility.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Feed Mill Market.- Cargill Incorporated

- Archer Daniels Midland Company (ADM)

- Nutreco N.V. (a subsidiary of SHV Holdings N.V.)

- Charoen Pokphand Foods Public Company Limited (CP Group)

- Land O'Lakes, Inc.

- New Hope Group Co., Ltd.

- ForFarmers N.V.

- Alltech Inc.

- Koninklijke DSM N.V.

- Kemin Industries, Inc.

- Zhengbang Group

- Wen's Food Group Co., Ltd.

- Kent Nutrition Group

- J.D. Heiskell & Co.

- De Heus Animal Nutrition

- Purina Animal Nutrition (a division of Land O'Lakes)

- Viterra (formerly Glencore Agriculture)

- Feed One Co., Ltd.

- Marubeni Corporation

- GrainCorp Limited

Frequently Asked Questions

Analyze common user questions about the Feed Mill market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary sustainability challenges facing modern feed mills?

The primary challenges include reducing the carbon footprint associated with energy-intensive grinding and pelletizing processes, sourcing deforestation-free soybean meal, managing water usage, and minimizing waste generated during milling operations. Mills are increasingly investing in renewable energy sources and utilizing byproducts to meet growing sustainability mandates.

How is the global restriction on antimicrobial growth promoters (AGPs) impacting feed formulation?

The restriction on AGPs has driven a major shift towards functional feed additives. Formulations now heavily incorporate alternatives such as prebiotics, probiotics, organic acids, and essential oils aimed at maintaining gut health and supporting animal immunity naturally. This necessitates higher precision in ingredient blending and stricter quality control.

Which animal segment contributes the most to Feed Mill Market revenue and why?

The Poultry segment typically contributes the highest volume and revenue share globally. This dominance is due to the short production cycles of broilers and layers, the high global consumption of poultry meat and eggs, and the high reliance of the industry on complete, manufactured feed for intensive farming systems worldwide.

What role does automation and IoT play in managing raw material price volatility?

Automation and IoT systems provide real-time inventory levels and ingredient quality data, which feeds into AI-driven least-cost formulation (LCF) software. This enables mill managers to instantaneously substitute ingredients based on market prices and nutrient availability without compromising nutritional specifications, significantly mitigating the financial risk associated with volatile commodity markets.

Is the aquaculture feed segment growing faster than traditional livestock feed, and what technologies support this growth?

Yes, the aquaculture feed segment is generally exhibiting a higher growth rate, driven by global efforts to secure seafood supplies. This growth is supported by highly specialized technologies like high-shear twin-screw extrusion, which produces stable, specific density pellets crucial for aquatic environments, alongside innovations in novel protein inclusion such as insect meal.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager