Feed Phytobiotics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431893 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Feed Phytobiotics Market Size

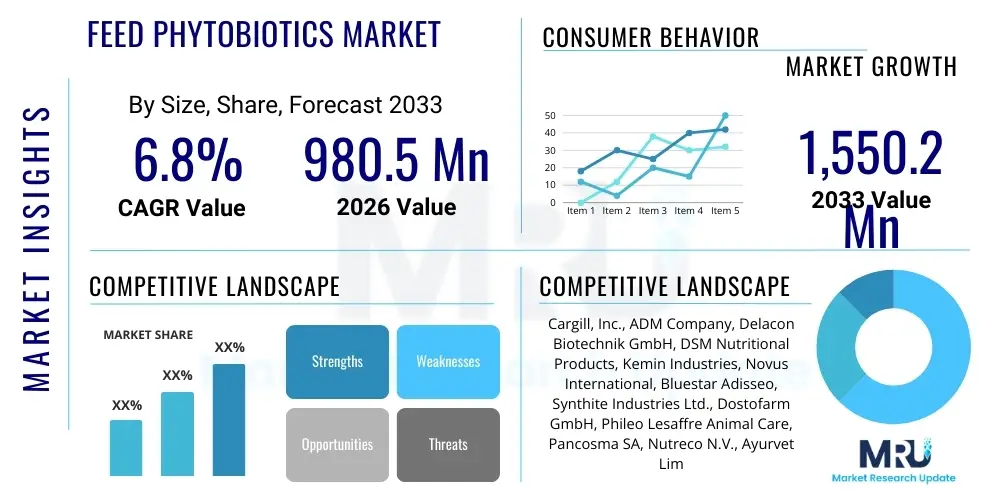

The Feed Phytobiotics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 980.5 Million in 2026 and is projected to reach USD 1,550.2 Million by the end of the forecast period in 2033.

Feed Phytobiotics Market introduction

Feed phytobiotics, also known as botanical feed additives or phytogenic feed additives (PFAs), are natural compounds derived from herbs, spices, essential oils, and other plant sources, incorporated into animal feed to enhance animal health, performance, and productivity. These compounds function through various mechanisms, including improving feed intake and digestion, stimulating endogenous enzyme production, acting as powerful antioxidants, and exerting antimicrobial effects. The primary objective of using phytobiotics is to offer a natural, sustainable alternative to antibiotic growth promoters (AGPs), aligning with global regulatory pressure to reduce antibiotic reliance in livestock farming. This shift is driven by increasing public health concerns regarding antimicrobial resistance (AMR), making phytobiotics crucial for maintaining gut integrity and immune function in production animals such as poultry, swine, and ruminants.

The product portfolio within the feed phytobiotics sector is diverse, encompassing a wide range of active ingredients such as essential oils (e.g., oregano, cinnamon), saponins, flavonoids, and oleoresins. These components are formulated to improve nutrient utilization efficiency, thereby reducing feed conversion ratios (FCR) and operational costs for farmers. Major applications span across almost all livestock sectors, but they are particularly prevalent in poultry and swine operations where intensive farming systems demand effective gut health management strategies. The inherent benefits of these natural additives—including improved flavor, palatability, and anti-inflammatory properties—further solidify their adoption across global feed manufacturing industries aiming for high-quality, sustainable animal production.

Key driving factors accelerating market adoption include stringent governmental regulations banning or restricting the use of conventional AGPs, consumer preference for naturally sourced meat and animal products, and intensive research demonstrating the efficacy of specific phytobiotic blends in challenging environments. Furthermore, advancements in extraction and encapsulation technologies ensure the stability and targeted release of active compounds within the animal's digestive tract, optimizing their biological effectiveness. The continuous need for enhancing livestock efficiency while maintaining high welfare standards positions feed phytobiotics as an indispensable component of modern animal nutrition strategies.

Feed Phytobiotics Market Executive Summary

The Feed Phytobiotics Market is characterized by robust growth, fundamentally driven by the global imperative to phase out antibiotic growth promoters (AGPs) in response to rising antimicrobial resistance concerns. Business trends indicate a significant focus on technological innovation, specifically in microencapsulation and targeted delivery systems, enabling superior efficacy and stability of active ingredients under harsh processing conditions. Strategic mergers, acquisitions, and partnerships aimed at vertically integrating supply chains and broadening product portfolios remain key activities among major market players seeking to consolidate their presence in specialized segments like essential oils and flavonoid compounds. Furthermore, increased investment in clinical trials proving specific mode-of-actions is vital for gaining regulatory acceptance and reinforcing commercial adoption across varying geographical regions and livestock types.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, primarily fueled by massive livestock production expansions in countries like China, India, and Vietnam, coupled with the rapid implementation of AGP bans similar to those seen in the European Union. Europe remains the largest and most mature market, serving as the regulatory benchmark and innovation hub, driving demand for premium, science-backed phytobiotic solutions. North America is experiencing accelerated growth due to strong consumer-led demand for 'antibiotic-free' meat products, prompting large integrated producers to adopt natural alternatives proactively. Investment is increasingly flowing into sustainable sourcing and traceable raw material supply chains to meet consumer and regulatory expectations for natural ingredients.

Segmentation trends indicate essential oils holding the dominant share, prized for their proven antimicrobial and gut health benefits, although flavonoids and saponins are gaining traction due to their antioxidant and immune-modulating properties, respectively. Based on livestock, poultry accounts for the largest application segment, attributed to the high volume of intensive poultry farming globally and the critical need for quick-acting gut health solutions to manage diseases like coccidiosis and necrotic enteritis without antibiotics. The function segment sees gut health modulators as the primary driver, reflecting the core value proposition of phytobiotics in supporting digestive efficiency and overall animal resilience against environmental stressors.

AI Impact Analysis on Feed Phytobiotics Market

Common user questions regarding AI's impact on the Feed Phytobiotics Market predominantly revolve around how artificial intelligence can optimize formulation precision, predict raw material quality fluctuations, and accelerate the discovery of novel synergistic botanical compounds. Users are concerned about whether AI can accurately model complex host-microbiome-phytobiotic interactions to tailor feed solutions for specific animal genetics or environmental stressors, thereby enhancing product efficacy and minimizing wastage. Key themes surfacing include the use of machine learning in processing vast metabolomics and transcriptomics data generated during efficacy studies, expectations regarding the development of precision feeding programs enabled by AI, and the potential for smart farming systems to dynamically adjust phytobiotic dosage based on real-time animal health indicators and performance metrics.

- AI-driven optimization of phytobiotic blend ratios for maximum efficacy based on microbial profiles.

- Machine learning algorithms predicting raw material quality and supply chain stability for botanicals.

- Accelerated discovery and screening of novel plant extracts with specific antimicrobial or antioxidant properties.

- Integration of AI into precision livestock farming (PLF) systems for dynamic dosing based on real-time animal data.

- Enhanced R&D through predictive modeling of phytobiotic compound stability and bioavailability in the digestive tract.

- Automated analysis of complex 'omics' data (metagenomics, metabolomics) to understand host-microbiome-diet interactions.

DRO & Impact Forces Of Feed Phytobiotics Market

The Feed Phytobiotics Market growth is significantly propelled by regulatory mandates restricting antibiotic usage in animal agriculture (Driver), creating a vast demand for effective natural alternatives to maintain productivity. However, this growth faces hurdles due to the high initial investment required for research into compound efficacy and stability, coupled with the variability inherent in botanical raw materials (Restraint). The increasing consumer preference for natural, clean-label animal products presents a substantial opportunity for manufacturers to innovate and differentiate their offerings, especially in emerging markets where agricultural intensification is accelerating. These dynamics create powerful impact forces, where the legislative push towards sustainable animal health strongly outweighs the technical and cost challenges, ensuring continuous market expansion.

Key drivers include the demonstrable benefits of phytobiotics in improving gut health, reducing pathogenic load, and enhancing feed conversion efficiency, directly addressing the core economic concerns of livestock producers. Furthermore, the rising awareness and acceptance of phytobiotics among veterinarians and nutritionists as scientifically validated tools are critical for mainstream adoption. Conversely, restraints primarily involve the inconsistent potency of natural extracts due to climate, harvesting, and processing variations, which necessitates sophisticated quality control protocols, increasing production costs. The regulatory landscape, while driving demand, can also be restrictive, requiring extensive documentation and clinical validation for new product approval across different geographies.

Opportunities are abundant, particularly in developing region-specific phytobiotic solutions tailored to local endemic diseases and feed formulations. The aquaculture sector represents a nascent yet highly promising growth area, given the acute challenges of disease management in intensive fish and shrimp farming without heavy antibiotic intervention. The market is also capitalizing on the opportunity to combine phytobiotics with prebiotics, probiotics, and organic acids to create synergistic multi-component feed additives, maximizing overall health benefits and strengthening market positioning against synthetic alternatives. Overall, the market's trajectory is highly positive, driven by a global shift towards sustainable and responsible animal protein production methods.

Segmentation Analysis

The Feed Phytobiotics Market segmentation provides a granular view of diverse product applications and their adoption across various livestock species and functional needs. The market is broadly categorized based on Type (Essential Oils, Flavonoids, etc.), Livestock (Poultry, Swine, Ruminants, Aquaculture), and Function (Performance Enhancers, Gut Health Modulators). This structured analysis allows stakeholders to understand specific demand patterns, identify high-growth segments, and tailor product development strategies. The dominance of Essential Oils within the Type segment is attributable to their well-established antimicrobial properties, while the pervasive application in Poultry highlights the segment's acute sensitivity to gut health issues and the resulting need for immediate, effective natural solutions.

- By Type: Essential Oils, Carotenoids, Flavonoids, Saponins, Alkaloids, Others

- By Livestock: Poultry (Broilers, Layers), Swine (Piglets, Growers), Ruminants (Dairy Cattle, Beef Cattle), Aquaculture, Equine, Others

- By Function: Performance Enhancers, Gut Health Modulators, Palatability Enhancers, Antioxidants, Immune Modulators

Value Chain Analysis For Feed Phytobiotics Market

The value chain for the Feed Phytobiotics Market begins with the upstream sourcing of high-quality botanical raw materials, which is crucial given the direct correlation between raw material potency and final product efficacy. This initial stage involves cultivation, harvesting, and meticulous preliminary processing of herbs, spices, and specific plant parts, often requiring sustainable and traceable sourcing practices to meet stringent industry standards. Key upstream challenges include managing the seasonality and geographical variability of plant compounds, which necessitates sophisticated extraction and quality control technologies to standardize active ingredient concentration before they enter the processing phase. Investment in sustainable agriculture and contract farming is increasingly common to mitigate supply risk and ensure consistent quality parameters.

The midstream stage involves the highly specialized manufacturing processes, including extraction (e.g., supercritical fluid extraction, solvent extraction), formulation, and encapsulation. Advanced processing technologies are employed to enhance the bioavailability, stability, and target release of phytobiotic compounds within the animal's gastrointestinal tract, ensuring they survive feed pelleting processes and acidic stomach environments. Manufacturers must invest heavily in R&D to create proprietary blends and delivery systems (like microencapsulation) that provide a competitive edge. This phase is critical as it transforms volatile or sensitive botanical extracts into practical, stable feed additives that integrate seamlessly into commercial feed production lines.

Downstream activities focus on distribution, marketing, and final delivery to feed manufacturers, integrators, and large farm operations. Distribution channels are primarily direct sales or through specialized feed additive distributors, requiring expert technical support and nutritional consultation services. The indirect channel involves premix manufacturers who incorporate phytobiotics into larger nutritional blends before selling to end-users. Regulatory compliance and validation studies are essential throughout the chain, and successful market penetration depends significantly on the technical proficiency of the sales force in demonstrating the cost-effectiveness and efficacy of the phytobiotics compared to conventional solutions. The final stage involves the integration of these products into the animal's diet, monitored by veterinarians and animal nutritionists.

Feed Phytobiotics Market Potential Customers

The primary potential customers and end-users of feed phytobiotics are large integrated livestock producers and commercial feed manufacturers globally. Integrated operations, particularly those involved in poultry and swine production, manage the entire supply chain from breeding to processing, making them highly receptive to solutions that optimize feed conversion ratio (FCR) and reduce disease incidence naturally. These customers prioritize performance enhancement, disease prevention without antibiotics, and compliance with retail buyer mandates for sustainable sourcing and animal welfare practices. The financial scale of these operations means that even marginal improvements in feed efficiency translate into significant cost savings, justifying the premium pricing often associated with high-quality phytobiotic products.

Commercial feed manufacturers represent another critical customer segment, as they act as intermediaries, incorporating phytobiotics into standardized compound feeds and premixes supplied to independent farmers and smaller operations. For these customers, stability, ease of incorporation, and consistency of the additive are paramount. They rely on phytobiotics suppliers to provide robust technical data and regulatory documentation to ensure the safety and claimed efficacy of the final feed product. The selection criteria for these customers are typically based on proven product performance under commercial settings, supply reliability, and competitive pricing structures relative to other growth promoters.

Emerging potential customers include specialized aquaculture farms (particularly for shrimp and high-value fish species) and boutique or organic livestock producers who strictly adhere to natural inputs. The aquaculture sector faces extreme pressure from bacterial and parasitic diseases, and phytobiotics offer a necessary mitigation strategy without resorting to antibiotics that could contaminate water systems or aquaculture products. Furthermore, veterinary clinics and nutritional consultants increasingly influence purchasing decisions by recommending specific phytobiotic formulations as part of comprehensive animal health protocols, especially in managing transition periods (e.g., weaning in piglets, stress in poultry) or addressing subclinical challenges where prophylactic antibiotic use is no longer viable.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 980.5 Million |

| Market Forecast in 2033 | USD 1,550.2 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cargill, Inc., ADM Company, Delacon Biotechnik GmbH, DSM Nutritional Products, Kemin Industries, Novus International, Bluestar Adisseo, Synthite Industries Ltd., Dostofarm GmbH, Phileo Lesaffre Animal Care, Pancosma SA, Nutreco N.V., Ayurvet Limited, Chr. Hansen Holding A/S, Vetsfarma, Silvateam S.p.A., Phytobiotics Futterzusatzstoffe GmbH, BIOMIN Holding GmbH, Global Nutritech, Solvay S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Feed Phytobiotics Market Key Technology Landscape

The technological evolution in the Feed Phytobiotics Market is primarily concentrated on overcoming the inherent instability and poor bioavailability of natural plant compounds. A critical technology is microencapsulation, which involves coating active ingredients with protective matrices (e.g., lipid-based or polymer-based) to safeguard them against degradation during feed processing (pelleting, high heat) and transit through the acidic conditions of the upper digestive tract. This technology ensures the controlled and targeted release of phytobiotics into the specific sections of the gut, maximizing their interaction with the intestinal lining and microflora. Innovations in microencapsulation directly correlate with increased product stability, shelf life, and, most importantly, enhanced biological efficacy, which is a major differentiator in a competitive market.

Another pivotal technological area involves advanced extraction and purification techniques, crucial for standardizing the concentration of active components in raw botanical materials. Techniques such as Supercritical Fluid Extraction (SFE) using CO2 are gaining prominence over traditional solvent-based methods. SFE offers a cleaner, safer, and more environmentally friendly way to obtain high-purity, standardized extracts free from harmful residues, addressing both regulatory compliance and consumer preference for clean-label ingredients. Furthermore, standardization technologies, often utilizing High-Performance Liquid Chromatography (HPLC) and Gas Chromatography (GC), are essential for quality assurance, ensuring batch-to-batch consistency—a significant challenge when dealing with biological feedstock.

Lastly, digitalization and "omics" technologies are emerging as crucial tools in product development. Genomics, metabolomics, and metagenomics are used to deeply analyze the interaction between specific phytobiotics, the animal host, and the gut microbiome. This data-intensive approach, often powered by AI, allows researchers to identify synergistic combinations of compounds and develop precision formulations optimized for specific health outcomes (e.g., enhanced tight junction integrity, specific pathogen reduction). Utilizing these technologies helps validate efficacy claims with strong scientific backing, accelerating product innovation and regulatory approval processes for next-generation phytobiotic solutions.

Regional Highlights

The geographic landscape of the Feed Phytobiotics Market demonstrates varied maturity levels and growth trajectories across key regions, fundamentally shaped by regional livestock production intensity, regulatory environments, and local consumer demand dynamics.

Europe: Europe holds a dominant position, largely due to its pioneering role in implementing bans on antibiotic growth promoters, notably following the 2006 EU mandate. This regulatory pressure forced early and broad adoption of phytobiotics as standard components of feed formulations. The region is characterized by high-quality standards, extensive research and development activities, and a strong focus on animal welfare and sustainable practices. Demand is concentrated in advanced formulations providing proven alternatives for health challenges in swine and poultry, reinforcing Europe's status as a benchmark market for innovation and product sophistication.

Asia Pacific (APAC): APAC is projected to exhibit the fastest growth, driven by exponential expansion in livestock production (especially in China, India, and Southeast Asian nations) to meet soaring domestic demand for meat and dairy. Simultaneously, the region is rapidly adopting stricter regulations on antibiotic usage, following the global trend. The sheer scale of animal farming, combined with technological transfer from Western markets and local R&D initiatives, creates massive opportunities, although challenges persist related to raw material standardization and ensuring consistent product quality across diverse local markets.

North America: The market in North America, encompassing the U.S. and Canada, is driven primarily by voluntary industry shifts and consumer pressure, particularly the demand for 'No Antibiotics Ever' (NAE) poultry programs. While regulatory bans are less uniform than in the EU, major integrators are transitioning proactively, spurring high growth rates. Focus areas include phytobiotics that offer reliable performance enhancement in large-scale operations and innovative delivery systems that simplify integration into complex feed mills. The market is receptive to premium, scientifically validated products.

Latin America and MEA: Latin America shows significant potential, particularly in Brazil and Argentina, which are major global exporters of poultry and beef. Growth is linked to improving export competitiveness by meeting international standards regarding antibiotic use. The Middle East and Africa (MEA) region is emerging, with adoption rates tied to modernizing agricultural practices and addressing heat stress and endemic diseases in rapidly industrializing farming sectors, particularly in the Gulf Cooperation Council (GCC) countries.

- Europe: Largest and most mature market; defined by stringent regulatory standards (AGP ban); focus on advanced, scientifically backed formulations for swine and poultry gut health.

- Asia Pacific (APAC): Fastest-growing market; driven by rapid industrialization of livestock and recent adoption of AGP restriction policies in major production hubs like China and Vietnam.

- North America: Growth fueled by consumer-driven 'antibiotic-free' meat trends and major integrator adoption of natural solutions, especially in broiler production.

- Latin America: Rising demand driven by the need to maintain global export competitiveness and improve efficiency in large-scale beef and poultry operations.

- Middle East & Africa (MEA): Emerging market focused on solutions for addressing regional challenges such as high environmental stress and improving feed efficiency.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Feed Phytobiotics Market.- Cargill, Inc.

- ADM Company (Archer Daniels Midland)

- Delacon Biotechnik GmbH

- DSM Nutritional Products (Royal DSM)

- Kemin Industries

- Novus International

- Bluestar Adisseo

- Synthite Industries Ltd.

- Dostofarm GmbH

- Phileo Lesaffre Animal Care

- Pancosma SA

- Nutreco N.V.

- Ayurvet Limited

- Chr. Hansen Holding A/S

- Vetsfarma

- Silvateam S.p.A.

- Phytobiotics Futterzusatzstoffe GmbH

- BIOMIN Holding GmbH

- Global Nutritech

- Solvay S.A.

Frequently Asked Questions

Analyze common user questions about the Feed Phytobiotics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary functions of feed phytobiotics in animal nutrition?

Feed phytobiotics primarily function as gut health modulators, supporting the integrity of the intestinal barrier and balancing the microflora. They also act as performance enhancers, improving feed intake, increasing nutrient absorption, and exhibiting strong antimicrobial and antioxidant properties, thereby providing natural alternatives to antibiotic growth promoters (AGPs).

How do global antibiotic reduction regulations influence the Feed Phytobiotics Market?

Stringent global regulations, particularly the phase-out of routine prophylactic antibiotic use in livestock, serve as the primary growth driver for the market. These mandates necessitate effective, natural substitutes for maintaining animal health and productivity, directly increasing the adoption and demand for validated phytobiotic solutions across all major livestock segments.

Which type of livestock segment is the largest consumer of feed phytobiotics?

The poultry segment (including broilers and layers) is the largest consumer globally. This dominance is attributed to the high volume of intensive poultry production, short production cycles, and the critical need for effective natural solutions to manage enteric diseases and optimize feed conversion efficiency rapidly.

What technological advancements are critical for improving phytobiotic efficacy?

Key technological advancements include microencapsulation and targeted delivery systems, which protect volatile active compounds from degradation during feed processing and ensure their controlled release specifically within the intestines. Advanced standardized extraction techniques (like SFE) are also vital for maintaining consistent potency and quality.

Why is the Asia Pacific region expected to show the fastest market growth?

APAC's rapid growth is driven by the vast expansion and industrialization of its livestock sector, coupled with the recent adoption of stringent government policies restricting or banning AGP use in major production economies like China, accelerating the shift toward natural, performance-enhancing feed additives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager