Feeder And Distribution Pillar Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435536 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Feeder And Distribution Pillar Market Size

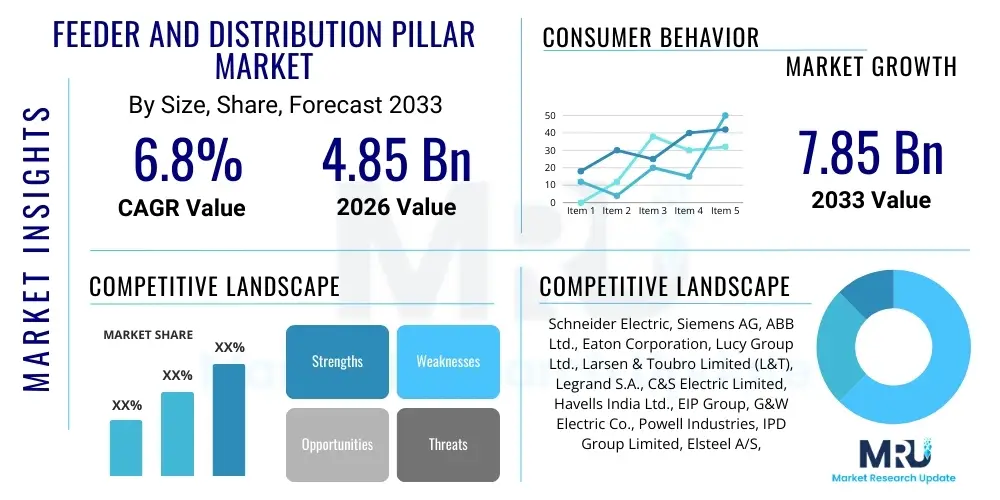

The Feeder And Distribution Pillar Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.85 Billion in 2026 and is projected to reach USD 7.85 Billion by the end of the forecast period in 2033.

Feeder And Distribution Pillar Market introduction

The Feeder and Distribution Pillar Market encompasses specialized electrical enclosures designed for the safe, robust, and centralized termination, connection, and protection of low and medium voltage power distribution cables. These pillars, often referred to as feeder pillars or street cabinets, serve as critical interface points between the primary distribution network (substations or main feeders) and the secondary consumption points (residential areas, commercial establishments, or industrial facilities). Their primary function is to facilitate effective load management, provide fuse protection against overcurrents, and offer easy access for maintenance and isolation purposes, thereby minimizing downtime and ensuring network stability. The reliability and durability of these units are paramount, requiring construction from materials such as galvanized steel, stainless steel, or composites that offer high resistance to environmental factors, vandalism, and corrosion.

Major applications for feeder and distribution pillars span across urban and rural infrastructure development projects, including street lighting systems, housing estates, shopping centers, and industrial parks. These devices are integral to smart grid initiatives, allowing for modular expansion and integration of advanced monitoring and control technologies. The benefits derived from utilizing standardized distribution pillars include enhanced safety for utility workers and the public due to fully enclosed conductors, simplified installation processes compared to underground jointing, and superior aesthetic integration into modern urban landscapes. Furthermore, their modular design allows utility providers to quickly adapt to changing load requirements or facilitate repairs without widespread service interruptions, thereby improving overall system resilience and operational efficiency.

The market expansion is fundamentally driven by global trends in urbanization, massive investment in upgrading aging electrical infrastructure across developed nations, and rapid electrification programs in emerging economies. Specifically, the escalating demand for reliable electricity supply to support burgeoning data centers, electric vehicle (EV) charging infrastructure, and smart city projects mandates the deployment of high-capacity and technologically advanced distribution pillars. Regulatory mandates promoting electrical safety standards (such as IEC and IEEE) further necessitate the replacement of outdated switchgear with modern, compliant distribution enclosures. This convergence of infrastructure spending and technological mandates establishes a robust foundation for sustained market growth throughout the forecast period.

Feeder And Distribution Pillar Market Executive Summary

The global Feeder and Distribution Pillar Market is experiencing significant upward momentum, largely propelled by synchronized global investments in grid modernization and renewable energy integration. Key business trends indicate a shift towards modular and customizable pillar designs that can accommodate integrated smart sensors, remote monitoring units, and advanced metering infrastructure (AMI), catering specifically to the requirements of digital utilities. Mergers and acquisitions focused on consolidating manufacturing capabilities and expanding geographical reach are defining the competitive landscape, with major players emphasizing materials innovation, such as utilizing corrosion-resistant polymer composites to reduce lifecycle costs and maintenance burdens. This transition reflects a demand for low-maintenance, high-reliability distribution components capable of operating effectively in harsh environmental conditions, thereby driving product innovation and specialization across the value chain.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by unprecedented infrastructure development in countries like China, India, and Southeast Asia, coupled with ambitious government initiatives aimed at universal electrification. North America and Europe are characterized by investments in grid resilience and smart grid deployment, replacing legacy infrastructure with sophisticated distribution pillars equipped for bidirectional power flow necessary for distributed energy resources (DERs). Trends in these developed regions also focus on standardizing low-voltage distribution architecture to support rapid deployment of EV charging networks, pushing demand for compact, highly rated feeder pillars. Conversely, Latin America and the Middle East and Africa (MEA) present burgeoning opportunities driven by rapid urbanization and the establishment of new utility-scale power projects, requiring substantial deployment of robust power distribution infrastructure.

Segment trends reveal that the Low Voltage (LV) feeder pillar segment maintains the largest market share due to its ubiquitous application in secondary distribution networks, directly serving end-users. However, the Medium Voltage (MV) segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by increasing complexity in sub-transmission networks and the demand for higher power handling capacities in industrial and large commercial installations. Application-wise, the Utilities segment remains dominant, as they are the primary purchasers for grid maintenance and expansion. The Industrial and Commercial segments are also expanding rapidly, spurred by increasing industrialization and the construction of massive commercial complexes that require dedicated and highly protected power distribution points, emphasizing safety and operational reliability as key purchasing criteria.

AI Impact Analysis on Feeder And Distribution Pillar Market

Common user questions regarding AI's impact on the Feeder and Distribution Pillar market revolve around predictive maintenance capabilities, optimal asset placement, and enhanced security monitoring. Users are primarily concerned with how AI can transform these passive physical assets into intelligent nodal points within a smart grid. They seek validation on the feasibility of using machine learning (ML) algorithms to analyze data from integrated smart sensors—such as temperature, current load, and vibration—to predict potential failures before they occur, thus moving from reactive to prescriptive maintenance schedules. Another recurring theme is the expectation that AI can optimize the geographical distribution and sizing of these pillars based on real-time load forecasting and demographic changes, leading to significant capital expenditure savings and improved service reliability. Consequently, users anticipate that future generations of feeder pillars will be factory-equipped with AI-ready hardware capable of real-time data processing and secure communication.

The integration of AI directly influences the design parameters of feeder and distribution pillars, necessitating the inclusion of highly secure, robust communication modules (often 5G-enabled) and edge computing capabilities within the enclosure. AI algorithms are crucial for analyzing the vast datasets generated by smart grid components connected through these pillars, enabling advanced fault detection and isolation. For instance, ML models can differentiate between transient faults and sustained anomalies, allowing grid operators to automatically reconfigure power flow pathways through adjacent pillars, significantly reducing outage times. This shift transforms the distribution pillar from a static protective housing into a dynamic, data-generating node essential for grid optimization and self-healing functionality.

Furthermore, AI-driven asset management is revolutionizing inventory management and component lifecycle tracking. By monitoring environmental stress indicators and operational metrics via installed sensors, ML models can accurately predict the Remaining Useful Life (RUL) of internal components like fuses and circuit breakers, ensuring proactive replacement scheduling. This reduces operational expenditure (OPEX) and extends the useful service life of the distribution infrastructure. The application of AI in analyzing aerial imagery and environmental data also assists in determining the ideal material specifications and protection ratings required for pillars deployed in extreme or challenging climates, enhancing product durability and lowering risk exposure for utility companies and maximizing the longevity of the infrastructure investment.

- AI enhances predictive maintenance by analyzing sensor data (temperature, load) to forecast component failure.

- Optimizes pillar placement and sizing based on real-time load forecasting and geographical constraints.

- Facilitates self-healing grids by using ML algorithms for rapid fault detection and automatic network reconfiguration.

- Requires integration of robust communication modules (IoT/5G) and edge computing hardware within the pillar structure.

- Improves asset security through pattern recognition, detecting unauthorized access or tampering attempts immediately.

- Drives demand for standardized, modular internal architecture compatible with diverse smart sensors and monitoring equipment.

- Aids in compliance monitoring by logging and analyzing power quality metrics and consumption patterns automatically.

DRO & Impact Forces Of Feeder And Distribution Pillar Market

The Feeder and Distribution Pillar Market is shaped by a powerful matrix of Drivers, Restraints, and Opportunities (DRO), all subject to significant Impact Forces stemming from technological and regulatory shifts. Primary drivers include rapid global urbanization and the resultant need for sophisticated municipal power infrastructure, coupled with stringent governmental mandates globally requiring utilities to enhance grid reliability and safety standards. The massive influx of capital into renewable energy projects, particularly distributed solar and wind generation, necessitates bi-directional power management capabilities, fundamentally requiring advanced distribution pillars to interface these new sources with existing grids. These forces collectively create a sustained, non-cyclical demand for modern distribution components.

Restraints, however, temper the market growth. High initial investment costs associated with upgrading older infrastructure, especially replacing concrete kiosks with advanced metal-clad or composite distribution pillars, can delay adoption in price-sensitive markets. Furthermore, the complexity of regulatory approval processes, which vary significantly across different regions and municipal bodies, often creates project backlogs and extended deployment timelines for utility providers. Skilled labor shortages required for the installation, commissioning, and maintenance of modern smart pillars also present an operational bottleneck, potentially hindering the rapid scale-up necessary to meet electrification goals in emerging economies. Manufacturers must address these constraints through cost-optimization in production and standardized, easy-to-install designs.

Opportunities in this market are significant and primarily centered around technological integration and geographic expansion. The proliferation of smart city projects worldwide offers a greenfield opportunity for integrating highly sophisticated, IoT-enabled distribution pillars that manage street lighting, EV charging, and public Wi-Fi infrastructure simultaneously. Furthermore, the untapped potential in rural electrification programs across Africa and parts of Asia provides a substantial market for resilient, off-grid or microgrid-compatible distribution pillars. The impact forces accelerating this market are primarily regulatory pressure towards safety compliance and consumer demand for uninterrupted, high-quality power supply, forcing utility companies to prioritize investments in reliable, low-failure distribution components like advanced feeder pillars. Cybersecurity threats also function as a force, driving innovation toward physically and digitally hardened enclosures.

Segmentation Analysis

The Feeder and Distribution Pillar Market is systematically segmented primarily by Voltage Type, Material Type, and End-User Application, reflecting the diverse requirements of modern power distribution networks across geographies. Analyzing these segments provides strategic insights into the market dynamics, identifying areas of rapid growth and stabilization. The technical segmentation by Voltage Type—Low Voltage (LV) and Medium Voltage (MV)—is crucial as it dictates the design specifications, safety features, and power handling capacity of the pillars. The material segmentation, including galvanized steel, stainless steel, and composite materials (GRP/SMC), highlights ongoing innovation aimed at improving durability, reducing weight, and enhancing corrosion resistance for specific environments, particularly coastal or chemically active industrial zones.

The End-User Application segmentation provides a clear view of the demand drivers, categorizing consumption into Utilities, Industrial, Commercial, and Residential sectors. Utility companies represent the foundational demand, focusing on large-scale infrastructure projects, standardization, and long lifecycle products. Industrial applications prioritize resilience, high protection ratings, and customized load management features to handle heavy machinery and demanding operational environments. Commercial and residential uses, while demanding lower voltage, focus on aesthetics, compactness, and high safety standards due to their proximity to the public. Understanding this segment mix is vital for manufacturers tailoring their product portfolios to meet specific regulatory and operational needs globally.

Geographically, the market is dissected into key regions—North America, Europe, Asia Pacific, Latin America, and Middle East & Africa—where consumption patterns, regulatory landscapes, and infrastructure investment cycles vary significantly. APAC leads due to robust new construction and electrification initiatives, while North America and Europe emphasize replacement cycles and smart grid technology integration. This multi-faceted segmentation structure allows stakeholders to precisely identify lucrative niche markets, such as the growing demand for highly secure composite pillars in underground distribution networks or the specialized requirements for MV pillars in renewable energy substations, thus enabling targeted product development and marketing strategies that maximize market penetration and revenue capture.

- Voltage Type

- Low Voltage (LV) Feeder Pillars (Dominant segment, used for secondary distribution and final consumer interface)

- Medium Voltage (MV) Distribution Pillars (Higher growth segment, used in industrial zones and specialized grid architecture)

- Material Type

- Galvanized Steel

- Stainless Steel (Preferred in corrosive environments)

- Composite Materials (GRP/SMC/Polyester) (Lightweight and highly corrosion resistant)

- End-User Application

- Utilities and Government (Largest segment, grid expansion and maintenance)

- Industrial (Heavy-duty protection and high load capacity required)

- Commercial (Shopping centers, offices, infrastructure)

- Residential (Housing estates and local distribution)

- Mounting Type

- Ground Mounted

- Wall Mounted

Value Chain Analysis For Feeder And Distribution Pillar Market

The Value Chain for the Feeder and Distribution Pillar Market commences with the procurement of critical raw materials, primarily specialized metals (steel, aluminum), insulation materials, and electronic components (fuses, switchgear, monitoring devices). Upstream analysis reveals that raw material costs, particularly steel and copper, significantly influence the final product price. Key strategic activities at this stage include negotiating long-term supply contracts and implementing advanced inventory management to mitigate commodity price volatility. Manufacturers who integrate vertically by owning fabrication facilities gain a substantial cost and quality control advantage. The design and engineering phase, situated mid-chain, is pivotal, focusing on compliance with international safety standards (e.g., IP ratings, short-circuit withstand capabilities) and incorporating modular designs to facilitate easy customization and integration of smart components demanded by modern utilities.

Manufacturing and assembly constitute the core of the value chain, involving precision cutting, welding, surface treatment (e.g., galvanization, powder coating), and the integration of internal switchgear components. This stage demands stringent quality control and automated processes to ensure high-tolerance enclosures that withstand harsh external conditions for decades. Distribution channels are typically multi-layered, relying heavily on both direct and indirect sales models. Direct sales are often preferred for large utility tenders or customized industrial projects, ensuring direct technical consultation and project management. Conversely, indirect channels, involving authorized distributors, wholesalers, and electrical contractors, are crucial for reaching smaller commercial and residential installation markets, providing necessary localized stock and installation support.

The downstream segments focus on installation, commissioning, and aftermarket services. Installation is highly specialized, requiring certified electrical contractors to ensure proper grounding and connection to the main grid. Aftermarket support, including spare parts supply, maintenance contracts, and system upgrades (especially for smart components), contributes significantly to long-term revenue streams and customer loyalty. The increasing complexity of integrated electronics is elevating the importance of technical support and remote diagnostics. Effective collaboration across the value chain—from steel suppliers guaranteeing consistent material quality to distributors offering reliable logistics—is essential for maintaining market competitiveness and delivering resilient, certified distribution infrastructure to end-users globally, optimizing the total cost of ownership (TCO) for the utility sector.

Feeder And Distribution Pillar Market Potential Customers

The potential customer base for Feeder and Distribution Pillars is broad and critically linked to large-scale infrastructure spending and maintenance cycles, placing utility companies at the forefront. National and regional Power Utility Providers (PUPS), including transmission and distribution operators, constitute the largest segment of end-users. Their demand is driven by ongoing network expansion, mandatory replacement of aging assets (which often exceed 30 years of service life), and grid hardening initiatives designed to withstand extreme weather events. These entities typically procure large volumes through structured, long-term procurement tenders, prioritizing product longevity, compliance with national standards, and the capability for smart grid integration. Reliability and proven service history are paramount buying criteria for this customer group.

Beyond utilities, the Industrial sector represents a significant potential customer group, encompassing manufacturers, oil and gas facilities, data centers, and large processing plants. These customers require highly robust distribution pillars capable of handling substantial, often fluctuating, power loads with enhanced fault protection mechanisms and superior ingress protection (IP ratings). Their procurement decisions are often influenced by specific operational safety requirements and the need for customized solutions that integrate seamlessly with internal factory floor power management systems. Data centers, in particular, are driving demand for high-capacity MV pillars due to their exponential power requirements and zero-tolerance policies for downtime, making redundancy and rapid isolation capabilities crucial buying factors.

The Commercial and Residential segments form the remainder of the customer landscape. Commercial customers, including real estate developers building shopping malls, high-rise office towers, and airport complexes, require aesthetic yet functional distribution solutions that often need to be integrated into restricted urban spaces. Residential developers, particularly in large housing projects and smart city developments, drive demand for standard LV feeder pillars focusing on cost-efficiency, safety, and ease of maintenance. Municipal bodies and Public Works departments also act as potential customers for distribution pillars used in public infrastructure like street lighting circuits, water treatment facilities, and public transport networks, prioritizing pillars with high durability against vandalism and severe weather conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.85 Billion |

| Market Forecast in 2033 | USD 7.85 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schneider Electric, Siemens AG, ABB Ltd., Eaton Corporation, Lucy Group Ltd., Larsen & Toubro Limited (L&T), Legrand S.A., C&S Electric Limited, Havells India Ltd., EIP Group, G&W Electric Co., Powell Industries, IPD Group Limited, Elsteel A/S, Rittal GmbH & Co. KG, WEG S.A., Hitachi Energy, Hubbell Incorporated, Federal Pacific, Enclosures & Systems (ECS) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Feeder And Distribution Pillar Market Key Technology Landscape

The technological landscape of the Feeder and Distribution Pillar Market is rapidly evolving from simple enclosure technology to sophisticated integrated smart platforms, driven by the necessities of the modern smart grid. A core technological shift involves the integration of advanced Remote Terminal Units (RTUs) and Supervisory Control and Data Acquisition (SCADA) systems directly within the pillar structure. These integrated monitoring systems allow utility operators to remotely observe critical operational parameters such as voltage levels, current load, power factor, and harmonic distortion in real-time. This capability significantly reduces the need for manual site inspections, improves data fidelity for network planning, and, most importantly, allows for immediate isolation and diagnosis of faults, thereby drastically reducing Customer Average Interruption Duration Index (CAIDI) scores.

Material innovation represents another vital technological domain. The shift towards non-metallic enclosures, specifically those utilizing Glass Reinforced Polyester (GRP) or Sheet Moulding Compound (SMC) composites, is gaining traction. These composite materials offer superior performance characteristics over traditional steel, including inherent corrosion resistance, reduced weight for easier transportation and installation, and non-conductive properties that enhance safety. Furthermore, manufacturers are employing advanced anti-vandalism technologies, such as enhanced locking mechanisms and impact-resistant coatings, ensuring the physical integrity of the enclosed switchgear and electronics in publicly accessible areas. This technological evolution ensures that the physical infrastructure component remains relevant and reliable in challenging operational environments, extending the maintenance cycle significantly.

The most transformative technology permeating this market is the embedding of Internet of Things (IoT) sensors and edge computing capabilities, facilitating Generative Engine Optimization (GEO) in grid operations. These smart pillars act as data aggregation points for Distributed Energy Resources (DERs) like solar PV and EV charging stations. Technologies such as high-speed, secure communication protocols (e.g., LoRaWAN, 5G cellular) are essential for securely transmitting aggregated data back to the central control systems or cloud platforms for AI-driven analysis. Furthermore, advanced metering technologies, including smart meters integrated at the pillar level, allow for granular monitoring of consumption and generation, enabling better load balancing and demand response programs, ultimately making the entire distribution network more resilient, flexible, and capable of handling complex bi-directional power flows inherent to future decentralized energy systems.

Regional Highlights

- Asia Pacific (APAC)

The Asia Pacific region currently dominates the global Feeder and Distribution Pillar Market and is forecasted to maintain the highest growth rate during the projection period. This growth is predominantly fueled by high-intensity infrastructure investment across populous nations such as India, China, and Indonesia. Rapid urbanization is leading to the swift development of new residential complexes, commercial hubs, and industrial zones, all requiring foundational electrical distribution infrastructure. Government initiatives like India's ambitious "Power for All" program and China's continuous upgrades to its national grid drive substantial demand. Furthermore, the massive integration of renewable energy sources, especially solar farms, requires new substations and feeder pillars capable of handling large-scale energy injection into the medium and low voltage networks. The competitive landscape in APAC is characterized by a strong presence of both global leaders and robust local manufacturers who specialize in cost-effective, high-volume production tailored to varying environmental conditions.

However, the APAC market presents heterogeneity in terms of regulatory standards and procurement practices. While developed economies like Japan and South Korea focus on replacing aging assets with high-technology, smart pillars, emerging markets prioritize basic reliability and cost-efficiency. This creates a multi-tiered market requiring localized product strategies. Significant opportunities exist in Southeast Asia, where rapid industrialization and commercial expansion are creating new centers of demand for reliable power distribution solutions. Investment in smart city projects across the region is also accelerating the demand for pillars equipped with integrated sensors and advanced communication capabilities, transitioning these countries toward intelligent distribution architectures and moving past basic protective enclosures.

- North America

North America is a mature market characterized primarily by replacement demand and significant regulatory emphasis on grid resilience and security. The driving factor is the necessity to upgrade decades-old infrastructure to better withstand severe weather events, a trend intensified by climate change risks. The region is seeing substantial investment under utility modernization plans aimed at deploying smart grid components. Distribution pillars here often integrate advanced technology such as fault circuit indicators, surge protection devices, and extensive remote monitoring capabilities. The rapid deployment of Electric Vehicle (EV) charging infrastructure is also a key growth catalyst, necessitating robust and high-capacity LV distribution pillars to manage the concentrated electrical loads in dense urban areas and along major transport corridors.

The market is highly regulated, demanding compliance with strict NEMA and UL standards, which often leads to higher manufacturing costs but guarantees superior quality and safety. Competition is intense, with established global and domestic players focusing on niche specialization, such as highly customized solutions for specific industrial clients or underground distribution networks. Canada’s market often mirrors U.S. trends but with added considerations for extreme cold weather performance, driving innovation in material composites and heating elements. The focus remains on enhancing the intelligence of the distribution network, ensuring minimal latency in data transmission, and bolstering cybersecurity measures within the pillar's control unit, reflecting the maturity and complexity of the regional power grid.

- Europe

Europe’s Feeder and Distribution Pillar Market is driven by the European Union’s ambitious energy transition goals, focusing on decarbonization and the integration of substantial distributed renewable energy sources. This requires a complete overhaul of distribution networks to manage bi-directional power flow effectively. European utilities are highly focused on standardized, highly efficient, and environmentally friendly solutions, often preferring non-metallic or low-carbon footprint materials. Strict safety regulations (IEC standards) and a strong push toward underground cabling in many urban centers necessitate distribution pillars designed for restricted access and high environmental protection ratings.

Key growth areas include Germany, France, and the UK, which are actively investing in smart meter rollouts and local grid optimization projects. The market is also heavily influenced by the adoption of microgrids, particularly in industrial parks and remote communities, requiring specialized MV distribution pillars that can manage islanded operations. Sustainability is a critical procurement factor; thus, manufacturers offering pillars with long service lives, low maintenance requirements, and readily recyclable components hold a significant competitive edge. The implementation of smart street lighting systems across major European cities also contributes substantially to the demand for compact, highly integrated LV feeder pillars.

- Latin America (LATAM)

The Latin American market is characterized by varying levels of maturity, with Brazil and Mexico leading in terms of power sector investment. Market growth is primarily driven by expansion into underserved areas and necessary upgrades to stabilize often unreliable existing grids. Challenges include complex political environments and economic volatility, which can lead to delayed infrastructure projects. However, the consistent need to modernize electricity networks to support industrial expansion, particularly in mining and manufacturing sectors, sustains demand for robust feeder pillars.

- Middle East and Africa (MEA)

The MEA region is witnessing high growth, spurred by massive greenfield infrastructure projects, especially in the Gulf Cooperation Council (GCC) countries. These markets prioritize high ingress protection (IP) ratings and durable materials (often stainless steel) to withstand extreme heat, dust, and corrosive coastal conditions. Africa’s demand is largely driven by rapid electrification efforts, particularly in sub-Saharan Africa, focusing on low-cost, resilient, and easily deployable distribution solutions for rural and peri-urban areas. Oil and gas infrastructure development also provides steady demand for high-specification industrial distribution pillars throughout the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Feeder And Distribution Pillar Market.- Schneider Electric

- Siemens AG

- ABB Ltd.

- Eaton Corporation

- Lucy Group Ltd.

- Larsen & Toubro Limited (L&T)

- Legrand S.A.

- C&S Electric Limited

- Havells India Ltd.

- EIP Group

- G&W Electric Co.

- Powell Industries

- IPD Group Limited

- Elsteel A/S

- Rittal GmbH & Co. KG

- WEG S.A.

- Hitachi Energy

- Hubbell Incorporated

- Federal Pacific

- Enclosures & Systems (ECS)

Frequently Asked Questions

Analyze common user questions about the Feeder And Distribution Pillar market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected CAGR for the Feeder and Distribution Pillar Market?

The Feeder and Distribution Pillar Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033, driven primarily by global smart grid investments and infrastructure modernization projects worldwide.

Which material type is seeing the highest growth in the distribution pillar market?

Composite materials, such as GRP and SMC, are experiencing high growth due to their superior corrosion resistance, lightweight properties, and enhanced durability compared to traditional galvanized steel, making them ideal for coastal and high-stress industrial environments.

How does AI technology affect the operational efficiency of feeder pillars?

AI integrates with smart sensors within feeder pillars to enable predictive maintenance, real-time load balancing, and rapid fault isolation. This optimization reduces unscheduled downtime, lowers operational expenditure, and transforms the pillar into an intelligent node for grid management.

Which region currently leads the global demand for Feeder and Distribution Pillars?

The Asia Pacific (APAC) region currently holds the largest market share, fueled by massive government-backed electrification schemes, rapid urbanization, and high-volume infrastructure development across key emerging economies like China and India.

What are the primary applications of Medium Voltage (MV) distribution pillars?

Medium Voltage distribution pillars are primarily utilized in large-scale industrial complexes, centralized commercial power distribution systems, dedicated renewable energy substations, and major utility sub-transmission networks where higher power handling capacity and robust protection are essential.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager