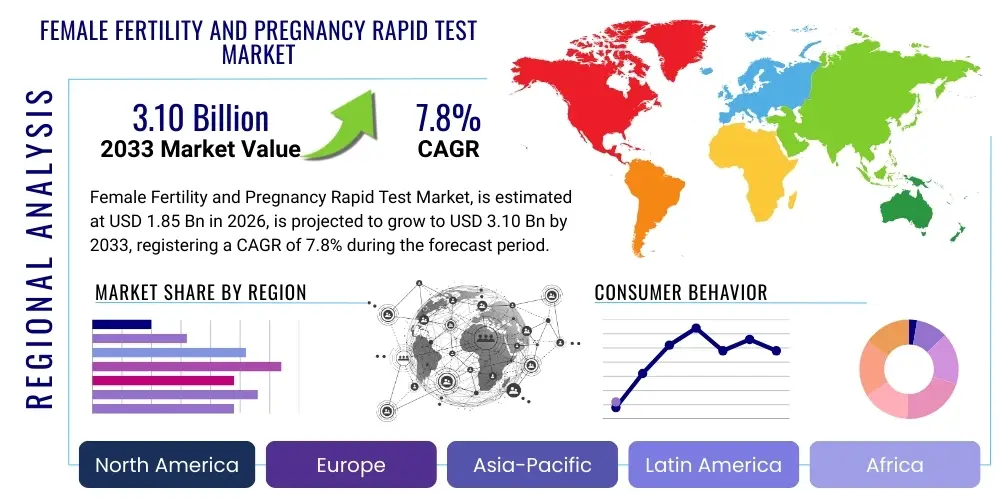

Female Fertility and Pregnancy Rapid Test Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437151 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Female Fertility and Pregnancy Rapid Test Market Size

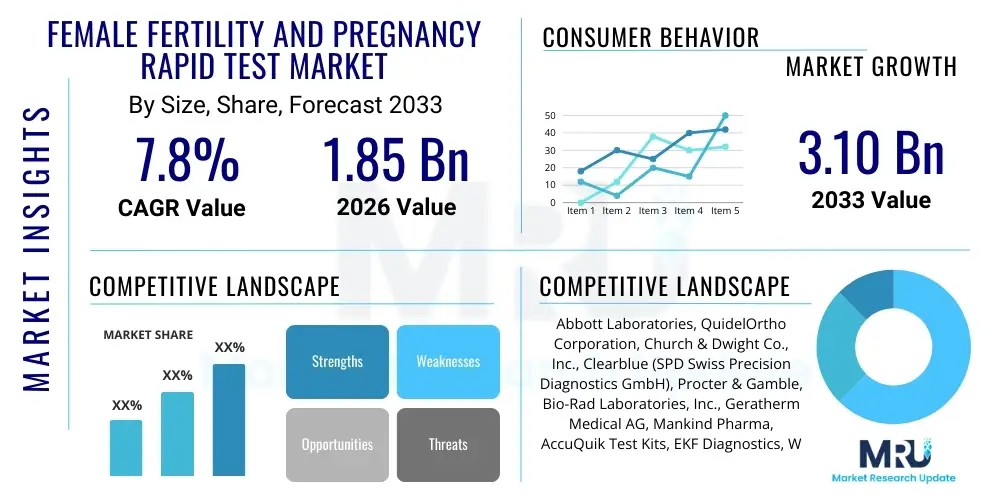

The Female Fertility and Pregnancy Rapid Test Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 3.10 Billion by the end of the forecast period in 2033.

Female Fertility and Pregnancy Rapid Test Market introduction

The Female Fertility and Pregnancy Rapid Test Market encompasses a range of diagnostic tools designed for quick and convenient detection of hormones associated with fertility tracking (such as Luteinizing Hormone or LH) and pregnancy confirmation (Human Chorionic Gonadotropin or hCG). These tests utilize immunochromatographic assays, offering high specificity and sensitivity in an over-the-counter (OTC) format, enabling women to manage their reproductive health discreetly and effectively from home. The simplicity, speed, and affordability of these rapid tests are crucial factors driving their widespread adoption globally, offering actionable insights without requiring immediate clinical intervention.

Major applications of these rapid tests include ovulation tracking for conception planning, early and reliable detection of pregnancy, and monitoring hormone levels related to menstrual cycles. The market is broadly segmented by product type, focusing on pregnancy test kits (strips, midstream devices, and digital readers) and fertility/ovulation predictor kits (OPKs). Advancements in digital integration and connectivity are enhancing the utility of these tests, allowing for data logging and personalized feedback via smartphone applications, thereby improving accuracy and user experience.

The market growth is primarily driven by increasing awareness regarding self-health management, rising average maternal age globally leading to increased fertility concerns, and the convenience offered by at-home testing solutions. Furthermore, continuous product innovation, particularly the development of high-sensitivity tests and connected digital devices, contributes significantly to market expansion. The high prevalence of infertility worldwide and shifting societal norms favoring planned pregnancies underscore the critical importance and expanding market opportunity for these accessible diagnostic tools.

Female Fertility and Pregnancy Rapid Test Market Executive Summary

The Female Fertility and Pregnancy Rapid Test Market is experiencing robust expansion, fundamentally driven by shifts in consumer preference toward self-testing and the maturation of diagnostic technologies. Business trends indicate a strong focus on merger and acquisition activities among key players aiming to consolidate market share and integrate complementary digital health platforms, thereby offering end-to-end reproductive health solutions. Furthermore, the push for increased test sensitivity and the development of predictive fertility tracking algorithms through digital OPKs represent significant strategic moves by market leaders to differentiate their product offerings in a highly competitive landscape.

Regionally, North America and Europe maintain dominance due to high disposable income, established regulatory frameworks, and high awareness levels regarding reproductive health monitoring. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by substantial population growth, improving healthcare infrastructure, and aggressive marketing campaigns targeting emerging middle-class consumers in countries like China and India. Local manufacturers in APAC are increasingly developing cost-effective alternatives, intensifying competitive dynamics, and driving volume growth across the region.

Segment trends highlight the digital pregnancy and fertility tests segment as the fastest growing, reflecting consumer demand for clear, unambiguous results and data connectivity. In terms of end-users, the direct-to-consumer channel, facilitated by e-commerce platforms and retail pharmacy distribution, remains the primary growth catalyst, providing consumers with unparalleled accessibility and privacy. Technology-wise, lateral flow assays still dominate the volume, but microfluidic technology integration is beginning to appear in premium, next-generation tests, promising enhanced accuracy and multiplexing capabilities for simultaneous hormone analysis.

AI Impact Analysis on Female Fertility and Pregnancy Rapid Test Market

User queries regarding AI's influence in the rapid test market frequently revolve around its ability to enhance predictive accuracy, automate result interpretation, and integrate data from various sources (wearable technology, rapid test results, cycle tracking) into a unified, actionable profile. Key user concerns focus on data privacy when utilizing AI-driven fertility apps and the clinical validation of algorithms used to predict ovulation windows or potential fertility issues based on hormonal trends detected by rapid tests. There is a high expectation that AI will transition these rapid tests from simple diagnostic confirmations to sophisticated, personalized, and preventative reproductive health management tools, offering timely alerts and tailored recommendations.

The deployment of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is transforming the utility of rapid tests, especially in the context of ovulation prediction kits (OPKs). AI algorithms analyze historical cycle data combined with real-time hormone readings (derived from digital test inputs) to improve the precision of the fertile window identification beyond what traditional threshold detection offers. This enhanced predictive capability reduces the time-to-conception for users and increases the overall efficacy perception of rapid testing devices. Furthermore, AI platforms are being utilized for quality control and manufacturing optimization within production facilities, ensuring the consistency and reliability of the test strips themselves, leading to higher consumer trust.

AI also plays a critical role in customer support and data interpretation post-purchase. Many leading fertility app platforms utilize natural language processing (NLP) to analyze user input and provide automated, contextual advice regarding test result interpretation, troubleshooting, or optimal testing schedules. This shift moves the market from selling a standalone physical product to selling a comprehensive, data-driven reproductive health service package, which significantly enhances customer loyalty and recurring revenue streams for manufacturers who successfully integrate these digital components.

- AI-driven interpretation minimizes human error in reading faint lines or complex results.

- Machine Learning enhances personalized fertility prediction by analyzing trend data across multiple cycles.

- NLP integration facilitates immediate, contextual customer support and product guidance.

- AI optimizes manufacturing processes, improving consistency and reducing batch failure rates.

- Development of proprietary algorithms creates high barriers to entry for competitors.

- Enables seamless integration of rapid test data with electronic health records (EHRs) for telemedicine applications.

DRO & Impact Forces Of Female Fertility and Pregnancy Rapid Test Market

The market is primarily driven by escalating consumer interest in convenient home diagnostics, supported by technological advancements improving test accuracy and digital integration. Restraints include regulatory scrutiny over high-sensitivity claims and inherent limitations of lateral flow technology in quantitative analysis. Opportunities lie in expanding into remote and underserved areas, developing multiplex testing capabilities (e.g., testing for multiple hormones simultaneously), and leveraging telemedicine platforms for consultation following test results. These forces collectively shape the market trajectory, emphasizing accessibility, technological innovation, and trust in rapid diagnostic outputs.

Drivers: A significant driver is the global increase in planned pregnancies and the corresponding delay in childbearing, which necessitates precise fertility monitoring. Furthermore, the affordability and non-invasiveness of rapid tests compared to clinical laboratory diagnostics make them the preferred first-line screening tool. The enhanced retail accessibility through e-commerce platforms, coupled with increasing public health campaigns promoting reproductive health awareness, has dramatically expanded the user base. Moreover, continuous innovation, such as the transition from qualitative visual readout to quantitative digital results, offers tangible value to the consumer, strengthening market demand.

Restraints: Key restraints include consumer skepticism regarding the absolute accuracy of at-home tests, which can sometimes lead to follow-up clinical visits, negating some of the cost-saving benefits. Variability in user technique, especially regarding sample collection and timing, can lead to false positives or negatives. Additionally, while the market is fragmented, intense price competition, particularly in the standard pregnancy strip segment, pressurizes profit margins for manufacturers, limiting large-scale investment in novel, expensive technologies for rapid testing formats.

Opportunities: Major opportunities exist in developing highly sensitive tests capable of early detection, expanding beyond fertility/pregnancy to areas like menopause monitoring or specific hormonal disorder screening using the rapid test format. The underserved market segment of fertility awareness in developing economies presents a significant untapped revenue stream. Furthermore, strategic partnerships between rapid test manufacturers and digital health companies to offer subscription-based testing services integrated with professional medical advice represent a key future growth avenue.

- Drivers:

- Increasing global acceptance of at-home testing and self-diagnosis.

- Rising average maternal age and associated fertility monitoring needs.

- High convenience and rapid results compared to laboratory testing.

- Strong e-commerce penetration enhancing product availability.

- Government and NGO initiatives promoting reproductive health awareness.

- Restraints:

- Risk of user error affecting test accuracy and reliability.

- Lack of quantitative precision compared to centralized lab assays.

- Regulatory hurdles regarding marketing claims and product standardization across diverse regions.

- Intense price competition, particularly in generic test formats.

- Opportunities:

- Integration with connected health ecosystems and smart devices.

- Development of multiplex rapid tests for comprehensive hormonal profiling.

- Geographic expansion into high-growth, underserved emerging markets.

- Targeting niche segments such as menopausal transition testing and specific hormone imbalance screening.

- Impact Forces:

- Technological Sophistication: Constant pressure to integrate digital features and increase chemical sensitivity.

- Regulatory Landscape: Strict oversight, especially in North America and Europe, influencing product launch timelines.

- Consumer Education: Necessity of clear instructions and robust marketing to build trust in at-home diagnostic capabilities.

Segmentation Analysis

The Female Fertility and Pregnancy Rapid Test Market is comprehensively segmented based on product type, application, technology, and end-user, providing a granular view of consumer preferences and market dynamics. Understanding these segments is crucial for strategic market positioning, enabling manufacturers to tailor product development and distribution strategies to meet specific demands, such as the growing preference for digital, connected devices versus traditional test strips. The technology segment is highly dynamic, reflecting the continuous efforts to improve sensitivity and result clarity across various platforms, while the end-user segmentation clearly indicates the dominance of direct consumer purchasing channels.

By product type, the market is bifurcated into Pregnancy Rapid Tests and Ovulation Rapid Tests (Fertility Monitoring Kits). Pregnancy tests, particularly the highly recognized midstream and digital formats, hold the largest revenue share due to their widespread use and critical nature. However, the Ovulation Test segment is experiencing faster growth, driven by couples proactively engaging in family planning and the advent of sophisticated digital ovulation kits that offer enhanced predictive accuracy and cycle tracking features. This differentiation allows companies to capture distinct consumer bases—those seeking confirmation versus those seeking predictive guidance.

The application segmentation largely mirrors the product breakdown but focuses on the intended use: Conception Planning and Pregnancy Detection/Monitoring. The end-user segment is crucial, dominated by Home Care Settings, where the convenience and privacy of self-testing are paramount. Although Clinical Settings (hospitals, clinics) use professional-grade rapid tests, the significant volume and value contribution stem from OTC sales made directly to consumers via retail pharmacies and online stores, which necessitate distinct packaging and marketing strategies focusing on ease of use and emotional trust.

- By Product Type:

- Pregnancy Rapid Tests

- Test Strips/Cassettes

- Midstream Devices

- Digital/Connected Devices

- Ovulation Rapid Tests (OPKs)

- Standard (LH) Strips/Cassettes

- Digital Ovulation Predictor Kits

- Advanced (Estrone-3-Glucuronide - E3G) Monitors

- Pregnancy Rapid Tests

- By Application:

- Fertility/Conception Planning

- Pregnancy Detection and Confirmation

- Hormonal Monitoring

- By Technology:

- Lateral Flow Immunochromatographic Assays (LFIA)

- Digital Immunoassays

- Microfluidic Devices

- By End-User:

- Home Care Settings (Direct-to-Consumer)

- Hospitals and Clinics (Professional Use)

- Fertility Clinics

- By Distribution Channel:

- Retail Pharmacies

- Online Sales/E-commerce Platforms

- Supermarkets/Hypermarkets

Value Chain Analysis For Female Fertility and Pregnancy Rapid Test Market

The value chain for the Female Fertility and Pregnancy Rapid Test Market begins with upstream activities focused on the procurement of critical raw materials, primarily specialized membranes (nitrocellulose), antibodies specific to target hormones (hCG and LH), and plastic components for housing. Suppliers of highly purified biochemicals and specialized paper membranes hold significant influence due to quality requirements. Efficient upstream supply chain management, ensuring stable sourcing and minimizing contamination risks, is essential for maintaining product reliability and cost-effectiveness in the manufacturing phase.

Midstream activities involve R&D, manufacturing, assembly, and quality control. Core manufacturing processes include antibody conjugation, precise dispensing onto the membrane, lamination, cutting, and final assembly into the device casing. Companies specializing in automation and high-throughput production benefit significantly here. The integration of digital components and application development (for connected devices) requires partnerships with specialized software developers, adding complexity and value. Quality assurance, including batch testing for sensitivity and stability, is paramount before release into the distribution network.

Downstream analysis focuses on distribution channels, marketing, and end-user engagement. The primary distribution channels are indirect, utilizing large retail pharmacy chains and increasingly, specialized e-commerce platforms which offer discretion and convenience. Direct sales are minimal, usually restricted to professional-use kits sold to fertility clinics. Effective marketing emphasizes reliability, early detection capability, and ease of use (AEO alignment). Post-sale support, particularly for digital kits involving app troubleshooting and cycle interpretation, closes the loop, building long-term consumer trust and driving repeat purchases.

Female Fertility and Pregnancy Rapid Test Market Potential Customers

The primary customers for Female Fertility and Pregnancy Rapid Tests are individual women and couples actively engaged in family planning or requiring confirmation of pregnancy status. This core demographic spans a wide age range, typically from 18 to 45, and is highly characterized by proactive health management and reliance on accessible, discreet diagnostic tools. These consumers often utilize products multiple times, leading to a subscription-like demand structure for fertility monitoring kits, whereas pregnancy tests are purchased on a needs basis.

A rapidly growing segment of potential customers includes women experiencing difficulties with conception who seek initial self-screening tools before committing to expensive clinical investigations. This group values the predictive accuracy of advanced digital OPKs and the early detection capabilities of high-sensitivity pregnancy tests. Manufacturers must tailor messaging to address the emotional context of this consumer segment, emphasizing reliability and support services integrated with the product.

Secondary customers include healthcare providers, specifically gynecologists, obstetricians, and fertility clinics. While these professionals often rely on laboratory tests for definitive diagnosis, rapid tests are utilized for quick, preliminary confirmation in clinical settings or dispensed to patients for ongoing at-home monitoring. Institutional buyers prioritize bulk purchasing capabilities, clinical validation data, and seamless integration into patient care protocols, focusing on tests certified for professional use rather than standard OTC products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 3.10 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Abbott Laboratories, QuidelOrtho Corporation, Church & Dwight Co., Inc., Clearblue (SPD Swiss Precision Diagnostics GmbH), Procter & Gamble, Bio-Rad Laboratories, Inc., Geratherm Medical AG, Mankind Pharma, AccuQuik Test Kits, EKF Diagnostics, Wondfo Biotech, First Response, Swiss-Tec Diagnostics, Medline Industries, Inc., Guangzhou Wondfo Biotech Co., Ltd., Piramal Enterprises, Alere (Abbott), Diagnostic Automation, Inc., Princeton BioMeditech Corporation, Prega News. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Female Fertility and Pregnancy Rapid Test Market Key Technology Landscape

The Female Fertility and Pregnancy Rapid Test Market is fundamentally built upon Lateral Flow Immunoassay (LFIA) technology, which utilizes capillary action to move a liquid sample across a porous membrane containing immobilized capture reagents. This technology forms the core of both basic test strips and sophisticated midstream devices due to its low cost, rapid result display, and simplicity of use. Recent technological improvements within LFIA focus on enhancing the sensitivity of the capture antibodies to detect lower concentrations of hCG (for early pregnancy detection) and LH (for precise ovulation prediction), moving toward near-quantitative results rather than purely qualitative outputs.

Beyond traditional LFIA, the market is increasingly adopting Digital Immunoassay technology. Digital tests incorporate embedded optics or electrochemical sensors to interpret the visual results of the immunoassay, eliminating user subjectivity and displaying results clearly (e.g., "Pregnant" or "No"). Crucially, digital tests often include integrated microprocessors that can store data, track cycles, and communicate wirelessly with smartphone applications. This technological shift is paramount for AEO, as consumers prioritize unambiguous, reliable results that are easily integrated into their digital health profile.

Furthermore, emerging technologies, particularly Microfluidics, are being explored for next-generation rapid tests. Microfluidic devices allow for the precise handling and mixing of tiny fluid volumes, enabling more complex, multiplexed assays that could potentially measure multiple fertility biomarkers (e.g., LH, FSH, Estrogen) from a single sample simultaneously. While still nascent and generally higher cost, microfluidics holds the promise of delivering laboratory-grade accuracy and quantitative hormone profiling in a portable, rapid format, opening doors for personalized hormone monitoring previously confined to central laboratories.

Regional Highlights

North America holds the largest revenue share in the Female Fertility and Pregnancy Rapid Test Market, primarily driven by high consumer awareness, widespread availability of technologically advanced digital products, and established distribution networks involving major retail and e-commerce giants. The presence of key market players and favorable reimbursement policies for certain fertility-related diagnostic tools further cement its leading position. Consumer willingness to spend on premium, connected health devices, especially sophisticated digital ovulation monitors integrated with companion apps, drives the high market value in this region, particularly within the United States.

Europe represents a mature and stable market, characterized by stringent regulatory standards enforced by bodies such as the European Medicines Agency (EMA), ensuring high product quality and reliability. Demand is strong across Western European nations, fueled by increasing prevalence of late-age pregnancies and proactive family planning. While cost sensitivity is higher compared to North America, the shift towards environmentally friendly and digitally connected testing solutions is gaining momentum, pushing manufacturers to innovate in packaging and data integration services.

The Asia Pacific (APAC) region is forecasted to exhibit the highest CAGR during the forecast period. This accelerated growth is attributed to massive population bases, rising disposable incomes, rapid urbanization, and significant improvements in access to healthcare products via localized retail and extensive online pharmacies. Countries like China and India are experiencing a surge in demand due to increasing reproductive health consciousness and the availability of both international premium brands and robust, cost-effective local alternatives. Investment in localized manufacturing and aggressive e-commerce penetration are defining characteristics of the APAC rapid test market expansion.

- North America (Dominant Market): High adoption of premium, digital rapid tests; strong regulatory framework; robust e-commerce penetration.

- Europe (Mature Market): Focus on regulatory compliance and high-quality standards; increasing demand for non-invasive fertility tracking; strong presence of established global brands.

- Asia Pacific (Fastest Growth): Rapid urbanization and rising disposable income; increasing awareness campaigns; expansion of local manufacturing capabilities; large untapped rural markets.

- Latin America (Emerging Potential): Growing government focus on maternal health; improving healthcare infrastructure; reliance on imported products.

- Middle East & Africa (MEA): Increasing awareness, particularly in urban GCC countries; significant cultural sensitivity necessitating discreet packaging and purchasing options.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Female Fertility and Pregnancy Rapid Test Market.- Abbott Laboratories

- QuidelOrtho Corporation

- Church & Dwight Co., Inc. (First Response)

- Clearblue (SPD Swiss Precision Diagnostics GmbH)

- Procter & Gamble (P&G)

- Bio-Rad Laboratories, Inc.

- Geratherm Medical AG

- Mankind Pharma

- AccuQuik Test Kits

- EKF Diagnostics

- Guangzhou Wondfo Biotech Co., Ltd.

- Swiss-Tec Diagnostics

- Medline Industries, Inc.

- Diagnostic Automation, Inc.

- Princeton BioMeditech Corporation

- Piramal Enterprises (Prega News)

- Dixion Diagnostics

- ACON Laboratories, Inc.

- Merck KGaA

- Roche Diagnostics

Frequently Asked Questions

Analyze common user questions about the Female Fertility and Pregnancy Rapid Test market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the key difference between analog and digital fertility rapid tests?

Analog (strip) tests provide a subjective visual result (lines) based on hormone thresholds, requiring user interpretation. Digital tests incorporate electronic readers to interpret the colorimetric or electrochemical reaction objectively, providing unambiguous text results like "Yes/No" or "High/Low," often integrating data tracking via connected applications, which enhances accuracy and user convenience significantly.

How reliable are at-home pregnancy rapid tests compared to clinical blood tests?

At-home pregnancy rapid tests are highly reliable, often claiming 97-99% accuracy when used correctly, detecting the hCG hormone in urine. However, clinical blood tests are generally more sensitive and can detect pregnancy a few days earlier by measuring the precise quantitative level of hCG in the bloodstream, serving as the gold standard for confirmation.

What technological advancements are driving the growth of the ovulation predictor kit (OPK) segment?

The primary technological advancements include the transition from simple LH detection to combined detection of E3G (Estrogen) and LH for a wider fertile window prediction, the integration of wireless connectivity (Bluetooth) to mobile apps for trend analysis, and the use of AI/ML algorithms to personalize cycle tracking and improve the prediction accuracy beyond standard cycle averages.

Which geographical region offers the highest growth potential for rapid test manufacturers?

The Asia Pacific (APAC) region offers the highest growth potential (CAGR). This is driven by the vast, growing population, increasing awareness of family planning methods, and rapid investment in distribution channels (especially e-commerce), which makes at-home testing solutions widely accessible to the emerging middle class in countries like India and China.

What are the main regulatory challenges faced by new entrants in this market?

New entrants primarily face challenges related to demonstrating rigorous clinical validation and sensitivity claims to regulatory bodies (like the FDA or EMA). Additionally, securing IVD (In Vitro Diagnostic) certification, navigating complex international regulatory heterogeneity, and meeting strict quality manufacturing standards are crucial hurdles to market entry and expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager