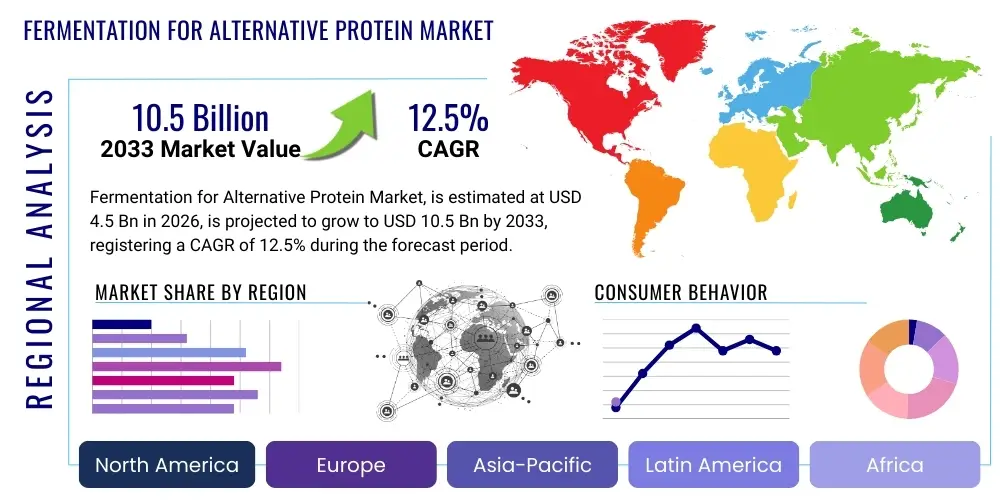

Fermentation for Alternative Protein Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434911 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Fermentation for Alternative Protein Market Size

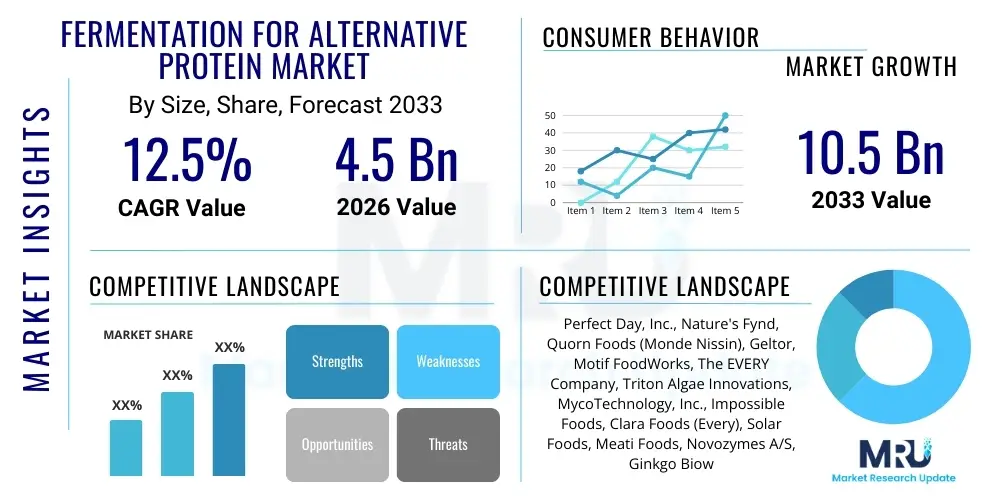

The Fermentation for Alternative Protein Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 10.5 billion by the end of the forecast period in 2033. This substantial growth trajectory is attributed to the increasing global focus on sustainable food systems, technological advancements in bioprocessing, and robust investment in scalable protein production platforms, particularly those leveraging precision fermentation techniques to produce functional and nutritionally superior ingredients.

Fermentation for Alternative Protein Market introduction

The Fermentation for Alternative Protein Market encompasses the utilization of various microbial organisms, including bacteria, yeast, fungi, and microalgae, within controlled environments (bioreactors) to produce proteins and functional ingredients for human consumption and animal feed. This market leverages three primary methodologies: traditional fermentation (enhancing plant-based ingredients), biomass fermentation (producing large quantities of cell mass like mycoprotein), and precision fermentation (engineering microbes to produce specific functional proteins such as casein, whey, or growth factors). These technologies collectively address the urgent global need for scalable, reliable, and environmentally benign protein sources, mitigating the environmental burdens associated with conventional livestock farming and overcoming limitations inherent in first-generation plant-based alternatives.

The core products generated through these fermentation processes span a wide range, from structural protein biomass used in meat analogs and chicken breast alternatives to highly functional dairy proteins and specialty fats used in formulating premium food products. Major applications include dairy-free cheeses, milk substitutes, egg replacements, complex flavor enhancers, and nutrient-dense nutritional supplements. The versatility of fermentation allows for the creation of ingredients that possess superior texture, flavor, and nutritional profiles, often matching or exceeding their animal-derived counterparts, thus appealing to a broader consumer base seeking quality, sustainability, and ethical sourcing.

Key benefits driving market adoption include significantly reduced land and water usage compared to conventional agriculture, enhanced supply chain stability through localized, vertical production, and the ability to tailor protein functionality for specific food applications. Furthermore, the market is profoundly driven by favorable investment climates, substantial research and development in synthetic biology and strain optimization, and increasing consumer awareness regarding climate change and animal welfare. These converging factors solidify fermentation as a critical pillar in the global transition toward a resilient and sustainable protein future, attracting multi-billion-dollar investments globally from venture capital and major food corporations alike.

Fermentation for Alternative Protein Market Executive Summary

The Fermentation for Alternative Protein Market is characterized by rapid technological innovation and significant capital inflow, primarily centered on scaling precision fermentation capabilities for ingredient production. Business trends show a strong shift from product development toward large-scale manufacturing capacity expansion, particularly in North America and Europe, driven by strategic partnerships between biotech startups and established food and ingredient manufacturers. The market is witnessing consolidation among upstream technology providers specializing in strain engineering and downstream processing experts focusing on purification and formulation efficiency. Intellectual property related to optimized microbial strains and novel production pathways is a major competitive battleground, positioning first-movers with robust platform technologies at a significant advantage.

Regionally, North America maintains market leadership, fueled by extensive venture capital funding, a permissive regulatory environment (especially in the US), and a robust ecosystem of synthetic biology expertise. Europe follows closely, driven by stringent sustainability mandates and strong consumer acceptance of plant-based and fermented products, though regulatory pathways for novel foods often present unique challenges. Asia Pacific (APAC) represents the highest potential growth region, spurred by increasing urbanization, rising disposable incomes, and mounting concerns over food security, prompting governments and local companies in countries like Singapore and China to invest heavily in self-sufficient protein production methods, including fermentation for biomass and ingredients.

Segment trends highlight the exceptional growth of precision fermentation, which, while capital-intensive, delivers high-value, functional ingredients critical for replicating complex animal products (e.g., dairy proteins). Biomass fermentation remains crucial for high-volume, cost-effective structural proteins (e.g., mycoprotein), serving as a base for many meat alternative products. The application segment sees the Food industry, particularly the dairy alternatives and baked goods sectors, as the primary consumer of fermentation-derived ingredients, followed by the burgeoning pet food and specialized nutritional sectors seeking sustainable, allergen-reduced protein sources.

AI Impact Analysis on Fermentation for Alternative Protein Market

User queries regarding AI's influence in the Fermentation for Alternative Protein Market frequently revolve around maximizing bioprocess efficiency, accelerating novel strain discovery, and ensuring product consistency at scale. Common themes include how AI can reduce the fermentation cycle time, optimize nutrient media composition for specific microbial hosts, and predict scaling challenges before costly pilot runs. Users are keenly interested in the application of machine learning for phenotype prediction, designing highly efficient genetic circuits for protein expression, and implementing digital twins of bioreactors for precise, real-time control, ultimately seeking assurance that AI can dramatically lower the cost of goods sold (COGS) for precision-fermented proteins, making them competitive with conventional alternatives.

- AI optimizes microbial strain engineering through predictive modeling, significantly shortening the time required for developing high-yield host organisms.

- Machine learning algorithms analyze vast datasets from bioreactor runs to optimize critical parameters like temperature, pH, dissolved oxygen, and feed rates, ensuring maximum titer production.

- Implementation of digital twin technology allows for simulated experimentation and predictive maintenance of fermentation infrastructure, minimizing downtime and energy consumption.

- AI-driven image analysis accelerates high-throughput screening of microbial colonies, identifying superior producers faster than traditional laboratory methods.

- Advanced analytics are used to model supply chain risks and optimize ingredient sourcing, buffering against volatility in raw material costs (e.g., sugars and nutrients).

- Natural Language Processing (NLP) is increasingly deployed to rapidly review and synthesize global scientific literature, guiding R&D strategy toward promising production pathways and novel target proteins.

- AI models predict the sensory properties (flavor, texture, mouthfeel) of fermented protein ingredients, aiding formulation scientists in creating better final consumer products.

DRO & Impact Forces Of Fermentation for Alternative Protein Market

The market trajectory is shaped by a robust set of driving forces centered on sustainability and efficiency, moderated by significant financial and regulatory hurdles, while vast opportunities emerge from technological leapfrogging and market expansion into emerging economies. The fundamental driver remains the need to decouple protein production from environmental degradation, providing a highly scalable method that is not subject to climatic variability or zoonotic disease risks. However, the requirement for massive capital investment in specialized stainless-steel infrastructure (bioreactors) and complex downstream purification processes acts as a major restraint, creating high barriers to entry for smaller players and lengthening the path to profitability for even well-funded startups. Successfully navigating these forces relies on rapid technological iteration, cost reduction through efficient biomanufacturing, and effective communication with consumers and regulators regarding the safety and benefits of these novel proteins.

Key drivers include substantial consumer movement toward flexitarian, vegetarian, and vegan diets, globally mandated sustainability goals, and the inherent efficiency of microbial systems in converting feedstock into high-purity protein ingredients. Furthermore, large multinational food and beverage corporations are actively diversifying their protein portfolios through mergers, acquisitions, and investment in fermentation capacity, viewing it as essential for future growth and risk mitigation. These drivers are amplified by the growing sophistication of precision fermentation, which allows for the exact replication of highly functional animal proteins that traditional plant proteins cannot match, unlocking premium market segments such as functional nutrition and specialized infant formula ingredients.

Restraints are dominated by the high initial capital expenditure (CapEx) needed for large-scale facilities, the operational complexity and energy intensity of industrial fermentation, and, critically, the slow and often fragmented novel food regulatory approval processes across various jurisdictions, particularly in Europe and parts of Asia. Opportunities, conversely, are abundant, encompassing the development of novel microbial hosts optimized for low-cost waste streams (e.g., agricultural byproducts) as feedstocks, the expansion of fermented proteins into functional materials (e.g., biodegradable packaging), and penetration into massive, underserved animal feed markets with sustainable alternatives. The creation of entirely new, proprietary ingredients with unique functionalities also offers a significant opportunity for market differentiation and high-margin profitability.

Segmentation Analysis

The Fermentation for Alternative Protein Market is comprehensively segmented based on the type of fermentation used, the resulting ingredient product, and the final application sector, providing a granular view of market dynamics and growth pockets. Understanding these segments is crucial for stakeholders positioning their technology and investment strategies, particularly distinguishing between volume-based markets (biomass fermentation) and value-based, functional ingredient markets (precision fermentation). The inherent differences in technological complexity, required infrastructure, and regulatory hurdles across these segmentation types necessitate highly specialized operational approaches.

The market is predominantly driven by the technological segmentation, where precision fermentation, utilizing genetically engineered microorganisms to produce specific, non-native proteins, captures the highest investment due to its ability to generate high-value, premium ingredients (e.g., growth factors, functional enzymes, and true dairy proteins). Conversely, biomass fermentation, which focuses on producing the cellular mass itself (e.g., mycoprotein from fungi), commands the largest volume share, serving as the primary structural component for cost-effective meat analogs. This dual segmentation reflects the industry's strategy to address both the premium functional ingredient gap and the high-volume structural protein need simultaneously.

Application analysis demonstrates that the human Food & Beverage sector dominates demand, driven by the need for superior dairy and meat substitutes. However, the emerging Feed segment, particularly aquaculture and pet food, is accelerating rapidly, seeking sustainable, consistent, and highly digestible protein sources to replace traditional fishmeal and soy protein. Geographical segmentation remains vital, with North America leading in innovation and capital deployment, while the Asia Pacific region increasingly dominates in terms of projected future production capacity and consumer volume growth, largely motivated by resource scarcity and increasing population demands for diversified protein sources.

- By Type:

- Biomass Fermentation

- Precision Fermentation

- Traditional Fermentation (Solid-State and Submerged)

- By Ingredient:

- Mycoprotein

- Microalgae Protein

- Recombinant Proteins (Casein, Whey, Ovalbumin)

- Functional Enzymes and Fats

- By Application:

- Food & Beverage (Dairy Alternatives, Meat Substitutes, Baked Goods, Functional Nutrition)

- Animal Feed & Pet Food

- Nutraceuticals

- By Scale:

- Pilot Scale

- Commercial Scale

Value Chain Analysis For Fermentation for Alternative Protein Market

The value chain for fermented alternative proteins is highly intricate, starting with complex biological inputs and ending with specialized consumer products, demanding rigorous control and integration across all stages. The upstream segment is focused on sourcing sustainable, cost-effective carbon and nitrogen feedstocks (e.g., corn steep liquor, molasses, low-cost sugars), alongside specialized activities like microbial strain isolation, selection, and advanced genetic engineering, which form the intellectual property core of the business. Successful upstream performance is critical as feedstock costs and strain performance often dictate the final manufacturing profitability. This stage is dominated by synthetic biology companies and specialty feedstock providers who must ensure consistent quality and scalable supply to meet massive industrial demand.

The midstream segment involves the core bioprocessing activities: large-scale sterile fermentation within highly specialized bioreactors, followed by rigorous downstream processing (DSP), which includes cell harvest, lysis, purification, and drying/stabilization of the final protein product. DSP is particularly challenging and cost-intensive for precision-fermented ingredients, requiring chromatographic separation and advanced filtration to achieve high purity necessary for food applications. This stage requires significant CapEx in bioreactor capacity (50,000L to 300,000L tanks) and expertise in industrial biotechnology, typically managed by dedicated Contract Development and Manufacturing Organizations (CDMOs) or integrated protein manufacturers focused on achieving economies of scale.

The downstream distribution channel involves transporting the processed protein ingredients to Business-to-Business (B2B) customers, primarily large Food & Beverage manufacturers, specialized ingredient distributors, and formulators. Direct distribution often occurs when the fermentation company integrates vertically to launch its own consumer-facing products (Business-to-Consumer, B2C). Indirect channels rely on specialized food ingredient distributors who handle storage, logistics, and sales to smaller manufacturers. Effective cold chain management and robust supply chain transparency are crucial for maintaining ingredient integrity and meeting stringent food safety standards throughout this final stage of the value chain, ensuring the novel products reach the end consumer efficiently.

Fermentation for Alternative Protein Market Potential Customers

The primary customers of fermentation-derived alternative proteins are large-scale industrial buyers seeking high-performance, cost-effective, and sustainable ingredients to replace conventional animal-derived components or to enhance the functionality of plant-based products. These end-users are typically characterized by their massive scale of production and their need for consistent quality, defined functionality (e.g., emulsification, foaming, gelation), and competitive pricing to meet mass-market demands. The ability of fermentation technology to deliver specific protein attributes, such as superior binding in meat analogs or enhanced creaminess in dairy replacements, makes these ingredients indispensable for next-generation food formulation.

Potential customers span across the entire food and nutrition industry, with specialized segments showing increased adoption rates. Ingredient suppliers purchase bulk fermented proteins, often specializing in texturization or flavor enhancement before selling to final manufacturers. Cultivated meat companies utilize precision-fermented growth factors and specialized media components, making fermentation technology a foundational enabler for that nascent sector. Furthermore, major CPG companies are strategically integrating these novel ingredients into their core product lines to meet ambitious Environmental, Social, and Governance (ESG) targets and respond to evolving consumer preferences for transparent and sustainable sourcing.

- Food & Beverage Manufacturers (Tier 1 Global CPG companies)

- Specialized Ingredient Suppliers (focusing on flavor, texture, and nutrition)

- Dairy Alternative Producers (seeking true dairy proteins like casein and whey)

- Cultivated Meat and Seafood Companies (requiring growth factors and scaffolding proteins)

- Pet Food and Aquaculture Feed Producers (seeking sustainable protein alternatives to fishmeal)

- Nutraceutical and Sports Nutrition Companies (requiring highly pure, bioavailable proteins)

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 billion |

| Market Forecast in 2033 | USD 10.5 billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Perfect Day, Inc., Nature's Fynd, Quorn Foods (Monde Nissin), Geltor, Motif FoodWorks, The EVERY Company, Triton Algae Innovations, MycoTechnology, Inc., Impossible Foods, Clara Foods (Every), Solar Foods, Meati Foods, Novozymes A/S, Ginkgo Bioworks, DSM Nutritional Products |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fermentation for Alternative Protein Market Key Technology Landscape

The technological landscape of the fermentation market is highly dynamic, driven by breakthroughs in synthetic biology and process engineering aimed at maximizing efficiency and reducing production costs. Key innovation centers around optimizing the microbial hosts—including yeast (Pichia pastoris, Saccharomyces cerevisiae), filamentous fungi (Fusarium venenatum), and various bacteria—to act as highly efficient "cell factories." Advanced genetic tools like CRISPR/Cas9 are standard practice for engineering these strains, focusing on maximizing protein yield (titer), enhancing stability, and enabling the utilization of inexpensive, non-food-competitive feedstocks. The core challenge is the shift from laboratory-scale yields to industrial-scale profitability, which demands consistent technological improvements in bioprocess control.

Central to large-scale production is the refinement of bioreactor technology and operational protocols. Companies are increasingly adopting continuous fermentation systems (perfusion or chemostat) over traditional batch processes to enhance productivity and reduce operational expenditure. Furthermore, the integration of advanced sensors and data analytics, often leveraging AI and machine learning, is transforming traditional biomanufacturing into Smart Manufacturing. These digital tools enable real-time monitoring and adaptive control of critical process parameters (CPPs), ensuring optimal growth conditions, minimizing contamination risks, and maximizing protein purity and functional performance across multi-thousand-liter vessels.

Another crucial technological focus lies in downstream processing (DSP), which remains a significant cost bottleneck, particularly for highly purified precision-fermented proteins. Innovations in DSP include highly efficient membrane filtration systems (ultrafiltration, diafiltration), scalable chromatography techniques (including continuous chromatography), and novel gentle drying methods (e.g., spray drying or freeze drying) that preserve the native structure and functionality of the sensitive proteins. Success in the competitive market hinges on proprietary, scalable DSP protocols that significantly reduce energy usage and chemical inputs while delivering a food-grade ingredient with impeccable sensory attributes, pushing the boundaries of traditional biochemical engineering toward industrialized food production standards.

Regional Highlights

Regional dynamics in the Fermentation for Alternative Protein Market reflect a dichotomy between areas leading in technological innovation and capital expenditure (North America and Europe) and those representing immense future consumer demand and capacity expansion (Asia Pacific). North America, driven predominantly by the United States, is the epicenter of synthetic biology and receives the lion's share of global venture capital funding for novel protein technologies. This region benefits from sophisticated research institutions, a streamlined regulatory path (via GRAS status), and strong consumer affinity for innovative health and wellness products, positioning it as the primary hub for precision fermentation scale-up.

Europe, meanwhile, exhibits robust market maturity and strong regulatory emphasis on sustainability, particularly through policies like the European Green Deal. Countries such as the Netherlands, Germany, and the UK are global leaders in food science and biotech engineering, driving significant advancements in biomass fermentation (e.g., Quorn) and specialized ingredient formulation. Although the EU's novel food authorization process is rigorous and time-intensive, it provides a high level of consumer assurance, and investment is strong, focused on achieving regional protein self-sufficiency and adhering to high ethical standards regarding food production practices.

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth rates, spurred by rapid population growth, rising meat consumption trends, and government initiatives addressing food security and environmental concerns (notably in Singapore, China, and Australia). Singapore has positioned itself as a regional food tech hub, actively funding and permitting the production of novel proteins. While currently reliant on North American and European IP, APAC is rapidly building its own large-scale fermentation infrastructure to cater to a massive, increasingly health-conscious middle class, especially focusing on integrating fermented ingredients into traditional Asian diets and addressing the region's intense demand for seafood alternatives.

- North America (US & Canada): Dominant in venture capital investment, synthetic biology R&D, and precision fermentation scale-up; favorable regulatory framework (GRAS).

- Europe (UK, Netherlands, Germany): Mature consumer market, strong regulatory push for sustainability, leadership in biomass fermentation, stringent Novel Food regulations.

- Asia Pacific (China, Singapore, Australia): Highest future growth potential, driven by food security concerns, rising middle-class consumption, and government support for localized protein production; emerging as a critical manufacturing hub.

- Latin America: Emerging market focused on utilizing regional agricultural feedstocks (sugarcane, soy derivatives) for localized fermentation, often collaborating with international partners for technology transfer.

- Middle East & Africa (MEA): Nascent market primarily focused on securing reliable, climate-resilient protein sources; growing consumer interest in alternative proteins, supported by strategic government investments in food security projects (e.g., UAE).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fermentation for Alternative Protein Market.- Perfect Day, Inc.

- Nature's Fynd

- Quorn Foods (Monde Nissin)

- Geltor

- Motif FoodWorks

- The EVERY Company (formerly Clara Foods)

- Triton Algae Innovations

- MycoTechnology, Inc.

- Impossible Foods

- Solar Foods

- Meati Foods

- Novozymes A/S

- Ginkgo Bioworks

- DSM Nutritional Products

- Chr. Hansen A/S

- Deep Branch

- ProFerm Technologies

- Lallemand Inc.

- Kerry Group plc

- ADM (Archer Daniels Midland)

Frequently Asked Questions

Analyze common user questions about the Fermentation for Alternative Protein market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary types of fermentation utilized for alternative proteins?

The market primarily relies on three types: Biomass Fermentation (growing high volumes of microbial cells like fungi for structural protein), Precision Fermentation (engineering microbes to produce specific functional ingredients like whey protein), and Traditional Fermentation (using microbes to process and enhance existing plant ingredients).

What are the main regulatory hurdles facing precision-fermented proteins?

The main hurdles involve obtaining Novel Food Authorization, which requires extensive safety and toxicity data in regions like the European Union. In the US, the path is often quicker through the Generally Recognized As Safe (GRAS) self-affirmation or notification process, focusing heavily on purity and identity confirmation.

How does fermentation contribute to sustainability compared to animal agriculture?

Fermentation drastically reduces resource intensity, requiring significantly less land and water usage, and generating lower greenhouse gas emissions compared to traditional livestock farming. Production is highly efficient and scalable, minimizing reliance on agricultural supply chains and external climate factors.

What is the current biggest constraint to market growth and adoption?

The most significant constraint is the cost of scaling production. Fermentation facilities require massive capital investment (CapEx) for specialized bioreactors and complex downstream purification, which currently keeps the cost of goods sold (COGS) for precision-fermented ingredients higher than conventional counterparts, impeding mass-market price parity.

Which regions are leading the research and commercialization of these technologies?

North America (specifically the US) leads in R&D investment and technological innovation, particularly in precision fermentation. Europe follows with strong market adoption driven by sustainability mandates, and the Asia Pacific region is rapidly expanding its manufacturing capacity to address localized food security and high consumer demand.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager