Fermented Food and Ingredients Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433041 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Fermented Food and Ingredients Market Size

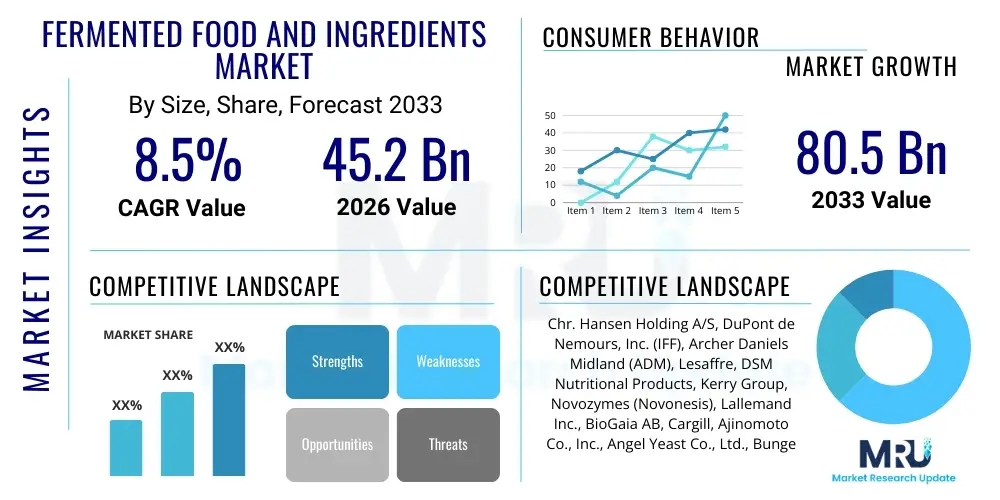

The Fermented Food and Ingredients Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 80.5 Billion by the end of the forecast period in 2033.

Fermented Food and Ingredients Market introduction

The Fermented Food and Ingredients Market encompasses a diverse range of products derived through controlled microbial growth and enzymatic conversion, processes that enhance nutritional profiles, extend shelf life, and improve sensory attributes. These products include traditional staples such as yogurt, cheese, sauerkraut, kefir, and newer functional ingredients like probiotics, prebiotics, and postbiotics utilized across the food and beverage, dietary supplements, and pharmaceutical industries. Key driving factors include the escalating global consumer focus on gut health and digestive wellness, rising demand for natural and minimally processed foods, and the increasing acceptance of plant-based fermented alternatives, which align with modern dietary trends. The inherent benefits of fermentation, such as enhanced bioavailability of nutrients and the production of bioactive compounds, solidify its position as a critical segment in the modern food system.

Fermented Food and Ingredients Market Executive Summary

The market trajectory is characterized by robust innovation in microbial strain selection and fermentation technology, leading to the development of novel functional ingredients. Business trends indicate a high degree of merger and acquisition activity focused on securing specialized fermentation expertise and scaling production capabilities, particularly in the probiotic and industrial enzymes sectors. Regional trends show Asia Pacific leading in consumption due to deep-rooted cultural reliance on fermented foods like kimchi and soy products, while North America and Europe are spearheading demand for advanced, fortified probiotic beverages and personalized nutrition solutions. Segment trends highlight rapid growth in the plant-based dairy alternatives segment and the increasing adoption of precision fermentation techniques to produce sustainable protein sources and flavor compounds, signaling a shift towards high-value, sustainable ingredient manufacturing.

AI Impact Analysis on Fermented Food and Ingredients Market

User queries regarding AI's role in the fermented food sector primarily revolve around optimizing microbial performance, ensuring consistent batch quality, and accelerating new product development cycles. Key themes include leveraging machine learning for predictive modeling of fermentation parameters (temperature, pH, nutrient consumption), utilizing computational biology to design superior starter cultures and engineered yeasts, and implementing AI-driven sensory analysis systems to maintain flavor profiles across large-scale production runs. Consumers and industry stakeholders are highly interested in how AI can reduce variability, enhance food safety through rapid contamination detection, and ultimately contribute to more efficient, sustainable, and cost-effective production of functional fermented ingredients, particularly in highly sensitive areas like probiotic encapsulation and strain optimization.

The application of Artificial Intelligence and Machine Learning in the fermentation industry is transitioning from conceptual application to practical implementation, focusing heavily on process control and optimization. AI algorithms are increasingly being used to analyze vast datasets generated by high-throughput screening of microbial strains, allowing researchers to quickly identify strains with optimal yield, stability, and specific metabolite production characteristics. This speeds up R&D timelines, which are traditionally lengthy due to the complex, biological nature of fermentation processes. Furthermore, the integration of AI with advanced sensors within bioreactors enables real-time monitoring and dynamic adjustments of process variables, minimizing waste and maximizing conversion efficiency, thereby addressing critical operational challenges faced by large industrial fermenters.

Moreover, AI plays a pivotal role in maintaining the stringent quality control standards required for functional ingredients. By analyzing spectral data and chromatographic profiles, machine learning models can accurately predict the concentration of target compounds or detect subtle signs of microbial stress or contamination far faster than traditional laboratory methods. This predictive quality assurance is crucial for maintaining consumer trust in high-value products like live probiotics and bio-identical ingredients produced via precision fermentation. The long-term impact of AI is expected to democratize access to customized microbial solutions, enabling smaller companies to optimize their processes without extensive traditional R&D overhead, thereby accelerating overall market innovation.

- AI-Driven Strain Optimization: Utilizing machine learning for rapid screening and selection of microbial strains with superior functional characteristics, stability, and yield.

- Real-Time Bioreactor Control: Implementation of predictive algorithms linked to sensors for dynamic adjustment of fermentation parameters (e.g., pH, dissolved oxygen, feed rates) to maintain peak microbial activity.

- Predictive Quality Assurance (PQA): Employing computer vision and spectral analysis combined with AI to detect contaminants or deviations in product composition instantly, enhancing food safety.

- Accelerated Product Development: Simulation and modeling tools powered by AI to predict the performance and flavor profile of new fermented products before large-scale trials, reducing time-to-market.

- Supply Chain Forecasting: Utilizing ML models to optimize inventory management of raw materials (substrates) and finished ingredients based on volatile market demand and seasonal variations.

DRO & Impact Forces Of Fermented Food and Ingredients Market

The market growth is primarily driven by the escalating consumer awareness regarding the linkage between gut health and overall systemic wellness, particularly in developed economies. Restraints include stringent regulatory hurdles related to novel food ingredient approvals and the inherent challenges associated with maintaining the stability and viability of live microbial cultures (probiotics) through processing, storage, and distribution channels. Opportunities are vast, centered on the expansion of precision fermentation for sustainable protein alternatives, the development of postbiotic ingredients that offer functional benefits without the instability concerns of live bacteria, and the integration of personalized nutrition platforms leveraging fermented food consumption data. These forces collectively shape a market environment characterized by high consumer pull and significant technological investment, particularly in areas addressing biological complexity and regulatory compliance.

Drivers for the fermented food and ingredients market are deeply rooted in demographic and wellness shifts. The aging global population, increasingly concerned about age-related health issues and chronic digestive disorders, seeks preventive health solutions, making probiotic and prebiotic-rich fermented foods highly appealing. Furthermore, the sustainability imperative is pushing manufacturers toward fermented ingredients, such as microbial proteins and bio-synthesized flavors, which require less land and water compared to traditional agricultural sources. This dual focus on health optimization and environmental responsibility provides a powerful long-term tailwind for market expansion across all segments, from dairy to functional beverages.

Restraints necessitate careful mitigation strategies by market players. The primary constraint remains the regulatory fragmentation across different regions, particularly concerning health claims associated with specific microbial strains and functional outcomes. Manufacturers must invest heavily in clinical trials to substantiate claims, adding significant costs and time to market entry. Operational restraints include the high capital expenditure required for sophisticated bioreactor facilities and the need for highly skilled labor capable of managing complex bioprocesses. Moreover, consumer education remains a hurdle, as misconceptions about fermentation and microbial ingredients sometimes impede broader adoption, requiring sustained marketing efforts focused on scientific clarity.

Opportunities are abundant, driven by technological breakthroughs. Precision fermentation opens new avenues for producing high-purity, standardized ingredients like specific vitamins, fats, and colorants efficiently, reducing dependence on volatile agricultural supply chains. The rise of personalized nutrition offers a lucrative niche, where fermented foods can be customized based on individual microbiome analysis, maximizing efficacy. Additionally, developing shelf-stable, spore-forming, or encapsulated probiotic formulations that withstand harsh processing conditions and long transit times represents a major technical opportunity to unlock new application areas in baked goods and shelf-stable snacks. The synergy between synthetic biology and traditional fermentation techniques promises a pipeline of novel ingredients addressing specific therapeutic or functional needs.

- Drivers:

- Surging consumer demand for digestive wellness and immune health functional foods.

- Increasing preference for natural, clean-label, and minimally processed ingredients.

- Technological advancements in microbial strain selection and precision fermentation techniques.

- Growing acceptance and expansion of plant-based fermented dairy and meat alternatives.

- Restraints:

- High operational costs associated with large-scale industrial fermentation and bioreactor maintenance.

- Regulatory complexity and inconsistencies across different global markets regarding health claims and novel food ingredient approval.

- Challenges in maintaining viability and stability of live probiotic cultures during storage and application.

- Opportunities:

- Expansion into therapeutic areas using targeted postbiotics and microbiome-modulating ingredients.

- Application of fermentation technology for sustainable production of alternative proteins (mycoproteins) and high-value fats.

- Development of customized and personalized fermented food solutions based on genetic and microbiome profiles.

- Untapped potential in leveraging traditional fermentation practices from emerging markets for global innovation.

- Impact Forces:

- Technology Adoption: High, driven by AI and synthetic biology integrating into bioprocess optimization.

- Regulatory Environment: Moderate to high, influencing market access and product claim substantiation.

- Consumer Preference: High, favoring functional benefits and clean labeling, directly influencing product innovation.

- Sustainability Mandates: Strong force driving investment toward microbial-based ingredient production as a sustainable alternative.

Segmentation Analysis

The Fermented Food and Ingredients market is comprehensively segmented based on the product type, application area, and specific ingredient functionality, providing granular insights into consumer preferences and industrial utilization. Product segmentation distinguishes between traditional fermented foods, which constitute the foundational and largest volume segment, and high-value fermented ingredients, which are driving revenue growth due to their incorporation into functional foods and pharmaceuticals. Application segmentation demonstrates the broad utility of fermentation output, ranging from dietary staples and health supplements to animal nutrition and specialized industrial uses. Understanding these segment dynamics is critical for stakeholders targeting specific consumer cohorts, particularly those seeking functional benefits like immune support and gut microbiota modulation, which demand specialized, high-purity ingredients.

The segmentation by ingredient type, specifically the differentiation between microbial starters, enzymes, amino acids, and bulk ingredients, highlights the value migration within the supply chain. For instance, the microbial starter culture segment, while small in volume, is critical for defining the quality and scalability of end products, commanding premium pricing due to proprietary strain development. Conversely, fermentation-derived bulk ingredients like yeast extracts and organic acids are essential industrial commodities, characterized by competitive pricing and high-volume production. Analyzing the growth rates within these sub-segments reveals that high-purity, functional ingredients leveraging precision fermentation techniques are experiencing the fastest acceleration, reflecting the industry's shift toward bio-optimized solutions.

Furthermore, regional variations significantly influence segmentation dominance. Asia Pacific continues to dominate the traditional fermented foods segment (e.g., soy sauces, tempeh, rice wines), while North America and Europe show a higher concentration of demand for high-end probiotic supplements and fermentation-derived proteins (mycoprotein). This regional divergence mandates tailored market entry strategies, requiring companies to adapt their product formulations and marketing focus, either toward broad cultural appeal or targeted functional benefits, depending on the geographical focus. The consistent trend across all segments is the increasing consumer willingness to pay a premium for verified functionality and provenance.

- By Product Type:

- Fermented Foods (Yogurt, Cheese, Sauerkraut, Kimchi, Pickles, Kombucha, Tempeh, Kefir, Wine, Beer)

- Fermented Ingredients (Amino Acids, Organic Acids, Vitamins, Enzymes, Starter Cultures, Functional Lipids)

- By Ingredient Functionality:

- Probiotics (Lactobacillus, Bifidobacterium, Saccharomyces Boulardii)

- Prebiotics (FOS, GOS, Inulin)

- Postbiotics (Inactivated Microbial Cells and their Metabolites)

- Enzymes (Amylases, Proteases, Lipases, Cellulases)

- By Application:

- Food and Beverage (Dairy, Bakery, Confectionery, Beverages, Alcoholic Drinks)

- Dietary Supplements and Nutraceuticals

- Pharmaceuticals and Medical Foods

- Animal Feed and Nutrition

- By Form:

- Dry (Powders, Granules)

- Liquid (Concentrates, Live Cultures in Medium)

Value Chain Analysis For Fermented Food and Ingredients Market

The value chain for the fermented food and ingredients market begins with the upstream sourcing of raw materials, primarily agricultural substrates such as sugars (glucose, sucrose), proteins (peptones), and complex nutrients required for microbial growth. This stage is crucial, as the quality and cost volatility of these inputs directly impact the final production cost and yield of the fermentation process. Upstream specialization is focused on developing proprietary, cost-effective growth media tailored to specific microbial strains, ensuring maximum efficiency and purity. Key upstream suppliers include agricultural commodity traders and specialized biochemical companies providing analytical services and media optimization solutions.

The core of the value chain involves the fermentation process itself, which relies on high-tech bioreactors, precise process control, and intellectual property centered around proprietary microbial strains (starter cultures). This midstream phase involves significant capital investment and technical expertise, particularly for precision fermentation used to produce high-value compounds like specialized amino acids or recombinant proteins. Downstream processing follows, including separation, purification, drying (lyophilization), and encapsulation, which are critical for stabilizing ingredients, particularly sensitive probiotics, and ensuring their effective delivery into final product applications. The efficiency of downstream processes directly affects the shelf-stability and commercial viability of the ingredient.

Distribution channels for fermented ingredients are bifurcated into direct sales for high-volume industrial clients (e.g., major food manufacturers and pharmaceutical companies) and indirect sales through specialized distributors and brokers for smaller businesses and international markets. The distribution network must accommodate stringent cold chain logistics for live cultures and highly sensitive enzymes. The final stage involves branding, formulation, and retail sales, where finished goods leverage scientific claims and functional benefits to reach end consumers. Integration and strategic partnerships across the chain, from substrate suppliers to nutraceutical manufacturers, are essential to control quality, maintain consistency, and optimize cost structures in this biologically complex sector.

Fermented Food and Ingredients Market Potential Customers

The primary customers for the Fermented Food and Ingredients Market span across several key industries, all united by the need for functional, clean-label, and health-promoting components. Major buyers include large multinational Food and Beverage (F&B) corporations utilizing ingredients like starter cultures, organic acids, and yeast extracts to enhance flavor, preservation, and texture in dairy, bakery, and beverage products. The nutraceutical and dietary supplements industry represents a critical, high-growth customer segment, demanding premium, scientifically validated probiotics, prebiotics, and postbiotics for immune, digestive, and mental health formulations. These buyers prioritize efficacy and stability, often seeking encapsulated or spore-forming solutions to integrate into pills, powders, and functional gummies.

Furthermore, the pharmaceutical and biotechnology sectors are significant purchasers, utilizing fermentation-derived ingredients, such as specific amino acids and enzymes, for therapeutic applications and drug manufacturing. The shift towards sustainable protein sources has also positioned traditional meat and dairy producers, as well as new alternative protein companies, as major customers for fermentation-derived mycoproteins and bio-identical flavor enhancers. The Animal Feed sector constitutes another major volume buyer, incorporating fermentation products to enhance gut health and nutrient absorption in livestock, serving as a critical component in reducing antibiotic use in animal agriculture. This diverse customer base necessitates specialized sales approaches and detailed regulatory documentation tailored to each industry's quality standards and application requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 80.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Chr. Hansen Holding A/S, DuPont de Nemours, Inc. (IFF), Archer Daniels Midland (ADM), Lesaffre, DSM Nutritional Products, Kerry Group, Novozymes (Novonesis), Lallemand Inc., BioGaia AB, Cargill, Ajinomoto Co., Inc., Angel Yeast Co., Ltd., Bunge Limited, Döhler GmbH, BASF SE, Probi AB, Yakult Honsha Co., Ltd., Biena Inc., General Mills, Nestle S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fermented Food and Ingredients Market Key Technology Landscape

The technology landscape governing the production of fermented food and ingredients is rapidly evolving, driven by advancements in biotechnology and process engineering aimed at improving yield, purity, and functionality. Key technologies revolve around advanced strain development, including genetic engineering and high-throughput screening, which allow manufacturers to isolate and optimize microbial cultures for specific industrial outcomes, such as enhanced stability or targeted metabolite production. Precision fermentation, utilizing engineered microorganisms in highly controlled bioreactors, is emerging as a disruptive technology, enabling the sustainable production of complex molecules like customized proteins, fats, and specialty flavors that were previously difficult or uneconomical to synthesize.

Furthermore, significant technological investment is directed towards optimizing the operational efficiency of large-scale fermentation. This includes the deployment of advanced sensor technologies—such as spectroscopic and chromatographic methods—integrated with sophisticated control systems that utilize AI and machine learning for real-time monitoring and dynamic adjustment of bioreactor conditions. These innovations reduce batch variation, minimize contamination risks, and significantly lower energy consumption per unit of output. The shift towards continuous fermentation processes, as opposed to traditional batch methods, is also gaining traction, promising higher throughput and reduced downtime, which is essential for scaling up high-demand ingredients like industrial enzymes and organic acids.

Post-fermentation technology, particularly encapsulation and stabilization techniques, remains vital for protecting and delivering sensitive ingredients, notably probiotics. Technologies like microencapsulation using specialized matrices (e.g., alginate or starch) ensure that live cultures survive the harsh gastric environment and maintain viability during product shelf life. Moreover, the development of postbiotics relies heavily on effective cell lysis and purification technologies to isolate beneficial metabolites with high purity. This combination of upstream genetic optimization, midstream process automation, and downstream stabilization techniques defines the competitive edge in the highly technical fermented food and ingredients manufacturing sector.

Regional Highlights

The Fermented Food and Ingredients Market exhibits significant regional variation in consumption patterns, regulatory environments, and technological adoption, influencing the global market structure.

Asia Pacific (APAC) is the undisputed leader in volume consumption, primarily driven by cultural heritage and deep-rooted traditions of consuming fermented staples such as kimchi, miso, tempeh, natto, and various regional rice wines. This region benefits from a large consumer base and rapid economic development, leading to increasing disposable income and growing demand for fortified and functional food products. India and China are major drivers, not only in consumption but also in production, particularly of industrial enzymes and specific amino acids utilizing large-scale fermentation capabilities. The trend here is focused on merging traditional fermentation techniques with modern safety standards and functional fortification.

North America represents the fastest-growing market in terms of value, characterized by high consumer awareness regarding gut health and a proactive acceptance of functional ingredients. The demand is concentrated in high-value segments, including premium probiotic supplements, kombucha, Kefir, and sophisticated fermentation-derived plant-based alternatives. Stringent food safety standards and a strong R&D infrastructure support continuous innovation, particularly in applying synthetic biology to produce next-generation ingredients and novel protein sources via precision fermentation, catering to the health-conscious and clean-label consumer base.

Europe is a mature market distinguished by strong regulatory frameworks (e.g., EFSA) that dictate health claim substantiation, influencing the market structure toward scientifically proven, high-quality products. Western European nations, such as Germany, France, and the UK, show high consumption rates for yogurt, cheese, and traditional fermented beverages. The region is a key hub for industrial biotechnology, specializing in the production of microbial starter cultures and food enzymes. The European Green Deal and associated sustainability mandates further accelerate the adoption of fermentation technology for sustainable food production and waste reduction.

Latin America (LATAM) shows potential, driven by rising health consciousness and urbanization. While traditional fermented foods are common, the market for industrialized, packaged functional foods (especially probiotics and fortified dairy) is expanding rapidly, supported by foreign direct investment and technology transfer. Middle East and Africa (MEA) represent an emerging market where growth is spurred by improving food security concerns, rising incomes, and the initial adoption of packaged, shelf-stable fermented products, although infrastructure and regulatory harmonization remain challenging factors.

- Asia Pacific (APAC): Dominates consumption volume; characterized by traditional fermented foods, rapidly integrating modern industrial enzyme production. Key markets: China, India, Japan. Focus on affordability and staples fortification.

- North America: Fastest growth in value; characterized by high demand for premium functional beverages, personalized nutrition, and precision fermentation-derived ingredients. Key markets: USA, Canada. Focus on digestive wellness and clean label.

- Europe: Mature market with stringent quality control; leading in industrial starter culture and food enzyme production. Strong focus on sustainability and scientifically validated health claims. Key markets: Germany, France, UK.

- Latin America (LATAM): Emerging market driven by urbanization and demand for packaged functional dairy and beverages. Infrastructure development is key to unlock potential.

- Middle East and Africa (MEA): Nascent market, showing potential growth in packaged probiotic yogurts and shelf-stable foods, constrained by logistical challenges and varying regulatory landscapes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fermented Food and Ingredients Market.- Chr. Hansen Holding A/S

- DuPont de Nemours, Inc. (IFF)

- Archer Daniels Midland (ADM)

- Lesaffre

- DSM Nutritional Products

- Kerry Group

- Novozymes (Novonesis)

- Lallemand Inc.

- BioGaia AB

- Cargill

- Ajinomoto Co., Inc.

- Angel Yeast Co., Ltd.

- Bunge Limited

- Döhler GmbH

- BASF SE

- Probi AB

- Yakult Honsha Co., Ltd.

- General Mills

- Nestle S.A.

- Biena Inc.

Frequently Asked Questions

Analyze common user questions about the Fermented Food and Ingredients market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Fermented Food and Ingredients Market?

The principal driver is the globally escalating consumer awareness regarding the profound link between gut microbiome health, immunity, and overall well-being. This awareness translates directly into heightened demand for functional products rich in probiotics, prebiotics, and postbiotics, moving fermented foods beyond traditional staples into the nutraceutical mainstream.

How does precision fermentation differ from traditional fermentation, and what is its market impact?

Precision fermentation involves engineering specific microorganisms to produce highly targeted, complex molecules, such as specific proteins, fats, or high-purity vitamins, within highly controlled bioreactors. Unlike traditional fermentation, which uses naturally occurring strains for bulk food production, precision fermentation facilitates the sustainable and scalable creation of novel, high-value ingredients with pharmaceutical-grade consistency, significantly impacting the sustainable protein and specialty chemical segments.

Which ingredient segment is projected to experience the fastest growth rate?

The Postbiotics segment is anticipated to witness the highest Compound Annual Growth Rate (CAGR). Postbiotics, which are the stable, functional metabolites or inactivated microbial biomass, offer documented health benefits without the stability and viability challenges inherent to live probiotic cultures, making them highly attractive for integration into shelf-stable food matrices and medical applications.

What are the main regulatory challenges faced by manufacturers in this market?

The major regulatory challenge involves obtaining approval for specific health claims, particularly in regions like the European Union (EU). Manufacturers must provide robust, scientifically validated clinical data to substantiate functional claims related to specific microbial strains, which is a costly and time-consuming process that acts as a significant barrier to entry for novel products.

What role do starter cultures play in the industrial fermented food production?

Starter cultures are critical for industrial production as they are selected, highly purified microbial strains that ensure consistent quality, predictable flavor profiles, and efficient conversion of substrates. They are proprietary, high-value ingredients that standardize the fermentation process, guaranteeing the safety and repeatability required for large-scale manufacturing of products like yogurt, cheese, and industrial enzymes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager