Fermented Plant Extract Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432450 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Fermented Plant Extract Market Size

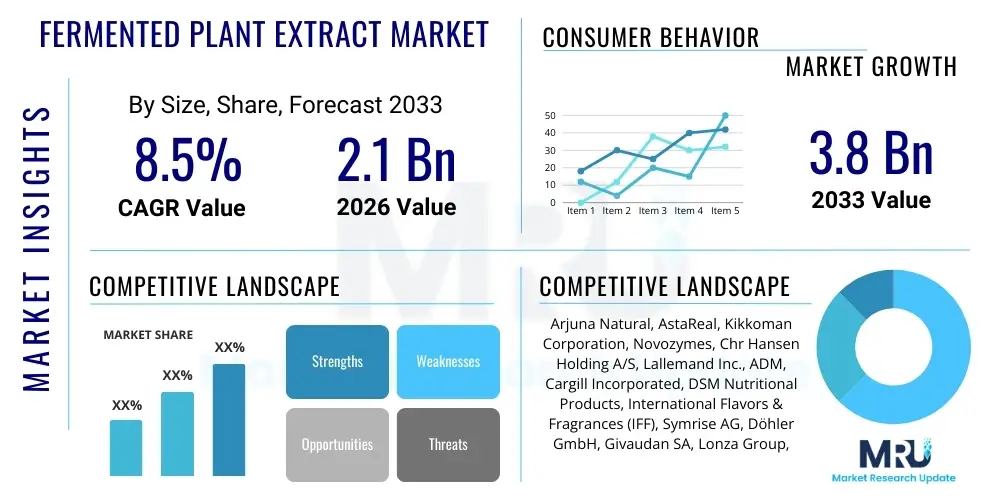

The Fermented Plant Extract Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.8 Billion by the end of the forecast period in 2033.

Fermented Plant Extract Market introduction

The Fermented Plant Extract Market encompasses highly specialized ingredients derived from the controlled biotransformation of diverse botanical sources, including various species of herbs, nutrient-rich fruits, common vegetables, and complex grains. This transformative process relies on meticulously selected and controlled microbial cultures, primarily involving specific strains of lactic acid bacteria, specialized yeasts, or filamentous fungi. These microorganisms act as natural biocatalysts, systematically breaking down large, complex macro-molecules—such as polysaccharides, proteins, and insoluble fibers—into smaller, more readily available micro-nutrients, including easily absorbed peptides, free-form amino acids, and enhanced concentrations of vitamins. Crucially, the fermentation process results in the superior bioavailability of these compounds, meaning the human body can absorb and utilize them more efficiently compared to traditional unfermented extracts, which is a major value proposition driving industry adoption globally. The enhanced efficacy positions these ingredients as premium offerings across various consumer sectors prioritizing functional outcomes and holistic wellness benefits.

The functional advantages of fermented plant extracts extend beyond mere nutrient enhancement; the biotransformation inherently leads to the generation of novel beneficial metabolites, often referred to as postbiotics, which include short-chain fatty acids (SCFAs) and unique peptides. These secondary metabolites are instrumental in mediating positive health effects, particularly in regulating the gut microbiome, enhancing immune function, and reducing systemic inflammation. Major applications are concentrated within the burgeoning nutraceutical sector, where these extracts are formulated into targeted supplements for digestive health, stress management, and improved physical performance. Simultaneously, the cosmetic industry utilizes these extracts for their refined molecular structure, which facilitates deeper penetration into the skin layers, delivering superior hydration, potent antioxidant protection, and accelerated cellular regeneration, addressing a growing demand for scientifically advanced, natural cosmetic actives. The inherent natural origin, coupled with the enhanced performance profile, secures their place as key components in clean-label product development across multiple global markets.

Market expansion is fundamentally driven by two primary forces: pervasive global shifts in consumer health perspectives and continuous innovation in bioprocessing technology. Consumers are increasingly adopting a proactive approach to wellness, seeking natural alternatives to synthetic ingredients, a trend strongly supported by the clean-label movement. The established scientific connection between gut health and overall systemic well-being further boosts the demand for fermentation-derived products containing beneficial postbiotics. On the technological front, sophisticated developments, such as the application of precision fermentation and the identification of novel, high-performance microbial starter cultures, enable manufacturers to produce highly standardized extracts with guaranteed concentrations of active markers. Furthermore, regulatory environments in key markets, especially North America and Europe, are becoming increasingly receptive to these novel natural ingredients, provided they are supported by robust toxicological and clinical data, thereby facilitating smoother market entry and accelerating the commercialization of new fermented ingredients designed to replace conventional additives and preservatives across the food and personal care value chains, while ensuring a high level of product consistency and safety.

Fermented Plant Extract Market Executive Summary

The Fermented Plant Extract Market trajectory is characterized by accelerated growth, primarily fueled by significant business investment in scaling up precision fermentation infrastructure globally. A critical business trend involves the rapid integration of horizontal strategies, where large flavor, fragrance, and ingredient corporations acquire specialized fermentation biotechnology firms to secure proprietary knowledge and specialized microbial strains. This movement is focused on creating vertically integrated supply chains capable of delivering consistent, high-purity extracts efficiently to high-volume end-users in the functional food and cosmetic domains. Furthermore, the industry is witnessing a pronounced trend towards product customization, with strategic partnerships between extract producers and specific end-product manufacturers to develop tailored extracts that meet precise requirements regarding color, flavor, or functional markers, moving away from generic bulk ingredient supply and focusing instead on high-value, differentiated products that offer specific competitive advantages in the consumer market.

Regionally, the market dynamic is heavily skewed towards Asia Pacific, which leverages its cultural heritage in fermentation techniques and robust domestic consumer demand for traditional health ingredients, particularly fermented medicinal mushrooms and herbal extracts prevalent in countries like South Korea and Japan. However, the highest incremental growth opportunity is emerging from the highly demanding European and North American markets. In these regions, growth is catalyzed by advanced regulatory clarity concerning novel food ingredients derived from fermentation and significant consumer disposable income allocated towards premium health supplements and high-end cosmeceuticals. These Western markets demand extensive clinical documentation and stringent quality certifications, pushing manufacturers to invest heavily in scientific validation to build strong brand trust and establish efficacy claims within competitive retail environments. The regional disparity often reflects differing priorities, with APAC focusing on high volume and traditional usage, and the West emphasizing standardization, scientific proof, and clean-label verification.

Segmentation analysis clearly indicates the overwhelming dominance of the Dietary Supplements sector, driven by extracts targeting specific conditions such as irritable bowel syndrome (IBS) management, enhanced mineral absorption, and targeted immune modulation. Within this segment, extracts derived from grains and specific botanicals are experiencing the most rapid uptake due to their comprehensive nutrient profile. Concurrently, the Cosmetics and Personal Care segment is poised for exceptional compound annual growth. This rapid expansion is driven by the perceived luxury and proven efficacy of fermented ingredients (like fermented yeast extracts or floral ferments) in high-end anti-aging, moisturizing, and skin microbiome-balancing product lines. The shift in consumer preference towards water-free or highly concentrated powder forms is also noteworthy across both segments, as powders offer superior logistical stability, lighter shipping profiles, and easier integration into various formulation matrices, effectively addressing shelf-life concerns common with traditional liquid extracts and supporting global distribution models.

AI Impact Analysis on Fermented Plant Extract Market

User queries regarding the intersection of Artificial Intelligence and the Fermented Plant Extract Market frequently address the potential for AI to resolve the notorious variability inherent in biological production systems. Users are keen to understand how sophisticated machine learning models can process complex, multi-dimensional biological data—including genetic sequences of microbial strains, real-time bioreactor sensor data (pH, dissolved oxygen, temperature gradients), and final-product metabolomic profiles—to predict and stabilize output quality. A core concern is the reduction of R&D cycles: traditional screening and optimization of fermentation processes can take years; users expect AI to compress this timeline significantly by identifying optimal culture media compositions and precise process parameters. This high level of predictive optimization is viewed as the key to transitioning fermented ingredients from niche, artisanal products to reliable, scalable industrial commodities, meeting the strict consistency standards required by major multinational corporations in the food and pharmaceutical sectors. The ability of AI to detect and prevent subtle contamination events before they ruin large, costly batches is also a significant area of user inquiry and expectation, highlighting the technology's role in risk mitigation and operational efficiency.

- AI-driven optimization of fermentation kinetics, reducing batch variation and maximizing bioactive compound yield through dynamic control loops adjusting nutrient feed rates and environmental conditions in real-time.

- Predictive modeling for raw material selection, utilizing spectral analysis and Machine Learning (ML) algorithms to precisely assess the quality of botanical feedstock, ensuring optimal starting composition for target extract profiles before batch commencement.

- Accelerated discovery of novel, efficient microbial strains (probiotics/starter cultures) using genomic screening and ML applied to large databases, identifying non-conventional organisms suitable for robust industrial fermentation processes.

- Automated quality control and monitoring systems utilizing sophisticated sensor arrays, coupled with computer vision and data analytics, to detect microbial contamination or suboptimal process deviations in real-time, significantly improving operational safety and purity metrics.

- Enhanced supply chain transparency and traceability by integrating AI analytics across sourcing, processing, and distribution layers, satisfying complex global regulatory requirements and consumer demand for ethical sourcing verification.

- Personalized nutrition development by linking individual genomic or microbiome health data with specific fermented extract profiles to predict and tailor the efficacy of the final health product for highly specific consumer demographics.

- Optimization of downstream processing (filtration, drying, purification) through AI models, reducing energy consumption and material waste, thereby improving the overall sustainability and lowering the carbon footprint and cost-efficiency of production.

- Simulation and modeling of large-scale bioreactor performance under varying load and input conditions, allowing manufacturers to rapidly and confidently scale production capacity with minimal physical prototyping and reduced inherent risk.

DRO & Impact Forces Of Fermented Plant Extract Market

The market for Fermented Plant Extracts is propelled by fundamental drivers rooted in global demographics and consumer health trends, creating a strong impetus for innovation and investment across the supply chain. The undeniable shift towards preventative healthcare, driven by an aging global population and rising chronic disease rates related to lifestyle, fuels massive demand for functional ingredients, particularly those demonstrated to support the gut-brain axis and immune system modulation. Fermented extracts, rich in easily absorbed nutrients, specialized peptides, and beneficial postbiotics, perfectly align with this trend and offer superior bioavailability narratives. Furthermore, technological progress in strain development and bioprocess engineering has dramatically improved the economic viability of these extracts, enabling high-purity production at industrial scales. The continuous output of clinical research substantiating the specific health benefits of fermented metabolites (such as butyrate and other short-chain fatty acids) provides the necessary scientific credibility for market expansion and consumer confidence, cementing these products as mainstream, evidence-based health solutions, rather than temporary dietary fads.

Conversely, significant restraints impede the unbridled expansion of the market, primarily revolving around operational complexity and regulatory heterogeneity across international borders. The initial capital outlay required for setting up state-of-the-art bioreactor facilities, implementing specialized sterilization equipment, and maintaining proprietary starter culture banks is extremely high, acting as a steep barrier to entry and consequently concentrating market power among large multinational firms with extensive capital reserves. Moreover, regulatory bodies, especially in key markets like the European Union and the United States, maintain stringent requirements for 'Novel Food' or GRAS (Generally Recognized as Safe) approvals, demanding comprehensive toxicological studies and often costly, long-term human clinical trials to validate specific health claims for unique fermented ingredients. This regulatory friction significantly slows down product launch timelines and substantially increases R&D expenditure. A parallel operational restraint is the persistent challenge of standardizing the final product; since the source material (plants) naturally varies in composition due to seasonal and geographic factors, maintaining consistent quality and active marker concentration across diverse harvests requires complex, highly controlled processing protocols that increase overhead costs and necessitate specialized, highly technical personnel.

The market is defined by potent impact forces that reshape competitive strategies and mandate continuous operational improvements. Socio-economically, the pervasive consumer demand for ‘clean label,’ sustainable, and ethically sourced products forces profound transparency in sourcing and manufacturing, favoring companies that can demonstrate sustainable and responsible supply chain management from farm to fermentation tank, often through third-party certifications. Technologically, the rapid adoption and proficiency in utilizing AI, sophisticated sensor technology, and genomic screening are becoming non-negotiable factors for competitive differentiation, enabling superior operational efficiency, enhanced product consistency, and accelerated product innovation speed. Environmentally, fermentation offers a compelling advantage: it often utilizes agricultural side streams or food processing waste products as efficient substrates and typically requires less chemical solvent usage compared to traditional extraction, aligning favorably with global corporate sustainability goals and appealing directly to environmentally conscious consumer segments. Strategically, successful market participants are directing substantial resources towards developing proprietary, clinically tested extracts backed by strong intellectual property and patent protection, shifting the competitive focus from mere cost of goods sold to demonstrated functional efficacy, scientific uniqueness, and brand trust built on validation.

Segmentation Analysis

Segmentation within the Fermented Plant Extract Market is critical for strategic focus, dividing the vast array of products based on source material, final application, and physical form. The source segmentation (Fruits, Vegetables, Grains, Herbs) dictates the primary phytochemical profile—for example, fruit fermentation typically yields high levels of bioavailable antioxidants and organic acids, while grains often result in complex B vitamins and specialized peptides suitable for fortification. Manufacturers strategically align their fermentation processes with the inherent properties of the feedstock to maximize the yield of desired functional components, creating specific product lines tailored for different therapeutic uses. Understanding the raw material supply chain's robustness, quality consistency, and overall sustainability footprint is paramount when defining segmentation strategies based on source materials.

The application segment, covering dietary supplements, cosmetics, functional foods, and animal feed, determines the required product specifications and regulatory hurdles that must be met. Supplements demand exceptional purity, high concentration, and scientifically backed claims, often necessitating rigorous clinical trials. Functional foods require considerations for flavor modification, color stability, and easy integration into complex food matrices. The Cosmetics sector requires highly stable, skin-penetrating actives that often utilize yeast or bacterial ferments. This segment requires producers to adhere strictly to industry-specific quality standards (e.g., cGMP for supplements, ISO standards for cosmetics), necessitating tailored production processes, specialized technical support, and comprehensive documentation for each distinct end-market, thereby fragmenting the approach required for sales and marketing.

Segmentation by form, primarily powder and liquid, directly influences logistics profiles, product stability, and ease of use for the downstream manufacturer. Powder forms (often achieved via sophisticated techniques like spray drying or freeze-drying) offer superior stability, significantly reduced shipping weight, and extended shelf life, making them the preferred format for tablet, capsule, and dry mix formulations used by nutraceutical firms. Liquid forms are typically utilized in beverage production and topical cosmetics, requiring specialized aseptic packaging and preservation techniques but offering potentially higher immediate bioavailability and easier integration into liquid formulations. The choice of form is a key determinant in formulation cost, shelf stability, and the ultimate success of the finished product on store shelves, demanding flexible manufacturing capabilities to address diverse customer needs across the highly fragmented end-use industries.

- By Source:

- Fruits (e.g., Berry extracts, Citrus extracts, Pomegranate)

- Vegetables (e.g., Cruciferous extracts, Root vegetables, Leafy greens)

- Grains and Cereals (e.g., Rice bran, Barley, Oats, Wheat germ)

- Herbs and Botanicals (e.g., Ginseng, Turmeric, Ashwagandha, Elderberry, Green Tea)

- Others (e.g., Algae, Mushrooms, Legumes)

- By Application:

- Dietary Supplements and Nutraceuticals (e.g., Probiotics, Gut Health, Immunity, Cognitive Support)

- Cosmetics and Personal Care (e.g., Anti-aging serums, Moisturizers, Shampoos, Masks)

- Functional Food and Beverages (e.g., Health shots, Fortified yogurts, Functional drinks, Cereal bars)

- Animal Feed and Pet Nutrition (e.g., Gut health supplements for livestock and pets, Performance enhancers)

- Pharmaceuticals (e.g., Excipients, Active Pharmaceutical Ingredients (APIs) derived from fermentation)

- By Form:

- Liquid (Aqueous or Oil-based solutions, high-concentration liquid extracts)

- Powder (Freeze-dried, Spray-dried concentrates for enhanced stability and ease of formulation)

- Paste/Gel (Intermediate forms used primarily in topical cosmetic and specialized food formulations)

- By End-Use Industry:

- Retail Pharmacies and Drug Stores

- E-commerce Platforms and Direct-to-Consumer (D2C) Channels

- Specialty Health Food Stores and Wellness Centers

- Food & Beverage Manufacturing Units (B2B Supply)

- Cosmetic Formulation Houses and Contract Manufacturers (B2B Supply)

Value Chain Analysis For Fermented Plant Extract Market

The value chain of the Fermented Plant Extract Market initiates with highly discerning upstream activities focused on securing premium, standardized raw botanical materials. Upstream analysis involves rigorous vendor qualification, focusing intensely on geographic sourcing integrity, minimizing pesticide residue levels and heavy metal contamination, and ensuring a consistent primary phytochemical concentration, as these factors fundamentally determine the success of the subsequent biotransformation stage. Specialized agricultural producers and professional collectors of wild-harvested botanicals form this crucial base. Manufacturers often implement advanced testing methodologies, such as high-performance liquid chromatography (HPLC) and genomic sequencing, to verify the identity, purity, and quality of the raw plant biomass before it enters the production facility. Investments in sustainable, organic, and highly traceable sourcing practices are increasingly mandated by downstream consumers and major regulatory bodies, making this initial stage critical for maintaining brand integrity and securing reliable, high-quality input supplies necessary for standardized output.

The core manufacturing stage, or midstream processing, is where the primary and most complex value addition occurs, demanding significant technological investment and specialized intellectual property. This involves three key phases: sophisticated starter culture preparation (cultivating proprietary yeast or bacterial strains), the highly controlled fermentation cycle itself (conducted in advanced, sterile bioreactors), and post-fermentation separation and purification. This stage is characterized by high technological barriers to entry, demanding deep expertise in industrial microbiology, bioprocess engineering, and stringent aseptic processing techniques to prevent contamination and maximize targeted metabolite yields, such as specific postbiotics or highly concentrated vitamins. The goal here is ingredient standardization—ensuring that irrespective of the starting raw material variability, the final extract maintains a guaranteed, verifiable level of active components, thus justifying the premium pricing over conventional extracts. Companies that hold proprietary microbial patents or specialized continuous flow bioreactor designs possess significant competitive advantage at this critical, value-creating stage.

The downstream segment focuses on sophisticated marketing, functional formulation integration, packaging, and complex distribution logistics. Extracts are sold either directly to major contract manufacturers or indirectly through specialized chemical and ingredient distributors. Direct sales channels are typically preferred by large nutraceutical or cosmetic conglomerates requiring high volumes, customized technical support for complex formulation challenges, and direct communication regarding quality assurance. Indirect channels facilitate essential access to smaller, niche, or regional manufacturers who rely on distributors for smaller minimum order quantities and access to a wider portfolio of complementary ingredients. Effective distribution relies heavily on efficient, verified cold chain logistics for certain liquid or semi-stable extracts. Moreover, successful downstream activities are heavily reliant on powerful scientific marketing, which involves translating complex fermentation science and clinical trial data into clear, compelling, and legally compliant consumer narratives about superior bioavailability, targeted health benefits, and clean-label credentials, essential for maximizing consumer acceptance and securing long-term brand loyalty.

Fermented Plant Extract Market Potential Customers

The core customer base for Fermented Plant Extracts consists of large-scale Dietary Supplement and Nutraceutical manufacturers who are constantly seeking high-efficacy, novel ingredients to innovate their product lines, specifically targeting the burgeoning digestive and immune health categories. These customers require extracts that are highly stable, offered in standardized concentrations, and most critically, backed by robust clinical evidence demonstrating superior absorption or targeted health outcomes compared to their non-fermented counterparts. They are primarily driven by the need to differentiate their finished goods in a fiercely competitive market by leveraging the scientific narrative of enhanced bioavailability and postbiotic content inherent in fermented products. These companies represent the largest volume buyers, often negotiating long-term, bulk contracts for standardized powdered extracts, which are the easiest format for large-scale encapsulation and tableting operations, prioritizing supply chain reliability and consistency above all else.

A rapidly expanding segment of high-value customers includes Cosmetics and Personal Care Product formulators, ranging from global beauty conglomerates to niche clean-beauty and artisanal skincare brands. These buyers utilize fermented extracts—such as fermented rice water, specialized yeast filtrate, or lactobacillus-fermented botanicals—as highly sophisticated active ingredients in premium serums, luxurious moisturizers, and targeted masks. For this customer group, the key value proposition lies in the extracts’ smaller molecular weight, which translates to superior skin penetration, reduced potential for irritation, and often improved sensory attributes (less stickiness, better texture), directly driving the premiumization of their product offerings. These customers prioritize aesthetics and formulation stability alongside functional efficacy, requiring high-purity, often liquid or gel-based extracts tailored specifically for topical application and adhering to specific cosmetic regulatory standards.

Furthermore, the Functional Food and Beverage industry constitutes a significant and continually growing customer group globally. Manufacturers of specialized fermented yogurts, health drinks, energy bars, and fortified cereals rely on these extracts not only for their inherent nutritional and functional benefits but also for their properties related to flavor modification and natural shelf-life extension. Fermented extracts can effectively mitigate the grassy or bitter notes often associated with raw botanical extracts and provide natural preservation benefits through organic acid content, making them ideally suited for the stringent requirements of clean-label formulation strategies in the fast-moving consumer goods (FMCG) sector. Finally, the Animal Feed and Veterinary Nutrition sector is an important emerging customer base, increasingly adopting these extracts as effective replacements for conventional antibiotics and growth promoters, driven by evolving consumer consciousness and global regulatory pressure to reduce antibiotic usage in livestock, focusing on extracts that optimize gut flora, enhance feed efficiency, and improve general animal wellness and performance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.8 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Arjuna Natural, AstaReal, Kikkoman Corporation, Novozymes, Chr Hansen Holding A/S, Lallemand Inc., ADM, Cargill Incorporated, DSM Nutritional Products, International Flavors & Fragrances (IFF), Symrise AG, Döhler GmbH, Givaudan SA, Lonza Group, Probi AB, Sanyo Chemical Industries, Kyowa Hakko Bio, Bionutrigen, Biosynthesis Pharma Group, Sabinsa Corporation, Glanbia Nutritionals, DuPont de Nemours, Inc., ABF Ingredients, Ajinomoto Co. Inc., BASF SE, Naturex (Givaudan), Bio-Extracts, Innova BioTech, Shanghai Huilin Biotech Co., Ltd., Lesaffre, Kerry Group, Mitsubishi Chemical Holdings, Biocatalytics, Enzymotec, Ingredia, Koninklijke FrieslandCampina N.V., Mead Johnson Nutrition, Nestle S.A. (Ingredient Division) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fermented Plant Extract Market Key Technology Landscape

The modern technological landscape governing the Fermented Plant Extract Market is shifting fundamentally from conventional large-scale microbial processes to highly controlled, high-throughput biomanufacturing systems, driven by the imperative for standardization and yield maximization. The central advancement is precision fermentation, which utilizes engineered or highly selected wild-type microbial strains (yeasts, bacteria, fungi) in fully automated, sterile bioreactors to ensure predictable yields of specific target compounds, such as specific postbiotics, complex peptides, or highly concentrated vitamins, thereby eliminating the inherent unpredictability associated with traditional open or spontaneous fermentation methods. Continuous efforts are being dedicated to strain development using advanced genetic tools and metabolic engineering to enhance the organism’s intrinsic efficiency in utilizing complex plant substrates and converting them into high-value metabolites at greater speed and purity. This technological evolution allows manufacturers to achieve pharmacopoeia-grade consistency, which is increasingly required by regulatory bodies and high-end consumers in the nutraceutical and pharmaceutical sectors.

Complementary technological innovations are absolutely crucial in the downstream processing phase, which is essential for ensuring superior product quality, purity, and market compatibility. Sophisticated separation techniques like preparative chromatography, ultrafiltration, and nanofiltration are meticulously employed to isolate and purify the fermented compounds from the microbial biomass and spent media, ensuring the high level of purity suitable for sensitive applications like highly concentrated supplements or premium cosmetics. Furthermore, solvent-free or green chemistry extraction methods, such as utilizing subcritical water or carbon dioxide in Supercritical Fluid Extraction (SFE), are being adopted post-fermentation to stabilize the extracts and align with strict clean-label standards while preserving thermolabile compounds. Innovative microencapsulation technologies are also pivotal, utilized to protect sensitive bioactive ingredients from degradation due to heat, light, or harsh gastric acids, ensuring highly targeted delivery and maximizing their functional efficacy upon consumption or topical application.

Digitalization represents the third, transformative pillar of the technological landscape, rapidly integrating into fermentation operations. Implementation of advanced bioreactor control systems, integrated with sophisticated Process Analytical Technology (PAT) and machine learning algorithms, allows for granular, real-time monitoring and predictive optimization of every critical parameter within the fermentation vessel—including nutrient flow, oxygenation levels, and by-product concentration. This real-time control significantly minimizes risks associated with batch failure, dramatically accelerates process scale-up from pilot to industrial volumes, and reduces overall operational costs. High-throughput screening (HTS) robotics are widely used in R&D settings to rapidly test hundreds of fermentation conditions and thousands of microbial strains simultaneously, thereby drastically speeding up the R&D timeline for new extract development. The ability to integrate genomic data of proprietary starter cultures with the metabolomic profile of the final extract provides an unprecedented level of process control and intellectual property protection, driving competitive dominance through superior, patented production methodology rather than just raw material availability.

Regional Highlights

Asia Pacific (APAC) continues to hold its status as the most significant market region in terms of volume and market share, benefiting from both a historical consumption legacy and modern manufacturing scale. Countries like South Korea and Japan have highly developed biotechnology sectors that strategically integrate advanced fermentation techniques with deep-rooted traditional health practices, such as the fermentation of high-value botanicals like ginseng and specific medicinal mushrooms. China represents an enormous consumption market, driven by rapidly rising disposable incomes and a strong consumer commitment to traditional Chinese medicine (TCM) that increasingly incorporates bioavailable, standardized fermented herbs. The market in this region is characterized by high volume consumption and an accelerating pace of technological innovation, particularly in applying precision fermentation to local botanical resources to enhance their functional properties for domestic use and aggressive export market expansion. Furthermore, supportive government policies fostering bio-industry development in nations like Singapore, South Korea, and Australia enhance regional competitive stability.

North America is recognized for its dynamic growth trajectory, anticipated to register the highest Compound Annual Growth Rate (CAGR), fueled by early and widespread adoption of sophisticated health and wellness trends and a consumer base explicitly willing to invest a premium for evidence-based, clean-label nutritional products. The strong presence of major nutraceutical, cosmetic, and functional food industry giants in the U.S. and Canada drives continuous, high-volume demand for novel, clinically substantiated fermented ingredients, especially those focusing on personalized nutrition solutions and the rapidly evolving microbiome science. The robust ecosystem of venture capital funding and world-class academic research focused on industrial biotechnology accelerates the commercialization of new fermentation strains and extracts. Regulatory pathways, although strict (e.g., GRAS notification), are generally transparent compared to other regions, provided manufacturers supply comprehensive scientific data, encouraging aggressive market entry and rapid product portfolio expansion by both domestic and international players focused on high-purity, standardized powder forms for mass market consumption.

The European market, including Western and Northern Europe, demonstrates steady, reliable, quality-driven growth, heavily influenced by stringent regulations regarding organic sourcing, clear clean labeling, and environmental sustainability mandates. European consumers place a consistently high premium on supply chain transparency, product traceability, and ecologically sound manufacturing processes, often favoring fermented extracts over traditional chemical extraction counterparts due to the demonstrably lower environmental footprint of modern bioprocessing. The region's significant cosmetics and personal care sector, particularly anchored in France, Germany, and the UK, is a major consumption driver, utilizing high-efficacy fermented extracts for advanced, high-end skincare lines that prioritize natural origin and proven functional results. Market expansion relies heavily on successful and proactive navigation of the EU's complex Novel Food requirements and effective communication of both health benefits and sustainability credentials to a highly discerning consumer base focused equally on efficacy and ethical sourcing.

- Asia Pacific (APAC): Market leader due to deep cultural integration of fermented foods, high consumer spending on traditional health modalities, established, large-scale supply chains for botanicals, and significant governmental support for advanced biotechnology sectors in key nations like South Korea, Japan, and China.

- North America: Fastest growing market segment driven by high nutraceutical penetration rates, significant private investment in advanced bioprocessing R&D, and strong consumer expenditure on personalized and evidence-based functional products targeting chronic health concerns and preventative medicine.

- Europe: Stable, quality-focused growth maintained by stringent clean-label and sustainability requirements, strong consumer preference for organic and highly traceable ingredients, and high adoption of fermented actives in premium cosmetic and functional beverage formulations across the continent.

- Latin America (LATAM): Emerging high-potential market characterized by growing urbanization, increasing public awareness of preventative health, and local adaptation of international wellness trends, leading to rising demand for affordable functional beverages and supplements, particularly in the major economies of Brazil and Mexico.

- Middle East and Africa (MEA): Growth opportunities exist primarily through the increasing importation of specialty functional foods and rising governmental healthcare expenditure in wealthy GCC nations, focusing on premium imported extracts for high-end nutritional and cosmetic applications, though local manufacturing remains limited.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fermented Plant Extract Market.- Arjuna Natural

- AstaReal

- Kikkoman Corporation

- Novozymes

- Chr Hansen Holding A/S

- Lallemand Inc.

- ADM

- Cargill Incorporated

- DSM Nutritional Products

- International Flavors & Fragrances (IFF)

- Symrise AG

- Döhler GmbH

- Givaudan SA

- Lonza Group

- Probi AB

- Sanyo Chemical Industries

- Kyowa Hakko Bio

- Bionutrigen

- Biosynthesis Pharma Group

- Sabinsa Corporation

- Glanbia Nutritionals

- DuPont de Nemours, Inc.

- ABF Ingredients

- Ajinomoto Co. Inc.

- BASF SE

- Naturex (Givaudan)

- Bio-Extracts

- Innova BioTech

- Shanghai Huilin Biotech Co., Ltd.

- Lesaffre

- Kerry Group

- Mitsubishi Chemical Holdings

- Biocatalytics

- Enzymotec

- Ingredia

- Koninklijke FrieslandCampina N.V.

- Mead Johnson Nutrition

- Nestle S.A. (Ingredient Division)

- Biosearch Life

- Biocatalysts Ltd.

- Fermentis (Lesaffre Group)

Frequently Asked Questions

Analyze common user questions about the Fermented Plant Extract market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of using fermented plant extracts?

Fermentation is a biotransformation process that significantly enhances the bioavailability, potency, and nutritional profile of plant extracts. Key benefits include improved gut health support (due to probiotic, prebiotic, and postbiotic content), enhanced nutrient absorption efficiency, superior efficacy in cosmetic applications (better skin penetration), and detoxification of undesirable compounds often present in raw botanicals, resulting in a cleaner, more functional ingredient highly sought after by consumers.

Which application segment drives the highest demand in the market?

The Dietary Supplements and Nutraceuticals segment currently commands the largest market share globally. This high demand is primarily driven by the escalating consumer focus on preventative health strategies, the desire for natural ingredients that offer clinically validated immune support, and the recognized benefits of fermentation-derived ingredients for optimized digestive wellness and efficient nutrient delivery.

How does fermentation technology enhance the safety and stability of extracts?

Controlled fermentation enhances safety by breaking down complex molecules that might be allergenic or difficult to digest, and it reduces microbial load. Stability is improved because fermentation often generates natural anti-microbial compounds (organic acids), extending the product's shelf-life and ensuring reliable efficacy without requiring extensive synthetic preservation, aligning with strict clean-label and food safety standards worldwide.

What regional market holds the highest growth potential for fermented plant extracts?

While the Asia Pacific (APAC) region currently holds the largest overall market volume due to cultural and historical usage, North America is definitively projected to exhibit the fastest Compound Annual Growth Rate (CAGR). This accelerated growth is fueled by advanced biotechnological R&D, substantial private equity investment in bioprocessing, and strong consumer acceptance of high-value, functional, and science-backed nutritional and cosmetic products.

What role does AI play in optimizing the production of these extracts?

Artificial Intelligence (AI) and Machine Learning (ML) are crucial for optimizing production by analyzing massive volumes of complex biological and sensor data in real-time. This allows manufacturers to precisely control bioreactor conditions, predict optimal harvest times, rapidly identify novel high-yield microbial strains, and ensure superior batch-to-batch consistency and purity, significantly enhancing the economic efficiency and scalability of the entire production process.

Why are fermented extracts considered "clean label" ingredients?

Fermented extracts are highly valued in the clean label movement because their production typically relies on natural microbial action and biotransformation rather than harsh chemical solvents or extensive thermal treatments. This results in a final product that often requires fewer artificial preservatives and aligns with consumer demand for natural, recognizable, and minimally processed functional ingredients.

What is the difference between probiotics and postbiotics in fermented extracts?

Probiotics are the live microorganisms (bacteria or yeast) utilized as the starter culture during the fermentation process. Postbiotics, conversely, are the beneficial metabolic compounds—such as short-chain fatty acids (SCFAs), functional proteins, and organic acids—produced by these live cultures, which are often the primary active, stable, and functionally relevant ingredients retained in the final stabilized extract, delivering systemic health benefits.

How is the volatility of botanical raw materials managed during fermentation?

Volatility is managed through sophisticated standardization and process control measures. Manufacturers conduct rigorous pre-fermentation analysis of raw material input, select proprietary microbial strains capable of metabolizing varied substrates consistently, and use AI-driven real-time bioreactor monitoring to dynamically adjust parameters, ensuring the final extract maintains a defined marker concentration regardless of raw material slight variations.

What impact does the cosmetics segment have on the market?

The cosmetics segment is a key growth accelerator, particularly in premium and luxury skincare categories. Fermented extracts offer enhanced efficacy in anti-aging, hydration, and skin microbiome balance due to their naturally smaller molecular size, allowing for superior dermal absorption and reduced sensitization compared to traditional topical actives, thereby driving high-margin revenue growth and product differentiation.

Which technology is most crucial for achieving high purity in the final extract?

Advanced downstream processing technologies are most crucial for ensuring high purity. These include high-resolution membrane separation techniques (like ultrafiltration and nanofiltration) and preparative chromatography, which are essential for selectively isolating the desired small-molecule metabolites and efficiently removing residual microbial biomass, unused substrate, and other process impurities post-fermentation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager