Ferro Vanadium Alloy Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434241 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Ferro Vanadium Alloy Market Size

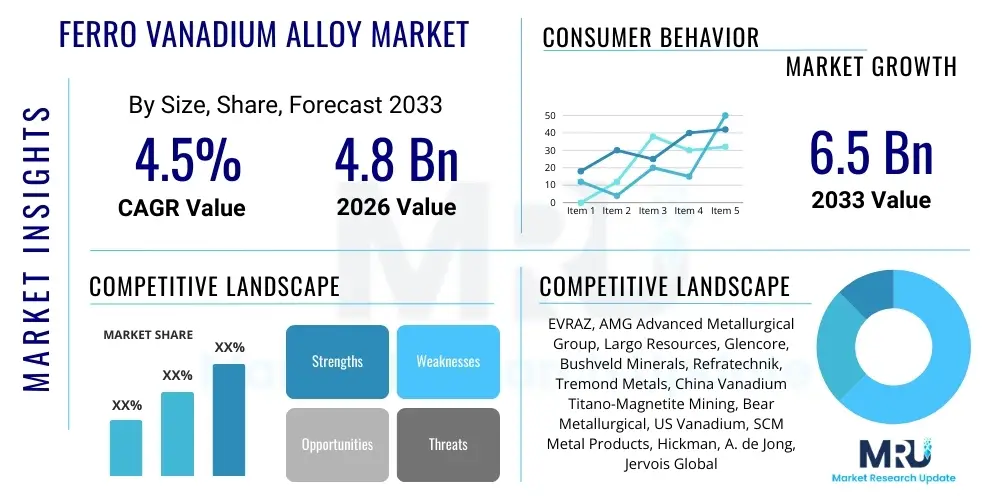

The Ferro Vanadium Alloy Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 6.5 Billion by the end of the forecast period in 2033.

Ferro Vanadium Alloy Market introduction

Ferro Vanadium (FeV) alloy is a critical master alloy composed primarily of iron and vanadium, utilized extensively as an alloying element in the production of specialty steels. Its primary function is to enhance the physical properties of steel, conferring exceptional strength, toughness, hardness, and resistance to abrasion and impact fatigue, even at high temperatures. The market is fundamentally driven by the global demand for high-performance materials necessary for modern infrastructure, automotive efficiency, and aerospace safety.

The product, predominantly categorized by its vanadium content (e.g., FeV50, FeV80), is indispensable in manufacturing High-Strength Low-Alloy (HSLA) steels, tool steels, and structural components. These materials are crucial for constructing earthquake-resistant buildings, manufacturing lightweight vehicle chassis that meet stringent emission standards, and producing high-pressure pipelines. The unique attributes imparted by vanadium, such as fine grain size control and precipitation hardening effects, position ferro vanadium as a strategic material far beyond a mere commodity.

The expansion of the market is closely tied to the cyclic demands of the construction and transportation sectors, particularly in rapidly industrializing regions like Asia Pacific. Furthermore, the emerging requirement for durable materials in renewable energy infrastructure, such as wind turbine components and specialized pressure vessels, significantly boosts the adoption rate. These driving factors, coupled with the slow but steady adoption of vanadium-based alloys in non-steel applications like catalysts and, potentially, large-scale battery storage, solidify the alloy’s central role in advanced manufacturing processes.

Ferro Vanadium Alloy Market Executive Summary

The Ferro Vanadium Alloy Market demonstrates resilient growth driven by infrastructural spending and the global push toward material lightweighting in the automotive industry. Key business trends include supply chain consolidation, particularly involving primary producers in China, Russia, and South Africa, and increasing regulatory scrutiny regarding environmental impact during the mining and smelting processes. Manufacturers are focusing on optimizing production methods to enhance vanadium recovery rates from secondary sources, such as spent catalysts and steel slag, mitigating reliance on volatile primary ore markets.

Regionally, the market is highly segmented. Asia Pacific, led by China and India, maintains market dominance due to massive construction projects and robust industrial output. Europe and North America, while slower in tonnage growth, focus heavily on high-specification, high-value FeV products required for aerospace, defense, and premium automotive applications. A significant regional trend involves the increasing strategic inventory holding in Western nations to hedge against geopolitical risks affecting major supply sources, stabilizing domestic supply chains for critical alloy production.

Segmentally, the application of Ferro Vanadium in HSLA steels remains the largest and most reliable segment, bolstered by global standards demanding higher yield strength in rebar and structural members. However, the most compelling long-term trend lies in the nascent but high-potential vanadium redox flow battery (VRFB) segment. Although currently a minor consumer of vanadium compared to steel, the accelerating development of grid-scale energy storage solutions represents a paradigm shift that could fundamentally reshape long-term vanadium demand dynamics, warranting significant investment and technological exploration.

AI Impact Analysis on Ferro Vanadium Alloy Market

Common user questions regarding AI's influence in the Ferro Vanadium Alloy market center on themes of operational efficiency, supply chain robustness, and material innovation. Users frequently inquire how AI can predict demand fluctuations given the cyclical nature of steel production, optimize complex mining and processing routes (especially concerning environmental compliance), and accelerate the discovery of novel alloy compositions. Key concerns revolve around the integration costs of sophisticated AI systems into established, heavy-industrial operations and ensuring data security across the globally fragmented supply chain. Users generally expect AI to deliver significant gains in predictive maintenance for smelting equipment and improving the efficiency of resource recovery from low-grade ores, ensuring greater price stability and sustainability.

- AI-powered predictive modeling enhances precision demand forecasting for ferro vanadium, aligning production schedules with cyclical steel market needs.

- Machine learning algorithms optimize blast furnace and aluminothermic reduction processes, reducing energy consumption and minimizing waste generation during smelting.

- AI facilitates real-time monitoring and analysis of complex ore leaching processes, maximizing vanadium recovery yield from lower-grade or secondary sources like slag.

- Advanced analytics supports predictive maintenance of specialized processing equipment, reducing unplanned downtime and lowering operational expenditure (OPEX).

- Computational material science leveraging AI accelerates the development and qualification of new high-strength steel grades utilizing ferro vanadium, shortening the time-to-market for specialized alloys.

- AI improves supply chain transparency and risk management by tracking origin, quality verification, and geopolitical stability across mining and refining hubs.

- Autonomous drilling and sorting systems, managed by AI, improve safety and efficiency in the primary extraction of vanadium-bearing titanomagnetite or stone coal ores.

DRO & Impact Forces Of Ferro Vanadium Alloy Market

The Ferro Vanadium Alloy Market is governed by a dynamic interplay of strategic drivers, inherent market constraints, and substantial future opportunities, which collectively define the impact forces acting upon industry participants. Primary drivers include the robust, sustained demand for lighter, safer, and fuel-efficient vehicles, necessitating greater use of HSLA steels, and massive global infrastructure initiatives focused on urban expansion and transportation network development. These forces create a baseline demand that is inelastic to minor price variations, driven by mandated material performance standards. However, the reliance on these macro trends makes the market susceptible to global economic deceleration and large-scale project postponements.

Key restraints center on the significant volatility and opacity of vanadium raw material pricing, which is often dictated by geopolitical shifts and the concentration of mining operations in a few dominant regions (China, Russia, South Africa). Environmental restrictions on mining and processing activities, particularly stricter controls on air emissions and tailings disposal, also impose escalating capital expenditure and operational costs on producers. Furthermore, the limited short-term substitutability of vanadium in high-performance applications restricts flexibility, although alternatives like niobium and titanium are continuously being investigated for specific niche uses, representing a minor long-term competitive restraint.

The major opportunity lies in the burgeoning energy storage sector, specifically the commercial viability of Vanadium Redox Flow Batteries (VRFBs). As global renewable energy integration necessitates large-scale, long-duration storage solutions, the scalability and longevity offered by VRFBs present a monumental, diversification opportunity for vanadium producers. If VRFB technology achieves widespread adoption, it would introduce a completely new, stable, and exponentially growing demand segment for vanadium compounds, significantly altering the traditional market structure dominated by the steel industry. This potential energy-segment growth is the most powerful impact force influencing long-term strategic planning for major market players.

Segmentation Analysis

The Ferro Vanadium Alloy market is intricately segmented across various dimensions, including vanadium content grade, end-use application, and manufacturing process. This segmentation reflects the highly specific requirements of end-user industries, where the purity and concentration of the alloy are critical determinants of performance. The highest volume consumption typically occurs within the steel industry, which relies on standard grades for bulk commodity steels, contrasting sharply with the niche demand for ultra-pure, high-grade FeV required for specialized aerospace components or tool steel manufacturing where material integrity is paramount.

The most crucial segmentation factor remains the application category, particularly the division between structural steel (construction/infrastructure), which consumes large quantities of lower-cost FeV, and specialized alloys (aerospace/chemical), which demand premium, high-vanadium content grades like FeV80. Analyzing these segments helps discern profitability margins; while the construction segment offers volume stability, the specialized alloy market provides higher profitability and resilience against cyclical downturns due to its essential nature in defense and high-technology manufacturing. Understanding these distinct consumption profiles is vital for producers planning output mix and supply chain logistics.

Furthermore, geographic segmentation is crucial, with localized demands dictating product preferences. For instance, in Asia Pacific, the demand is heavily skewed towards rebar and high-rise structural components, whereas North American and European markets exhibit a stronger focus on value-added segments such as advanced automotive components and wear-resistant tool steels. The segmentation based on vanadium content—FeV50 vs. FeV80—also reflects technological maturity, where FeV80 is often favored for its efficiency in high-performance steelmaking, minimizing the addition of non-metallic impurities into the final alloy batch.

- By Application:

- High-Strength Low-Alloy (HSLA) Steel

- Carbon Steel

- Tool Steel & High-Speed Steel (HSS)

- Stainless Steel & Heat-Resistant Steel

- Aerospace Components

- Chemical Catalysts

- Energy Storage (Vanadium Redox Flow Batteries - VRFB)

- By Grade:

- FeV50 (50-60% Vanadium Content)

- FeV80 (75-85% Vanadium Content)

- Other Grades (FeV60, etc.)

- By Manufacturing Process:

- Aluminothermic Reduction

- Silicon Reduction

- Electroslag Refining (ESR)

Value Chain Analysis For Ferro Vanadium Alloy Market

The value chain of the Ferro Vanadium Alloy Market is complex, beginning with the highly capital-intensive upstream sector focused on mining and primary processing, followed by the midstream conversion into the ferroalloy, and culminating in the downstream consumption by diverse manufacturing sectors. Upstream activities involve the extraction of vanadium-bearing ores, primarily titanomagnetite or uraniferous stone coal, requiring sophisticated processing steps such as roasting, leaching, and solvent extraction to produce high-purity V2O5 flakes or powder. This stage is dominated by large, integrated producers who control both mining assets and initial conversion facilities, which creates significant barriers to entry.

The midstream processing, where V2O5 is reduced to Ferro Vanadium alloy (FeV) through exothermic aluminothermic or silicon reduction processes, represents the core manufacturing step. Quality control and purity are critical here, as the final FeV specification directly impacts the integrity of the downstream steel products. Distribution channels are bifurcated: direct sales characterize the relationship between major producers and large, integrated steel mills who require predictable, high-volume supply contracts. Conversely, smaller foundries, specialty steel producers, and tool steel manufacturers often rely on indirect channels, engaging distributors and traders who manage inventory, handle complex logistics, and provide financing solutions.

Downstream consumers are primarily steel manufacturers, ranging from mega-scale integrated mills producing rebar and structural beams to specialized manufacturers producing advanced turbine blades and wear-resistant machinery components. The trend in the downstream sector is toward tighter integration with alloy suppliers, often involving technical collaboration to tailor FeV specifications for unique alloy recipes. The direct channel fosters long-term partnerships and price stability, whereas the indirect channel provides flexibility for customers requiring smaller, specialized batches quickly, ensuring that the supply chain caters efficiently to both high-volume commodity demand and high-specification niche demand.

Ferro Vanadium Alloy Market Potential Customers

The primary customer base for Ferro Vanadium alloy consists overwhelmingly of entities within the metallurgical industries, specifically steel manufacturers who leverage the alloy's strengthening properties to meet modern material specifications. These customers are broadly categorized into large-scale integrated steel producers focused on construction and infrastructure materials, specialized mini-mills manufacturing tool steels and high-speed steels, and dedicated component manufacturers serving highly regulated sectors. The demand profile of these customers is heavily correlated with global GDP growth, infrastructure investment cycles, and regulatory mandates emphasizing improved safety and energy efficiency in transportation.

Secondary, yet critically important, customers include manufacturers in the aerospace and defense sectors, where the demand for ultra-high-strength, low-density alloys (such as titanium-vanadium alloys) is non-negotiable for critical components like landing gear, engine casings, and structural frames. These customers prioritize quality assurance, traceability, and adherence to stringent material certifications above cost considerations. Their purchasing decisions are driven by long-term strategic needs and strict regulatory compliance, often requiring long-term certified supplier relationships.

An emerging segment of potential customers includes utility companies and independent power producers (IPPs) investing in grid stabilization and renewable energy integration. These entities are the end-users for Vanadium Redox Flow Batteries (VRFBs), representing a future high-growth segment. While the direct buyer of the ferro vanadium alloy might be the electrolyte manufacturer, the ultimate demand signal is driven by the energy sector's need for industrial-scale battery storage solutions, marking a strategic shift in potential market diversification beyond traditional metallurgical applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 6.5 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | EVRAZ, AMG Advanced Metallurgical Group, Largo Resources, Glencore, Bushveld Minerals, Refratechnik, Tremond Metals, China Vanadium Titano-Magnetite Mining, Bear Metallurgical, US Vanadium, SCM Metal Products, Hickman, A. de Jong, Jervois Global, Australian Vanadium, Hunan Gold Group, Atlantic Metals, V-Resources. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ferro Vanadium Alloy Market Key Technology Landscape

The technological landscape of the Ferro Vanadium Alloy market is centered around optimizing the efficiency, environmental compliance, and cost-effectiveness of the reduction process, alongside innovations in raw material sourcing. The two dominant production technologies remain the exothermic aluminothermic reduction and the silicon reduction processes. Aluminothermic reduction is favored for high-purity requirements due to its ability to generate high temperatures without external energy input, but it requires careful control of the heat balance and relies on aluminum consumption. Silicon reduction is often used for lower-grade production or when high silicon content is permissible in the final alloy, demanding stringent process control to manage slag composition and achieve high metal yield.

A significant technological focus is on enhancing environmental sustainability through improved slag processing and the recycling of vanadium from secondary sources. Innovations in hydrometallurgy and pyrometallurgy are enabling producers to economically extract vanadium from spent petroleum catalysts, power plant ash, and steel production slag. This recycling effort not only diversifies the supply chain but also lowers the environmental footprint associated with primary mining. The development of specialized leaching agents and solvent extraction techniques is critical to ensuring high recovery rates while minimizing hazardous waste generation, thus satisfying increasingly strict global environmental regulations.

Furthermore, technology related to material handling and quality assurance, particularly in the production of high-grade FeV80, is becoming increasingly automated. Advanced spectroscopic analysis and continuous monitoring systems are being implemented to ensure precise chemical composition and homogeneity, which is vital for aerospace and specialty steel applications. New technologies are also being developed for the production of high-purity vanadium chemicals (like V2O5 and electrolyte solutions) necessary for the burgeoning VRFB sector, which demands extremely low impurity levels to ensure battery longevity and optimal performance, representing a technological pivot from bulk metallurgical production to specialized chemical manufacturing.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of global ferro vanadium consumption, predominantly driven by China and India. China, being the world's largest steel producer and a major vanadium miner, dictates global price trends and supply dynamics. The immense infrastructural development, high-volume automotive manufacturing, and rapid urbanization across the region sustain an unparalleled demand for HSLA steels, making APAC the highest volume market, though facing increasing internal environmental regulations impacting production capacity.

- North America: Characterized by demand for high-specification alloys, North America focuses on sectors like aerospace, defense, and premium automotive manufacturing. The market emphasizes high-purity FeV80 grades. Regulatory stability and a strategic need to secure domestic supply chains drive interest in localized vanadium recycling operations and partnerships with stable primary producers.

- Europe: Similar to North America, European demand is highly focused on quality and performance, particularly in the tool steel, machinery, and specialty vehicle sectors. Stringent EU environmental policies push manufacturers towards adopting cleaner production technologies and prioritizing materials with certified sustainable sourcing. The region is a key innovator in the development and deployment of Vanadium Redox Flow Batteries (VRFBs).

- Middle East & Africa (MEA): This region is pivotal for its upstream activities, particularly South Africa, which holds significant primary vanadium reserves and contributes substantially to global supply. Demand within the MEA region is growing, primarily linked to oil and gas pipeline infrastructure and large-scale urban development projects.

- Latin America: Growth in Latin America is tied to commodity cycles, specifically mining equipment manufacturing and expanding transportation infrastructure projects. Brazil is a crucial market, both as a producer (Largo Resources) and as a substantial consumer in its domestic construction and industrial sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ferro Vanadium Alloy Market.- EVRAZ

- AMG Advanced Metallurgical Group

- Largo Resources

- Glencore

- Bushveld Minerals

- Refratechnik

- Tremond Metals

- China Vanadium Titano-Magnetite Mining

- Bear Metallurgical

- US Vanadium

- SCM Metal Products

- Hickman

- A. de Jong

- Jervois Global

- Australian Vanadium

- Hunan Gold Group

- Atlantic Metals

- V-Resources

- Shaanxi Changbai Ferroalloy

- Treibacher Industrie AG

Frequently Asked Questions

Analyze common user questions about the Ferro Vanadium Alloy market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of demand in the Ferro Vanadium Alloy Market?

The primary driver is the global steel industry's requirement for High-Strength Low-Alloy (HSLA) steels, which are essential for increasing the safety, longevity, and fuel efficiency of infrastructure and automotive components, driven by stricter engineering and environmental standards worldwide.

How does Ferro Vanadium (FeV) contribute to steel quality?

FeV acts as a potent strengthening agent and grain refiner in steel. By forming extremely fine, stable carbonitrides, it inhibits grain growth, leading to higher yield strength, increased fatigue resistance, and superior toughness, particularly vital for earthquake-resistant structures and tool applications.

What role do Vanadium Redox Flow Batteries (VRFBs) play in the future market growth?

VRFBs represent the most significant non-metallurgical opportunity. As demand for grid-scale, long-duration energy storage accelerates, VRFBs require large volumes of high-purity vanadium electrolyte. Widespread VRFB adoption could introduce a stable, high-growth demand segment, potentially diversifying the market away from its heavy reliance on cyclical steel demand.

Which regions dominate the global supply of Ferro Vanadium?

Global supply is highly concentrated, primarily dominated by producers in Asia Pacific (especially China) and Eastern Europe/Africa (Russia and South Africa). These regions control the majority of primary vanadium ore mining and processing capacity, influencing global price and availability.

What are the key grades of Ferro Vanadium and their differences?

The key commercial grades are FeV50 (50-60% Vanadium) and FeV80 (75-85% Vanadium). FeV80 is preferred for high-performance and high-purity steel applications as it allows steelmakers to add the necessary vanadium while minimizing the introduction of iron and other residual elements into the highly specified molten steel bath.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager