Ferrochrome Alloy Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437225 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Ferrochrome Alloy Market Size

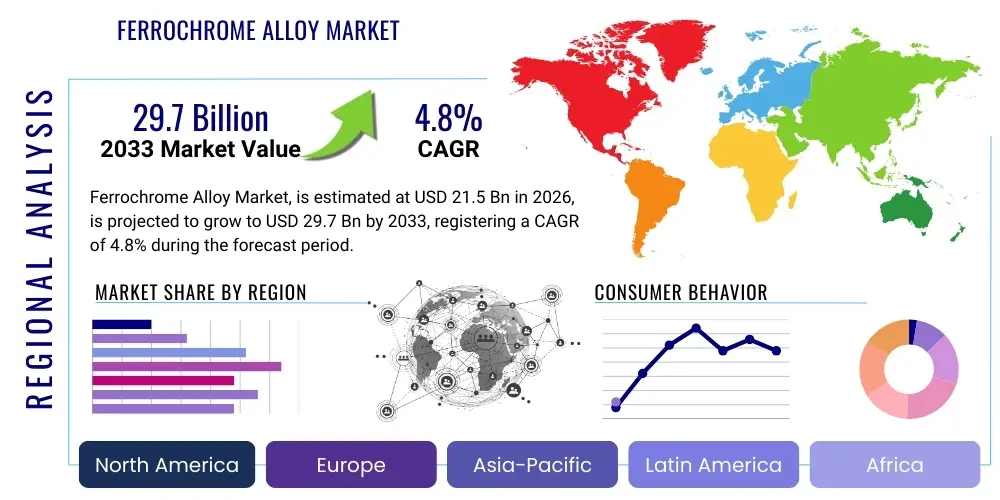

The Ferrochrome Alloy Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 21.5 Billion in 2026 and is projected to reach USD 29.7 Billion by the end of the forecast period in 2033.

Ferrochrome Alloy Market introduction

Ferrochrome (FeCr) alloy is fundamentally an alloy of chromium and iron, characterized by its high chromium content, typically ranging between 50% and 70%. This alloy is indispensable in metallurgical processes, primarily serving as a key component for imparting critical characteristics such as corrosion resistance, heat resistance, and enhanced hardness to steel. The primary commercial production methods involve the reduction of chrome ore using carbon in large submerged arc furnaces, a process requiring substantial energy input and sophisticated thermal management. The quality and composition of the resulting ferrochrome, categorized mainly by carbon content (High Carbon, Medium Carbon, Low Carbon), dictate its specific end-use application in the stainless steel industry.

The overwhelming majority of ferrochrome produced globally, estimated at over 80%, is consumed by stainless steel manufacturers. Chromium is the elemental component that differentiates stainless steel from conventional carbon steel, forming a stable, passive oxide layer on the steel surface that resists rust and corrosion. Beyond stainless steel production, ferrochrome finds application in superalloys, tool steels, and cast irons where improved mechanical properties and chemical stability under extreme conditions are required. The continuous expansion of global infrastructure projects, coupled with robust demand from the automotive and construction sectors, ensures sustained reliance on high-quality ferrochrome alloys.

Key driving factors supporting market expansion include the rapid urbanization and industrialization occurring across developing economies, notably in Asia Pacific, which fuels massive demand for stainless steel products in construction and consumer goods. Furthermore, the rising adoption of duplex and specialized stainless steel grades in demanding applications such as chemical processing plants and oil and gas infrastructure further cements ferrochrome's essential role. The intrinsic benefits provided by ferrochrome, such as improved longevity and reduced maintenance requirements for final steel products, maintain its position as a critical upstream commodity.

Ferrochrome Alloy Market Executive Summary

The Ferrochrome Alloy Market is currently experiencing a period of transformation characterized by significant shifts in production geography and increasing emphasis on sustainability within the supply chain. Business trends indicate a consolidation among major mining and smelting entities focused on optimizing economies of scale and securing long-term chrome ore supply contracts, particularly in resource-rich nations such as South Africa and Kazakhstan. Market stability remains sensitive to global stainless steel output, which serves as the primary demand indicator. Technological advancements, particularly in smelting efficiency and energy utilization, are becoming central to maintaining competitive production costs amidst volatile energy prices.

Regional trends unequivocally highlight Asia Pacific (APAC), led by China and India, as the epicenter of both ferrochrome production and consumption. China’s vast stainless steel industry drives unprecedented demand, necessitating large-scale imports of high-grade ferrochrome and chrome ore. Conversely, traditional producing regions like Europe and North America are focusing more intensely on specialized, high-purity ferrochrome grades and are grappling with stricter environmental regulations that necessitate investments in decarbonization technologies. The geopolitical stability of key chrome ore suppliers critically influences global pricing and trade flows, creating inherent supply chain risks that are closely managed by large consuming nations.

Segmentation trends reveal a persistent demand for High Carbon Ferrochrome (HCFeCr) due to its cost-effectiveness in bulk stainless steel production. However, there is a moderate but growing preference for refined grades such as Low Carbon Ferrochrome (LCFeCr) and Ultra-Low Carbon Ferrochrome (ULCFeCr) in high-specification engineering applications, including aerospace and specialized automotive components, where precise carbon control is paramount. The increasing focus on circular economy models also highlights the emerging trend of utilizing recycled chrome materials, though this segment currently represents a minor fraction of the total market volume, primarily constrained by the availability of quality scrap.

AI Impact Analysis on Ferrochrome Alloy Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Ferrochrome Alloy Market frequently revolve around optimizing energy-intensive smelting processes, improving raw material quality prediction, and enhancing supply chain resilience against geopolitical disruptions. Users are particularly concerned with how AI can mitigate the enormous energy consumption associated with submerged arc furnaces and reduce operational expenditure. Key themes emerging from these inquiries include the potential for AI-driven predictive maintenance to minimize unplanned downtime, the application of machine learning for instantaneous quality control of the final alloy composition, and utilizing advanced analytics to forecast volatile chrome ore and electricity prices accurately, thereby informing strategic purchasing decisions. The expectation is that AI integration will lead to higher resource efficiency, lower environmental impact, and superior product consistency, fundamentally changing how large-scale ferrochrome operations are managed globally.

- Enhanced Energy Optimization: AI algorithms monitor real-time thermal conditions and power consumption in electric arc furnaces, adjusting parameters dynamically to minimize electricity usage per ton of ferrochrome produced.

- Predictive Maintenance: Machine learning models analyze vibration, temperature, and current data from smelting equipment to predict equipment failure, drastically reducing unexpected operational downtime and maintenance costs.

- Raw Material Blending Optimization: AI analyzes the chemical composition of incoming chrome ore and reductants, optimizing the charging mixture for maximum yield and desired alloy specifications, reducing waste in the process.

- Supply Chain Risk Mitigation: Advanced analytics platforms predict demand fluctuations and potential geopolitical or logistical bottlenecks affecting chrome ore shipments, enabling proactive inventory management and diversification of sourcing.

- Quality Control Automation: Computer vision and sensor fusion systems utilize AI to perform real-time analysis of the molten bath and solidified alloy, ensuring immediate detection and correction of compositional deviations.

- Decarbonization Pathway Modeling: AI simulates various alternative production pathways (e.g., hydrogen reduction, biomass reductants) to quantify their viability, cost implications, and carbon footprint reduction potential for sustainable ferrochrome production.

DRO & Impact Forces Of Ferrochrome Alloy Market

The Ferrochrome Alloy Market is simultaneously propelled by robust global demand for stainless steel products and constrained by significant operational challenges, primarily relating to energy intensity and raw material sourcing volatility. Key drivers include sustained global infrastructure investment, particularly rapid urbanization in emerging economies necessitating massive volumes of stainless steel for construction and utilities, alongside the increasing complexity and volume of consumer applications utilizing stainless components. However, growth is tempered by substantial restraints, notably the inherently high energy costs associated with smelting, which account for a major portion of production expenditure, and the volatile, often geopolitically influenced pricing dynamics of chrome ore, creating significant uncertainty for producers lacking captive mining capabilities. These forces, when combined, create a dynamic market environment where resilience and technological efficiency are paramount to sustaining profitability and competitiveness.

Opportunities for market players are concentrated around the pivot towards sustainable and green ferrochrome production. This involves exploring and implementing alternative, less carbon-intensive reductants (such as biomass or hydrogen) and investing in efficient closed-loop recycling processes for chrome-containing waste. Furthermore, the market opportunity extends to specialized, high-purity ferrochrome grades, which command premium pricing in niche but rapidly growing sectors like aerospace and medical devices, requiring stringent material specifications. The inherent impact forces are defined by the critical reliance of the ferrochrome industry on chrome ore availability, the downstream dependence on global steel demand cycles, and the regulatory pressure from industrialized nations pushing for lower carbon footprints across all heavy industries. These forces dictate strategic choices regarding location, technology, and supply chain management.

The interplay of these drivers, restraints, and opportunities ensures that the market remains structurally complex. For instance, while urbanization in Asia drives volume demand (a major driver), the corresponding increase in global energy costs (a major restraint) disproportionately impacts producers relying on grid electricity, leading to competitive advantages for producers in regions with access to stable, low-cost power, such as South Africa or certain parts of China with access to subsidized power. Managing this balance, coupled with securing long-term access to reliable chrome ore deposits, defines the strategic success of market participants over the forecast period, emphasizing vertical integration as a key strategic move to absorb supply chain shocks and control input costs effectively.

Segmentation Analysis

The Ferrochrome Alloy Market is extensively segmented based on criteria encompassing alloy type, application spectrum, and end-user industries, reflecting the diverse requirements of downstream metallurgical processes. The primary segmentation by product type revolves around the carbon content, which dictates the alloy's physical properties and suitability for specific stainless steel grades. High Carbon Ferrochrome (HCFeCr), containing 6% to 8% carbon, dominates volume due to its cost-efficiency in producing standard 300 series stainless steel. Conversely, the smaller volume segments of Medium Carbon (MCFeCr) and Low Carbon Ferrochrome (LCFeCr) serve high-specification markets where carbon control is vital to prevent intergranular corrosion, ensuring market diversification based on technical need and resulting in highly differentiated pricing structures across these product categories.

Segmentation by application clarifies the overwhelming dominance of the stainless steel industry, which relies on ferrochrome to provide essential corrosion and oxidation resistance. Within stainless steel, the material is used extensively in flat products (sheets, plates) and long products (bars, rods). Secondary applications, while smaller in volume, are crucial for specialty metallurgy, including the production of tool and die steels, specialized superalloys utilized in high-temperature environments (such as turbine blades), and specific grades of cast iron where chromium improves wear resistance. This application diversity provides resilience to the market, mitigating complete reliance on a single downstream sector, although stainless steel remains the primary determinant of global market dynamics and pricing benchmarks.

The segmentation by end-user industry illustrates the linkage between macroeconomic activities and ferrochrome consumption. Construction and infrastructure represent the largest end-user segment, driven by global building projects, including commercial structures and utility piping systems. The automotive sector is another significant consumer, demanding stainless steel for exhaust systems, catalytic converters, and structural components requiring high heat resistance. Furthermore, the machinery and equipment manufacturing sector utilizes ferrochrome alloys for robust industrial components, reflecting the integral role of high-chromium steel in mechanical engineering, thus ensuring broad market exposure across multiple industrial expenditure cycles.

- By Product Type:

- High Carbon Ferrochrome (HCFeCr)

- Medium Carbon Ferrochrome (MCFeCr)

- Low Carbon Ferrochrome (LCFeCr)

- Ultra-Low Carbon Ferrochrome (ULCFeCr)

- Ferrochrome Silicon

- By Application:

- Stainless Steel Production (Major Segment)

- Engineering and Tool Steel

- Superalloys and Special Alloys

- Foundry and Cast Iron Production

- By End-User Industry:

- Construction and Infrastructure

- Automotive and Transportation

- Machinery and Equipment

- Chemical and Petrochemical Processing

- Aerospace and Defense

Value Chain Analysis For Ferrochrome Alloy Market

The value chain for the Ferrochrome Alloy Market is complex, beginning with the upstream activities of chrome ore mining and concentrating, primarily located in geopolitical hotspots such as South Africa, Kazakhstan, and India. Upstream analysis focuses on the extraction efficiency, logistical costs associated with transporting the ore, and the quality of the chrome content, which directly impacts the subsequent smelting process. Raw material sourcing involves intense negotiation and long-term contracts, as access to high-grade ore reserves is a critical competitive advantage. Smelting—the core process involving the conversion of chrome ore and reductants (coke, coal) into ferrochrome in submerged arc furnaces—represents the most capital- and energy-intensive stage of the value chain, where technological efficiency dictates cost leadership.

Midstream activities involve refining and alloy modification, especially for producing specialized grades like LCFeCr and ULCFeCr, often utilizing processes such as Argon Oxygen Decarburization (AOD) or Vacuum Oxygen Decarburization (VOD). Distribution channels bridge the gap between large-scale smelters and global end-users, encompassing both direct sales channels for major integrated steel producers and indirect distribution through international commodity traders and regional stocking distributors. Direct sales offer higher margins and closer customer relationships but require significant logistical capabilities, whereas indirect sales provide broader market reach and liquidity, particularly for smaller market players and fluctuating spot demands across various geographical regions.

Downstream analysis is dominated by the demand emanating from stainless steel mills, which act as the final major consumers. These mills utilize ferrochrome in precise quantities to achieve required alloy compositions. The performance of the ferrochrome alloy is evaluated based on its consistency, purity, and ease of dissolution during steelmaking. The efficiency of the entire chain is measured by its ability to deliver consistent, cost-effective ferrochrome, often requiring strong vertical integration from ore to alloy. Price volatility in the downstream stainless steel market significantly influences the margins achievable at the smelting and distribution stages, ensuring strong feedback loops throughout the entire value structure.

Ferrochrome Alloy Market Potential Customers

The primary and most critical customer base for the Ferrochrome Alloy Market consists of global stainless steel manufacturers. These entities, ranging from multinational integrated steel giants to specialized regional mills, rely on large, consistent volumes of ferrochrome—particularly High Carbon Ferrochrome—as a primary alloying agent to achieve the desired mechanical and corrosion-resistant properties of their products. Consumption is heavily concentrated among the top 10 stainless steel producers globally, which often enter into long-term procurement agreements with major ferrochrome suppliers to ensure stable, high-volume supply and favorable pricing structures. The purchasing criteria for these major customers prioritize consistency in chromium content, low impurity levels (like phosphorus and sulfur), and reliability of delivery, often dictating the quality standards for the entire market.

Secondary but significant customers include specialized foundries and producers of high-performance non-ferrous alloys. Foundries utilize ferrochrome for casting high-wear components, particularly in the mining, cement, and construction machinery sectors, where high chromium content improves hardness and abrasive wear resistance in cast iron. Producers of superalloys, crucial for the aerospace and energy sectors (gas turbines, jet engines), are critical customers for highly refined Low Carbon and Ultra-Low Carbon Ferrochrome grades, demanding exceptionally high purity and specific trace element limits. Although their volume requirement is smaller, these niche buyers are willing to pay a substantial premium for customized, high-specification materials, demonstrating the market's differentiation capability.

Furthermore, intermediate trading houses and commodity brokers act as crucial intermediaries, purchasing bulk quantities from producers and reselling to various smaller steel mills and end-users worldwide. While not the final consumers, their role is essential for maintaining market liquidity, managing logistics, and providing risk hedging services. The procurement decisions of all these customer types are intricately linked to global economic growth indicators, especially industrial capacity utilization rates and capital expenditure cycles in the infrastructure, automotive, and machinery manufacturing sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 21.5 Billion |

| Market Forecast in 2033 | USD 29.7 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Glencore, Merafe Resources, Samancor Chrome, Eurasian Resources Group (ERG), Outokumpu, Tata Steel, Sinosteel Corporation, IMFA (Indian Metals & Ferro Alloys), Vametco, Afarak Group, JSW Steel, S.A. Minerals, Balasore Alloys, Minara Resources, Assmang Limited, Anglo American, Tsingshan Holding Group, FELMAN Production, LLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ferrochrome Alloy Market Key Technology Landscape

The technological landscape of the Ferrochrome Alloy Market is dominated by the energy-intensive smelting process, primarily conducted in large Submerged Arc Furnaces (SAF). Recent technological advancements focus heavily on optimizing energy efficiency and reducing the environmental footprint of these SAFs. Improvements include enhanced furnace design, sophisticated process control systems utilizing advanced sensors and data analytics for consistent charge control, and optimization of pre-reduction processes, such as pelletizing and sintering of chrome ore fines, to reduce the energy requirement during the final smelting stage. These improvements are crucial for major producers competing globally against fluctuating electricity prices and increasing pressure to meet sustainability targets, driving the adoption of more advanced closed-furnace technology over traditional open units.

Beyond the primary smelting, significant technological innovation centers on refining processes required to produce specialized low-carbon grades. The Argon Oxygen Decarburization (AOD) process and the Vacuum Oxygen Decarburization (VOD) process remain the core methods for reducing the carbon content in the molten alloy to specified ultra-low levels. Efficiency gains in these refining stages are vital, involving improvements in gas injection rates, temperature management, and refractory life extension, all aimed at minimizing process time and material loss. The move toward specialized alloys necessitates greater precision in these secondary metallurgical steps, leading to increased investment in advanced instrumentation and metallurgical modeling capabilities to ensure homogeneity and purity.

Looking ahead, the market is seeing burgeoning interest in revolutionary, sustainable technologies designed to eliminate high carbon emissions. This includes research into utilizing biomass and plastic waste as environmentally friendly reductants in place of metallurgical coke, a technology particularly relevant in regions with stringent carbon taxes. Furthermore, experimental research involves hydrogen reduction technology, aiming to replace carbon entirely and produce 'green ferrochrome' with minimal associated CO2 emissions. While these sustainable alternatives are currently high-cost and low-volume, they represent the future direction of technological investment driven by global decarbonization mandates and consumer preference for sustainably sourced materials.

Regional Highlights

-

Asia Pacific (APAC) Market Dominance: The APAC region stands as the undisputed leader in the Ferrochrome Alloy Market, accounting for the vast majority of both global consumption and production capacity. This dominance is primarily driven by the massive scale of the Chinese stainless steel industry, which requires continuous, high-volume inputs of ferrochrome to sustain its output of construction materials, kitchenware, and industrial equipment. China, despite lacking substantial domestic chrome ore reserves, has invested heavily in smelting capacity, importing vast quantities of ore from South Africa and other resource-rich nations. India is rapidly emerging as another significant growth pole, fueled by its infrastructure boom, expanding domestic steel production capabilities, and supportive governmental policies encouraging manufacturing self-sufficiency. This regional dynamic centers on high-volume High Carbon Ferrochrome production, defining global price trends and logistics.

The high growth rate in the APAC region is structurally supported by favorable economics, including generally lower operational costs compared to North America and Europe, and proximity to major downstream processing centers. South Korea, Japan, and Taiwan also contribute significantly, focusing more on higher-grade stainless steel products for electronics and specialized manufacturing, thus driving moderate demand for Medium and Low Carbon Ferrochrome. Strategic regional players are focused on securing captive power supply and implementing advanced logistics to manage the complex supply chain of imported ore and exported finished alloy, making infrastructure and trade agreements vital components of regional success.

Environmental regulations are tightening in key APAC manufacturing hubs, particularly in China, leading to a structural shift where inefficient or polluting older smelters are being retired, creating opportunities for large, modern plants to consolidate market share based on superior environmental compliance and energy efficiency. This regulatory pressure, though less severe than in Europe, is initiating the gradual adoption of cleaner production technologies across the region, especially in newly constructed facilities designed for future compliance, while demand volume continues its upward trajectory fueled by urban expansion.

-

North American Market Focus on Specialization: The North American ferrochrome market is characterized by mature demand, lower domestic production capacity compared to consumption, and a strong focus on high-specification, niche applications. While the region is a net importer of bulk ferrochrome, its domestic producers concentrate on high-purity, specialty alloys demanded by the aerospace, defense, and high-end automotive sectors. These industries prioritize material reliability and certification over sheer cost, driving demand for Low Carbon and Ultra-Low Carbon grades used in superalloys and specialized corrosion-resistant components.

Market dynamics in North America are highly influenced by trade policies and the cost of energy, which make large-scale, high-carbon ferrochrome production economically challenging relative to imports. Manufacturers in this region often integrate backward into refining processes (AOD, VOD) to create value-added products from imported bulk HCFeCr. The market is also highly sensitive to cycles in capital expenditure within the oil and gas industry and commercial aerospace manufacturing, sectors that require stringent material specifications and performance guarantees, compensating for lower overall volume compared to Asia.

Technological innovation in North America is geared towards material science and efficient recycling methods. There is significant investment in developing advanced steel grades that require precise ferrochrome compositions, pushing metallurgical boundaries. Furthermore, stringent environmental standards necessitate continuous upgrades in emission control and waste management technologies, driving a strategic focus on sustainability and material traceability throughout the supply chain to meet discerning customer and regulatory expectations.

-

European Market Under Regulatory Pressure: Europe represents a technologically advanced but cost-pressured market for ferrochrome alloys. The region historically possessed strong smelting capabilities, but high energy costs and the comprehensive framework of the European Green Deal, including the Emissions Trading System (ETS), have structurally constrained bulk production capacity. European producers are now fiercely focused on producing specialty grades and ferrochrome derivative products, leveraging advanced metallurgical expertise to cater to high-value markets such as high-precision manufacturing and specialized machinery.

The core challenge in Europe remains mitigating operational costs while complying with some of the world's strictest environmental mandates. This has catalyzed investment in breakthrough technologies, particularly the exploration of carbon-neutral production pathways utilizing hydrogen or advanced biomass reductants, positioning Europe as a key development hub for "green ferrochrome" technologies. The demand side is stable, anchored by robust manufacturing sectors in Germany, Italy, and Nordic countries, which maintain high standards for the quality and sustainability of their material inputs, driving the trend toward certified, low-carbon sourcing.

Sourcing strategies within Europe are highly sophisticated, emphasizing security of supply and ethical sourcing. Major European stainless steel producers maintain diverse supply channels, including long-term contracts with suppliers in South Africa, Kazakhstan, and Turkey, mitigating dependency on any single source. The regional market reflects a critical balance between cost competitiveness, technological leadership in specialized grades, and adherence to the continent’s ambitious decarbonization agenda, fundamentally reshaping its role from a volume producer to a quality and technology leader.

-

Middle East and Africa (MEA) - Resource and Export Hub: The MEA region is vital due to its immense chrome ore reserves, particularly in South Africa, which dominates global chrome ore supply and is a major exporter of High Carbon Ferrochrome. South Africa's market strength lies in its abundant domestic ore supply and large-scale smelting capacity, making it a critical global benchmark for HCFeCr pricing. However, the region faces significant internal challenges, including recurring issues with electricity supply (load shedding) and high logistical hurdles, which intermittently constrain production output and affect global supply stability.

Other countries in the MEA, notably in the Middle East, are exploring new smelting capacities, often leveraging abundant, relatively low-cost natural gas resources to power the process, offering a competitive edge over coal-dependent regions. The strategic focus here is on exporting bulk commodity ferrochrome to high-demand regions like APAC, utilizing their natural resource advantages. Political and economic stability remains a crucial factor influencing investment in new mining and smelting infrastructure across the region.

Future growth is contingent upon resolving infrastructural constraints and modernizing existing smelters to improve efficiency and stability. The region is increasingly focused on vertical integration to capture more value from its raw materials, moving beyond simple ore export to sophisticated alloy production. Global buyers view MEA output as essential, making the region's operational consistency a primary concern for worldwide stainless steel production planning.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ferrochrome Alloy Market.- Glencore

- Merafe Resources

- Samancor Chrome (Pty) Ltd.

- Eurasian Resources Group (ERG)

- Outokumpu Oyj

- Tata Steel Limited

- Sinosteel Corporation

- Indian Metals & Ferro Alloys Ltd. (IMFA)

- Vametco (A strategic entity of Bushveld Minerals)

- Afarak Group Oyj

- JSW Steel Ltd.

- S.A. Minerals Group

- Balasore Alloys Ltd.

- Minara Resources (A subsidiary of Glencore)

- Assmang Limited

- Anglo American plc

- Tsingshan Holding Group Co., Ltd.

- FELMAN Production, LLC

- Monarch Metals Pvt. Ltd.

- Donetsk Electrometallurgical Plant (DEMZ)

Frequently Asked Questions

Analyze common user questions about the Ferrochrome Alloy market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Ferrochrome Alloy Market?

The primary factor driving demand is the consistent and escalating global production of stainless steel. Ferrochrome is an indispensable alloying agent, constituting the main source of chromium necessary to impart corrosion resistance and strength to stainless steel, which is heavily consumed by the construction and automotive sectors.

Which geographical region dominates the global consumption of Ferrochrome?

Asia Pacific (APAC), particularly China, dominates global ferrochrome consumption. This is due to the region's massive industrial base and overwhelming stainless steel production capacity, fueled by large-scale urbanization and infrastructure development projects.

How do energy prices impact the production cost of Ferrochrome?

Energy prices significantly impact production costs because ferrochrome smelting in submerged arc furnaces is extremely energy-intensive. Electricity can account for a substantial portion of the total operating expenditure, making producers in regions with high or volatile energy costs less competitive than those with access to stable, low-cost power.

What are the different types of Ferrochrome alloys and their main uses?

Ferrochrome alloys are mainly categorized by carbon content: High Carbon Ferrochrome (HCFeCr) is used for bulk stainless steel production; Medium Carbon (MCFeCr) and Low Carbon Ferrochrome (LCFeCr/ULCFeCr) are used for specialized high-performance and corrosion-resistant alloys, such as superalloys and specialized tool steels, where tight carbon control is critical.

What sustainability opportunities exist within the Ferrochrome Market?

Sustainability opportunities include the adoption of green production technologies, such as utilizing biomass or hydrogen as reductants instead of traditional coke, to lower carbon emissions. Furthermore, increased efficiency in recycling chromium from steel slag and spent refractories offers pathways toward circular economy models and reduced environmental impact.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager