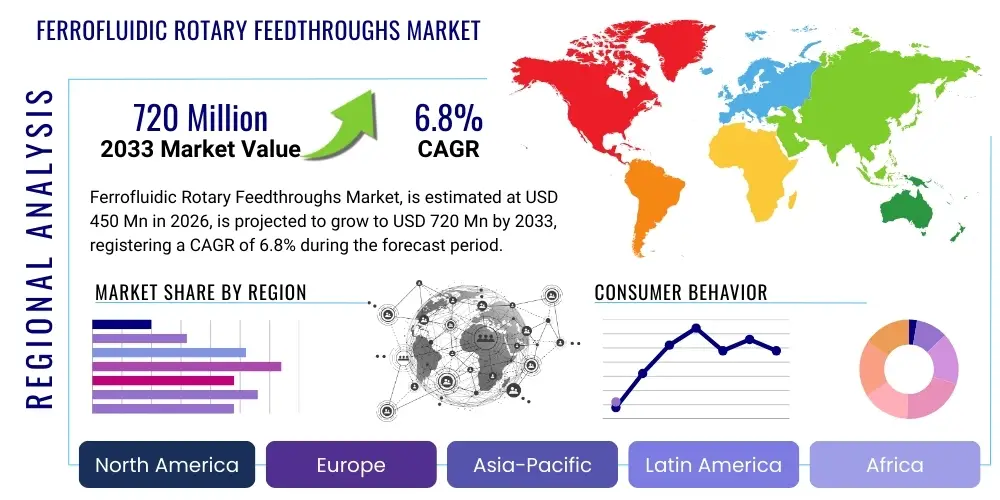

Ferrofluidic Rotary Feedthroughs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437542 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Ferrofluidic Rotary Feedthroughs Market Size

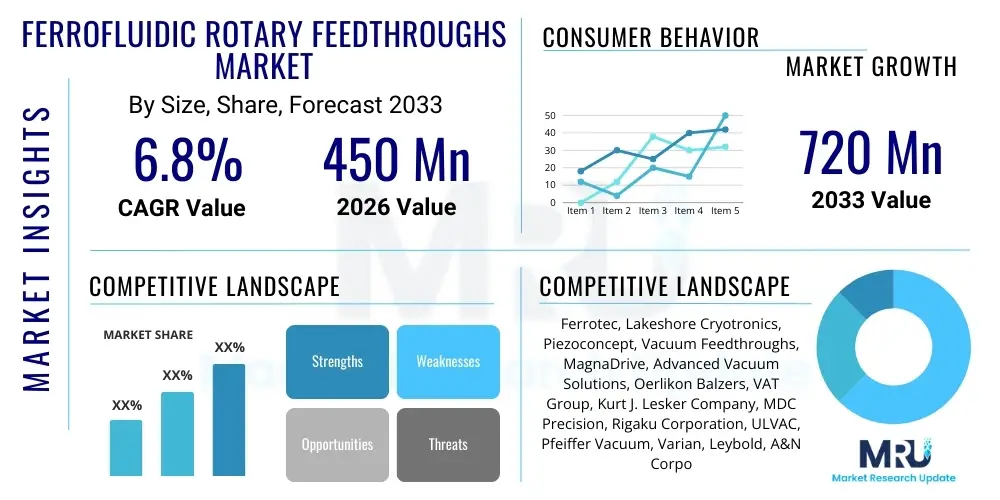

The Ferrofluidic Rotary Feedthroughs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $450 Million USD in 2026 and is projected to reach $720 Million USD by the end of the forecast period in 2033.

Ferrofluidic Rotary Feedthroughs Market introduction

Ferrofluidic Rotary Feedthroughs (FRFs) represent a critical technology used for transmitting rotational motion into a vacuum or pressurized environment while maintaining an absolute hermetic seal. These devices utilize ferrofluids—magnetic liquids—held in place by permanent magnets, creating a liquid O-ring that seals the rotating shaft against the housing. This unique sealing mechanism provides distinct advantages over conventional dynamic seals, such as zero leakage, extremely low friction, and particle-free operation, which are essential requirements in ultra-high vacuum (UHV) and highly sensitive manufacturing processes.

The primary applications of FRFs span several high-tech industries, most notably semiconductor fabrication, solar cell manufacturing, thin-film deposition (PVD/CVD), and advanced research facilities like synchrotrons and particle accelerators. In semiconductor manufacturing, FRFs are indispensable for operating wafer handling systems, substrate transfer mechanisms, and robotic arms inside high-vacuum chambers. Their ability to operate reliably at high speeds with minimal contamination positions them as foundational components supporting the global expansion of microelectronics and complex material science research.

The core benefits driving the adoption of FRFs include unparalleled vacuum integrity (achieving pressures down to 10-10 Torr), extended service life due to non-contact sealing between the shaft and the liquid, and suitability for high-differential pressure environments. Key driving factors stimulating market growth involve increasing global investment in advanced semiconductor fabrication plants (fabs), the accelerating demand for flat panel displays (FPDs) and solar photovoltaic technologies, and continuous technological advancements aimed at improving FRF designs for higher torque capabilities and integration into magnetic bearing systems, enhancing overall system throughput and reliability.

Ferrofluidic Rotary Feedthroughs Market Executive Summary

The Ferrofluidic Rotary Feedthroughs market demonstrates robust business trends driven primarily by significant capital expenditure in the global semiconductor sector, particularly in Asia Pacific. Business models are shifting towards providing highly customized, application-specific solutions, focusing on large bore feedthroughs required for advanced process chambers and multi-axis rotation systems. Supply chain resilience and the strategic acquisition of specialized material science capabilities remain paramount for key manufacturers to maintain competitive advantages. Furthermore, there is a growing trend towards incorporating condition monitoring systems and smart sensors within FRFs to facilitate predictive maintenance in high-stakes manufacturing environments.

Regionally, the Asia Pacific (APAC) market, spearheaded by China, Taiwan, South Korea, and Japan, commands the largest market share due to the concentration of semiconductor foundries and FPD manufacturing facilities. This region is projected to exhibit the highest growth rate as countries aggressively expand domestic chip production capabilities driven by geopolitical factors and increasing electronic device consumption. North America and Europe maintain stable growth, primarily anchored by aerospace applications, specialized vacuum coating industries, and government-funded research institutions that require highly reliable UHV components.

Segment trends indicate that the Semiconductor Manufacturing application segment remains the largest revenue contributor, although the Vacuum Coating segment is experiencing substantial growth spurred by the booming demand for durable, performance-enhancing surface treatments in automotive and consumer electronics. In terms of type, high-speed and high-torque feedthroughs are witnessing increasing demand, reflecting the industry need for faster processing cycles and larger substrate sizes. The underlying technological trend focuses on developing more thermally stable ferrofluids and improving bearing designs to handle greater mechanical loads and prolonged operating periods under extreme temperature differentials.

AI Impact Analysis on Ferrofluidic Rotary Feedthroughs Market

User inquiries regarding AI's impact on Ferrofluidic Rotary Feedthroughs predominantly center on enhancing operational efficiency, predicting component failure, and optimizing manufacturing quality. Common concerns involve whether AI can effectively model the complex fluid dynamics within the magnetic seal to extend seal life, and if integrated AI systems can diagnose subtle performance degradation before catastrophic vacuum breaches occur. The general expectation is that AI and Machine Learning (ML) will transform FRF utilization from a reactive maintenance model to a proactive predictive maintenance framework, thereby minimizing costly downtime in capital-intensive industries like semiconductor fabrication. Furthermore, users anticipate AI-driven optimization of the manufacturing process itself, leading to tighter tolerance control and improved quality assurance for these precision components.

- AI-Driven Predictive Maintenance: Utilizing sensor data (temperature, vibration, shaft speed) from feedthroughs to predict the remaining useful life (RUL) of ferrofluid seals and bearings, minimizing unscheduled maintenance.

- Operational Parameter Optimization: AI algorithms determining the optimal speed and load profiles for feedthroughs based on real-time chamber conditions, maximizing throughput without compromising seal integrity.

- Automated Quality Control: Employing computer vision and ML models during FRF manufacturing for highly precise, automated inspection of critical components (shaft runout, magnetic circuit assembly) surpassing human inspection limitations.

- Smart Process Control Integration: Integrating FRF performance metrics into larger AI-controlled vacuum systems (e.g., in PVD machines) to adjust process variables dynamically, ensuring stable vacuum integrity throughout complex deposition sequences.

- Ferrofluid Formulation Optimization: Using computational fluid dynamics simulations and ML to analyze and optimize the thermal stability and magnetic properties of new ferrofluid compositions for extreme operating environments.

- Supply Chain Forecasting: AI systems predicting future demand for specific FRF configurations based on global semiconductor capacity expansion plans, improving inventory management and lead times for manufacturers.

DRO & Impact Forces Of Ferrofluidic Rotary Feedthroughs Market

The market for Ferrofluidic Rotary Feedthroughs is characterized by significant momentum driven by the global imperative to enhance semiconductor fabrication capabilities and increase the efficiency of vacuum-based processes. Restraints often center on the high initial cost and technical complexity of these highly engineered components, alongside the necessity for specialized replacement ferrofluid kits and highly trained maintenance personnel. Opportunities lie primarily in expanding their application scope into emerging high-vacuum areas such as fusion energy research, advanced biomedical device manufacturing, and the rapidly growing space simulation industry. These internal and external forces shape the competitive landscape and technological investment decisions within the market.

Drivers: A primary driver is the continuous investment cycle in advanced semiconductor manufacturing equipment, particularly for logic and memory chips, which require stringent UHV environments achieved only through highly reliable sealing solutions like FRFs. Additionally, the proliferation of large-area vacuum coating applications for display technologies (OLED/QLED) and architectural glass further accelerates demand for large-diameter, high-load feedthroughs. The inherent superiority of ferrofluid sealing—offering contamination-free operation and high speeds—over conventional mechanical seals in cleanroom environments remains a critical growth catalyst, ensuring FRFs are specified in new generation processing tools.

Restraints: Significant restraints include the susceptibility of ferrofluids to temperature extremes and chemical contamination, which can degrade the magnetic liquid over time, necessitating costly periodic maintenance and fluid replacement. Furthermore, the market is somewhat constrained by the limited number of suppliers possessing the proprietary technology and specialized manufacturing capabilities required to produce UHV-rated FRFs, leading to higher component costs compared to conventional seals. The risk of sudden catastrophic failure if the fluid seal integrity is compromised, though low, poses a substantial risk in high-value manufacturing processes.

Opportunities: Key opportunities are found in developing advanced FRFs specifically tailored for extreme operating conditions, such as cryogenics and elevated plasma exposure, necessary for next-generation etching and deposition techniques. The expanding Electric Vehicle (EV) battery manufacturing sector, which utilizes high-vacuum drying and deposition processes, presents a large, untapped market opportunity. Moreover, manufacturers focusing on miniaturization and integration—developing compact, multi-functional feedthroughs with integrated encoders or cooling channels—will capture significant market share.

Impact Forces Summary: The market impact is predominantly shaped by the high capital expenditure cycles within the semiconductor and display industries (Driving Force), countered by the technical limitations regarding fluid lifetime and operating temperatures (Restraining Force). The overall positive impact is amplified by the necessity for zero-leakage, high-reliability components in mission-critical vacuum processes, reinforcing the indispensable nature of ferrofluid technology despite the high cost barrier.

Segmentation Analysis

The Ferrofluidic Rotary Feedthroughs market is comprehensively segmented based on the critical characteristics that dictate their performance and application suitability, including the type of sealing mechanism, design specifications, torque rating, and the end-user industry. Segmentation allows for a focused analysis of demand patterns, indicating distinct growth trajectories across product variants such as standard feedthroughs used in general R&D versus highly specialized large bore units essential for industrial production lines. The structure of segmentation reflects the high degree of customization inherent in the product category, driven by precise vacuum and motion requirements.

- By Type:

- Standard Rotary Feedthroughs (Low Speed, General Purpose)

- High-Speed Rotary Feedthroughs (Optimized for 3,000 RPM+)

- High-Torque Rotary Feedthroughs (Enhanced magnetic circuits for heavy loads)

- Large Bore/Large Diameter Feedthroughs (Used for large substrate handling)

- Low Outgassing/UHV Specific Feedthroughs (Designed for extreme vacuum integrity)

- By Bearing Type:

- Ball Bearing

- Roller Bearing

- Hydrodynamic Bearing

- Magnetic Bearing (Emerging Technology)

- By Application:

- Semiconductor Manufacturing (Etching, PVD/CVD, Wafer Handling)

- Vacuum Coating Equipment (Optical coatings, Metallization, Architectural glass)

- Aerospace & Defense (Space simulation, Satellite testing, Inertial systems)

- Industrial Automation and Robotics (Cleanroom robots, specialized packaging)

- Research & Development (Particle accelerators, Synchrotrons, Material science labs)

- Flat Panel Display (FPD) Manufacturing

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Ferrofluidic Rotary Feedthroughs Market

The value chain for Ferrofluidic Rotary Feedthroughs is highly specialized, beginning with the procurement of niche raw materials and culminating in installation and maintenance within high-value manufacturing systems. The upstream segment is characterized by specialized suppliers providing high-purity, corrosion-resistant stainless steel alloys, high-performance permanent magnets (e.g., NdFeB), and, most critically, the proprietary ferrofluids, often sourced from highly specialized chemical companies or formulated internally by the feedthrough manufacturer. Access to consistent quality materials, particularly the magnetic fluid, is a significant bottleneck in the upstream process, heavily influencing the final product performance and cost.

Midstream activities involve sophisticated precision engineering and manufacturing, including ultra-precision machining of shafts and housing components, cleanroom assembly, and rigorous vacuum testing. Manufacturers must possess proprietary expertise in magnetic circuit design to ensure the magnetic field effectively retains the ferrofluid seal under dynamic operating conditions. Quality control in this stage is exceptionally strict, as even micron-level tolerances can compromise UHV performance. Strategic decisions regarding vertical integration—such as in-house ferrofluid production or specialized bearing manufacturing—often determine the competitive edge of market leaders.

Downstream analysis focuses on distribution channels and end-user engagement. Due to the technical nature of the product, sales are predominantly direct or through highly specialized technical distributors and integrators who possess deep application knowledge in vacuum technology. Direct sales are common for major Original Equipment Manufacturers (OEMs) in the semiconductor and FPD sectors, where FRFs are integrated components in complex deposition or etching tools. Indirect channels, typically regional vacuum equipment suppliers, cater more to research institutions and smaller vacuum coating firms. Post-sale services, including fluid replacement kits, technical support, and refurbishment services, form a crucial component of the downstream revenue stream and customer retention strategy.

Ferrofluidic Rotary Feedthroughs Market Potential Customers

The primary consumers and end-users of Ferrofluidic Rotary Feedthroughs are organizations operating equipment that necessitates the transmission of motion into a vacuum environment while maintaining exceptionally high standards of cleanliness and vacuum integrity. These buyers are typically characterized by high capital expenditures, long-term equipment lifecycles, and a low tolerance for equipment downtime, making component reliability a paramount purchasing criterion. Consequently, potential customers prioritize performance specifications such as leak rate, operating speed, torque capacity, and mean time between failures (MTBF) over initial acquisition cost.

The largest group of buyers comprises Original Equipment Manufacturers (OEMs) specializing in semiconductor processing equipment, including physical vapor deposition (PVD), chemical vapor deposition (CVD), and atomic layer deposition (ALD) systems. These OEMs integrate FRFs directly into their wafer handling and sputtering systems. Another major customer segment includes research laboratories and academic institutions, particularly those managing large, complex experimental facilities such as particle accelerators (e.g., CERN, Fermilab) and synchrotron light sources, which require precise motion control within UHV chambers for advanced experimentation.

Furthermore, buyers in the specialized vacuum coating sector—ranging from producers of high-performance architectural glass and protective automobile coatings to manufacturers of optical components—represent a growing customer base. These firms purchase FRFs as critical components for rotating substrates or targets inside large vacuum chambers. Procurement decisions in this sector are often influenced by the feedthrough’s ability to handle heavy loads and operate continuously over long cycles, driving demand for high-torque and robustly designed units.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450 Million USD |

| Market Forecast in 2033 | $720 Million USD |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ferrotec, Lakeshore Cryotronics, Piezoconcept, Vacuum Feedthroughs, MagnaDrive, Advanced Vacuum Solutions, Oerlikon Balzers, VAT Group, Kurt J. Lesker Company, MDC Precision, Rigaku Corporation, ULVAC, Pfeiffer Vacuum, Varian, Leybold, A&N Corporation, CVC Technologies, CeramTec, Hine Automation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ferrofluidic Rotary Feedthroughs Market Key Technology Landscape

The core technology underpinning Ferrofluidic Rotary Feedthroughs involves the precision engineering of magnetic circuits and the formulation of proprietary ferrofluids. A stable FRF requires a highly uniform, intense magnetic field concentrated in the gap between the rotating shaft and the stationary pole pieces. Innovations in magnetic material science, specifically the use of high-energy permanent magnets, allow manufacturers to create seals that can withstand high differential pressures and rotational speeds while minimizing the volume of ferrofluid required. Technological advancements are focused on improving the heat dissipation capabilities of the assembly, as localized heating can lead to ferrofluid evaporation and subsequent seal degradation, especially in high-speed applications.

A significant area of technological evolution is in ferrofluid chemistry. Modern applications demand fluids with greater thermal stability, lower vapor pressure for UHV compatibility, and improved resistance to chemical attack from process gases (e.g., corrosive plasma environments). Researchers are constantly optimizing the carrier fluid (typically hydrocarbon or ester based) and the magnetic nanoparticle coatings to prevent particle agglomeration and settling, which are common failure modes. The integration of magnetic bearings or advanced ceramic bearings is also a key trend, aiming to completely eliminate mechanical friction and lubrication requirements, thereby extending service life and reducing particle generation.

Current technological differentiation among leading manufacturers often revolves around two aspects: the mechanical bearing system and integrated monitoring features. Advanced manufacturers are incorporating sophisticated, non-contact bearing systems for ultra-high-speed operation. Furthermore, the embedding of smart technologies, such as integrated temperature and vibration sensors, is becoming standard practice. This sensor integration facilitates real-time performance monitoring and enables the implementation of predictive maintenance routines, aligning the technology with Industry 4.0 standards for highly automated and critical manufacturing environments.

Regional Highlights

The global distribution of the Ferrofluidic Rotary Feedthroughs market is heavily skewed toward regions with robust infrastructure for advanced semiconductor fabrication and display manufacturing. Asia Pacific (APAC) stands out as the undisputed leader, accounting for the largest share of the market, primarily fueled by massive government and private investments in cutting-edge semiconductor foundries (fabs) in countries like China, Taiwan, and South Korea. These investments necessitate the bulk procurement of UHV components, including high-specification FRFs, to support high-volume production of microchips, memory modules, and flat panel displays, establishing APAC as the epicenter of global demand growth.

North America holds a substantial market position, driven by mature industries such as aerospace and defense, specialized research (e.g., national laboratories), and a strong presence of advanced vacuum equipment OEMs. Demand in this region is less volume-driven and more quality- and innovation-focused, often centered on custom, high-reliability FRFs designed for mission-critical applications like space simulation chambers and advanced plasma etching tools. Technological leadership and early adoption of new bearing technologies and integrated sensors characterize the North American market segment.

Europe represents a stable and mature market, primarily supported by Germany, France, and the UK, which have strong bases in industrial manufacturing, automotive coating (PVD), and specialized research institutions. The European market emphasizes energy efficiency and adherence to stringent environmental standards, driving demand for FRFs with extended service intervals and robust component traceability. While growth rates are generally lower than in APAC, the European demand for high-end, customized feedthrough solutions for scientific instruments and precision optics remains consistently strong.

- Asia Pacific (APAC): Dominates the market share and CAGR; driven by semiconductor (TSMC, Samsung, SK Hynix) and FPD production; high volume demand for standard and large bore feedthroughs. Key countries: China, Taiwan, South Korea, Japan.

- North America: Stable market with focus on high-reliability, custom solutions for Aerospace, Defense, and advanced R&D sectors; emphasis on technological innovation and integration. Key countries: United States, Canada.

- Europe: Mature market sustained by industrial coating (Germany, Italy), specialized research, and scientific instrument manufacturing; increasing emphasis on efficiency and component longevity. Key countries: Germany, UK, France.

- Latin America (LATAM): Emerging market with localized demand primarily driven by academic research and smaller industrial coating operations; growth is sporadic but potential exists in localized electronics assembly.

- Middle East & Africa (MEA): Smallest market share; demand largely confined to hydrocarbon processing research and specialized university laboratories; slow, but steady, growth in industrial diversification projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ferrofluidic Rotary Feedthroughs Market.- Ferrotec Holdings Corporation

- Lakeshore Cryotronics, Inc.

- Piezoconcept SAS

- Vacuum Feedthroughs, Inc.

- MagnaDrive Corporation

- Advanced Vacuum Solutions GmbH

- Oerlikon Balzers (OC Oerlikon)

- VAT Group AG

- Kurt J. Lesker Company

- MDC Precision (A&N Corporation)

- Rigaku Corporation

- ULVAC, Inc.

- Pfeiffer Vacuum Technology AG

- Leybold GmbH (Atlas Copco)

- Varian, Inc. (Now part of Agilent Technologies)

- Hine Automation

- CVC Technologies

- CeramTec GmbH

- Thermo Fisher Scientific Inc.

- Accu-Glass Products, Inc.

Frequently Asked Questions

Analyze common user questions about the Ferrofluidic Rotary Feedthroughs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of a Ferrofluidic Rotary Feedthrough over traditional dynamic vacuum seals?

The primary advantage is achieving a truly hermetic, zero-leakage seal by utilizing magnetic liquid (ferrofluid) held in place by permanent magnets, which eliminates mechanical friction between the rotating shaft and the housing. This results in ultra-high vacuum compatibility (UHV), zero particle generation, and superior service life compared to traditional O-ring or lip seals, making FRFs ideal for contamination-sensitive environments like semiconductor manufacturing.

Which industry segment drives the highest demand for Ferrofluidic Rotary Feedthroughs?

The Semiconductor Manufacturing industry segment is the highest demand driver. FRFs are essential components in deposition, etching, and wafer handling systems within high-vacuum chambers required for the production of advanced logic and memory chips. Global expansion of semiconductor fabrication capacity, particularly in Asia Pacific, directly correlates with increased FRF demand.

What factors restrict the broader adoption of Ferrofluidic Rotary Feedthrough technology?

The main restraining factors are the high initial cost compared to conventional sealing methods, the required precision for manufacturing and installation, and the sensitivity of the ferrofluid seal. Ferrofluids can degrade if exposed to high temperatures, certain corrosive process gases, or extreme magnetic fields, necessitating periodic fluid replacement and specialized maintenance procedures, adding to the total cost of ownership.

How is Artificial Intelligence (AI) expected to impact the maintenance and reliability of FRFs?

AI is expected to transform FRF maintenance by facilitating predictive monitoring. Through the analysis of integrated sensor data (vibration, temperature), ML algorithms can accurately predict the onset of seal or bearing failure, enabling operators to schedule proactive maintenance before vacuum integrity is compromised, significantly reducing expensive unplanned downtime in critical manufacturing processes.

What emerging application areas present significant growth opportunities for the FRF market?

Significant growth opportunities are emerging in sectors requiring stringent vacuum and high reliability outside of microelectronics. This includes advanced vacuum processes in Electric Vehicle (EV) battery manufacturing (especially drying and electrode coating), fusion energy research (tokamaks), and space simulation chambers used for satellite component testing, all demanding specialized, robust FRF designs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager