Ferrotitanium Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433300 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Ferrotitanium Market Size

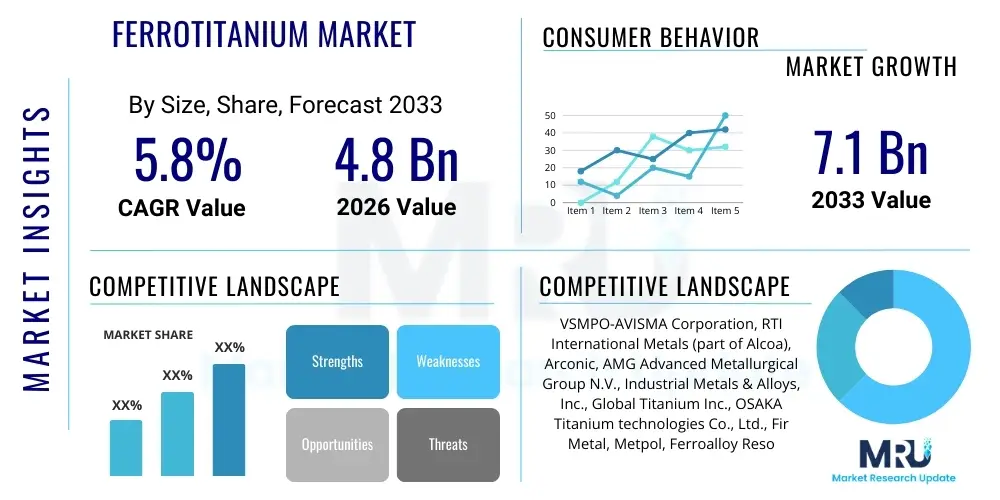

The Ferrotitanium Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.1 Billion by the end of the forecast period in 2033.

Ferrotitanium Market introduction

Ferrotitanium, a ferroalloy consisting of iron and titanium, with titanium content ranging typically between 30% and 70%, is a critical component in the production of high-performance steels and specialized alloys. This alloy is primarily utilized in the steel industry as a powerful deoxidizing and denitrifying agent, improving the structural integrity and mechanical properties of steel. Its ability to sequester nitrogen and oxygen impurities prevents the formation of detrimental inclusions, leading to cleaner steel products essential for demanding applications such. Ferrotitanium also serves as a crucial element for grain refinement and stabilization of carbides in stainless steels and other high-strength low-alloy (HSLA) steels, ensuring superior toughness and weldability.

The product description encompasses several grades, differentiated primarily by their titanium content (FeTi 30, FeTi 40, FeTi 70), tailored to specific metallurgical requirements. Major applications span structural steel for construction, automotive components requiring high strength-to-weight ratios, and crucial components within the aerospace and defense sectors where high temperature resistance and corrosion immunity are paramount. The benefits derived from using ferrotitanium are substantial, including enhanced corrosion resistance, improved ductility, and better mechanical strength, which collectively extend the lifespan and reliability of the final metal products.

Market growth is predominantly driven by the robust expansion of the global construction and infrastructure sector, particularly in emerging economies, coupled with escalating demand for specialty steel from the automotive industry focusing on lightweight vehicle manufacturing. Furthermore, the stringent material specifications in the aerospace sector for engines and airframe components necessitate continuous uptake of high-grade ferrotitanium. Regulatory trends favoring cleaner steel production methods and the increasing utilization of recycled steel, where precise deoxidation is critical, further amplify the demand trajectory for this essential ferroalloy.

- Product Description: A ferroalloy of iron and titanium, used primarily as a deoxidizer and alloying addition in steel production.

- Major Applications: Specialty steel manufacturing, aerospace alloys, welding electrodes, and pigment production.

- Benefits: Improved steel strength, grain refinement, enhanced corrosion resistance, and effective removal of impurities (oxygen and nitrogen).

- Driving Factors: Growth in global steel production, rising demand for HSLA steels, and expansion of the aerospace and defense sectors.

Ferrotitanium Market Executive Summary

The Ferrotitanium Market exhibits dynamic growth propelled by key trends across business, regional, and segment landscapes. Business trends indicate a strong push toward vertical integration among major producers to secure raw material supply, primarily titanium scrap and rutile, optimizing production costs, and ensuring supply chain resilience against fluctuating commodity prices. There is an increasing focus on developing optimized low-carbon grades of ferrotitanium to align with global sustainability mandates and the steel industry’s transition towards greener manufacturing processes, attracting investments in advanced reduction technologies such as aluminothermic reduction and plasma melting processes.

Regionally, the Asia Pacific (APAC) continues to dominate the market due to massive steel production capacities, primarily centered in China and India, driven by rapid urbanization and infrastructural development. North America and Europe, while representing mature markets, show steady growth fueled by the highly specialized aerospace and defense sectors, which prioritize high-purity ferrotitanium grades. These regions are also witnessing technological advancements in alloy formulation, necessitating consistent, high-quality ferrotitanium inputs for superalloys and nickel-based titanium alloys. Trade tariffs and geopolitical stability are crucial regional factors influencing import and export dynamics of both the raw materials and the finished ferroalloy.

Segment trends highlight the dominance of the steel manufacturing application, particularly the production of stainless steel and electrical steel, which utilize ferrotitanium for stabilization and grain control. By grade, Ferrotitanium 70 (FeTi 70), characterized by its higher titanium content, is gaining traction due to its efficiency in specialized alloy preparation and its lower overall impurity profile, although Ferrotitanium 30 remains the volume leader due to its cost-effectiveness in bulk steel production. The market is undergoing consolidation, where key players are acquiring smaller, technologically adept manufacturers to expand their global footprint and diversify their product portfolio in response to specialized customer needs in the high-end industrial sectors.

- Business Trends: Focus on vertical integration, development of low-carbon production methods, and supply chain optimization.

- Regional Trends: APAC dominance driven by infrastructure; stable growth in North America/Europe propelled by aerospace specialization.

- Segments Trends: Increased adoption of high-grade FeTi 70 for specialized alloys; steel manufacturing remains the largest application segment.

AI Impact Analysis on Ferrotitanium Market

Common user questions regarding AI's impact on the Ferrotitanium market center on predicting raw material price volatility, optimizing complex furnace operations for energy efficiency, and enhancing quality control in ferroalloy synthesis. Users are primarily concerned with whether AI can streamline the highly energy-intensive and batch-dependent production process of ferrotitanium, thereby lowering operational costs and increasing yield consistency. Furthermore, there is significant interest in using predictive analytics driven by AI to forecast steel demand cycles, allowing ferrotitanium producers to adjust inventory and production schedules proactively, mitigating the risk associated with overstocking or supply shortages in this commodity market.

The application of Artificial Intelligence and Machine Learning (ML) models is poised to revolutionize several aspects of ferrotitanium production and market strategy. AI systems are being implemented to analyze large datasets derived from smelting processes, including temperature curves, chemical inputs, and energy consumption, enabling real-time process adjustments that maximize titanium yield and minimize slag generation. This optimization not only improves the final product quality, ensuring precise alloy composition required by specialty steel manufacturers, but also significantly reduces the environmental footprint associated with traditional high-temperature reduction methods. The adoption of smart automation and predictive maintenance schedules, driven by AI algorithms, is expected to drastically reduce unplanned downtime in ferrotitanium processing plants.

- Process Optimization: AI algorithms used for optimizing aluminothermic reduction process parameters, increasing titanium recovery rate and reducing energy consumption.

- Predictive Quality Control: Machine Learning models analyze real-time spectrometry data to ensure tighter tolerances on titanium and impurity levels (e.g., carbon, sulfur).

- Demand Forecasting: AI integrates macroeconomic indicators with steel production forecasts to optimize ferrotitanium inventory and production planning.

- Supply Chain Management: AI analyzes global titanium scrap availability and pricing trends to guide optimal purchasing strategies for raw materials.

DRO & Impact Forces Of Ferrotitanium Market

The Ferrotitanium Market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which exert significant influence on market trajectory and investment decisions. The primary Driver is the relentlessly increasing global demand for high-strength, lightweight materials, particularly High-Strength Low-Alloy (HSLA) steels and stainless steel, crucial for modern infrastructure, energy, and transportation sectors. This demand, coupled with stringent quality standards in industries like aerospace and nuclear power, compels steel manufacturers to utilize high-purity ferroalloys for precise metallurgical control, fueling ferrotitanium consumption. Additionally, the role of ferrotitanium as a superior deoxidizer compared to alternatives, ensuring cleaner steel, acts as a powerful market stimulant.

Conversely, significant Restraints challenge sustained growth. The high energy intensity and capital costs associated with ferrotitanium production, particularly the aluminothermic process, render manufacturing susceptible to volatile energy prices. Furthermore, the market relies heavily on the supply and pricing of titanium-containing raw materials, such as ilmenite and rutile, and high-quality titanium scrap. Price volatility and supply chain disruptions of these inputs create cost uncertainty for producers. Another restraint is the development and adoption of alternative alloying elements or substitute technologies in specific low-end steel applications, though ferrotitanium maintains a critical niche in high-performance materials.

Opportunities for growth are abundant, notably through advancements in recycling technology and increased utilization of titanium scrap, which offers a more sustainable and cost-effective raw material source, thereby mitigating dependence on primary mineral extraction. The strategic focus on expanding the application base into emerging fields such as additive manufacturing (3D printing) of metal components, which requires highly refined metal powders, presents a lucrative future avenue. The market is also benefiting from research and development aimed at creating advanced, customized ferrotitanium grades optimized for specific superalloy applications in extreme environments, driving technological differentiation and premium pricing.

- Drivers: Rising global demand for HSLA and stainless steels; stringent material quality requirements in aerospace; effectiveness as a deoxidizing and denitrifying agent.

- Restraints: High volatility of energy and raw material (titanium scrap/ore) prices; capital-intensive production methods; geopolitical risks affecting global trade.

- Opportunities: Increased focus on sustainable production via recycling; expansion into niche markets like additive manufacturing powders; technological advancements in customized alloy grades.

- Impact Forces: Significant influence exerted by global infrastructure spending (pull factor) and volatility in global commodity markets (push factor).

Segmentation Analysis

The Ferrotitanium Market segmentation provides a granular understanding of the consumption patterns across various grades, applications, and regional landscapes, allowing stakeholders to pinpoint high-growth areas. The market is primarily segmented based on the percentage content of titanium, which directly influences its metallurgical effectiveness and pricing. Application segmentation reveals the end-use industries that drive consumption, with the steel industry being the undisputed largest consumer, relying on ferrotitanium for essential alloying and cleansing functions. Understanding these segment dynamics is crucial for tailored product development and strategic market penetration efforts.

The dominant grade segment is Ferrotitanium 30 (FeTi 30), owing to its economical use in large-volume steel production where precise titanium content is less critical than its general deoxidizing capability. However, Ferrotitanium 70 (FeTi 70) commands premium pricing and is experiencing faster growth due to its indispensability in producing specialized aerospace-grade alloys and titanium-stabilized stainless steels, requiring minimum levels of impurities such as carbon and aluminum. The varying regulatory requirements for different application grades dictate production standards and market accessibility for manufacturers globally, pushing the focus toward higher purity standards.

From an application perspective, steel manufacturing absorbs the vast majority of the produced ferrotitanium, utilizing it heavily in the production of flat products, long products, and specialty alloys. The secondary application, the production of welding electrodes and fluxes, relies on ferrotitanium for arc stability and enhanced weld bead properties. The growing complexity of infrastructure projects and the focus on deep-sea drilling and energy pipelines further solidify the demand for ferrotitanium-treated steel, requiring materials that can withstand extreme pressure, temperature, and corrosive environments, thus ensuring stable demand across core segments.

- By Grade:

- Ferrotitanium 30 (FeTi 30)

- Ferrotitanium 40 (FeTi 40)

- Ferrotitanium 70 (FeTi 70)

- By Application:

- Steel Manufacturing (Stainless Steel, HSLA Steel, Tool Steel)

- Aerospace Alloys and Superalloys

- Pigments and Chemicals Production

- Welding Electrodes and Fluxes

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Ferrotitanium Market

The Ferrotitanium value chain commences with upstream analysis, focusing on the procurement of primary raw materials: titanium ores (ilmenite, rutile), titanium scrap, and aluminum (used as a reducing agent in the aluminothermic process). This stage is characterized by high capital investment in mining or specialized scrap processing facilities and is sensitive to global commodity pricing and geopolitical stability in regions possessing titanium reserves. Suppliers of high-purity aluminum and energy utilities play a critical role, as the subsequent reduction phase is energy-intensive. Efficiency in raw material sourcing and pre-treatment directly dictates the purity and cost structure of the final ferroalloy product.

The midstream segment involves the manufacturing process, predominantly aluminothermic reduction, vacuum induction melting (VIM), or plasma melting, transforming raw materials into various grades of ferrotitanium. Producers must maintain stringent quality control measures to meet the precise elemental specifications required by end-users, especially those in the aerospace and medical device industries. Distribution channel strategies vary; direct sales are common for large-volume contracts with major integrated steel mills, fostering strong buyer-supplier relationships and customized product offerings. Indirect distribution often involves specialized ferroalloy traders and distributors who manage smaller orders and inventories across diverse geographical markets, providing logistical support and market liquidity.

Downstream analysis centers on the primary consuming industries, mainly integrated steel producers and specialty alloy manufacturers, where ferrotitanium is introduced into the melt for deoxidation, nitrogen control, and alloying purposes. The performance feedback from these end-users is crucial for innovation and product adaptation. The effectiveness of ferrotitanium directly impacts the final quality, durability, and cost-competitiveness of steel products used in construction, automotive manufacturing, and defense applications, solidifying its essential role within the broader metallurgical supply chain.

Ferrotitanium Market Potential Customers

The potential customers and primary end-users of ferrotitanium are concentrated in highly industrialized sectors that require materials with exceptional strength, corrosion resistance, and specific microstructural properties. The largest volume buyers are integrated steel manufacturers and mini-mills, specifically those focusing on high-grade products such as High-Strength Low-Alloy (HSLA) steel used in pipelines, bridges, and heavy machinery, and various grades of stainless steel where titanium acts as a crucial carbide stabilizer. These large consumers prioritize suppliers capable of delivering consistent quality in bulk quantities with reliable logistical support.

A second crucial segment of potential customers includes specialized alloy producers catering to niche high-specification markets. This includes companies manufacturing superalloys for gas turbine engines, aerospace components, and biomedical implants. These buyers demand ultra-high purity grades (e.g., FeTi 70) with extremely low carbon and sulfur content, often procured under strict contractual agreements ensuring traceability and compliance with international aerospace standards (e.g., ASTM, AMS). Their purchasing decisions are primarily driven by product purity and performance rather than unit cost.

Furthermore, chemical and pigment manufacturers represent significant, albeit secondary, customers. Ferrotitanium, or related titanium compounds derived from it, are used in certain chemical processes or in the production of titanium dioxide pigments. Companies involved in producing welding consumables, such as coated electrodes and flux-cored wires, are also regular buyers, leveraging ferrotitanium's ability to improve the mechanical properties and microstructure of the weld metal. Penetration of these segments requires tailored packaging and smaller batch sizes compared to the bulk sales directed towards steel mills.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | VSMPO-AVISMA Corporation, RTI International Metals (part of Alcoa), Arconic, AMG Advanced Metallurgical Group N.V., Industrial Metals & Alloys, Inc., Global Titanium Inc., OSAKA Titanium technologies Co., Ltd., Fir Metal, Metpol, Ferroalloy Resources Ltd., Kronos Worldwide, Inc., Tronox Holdings plc, S.M.C. Global, KISHO Corporation, Minmetals Group, Cogne Acciai Speciali, Fushun Titanium Industry Co., Ltd., TIMET (Titanium Metals Corporation), Toho Titanium Co., Ltd., Eramet Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ferrotitanium Market Key Technology Landscape

The primary technological method dominating ferrotitanium production is the aluminothermic reduction process, which involves reducing titanium-bearing materials, usually concentrated titanium oxide (rutile or ilmenite), using aluminum as the reductant in a highly exothermic reaction. This technique is favored for its simplicity and relatively low capital investment compared to electric furnace methods, enabling high-volume production of standard-grade ferrotitanium. However, a major technological challenge in this process is controlling the residual aluminum content and ensuring precise homogeneity of the titanium component, necessitating post-reaction refining and detailed quality assurance procedures for high-purity applications.

For high-purity and specialized grades, advanced technologies like Vacuum Induction Melting (VIM) and Electric Arc Furnace (EAF) refining are employed. VIM technology allows for the controlled melting and homogenization of the ferroalloy under vacuum conditions, significantly minimizing the incorporation of atmospheric contaminants like oxygen and nitrogen, which are detrimental to aerospace-grade steel. Plasma melting is an emerging technology offering even greater control over purity and energy efficiency, providing a pathway for producing ferrotitanium powders essential for additive manufacturing applications, characterized by fine particle size and exceptional spherical morphology.

Current technological innovation is focused heavily on sustainable production methods, including enhanced scrap recycling and processing techniques. Producers are investing in advanced sorting and cleaning systems to efficiently utilize titanium scrap derived from aerospace and medical waste streams, reducing dependence on primary ore extraction and lowering overall energy consumption. Furthermore, optimization of furnace linings and refractory materials is a constant R&D area, aiming to reduce impurity pickup from the furnace environment during high-temperature processing, thereby improving the overall cost-efficiency and quality consistency of the final ferrotitanium product, meeting the escalating technical demands of the specialty steel market.

Regional Highlights

The Asia Pacific (APAC) region stands as the undisputed market leader in the consumption and production of ferrotitanium, largely driven by the monumental scale of steel manufacturing in countries like China, India, and Japan. China, being the world’s largest steel producer, dictates global demand trends for ferroalloys, utilizing vast quantities of ferrotitanium for HSLA steel production critical for its expansive infrastructure projects, rapid urbanization, and massive manufacturing base. India is rapidly catching up, fueled by national initiatives focused on infrastructure development and enhanced domestic steel production capacity. The growth in APAC is further supported by the relatively lower operational costs and the availability of essential raw materials compared to Western markets. However, the regulatory landscape regarding environmental compliance in this region is becoming increasingly stringent, potentially leading to consolidation among less efficient producers.

North America (NA) represents a mature, high-value market characterized by demand for specialized, high-purity ferrotitanium grades, primarily consumed by the robust aerospace, defense, and oil & gas sectors. The US aerospace industry, with its stringent quality requirements for jet engine components and structural airframe alloys, drives the consistent demand for FeTi 70, ensuring stable growth despite lower volume consumption compared to APAC. Producers in North America often integrate closely with specialty steel manufacturers to ensure customized alloy formulations. The focus here is less on bulk commodity sales and more on precision, technical support, and supply chain security, reflecting the high-specification nature of the end-use applications, which are governed by strict federal and industrial standards.

Europe holds a substantial share of the ferrotitanium market, driven by the strong presence of the automotive sector, focusing on lightweight vehicle manufacturing, and the well-established stainless steel production industry, particularly in Germany, Italy, and Scandinavia. European demand is heavily influenced by the strict regulatory environment regarding carbon emissions and sustainability, prompting consumers to favor ferrotitanium producers who demonstrate superior environmental performance and utilize sustainable raw material sourcing, such as recycled titanium scrap. Investment in advanced manufacturing facilities for specialty alloys, particularly in Eastern Europe, contributes to steady market expansion, though overall steel production growth rates are moderate compared to emerging economies.

The Latin America (LATAM) market, while smaller in absolute terms, presents high growth potential tied primarily to the region's raw material wealth and emerging industrialization. Countries like Brazil and Mexico are primary consumers, driven by domestic infrastructure development and automotive production. Brazil, with its significant iron ore and mining activities, represents a foundational market for ferroalloys. Growth here is inherently linked to political and economic stability; market expansion requires overcoming local logistical challenges and attracting foreign direct investment into integrated steel facilities. The current trend shows increasing reliance on imports of high-grade ferrotitanium due to limited local production capacity specializing in premium alloys.

The Middle East and Africa (MEA) region is experiencing accelerated growth, largely attributed to large-scale construction projects, diversification efforts away from oil economies, and growing defense spending. Countries such as Saudi Arabia and the UAE are investing heavily in new infrastructure and industrial zones, necessitating significant volumes of high-quality structural steel. The local demand for ferrotitanium is growing, although most of the supply is currently met through imports. The presence of titanium mineral reserves in certain African nations (e.g., South Africa) suggests future potential for localized production and processing facilities, provided the necessary technological and capital investments are secured to establish a robust domestic ferroalloy industry.

Specific market dynamics within APAC include the strategic shift by Chinese producers towards higher value-added steels, increasing the requirement for precise alloying agents like ferrotitanium to meet international export standards. South Korea and Taiwan maintain robust demand driven by advanced electronics manufacturing and high-tech maritime shipbuilding, both demanding specialized titanium-stabilized steels resistant to aggressive environments. Geopolitical factors, particularly trade relations impacting titanium scrap flow, frequently influence pricing volatility across the entire Asian supply chain, making long-term strategic raw material agreements a priority for key market participants seeking stability.

In Europe, the emphasis on circular economy principles has intensified the development of technologies focused on recycling titanium components from waste streams. This technological push is changing the input mix for European ferrotitanium producers, moving them towards greater independence from primary sources. Furthermore, strict REACH regulations and other chemical compliance standards mean that European buyers demand meticulous quality documentation and adherence to impurity limits, creating a barrier to entry for lower-cost producers unable to guarantee high technical specifications and environmental compliance throughout the supply chain.

North American consumption is characterized by a strong coupling between the ferrotitanium market and the cyclical nature of the commercial aerospace manufacturing sector. The long lead times and high inventory requirements typical of aerospace supply chains mean that ferrotitanium producers must maintain exceptional reliability and quality standards. The defense sector provides a steady base load demand, especially for specialized military shipbuilding and ground vehicle armor requiring ultra-tough, high-performance steel alloys, guaranteeing consistent, though highly scrutinized, consumption patterns for specialized ferrotitanium grades.

The potential for ferrotitanium market growth in the LATAM region is closely tied to the modernization of their domestic steel industries. Current infrastructure gaps often necessitate the use of advanced, durable materials, which encourages the import of ferrotitanium treated steel. Local producers are gradually investing in technology upgrades to meet this domestic demand, signifying a gradual shift from relying solely on commodity-grade steel production to specializing in high-performance alloys suitable for export markets, mirroring the evolutionary trends observed in Asian steel markets two decades prior.

For the MEA region, the immediate drivers are mega-projects in construction and the expansion of the regional energy sector, including sophisticated petrochemical and power generation facilities, which require highly corrosive-resistant stainless steel and duplex alloys. The region’s aspiration to become a major hub for diversified manufacturing creates a future opportunity for domestic ferroalloy production, mitigating reliance on distant supply chains and potentially stabilizing local prices for these critical alloying materials within the broader economic diversification strategies.

- Asia Pacific (APAC): Dominant market due to high steel production volumes (China, India); rapid infrastructure development and urbanization; strong focus on high-volume, economical grades.

- North America (NA): High-value market; driven by stringent demands from aerospace, defense, and advanced oil & gas sectors; preference for high-purity FeTi 70.

- Europe: Focus on sustainable production; significant consumption in automotive lightweighting and specialized stainless steel manufacturing; adherence to strict environmental regulations (REACH).

- Latin America (LATAM): Emerging growth tied to infrastructure and domestic automotive production; reliance on imports for specialized grades; economic stability is key growth factor.

- Middle East and Africa (MEA): Growth stimulated by large-scale construction projects and defense sector spending; potential for localized processing due to raw material reserves.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ferrotitanium Market.- VSMPO-AVISMA Corporation

- RTI International Metals (part of Alcoa)

- AMG Advanced Metallurgical Group N.V.

- Global Titanium Inc.

- OSAKA Titanium technologies Co., Ltd.

- Fir Metal

- Ferroalloy Resources Ltd.

- Industrial Metals & Alloys, Inc.

- Metpol

- Kronos Worldwide, Inc.

- Tronox Holdings plc

- S.M.C. Global

- KISHO Corporation

- Minmetals Group

- Cogne Acciai Speciali

- Fushun Titanium Industry Co., Ltd.

- TIMET (Titanium Metals Corporation)

- Toho Titanium Co., Ltd.

- Eramet Group

- Magrafer Ltd.

Frequently Asked Questions

Analyze common user questions about the Ferrotitanium market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Ferrotitanium in steel production?

The primary function of ferrotitanium is to act as a powerful deoxidizing and denitrifying agent. It scavenges harmful oxygen and nitrogen impurities from molten steel, thereby preventing the formation of voids and inclusions, resulting in cleaner, tougher, and more ductile final steel products essential for high-stress applications.

Which grade of Ferrotitanium is most commonly used in bulk steel manufacturing?

Ferrotitanium 30 (FeTi 30), containing approximately 30% titanium, is the most commonly used grade in bulk steel manufacturing, particularly due to its cost-effectiveness and efficiency in large-scale deoxidation and alloying processes for standard structural and stainless steel production.

How does the volatile price of titanium scrap affect the Ferrotitanium market?

Titanium scrap is a critical and often cost-effective raw material source for ferrotitanium production. Volatility in scrap prices directly impacts the manufacturing costs and profit margins of ferrotitanium producers. High scrap prices can increase end-product costs, while supply instability necessitates greater reliance on primary titanium ores like rutile or ilmenite, which are subject to their own geopolitical pricing factors.

Which region dominates the global Ferrotitanium market consumption?

The Asia Pacific (APAC) region, driven predominantly by China and India, dominates the global ferrotitanium consumption. This dominance is attributed to the massive scale of steel production activities supporting ongoing rapid infrastructure development, automotive manufacturing, and general industrial expansion across the region.

What role does Ferrotitanium play in the production of aerospace alloys?

Ferrotitanium, specifically the high-purity FeTi 70 grade, is crucial for aerospace alloys. It is utilized for grain refinement, stabilization of carbide structures, and achieving precise alloy compositions necessary to create superalloys and specialized stainless steels that exhibit superior strength, fatigue resistance, and high-temperature performance required for jet engine components and critical airframe structures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Ferrotitanium Market Size Report By Type (Ferrotitanium 35%, Ferrotitanium 70%, Other), By Application (Stainless Steel Stabilizer, Molten Metal Additive, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Ferrotitanium Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Electric Silicon Thermal Method, Electrothermal Method, Others), By Application (Aerospace, Marine, Industrial, Medical, Pigments, Additives and Coatings, Energy, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager