Fertility and Pregnancy Rapid Test Kits Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437580 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Fertility and Pregnancy Rapid Test Kits Market Size

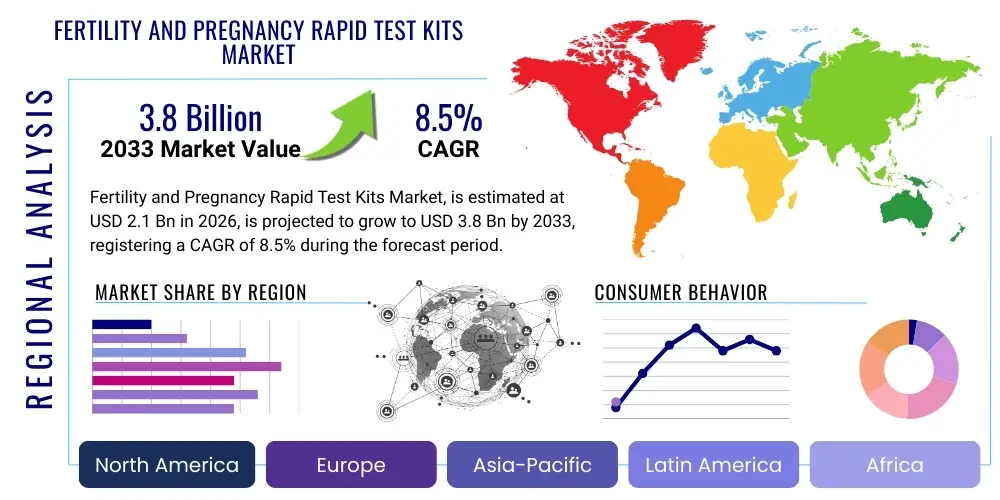

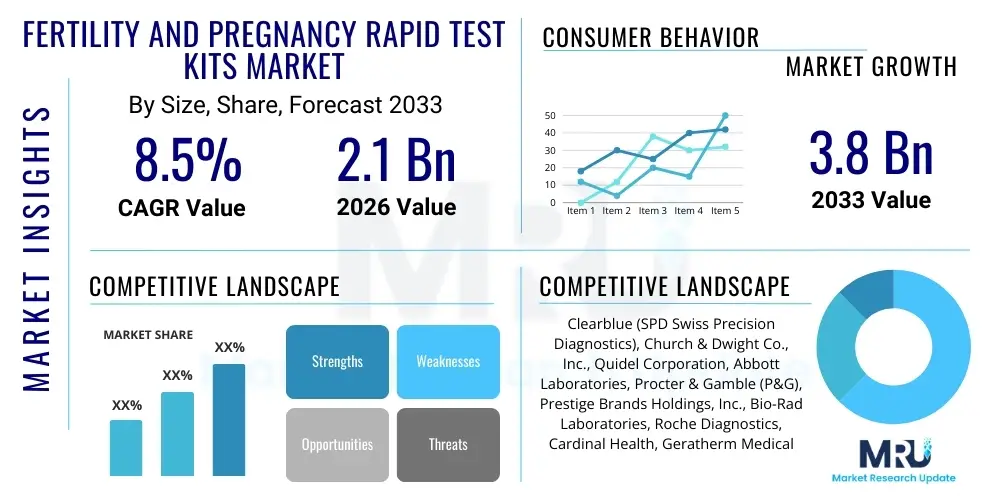

The Fertility and Pregnancy Rapid Test Kits Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.8 Billion by the end of the forecast period in 2033.

Fertility and Pregnancy Rapid Test Kits Market introduction

The Fertility and Pregnancy Rapid Test Kits Market encompasses the sale and distribution of diagnostic devices utilized for quick, convenient detection of reproductive hormone levels, primarily Human Chorionic Gonadotropin (hCG) for pregnancy and Luteinizing Hormone (LH) for fertility tracking. These kits leverage lateral flow immunoassay technology, providing accurate results within minutes, making them indispensable tools for self-care and preliminary diagnosis in home settings. The core products include standard pregnancy test strips, digital pregnancy tests offering clear results, and sophisticated ovulation predictor kits (OPKs) designed to assist couples in maximizing their chances of conception by identifying the optimal fertile window. The ease of use, high accessibility, and non-invasiveness inherent in these kits position them as primary diagnostic screening tools before professional medical consultation is sought.

Major applications of these rapid test kits center around personal health management, reproductive planning, and early medical intervention. Pregnancy tests allow for timely confirmation, enabling women to initiate prenatal care sooner, which significantly improves maternal and fetal outcomes. Fertility kits, conversely, serve as critical aids in family planning, particularly for individuals or couples experiencing subfertility, offering a cost-effective and immediate method for cycle monitoring. The market is driven by several macroeconomic and demographic factors, including rising global awareness regarding reproductive health, increasing average maternal age leading to higher reliance on fertility tracking, and a pronounced shift towards self-testing and decentralized diagnostics fueled by advancements in testing technology accuracy and digital integration.

The benefits derived from these products are substantial, offering privacy, immediacy, and empowerment to users. They reduce the reliance on clinical laboratory testing for initial screening, thereby lowering healthcare costs and wait times. Furthermore, the relentless pursuit of enhanced accuracy, particularly through the introduction of digital and smart kits that interpret results automatically and synchronize data with smartphone applications, is profoundly shaping consumer behavior. This technological sophistication, coupled with growing disposable incomes in emerging economies and robust marketing strategies emphasizing convenience, ensures the continued expansion of the Fertility and Pregnancy Rapid Test Kits Market across diverse global demographics.

Fertility and Pregnancy Rapid Test Kits Market Executive Summary

The global Fertility and Pregnancy Rapid Test Kits Market demonstrates robust growth, primarily propelled by favorable business trends such as technological miniaturization, digitalization, and increased direct-to-consumer accessibility. Key business trends involve the merger of diagnostics with wellness technology, leading to the proliferation of smart kits that offer hormonal tracking integrated with personal health applications, moving the market beyond simple binary results toward quantitative, personalized data. Segment trends indicate a substantial shift towards Fertility Rapid Test Kits, particularly advanced ovulation predictor kits (OPKs) utilizing digital interpretation, reflecting the growing global challenges associated with infertility and the proactive approach taken by consumers in family planning. While pregnancy kits remain the volume leader, the higher value and sophistication of advanced fertility kits are driving revenue growth.

Regional trends highlight the dominance of North America and Europe due to high consumer spending on healthcare, established distribution networks, and a strong presence of key market players who continuously innovate in product design and accuracy. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR). This surge is attributed to rapidly improving healthcare infrastructure, massive population bases, increasing awareness of reproductive health, and governmental initiatives promoting maternal care. Developing nations in APAC are witnessing a transition from traditional family planning methods to modern, easy-to-use rapid diagnostic tools, signifying a major geographical pivot in market opportunity and investment focus.

Strategically, market participants are concentrating on product differentiation through enhanced sensitivity and digital integration to maintain competitive advantages. Business models are shifting towards subscription services for recurring fertility tracking supplies, capitalizing on the cyclical nature of product usage. The regulatory environment, particularly the streamlining of approvals for over-the-counter (OTC) diagnostic devices, is further accelerating market penetration. The overall market trajectory is one of modernization, driven by consumer demand for convenience, reliability, and the seamless integration of self-diagnostic tools into broader digital health ecosystems.

AI Impact Analysis on Fertility and Pregnancy Rapid Test Kits Market

Common user questions regarding AI's influence in the Fertility and Pregnancy Rapid Test Kits Market revolve primarily around result interpretation reliability, personalization of reproductive advice, and the potential for predictive analytics. Users often question how AI can improve the accuracy of interpreting faint lines or complex hormonal patterns beyond what simple optical reading provides. There is also significant curiosity regarding the use of machine learning algorithms to synthesize data points from digital test results, cycle tracking apps, and wearable technology to offer highly personalized fertility windows or early alerts regarding potential issues requiring medical consultation. A key concern centers on data privacy and the security protocols associated with sharing intimate biological data with AI-driven platforms, alongside the ethical implications of using predictive AI in family planning decisions.

The synthesis of user concerns indicates a strong expectation that AI will transform these kits from passive diagnostic tools into active, predictive health management systems. Users anticipate that AI integration, particularly through dedicated mobile applications processing data from digital rapid tests, will minimize human error in reading results and provide a quantitative, longitudinal assessment of reproductive health. This shift moves the market from "Did I conceive?" to "When is the best time to conceive, and are there any underlying issues?" thereby significantly increasing the perceived value and utility of rapid test kits, repositioning them as critical components of preventative reproductive healthcare.

The successful implementation of AI will hinge on demonstrating superior accuracy and actionable insights while rigorously adhering to data protection standards. Early adopters of AI-enhanced kits seek sophisticated pattern recognition capabilities that can identify subtle hormonal irregularities or persistent issues that require clinical intervention, thereby acting as an intelligent triage system. This technological leap, supported by user trust in data security and analytical precision, is expected to create a premium segment within the market, distinguishing basic chemical tests from advanced, digitally integrated diagnostic platforms.

- AI enhances result interpretation accuracy, particularly in detecting minute hormone concentrations or complex cycle variations.

- Predictive algorithms leverage longitudinal data to forecast optimal fertility windows with greater precision than traditional calendar methods.

- Machine learning integrates results with personalized user data (e.g., basal body temperature, lifestyle factors) for customized reproductive health advice.

- AI-driven image analysis improves the consistency of interpreting standard lateral flow test lines, minimizing subjectivity.

- Potential for early identification of hormonal irregularities or pregnancy complications requiring clinical follow-up.

DRO & Impact Forces Of Fertility and Pregnancy Rapid Test Kits Market

The dynamics of the Fertility and Pregnancy Rapid Test Kits Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively manifesting as powerful Impact Forces. A primary driver is the accelerating trend of delayed parenthood globally, which naturally increases the demand for precise ovulation tracking and quick pregnancy confirmation tools due to perceived challenges in natural conception. Furthermore, the pervasive shift towards self-monitoring and preventative health management, fueled by accessible over-the-counter (OTC) diagnostic technology and digital connectivity, strengthens consumer reliance on rapid, home-based testing. Advances in immunochromatographic technology have continually improved the sensitivity and reliability of these kits, directly supporting user confidence and market growth.

Significant restraints include the inherent limitations of home testing accuracy compared to sophisticated laboratory diagnostics, which sometimes leads to false negatives or positives, causing confusion or delaying necessary medical consultation. Price sensitivity, particularly in developing markets, remains a considerable barrier, as high-end digital or smart kits may be unaffordable for mass consumption. Regulatory hurdles, although generally streamlined for OTC products, can still impose delays on the introduction of highly innovative or digitally integrated devices that incorporate medical advice algorithms, requiring extensive clinical validation to ensure user safety and efficacy standards are met.

Opportunities for market expansion are abundant, centered around product innovation and geographical penetration. The continuous integration of smart technology, including wearable sensors and mobile application synergy, promises to create highly valuable diagnostic ecosystems. Moreover, untapped potential exists in developing customized tests targeting specific hormonal markers beyond standard LH and hCG, addressing diverse medical conditions such as Polycystic Ovary Syndrome (PCOS) or menopause transition. Strategic focus on expanding distribution channels, especially e-commerce platforms and personalized subscription models, provides a robust avenue for reaching a wider, digitally engaged customer base globally.

Impact Forces Summary: Increased global infertility rates and delayed childbearing act as persistent growth drivers, creating a baseline demand for sophisticated tracking tools. Counteracting this growth are accuracy concerns and market fragmentation, where numerous low-cost providers dilute the premium segment. The overarching opportunity lies in leveraging digitalization—specifically telehealth integration and AI-enhanced predictive capabilities—to establish products as integral components of holistic reproductive wellness programs, overcoming accuracy restraints through data synthesis and personalized guidance.

Segmentation Analysis

The Fertility and Pregnancy Rapid Test Kits Market is fundamentally segmented based on the type of test, the physical format of the product, the primary distribution channels utilized, and the ultimate end-user setting. This granular segmentation is crucial for market participants to tailor their offerings, marketing strategies, and pricing structures effectively. The segmentation by type clearly delineates the high-volume, relatively standardized pregnancy test segment from the higher-value, more technically diverse fertility test segment, which is increasingly focused on identifying the LH surge with high precision or monitoring FSH levels. Understanding these segment dynamics is paramount for predicting revenue streams and identifying areas ripe for technological investment, such as multi-hormone detection kits.

Segmentation by product format—strips, midstream devices, and cassettes—reflects consumer preference for convenience versus cost. Test strips represent the low-cost entry point, dominant in high-volume settings or markets constrained by price sensitivity. Midstream devices, typically encased in plastic for hygienic handling and easier use, command the highest market share due to balancing convenience and moderate cost. Cassettes, requiring a pipette for sample application, are often utilized in professional clinic settings or specialized home testing scenarios. The convergence of digital technology into the midstream format is creating the fastest-growing sub-segment, offering both convenience and error-free interpretation, catering to the affluent consumer base demanding assurance and ease of use.

Distribution channel segmentation illustrates the critical role of retail accessibility, with pharmacies and drug stores serving as the traditional, high-trust point of sale. However, the rapidly expanding online channels have democratized access, offering discrete delivery, wider product choices, and competitive pricing, which resonates particularly well with fertility tracking customers seeking privacy. End-user categorization highlights that while home care settings represent the vast majority of consumption volume, hospitals and clinics remain vital for initial screening, confirmation, and professional counseling, particularly in cases where quantitative measurements are required before specialized diagnostic testing is ordered.

- Type:

- Pregnancy Rapid Test Kits (Standard, Digital)

- Fertility Rapid Test Kits (Ovulation Predictor Kits (OPKs), FSH Tests, Semen Quality Tests)

- Product Format:

- Strips

- Midstream Devices (Analog and Digital)

- Cassettes

- Distribution Channel:

- Pharmacies & Drug Stores (Retail)

- Online Channels (E-commerce Platforms, Company Websites)

- Supermarkets & Hypermarkets

- Specialty Clinics & Diagnostic Centers

- End-User:

- Home Care Settings (Consumer Use)

- Hospitals & Clinics (Professional Use)

Value Chain Analysis For Fertility and Pregnancy Rapid Test Kits Market

The value chain for Fertility and Pregnancy Rapid Test Kits begins with upstream activities focused heavily on raw material sourcing and technological development. This involves the supply of key biological components, predominantly highly specific monoclonal and polyclonal antibodies that bind to target hormones like hCG and LH, alongside specialized nitrocellulose membranes and chemical reagents crucial for the lateral flow assay mechanism. Research and development (R&D) at this stage is focused on enhancing antibody sensitivity to enable earlier and more accurate detection, a critical differentiator in this competitive market. Suppliers of plastics, paper, and electronic components (for digital kits) also form part of this foundational stage, demanding robust quality control and efficient supply chain management to maintain high manufacturing standards and cost efficiency.

Mid-chain activities center on the manufacturing, assembly, and quality assurance processes. Leading market players prioritize large-scale, automated manufacturing to meet global demand while strictly adhering to regulatory standards (e.g., FDA, CE Mark). Packaging and branding are critical steps here, as consumer trust and ease of understanding are paramount for OTC diagnostic products. Distribution channels, forming the crucial downstream link, are multifaceted. Direct channels involve manufacturers selling directly to large pharmacy chains or via proprietary e-commerce sites, offering greater control over pricing and branding. Indirect channels, encompassing wholesalers, distributors, and third-party logistics providers, ensure wide geographical reach, particularly in fragmented or less accessible regional markets.

The downstream analysis focuses on market access and the end-user interaction. Pharmacies and online retailers serve as primary points of sale, emphasizing accessibility, discretion, and consumer education provided through clear instructions and accompanying digital support. The effectiveness of the indirect channel is measured by its ability to penetrate remote areas and provide timely inventory replenishment. For professional settings (hospitals/clinics), the channel often involves specialized medical distributors who also supply other diagnostic equipment. The increasing prominence of telehealth and digital health integration is further optimizing the downstream segment, enabling manufacturers to engage directly with consumers post-purchase through apps, offering personalized advice and establishing brand loyalty, effectively shortening the psychological distance between the manufacturer and the end-user.

Fertility and Pregnancy Rapid Test Kits Market Potential Customers

The primary customer base for Fertility and Pregnancy Rapid Test Kits is broadly segmented into individual consumers managing their reproductive health and professional medical institutions utilizing these tools for preliminary screening. Individual consumers, constituting the largest volume segment, include women actively trying to conceive, women who suspect they might be pregnant, and couples engaging in proactive family planning. This group places a high value on discretion, immediate results, high accuracy, and user-friendliness. Within this segment, a critical sub-group consists of women over the age of 30 who are delaying pregnancy, often leading to a greater reliance on advanced Ovulation Predictor Kits (OPKs) and digital tracking solutions to optimize conception timing.

A rapidly growing segment of potential customers includes individuals and couples experiencing infertility or subfertility. These consumers are actively seeking advanced, often digital or quantitative, fertility tracking kits as part of their initial diagnostic journey, before engaging in expensive or invasive clinical treatments. They are discerning buyers, often influenced by specialized online communities and seeking products with clinical validation and comprehensive digital features. Furthermore, men seeking simple, home-based semen quality screening tests represent an emerging, high-potential customer group, reflecting a societal trend towards shared responsibility in reproductive health assessment.

Institutional customers encompass general practitioners, obstetrician-gynecologists (OB/GYN) clinics, urgent care centers, and general hospitals. These buyers primarily purchase kits in bulk for professional use, relying on products that offer high reliability, cost-effectiveness, and often the cassette or dipstick format suitable for clinical laboratory confirmation procedures. For these professional settings, the ease of integration into existing clinical workflows and the availability of professional-grade, highly sensitive tests capable of detecting extremely low hormone levels are key purchasing criteria, ensuring timely diagnosis and subsequent patient care planning.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.8 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Clearblue (SPD Swiss Precision Diagnostics), Church & Dwight Co., Inc., Quidel Corporation, Abbott Laboratories, Procter & Gamble (P&G), Prestige Brands Holdings, Inc., Bio-Rad Laboratories, Roche Diagnostics, Cardinal Health, Geratherm Medical AG, DCC plc (SureScreen Diagnostics), Piramal Enterprises Ltd., Mankind Pharma, i-Health, Inc. (Culturelle), Inito, Mira (Quanovate). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fertility and Pregnancy Rapid Test Kits Market Key Technology Landscape

The underlying technological backbone of the Fertility and Pregnancy Rapid Test Kits Market is the lateral flow immunoassay (LFIA), which has seen incremental but impactful improvements over recent decades. This technology relies on the principle of immunochromatography, where target analytes (hormones) in the sample fluid migrate along a porous membrane and are captured by immobilized antibodies, leading to a visible color change. Recent innovations focus heavily on enhancing the sensitivity of these LFIAs, aiming for earlier detection of hCG in pregnancy kits and more precise quantification of the LH surge in fertility kits. This is achieved through optimization of antibody conjugation chemistry, advancements in colloidal gold particle size uniformity, or the substitution of traditional colorimetric reporters with highly fluorescent or magnetic detection systems to amplify the signal, thus lowering the limit of detection (LOD).

A second crucial technological wave involves digitalization and connectivity, which is transforming the physical rapid test into a sophisticated data-generating device. Digital midstream tests use optical sensors or embedded microprocessors to objectively read the test result, eliminating user interpretation error and displaying clear results (e.g., "Pregnant" or "Fertile"). Furthermore, advanced digital kits incorporate Bluetooth or near-field communication (NFC) capabilities to transmit results directly to dedicated smartphone applications. These apps not only log the result chronologically but also apply machine learning algorithms to interpret hormonal patterns over multiple cycles, integrating data from other wellness trackers (like basal body temperature monitors) to provide holistic, predictive cycle analysis and personalized health recommendations, thereby significantly augmenting product value.

The future technology landscape is moving towards multiplex testing and quantitative analysis. Multiplexing involves testing for multiple hormones simultaneously (e.g., estrogen, LH, and progesterone metabolites) on a single strip, providing a more comprehensive view of the fertility cycle or early pregnancy status. Quantitative rapid tests, moving beyond the binary "yes/no" result, utilize photometric readings to assign a numerical value to hormone levels. This transition from qualitative to quantitative data is critical for professional use and for advanced consumer applications that feed into predictive models. Microfluidics is another emerging area, promising even smaller, faster, and more efficient test formats that require minimal sample volume and offer increased accuracy, potentially leading to the development of non-invasive hormone monitoring tools integrated directly into wearable technology.

Regional Highlights

- North America: This region holds a dominant share in terms of market revenue, driven by high consumer awareness, widespread acceptance of self-diagnostic tools, and high expenditure on personal healthcare and wellness products. The market is mature but highly innovative, characterized by the rapid adoption of high-priced digital and smart fertility tracking systems. Key growth factors include the robust presence of leading global manufacturers and an increasing number of women postponing childbirth, leading to higher reliance on advanced Ovulation Predictor Kits (OPKs) and the sophisticated integration of digital apps and telehealth services. The U.S. remains the core consumer market due to easy access to over-the-counter products and effective retail distribution networks.

- Europe: The European market is characterized by stringent quality standards and a strong demand for clinically validated products, particularly in Western European countries like the UK, Germany, and France. Growth is supported by well-established pharmacy channels and robust maternal care programs that encourage early pregnancy detection. While slightly more price-sensitive than North America, there is significant uptake of advanced digital pregnancy tests and branded fertility monitoring kits. The adoption rate of direct-to-consumer digital health platforms and subscription services is accelerating, driven by favorable regulatory frameworks for medical devices.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing regional market globally. This exponential growth is fueled by massive, growing populations, rising disposable incomes, significant improvements in healthcare access, and increased educational campaigns regarding reproductive health. Countries such as China and India are experiencing a sharp transition from traditional to modern diagnostic methods. The market is highly sensitive to pricing, favoring basic test strips for mass distribution, but the burgeoning middle class in urban centers is rapidly adopting mid-range digital kits. Local manufacturing expansion and government focus on improving maternal and child health outcomes are critical market catalysts.

- Latin America (LATAM): The LATAM market is experiencing steady growth, influenced primarily by urbanization and increasing consumer awareness about modern contraceptives and fertility management. Brazil and Mexico are the largest contributors to the regional revenue. Challenges include economic instability and fragmented distribution networks, necessitating reliance on established pharmaceutical distributors. Growth opportunities lie in targeting the younger demographic with affordable, reliable pregnancy tests and introducing basic fertility kits through accessible retail channels.

- Middle East and Africa (MEA): This region presents varied growth patterns. The Gulf Cooperation Council (GCC) countries show high adoption rates of premium, imported kits due to high healthcare spending and a preference for international brands. Conversely, sub-Saharan Africa faces significant challenges related to product accessibility, affordability, and infrastructure limitations. Market expansion focuses on strategic partnerships to distribute reliable, low-cost pregnancy test kits through NGOs and public health initiatives aimed at reducing maternal mortality and improving early antenatal care access.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fertility and Pregnancy Rapid Test Kits Market.- Clearblue (SPD Swiss Precision Diagnostics)

- Church & Dwight Co., Inc.

- Quidel Corporation

- Abbott Laboratories

- Procter & Gamble (P&G)

- Prestige Brands Holdings, Inc.

- Bio-Rad Laboratories

- Roche Diagnostics

- Cardinal Health

- Geratherm Medical AG

- DCC plc (SureScreen Diagnostics)

- Piramal Enterprises Ltd.

- Mankind Pharma

- i-Health, Inc. (Culturelle)

- Inito

- Mira (Quanovate)

- First Response (Church & Dwight)

- Runbio Biotech Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Fertility and Pregnancy Rapid Test Kits market and generate a concise list of summarized FAQs reflecting key topics and concerns.What technological trends are driving growth in the rapid test kits market?

The market is primarily driven by the transition from analog to digital testing, which minimizes interpretation errors, and the integration of AI-enabled mobile applications. These apps process lateral flow test data to provide personalized, predictive fertility tracking and cycle analysis, elevating kits from simple diagnostics to advanced health management tools.

What is the most accurate time to use a home pregnancy test kit?

The highest accuracy is achieved when testing on or after the day of the expected period, as this ensures sufficient levels of Human Chorionic Gonadotropin (hCG) hormone have accumulated. Highly sensitive kits may detect pregnancy a few days earlier, but users should follow specific manufacturer guidelines for optimal reliability and result confirmation.

How do digital fertility kits differ from traditional ovulation test strips?

Traditional strips provide a qualitative or semi-quantitative reading based on visual line intensity. Digital fertility kits utilize advanced photometric reading or biosensors to objectively detect the Luteinizing Hormone (LH) surge and often measure secondary hormones like estrogen, providing a clear digital display and often synchronizing data with an app for detailed cycle tracking and precise fertile window prediction.

Which geographical region represents the largest growth opportunity?

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid improvements in healthcare infrastructure, increasing awareness of reproductive health, and a large, growing consumer base transitioning towards modern, accessible self-testing products for family planning and early pregnancy detection.

What are the primary restraints affecting market expansion?

Key restraints include the inherent limitations in the accuracy of certain low-cost home tests compared to laboratory methods, leading to user skepticism. Furthermore, high manufacturing costs associated with advanced digital and quantitative kits create price sensitivity, limiting mass adoption in developing or economically constrained markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager