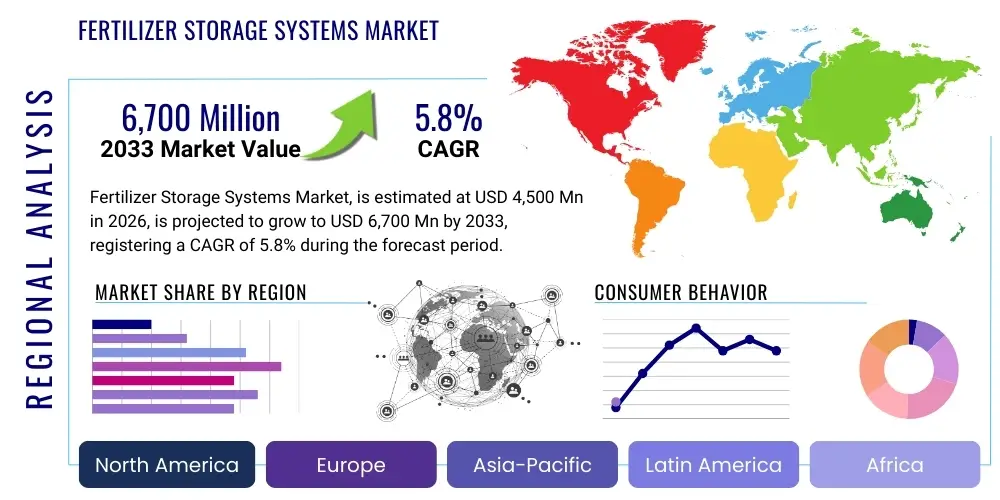

Fertilizer Storage Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437608 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Fertilizer Storage Systems Market Size

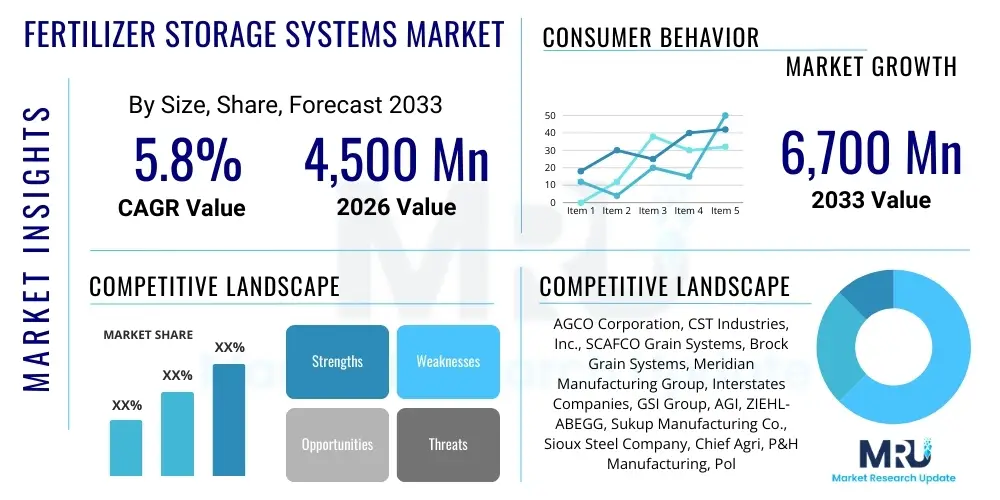

The Fertilizer Storage Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $4,500 Million in 2026 and is projected to reach $6,700 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the increasing global population and the resultant pressure on agricultural output, necessitating efficient management and application of fertilizers. Modern storage systems are crucial for maintaining the quality and integrity of diverse fertilizer types, ranging from bulk solids to specialty liquids, thereby reducing waste and ensuring optimal nutrient availability for crops.

The valuation reflects robust demand driven by modernization initiatives in emerging economies and the imperative for regulatory compliance in established agricultural regions. Investments are flowing into high-capacity, automated storage solutions that offer enhanced safety features and environmental protection, particularly concerning the prevention of chemical runoff and atmospheric emissions. Furthermore, the shift towards smart agriculture and precision farming requires reliable, on-demand access to various fertilizer formulations, making sophisticated storage and inventory management systems indispensable components of the agricultural supply chain.

Fertilizer Storage Systems Market introduction

The Fertilizer Storage Systems Market encompasses the infrastructure, technologies, and services dedicated to the safe, secure, and efficient warehousing of chemical and organic fertilizers across the entire supply chain, from manufacturing sites to distribution centers and large commercial farms. These systems are designed to protect fertilizers from degradation caused by moisture, temperature fluctuations, and contamination, while also meeting stringent governmental safety and environmental regulations, especially concerning hazardous materials like ammonium nitrate. Product descriptions include specialized bulk warehouses, vertical silos (for granular or powdered fertilizers), and large industrial tanks (for liquid fertilizers such as UAN solutions or anhydrous ammonia). Major applications span fertilizer manufacturing plants, wholesale distribution hubs, retail agricultural suppliers, and large-scale farming operations that require significant on-site storage capacity to leverage bulk purchasing advantages and ensure timely application during planting seasons.

The primary benefit derived from advanced storage systems is the preservation of fertilizer efficacy and longevity, directly translating into improved yield stability and reduced operational losses for end-users. Additionally, modern systems incorporate features like advanced ventilation, temperature monitoring, and structural integrity enhancements to mitigate risks associated with fire, explosion, or structural collapse, which are critical safety concerns in this industry. Driving factors include the intensification of global agricultural practices, the rising adoption of specialized and blended fertilizers, and the implementation of stricter environmental mandates globally, pushing stakeholders towards safer, more controlled storage environments that minimize environmental spillage and manage dust emissions effectively.

Fertilizer Storage Systems Market Executive Summary

The Fertilizer Storage Systems market exhibits strong business trends characterized by digitalization and automation, moving towards integrated solutions that combine physical storage infrastructure with sophisticated inventory management software and IoT sensors for real-time monitoring of conditions such as temperature, humidity, and pressure within silos and tanks. Segment trends highlight accelerating growth in liquid fertilizer storage solutions, particularly large, corrosion-resistant stainless steel or fiberglass reinforced plastic (FRP) tanks, reflecting the increasing preference for liquid nutrient application methods in precision agriculture. Conversely, the demand for high-capacity bulk warehouses remains strong, driven by centralized distribution models utilized by major fertilizer producers aiming for economies of scale.

Regional trends indicate that Asia Pacific (APAC) is emerging as the fastest-growing region, fueled by massive government investment in agricultural infrastructure, particularly in India and China, to support high-intensity crop production and food security goals. North America and Europe, while mature markets, are leading in the adoption of advanced, high-specification safety and compliance features, requiring retrofitting and replacement of older facilities. The stringent regulatory landscape in these Western markets is driving demand for containment systems and secondary spill prevention technologies. Overall, market growth is firmly anchored in the non-negotiable need for food production stability, which necessitates robust, safe, and technologically compliant fertilizer handling and storage practices globally.

AI Impact Analysis on Fertilizer Storage Systems Market

Common user questions regarding AI's impact on fertilizer storage often revolve around predictive maintenance capabilities, optimization of inventory levels, and enhanced safety monitoring. Users are primarily concerned with how AI can minimize catastrophic failures, reduce operational downtime due to equipment malfunction, and optimize complex supply chain logistics involving various fertilizer types with different storage requirements. Key themes focus on AI-driven forecasting to adjust storage needs based on weather patterns and planting schedules, integrating machine learning algorithms with sensor data (IoT) to predict structural integrity issues, and automating inventory rotation (First-In, First-Out, or FIFO) within large storage complexes to prevent material degradation. The consensus expectation is that AI will transform storage management from a reactive safety measure into a proactive, cost-saving component of the agricultural supply chain.

- AI-Powered Predictive Maintenance: Utilizing sensor data to forecast equipment failure (e.g., ventilation systems, conveyer belts) in silos and tanks, significantly reducing unexpected downtime and costly emergency repairs.

- Inventory Optimization and Demand Forecasting: Machine learning algorithms analyze historical usage, weather forecasts, and crop cycle data to optimize fertilizer stock levels, minimizing storage costs and avoiding spoilage or stockouts.

- Enhanced Safety and Risk Mitigation: AI processes real-time data from gas sensors and temperature monitors to detect anomalies indicative of chemical reactions (e.g., self-heating in bulk solids like urea), triggering automated safety protocols faster than human operators.

- Automated Supply Chain Integration: Integrating storage data with transport logistics and farm management software to optimize loading schedules and truck routing, enhancing overall system efficiency.

- Structural Health Monitoring: Applying deep learning to acoustic or visual data to identify early signs of corrosion, stress fractures, or structural weakness in storage containers, thereby extending asset life and preventing failures.

DRO & Impact Forces Of Fertilizer Storage Systems Market

The market for Fertilizer Storage Systems is significantly shaped by a confluence of driving factors, restrictive constraints, and opportunistic pathways, all subjected to strong external impact forces. The primary drivers stem from the continuous global demand for enhanced food security, which mandates increased fertilizer usage, coupled with stringent government regulations focused on environmental protection and worker safety, forcing agricultural stakeholders to invest in compliant, high-specification storage infrastructure. However, the market faces restraints such as the exceptionally high initial capital investment required for constructing large-scale, automated, and safety-compliant storage facilities, particularly those designed for complex or hazardous liquid fertilizers like anhydrous ammonia. Fluctuations in commodity prices and the cyclical nature of agricultural markets also introduce financial volatility, sometimes delaying planned infrastructure upgrades.

Opportunities in this sector primarily lie in the rapid technological advancements integrating IoT, AI, and remote monitoring capabilities into storage design, offering solutions that maximize efficiency, minimize human error, and provide unparalleled traceability. The rising adoption of specialized micronutrient and controlled-release fertilizers, which require precise storage environments (e.g., temperature and humidity control), opens new niches for specialized storage providers. Furthermore, the push towards circular economy models and the storage of organic fertilizers derived from waste streams presents a novel growth area. The major impact forces include geopolitical instability affecting global fertilizer trade routes, climate change increasing the variability of planting seasons and thus storage duration requirements, and intensifying public scrutiny regarding the environmental footprint of agricultural practices, which elevates the necessity for leak-proof and environmentally benign storage solutions.

The interaction between these forces creates a complex operational environment. While safety regulations drive modernization (a key driver), they also significantly increase construction costs (a key restraint). Successful market players capitalize on opportunities by offering modular, scalable storage systems that address both cost concerns and compliance mandates, often through leasing or specialized financing models. The critical need for asset longevity and reduced maintenance costs ensures that materials science advancements, such as highly corrosion-resistant coatings and advanced composite materials, become decisive factors in purchasing decisions, influencing market segmentation towards durable, high-performance systems over low-cost alternatives.

Segmentation Analysis

The Fertilizer Storage Systems Market is comprehensively segmented based on several key operational and structural parameters, allowing for detailed analysis of demand patterns across different end-user groups and geographical regions. Segmentation by Type focuses on the physical structure used, predominantly dividing the market into bulk warehouses (for bagged or palletized solids), silos (for granular solids), and tanks (for liquid or gaseous fertilizers), with each requiring distinct design and safety features. Segmentation by Capacity helps differentiate between small farm-level storage, medium distribution centers, and large-scale manufacturing storage facilities, directly correlating with investment scale and technological complexity. Further segmentation by Fertilizer Type addresses the specific chemical requirements, distinguishing between nitrogenous (e.g., urea, ammonia), phosphatic, and potassic fertilizers, each having unique handling, ventilation, and material compatibility requirements, significantly influencing the choice of storage material (e.g., steel vs. FRP).

- By Type:

- Bulk Warehouses (Flat Storage)

- Vertical Silos (Hopper Bottom, Flat Bottom)

- Liquid Tanks (Above Ground, Underground, Pressure Vessels)

- By Capacity:

- Small (Below 1,000 Metric Tons)

- Medium (1,000 to 10,000 Metric Tons)

- Large (Above 10,000 Metric Tons)

- By Fertilizer Type:

- Nitrogenous Fertilizers (Urea, Ammonium Nitrate, Anhydrous Ammonia)

- Phosphatic Fertilizers (DAP, MAP, SSP)

- Potassic Fertilizers (MOP, SOP)

- Complex and Blended Fertilizers

- By Application/End-User:

- Fertilizer Manufacturers and Producers

- Wholesale Distributors and Trading Companies

- Retailers and Co-operatives

- Large Commercial Farms

Value Chain Analysis For Fertilizer Storage Systems Market

The value chain for Fertilizer Storage Systems begins with upstream activities dominated by raw material suppliers, including steel manufacturers, concrete providers, plastics and polymer producers (for FRP tanks), and specialized component suppliers such as manufacturers of conveyors, aeration systems, and highly sensitive environmental monitoring sensors. Quality and pricing of specialized, corrosion-resistant materials are critical at this stage, directly impacting the final cost and longevity of the storage structure. Following material procurement, the chain moves through engineering, procurement, and construction (EPC) firms that specialize in industrial agricultural infrastructure. These firms are responsible for customized design, regulatory compliance adherence (e.g., OSHA, EPA, regional fire codes), and the physical construction and integration of the storage system components, often requiring specialized certifications for hazardous material handling facilities.

The distribution channel for storage systems is characterized by a mix of direct and indirect engagement. Large fertilizer manufacturers or major cooperative farming groups typically engage in direct procurement, working closely with major global EPC contractors or specialized storage solution providers to design and build bespoke, high-capacity facilities. Conversely, smaller agricultural retailers and individual large farms often rely on indirect channels, purchasing pre-fabricated or modular silo and tank solutions through regional distributors or equipment dealers who also provide installation and maintenance services. This indirect channel focuses heavily on standardized, scalable products that can be rapidly deployed.

Downstream activities involve the operational maintenance and eventual decommissioning of the storage facilities. Maintenance providers, often third-party specialized service companies, offer services like internal cleaning, inspection, structural integrity assessments, and calibration of advanced monitoring equipment, ensuring compliance and operational safety throughout the asset life cycle. End-users are responsible for the daily inventory management and regulatory adherence. The efficiency of the storage system significantly impacts the downstream application efficiency of the fertilizers, as poorly stored materials can lose efficacy, leading to wasted application efforts and environmental risks, thereby reinforcing the imperative for high-quality, continuous monitoring and maintenance throughout the lifecycle of the storage asset.

Fertilizer Storage Systems Market Potential Customers

The primary potential customers and end-users of sophisticated Fertilizer Storage Systems are fundamentally those entities involved in the production, aggregation, and large-scale utilization of agricultural nutrients. Foremost among these are multinational and regional fertilizer manufacturers (e.g., producers of urea, phosphate, and potash), who require vast, highly engineered storage facilities at their production sites and port terminals to manage inventory volumes prior to bulk shipping. These customers prioritize capacity, rapid loading/unloading capabilities, and adherence to international safety standards, particularly for handling high-risk substances like anhydrous ammonia. Secondly, large agricultural cooperative associations and wholesale distributors represent a crucial customer segment, needing extensive regional distribution centers equipped with multi-product storage capabilities (e.g., separate facilities for solid, liquid, and blended products) to service a network of smaller farming retailers efficiently.

In addition to large corporate users, commercial farming enterprises, especially those engaged in large-scale cash crop production (such as corn, soy, or wheat belts in North America and Europe), constitute a growing segment of potential customers. These farms are increasingly investing in substantial on-site storage capacity, particularly bulk liquid tanks and customized silos, to enable just-in-time application, minimize transportation costs, and secure competitive pricing through off-season bulk purchases. Government agricultural agencies and national grain reserves, in specific regions focused on maintaining national food security, also act as key buyers, requiring large, government-spec warehouses designed for long-term strategic reserve storage. The buying decision across all segments is heavily influenced by total cost of ownership (TCO), regulatory compliance history, and the supplier's proven ability to integrate safety and automation features into the final design.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4,500 Million |

| Market Forecast in 2033 | $6,700 Million |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AGCO Corporation, CST Industries, Inc., SCAFCO Grain Systems, Brock Grain Systems, Meridian Manufacturing Group, Interstates Companies, GSI Group, AGI, ZIEHL-ABEGG, Sukup Manufacturing Co., Sioux Steel Company, Chief Agri, P&H Manufacturing, Polytank Group, Engineered Storage Products Co., Tank Connection, Superior Tank Co., Inc., Fiber-Tech Industries, Inc., Containment Solutions Inc., Enduraplas. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fertilizer Storage Systems Market Key Technology Landscape

The technology landscape for Fertilizer Storage Systems is rapidly evolving, driven primarily by the need for enhanced safety, efficiency, and compliance monitoring. One of the paramount technological advancements involves the integration of advanced material science, particularly the use of high-density polyethylene (HDPE), fiberglass reinforced plastic (FRP), and specialized stainless steel alloys in liquid tank construction to resist the highly corrosive nature of modern liquid fertilizers like UAN (Urea-Ammonium Nitrate) solutions. Furthermore, structural monitoring technology, utilizing sophisticated sensors embedded within concrete and steel structures, provides continuous data on stress, temperature, and moisture ingress, enabling predictive maintenance models that drastically reduce the risk of structural failure in large bulk warehouses and silos. This integration moves beyond simple materials, incorporating specialized coatings and linings designed to prevent caking, clumping, and chemical degradation of hygroscopic solid fertilizers like urea, ensuring the material retains its free-flowing properties for efficient loading and unloading.

Another critical area of technological innovation is in the field of automation and digital management. Modern storage facilities are increasingly equipped with sophisticated inventory control systems, utilizing ultrasonic level sensors, radar, and lidar technology to provide highly accurate, real-time measurements of fertilizer quantity within storage containers, minimizing human entry into hazardous environments. These systems are connected via the Industrial Internet of Things (IIoT) to centralized Building Management Systems (BMS) or Enterprise Resource Planning (ERP) platforms. Furthermore, automated ventilation and environmental control systems, incorporating high-efficiency filtration (HEPA) and humidity control mechanisms, are essential for maintaining stable storage conditions necessary for complex or reactive fertilizer blends. Specialized technologies for handling anhydrous ammonia, including advanced pressure monitoring, double-walled containment vessels, and automated emergency shut-off valves, represent the pinnacle of current safety-focused technological deployment in the market.

The adoption of robotic systems for tasks such as automated bag stacking in warehouses and drone-based visual inspection of silo exteriors is also gaining traction, enhancing operational efficiency and worker safety. Advanced security features, including infrared monitoring and specialized gas detection systems for nitrogen dioxide, sulfur dioxide, and methane, are becoming standard features, especially in facilities storing highly volatile or flammable materials. These technological applications collectively contribute to a paradigm shift, transforming static storage structures into dynamic, intelligent assets that provide continuous feedback, enabling operators to optimize storage life and drastically improve compliance with evolving global safety and environmental mandates, particularly those related to preventing dust explosions and atmospheric releases.

Regional Highlights

The market dynamics of Fertilizer Storage Systems show significant regional variation based on agricultural practices, regulatory stringency, and economic development levels. North America (NA) and Europe are characterized by mature agricultural sectors focusing on precision farming and high regulatory compliance. In NA, the vast scale of commodity crop production drives demand for very large, highly automated liquid storage tanks (UAN) and high-capacity steel silos. The stringent environmental regulations, particularly in the US and Canada, push for double-walled tanks, specialized containment berms, and advanced air quality control systems. Europe mirrors this trend, with an emphasis on modular, high-specification storage solutions that meet rigorous EU safety directives, often requiring advanced traceability features integrated into inventory management systems to comply with farm-to-fork reporting requirements. Investment in these regions is frequently focused on retrofitting older infrastructure to meet current safety standards and adopting advanced sensing technologies.

Asia Pacific (APAC) represents the dominant growth engine for the Fertilizer Storage Systems market, driven by rapidly expanding population, intensive agricultural practices, and significant government subsidies for infrastructure modernization, particularly in countries like India, China, and Southeast Asia. The demand here is primarily for new construction of large bulk warehouses (flat storage) and high-capacity vertical silos to manage imported and domestically produced granular fertilizers (like urea and NPK blends). The growth is supported by increasing mechanization of farming and the consolidation of agricultural distribution networks, necessitating centralized, high-volume storage hubs. While safety regulations are catching up, the immediate priority remains capacity expansion and logistics efficiency, creating a high-volume, cost-sensitive market segment that is increasingly adopting basic automation features to improve handling efficiency and minimize labor costs.

Latin America (LATAM), particularly Brazil and Argentina, which are major global agricultural exporters, demonstrates strong demand for both solid and liquid fertilizer storage to support massive soybean and corn operations. The market here is dynamic, characterized by rapid adoption of new technologies when proven efficient, focusing on corrosion-resistant silos and large-scale bulk storage facilities near major ports and railway lines. The Middle East and Africa (MEA) market growth is uneven, heavily concentrated in regions with large fertilizer production facilities (e.g., Saudi Arabia, Morocco) where huge export terminals require massive bulk storage capacity, often built to international standards due to their export focus. In sub-Saharan Africa, the market remains nascent but is growing, driven by international development initiatives supporting local food production, focusing primarily on small-to-medium scale, durable silo systems for local cooperatives and farm groups to prevent post-harvest loss and manage seasonal supply.

- North America: Focus on large-scale liquid fertilizer tanks (UAN) and highly automated, compliance-driven retrofit projects.

- Europe: Strong demand for high-specification, modular storage systems meeting strict EU safety and environmental directives, emphasizing inventory traceability.

- Asia Pacific (APAC): Leading in volume growth, prioritizing large new construction projects (warehouses and silos) driven by population density and food security mandates.

- Latin America (LATAM): High demand supporting major agricultural exports (soy, corn), focusing on robust, corrosion-resistant storage near key logistics hubs.

- Middle East and Africa (MEA): Growth concentrated around major fertilizer producers (export focus) and development-driven projects for basic storage infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fertilizer Storage Systems Market.- AGCO Corporation

- CST Industries, Inc.

- SCAFCO Grain Systems

- Brock Grain Systems

- Meridian Manufacturing Group

- Interstates Companies

- GSI Group (A Division of AGCO)

- AGI (Ag Growth International)

- ZIEHL-ABEGG

- Sukup Manufacturing Co.

- Sioux Steel Company

- Chief Agri

- P&H Manufacturing

- Polytank Group

- Engineered Storage Products Co.

- Tank Connection

- Superior Tank Co., Inc.

- Fiber-Tech Industries, Inc.

- Containment Solutions Inc.

- Enduraplas

Frequently Asked Questions

Analyze common user questions about the Fertilizer Storage Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary safety concerns associated with fertilizer storage systems?

The primary safety concerns include structural collapse, dust explosions (especially for granular fertilizers like urea), chemical fires or self-heating events (particularly with ammonium nitrate), and leaks or spills of hazardous liquid fertilizers (e.g., anhydrous ammonia or UAN), necessitating strict adherence to NFPA, OSHA, and regional environmental standards for design and operational protocols.

How does the type of fertilizer influence the choice of storage system design and materials?

Fertilizer type is critical; solid, hygroscopic fertilizers (like urea) require sealed, humidity-controlled silos or warehouses with specialized ventilation to prevent caking and degradation. Liquid fertilizers (e.g., UAN) require corrosion-resistant materials such as fiberglass reinforced plastic (FRP) or specific stainless steel alloys, while gaseous fertilizers (anhydrous ammonia) demand high-pressure, heavily regulated containment vessels with robust safety monitoring systems.

Which technological trends are driving efficiency improvements in fertilizer storage?

Efficiency improvements are primarily driven by the integration of IoT sensors for real-time environmental and quantity monitoring, AI-driven inventory management and predictive maintenance systems, and automated loading/unloading mechanisms. These technologies minimize human intervention, reduce operational losses, and ensure optimal fertilizer quality is maintained before application.

What is the estimated typical lifespan of a modern, large-scale fertilizer storage silo or tank?

The typical lifespan of a well-maintained, modern, large-scale steel silo or corrosion-resistant liquid tank is generally estimated to be between 25 and 40 years. This longevity is heavily dependent on the quality of initial materials, the corrosiveness of the stored fertilizer, and the consistency of the maintenance and inspection schedule, often requiring specialized coatings refurbishment over time.

Is the market shifting more towards solid or liquid fertilizer storage solutions globally?

While solid fertilizer storage (silos and bulk warehouses) still holds the largest market share by volume, the market is exhibiting a faster growth rate in the liquid fertilizer storage segment (tanks). This shift is driven by the rising popularity of precision farming and specialized liquid nutrient blends (like UAN) which allow for easier, more uniform, and efficient application techniques compared to granular forms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager